Summary

Table of Content

Printed and Chipless RFID Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Printed and Chipless RFID Market Size

Printed and Chipless RFID Market size was USD 2.52 billion in 2015, and is forecast to grow with 26.7% CAGR to surpass USD 16 billion by 2023.

To get key market trends

Radio frequency identification is employed in the transport sector, where contactless and contact smart cards contribute to the operational efficiency as well as save commute time. The segment will grow at 28% CAGR expectations from 2016 to 2023 to exceed USD 6 billion by 2023.

Tangible benefits in inventory control are also likely to augment industry revenue. Remote reading of tags containing unique codes for tracking, as well as simultaneous reading enabling a large volume of products to be checked are among other advantages of this approach.

Growing R&D and developments in nanotechnology and conductive inks will present viable growth opportunities to incumbent participants. Need to counter the expanding counterfeit drugs ecosystem is forecast to propel adoption across the pharmaceutical sector.

Printed and Chipless RFID Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2015 |

| Market Size in 2015 | 2.52 Billion (USD) |

| Forecast Period 2016 - 2023 CAGR | 26.7% |

| Market Size in 2023 | 16.29 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Barriers to revenue mainly included high capital investment. However, low printed and chipless RFID market price trend due to reducing solution cost with the help of technological advancements will drive growth. Concerns regarding privacy and the possibility of sensitive data leak will spur security initiatives in the coming years.

Printed and Chipless RFID Market Analysis

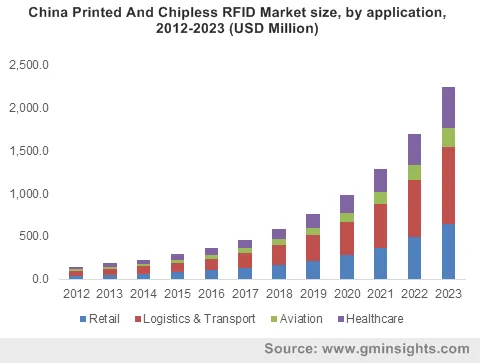

Retail applications were responsible for over 29% of the printed and chipless RFID market share in 2015. Growing use in improving the overall customer experience, inventory accuracy, store execution, on-shelf availability, as well as omni-channel retailing will drive growth over the forecast timeframe.

The aviation industry contributed over USD 300 million to the printed and chipless RFID market size in 2015. Favorable regulatory landscape is a major growth driver in the healthcare space. Major use cases include patient tracking, surgical instrument track and trace, staff identification, document management, inventory control, etc.

The industry has witnessed replacements of chip-based tags with chipless counterparts; these help in avoiding theft through asset tracking and also contribute in preventing counterfeiting. Government initiatives such as e-passports combined with growth in the number of electronic transactions and higher customer satisfaction will positively impact revenue.

U.S. printed and chipless RFID market size is forecast to surpass USD 4.8 billion by 2023, at 25% CAGR estimations from 2016 to 2023. Growing demand across application areas is expected to drive growth. Companies operating in the region have been adopting this technology to streamline supply chain management and enhancing inventory visibility.

Growing need for document management in government agencies and medical institutions will favor Asia Pacific printed and chipless RFID market growth. The Brazilian government offers incentives schemes to local companies adopting the technology. Companies based in the region have been leveraging it to track and trace their inventory and improve supply chain management.

Chip based solutions and barcodes represent external substitutes; however, any rise in demand is predicted to be offset by growing awareness regarding advantages offered by chipless RFID market implementation. Growing popularity is also forecast to attract new companies to enter the industry.

Printed and Chipless RFID Market Share

Major players include

- Zebra Technologies

- Impinj Corporation

- Alien Technology Corporation

- TAGSYS RFID

- Intermec

Companies aim at ensuring considerable product differentiation and actionable solutions through R&D and product innovation activities. Focal areas include extensiveness of the product portfolio, quality of the products and services, performance characteristics, availability, etc. Companies accounting for printed and chipless RFID market share also need to ensure effective branding and strong customer relationships to sustain in the competition.

In October 2014, Zebra acquired Motorola Solutions’ Enterprise Business, which helped the company gain Motorola’s RFID hardware, mobile computing, card printing, bar coding, and cloud-based devices businesses.

In addition to products, Alien Technology also has a strong service portfolio, comprising technical consulting, program and project management, system configuration, training services, etc.

Frequently Asked Question(FAQ) :

How much did the printed and chipless RFID market size account for in 2015?

The market size of printed and chipless RFID was valued over USD 2.52 billion in 2015.

How much growth will the printed and chipless RFID industry share witness during the forecast timeframe?

The industry share of printed and chipless RFID is projected to expand at 26.7% CAGR during 2016 to 2023.

Printed and Chipless RFID Market Scope

Related Reports