Summary

Table of Content

Polytetrafluoroethylene (PTFE) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Polytetrafluoroethylene Market Size

Polytetrafluoroethylene Market size was valued at USD 1.07 billion in 2019 and is estimated to exhibit over 5% CAGR from 2020 to 2026. Growing prominence of fluoropolymers across the world and rising product demand in chemical processing sector will drive the business growth rate by the end of 2026.

The polytetrafluoroethylene market holds significant share of overall fluoropolymers industry. PTFE is considered under homopolymer category and are commercially available in granular, powder or dispersed form. Although polytetrafluoroethylene is excellent choice for many end-users, the availability of variety of grades and their suitability will play a pivotal role in industry development.

To get key market trends

PTFE used in diaphragm and gaskets should not have porous structure as it can contribute in accumulation of bacterial growth, which can dilute the product quality in healthcare, pharmaceutical or food industry. However, the industry will stimulate at substantial rate through 2026 owing to rising product demand in different end-user industries.

The key growth enabling factor behind PTFE market is rising product demand from chemical processing sector. Polytetrafluoroethylene is extensively utilized as coating on variety of equipment including vessels, laboratory equipment, pipework, fuel cell, etc. in chemical industry. The product possesses superior corrosion resistance and chemically inert substance, which makes them ideal choice for chemical manufacturers.

Polytetrafluoroethylene Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | 1,069.1 Million (USD) |

| Forecast Period 2020 to 2026 CAGR | 5.5% |

| Market Size in 2026 | 1,316.8 Million (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Growing production of chemicals around the globe will further create need for polytetrafluoroethylene market in the sector. Emerging countries including GCC will report substantial growth in chemical production by 2020. Saudi Arabia dominated overall GCC chemical production with more than 65% share in 2016, which is further expected to increase over coming decades.

Although the product has gained substantial attention from end-user industries, the challenges associated with ongoing coronavirus pandemic will slow down growth rate in short span of time. This is majorly attributed to shutdown of production facilities of majority of end-users. However, the PTFE market price will attain descent growth post 2021 in terms of revenue, which can be majorly attributed to stable industry growth of different end-users.

Polytetrafluoroethylene Market Analysis

Learn more about the key segments shaping this market

Granular PTFE accounted for substantial share of overall market in 2019 and estimated to grow at 6% CAGR by 2026. The form is ideally suited for molding variety of shapes including rods, ball valves, tubes, sheets, etc. Granular products are extensively used in making seal rings, valve seats, bearing pads, fittings, electrical insulations and many more components. Increasing demand for industrial parts in end-user industries will further create demand for this PFTE market segment.

Unmodified PTFE, also known as virgin polytetrafluoroethylene, is manufactured from 100% pure polytetrafluoroethylene. The product possesses superior chemical resistance and electrical insulation properties. Unmodified type is preferred in food & beverages, pharmaceuticals, cosmetics, etc. industries.

Suspension process will witness over 5% CAGR in global polytetrafluoroethylene market by 2026. This process produces granulated or powdered PTFE, which are utilized in manufacturing of gaskets, valves, seals, expansion joints, pipes, electrical insulators, etc. applications. Proliferation of industrial components manufacturing in emerging countries will create demand for suspension process during 2016 to 2026.

Learn more about the key segments shaping this market

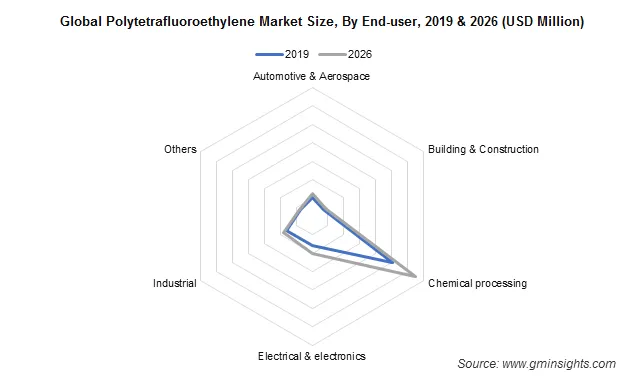

Chemical processing end use industry accounted for more than 45% share of global polytetrafluoroethylene market during 2016 to 2026. This can be attributed to superior product properties including corrosion resistance, chemical inertness, electrical insulation, heat resistance, etc.

Increasing production of chemicals worldwide will enhance penetration of PTFE over next few years. Globally, chemical production output has been estimated to cross USD 3 trillion by 2020, which can be contributed to rising consumption of variety of chemical products in end-user industries. Such trends will further provide opportunity to PTFE market manufacturers by 2026.

Looking for region specific data?

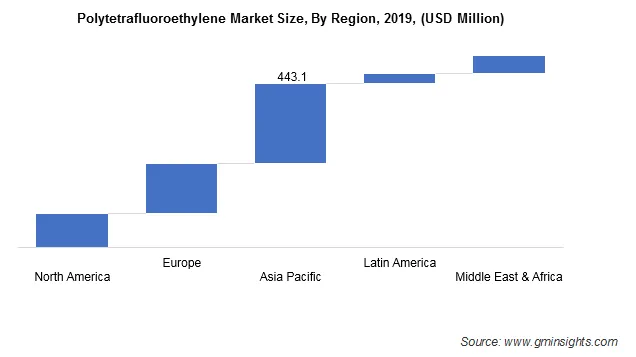

Asia Pacific was valued at over USD 440 million in 2019, which is expected to grow further by end of 2026. Presence of large number of chemical producers in major countries including China, India, Japan, etc. are expected to drive polytetrafluoroethylene market demand in near term.

Chinese chemical output is expected to cross a mark of USD 1.5 trillion by the end of 2020, which further drives their dominance in Asia Pacific polytetrafluoroethylene sector. Additionally, rising production of electrical & electronics products in major countries like, China, Japan and South Korea will increase the PTFE market consumption in Asian market.

Polytetrafluoroethylene Market Share

The market is highly competitive with presence of large number of players with strong production capacities. Strategic movements of key players including, production capacity expansion, new product launches and strategic agreements will differentiate themselves in the longer run. Some of the key manufacturers of the polytetrafluoroethylene industry are

- AGC Chemicals

- Arkema Group

- 3M

- Solvay

- The Chemours Company

- DuPont

- Saint-Gobain Performance Plastics

- SABIC

- Honeywell

The Chemours Company planned to expand capacity of Teflon, company’s branded PFA polymer, by around 25% in 2018. This has been owing to rising demand for Teflon in semiconductor sector worldwide. Similarly, 3M announced to provide 3D printed PTFE material for meet the growing need for advanced manufacturing in the sector. This will further create new possibilities for polytetrafluoroethylene market in the field of biomedical, chemical processing, pharmaceuticals, research laboratories, etc.

The polytetrafluoroethylene (PTFE) market report includes in-depth coverage of the industry with estimates & forecast in terms of volume in kilo tons and revenue in USD million from 2016 to 2026 for the following segments

By Form

- Granular

- Powder

- Dispersion

By Type

- Modified

- Unmodified

By Manufacturing Process

- Suspension

- Dispersion

By End-user

- Automotive & aerospace

- Building & construction

- Chemical processing

- Electrical & electronics

- Industrial

- Others (healthcare, food & beverages, etc.)

The above information is provided on a regional and country basis for the following:

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Russia

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Malaysia

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Qatar

Frequently Asked Question(FAQ) :

Which form of polytetrafluoroethylene is likely to gain substantial traction?

Granular form held appreciable share in 2019 and may record 6% CAGR through 2026. The form is suitable for molding ball valves, sheets, tubes, and rods.

Why will polytetrafluoroethylene market size from suspension process depict an increase?

Suspension process segment may exhibit 5% CAGR through 2026, as this process helps manufacture granulated or powdered PTFE that can be used in developing valves, expansion joints, gaskets, etc.

Which end-use sector may majorly push global polytetrafluoroethylene industry share?

Chemical processing end use sector held over 45% share of polytetrafluoroethylene industry share and may depict appreciable gains owing to excellent product properties such as chemical inertness, corrosion resistance, etc.

Where will global polytetrafluoroethylene market share exhibit an increase?

Asia Pacific busines was worth USD 440 million in 2019, and may grow further through 2026, owing to the presence of a huge number of chemical producers across India, China, etc.

How much growth rate is PTFE industry anticipated to register through 2026?

In 2019, the global polytetrafluoroethylene market size was worth USD 1.07 billion, and it may register 5% CAGR through 2026, driven by rising prominence of fluoropolymers globally.

Polytetrafluoroethylene Market Scope

Related Reports