Summary

Table of Content

Packaging Machinery Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Packaging Machinery Market Size

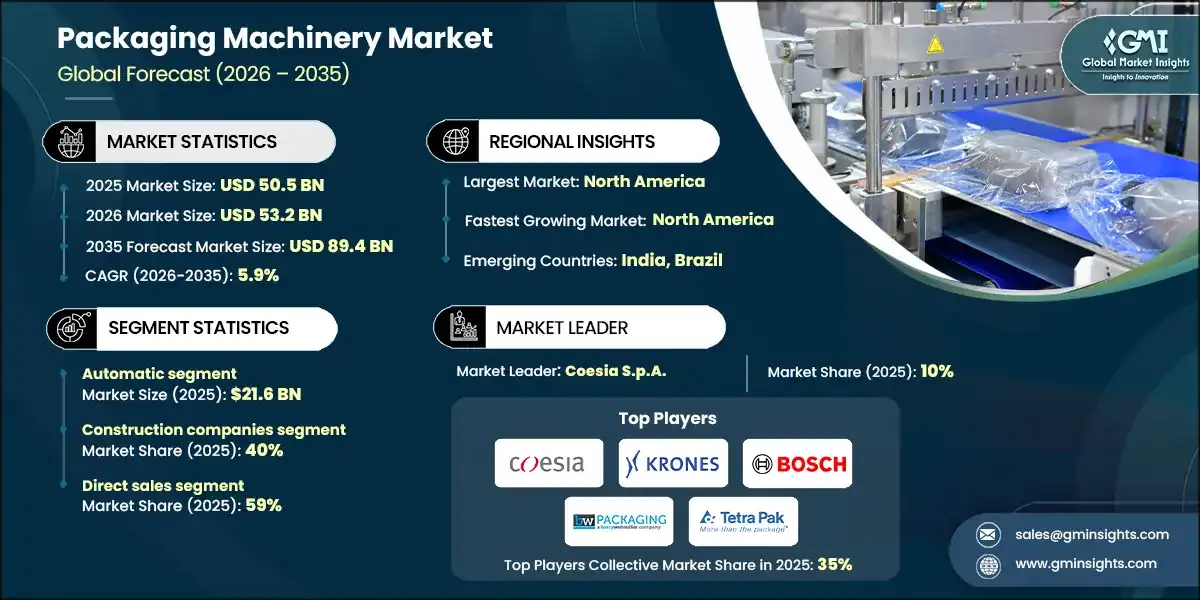

The global packaging machinery market was estimated at USD 50.5 billion in 2025. The market is expected to grow from USD 53.2 billion in 2026 to USD 89.4 billion in 2035, at a CAGR of 5.9% according to latest report published by Global Market Insights Inc.

To get key market trends

The packaging machinery market is fundamentally changing to accommodate the continuing evolution of manufacturing and distribution today. The demand for companies to produce higher-quality products in a shorter period, as well as with greater security and less environmental impact, is greater than at any time in history, and packaging machinery has an impact on every one of these processes (as well as others). Businesses relying upon automated systems will continue to do so because these systems provide excellent levels of accuracy, hygiene, and compliance with international standards, and they can wrap and seal products.

Packaging machinery manufacturers are concentrating on redesigning their machinery and systems to implement smarter machines (increased machinery incorporates (sensor) technology and digital controls to reduce machine downtime and to maximize speed and efficiency), and sustainability is a core value proposition (not an option) of the current packaging machinery sector. Manufacturers are developing machines and systems that are specifically designed to process sustainable materials, and manufacturers are redesigning their machines to minimize excess waste, which is happening in response to increased demand for greener products.

The ability to customize products has become more crucial for brands seeking to differentiate themselves in competitive retail environments and to build customer loyalty. Packaging machinery suppliers are therefore being pressured to offer flexible, configurable systems that can accommodate many different products, as well as many different formats, while providing high levels of output and without compromising the speed of operation. With the explosion of online shopping, online businesses are placing high demands on their suppliers to develop machinery that provides effective protection to the freight being shipped while minimizing costs.

Packaging Machinery Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 50.5 Billion |

| Market Size in 2026 | USD 53.2 Billion |

| Forecast Period 2026 - 2035 CAGR | 5.9% |

| Market Size in 2035 | USD 89.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising Demand for Automation and Efficiency | Manufacturers are increasingly adopting automated packaging machinery to improve production speed, reduce labor dependency, and ensure consistent quality. |

| Growth of E-Commerce and Consumer Packaged Goods (CPG) | The surge in online retail and changing consumer preferences for convenient, sustainable packaging formats are driving investments in advanced packaging solutions that can handle diverse product sizes and materials efficiently. |

| Technological Advancements and Smart Packaging Integration | Innovations such as IoT-enabled machines, robotics, and AI-driven predictive maintenance are enhancing operational efficiency, reducing downtime, and enabling real-time monitoring, making automated systems more attractive to manufacturers. |

| Pitfalls & Challenges | Impact |

| High Initial Capital Investment | Automated and advanced packaging machinery requires significant upfront costs, which can be a barrier for small and medium-sized enterprises (SMEs) with limited budgets. |

| Complexity in Maintenance and Skilled Workforce Shortage | Advanced systems demand specialized technical expertise for installation, operation, and maintenance. The shortage of skilled labor and training requirements can slow adoption in certain regions. |

| Opportunities: | Impact |

| Sustainability and Eco-Friendly Packaging Solutions | Growing environmental concerns and regulatory pressures are creating opportunities for machinery that supports recyclable materials, reduces waste, and optimizes energy consumption. |

| Expansion in Developing Economies | Rapid industrialization and urbanization in Asia-Pacific, Latin America, and Africa are fueling demand for modern packaging solutions, offering significant growth potential for manufacturers targeting these regions. |

| Market Leaders (2025) | |

| Market Leaders |

10% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | North America |

| Emerging countries | India, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Packaging Machinery Market Trends

The global packaging machinery industry is under significant change as consumer demands continue to show variance, technologies are continuously developing, and regulatory pressures mount. This dynamic landscape requires continuous innovation from manufacturers to deliver efficient, flexible, and sustainable solutions. These key trends are crucial to understand for stakeholders navigating this marketplace's future direction.

- Increasingly automated and robotic processes: process automation involves reducing human involvement in the creation of products by using automated machinery to perform monotonous, repetitive tasks, such as picking, placing and palletizing for manufacturers. Speeding up production time and reducing labor costs while providing an improved uniform and consistent working environment is the goal of automation and robotics integration.

- Cultural and environmental focus: the increased awareness of the environment and a growing number of legislative initiatives being introduced into the marketplace are prompting producers to invest in developing machinery capable of handling recyclable, biodegradable and/or compostable materials.

- The trend of smart packaging and IoT connectivity growth: the trend of using IoT sensors in packaging machinery allows for real-time monitoring and data collection, thus creating an opportunity for predictive maintenance, optimizing machinery performance, and providing an early warning for the detection of faults.

- The increased demand for flexibility and personalization to respond to current market trends; packaging machinery should easily adapt to different product sizes, shapes, and packaging formats. Flexible packaging can be used for small production runs, fast switching of product types and variations in packaging for personalized options in meeting the needs of diverse markets.

- The adoption of industry 4.0 and digitalization; the introduction of industry 4.0 is the use of advanced technologies such as artificial intelligence (ai), machine learning, and cloud computing to create a better way to package products.

Packaging Machinery Market Analysis

Learn more about the key segments shaping this market

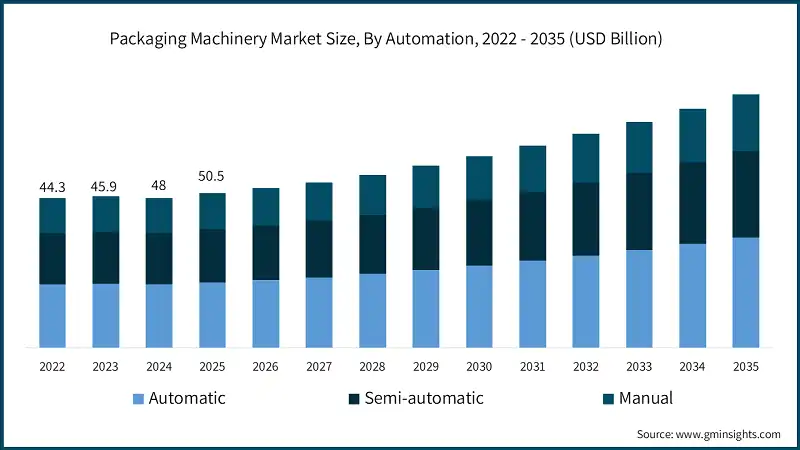

Based on automation, the market is divided into automatic, semi-automatic, and manual. In 2025, automatic held the major market share, generating a revenue of USD 21.6 billion.

- Automation minimizes human errors and therefore greatly reduces the chances of making an error. The consistency provided by automation gives companies that are involved with food and pharmaceuticals higher levels of compliance and hygiene.

- Automation allows companies to manufacture in bulk, as well as diversify packaging configurations to meet the growing consumer demands of today while providing a competitive advantage in lead time delivery.

- The combination of advanced technology such as IoT, robotics, and artificial intelligence is fueling the accelerated demand for the automated packaging machinery industry by providing predictive maintenance, real-time monitoring and data-driven optimalization methods to allow for significant decreases in operational costs over time. They also provide a higher degree of overall equipment effectiveness; therefore, automation has proven to be a cost-effective solution to many businesses.

- Labor shortages and the associated increase in wage costs continue to create an impetus for automation in many locations. As a result, businesses are implementing automated systems as part of a long-term strategy to ensure that they have a solution to their labor challenges by continually providing preferred productivity and operational efficiency. This is especially true in areas where there is an influx of demographic change.

Learn more about the key segments shaping this market

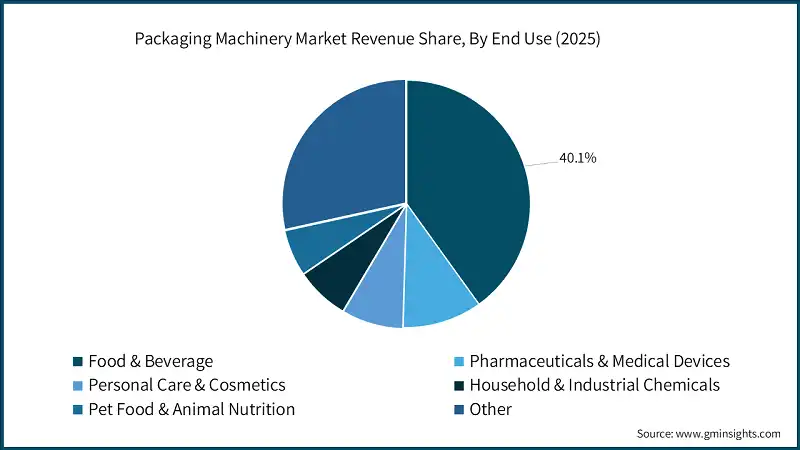

Based on end user, the packaging machinery market is segmented into food and beverage, pharmaceuticals and medical devices, personal care and cosmetics, household, industrial and agricultural chemicals, pet food and animal nutrition and others. The construction companies segment held the largest share, accounting for 40% of the global market in 2025.

- The food and beverage industry dominates the global packaging machinery market since these industries are characterized by high volumes of production along with strict hygiene requirements. Driven by a growing appetite for snacks, ready-to-eat meals, and beverages, including e-commerce and retail growth, investments keep pouring in for high-speed automated packaging systems to improve operational efficiency without compromising regulatory standards.

- The segment of pharmaceuticals and medical devices shows tremendous growth. This growth will be attributed to the increase in healthcare needs, aging population, and tough regulatory compliances. The sterile, tamper-proof, and traceable packaging demand for products, such as tablets, injectables, and medical devices, has escalated and favored the entry of advanced technologies by manufacturing companies.

- Technologies of aseptic packaging and serialization in the pharmaceuticals and medical device industry are increasingly being adopted, as they assure safety, retain the integrity of a product, and improve quality assurance. Such advancement in technology is taken seriously by manufacturers to be compliant with regulatory bodies and customer safety concerns.

- Overall, the overall packaging machinery market is evolving to meet diversified requirements across industries. Though the food and beverage segment continues to dominate, the rapid growth of the pharmaceutical and medical devices segment underlines that innovation and compliance are major driving forces in the market.

Based on the distribution channel, the market is segmented into direct sales and indirect sales. In 2025, direct sales dominate the market with the highest share of 59%.

- Direct sales capture much of the market and grow more rapidly due to their ability to facilitate close relationships between packaging machinery manufacturers and big CPG companies, medium-sized manufacturers, and co-packers. Direct engagement ensures better customization, faster responses, and tailored solutions-expected in high-volume operations for which efficiency and reliability are vital.

- Direct sales allow manufacturers to capture higher margins, but more importantly, to control pricing, service quality, and after-sales support. This also helps them provide consistent services while addressing client-specific needs and thereby gaining trust for a long-term relationship.

- In addition, direct sales will accommodate the integration of advanced technologies such as IoT and automation. In consultation with clients, manufacturers can apply smart systems to improve operational efficiencies and high productivity. Such an approach ensures that machinery matches the peculiar needs of a client to drive innovation and performance.

- With the demand for customized and high-performance machinery still on the rise, direct sales remain the preferred channel to secure strategic partnerships. This model supports the growth of manufacturers by meeting changing market needs but positions them for sustained growth through deeper client relationships and tailored solutions.

Looking for region specific data?

North America Packaging Machinery Market

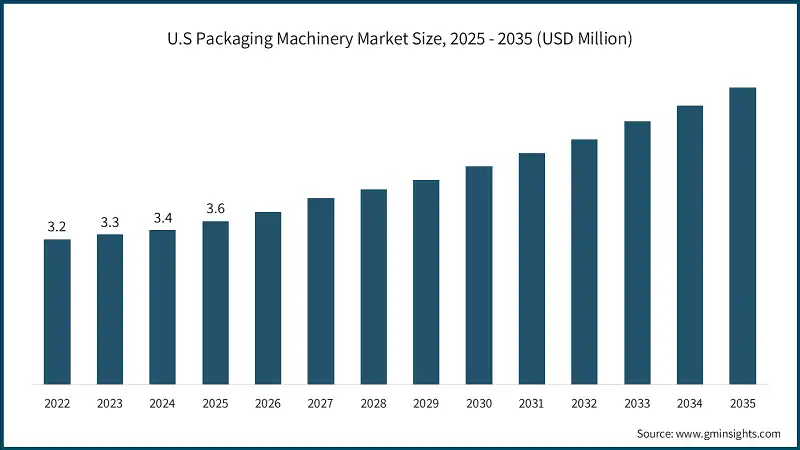

In 2025, the U.S. dominated the North America market, accounting for around 71% and generating around USD 12.6 billion revenue in the same year.

- North America accounts for the largest market share of packaging machinery in the world, mainly due to advanced manufacturing infrastructure and the significantly high degree of automation.

- This region has most of the leading players that invest intensively in smart technologies, thus ensuring that regulations are met concerning efficient, hygienic, and sustainable packaging solutions. E-commerce and food & beverages sectors also have increased growth and drive the demand for automated and high-speed systems.

- The United States is pivotal in the dominance of North America, given its strong focus on technological advancements and innovations. The organizations operating in the region are increasingly considering the industry 4.0 manufacturing concept and hence integrating IoT and AI into the packaging machinery to ensure higher productivity with lower operation costs. This trend is set to continue driving the growth in the market during the forecast period.

Europe Packaging Machinery Market

Europe market, Germany leads the market with 22% share in 2024 and is expected to grow at 5.8% during the forecast period.

- Europe represents the second-largest segment of the worldwide packaging machinery industry, primarily because of Europe's dedication to sustainable development, and innovation. Environmental regulations throughout Europe are becoming more rigid, and consumers in Europe continue to ask for additional eco-friendly products. As a result, both factors continue to push many packaging manufacturers towards producing energy-efficient packaging machines, along with packaging materials that can be readily recycled.

- The pharmaceutical and luxury goods industries represent two of the greatest drivers of growth in the European region's high-tech packaging machinery marketplace.

- Germany and Italy are the two European countries that have contributed heavily to the current state of the European market due to their renowned engineering and machine manufacturing expertise. Both countries lead the pack in the development of innovative and advanced packaging machinery for numerous industries, while adhering to the sustainable development requirements of customers.

Asia Pacific Packaging Machinery Market

The Asia Pacific leads the market China holds a market share of around 34% in 2024 and is anticipated to grow with a CAGR of around 6%from 2025 to 2034.

- The Asia-pacific region leads the world in terms of market share for packaging machinery, primarily due to the industrialization of the region, the rapid growth of e-commerce, and the rapidly increasing demand for packaging machinery from the food, beverage, and pharmaceutical sectors.

- China and India are two examples of the major contributors to the growth of Asia-Pacific packaging machinery, due to their enormous population and their governments' efforts to support manufacturing, automation, and export-driven industries. The availability of low-cost manufacturing operations, highly skilled work forces, and a growing consumer base are all factors that continue to support the expansion of advanced packaging solutions throughout Asia-pacific.

- The Asia-pacific region will remain the largest market for high-tech packaging equipment in the world because of continuing strong economic growth, increasing levels of foreign direct investment, increasing emphasis on smart manufacturing technology, and strong demand for innovative and advanced packaging equipment.

Packaging Machinery Market Share

Caterpillar is leading with 10% market share. Coesia S.p.A., Krones AG, Robert Bosch Packaging Technology, Barry-Wehmiller (BW Packaging), and Tetra Pak International S.A. collectively hold around 35%, indicating moderately fragmented market concentration. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- Coesia develops and manufactures an extensive range of industrial and packaging solutions, including automatic machines for consumer goods, healthcare, and aerospace.

- Krones specializes in machine manufacturing for bottling and packaging of beverages and liquid foodstuffs. Its strong presence across the entire value chain, from processing through to packaging, makes it a very important partner for big beverage manufacturers. Their continuous innovations in the fields of efficiency and sustainability ensure the leading market role.

- Bosch Packaging Technology: A leading global supplier of process and packaging technology, though spun off today as Syntegon Technology, its legacy and ongoing innovation in pharmaceutical and food packaging remain a driver in the market. Syntegon continues to hold a formidable position in the market with its premium, reliable, and intelligent solutions for sensitive product handling.

Packaging Machinery Market Companies

Major players operating in the packaging machinery industry are:

- Coesia S.p.A.

- Krones AG

- Robert Bosch Packaging Technology

- Barry-Wehmiller (BW Packaging)

- Tetra Pak International S.A.

- MULTIVAC Sepp Haggenmüller SE & Co. KG

- Rovema GmbH

- Ilapak International SA

- Fres-co System USA, Inc.

- Ishida Co., Ltd.

- Yamato Scale Co., Ltd.

- ENGEL Holding GmbH

- KraussMaffei Group GmbH

- ARBURG GmbH + Co KG

- Sumitomo Heavy Industries Ltd.

- JSW Plastics Machinery Co., Ltd.

BW Packaging is part of Barry-Wehmiller and has several of the top brands for packaging machinery. It offers a full range of packaging solutions for primary, secondary, and tertiary levels of packaging, and it can do this in many different industries, making BW Packaging a significant player in the packaging market.

Tetra Pak is the world's leading company in providing food processing and packaging solutions, especially through its use of aseptic carton packaging. They are in a strong position by offering complete integrated systems that guarantee food safety, extend shelf lives, and reduce the negative impact of liquid food and beverage products on the environment. Tetra Pak's complete solution is offered across the globe to an enormous market.

Packaging Machinery Industry News

- In March 2025, ULMA Packaging opened a new USD 12.5 million, 10,000 m² production facility specializing in automation solutions for complete packaging lines and turnkey systems across primary, secondary, and tertiary packaging. This is going to help the company in responding to sustained demand for automated packaging, expanding production capacity, enabling pre-shipment system integration/optimization, and positioning as a strategic partner in packaging process automation

- In July 2024, MULTIVAC Group acquired an 80% majority stake in Italianpack, an Italian automatic and semi-automatic packaging machine manufacturer based in Como. This is going to help the company in expanding its portfolio in tray sealers (lower and mid-price segments), fillers, and peripheral equipment while leveraging Italianpack's established dealer network.

- In April 2024, SIG launched the SIG Prime 55 In-Line Aseptic, featuring innovative in-line pouch sterilization technology adapted from aseptic carton systems, delivering >log 5 microbial reduction. This is going to help the company in eliminating third-party pre-sterilization, reducing supply-chain complexity and production costs, and enabling conversion from retorted formats to aseptic spouted pouches.

- In April 2024, Bühler and Premier Tech launched CHRONOS OMP-2090 B, a fully automatic open-mouth bagging station achieving ±50g accuracy and up to 900 bags/hour capacity. This is going to help the companies in increasing packaging productivity and safety for mills and food/feed markets globally, excluding US, Canada, and EU member states.

- In September 2024, MULTIVAC announced a USD 100 million investment to build Factory 2 at its Wolfertschwenden, Germany headquarters, featuring 35,000 m² floor area for manufacturing and logistics. This is going to help the company in relieving capacity constraints, accommodating growth in slicer and turnkey line business, centralizing spare-parts logistics, and addressing labor shortages through automation.

The packaging machinery market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2022 to 2035, for the following segments:

Market, By Equipment Type

- Filling & dosing equipment

- Volumetric fillers

- Gravimetric fillers

- Liquid fillers

- Powder fillers

- Bagging & flexible packaging equipment

- Vertical form-fill-seal (vffs)

- Horizontal form-fill-seal (hffs)

- Pre-made bag filling & sealing

- Pouch making & filling

- Product wrapping equipment

- Cartoning, case packing & multipacking equipment

- Horizontal cartoners

- Vertical cartoners

- Wraparound case packers

- Tray formers

- Shrink bundlers and multipack wrappers

- Labeling, coding & marking equipment

- Pressure-sensitive labelers

- Hot-melt and cold-glue labelers

- Sleeve labelers

- Inkjet and laser coders

- Thermal transfer printers

- Palletizing & end-of-line equipment

- Robotic palletizers

- Conventional palletizers

- Pallet stretch wrappers

- Pallet shrink wrappers

- Strapping machines

- Case sealers

- Conveying, feeding & handling equipment

- Belt and roller conveyors

- Accumulation tables

- Product feeders and sorters

- Robotic pick-and-place

- Inspection & quality control equipment

- Checkweighers

- Metal detectors and x-ray inspection

- Vision inspection systems

- Leak testers

- Capping & closing equipment

- Screw cappers

- Snap cappers and crimpers

- Seamers and induction sealers

- Bulk bag & fibc handling equipment

- Bulk bag fillers

- Fibc dischargers

- Other equipment types

- Blister packaging machines

- Bottle blowing and molding

- Aseptic packaging system

Market, By Automation

- Manual

- Semi-automatic

- Fully automatic

Market, By End Use Industry

- Food & beverage

- Fresh & frozen foods

- Dry foods & snacks

- Beverages

- Dairy

- Pharmaceuticals & medical devices

- Tablets and capsules

- Injectables and biologics

- Medical devices and diagnostics

- Nutraceuticals

- Personal care & cosmetics

- Skincare and haircare

- Cosmetics and color

- Toiletries and hygiene products

- Household, industrial & agricultural chemicals

- Detergents and cleaners

- Fertilizers and pesticides

- Industrial chemicals

- Pet food & animal nutrition

- Dry pet food

- Wet pet food

- Treats and supplements

- Animal feed

- Others

Market, By Distribution Channel

- Direct sales

- Indirect sales

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the packaging machinery market?

Key players include Coesia S.p.A., Krones AG, Robert Bosch Packaging Technology (Syntegon), Barry-Wehmiller (BW Packaging), Tetra Pak International S.A., MULTIVAC, Ilapak, and Ishida. These companies focus on automation, digitalization, and sustainable packaging innovations to strengthen their market position.

What are the key trends shaping the packaging machinery industry?

Major trends include increased automation and robotics, IoT-enabled smart packaging machinery, Industry 4.0 adoption, demand for flexible and customizable systems, and growing focus on eco-friendly and energy-efficient packaging solutions.

Which region leads the packaging machinery market?

North America leads the global market, with the U.S. generating around USD 12.6 billion in revenue in 2025 and accounting for approximately 71% of the regional share. Advanced manufacturing infrastructure and high automation adoption drive regional dominance.

How much revenue did the automatic packaging machinery segment generate in 2025?

The automatic packaging machinery segment generated USD 21.6 billion in 2025, holding the largest share by automation type. Strong demand for high-speed, error-free, and hygienic packaging solutions is driving adoption.

What is the packaging machinery market size in 2025?

The global market size for packaging machinery is valued at USD 50.5 billion in 2025. Rising demand for automation, efficiency, and compliance across food, beverage, pharmaceutical, and consumer goods manufacturing is supporting market expansion.

What is the projected value of the packaging machinery market by 2035?

The market size for packaging machinery is expected to reach USD 89.4 billion by 2035, growing at a CAGR of 5.9% from 2026 to 2035. Growth is fueled by e-commerce expansion, Industry 4.0 adoption, and sustainability-focused machinery upgrades.

What is the market size of the packaging machinery industry in 2026?

The market size for packaging machinery reached USD 53.2 billion in 2026, reflecting steady growth driven by increased investments in automated and smart packaging systems.

Packaging Machinery Market Scope

Related Reports