Summary

Table of Content

Overhead Conductor Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

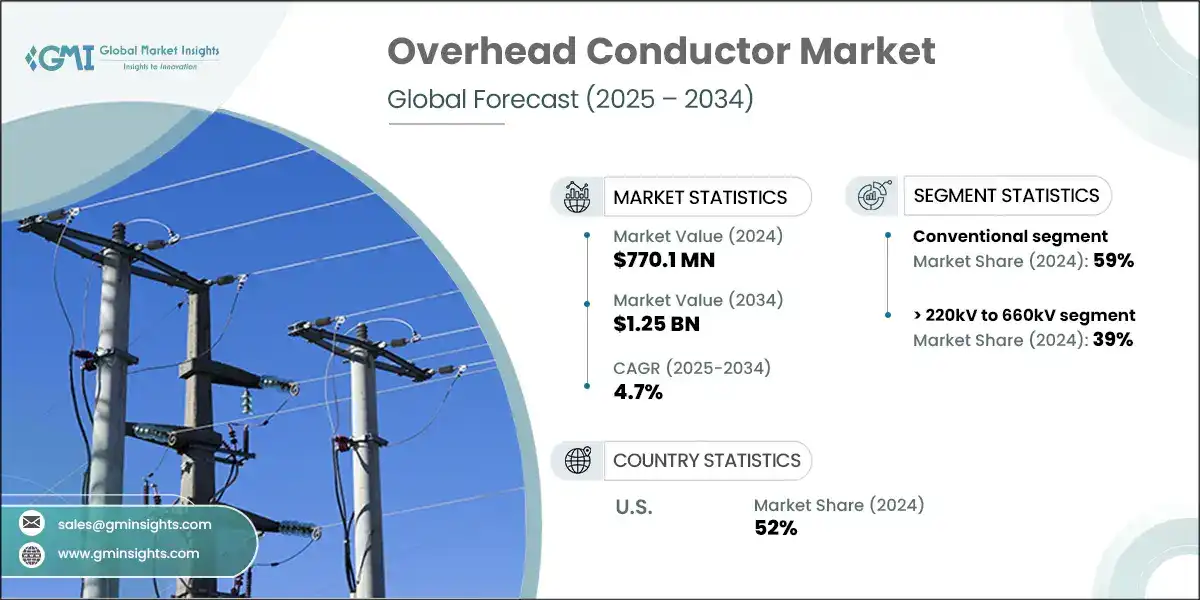

Overhead Conductor Market Size

The global overhead conductor market was valued at USD 770.1 million in 2024. The market is expected to grow from USD 829.1 million in 2025 to USD 1.25 billion by 2034, at a CAGR of 4.7%.

To get key market trends

- Continuous & exponential increase in electricity demand driven by rapid urbanization, industrial growth and expanding technological infrastructure is influencing market growth. Developing economies are witnessing significant growth in power consumption due to increasing population and development of energy intensive sectors including data centers, transportation and manufacturing.

- For instance, in June 2025, India’s total installed power capacity reached 476 GW. According to the International Energy Agency (IEA), 85% of the increase in global electricity will come from emerging and developing economies. Overhead conductors play a critical role in high voltage transmission lines, which is essential for transporting electricity over long distances with minimal losses.

- National grid is lessening the gap between power generation sources and consumption centers the need for efficient, cost effective and high-capacity conductors has become of utmost importance. Public private partnerships have emerged as a strategic tool for governments to develop transmission infrastructure while ensuring technological efficiency and financial sustainability. For instance, in September 2024, DOE has initiated a USD 2.5 billion transmission facilitation program that will build out new interregional transmission line across the U.S.

- Various countries are facing problems with aging infrastructure which are unable to meet the current standards of reliability and capacity. To address these challenges utilities and governments are coming up with programs to upgrade or replace those infrastructures. For instance, in June 2025, SSEN’s Skye reinforcement project was approved worth USD 563 million for replacing 160km of old overhead powerline from Skye to Fort Augustus, Scotland.

- Technological innovations in the market with the use of new materials, construction techniques and grid enhancing tools are boosting the capacity of the overhead conductors. For instance, in June 2025, LineVision’s Line Rating (DLR) technology has been installed in National Grid, England which will increase the capacity of over 275 km of overhead line conductor.

- Asia-Pacific is experiencing significant growth in the overhead conductor market. This growth is driven by a global shift towards cleaner and the need of sustainable energy sources which has led to increase in the development of renewable energy projects including wind parks, solar farms, and hydroelectric stations across the region. For illustration, in May 2024, State Grid Corporation of China (SGCC) approved and investment of USD 33 million for a power transmission and storage project meant to improve the energy infrastructure in Qinghai Province of the country.

- North America is witnessing rapid growth due to increasing energy demand and renewable energy integration, with the Aluminum conductor composite core (ACCC) conductor gaining traction for its superior performance. For instance, in 2023, in an agreement with Invenergy, Prysmian supplied up to 12,500 miles of overhead conductor to support Grain Belt Express transmission project in the U.S.

Overhead Conductor Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 770.1 Million |

| Forecast Period 2025 – 2034 CAGR | 4.7% |

| Market Size in 2034 | USD 1.25 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Refurbishment & retrofitting of existing grid infrastructure | Power utilities are now adopting the approach of 3R’s- repair, refurbish, and retrofit to extend the lifecycle of assets and minimize environmental impact. |

| Increasing peak load demand | Demand for electricity across various sectors leads to peak demand. This impacts the grid stability causing power outages and blackouts. |

| Expansion of smart grid infrastructure | Smart grid infrastructure will integrate new technologies like automation and real time data analytics into the traditional system. |

| Pitfalls & Challenges | Impact |

| Dependency on imports | Import dependence exposes the market to a range of risks which include fluctuating exchange rates, supply chain disruption, and trade restrictions. |

| Opportunities: | Impact |

| Adoption of smart grid technologies | Global efforts to reduce the greenhouse effect and steps towards adoption of renewable energy technologies are being made. |

| Infrastructure development | Rising urbanization, industrialization and need to expand and modernize the existing grid. |

| Optimizing existing capacity | Aging transmission infrastructure in developed economies is opening a vast market for reconductoring projects. |

| Market Leaders (2024) | |

| Market Leaders |

12% market share |

| Top Players |

Collective market share in 2024 is 30% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Emerging Country | U.S., China, India, Saudi Arabia, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Overhead Conductor Market Trends

- The global market for overhead conductor is witnessing a notable transformation which is driven by rising energy needs, technological advancements, and policy led infrastructural development. Growing Preference for high performance conductors including high temperature low sag, composite core and other advanced variants of these overhead conductors are in high demand, thereby further influencing the industry dynamics.

- Utilities around the world are increasingly adopting these conductors to upgrade existing transmission lines without modifying the tower structure therefore saving cost and accelerating project timelines. For instance, in April 2025, in India, APAR Industries decided to collaborate with Maharashtra State Electricity Transmission Company Limited (MSETCL) in upgradation of 400kV Kalwa-Padgha line to enhance Mumbai’s power network.

- Climate related risks including wildfires, storms, and heatwaves in major parts of North America and Europe have become more frequent, prioritizing conductor technologies that can withstand extreme conditions. These include fire resistant coatings, corrosion-resistant material and conductors with enhanced thermal limits.

- For illustration, in June and July 2025, Europe experience a heatwave which led to a rise in demand for electricity. Power systems faced difficulties owing to heatwaves and outages in thermal power plants. These incidents in future will demand proactive grid operator planning, thereby reflecting a growing emphasis on grid resilience and disaster preparedness.

- Shifting focus of utilities & transmission developers from low CAPEX to total lifecycle cost optimization is increasing the installation of overhead conductors, especially across developed regions. Advanced overhead conductors will have a higher upfront cost compared to conventional ACSR types, but they deliver long-term savings through reduced energy losses, lower maintenance costs and fewer reconductoring needs.

- For Instance, recently in Europe, RIIO, an Ofgem’s regulatory framework which allows National Grid Electricity Transmission to earn revenue from incentives, innovation and outputs which motivates the transmission companies to focus on total lifecycle cost optimization.

- Global supply chain disruptions and quality related risks are the major issues painful for the utilities and to mitigate these risks, the utilities are adopting vertical integration by either setting up their own conductor manufacturing units or forming long term partnerships with OEMs. This will assist utilities in reducing the costs associated with sourcing raw material, transportation and processing thus resulting in improved quality, reliable supply chain and increased profitability.

- Utilities are and governments preferring conductors manufactured with recycled aluminum to align with ESG goals. Companies adopting cleaner manufacturing practices are gaining a competitive edge over the other companies. For instance, in October 2024, Nexans committed to scope 1&2 reduction by 2030, which in turn will lead in creating a long-term sustainable electrification solution while contributing to fight against climate change.

- Extensive R&D in carbon fiber composite core with hybrid conductors including aluminum-zirconium alloys promise high strength to weight ratio, lower sag and extended life in volatile weather zones and a replacement to traditional aluminum conductor steel reinforced conductors.

Overhead Conductor Market Analysis

Learn more about the key segments shaping this market

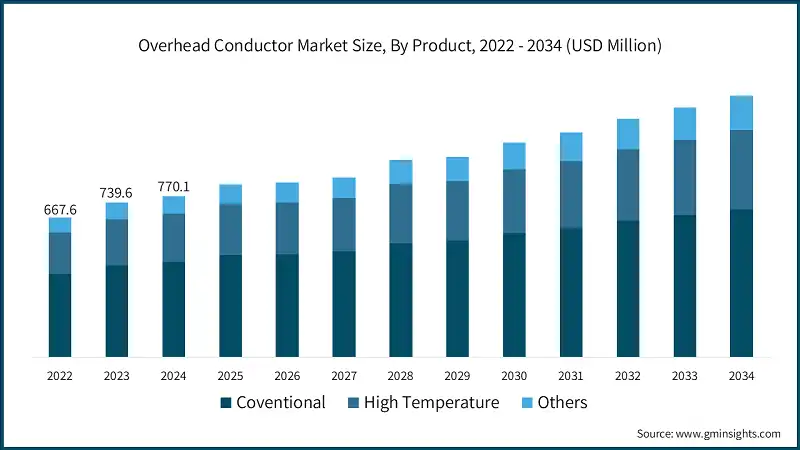

- Based on product, the market is segmented into conventional, high temperature, and others. The conventional overhead conductor dominated the 59% market share in 2024 and will grow at a CAGR of 4.2% through 2034. Conventional overhead conductors are of various types including ACSR, AAAC, ACAR, AACSR and AAC that are widely used due to their reliability and cost effectiveness.

- ACSR (Aluminum Conductor Steel Reinforced) type of conventional conductor will grow at a CAGR of 3.8% by 2034 and remain the most widely deployed due to combination of high tensile strength and good electrical conductivity. AAAC on the other hand offers superior corrosion resistance and is preferred in industrial and coastal areas.

- The All-Aluminum Alloy Conductors (AAAC) industry will grow at a CAGR of 3.5% through 2034, driven by their superior mechanical strength, corrosion resistance, and lighter weight compared to traditional ACSR conductors. AAAC conductors are increasingly preferred in coastal and industrial regions where environmental conditions demand durable materials. Their use is expanding in medium to high voltage transmission lines, especially in countries investing in grid reliability and modernization.

- The market for All Aluminum Conductors (AAC) is witnessing steady growth, driven by increasing demand for efficient and cost-effective transmission solutions in urban and short-span applications. AAC conductors are favored for their high conductivity, lightweight structure, and ease of installation, making them ideal for low and medium voltage overhead lines, especially in densely populated regions.

- High temperature conductors will showcase 4.8% CAGR till 2034. These types of overhead conductors are gaining traction owing to growing demand for increased capacity, efficiency and grid reliability. Unlike conventional conductors, High Temperature Low Sag (HTLS) variants are engineered to operate at 150ºC to 250 ºC, without compromising its electrical performance. These features make it ideal for environment with fluctuating loads and harsh climatic conditions.

- Based on rated strength the market is segmented into high strength, extra high strength and ultra-high strength. Ultra-high strength segment is expected to showcase a 5.5% CAGR till 2034. These conductors are engineered to minimize sag, endure extreme thermal and mechanical stress and operate at higher currents. High strength conductors offer a balance between mechanical strength and cost and are suitable for standard transmission applications where mechanical stress is moderate.

- The high strength overhead conductor market is witnessing robust growth driven by the global push for grid modernization, renewable energy integration, and infrastructure upgrades. Additionally, innovations in lightweight materials and corrosion-resistant designs are enhancing performance and reducing maintenance costs, making high strength conductors a strategic choice for future-ready power infrastructure.

Learn more about the key segments shaping this market

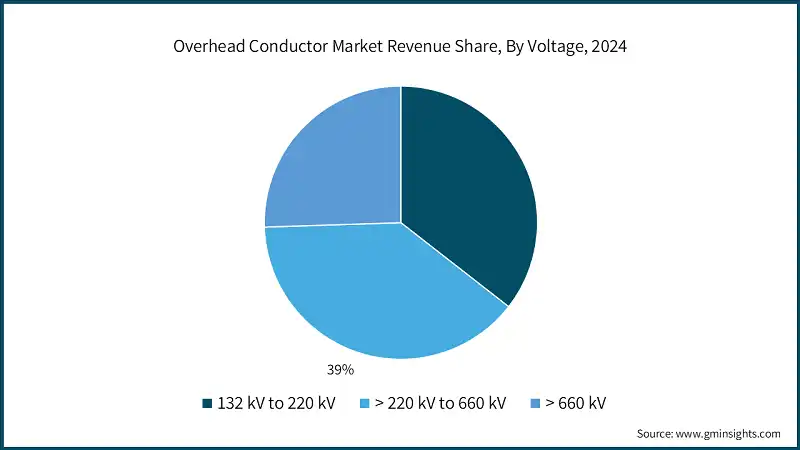

- Based on voltage the market is segmented into 132kV to 220kV, > 220kV to 660kV and > 660kV. The > 220kV to 660kV voltage overhead conductor dominated the market with 39% share in 2024 and is expected to grow at a CAGR of 4.7% from 2025 to 2034.

- The growth of the business will be aided by a surge in electricity needs from industrial operations and the increasing erection of extra high tension electrical transmission grids for the mining, oil, and gas industries. As electricity demand surges across industrial and residential sectors, utilities are increasingly adopting high-voltage conductors capable of withstanding extreme mechanical stress and environmental conditions.

- The 132kV to 220kV segment will grow at a CAGR of 4% through 2034 and play a critical role in regional power transmission and sub-transmission networks. This segment is vital in countries which are undergoing grid expansion, industrial development and rural electrification. Conventional conductors are widely used in this segment due to their established performance, local availability and lower costs.

- Based on current the market is segmented into HVAC (High Voltage Alternating Current) and HVDC (High Voltage Direct Current) and HVAC are the most widely used form of power transmission across the world owing to a well-established grid integration and three phase transmission ensuring power balance and reliability.

- Based on applications, the overhead conductor market is segmented into high tension, extra-high tension and ultra-high tension. The extra high-tension overhead conductors lead with a market share of 36% in 2024 and is expected to grow at a CAGR of over 4% from 2025 to 2034.

- Extra high tension overhead conductors’ range between 220kV to 400kV and serve as an integral infrastructure for interregional power transmission networks, enabling bulk power transfers over long distances with minimal losses. They support the national grid framework by linking regional grids and enabling real time load balancing.

Looking for region specific data?

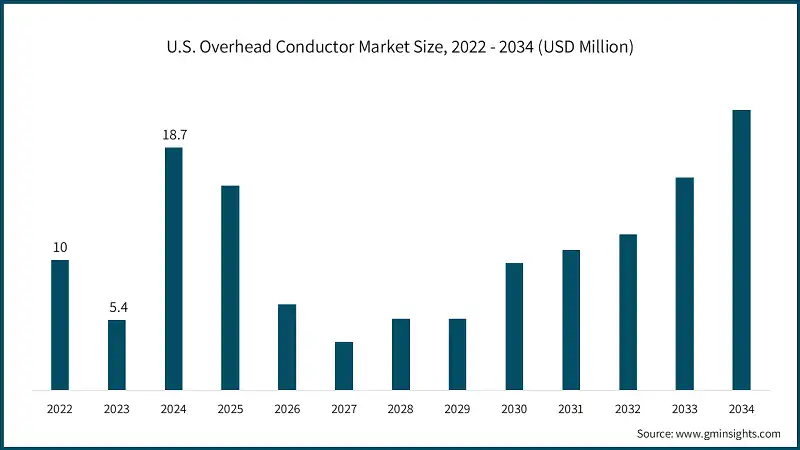

- The U.S. dominated the overhead conductor market in North America with around 52% share in 2024 and generated USD 18.7 million in revenue. Increasing investments for expansion of the electrical networks and implementation of renewable-integrated grids are shaping the business dynamics in North America.

- The Canada overhead conductor market is projected to surpass USD 25 million by 2034. The market is driven by the replacement of aging grid infrastructure and adoption of high temperature low sag conductors which allow more power transmission without need of new towers. Furthermore, increasing investment in smart grid development and advances in digital monitoring and automation of the transmission systems are propelling the industry growth.

- The Europe overhead conductor market was evaluated at about USD 50 million in 2024. Region’s commitment to energy transition and decarbonization goals by integration of large-scale renewable energy sources from offshore wind farms in the North Sea and solar parks across Southern Europe is driving the overhead conductor market.

- Favorable regulatory frameworks set by the European Network of Transmission System Operators for Electricity (ENTSO-E) play a central role in coordinating transmission development and grid interconnectivity across the various countries in the region. The Ten-Year Network Development Plan (TYNDP) by ENTSO-E identifies needs for the electricity transmission systems at a pan-European scale.

- The Asia-Pacific overhead conductor market is set to reach USD 600 million by 2034. Rapid industrialization, urban expansion and increasing electricity demand in industrial, residential and commercial areas are fueling the overhead conductor market in the region. Integration of renewable energy, particularly solar and wind, into the national grid along with private and public investments promoting long distance construction, high voltage transmission lines will contribute to market growth.

- For instance, in January 2025, Vietnam electricity board energized a 500kV transmission line connecting the Monsoon wind power plant, Laos to Quang Nam Province. The project had an investment of USD 41.9 million funded by Vietnam Bank of Agriculture and Rural Development and Vietnam Electricity’s (EVN) capital.

- The Middle East & Africa overhead conductor’s market will grow at CAGR of 3% by 2034, driven by integration of renewable energy and electrification of underserved areas. In Middle East, Saudi Arabia’s National Renewable Energy Program (NREP) is a major initiative for increasing the share of electricity generated by renewables by 2030.

- In Africa, the focus is on upgrading the infrastructure and electrification of rural areas. For Instance, in May 2025, Kenya Electricity Transmission Company (KETRACO)has restarted the process for construction of transmission lines under a public private partnership and the project is estimated to be around USD 245 million.

- The Latin America overhead conductor market is propelled by a combination of renewable energy integration, grid modernization and rural electrification programs. Brazil is expanding its high voltage network to connect solar and wind farms with the grid to cater the rising demand of electricity. Investments by domestic utilities and public private partnerships for development of transmission networks to optimize the existing infrastructure will shape the Latin American market dynamics.

Overhead Conductor Market Share

- The top 5 companies in the overhead conductor industry including Nexans, Prysmian Group, Southwire Company LLC, Sumitomo Electric Industries, Ltd., and Sterlite Power collectively accounted for around 30% of the market share in 2024. Nexans is popular for its overhead conductors due to their advanced design, vast product portfolio and superior construction.

- The company offer better corrosion resistance and higher tensile strength which helps in improving the durability of the overhead conductors. Their contribution in European grid expansion and renewable integration projects and reducing the supply chain related carbon emissions has been exemplary. Companies are investing heavily in R&D and focusing on differentiating themselves through robust supply chain, technology leadership and project partnerships with utilities and governments across various regions.

- Prysmian Group is popular for its high-performance overhead line solutions which include both conventional as well as high temperature conductors. The company also supports grid modernization efforts through low sag conductors which reduce energy losses and improve system efficiency.

- Strategic alliances and partnerships are playing a crucial role as power transmission network become more complex and demand for high-capacity conductors increase. Companies are collaborating to combine their technical expertise and regional presence. Public and private partnerships for grid modernization, expansion of transmission infrastructure and integration of renewable energy into the lines to meet the rising demand for electricity are taking place across the regions.

Overhead Conductor Market Companies

Major players operating in the overhead conductor industry are:

- Alcon Marepha

- APAR

- Bekaert

- CMI Limited

- CTC Global Corporation

- Elsewedy Electric

- Gupta Power

- Hindustan Urban Infrastructure Limited

- KEI Industries Limited

- Lamifil

- LS Cable and System Ltd

- LUMPI-BERNDORF Draht- und Seilwerk GmbH

- Midal Cable

- Neccon

- Nexans

- Prysmian Group

- Riyadh Cable Group Company

- Southwire Company LLC

- Sterlite Power

- Sumitomo Electric Industries, Ltd.

- ZTT

- Nexans is known for its innovative solutions for electrical transmission and distribution systems. The company specializes in making industrial cables, vacuum insulated piping, copper rod and wires, and bare overhead conductors. The company is known for its technological expertise and energy transition projects. The company’s reported net sales in the half year 2025 were recorded at USD 5.4 billion.

- Prysmian Group specializes in transmission, power grid, electrification and digital solutions. The transmission segment includes submarine power and onshore HVDC business. The company focuses on the transmission of renewable energy through innovative cables solutions. The power grid business is aimed at supporting the modernization of the power grid with innovative technologies. The company’s revenue was USD 19.6 billion in 2024.

- Southwire Company LLC is one of the major manufacturer and supplier in the North American overhead conductor market, known for its high-quality products and innovative solutions. Founded in 1950 and headquartered in Carrollton, Georgia, U.S., the company has grown into one of the major privately held electrical equipment manufacturers in the region.

Overhead Conductor Industry News

- In February 2025, Sterlite Power won new orders worth USD 256 Million and secured L1 positions in orders worth USD 7.41million in Q3 of financial year 2025 to supply conductors. These orders are spread across Sterlite’s global products and services business including high performance conductors, optical Ground Wire (OPGW), power cables and specialized Engineering, Procurement and Construction (EPC) services.

- In November 2024, Southwire company LLC in collaboration with Georgia power has led to a federal funding grant of USD 160 million to enhance the electrical grid throughout the state of Georgia including the installation of Southwire’s C7 overhead conductor. This will serve 2.7 million customers across the state.

- In May 2025, APAR Industries Limited allocated USD 34.4 million for its conductor business which includes manufacturing rods for cables. This assigned amount would enhance APAR’s conductor capacity by 25,000 tonnes and lead to growth of the company across various regions including India.

This overhead conductor market research report includes an in–depth coverage of the industry with estimates & forecast in terms of volume and revenue in ‘USD Million’ from 2021 to 2034, for the following segments:

Market, By Product

- Conventional

- ACSR

- AAAC

- ACAR

- AACSR

- AAC

- High temperature

- Tal

- ZTAl

- Others

- Others

- ACFR

- ACCR

- ACCC

- CRAC

- Gap conductors

- Others

Market, By Voltage

- 132 kV to 220 kV

- > 220 kV to 660 kV

- > 660 kV

Market, By Rated Strength

- High strength

- Extra high strength

- Ultra-high strength

Market, By Current

- HVAC

- HVDC

Market, By Application

- High tension

- Extra high tension

- Ultra-high tension

The above information has been provided for the following region & countries:

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Italy

- Germany

- Sweden

- Spain

- Asia Pacific

- China

- Australia

- India

- Japan

- South Korea

- Indonesia

- New Zealand

- Malaysia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Latin America

- Brazil

- Argentina

Frequently Asked Question(FAQ) :

What are the upcoming trends in the overhead conductor industry?

Key trends include adoption of high-performance conductors like HTLS variants, focus on climate-resistant technologies, lifecycle cost optimization, and preference for recycled aluminum conductors aligned with ESG goals.

Which region leads the overhead conductor market?

Asia Pacific leads the market and is set to reach USD 600 million by 2034, on account of rapid industrialization, urban expansion, and renewable energy integration across the region.

What is the growth outlook for high temperature conductors from 2025 to 2034?

High temperature conductors are projected to grow at a 4.8% CAGR through 2034, owing to growing demand for increased capacity, efficiency and grid reliability.

Who are the key players in the overhead conductor market?

Key players include Alcon Marepha, APAR, Bekaert, CMI Limited, CTC Global Corporation, Elsewedy Electric, Gupta Power, Hindustan Urban Infrastructure Limited, KEI Industries Limited, Lamifil, LS Cable and System Ltd.

What was the market share of the > 220kV to 660kV voltage segment in 2024?

The > 220kV to 660kV voltage segment held 39% market share in 2024, driven by surge in electricity needs from industrial operations and extra high tension transmission grids.

Which product segment dominated the overhead conductor market in 2024?

Conventional overhead conductors dominated with 59% market share in 2024 and will grow at a CAGR of 4.2% through 2034.

What is the market size of the overhead conductor in 2024?

The market size was USD 770.1 million in 2024, with a CAGR of 4.7% expected through 2034 due to increasing electricity demand and grid modernization initiatives.

What is the projected value of the overhead conductor market by 2034?

The overhead conductor market is expected to reach USD 1.25 billion by 2034, propelled by renewable energy integration, smart grid technologies, and infrastructure development.

Overhead Conductor Market Scope

Related Reports