Summary

Table of Content

Saudi Arabia Blood Collection Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Saudi Arabia Blood Collection Market Size

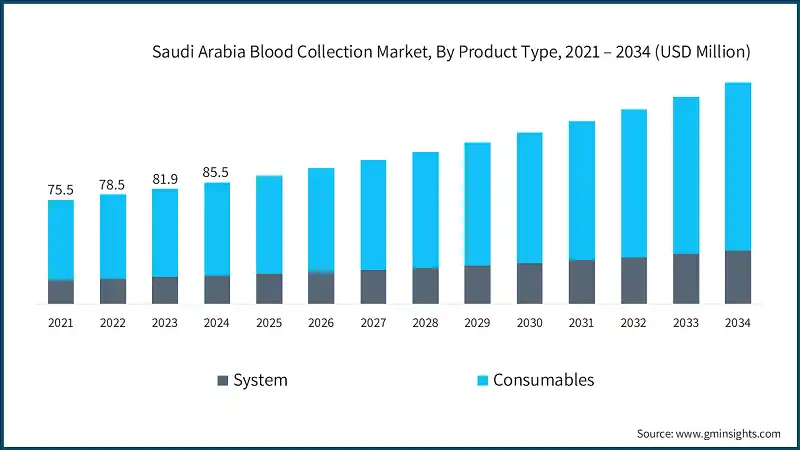

The Saudi Arabia blood collection market size was estimated at USD 85.5 million in 2024. The market is expected to grow from USD 89.4 million in 2025 to USD 138.7 million in 2034, growing at a CAGR of 5%, according to the latest report published by Global Market Insights Inc.

To get key market trends

The growth of the blood collection market is largely influenced by the high prevalence of genetic blood disorders such as thalassemia and sickle cell anemia, road traffic accidents and trauma cases, expansion of healthcare infrastructure, and increasing surgical procedures and emergency care. A blood collection device is a medical tool which is designed to draw blood samples safely and efficiently for diagnostic testing, transfusions, or research purposes. These devices play a vital role in clinical settings and are widely used across hospitals, laboratories, and blood banks. Major players in the Saudi Arabia blood collection industry include Becton, Dickinson and Company, Fresenius, Terumo Corporation, McKesson Corporation, and Nipro Corporation.

The market increased from USD 75.5 million in 2021 to USD 81.9 million in 2023. The growth of the blood collection market in Saudi Arabia is driven by the expansion of healthcare infrastructure under Vision 2030. By building new hospitals, modernizing existing ones, and creating specialized care facilities, the secondary capabilities of current healthcare systems drive the demand for complex blood collection methodologies. Other factors accompanying healthcare expansion include the associated rise in surgical volume, improvements in emergency care networks, and digital health integration, all of which necessitate the advanced blood collection tools required to support diagnostics, transfusions, and biobanking.

The high incidence of genetic blood disorders, such as thalassemia and sickle cell anemia, is accelerating the growth of the market. For instance, according to the Ministry of Health, in Saudi Arabia, about 4.2% of the population carries the sickle-cell trait, and 0.26% has sickle-cell disease. The highest prevalence is in the Eastern province, where approximately 17% of the population carries the gene, and 1.2% have sickle-cell disease. Sickle cell anemia significantly increases the need for blood collection products due to the nature of the disease, which causes chronic anemia that often require regular blood transfusions. Patients with sickle cell disease undergo routine blood tests to monitor hemoglobin levels, organ function, and detect complications. This creates consistent demand for blood collection tubes, sterile needles, and blood bags. Thus, this growing demand for blood collection is expected to significantly propel the growth of the market.

Additionally, increasing road traffic accidents and trauma care across Saudi Arabia have also emerged as key catalysts accelerating the growth of the blood collection market. For instance, according to the Ministry of Health, in 2020, individuals aged 19-30 accounted for the highest number of road injuries in Saudi Arabia, with 7,596 cases, followed by 6,527 injuries among those aged 31-40. Children and adolescents under 18 experienced 3,202 injuries, highlighting a significant burden of accident injuries across all age groups. These statistics underscore the critical role of blood collection systems in trauma care, as the high volume of road injuries continues to occur.

Blood collection is the process of collecting blood samples from a patient for diagnostic, therapeutic, or research purposes. Blood is collected through venous or capillary methods, depending on the volume required and the type of test. The procedure involves using various tools and devices, such as needles, syringes, lancets, blood collection tubes, and automated systems, to ensure safe, sterile, and accurate sample acquisition.

Saudi Arabia Blood Collection Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 85.5 Million |

| Market Size in 2025 | USD 89.4 Million |

| Forecast Period 2025 – 2034 CAGR | 5% |

| Market Size in 2034 | USD 138.7 Million |

| Key Market Trends | |

| Drivers | Impact |

| High incidence of genetic blood disorders such as thalassemia, and sickle cell anemia | Drives sustained demand for routine blood transfusions diagnostics, reinforcing the need for efficient and safe blood collection systems. |

| Rising road traffic accidents and trauma care | Accelerates the requirement for rapid-response blood collection and transfusion capabilities, boosting market growth in emergency care settings. |

| Expansion of healthcare infrastructure in Saudi Arabia | Supports broader adoption of advanced blood collection technologies across newly established hospitals and clinics, enhancing market penetration. |

| Increasing surgical procedures and emergency care | Fuels the need for reliable blood collection systems for transfusions and pre-operative diagnostics, contributing to the consistent market expansion. |

| Pitfalls & Challenges | Impact |

| Risks associated with blood transfusions | Concerns over contamination and infection increase regulatory scrutiny and demand for safer, sterile collection systems. |

| Lack of skilled healthcare professionals | Limits the adoption of advanced blood collection technologies in low-resource settings due to training gaps. |

| Opportunities: | Impact |

| Integration of digital health and smart blood systems such as RFID-tagged blood bags, automated donor tracking | Promotes innovation in traceability and inventory management, improving safety, efficiency, and transparency across the blood supply chain. |

| Market Leaders (2024) | |

| Market Leaders |

10% market share |

| Top Players |

Collective market share in 2024 is 40% |

| Competitive Edge |

|

| Regional Insights | |

| Future outlook |

|

What are the growth opportunities in this market?

Saudi Arabia Blood Collection Market Trends

- Increasing surgical procedures and emergency care is significantly shaping the Saudi Arabia market. Surgical procedures require a wide range of blood collection tools to support both pre-operative diagnostics and intra-operative transfusions.

- For instance, according to the Ministry of Health (MOH), 290,140 routine (non-critical) surgeries were conducted in various surgical specialties in the year 2022 in different regions of Saudi Arabia. In the first half of 2023, over 170,000 surgeries were performed, indicating a sustained demand for surgical care and tools.

- Moreover, the innovative blood collection techniques used in surgical procedures such as automated blood collection devices, micro sampling technology in case of pediatric or elderly surgical patients is further propelling growth of this market.

- For instance, BD Preset Eclipse Arterial Blood Collection Syringe by Becton Dickinson, and Company featured a safety-engineered Eclipse needle to reduce needlestick injuries. It is ideal for surgical care because of its ability to support both preset volume drawing and manual aspiration.

- Therefore, the increasing surgical volumes and changing patient populations are propelling the growth of the blood collections market, and the introduction of sophisticated, focused, collection technologies are enhancing safety and diagnostic accuracy associated with surgical care.

Saudi Arabia Blood Collection Market Analysis

Learn more about the key segments shaping this market

The Saudi Arabia market was valued at USD 75.5 million in 2021. The market size reached USD 81.9 million in 2023, from USD 78.5 million in 2022. Based on the product type, the blood collection market is segmented into system and consumables. The consumables segment accounted for 76.8% of the market in 2024 due to their precise sample collection and ability to support various types of blood tests. The segment is expected to reach USD 105.9 million by 2034, growing at a CAGR of 4.9% during the forecast period. On the other hand, the system segment is expected to grow with a CAGR of 5.2% from 2025 to 2034. The growth of this segment can be attributed to the rising demand for systems that improve efficiency, reduce contamination risks, and enhance patient comfort. As healthcare professionals seek faster and safer ways to collect blood samples, these systems are becoming an essential part of the modern diagnostic workflows.

- The consumables segment includes essential single-use items such as blood collection tubes, needles, lancets, blood bags, micro-container tubes. These products form the backbone of routine blood sampling, diagnostic testing, and transfusion procedures across hospitals, clinics, and mobile units. As Saudi Arabia expands its healthcare infrastructure and surgical capacity, the demand for these consumables is rising sharply due to their critical role in ensuring safe, sterile, and efficient blood handling.

- With over 290,000 surgeries performed annually and a growing burden of chronic and genetic diseases such as sickle cell anemia, the need for reliable consumables is becoming increasingly urgent. Their affordability, ease of use, and compatibility with automated systems make them indispensable, driving consistent growth in the blood collection market.

- Thus, consumables represent a high-volume, high-impact segment that directly supports the scalability and responsiveness of Saudi Arabia’s evolving healthcare ecosystem.

Based on the method, the Saudi Arabia blood collection market is segmented into manual blood collection and automated blood collection. The automated blood collection segment accounted for the market share of 47.1% in 2024.

- Automated blood collection technologies aim to enhance blood collection systems, especially in high-throughput settings such as tertiary hospitals, trauma centers, and blood banks, where safety, efficiency, and traceability are paramount.

- As Saudi Arabia develops its healthcare system and transitions to digital health solutions, automated blood collection systems are eliminating human errors, reducing contamination risks, and improving the donor experience. With higher surgical volumes and more trauma cases, the need for precision and speed in blood science and blood management is driving automation.

- For instance, the T-RAC II by Terumo is a compact, automated whole blood and source collection device. It provides precision weighing, gentle mixing, and smart data management to ensure consistent, high-quality whole blood donations. T-RAC II is designed to enable ergonomic weighing of blood in compliance with GMP standards, optimize the blood collection experience for donors, reduce operator workload, and allow for consistent and standardized classification, packaging, and preparation of blood donations efficiently.

- Thus, automated blood collection is emerging as a strategic growth area, aligning with Saudi Arabia’s push for smart healthcare and offering scalable solutions to meet rising clinical demands.

Based on application, the Saudi Arabia blood collection market is segmented into diagnostics, treatment, and research. The diagnostics segment accounted for the highest market share of 50.2% in 2024 due to the increasing number of diagnostic procedures requiring blood samples, including disease screenings and chronic condition monitoring such as diabetes, cardiovascular diseases, and cancer.

- The diagnostic applications involve blood collection devices that are utilized for clinical tests, screening for disease, and monitoring health in various locations, such as hospitals, laboratories, and points of care. It includes vacuum tubes and capillary collection that allow clinical analysis of a blood sample for numerous conditions, including, diabetes, cardiovascular diseases, infectious diseases, and genetic disorders.

- For instance, according to the International Diabetes Federation, approximately 5.3 million adults aged 20-79 were living with diabetes in Saudi Arabia as of 2024, a figure projected to reach 9.5 million by 2050. This growing diabetic population drives the need for scalable and efficient blood collection solutions, such as advanced lancets for routine glucose monitoring, thereby accelerating market growth.

- Moreover, Saudi Arabia has elevated its focus on preventive care and early identification, it is becoming common practice for routine blood testing to be included as part of the patient care pathway, resulting in steady-state demand for diagnostic blood collection to continue.

- With the country’s rising burden of chronic disorders and expanding access to healthcare services, diagnostic applications are playing a pivotal role in shaping the Saudi Arabia’s blood collection market.

- Furthermore, developments in technology are changing the workflows of the diagnostic processes. The addition of automated blood collection systems, capillary micro-sampling devices, and digital diagnostic platforms provides better accuracy of sample collection, reduced turnaround times, improved patient comfort, fostering the market growth.

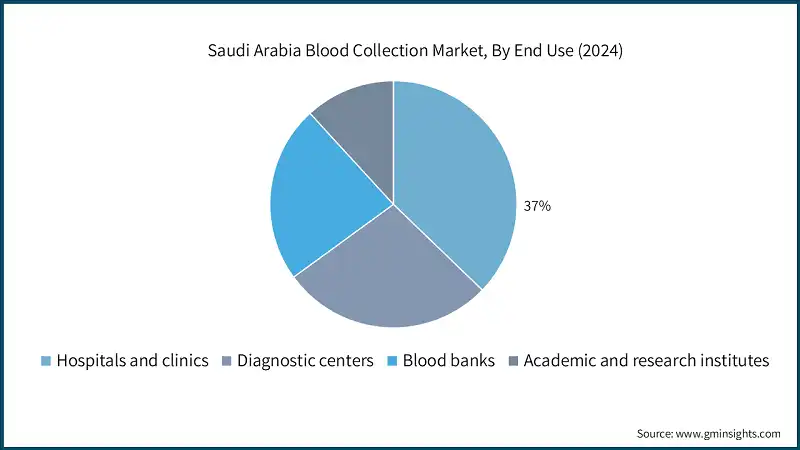

Learn more about the key segments shaping this market

Based on end use, the Saudi Arabia blood collection market is segmented into hospitals and clinics, diagnostic centers, blood banks, and academic and research institutes. The hospitals and clinics segment accounted for the highest market share of 37% in 2024 due to their role as primary healthcare providers managing a high number of patients requiring routine blood tests, emergency diagnostics, and pre- and post-operative assessments.

- Hospitals are the primary end users of blood collection products in Saudi Arabia, including public, private, and specialty medical hospitals.

- Saudi Arabia's hospital network is expanding through the addition of new facilities and the expansion of existing ones as part of Vision 2030. As part of Vision 2030, Saudi Arabia has allocated SAR 260 billion (USD 69.3 billion in 2023) for health and social development. This includes investments in digital health systems, funding for new hospitals and emergency services, and the incorporation of preventive health care programs.

- Thus, this expansion of hospital infrastructure is strengthening the backbone of the blood collection market, ensuring sustained demand for products used in diagnostics, treatment, and critical care.

Saudi Arabia Blood Collection Market Share

- The top five companies Becton, Dickinson and Company, Fresenius, Terumo Corporation, McKesson Corporation, and Nipro Corporation, collectively command 40% of the market share, driven by strong healthcare infrastructure, high diagnostic testing volumes, and a growing burden of genetic disorders. Industry leaders such as Becton, Dickinson and Company have established a robust local footprint by supplying hospitals and outpatient centers with comprehensive blood collection solutions.

- Healthcare providers in the region are increasingly adopting automated and safety-enhanced devices that support vacuum tube and capillary sampling, reducing manual handling and contamination risks. Additionally, digital tools such as barcode tracking are being successfully implemented in hospitals and laboratories to improve sample traceability and reduce diagnostic errors.

- BD remains a dominant force in the market, leveraging its expansive diagnostic solutions and blood collection systems. The company’s strategic restructuring under the “BD 2025” initiative aims to sharpen its focus on high growth medtech segments, including blood collection, where it continues to lead with innovations such as the BD Vacutainer system and the MiniDraw capillary collection device.

- Emerging trends in the market include the development of high-volume blood collection systems, integration of digital tracking for sample integrity, and the expansion of home-based blood collection kits. These innovations are being driven by the increasing demand for chronic disease diagnostics, personalized medicine, and decentralized healthcare delivery.

Saudi Arabia Blood Collection Market Companies

Some of the eminent market participants operating in the Saudi Arabia blood collection industry include:

- Abbott Laboratories

- Becton, Dickinson and Company

- Cardinal Health

- F. Hoffmann-La Roche

- FL MEDICAL

- Fresenius

- Greiner

- Haemonetics Corporation

- McKesson Corporation

- Nipro Corporation

- QIAGEN

- Sarstedt

- Siemens Healthineers

- Terumo Corporation

- Thermo Fisher Scientific

- Becton, Dickinson and Company (BD)

BD’s centers on its engineering expertise and patient centric innovation. The company’s FDA cleared MiniDraw capillary blood collection system, enables lab quality testing from fingertip samples, offering a less invasive alternative to traditional venous draw. BD also leads with its Vacutainer range, a gold standard in specimen management, reinforcing its dominance in clinical diagnostics.

Terumo stands out with its global reach and advanced blood collection technologies. The company offers a comprehensive portfolio of high-quality blood bags with advanced donor safety features, sterile docking options, and biocompatible materials.

The Company’s MiniCollect capillary blood collection system is tailored for pediatric, geriatric, and patients with fragile veins, enabling high-quality sampling with minimal invasiveness. Greiner also leads with its VACUETTE range of evacuated blood collection tubes made from virtually unbreakable PET plastic setting the benchmark for safety and precision in specimen handling across hospitals and laboratories in the region.

Saudi Arabia Blood Collection Industry News

- In December 2023, BD (Becton, Dickinson and Company) announced that it received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for an innovative blood collection device that uses a fingerstick to deliver lab-quality results for several commonly ordered blood tests. This regulatory approval provided BD with a competitive advantage in the market.

The Saudi Arabia blood collection market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 - 2034 for the following segments:

Market, By Product Type

- System

- Automated systems

- Manual systems

- Consumables

- Venous

- Needles and syringes

- Double-ended needles

- Winged blood collection sets

- Standard hypodermic needles

- Other blood collection needles

- Blood collection tubes

- Serum-separating

- EDTA

- Heparin

- Plasma-separating

- Blood bags

- Other venous products

- Needles and syringes

- Capillary

- Lancets

- Micro-container tubes

- Micro-hematocrit tubes

- Warming devices

- Other capillary products

- Venous

Market, By Method

- Manual blood collection

- Automated blood collection

Market, By Application

- Diagnostics

- Treatment

- Research

Market, By End Use

- Hospitals and clinics

- Diagnostic centers

- Blood banks

- Academic and research institutes

Frequently Asked Question(FAQ) :

Who are the leading companies in the Saudi Arabia blood collection market?

The leading companies include Becton, Dickinson and Company, Fresenius, Terumo Corporation, McKesson Corporation, and Nipro Corporation, which together held a collective market share of 40% in 2024.

Which end-use segment held the largest market share in 2024?

Hospitals and clinics accounted for the largest end-use share at 37% in 2024, due to high volumes of routine testing, emergency diagnostics, and pre- and post-operative blood assessments.

Which application segment led the Saudi Arabia blood collection market in 2024?

The diagnostics segment led the market with 50.2% share in 2024, driven by increasing disease screening, chronic condition monitoring, and preventive healthcare testing.

What was the market share of automated blood collection methods in 2024?

Automated blood collection accounted for 47.1% of the market share in 2024, reflecting growing adoption of precision systems across hospitals, trauma centers, and blood banks.

What is the growth outlook for blood collection systems?

The system segment, including both automated and manual devices, is projected to grow at a 5.2% CAGR from 2025 to 2034 due to rising demand for efficiency, safety, and reduced contamination risk in clinical workflows.

What was the market size of the Saudi Arabia blood collection market in 2024?

The market size was estimated at USD 85.5 million in 2024.

What is the estimated market size of the Saudi Arabia blood collection market in 2025?

The market is projected to reach USD 89.4 million in 2025 as demand continues to rise across healthcare facilities.

What is the projected value of the Saudi Arabia blood collection industry by 2034?

The market is expected to grow to USD 138.7 million by 2034, expanding at a CAGR of 5% during the forecast period.

Which product type segment dominated the market in 2024?

The consumables segment dominated the market with 76.8% share in 2024, supported by strong demand for blood collection tubes, lancets, needles, syringes, and blood bags used in routine testing and transfusions.

Saudi Arabia Blood Collection Market Scope

Related Reports