Summary

Table of Content

Pet Dental Health Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Pet Dental Health Market Size

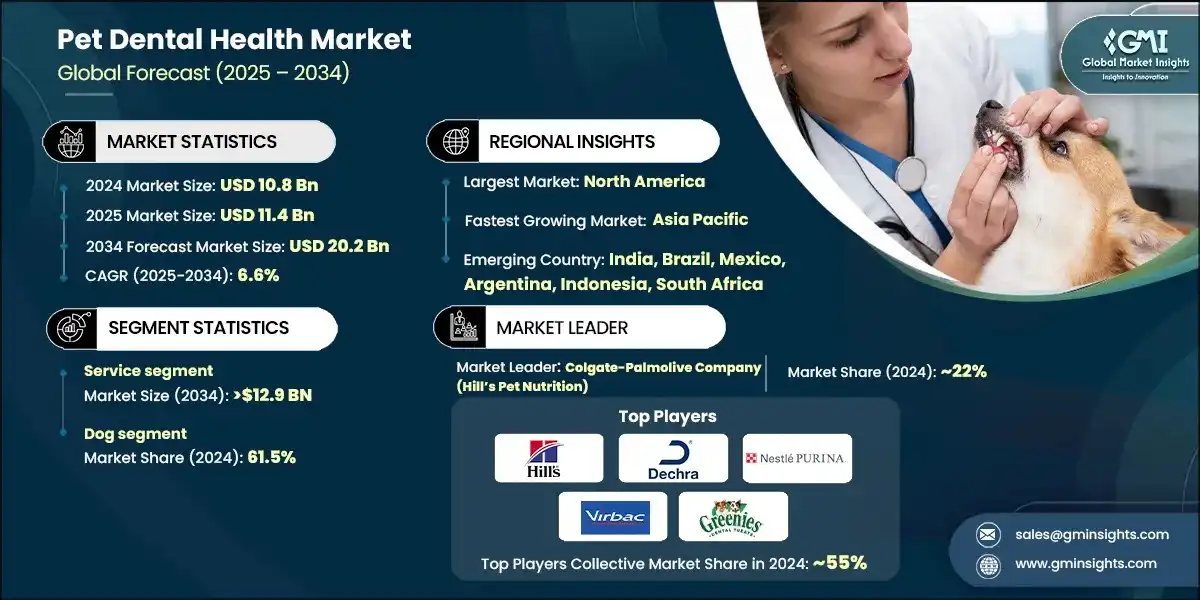

The global pet dental health market was valued at USD 10.8 billion in 2024. The market is anticipated to grow from USD 11.4 billion in 2025 to USD 20.2 billion in 2034, growing at a CAGR of 6.6% during the forecast period, according to the latest report published by Global Market Insights Inc.

To get key market trends

The pet dental health market is poised for substantial growth, fueled by increasing pet owner's awareness around preventive care and overall pet health and wellness. This trend, coupled with rising disposable incomes and the growing trend of pet humanization, is encouraging regular oral hygiene practices such as dental checkups and the adoption of dental care products, such as dental chews, diets, and rinses, particularly in urban and developed regions, fostering the market growth.

Pet dental health spans a range of veterinary and consumer solutions aimed at enhancing oral hygiene and preventing dental issues like plaque, tartar buildup, gum disease, and bad breath, promoting oral care. The product range encompasses dental chews and treats, toothbrushes and toothpaste, oral care solutions including oral mix, dental sprays, and other dental products.

In addition, services such as dental cleanings, surgery, root canal therapy, and orthodontic corrections also contribute to differentiation among providers. Leading companies in the industry include Colgate-Palmolive Company (Hills Pet Nutrition), Dechra Pharmaceuticals, Purina PetCare (Nestle), Virbac and Mars (GREENIES), with competition focused on innovation in dental chews, enzymatic toothpaste, and microbiome-friendly solutions.

The rising incidence of periodontal diseases in pets is driving the demand for preventive care solutions, including surging adoption of products and regular dental check-ups. Innovations such as microbiome-friendly formulations and natural ingredient-based products are appealing to health-conscious pet owners. Additionally, the growth of veterinary services and online retail channels is enhancing product accessibility. These factors collectively foster a robust growth environment, making pet dental health a key segment in the broader pet care industry.

Technological innovation is transforming pet dental care by introducing smart devices like oral health trackers and interactive dental tools. These innovations complement traditional products such as enzymatic toothpaste and dental chews, offering a more proactive approach to oral hygiene. For example, smart water additives and Bluetooth-enabled dental monitors help detect early signs of gum disease and encourage consistent care routines. This shift empowers pet owners to manage dental health more effectively, improving long-term outcomes and overall wellness.

The growth of the pet dental health market is driven by the availability of specialized dental diets, dental cleaning services, and educational campaigns led by pet health organizations. These efforts are encouraging pet owners to prioritize oral care. This professional push, combined with rising companion animal healthcare spending, is expected to significantly boost the demand for dental health solutions across both developed and emerging markets.

Pet Dental Health Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 10.8 Billion |

| Market Size in 2025 | USD 11.4 Billion |

| Forecast Period 2025 - 2034 CAGR | 6.6% |

| Market Size in 2034 | USD 20.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising pet adoption rate | Increasing pet ownership globally is driving demand for comprehensive dental care, as pets are treated like family members. |

| Increasing cases of pet dental problems | The growing incidence of periodontal diseases and oral infections in pets is propelling the demand for preventive and therapeutic dental solutions. |

| Growing awareness of pet oral health | Educational campaigns and veterinary guidance are raising awareness among pet owners, prioritizing the importance of regular dental checkups and hygiene. |

| Increasing animal healthcare expenditure | Rising disposable income and pet insurance coverage are encouraging owners to invest more in advanced dental treatments and wellness products. |

| Pitfalls & Challenges | Impact |

| High cost of advanced dental procedures | Specialized dental treatments like root canals or tooth extractions are expensive, limiting access for pet owners in lower-income brackets, hindering market growth. |

| Shortage of specialized veterinary dentists | Limited availability of trained veterinary dental professionals restricts the reach and quality of dental care in developing areas, restraining its adoption. |

| Opportunities: | Impact |

| Expanding technological advancements in pet dentistry | Innovations like smart toothbrushes, oral microbiome testing, and laser treatments are transforming pet dental care into a more precise and preventive field. |

| Natural and organic product demand | Pet owners increasingly prefer chemical-free dental products, driving growth in natural chews, toothpaste, and holistic oral care solutions. |

| Growing focus on preventive dental care | Shift toward routine dental checkups, early-stage interventions, and home-based care is creating new market segments and long-term growth potential. |

| Market Leaders (2024) | |

| Market Leaders |

~22% |

| Top Players |

Collective market share in 2024 is ~55% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | India, Brazil, Mexico, Argentina, Indonesia, South Africa |

| Future Outlook |

|

What are the growth opportunities in this market?

Pet Dental Health Market Trends

- As the pet ownership rate continues to rise, pet hygiene and oral health become a central focus for their pet wellness, upsurging the priority for dental care measures.

- This shift has led to growing attention to natural and organic oral care products, flavored dental solutions for better pet compliance, and subscription-based dental kits for convenience.

- In addition, veterinary-endorsed preventive care routines are becoming mainstream, supported by growing pet insurance coverage that includes dental services.

- Besides, digital health tracking and smart devices for monitoring oral hygiene are gaining popularity.

- For instance, in May 2025, Mars Incorporated launched AI-powered tools to support pet parents in monitoring their pet health, starting with GREENIES Canine Dental Check. Part of a USD 1 billion investment in pet nutrition, this innovation enhances digital care through smartphone-based dental assessments. This launch marked a significant move in transforming pet tech through accessible, tech-driven solutions.

- The rise of e-commerce platforms and a premium product range is further enhancing consumer engagement. Collectively, these trends signal a shift toward holistic, tech-enabled, and preventive dental care, positioning the segment for sustained growth.

Pet Dental Health Market Analysis

Learn more about the key segments shaping this market

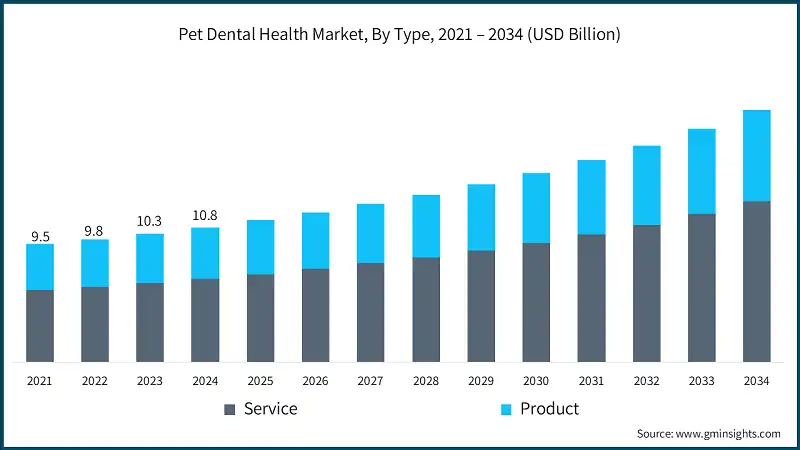

Based on the type, the pet dental health market is segmented into service and product. The service segment accounted for the largest revenue of USD 6.7 billion in 2024. The segment is expected to exceed USD 12.9 billion by 2034, growing at a CAGR of 6.9% during the forecast period due to rising awareness of oral hygiene and the increasing demand for professional veterinary care.

- Growing awareness among pet owners about the risks of dental issues, such as periodontal disease, tooth loss, and systemic infections, is increasing the veterinary clinic visits for regular dental checkups, cleanings, and advanced treatments, strengthening the demand for services.

- The advanced treatments include oral exams, cleanings, polishing, extractions, and radiography, which are essential for diagnosing and managing conditions beyond the scope of at-home care.

- Additionally, veterinary endorsements and expanding pet insurance coverage are further encouraging pet owners to seek routine dental services.

- On the other hand, the product segment is poised to grow at a CAGR of 6% during the forecast period, fueled by rising demand for convenient and non-invasive dental care products. This shift toward natural and organic formulations is also spurring innovation, accelerating product adoption.

Learn more about the key segments shaping this market

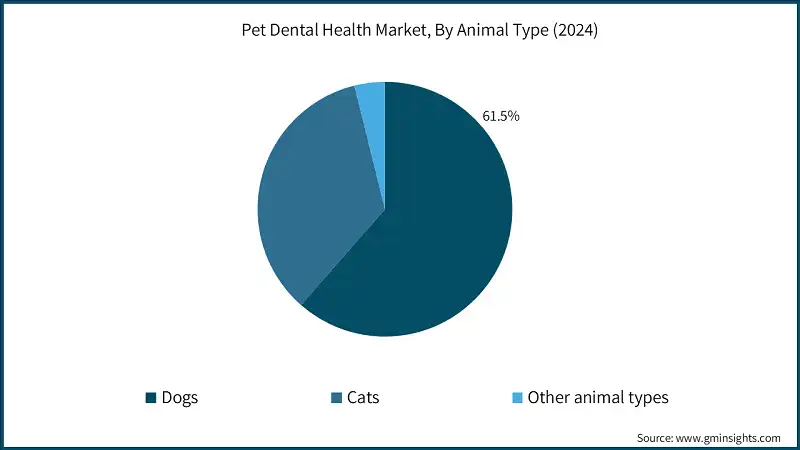

Based on animal type, the pet dental health market is segmented into dogs, cats, and other animal types. The dog segment accounted for the highest market share of 61.5% in 2024 due to a high dog ownership rate and awareness of their oral hygiene.

- Dogs are highly susceptible to dental issues such as plaque buildup, gingivitis, and periodontal disease, which can lead to pain, tooth loss, and systemic health complications if left untreated.

- Recent studies reveal that one in every eight dogs (12.5%) is diagnosed with dental disease annually, and over 80% of dogs aged three and older suffer from active dental disease. These figures highlight the necessity for preventive care and the increasing demand for both professional veterinary services and at-home dental products.

- Moreover, the rising preference among younger generations like Millennials and Gen Z for breed-specific and age-appropriate dental care is fueling demand for natural, vet-recommended, and user-friendly products, enhancing the market prominence of this segment.

- On the other hand, the cats segment is poised to grow at a significant rate of 7%, driven by increasing pet ownership, rising awareness of feline dental health, and the availability of specialized products and treatments tailored to cats’ unique oral care needs.

Looking for region specific data?

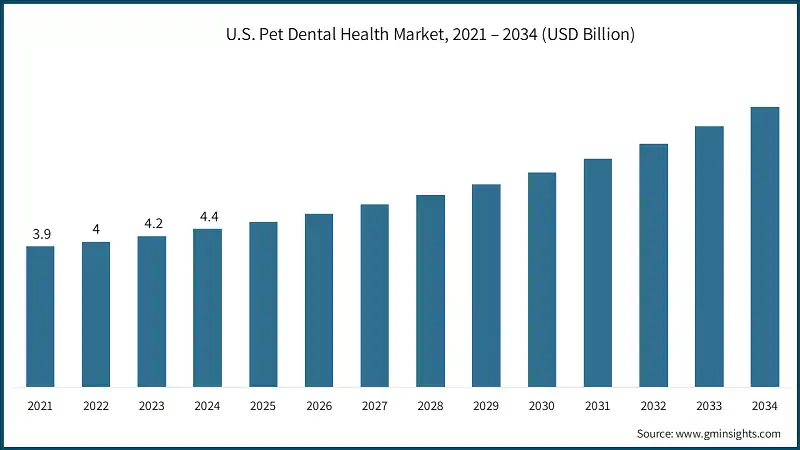

North America Pet Dental Health Market North America dominated the market with the highest market share of 44.9% in 2024. In 2024, the U.S. pet dental health market accounted for USD 4.4 billion in revenue, up from USD 4.2 billion in 2023, and is anticipated to grow at a CAGR of 6% between 2025 and 2034. Europe Pet Dental Health Market Germany is poised to achieve significant growth in the European market. Asia Pacific Pet Dental health Market Asia Pacific is poised to grow at a significant growth rate in the market over the next few years. China is anticipated to grow significantly within the Asia Pacific pet dental health market. Latin America Pet Dental health Market Brazil is projected to witness significant growth in the Latin American market in the coming years. Middle East and Africa Pet Dental health Market Saudi Arabia is anticipated to grow in the Middle East and African market. The market is highly competitive and fragmented, with a mix of established players and emerging brands offering a wide range of products and services. Key companies include Colgate-Palmolive Company (Hill’s Pet Nutrition), Dechra Pharmaceuticals, Purina PetCare (Nestle), Virbac, and Mars (GREENIES), which comprise strong portfolios in dental chews, oral care solutions, and veterinary dental treatments. For instance, Virbac leads in enzymatic toothpaste and dental rinses, while Greenies dominates the dental chew segment with clinically proven efficacy. These players collectively account for a significant portion of the market share, estimated at around 55%. Emerging brands are gaining traction by focusing on natural and organic formulations, responding to growing consumer demand for clean-label pet products. Companies are heavily investing in research and development and digital health integration to strengthen their market positioning. Further, strategic partnerships, product diversification, and the direct-to-consumer (DTC) model are shaping the competitive dynamics and driving long-term growth in the pet dental health sector. A few of the prominent players operating in the pet dental health industry include: Hill’s Pet Nutrition, a Colgate-Palmolive subsidiary, integrates dental health into its therapeutic pet food lines. Its products are vet-recommended and scientifically formulated to reduce plaque and tartar while supporting overall pet wellness. Dechra offers a comprehensive range of veterinary dental solutions, including prescription oral hygiene products and dental kits. Its focus on clinical efficacy and veterinary education strengthens its position in professional pet healthcare markets. Purina leads in consumer-focused dental treats like DentaLife, combining palatability with proven dental benefits. Its strong brand equity, retail presence, and investment in pet wellness research drive its competitive edge.Pet Dental Health Market Share

Pet Dental Health Market Companies

Virbac specializes in veterinary-exclusive dental care products, offering enzymatic toothpaste, dental chews, and rinses backed by clinical research. Its strong global distribution and vet partnerships make it a trusted brand among professionals and pet owners.Pet Dental Health Industry News:

The pet dental health market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Billion from 2021 - 2034 for the following segments:

Market, By Type

- Service

- By service type

- Treatment

- Diagnosis

- By end use

- Veterinary clinics

- Veterinary hospitals

- By service type

- Product

- By product type

- Dental chews and treats

- Oral care solutions

- Toothpastes and brushes

- Dental spray

- Other product types

- By distribution channel

- Retail pharmacies

- Online pharmacies

- Pet stores

- Other distribution channels

- By product type

Market, By Animal Type

- Dogs

- Cats

- Other animal types

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the pet dental health market?

Key players include Colgate-Palmolive (Hill’s Pet Nutrition), Dechra Pharmaceuticals, Purina PetCare (Nestle), Virbac, Mars (GREENIES), Vetoquinol, Boehringer Ingelheim, Ceva Santé Animale, TropiClean Pet Products, PetDine, and BarkBox.

What are the upcoming trends in the pet dental health industry?

Key trends include adoption of natural and organic oral care products, AI-powered pet dental monitoring tools, subscription-based dental kits, and growing e-commerce distribution of pet dental solutions.

Which region leads the pet dental health market?

North America led the market with 44.9% share in 2024, valued at USD 4.4 billion, supported by high pet ownership, strong veterinary infrastructure, and rising consumer spending on pet care.

What was the valuation of the dog segment?

The dog segment accounted for 61.5% share in 2024, supported by high dog ownership rates, rising incidence of periodontal disease, and growing demand for preventive and at-home oral care products.

What is the projected size of the pet dental health industry in 2025?

The pet dental health market is expected to reach USD 11.4 billion in 2025.

How much revenue did the services segment generate?

The services segment generated USD 6.7 billion in 2024 and is projected to exceed USD 12.9 billion by 2034, driven by rising demand for dental checkups, cleanings, and advanced veterinary treatments.

What is the projected value of the pet dental health market by 2034?

The market is expected to reach USD 20.2 billion by 2034, fueled by innovations in dental chews, enzymatic toothpaste, microbiome-friendly solutions, and the expansion of veterinary dental services.

What is the market size of the pet dental health in 2024?

The market size was USD 10.8 billion in 2024, with a CAGR of 6.6% expected through 2034 driven by rising awareness of preventive oral care, increasing pet humanization, and higher spending on pet wellness.

Pet Dental Health Market Scope

Related Reports