Summary

Table of Content

Satellite Modem Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Satellite Modem Market Size

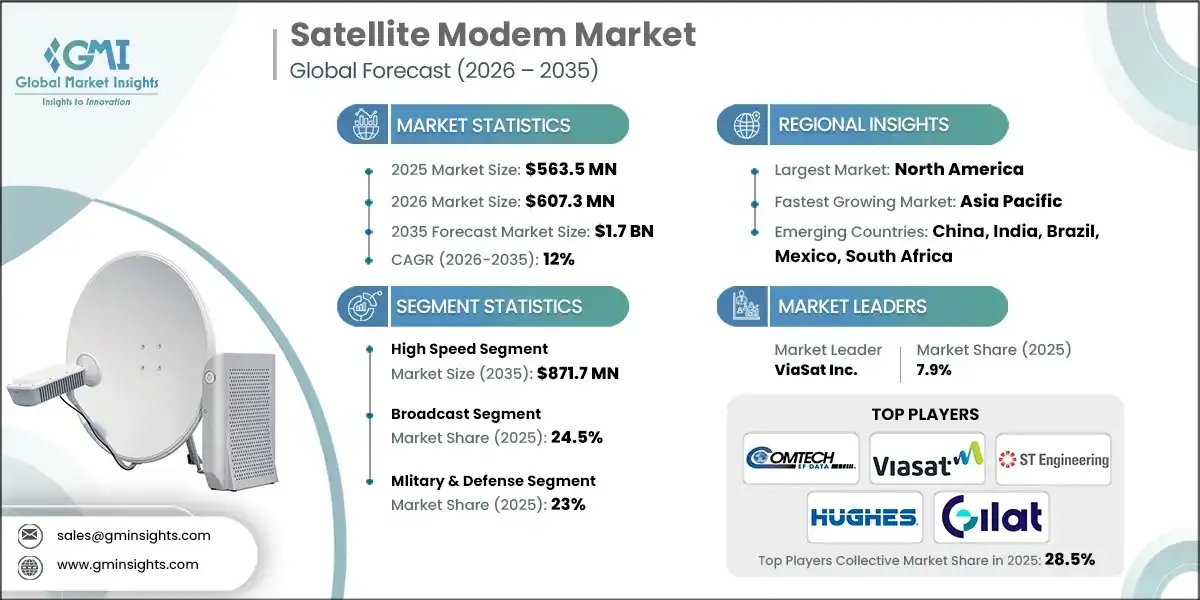

The global satellite modem market was estimated at USD 563.5 million in 2025. The market is expected to grow from USD 607.3 million in 2026 to USD 977.3 million in 2031 and USD 1.7 billion by 2035, at a CAGR of 12% during the forecast period of 2026–2035, according to the latest report published by Global Market Insights Inc.

To get key market trends

The growing use of satellite networks in military & defense applications is a major growth driver for the market. As defense agencies around the world rely more on satellite communication for secure and reliable data transmission, there is an increasing demand for advanced satellite modems that can meet stringent security and performance requirements. These modems enable encrypted communication, real-time situational awareness, and command & control functions, resulting in the development of specialized, high-performance solutions for military requirements. For instance, Comtech was awarded a USD 48.6 million contract by the Army for a new multi-network satellite communications modem. This modem is set to replace the existing standard modem used for transmitting and receiving SATCOM signals in Army ground systems, as well as those of the Navy and Air Force, as per company and Army documents.

The satellite modem market is experiencing significant growth owing to the rising demand for high-speed internet access in remote areas. Satellite modems provide broadband connectivity in areas where traditional wired infrastructure is unavailable or impractical. This demand is driven by the need for dependable internet access for businesses, educational institutions, healthcare facilities, and remote residents, driving the deployment of satellite communication networks and the use of satellite modem technology.

In satellite communication, a satellite modem is utilized for the transmission and reception of satellite network data. A satellite modem encodes digital data for the transmission of radio signals to satellites and decodes the received radio signals into digital data. Satellite modems support internet, telecommunication, distant object sensing, and data broadcasting, making it possible to communicate in remote and hard-to-reach locations, and where no conventional wired communication may be available.

Satellite Modem Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 563.5 Million |

| Market Size in 2026 | USD 607.3 Million |

| Forecast Period 2026-2035 CAGR | 12% |

| Market Size in 2035 | USD 1.7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing demand for high-speed internet access in remote areas | Directly drives adoption of satellite modems as primary connectivity solutions in underserved and rural regions |

| Growing adoption of satellite communication for maritime and aviation connectivity | Significantly drives demand for high-reliability, high-throughput satellite modems optimized for mobility applications |

| Expansion of satellite-based broadcasting and media services | Drives higher deployment of modems capable of handling large data volumes and continuous signal transmission |

| Increasing deployment of satellite networks for military & defense applications | Drives demand for secure, ruggedized, and low-latency satellite modem solutions |

| Pitfalls & Challenges | Impact |

| Dependence on atmospheric conditions | Negatively impacts service reliability and drives the need for adaptive modulation and robust modem technologies |

| Technological obsolescence | Drives frequent replacement cycles and accelerates adoption of software-defined and upgradeable modem architectures |

| Opportunities: | Impact |

| Growth of low earth orbit (LEO) satellite constellations | Enables low-latency connectivity and significantly expands the addressable market for advanced satellite modems |

| Miniaturization and power efficiency for small satellite platforms | Drives development and adoption of compact, low-power modems for CubeSat and small satellite deployments |

| Market Leaders (2025) | |

| Market Leaders |

7.9% market share in 2025 |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Satellite Modem Market Trends

- Some prominent advancements in the marketplace include the increased integration of High Throughput Satellites (HTS) in response to the growing bandwidth needs of applications including video streaming and data transfer. Additionally, the use of Adaptive Coding and Modulation (ACM) and more sophisticated Forward Error Correction (FEC) strategies are being used to enhance the reliability and efficiency of the signal.

- For instance, in June 2023, Qualcomm launched new satellite IoT solutions to provide uninterrupted remote monitoring and asset tracking. The company announced two modem chipsets with satellite capability: the Qualcomm 212S Modem and the Qualcomm 9205S Modem. These modem chipsets power off-grid industrial use cases that require standalone Non-terrestrial Network (NTN) connectivity or hybrid connectivity alongside terrestrial networks, and allow IoT enterprises, developers, ODMs, and OEMs to harness real-time information and insights to manage business projects.

- In addition, the market is experiencing an increase in the demand for satellite modems with integrated cyber security capabilities in order to mitigate risks associated with data security and privacy. On the whole, these trends represent an ongoing advancement in satellite modem technology to satisfy the rising need for high speed, reliable and secure satellite communications across an array of industries and applications.

Satellite Modem Market Analysis

Learn more about the key segments shaping this market

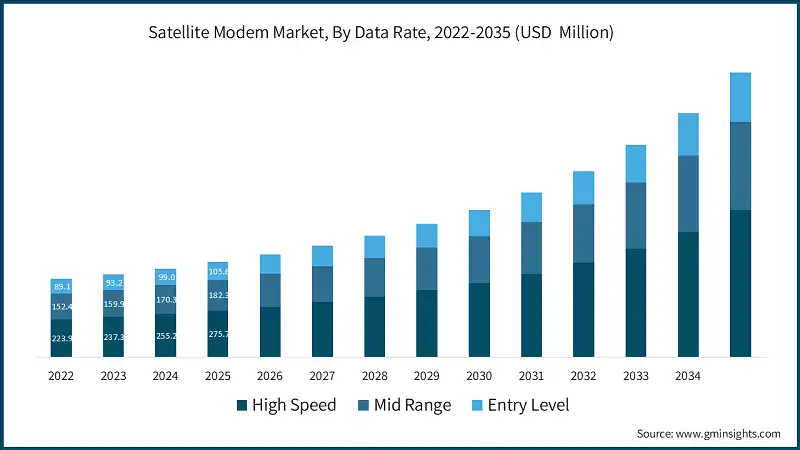

Based on data rate, the market is segmented into high speed, mid-range and entry level.

- The high speed market is anticipated to reach USD 871.7 million by 2035. Increased demand for low-latency and high-throughput connectivity for remote work, real-time communication, and cloud services have driven the rapid growth in this segment. The continuous development of new satellite modem technologies and in the modulation and coding of data allow for ever-faster data rates and enhanced user experience on applications that use high volumes of data and bandwidth.

- The mid range market is projected to grow at a CAGR of over 11.6% by 2035. The mid range segment continues to grow as it incorporates flexible satellite modem solutions that manage efficiency and cost. This segment is able to take advantage of the growing regional networks and hybrid satellite-terrestrial deployments that enable enterprises and service providers to deliver reliable data transmissions to semi-urban and remote areas.

Learn more about the key segments shaping this market

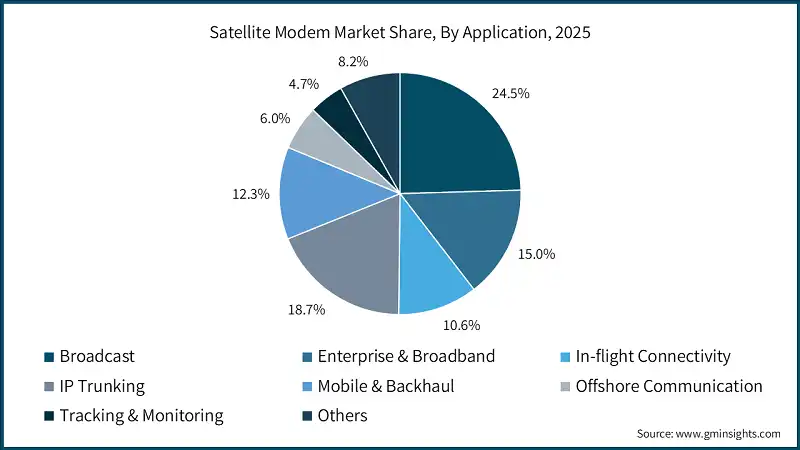

On the basis of application, the satellite modem market is segmented into broadcast, enterprise & broadband, in-flight connectivity, IP trunking, mobile & backhaul, offshore communication, tracking & monitoring, and others.

- The broadcast segment held a market share of 24.5% in 2025. The rise of direct-to-home (DTH) and over-the-top (OTT) media services has been shifting the dynamics of the broadcasting segment. Satellite modems in the segment are being tailored increasingly to support the delivery of high-capacity programmable video streams and to maximize spectrum efficiency and multicasting of content, thereby allowing broadcasters to expand their audience reach with better-quality signals and lower latencies.

- Enterprise & broadband market is projected to reach USD 262.9 million by 2035. The broadband and enterprise segment is growing because more organizations are using satellite connectivity for their primary broadband in unserved regions as well as for backup and redundancy. The trend is attributed to the demand for satellite modems that are highly secure, scalable, and fast. These modems support remote access to corporate networks and the cloud, thereby improving business continuity and operational productivity.

On the basis of end-use industry, the satellite modem market is divided into energy & utilities, government, marine, media & entertainment, military & defense, mining, oil & gas, telecommunications, transportation & logistics, and others.

- Mlitary & defense dominated the global market accounting for 23% market share in 2025. The media and entertainment sectors are utilizing sophisticated satellite communications technology to assist in live broadcasting, content dissemination, and remote production workstreams. Modems in this sector are designed for high data throughput and low lag, as well as on-demand interoperability with cloud services, thus allowing media companies to provide services globally with minimal disruptions.

- The media & entertainment market is projected to grow at a CAGR of 12.7% by 2035. The defense and military sector is experiencing strong growth due to developing reliable, secure, and mission-critical satellite communication solutions. The satellite modems are built for extreme environments and offer low latency and reliability for supporting military operations defense communications and exchange of protected data over land and space.

Looking for region specific data?

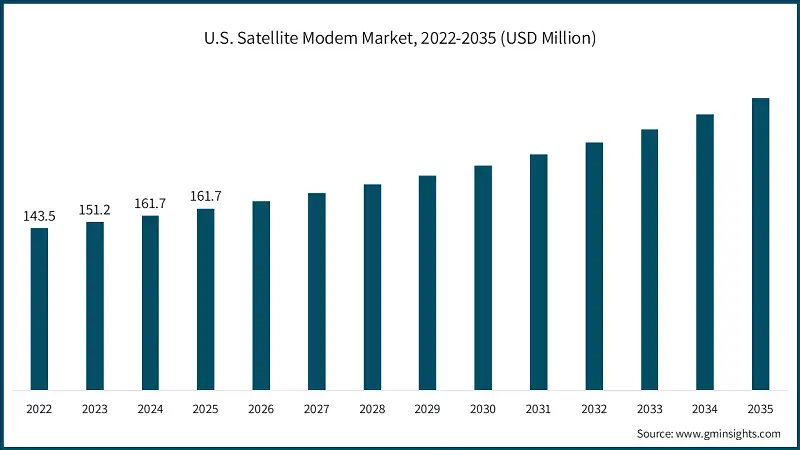

The North America satellite modem market held a 33.8% share of the global market in 2025.

- The North American market is supported by rural connectivity gaps. The Department of Agriculture reports that 22.3 percent of rural Americans and 27.7 percent of individuals on Tribal lands lack coverage from fixed terrestrial broadband at the FCC’s 25 Mbps/3 Mbps threshold, emphasizing reliance on satellite solutions.

The U.S. market was valued at USD 143.5 million and USD 151.2 million in 2022 and 2023, respectively. The market size reached USD 173.8 million in 2025, growing from USD 161.7 million in 2024.

- Satellite modem market in the United States is continuously increasing due to the rising need for strong communication in remote areas, defense telecommunication, and corporate computer networks.

- The integration of emerging technologies including 5G backhaul and 5G/IoT applications is driving the adoption of high-throughput, software-defined modems to facilitate more flexible and versatile modems.

Europe satellite modem market accounted for USD 164.2 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- Expanded efforts to provide broadband services to remote and rural locations has resulted in steady growth in the European market. Governments and regional organizations are implementing satellite broadband to reduce digital disparities in regions where terrestrial infrastructure is absent or difficult to build.

- New developments in satellite technology, such as multi-band and high-throughput modems, are helping boost performance for enterprise, defense, and maritime applications. The incorporation of emerging networks and IoT solutions is amplifying demand, as the regulatory frameworks and spectrum allocation practices support industry's development.

Germany dominates the Europe satellite modem market, showcasing strong growth potential.

- The persistent broadband gaps in rural and underserved areas across Germany are impacting the adoption of satellite modems.

- The Bundesnetzagentur's Breitbandatlas reports that in mid-2024, only approximately 36.8 percent of residences possessed gigabit-capable fixed connections, indicating a limited overall availability of broadband in rural areas.

The Asia Pacific satellite modem market is anticipated to grow at the highest CAGR of 12.8% during the analysis timeframe.

- The Asia Pacific market is expanding rapidly due to rising demand for connectivity in remote, rural, and island regions. The growing demand in the defense, maritime, and enterprise sectors, along with government efforts to expand broadband access, are the primary factors fostering the deployment of advanced satellite modems and their integration with new IoT and communication networks.

China satellite modem market is estimated to grow with a significant CAGR, in the Asia Pacific market.

- The growth of China satellite modem industry is attributed to government spending in satellite communications, broadband for remote areas, and the growing commercial and defense demand.

- High-throughput and software-defined modems adoption, alongside IoT and enterprise systems integration, is advancing the connectivity and the overall network efficiency of the country.

Brazil leads the Latin American satellite modem market, exhibiting remarkable growth during the analysis period.

- There is an increasing demand for reliable connectivity in remote and rural areas in sectors such as agriculture, maritime, and enterprises in Brazil, leading to an increase in the demand for satellite modems.

- The market is reinforced by the deployment of new high-capacity, multi-frequency modems, and their integration into programs aimed at expanding broadband facilitates.

South Africa satellite modem market to experience substantial growth in the Middle East and Africa market in 2025.

- South Africa's rural and underserved areas are experiencing steady growth in satellite modem adoption. Expected growth in adoption of satellite modems in the enterprise, public, and defense sectors, coupled with improvements on the high-throughput software defined modems are improving the availability of digital services and the country’s networked services.

Satellite Modem Market Share

The satellite modem industry is highly competitive. The top 5 players in the market are Comtech EF Data, ViaSat, ST Engineering, Hughes Network Systems, and Gilat Satellite Networks, accounting for a significant share of 28.5% in the market.

In order to compete in the satellite modem market, companies are focusing on new high-throughput and software-defined technologies, as well as the integration with new networks such as 5G and the internet of things (IoT). To withstand competition in the market, companies are concentrating on broadening their solution offering and improving their customers' experiences through partnerships, mergers and acquisitions, and development of new technologies.

Growth is further supported by global expansion, government-backed connectivity programs, and enterprise adoption across defense, maritime, and broadband sectors. Firms are also prioritizing energy-efficient and scalable modem designs, enabling differentiation in a market increasingly driven by network reliability, technological innovation, and the demand for seamless connectivity in remote and underserved regions.

Satellite Modem Market Companies

Prominent players operating in the satellite modem industry are as mentioned below:

- Amplus Communication Pvt. Ltd.

- Ayecka Communication Systems Ltd.

- Comtech EF Data Corporation

- Datum Systems Inc.

- Gilat Satellite Networks Ltd.

- Hughes Network Systems

- Iridium Communications Inc.

- ND SATCOM

- NOVELSAT

- Ntvsat

- ORBCOMM INC.

- ViaSat Inc.

ViaSat Inc.is a leading player in the satellite modem market with a market share of approximately 7.9%. ViaSat provides advanced satellite modem technology to the broadband, enterprise, and mobility industries, with an emphasis on optimizing and managing data-packet flow, and high data throughput. Its strategy centers on increasing network coverage with LEO/MEO constellations and strengthening network reliability. ViaSat also provides government and commercial customers with secure, scalable solutions for fast connectivity.

ST Engineering holds a significant market share of around 6.8% in the market. ST Engineering develops satellite communication systems and modems for both commercial and defense sectors. The company prioritizes advanced signal processing, secure data transmission, and interoperability with next-generation networks, enabling efficient broadband delivery in remote regions and strategic deployment in defense and enterprise communication infrastructures.

Comtech EF Data commands a market share of approximately 3.2% in the satellite modem market. Comtech EF Data focuses on providing advanced satellite communication solutions, including high-performance modems for enterprise, government, and defense applications. The company emphasizes innovation in high-throughput and software-defined modem technologies, enabling reliable connectivity across remote and challenging environments while supporting integration with emerging broadband and IoT networks.

Satellite Modem Industry News

- In December 2025, the NATO Communications and Information Agency (NCIA) selected Globecomm Systems, a subsidiary of UltiSat, Inc., as the prime contractor for its next-generation satellite modem program.

- In February 2025, AccelerComm launched its next-generation 5G Non-Terrestrial Network (NTN) physical layer solution, a high-performance modem designed for satellite constellations.

The satellite modem market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in (USD Million) from 2022 – 2035 for the following segments:

Market, By Channel Type

- Single Channel Per Carrier (SCPC) modem

- Multiple Channel Per Carrier (MCPC) modem

Market, By Data Rate

- High speed

- Mid range

- Entry level

Market, By Application

- Broadcast

- Enterprise & broadband

- In-flight connectivity

- IP trunking

- Mobile & backhaul

- Offshore communication

- Tracking & monitoring

- Others

Market, By End Use Industry

- Energy & utilities

- Government

- Marine

- Media & entertainment

- Military & defense

- Mining

- Oil & gas

- Telecommunications

- Transportation & logistics

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the satellite modem market?

Gilat Satellite Networks, Iridium Communications, and ORBCOMM. These companies are focusing on high-throughput technologies, secure communications, and multi-orbit modem solutions.

What are the key trends in the satellite modem industry?

Key trends include the deployment of LEO satellite constellations, adoption of software-defined modems, integration with 5G NTN, enhanced cybersecurity features, and rising demand for compact, power-efficient modems for small satellite platforms.

What was the leading end-use industry for satellite modems in 2025?

The military & defense segment led the market, accounting for 23% share in 2025. Increasing reliance on secure, encrypted satellite communications for mission-critical operations is driving demand for advanced satellite modem solutions.

Which region leads the satellite modem market?

North America leads the global market, holding a 33.8% share in 2025. Regional growth is driven by defense modernization programs, rural broadband gaps, and strong adoption of satellite connectivity across enterprise and government sectors.

Which application segment led the satellite modem market in 2025?

The broadcast segment held the largest share at 24.5% in 2025. Growth is supported by expanding direct-to-home (DTH) services, OTT media platforms, and demand for high-capacity video transmission.

What is the projected value of the satellite modem market by 2035?

The market size for is expected to reach USD 1.7 billion by 2035, growing at a CAGR of 12% during the forecast period. Growth is driven by LEO/MEO satellite constellation expansion, rising defense communication needs, and integration with 5G non-terrestrial networks (NTN).

Which data rate segment dominated the satellite modem industry in 2025?

The high-speed data rate segment is projected to reach USD 871.7 million by 2035. Strong demand for low-latency, high-throughput connectivity for enterprise, cloud, and real-time applications is driving segment growth.

What is the satellite modem market size in 2025?

The global market size for satellite modem is valued at USD 563.5 million in 2025. Rising demand for high-speed internet connectivity in remote and underserved regions is supporting steady market growth.

What is the market size of the satellite modem industry in 2026?

The market size for satellite modem reached USD 607.3 million in 2026, reflecting increased deployment of satellite communication networks across defense, enterprise, and broadband applications.

Satellite Modem Market Scope

Related Reports