Summary

Table of Content

Resistant Starch Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Resistant Starch Market Size

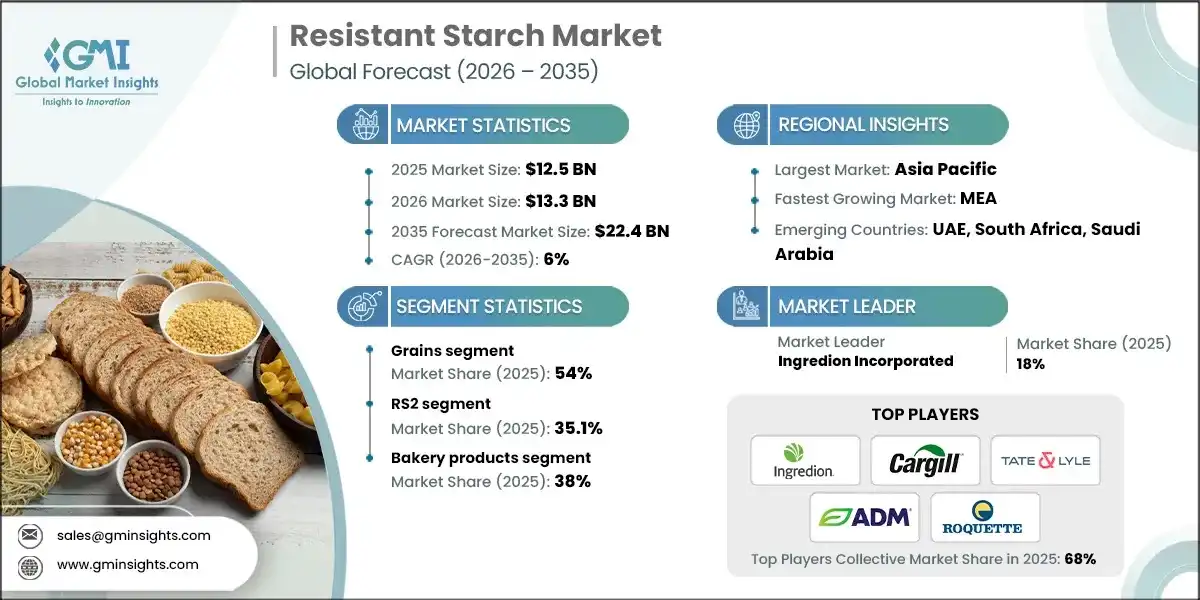

The global resistant starch market size was valued at USD 12.5 billion in 2025. The market is expected to grow from USD 13.3 billion in 2026 to USD 22.4 billion in 2035, at a CAGR of 6% according to latest report published by Global Market Insights Inc.

To get key market trends

- Between 2021 and 2025, due to increased prevalence of diabetes and obesity, food manufacturers have had to reformulate their products to include lower glycemic and fiber-rich ingredients. Resistant starch benefits manufacturers looking to preserve the familiar taste and texture in baked items, snacks and dairy products, as it helps with blood sugar control, satiety and gut health.

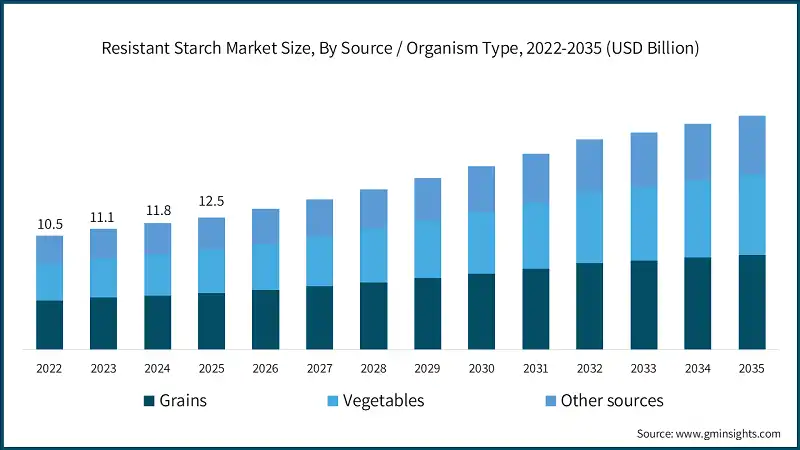

- During the years of 2021 and 2025, grains continued to be the main source of products, due to the high availability of processing streams of corn, wheat and rice in North America, Europe and Asia. Companies evaluated the waste streams of vegetable and “other” sources, such as potato peel, green banana flour and legume fractions, which aligned with the company’s waste reduction and clean label goals.

- RS2 and RS3 were the more popular products in the years between 2021 and 2025. RS2 had higher market growth from corn high in amylose and from green bananas due to satiety and blood glucose claims. RS3 had growth due to the cooling of starches as it was more fit to reformulation of baked goods and ready to eat meals. RS4 had slower growth in the market as it had greater chemically modified versions, which were more negatively viewed by the market.

- From 2022 to 2025, the demand from the Asia Pacific, North America, and Europe was the most significant regionally. Asia Pacific had a foundation in the bakery, instant noodles, and functional beverages. North America and Europe introduced the prebiotic, low-carb, and “metabolic health” products. Latin America and the MEA had previous stage adoption, but there was an increasing interest due to the increasing middle-class consumption of processed foods.

Resistant Starch Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 12.5 Billion |

| Market Size in 2026 | USD 13.3 Billion |

| Forecast Period 2026-2035 CAGR | 6% |

| Market Size in 2035 | USD 22.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising diabetes and obesity prevalence | Boosts demand for low-glycemic, fibre-rich foods |

| Clean-label and natural ingredient preference | Encourages substitution of synthetic functional additives |

| Growing gut health and prebiotic awareness | Drives inclusion in everyday staple food categories |

| Pitfalls & Challenges | Impact |

| Higher cost versus conventional starches | Limits penetration in price-sensitive mass markets |

| Limited consumer awareness and understanding | Slows adoption beyond niche health-conscious segments |

| Opportunities: | Impact |

| Expansion into plant‑based and vegan foods | Enables fortification without altering product taste |

| Use in medical and clinical nutrition | Positions resistant starch as therapeutic ingredient |

| Market Leaders (2025) | |

| Market Leaders |

18% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | MEA |

| Emerging Country | UAE, South Africa, Saudi Arabia |

| Future Outlook |

|

What are the growth opportunities in this market?

Resistant Starch Market Trends

- Gaining popularity among food brands, Signaling metabolic health. Recently, food brands reformulated products for metabolic health using familiar ingredients and resistant starches which lower glycemic impact without the use of artificial sweeteners. For example, North American and European markets have recently launched low-carb baked goods and cereals which include diabetes-friendly and weight-conscious marketing of “Slow-release carbs” and “High resistant starch” products.

- Marketing of resistant starch as a prebiotic. For the first time, companies’ market resistant starches as prebiotic fibers that feed beneficial gut bacteria and increase production of short-chain fatty acids. Positioning products around Microbiome health explain, MSPrebiotics and Gut Garden, marketed for the gut-reset, FODMAP, or digestive wellness programs, offer stand-alone packed resistant starch powders, drink mixes, and supplements.

- Removal of resistant starch from supplements. For example, bread, tortillas, noodles, and dairy snacks now have RS2 and RS3 starches which promote the addition of these fermentable fibers with good digestive comfort and the same taste, texture, and shelf-life, manufactured in baking facilities across the Asia Pacific and EU.

- Producers are creating modified starch from green bananas, potatoes, legumes, and cassava. All of these products are upcycled feedstocks which meet sustainable development goals. Businesses in Latin America and Asia are advertising cassava and banana based resistant starch as functional fiber which also serves as a value added for surplus crops. This is aligned with circular economy and waste reduction.

Resistant Starch Market Analysis

Learn more about the key segments shaping this market

Based on source / organism type, the resistant starch market is segmented into grains, vegetables, other sources. Grains dominated the market with an approximate market share of 54% in 2025 and are expected to grow with a CAGR of 5.1% till 2035.

- Resistant starches that are vegetable and grain-based are enjoying the movement toward more familiar and regionally available crops like rice, wheat, sorghum, and sago, which are especially popular and useful in the Asia Pacific region. At the same time, waxy corn, tapioca, and peas are better for cleaning label products and are more useful for non-GMO and specific functional products for use in baking, snacks, and instant meals.

- Business models in this area are more diversified in terms of crops, have more risk mitigating sourcing and are more upcycling oriented. Supplier blends of rice, wheat, and waxy corn are joined with tahini, peas, and other botanicals to achieve a better balance of price, performance, and sustainability. Collaborations with local starch processors and millers on margins capture meaningful valued products from secondary and even tertiary processing of byproducts in the supply chain for feed.

Based on product, the resistant starch market is segmented into RS1, RS2, RS3, RS4, RS5. RS2 held the largest market share of 35.1% in 2025 and is expected to grow at a CAGR of 5.6% during 2026 to 2035.

- Products RS1 through RS5 are better seen as parts of a product ladder and line rather than separate product offerings. RS2 and RS3 have the most food applications and use the most natural materials, while RS4 is most often used in more complex food and construction applications. Niche products like RS1 and RS5 entering the market more and more often have unique functional food applications as well as targeted health benefits.

- Businesses focus on blending different types of resistant starch. Manufacturers combine RS2 or RS3 with RS4 to achieve clean labels and are considering RS5 for premium launches focusing on glycemic index control, satiety, and microbiome friendly changes. These are directed to mainstream items for packaged food.

Learn more about the key segments shaping this market

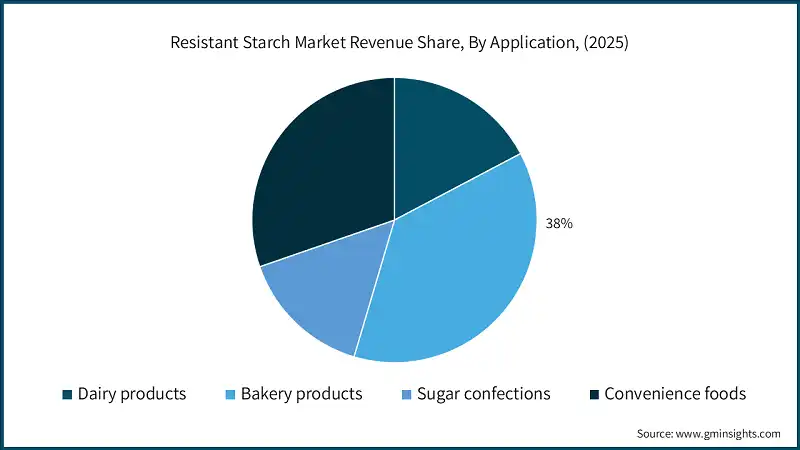

Based on applications, the resistant starch market is segmented into dairy products, bakery products, sugar confections, and convenience foods. Bakery products segment dominated the market with an approximate market share of 38% in 2025 and is expected to grow with the CAGR of 6% through 2035.

- The use of resistant starch in dairy, bakery items, confectionery, and convenience foods is aimed at the “stealth health” reformulation. Brands use it in yogurt, cheese snacks, breads, cookies, biscuits, noodles, and cereals to subtly improve the glycemic response, digestive comfort, and satiety of the everyday consumer to enhance the health profile of the foods with added fiber and lower net carbs.

- Commercial prudent is on multi product platforms. Suppliers are focusing on high volume items like sandwich bread, breakfast cereals, crackers, soups, and nutrition bars where small amounts of resistant starch impact total fiber claims and improves the food. Co-development with food manufacturers is efficient for scaling. Provided resistant starch is flexible and can serve multiple product categories.

Looking for region specific data?

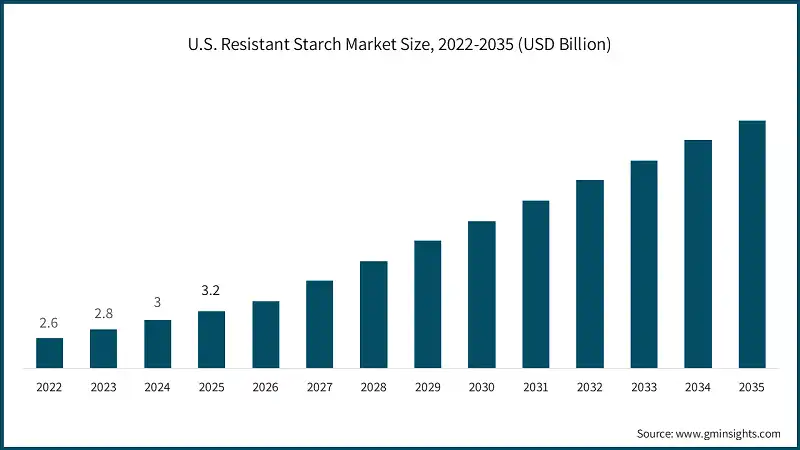

North America accounts for a sizeable share of the resistant starch market, rising from USD 3.5 billion in 2024 to USD 6.4 billion in 2034, supporting a CAGR of 6.1%. North America’s expansion is anchored in high diabetes prevalence, strong packaged-food penetration, and early adoption of functional fibers across bakery, cereals, snacks, and clinical nutrition channels.

- The U.S. is the primary resistant starch market in North America with a market of USD 3.2 billion in 2025, with extensive innovation. The U.S. benefits from advanced food R&D, active microbiome research, and strong retail distribution, enabling rapid commercialization of low-glycemic bakery, ready meals, and high-fiber nutrition products featuring resistant starch formulations.

Europe maintains a robust position in the global resistant starch market, growing from USD 3.17 billion in 2024 to USD 5.57 billion in 2034 at a healthy CAGR of 5.8%. Growth is driven by stringent fiber-intake recommendations, clean-label preferences, and sustained launches of high-fiber breads, biscuits, and breakfast cereals formulated with RS2 and RS3 for digestive and metabolic benefits.

- Germany represents a key resistant starch demand center within Europe’s mature market landscape. Germany’s strong bakery culture, organized retail, and stringent nutrition labelling rules make it an attractive hub for high-fiber bakery, cereals, and dairy products fortified with resistant starch for digestive comfort and satiety.

Asia Pacific is the largest and moderately growing regional market, increasing from USD 3.79 billion in 2024 to USD 6.88 billion in 2034 with a leading CAGR of 6.2%. Rising middle-class incomes, urban diets, and higher incidence of type-2 diabetes support the integration of resistant starch into noodles, rice products, bakery, and functional beverages across China, India, and Southeast Asia.

- China is the dominant market for resistant starch within Asia Pacific. China’s huge population, expanding processed-food sector, and proactive interest in gut health and weight management underpin accelerating demand for resistant starch in noodles, bakery, beverages, and nutritional powders.

Latin America shows steady growth in resistant starch, moving from USD 819 million in 2024 to USD 1.40 billion in 2034, supported by a solid CAGR of 5.5%. The region leverages abundant corn, cassava, and banana resources, with rising use of resistant starch in bakery, snacks, and dairy alternatives as awareness of metabolic health gradually increases.

- Brazil is the principal Latin American market for resistant starch products and ingredients. Brazil’s large processed-food industry, strong bakery and biscuits culture, and growing interest in fiber-rich foods support incremental uptake of resistant starch, especially from local cassava and corn sources, in mainstream packaged categories.

MEA contributes a smaller but fast-growing market share, expanding from USD 474 million in 2024 to USD 870 million in 2034, reflecting a CAGR of 6.2%. Rising lifestyle-disease prevalence, expanding modern retail, and increasing consumption of packaged bakery, snacks, and ready meals are prompting early adoption of resistant starch, primarily in Gulf economies and urban African markets.

- Saudi Arabia is an emerging resistant starch market within MEA with rising health focus. Saudi Arabia’s high obesity and diabetes rates, combined with premium retail formats and strong demand for fortified bakery and snacks, create opportunities for resistant starch as a tool for glycemic control and digestive support.

Resistant Starch Market Share

The resistant starch industry is moderately concentrated, with a few global ingredient majors shaping product standards, application development, and pricing. Leading firms leverage integrated corn and specialty starch portfolios, strong R&D, and deep partnerships with multinationals in bakery, cereal, snacks, and nutrition. Their capabilities in clean-label formulation, regulatory navigation, and regional application centres create high switching costs and sustain premium positioning.

- Ingredion Incorporated: Ingredion leads the resistant starch space with around 18% share, underpinned by its Hi-Maize and other specialty starch platforms. The company focuses on low-glycaemic and digestive health solutions, backed by clinical data and extensive application support. Recent efforts emphasize clean-label, non-GMO, and regionalised formulations for bakery, snacks, and dairy alternatives.

- Cargill: Cargill holds roughly 16% share, using its vast corn processing base and global reach to scale resistant starch offerings. Its strength lies in integrated sourcing, co-development with major food and beverage brands, and the ability to bundle resistant starch with sweeteners, fibres, and texturisers. Cargill is increasingly positioning solutions around sugar reduction and metabolic health.

- Tate & Lyle: Tate & Lyle commands about 14% share, specialising in fibres and functional starches tailored to calorie reduction, glycaemic control, and digestive wellness. The firm combines resistant starch with soluble fibres and sweetener systems to deliver full reformulation toolkits. It has recently highlighted resistant starch in high-fibre bakery, cereals, and nutrition bars, especially in Europe and North America.

- ADM: ADM accounts for approximately 11% share, leveraging its grain origination, milling, and ingredient platforms. It integrates resistant starch into broader health and wellness portfolios, targeting bakery, snacks, and clinical nutrition. ADM’s investments in nutrition science, microbiome research, and customer innovation centres help accelerate formulation of high-fibre, low-glycaemic products for global and regional brands.

- Roquette Frères: Roquette holds close to 9% share, with a strong European base and expertise in pea, potato, and maize-derived ingredients. The company emphasises plant-based, non-GMO, and clean-label resistant starches that complement its protein and fibre lines. Roquette is expanding applications in gluten-free bakery, meat alternatives, and specialised nutrition, aligning resistant starch with broader plant-based trends.

Resistant Starch Market Companies

Major players operating in the resistant starch industry include:

- Xian Kono Chem

- SunOpta

- MSPrebiotics

- Sheekharr Starch Private Limited

- AGRANA Beteiligungs

- Natural Stacks

- Gut Garden

- ADM

- Roquette Freres

- Arcadia Biosciences

- Tate & Lyle

- MGP Ingredients Inc.

- Ingredion Incorporated

- Cargill

Resistant Starch Industry News

- In May 2024, Ingredion Incorporated launched next-generation Hi-Maize resistant starch solutions targeting sugar-reduced bakery and cereal products, pairing clinical evidence on glycemic response with clean-label positioning and expanded technical support for regional customers in North America, Europe, and Asia Pacific.

- In October 2023, Tate & Lyle announced an expansion of its specialty starch capacity in Europe, enhancing supply security for resistant starch and fiber systems used in high-fiber breads, biscuits, and nutrition bars, aligned with growing consumer focus on gut and metabolic health.

- In March 2023, Cargill opened a new innovation hub focused on starches and fibers, supporting co-development of resistant starch-containing recipes with global food manufacturers. The center emphasizes sugar reduction, low-glycemic formulations, and texture optimization in bakery, snacks, and ready meals.

- In July 2022, Roquette Frères broadened its plant-based ingredients portfolio with new pea-and corn-derived functional starches, including resistant starch options aimed at gluten-free bakery, meat alternatives, and specialized nutrition, reinforcing its positioning at the intersection of fiber enrichment and plant-based product development.

This resistant starch market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Source / Organism Type

- Grains

- Rice

- Wheat

- Sorghum

- Sago

- Other grains

- Vegetables

- Waxy corn

- Tapioca

- Pea

- Other vegetables

- Other sources

Market By Product

- RS1

- RS2

- RS3

- RS4

- RS5

Market, By Application

- Dairy products

- Bakery products

- Bread

- Cookies

- Biscuits

- Others

- Sugar confections

- Nutrition Bars

- Others

- Convenience foods

- Noodles

- Pasta

- Breakfast Cereals

- Crackers

- Soup

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Which country leads the resistant starch sector in North America?

The U.S. leads the North American market, valued at USD 3.2 billion in 2025, supported by advanced food R&D, microbiome research, and strong retail distribution networks.

What are the key trends in the resistant starch market?

Key trends include reformulating foods for metabolic health, positioning resistant starch as a prebiotic, wider use of RS2 and RS3 in daily foods, and sourcing from upcycled, sustainable feedstocks.

Who are the key players in the resistant starch industry?

Key players include Xian Kono Chem, SunOpta, MSPrebiotics, Sheekharr Starch Private Limited, AGRANA Beteiligungs, Natural Stacks, Gut Garden, ADM, Roquette Freres, Arcadia Biosciences, and Tate & Lyle.

What was the market share of grains in the market in 2025?

Grains dominated the market with an approximate share of 54% in 2025 and is expected to grow at a CAGR of 5.1% through 2035.

What was the market share of RS2 in 2025?

RS2 held the largest market share of 35.1% in 2025 and is set to expand at a CAGR of 5.6% from 2026 to 2035.

What was the market share of the bakery products segment in 2025?

The bakery products segment accounted for approximately 38% of the market in 2025 and is anticipated to observe around 6% CAGR till 2035.

What is the expected size of the resistant starch industry in 2026?

The market size is expected to reach USD 13.3 billion in 2026.

What is the projected value of the resistant starch market by 2035?

The market is poised to reach USD 22.4 billion by 2035, growing at a CAGR of 6% during the forecast period.

What was the market size of the resistant starch in 2025?

The market size was valued at USD 12.5 billion in 2025, driven by increasing demand for low-glycemic and fiber-rich ingredients in food products.

Resistant Starch Market Scope

Related Reports