Summary

Table of Content

Outdoor Apparel Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Outdoor Apparel Market Size

The outdoor apparel market was estimated at USD 17.47 billion in 2024. The market is expected to grow from USD 18.44 billion in 2025 to USD 29.85 billion in 2034, at a CAGR of 5.5% according to latest report published by Global Market Insights Inc.

To get key market trends

One of the main driving factors in the outdoor apparel market is the growth of outdoor recreation and adventure tourism. Outdoor activities such as hiking, camping, skiing, and trail running are becoming more popular with consumers who desire wellness, experiential travel, and connection to nature. Millennials and Gen Z especially value active lifestyles and regularly participate in outdoor activities and events. Companies that innovate in fabric and ergonomic design stand to benefit, consumers not only view outdoor apparel as essential in an outdoor niche lifestyle but now an at-home lifestyle element.

Additionally, the ever-increasing use of social media and influencer-driven content has led to heightened interest in outdoor experiences and has given some aspirational value to adventure gear. Consumers are opting for functional apparel and are also considering aesthetic appeal that the gear can provide in an outdoor setting and in urban lifestyle settings. This blending of performance, fashion, and functional uses is leading some brands to create hybrid product lines, which adds to the growth of the outdoor apparel market.

In addition, consumers' increasing focus on health and wellness has changed their behaviors towards outdoor activities and shifted their valuations around apparel and outdoor apparel. Many people view outdoor activities as positive experiences in improving their physical fitness, well-being, and quality of life. This shift has led to an increase in hiking, yoga retreats, and nature-based sports, resulting in opportunity for apparel brands to find a product for goers that support comfort and perform without constraint. As consumers move towards this, they will expect apparel or clothing to support their activity, while being protected from the environment, which will include monsters such as their moisture-wicking capability, breathability, and temperature regulation.

Moreover, the health-conscious trend overlaps sharply with sustainability, due to consumers' desire to purchase eco-friendly apparel that matches their values. More brands are on the rise, which feature ethical sourcing and manufacturing processes, incorporate recycled materials for example, fabrics made from recycled waste like fishing nets and plastic bottles, and offer low-impact technologies, to draw in consumers focused on well-being and sustainability.

Outdoor Apparel Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 17.47 Billion |

| Market Size in 2025 | USD 18.44 Billion |

| Forecast Period 2025 - 2034 CAGR | 5.5% |

| Market Size in 2034 | USD 29.85 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising participation in outdoor activities and adventure tourism | The increase in outdoor activities has led to a larger consumer market and stimulated demand for versatile, durable and performance based outdoor apparel. Brands are responding with specialty products made for hiking, climbing, trail running, and travel. |

| Influence of health and wellness trends | As people prioritize their mental and physical health, outdoor apparel is considered part of an outdoor lifestyle, leading to a greater interest in activewear that encourages ease of movement, comfort and recovery. |

| Shift toward sustainable and lifestyle-oriented apparel | Consumers are looking for eco-ethical materials while keeping social equity in mind throughout the supply chain, and brands are beginning to respond with recycled fabrics, PFAS-free finishes, and circular design principles. |

| Pitfalls & Challenges | Impact |

| Supply chain disruptions and raw material shortages | Brands are creating more suppliers, spending more time on near shoring, and using digital tools in the supply chain to increase resiliency and responsiveness. |

| Weather dependency and seasonal volatility | Sales of outdoor apparel rely heavily on a seasonal demand and prevailing weather conditions. If there are mild winters or the monsoon is delayed, the sales of insulated items or rain gear are often damped, and brands are using flexible inventory strategies in creating broader product versatility. |

| Opportunities: | Impact |

| Sustainability and eco-friendly innovation | Consumer demand for ethical and low impact products is shifting brands focus on recycled materials, products free of PFAS-free finishes and circular design models. Brands are embedding sustainability measures into their core operations, resulting in increased transparency and loyalty to the brand overtime. |

| Technological advancements in fabric and design | New innovations including smart textiles, fabrics that are thermo-regulating, and seamless construction are elevating performance and comfort approaches. Shorter and more durable materials are elevating lighter, and multifunctional apparel to the changing consumer demands of outdoor enthusiasts. |

| Market Leaders (2024) | |

| Market Leaders |

14% market share |

| Top Players |

The collective market share in 2024 is 30% |

| Competitive Edge |

|

| Regional Insights | |

| Largest market | North America |

| Fastest growing market | North America |

| Emerging countries | UK, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Outdoor Apparel Market Trends

Today's consumer increasingly demands apparel that has high performance in rigorous outdoor environments and versatility for everyday wear, causing brands to invest in products that capture the best of both worlds, while being functional, stylish, and sustainable. Digitalization and the growth of e-commerce have complemented changes to consumer buying habits, alongside continuing global health and wellness trends that drive engagement in outdoor activities.

- Outdoor apparel products are less niche and are moving squarely into urban spaces as well. Urbanites increasingly want apparel that shifts seamlessly from outdoor treks to everyday settings, which is leading to hybrid styles that incorporate outdoor technical elements, like water resistance and breathability, within fashion-oriented finishes.

- Consumers who are eco-conscious are demanding clothing made from recycled, organic, and ethically sourced materials. The brands are reacting with circular economy practices, carbon-footprint reduction, and the elimination of toxic chemicals from products, such as PFAS. Sustainability has become a competitive point of difference, above and beyond a boutique offering.

- New innovations such as moisture-wicking textiles, thermoregulation, and UV protection have become commonplace in the outdoor apparel market segment. Smart textiles and wearable technology such as clothing that continuously monitors body temperature or hydration levels are entering the mainstream as premium products and enhance function and aesthetic appeal of user experience.

- The growth of e-commerce and direct to consumer methods has shifted the way outdoor apparel is sold and marketed. Many brands utilize data analytics towards personalized recommendations, virtual try-ons and campaign driven by influences creating more consumer engagement and reducing reliance on traditional retail.

Outdoor Apparel Market Analysis

Learn more about the key segments shaping this market

Based on product type, the market is divided into topwear, bottomwear, and other accessories. The topwear segment crossed USD 9.86 billion in 2024.

- Outdoor topwear is developed for high performance in a variety of settings. Outdoor brands develop moisture wicking base layers for trail running or windproof shells for alpine hikes. These pieces are developed using technical materials to work in relation to performance. Increasingly, brands are utilizing advanced materials like Gore-Tex, polartec, and merino wool to support better breathability, and insulation and weatherproofing. Many topwear pieces are also ergonomically structured with articulated arms and vents strategically placed for mobility and comfort when doing a high-level activity.

- As consumers focus their buying decisions on the environment and the consumption of various products, topwear producers are responding with sustainable options. Recycled polyester, organic cotton, and biodegradable insulation have become commonplace in outdoor apparel collections. Certifications such as bluesign, fair trade, and OEKO-TEX have become more common identifying a product is sourced responsibly. Modular and repairable designs have also garnered attention for allowing the user to provide extension for the lifecycle of the garment, reducing waste.

- Topwear is one of the fastest growing segments of the outdoor apparel market, spurred by participation in outdoor activities and an increasing consumer need for versatile clothing. Today’s consumers want a topwear that works on the trail and transition seamlessly into town and looks good. Consumers want options such as lightweight insulated jackets, hybrid hoodies and performance flannels as they continue to blend adventure into their everyday lives.

Learn more about the key segments shaping this market

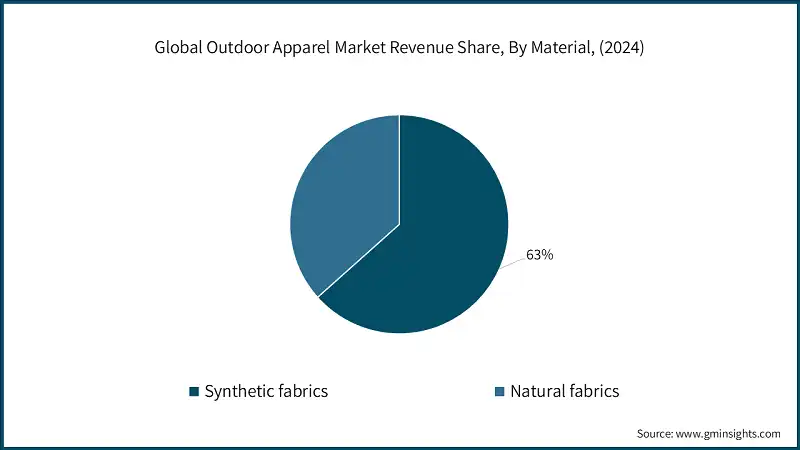

Based on material, the outdoor apparel market is segmented into synthetic fabrics and natural fabrics. The synthetic fabrics segment held around 63% of the market share in 2024.

- Synthetic fabrics such as polyester, nylon, and spandex are designed to handle the harsh conditions when you are engaging in outdoor activities. These materials are great at wicking moisture away, drying quickly, and holding up to abrasion, making them a great option for hiking, climbing, and trail running. Many outerwear products are coded with DWR (Durable Water Repellent) or feature a membrane like Gore-Tex to increase waterproof and breathability. They also hold their shape and provide a great deal of wear and tear in harsh conditions so synthetic topwear and outerwear have a performance advantage over natural fibres.

- These fabrics help reduce carbon footprints, while also actively pursuing circular fashion models. More companies are adopting certifications like Global Recycled Standard (GRS) and Bluesign as ways to bolster and legitimize sustainable production. The combination of performance and sustainable opportunity is engaging consumers and pushing brands to make plans for the future.

Based on the distribution channel, the outdoor apparel market is segmented into online and offline. The offline distribution channel held a major market share, generating a revenue of USD 11.98 billion in 2024.

- When customers engage with the retail environment, they are immersed in a more sensory experience since they can touch, feel and experience the outdoor apparel in person prior to purchase. This is helpful especially when purchasing jackets, base layers and other technical gear, as the fit, feel and features are important.

- Shoppers can experience the items breathability, insulation and mobility and often can get guidance from trained staff on the nuances of outdoor conditions. Retailers may also offer demo zones or mini climate chambers that mimic conditions, so customers can validate product selections for situations when they are physically engaged in these activities.

Looking for region specific data?

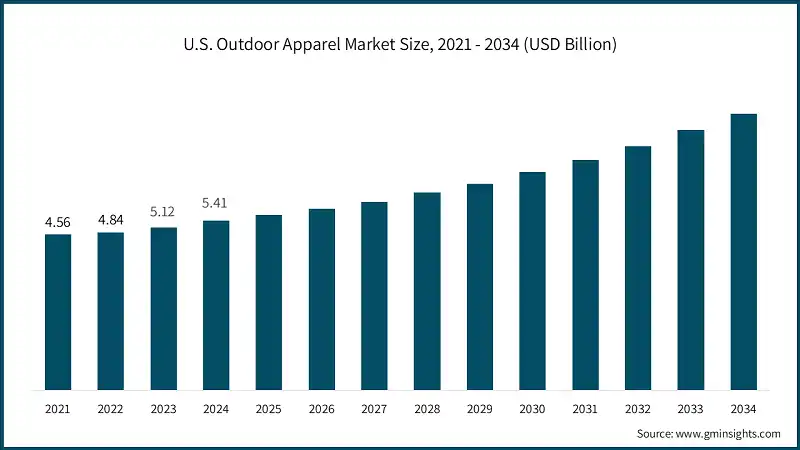

U.S outdoor apparel market accounted for around 88.7% share with generating around USD 5.41 billion revenue in 2024.

- The outdoor apparel industry in the U.S. is thriving, with a notable shift in culture toward wellness, adventure, and sustainability. Consumers are more interested in multifunctional apparel, focusing on items that can be worn both for performance and leisure, which is driving demand for items that are functional as well as fashionable. Brands are innovating with materials that are eco-friendly, or that have weather adaptive technology, while incorporating the changing consumer attitudes toward purchase values that include ethical sourcing and environmental stewardship. Also contributing to this market is a strong retail network, and a customer base that is digital qualified to shop both online and in-store.

- The North American market is the leader for outdoor apparel globally with an established outdoor culture and mature consumer base willing to pay for quality, performance, and sustainability. North America also has several legacy brands that will continue to be leaders driving innovation and creating trends in the outdoor apparel space through marketing practices they have owned. A convicted climate, and variety of sports, activities, and adventures consumers participate in hiking, skiing, camping and urban discovery create continual seasonal demand for outdoor apparel items. Recently, the increasing use of direct to consumer by brands, integrated with an emphasis on circular fashion, has also forced outdoor brands to rethink how they serve consumers who will purchase sustainability-friendly outdoor apparel.

Europe outdoor apparel market is expected to grow at 5.6% CAGR during the forecast period.

- The European market is influenced by a certain cultural proclivity for the outdoors, sustainability, and functional fashion. The outdoor community is shifting towards a blending of outdoor apparel with leisurewear, allowing for the emergence of apparel for multiple use purposes that are stylish, functional, and sustainability conscious. These changes are largely influenced by increasing interest in hiking, cycling, and urban exploration, especially among young people.

- Innovation in the outdoor apparel industry in Europe is often dictated by sustainability norms and conventional consumerism in transparency and ethical pricing. Companies are investing in circular design practice, biodegradable, and traceable supply chains in line with the EU sustainability agenda. The overall regulatory framework for Europe encourages lower-impact production and discourages the use of harmful products. Many brands are now forced to re-examine traditional industry production practices. Brand collaboration is another developing trend among outdoor brands and fashion brands, which brings performance attention to more affluent seasons for the outdoor clothing market, and attracts a larger general appeal to the outdoor clothing industry.

The Asia Pacific outdoor apparel market is growing at a CAGR of 5.3% during the forecast period.

- In the Asia Pacific region, the outdoor apparel sector is quickly expanding; interest in outdoor recreation, fitness, and adventure tourism is growing among a wider set of economies. Consumers are adopting more active lifestyles and demand for functional, weather-adaptive clothing that is produced with a pseudo-adventure attitude is increasing for most outdoor activities, such as hiking, trekking, cycling and travel. Key dynamics driving this behavior include urbanization, disposable income growth, and increasing awareness of health and wellness. In this context, local and ± global brands are developing product that highlight comfort, durability, and style on fabrics that reference region or climate.

- The Asia-Pacific region is emerging as a global center for innovation in outdoor apparel, with manufacturers applying and integrating advanced textile technologies, including breathability, moisture control, and UV protection. Areas of sustainability are also developing in the region, with brands creating eco-friendly materials and production models embracing a circular economy for environmentally conscious consumers. The strong manufacturing infrastructure in the region enables fast development and affordable scaling of products, facilitating a new wave of global players moving into the region as part of their strategy to expand.

Latin America outdoor apparel market is growing at a CAGR of 3.9% during the forecast period.

- Latin America’s outdoor apparel sector is on the rise as outdoor-focused activities like hiking, ecotourism, adventure activities are becoming popular throughout the region. The developing middle-class, growing awareness of health and wellness, and cultural affinity for nature indicates demand for functional, stylish outdoor wear. Customers are looking for gear that suits a variety of climatic environments from tropical rainforests to mountainous habitation areas while being an expression of their individuality. People living in cities, especially in Brazil, Mexico, and Argentina, have adopted outdoor wear as part of mainstream fashion, which provides a lifestyle, fashion context along with functionality.

- Latin America, concerning outdoor apparel is also evolving to reflect local designs which have increasingly accounted for culturally adapted products and sustainable production. As regional brands emerge, opportunities will abound for global brands that have commonalities such as existing environmental or cultural ties into their product offerings. Supply Chains are linked to centralized manufacturing as labor, and prices are less. Sustainability is beginning to be a key distinction with companies looking for recycled materials or making sustainable sourcing choices for products as they appeal to more environmentally concerned customers. Digital retail channels are entering expanding routes to access outdoor apparel to customers both in cities but also remote locations due to e-commerce expansion.

Outdoor Apparel Market Share

VF is leading with 14% market share. VF, Columbia Sportswear, Patagonia, Adidas, and Under Armour collectively hold around 30%, indicating moderately fragmented market concentration. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

VF corporation is a leading corporation in the outdoor apparel market, with a variety of brands made for performance, including The North Face, Timberland and Smartwool. Its focus on innovation and sustainability along with its focus on lifestyle allows it to target the hard-core adventurer, through the urban explorer. It utilises its global infrastructure and retail network to leverage the latest technologies in the development of high-performance gear while promoting good environmental stewardship through circular design and responsible sourcing.

Adidas builds on its athletic performance apparel expertise while also incorporating an outdoor functionality, to provide product options to consumers targeting sport-focused, style and adventures. It's Terrex line gained momentum among hikers and trail runners for the product being lightweight, durable, and eco conscious. Its established global footprint and brand identity provides the opportunity to influence outdoor fashion while continuing to rapidly expand its own technical apparel market.

Outdoor Apparel Market Companies

Major players operating in the outdoor apparel industry are:

- Adidas

- Amer Sports

- Anta Sports Products Ltd.

- Black Diamond Equipment

- Columbia Sportswear

- Fenix Outdoor International AG

- Haglöfs

- Jack Wolfskin

- La Sportiva

- Mammut Sports Group AG

- Patagonia

- Puma

- Under Armour

- VF Corporation

- Wolverine Worldwide

Under Armour has developed a position in the performance apparel market by marketing their moisture wicking, temperature regulating technologies for high intensity outdoor activities. Known for their compression wear and athletic aesthetic, Under Armour caters to individuals interested in fitness, who start at the gym and move to the outdoors. It continues to innovate and enhance its focus in smart textiles while relying on a direct-to-consumer approach, to enhance its emphasis on functional garment design.

Columbia Sportswear is a trailblazer in the rugged reliability and outdoor adventure space. It gained a reputation as the leader in high objective performance and secure apparel, accessible to consumers focused on hiking, camping, and mountaineering. Colombia with its emphasis on comfort, durability, and sustainability has its recent expansion into emerging markets like India, represents a reliable brand to both serious adventures and the casual consumer in their outdoor segment.

Outdoor Apparel Market News

- In October 2025, The North Face unveiled the Advanced Mountain Kit. As part of the Summit Series, the Advanced Mountain Kit represents the brand's most technically sophisticated apparel system designed for fast-and-light pursuits in high alpine settings. The Advanced Mountain Kit prioritizes the extreme performance of its apparel in the most demanding conditions. For mountaineers, the kit uses premium materials and innovative modular layering options to provide the highest degree of protection, breathability, and mobility in adverse conditions.

- In August 2025, Columbia Sportswear debuted its ambitious new brand platform “Engineered for Whatever” that celebrates the extremes of outdoor adventures. In ad spots, Columbia demonstrates the gear being put to the test, though using exaggerated (albeit humorous) circumstances a bear hug or a barrage of snowballs to demonstrate the durability and versatility of its technologies including Omni-Heat Infinity, Omni-Shade Sun Deflector, and Omni-Freeze Zero Ice. This represents an important shift in Columbia’s approach to storytelling, as it pairs rugged performance with playful and somewhat irreverent marketing to appeal to a broader audience who likes to adventure.

- In July 2025, La Sportiva created a Spring 2026 collection designed specifically for runners and climbers, unveiling new apparel and footwear that respected the performance demands of mountain athletes. The Spring collection uses lightweight, breathable, and durable materials and has been designed to respect the epithelial and performance aspects associated with developing high-performance products, while still being as comfortable as possible. The new collection embraces La Sportiva's commitment to continue innovating alpine sportswear and supporting outdoor athletes with products that are engineered for the outside world.

- In January 2025, Under Armour announced a partnership with BlacktipH, signifying a strategic effort to strengthen the brand's footing in outdoor and fishing apparel. The partnership aims to create performance-oriented gear designed for anglers and outdoor enthusiasts, leveraging Under Armour's technical experience and BlacktipH's strong connection to the fishing community.

- In September 2024, Adidas Terrex introduced an all-new outdoor gear line aimed at adventure sport enthusiasts, featuring the MYSHELTER Down Parka and Lightblaze POD hiking shoes. The parka offers progressive insulation in cold weather conditions, and the footwear is built for versatility on the trail. The release is a part of Adidas Sportswear's continued efforts to blur the lines between technical innovation and cultural relevance, ignited by collaborations and runway showcases that put the brand's distinctly evolving outdoor persona front and center.

The outdoor apparel market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Product Type

- Topwear

- T-shirts

- Jackets

- Vests

- Bottomwear

- Pants

- Shorts

- Trousers

- Leggings

- Other accessories

Market, By Material

- Synthetic fabrics

- Polyester

- Nylon

- Natural fabrics

- Cotton fabrics

- Hemp

- Bamboo

- Wool

Market, By Gender

- Men

- Women

- Kids

Market, By Price Range

- Low

- Medium

- High

Market, By Distribution Channel

- Online

- E-commerce

- Company website

- Offline

- Supermarket /hypermarket

- Specialty stores

- Other retail stores

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the outdoor apparel market?

Key players include VF Corporation, Columbia Sportswear, Patagonia, Adidas, Under Armour, Amer Sports, Anta Sports Products Ltd., Black Diamond Equipment, Fenix Outdoor International AG, Haglöfs, Jack Wolfskin, La Sportiva, Mammut Sports Group AG, Puma, and Wolverine Worldwide.

What are the upcoming trends in the outdoor apparel market?

Key trends include sustainable innovation with recycled and biodegradable materials, technological advancements in smart textiles and thermoregulation, hybrid styles blending outdoor technical elements with urban fashion, and growth of direct-to-consumer e-commerce channels.

Which region leads the outdoor apparel market?

The U.S. held 88.7% share with USD 5.41 billion in 2024, fueled by outdoor culture, wellness trends, and strong retail networks.

What is the growth outlook for the Europe outdoor apparel market from 2025 to 2034?

The Europe outdoor apparel market is expected to grow at 5.6% CAGR through 2034, supported by sustainability norms, circular design practices, and the blending of outdoor apparel with leisurewear.

What was the market share of the synthetic fabrics segment in 2024?

Synthetic fabrics held around 63% market share in 2024, favored for their moisture-wicking, quick-drying properties, and durability in harsh outdoor conditions.

How much revenue did the topwear segment generate in 2024?

The topwear segment crossed USD 9.86 billion in 2024, supported by demand for moisture-wicking base layers, windproof shells, and versatile clothing.

What is the market size of the outdoor apparel in 2024?

The market size was USD 17.47 billion in 2024, with a CAGR of 5.5% expected through 2034 driven by the rising popularity of outdoor recreation and adventure tourism activities like hiking, camping, and skiing.

What is the projected value of the outdoor apparel market by 2034?

The outdoor apparel market is expected to reach USD 29.85 billion by 2034, propelled by health and wellness trends, sustainable innovation, and the shift toward lifestyle-oriented apparel.

What is the current outdoor apparel market size in 2025?

The market size is projected to reach USD 18.44 billion in 2025.

Outdoor Apparel Market Scope

Related Reports