Summary

Table of Content

North America Hydraulic Cylinder Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

North America Hydraulic Cylinder Market Size

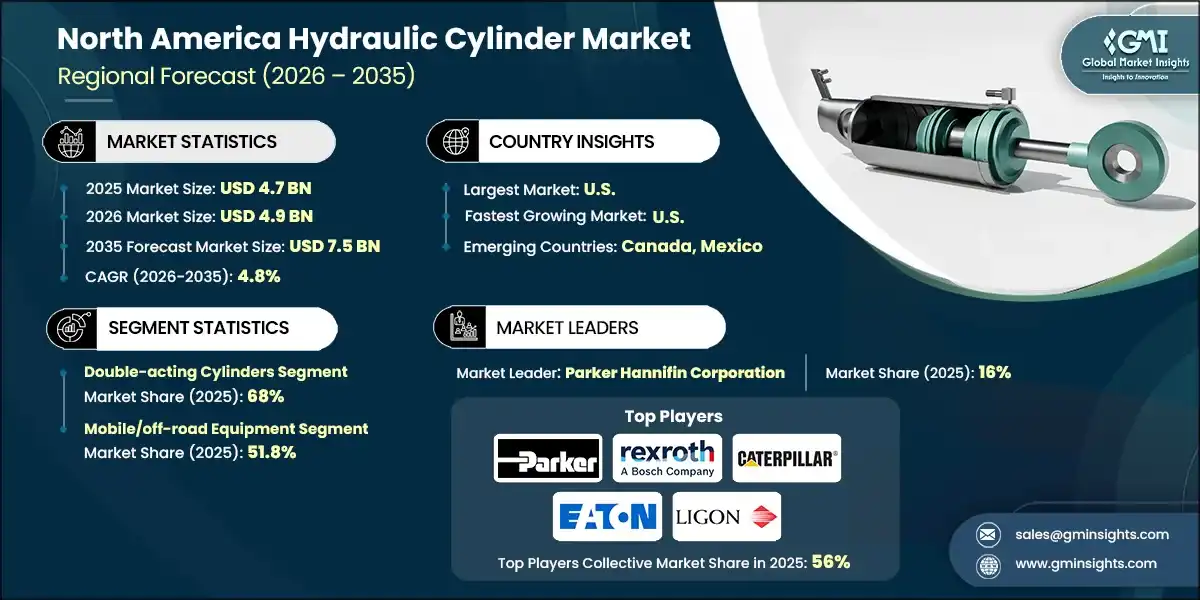

The North America hydraulic cylinder market was estimated at USD 4.7 billion in 2025. The market is expected to grow from USD 4.9 billion in 2026 to USD 7.5 billion in 2035, at a CAGR of 4.8% according to latest report published by Global Market Insights Inc.

To get key market trends

The hydraulic cylinder market is going through a radical change that is primarily caused by three major trends that are transforming industrial and off-highway machinery processes worldwide. The use of smart sensing and IoT integration along with advanced sealing technology and real-time hydraulic analytics and predictive maintenance features is revolutionizing an entire industry. Consequently, fleet operators and manufacturing companies are adopting digital monitoring tools and connected hydraulic systems that enable them to have precise control over the actuation processes at efficiency levels of up to 96% in heavy-load industrial applications. These intelligent solutions for cylinders integrate industrial IoT platforms with edge computing and smart analysis layers that facilitate operators to enhance efficiency, fluid life, and performance quality.

The transition from conventional simple mechanical actuators to electro-hydraulic systems is the emerging trend that signifies a major technological change in the mobile and industrial sectors. Compared with standard manual systems, smart hydraulic cylinders offer improved accuracy, programmable stroke control, and the operational responsiveness increase by 100%. These sophisticated systems move OEMs to attain tighter tolerance, reduce their machine setup times, and increase the component life by 20% to more than 150% depending on the application, moreover, at the same time, eliminate unscheduled maintenance and leakage problems. The major equipment manufacturers: Parker Hannifin, Caterpillar, and Ligon, have introduced their new-generation high-performance cylinder series with features such as incorporated position sensors, regenerative circuits, and modular porting systems that permit continuous operation.

High-pressure and heavy-duty actuation demand in infrastructure development and modern agriculture are some of the most significant reasons resulting in innovation in cylinder technologies and processes. The industrial sector's shift to efficient, automated material handling methods is the primary reason for the need for advanced force capabilities of heavy earthmovers (e.g., excavators, loaders), automated mining equipment, and precision factory automation. Advanced cylinders can reduce the cycle time by 10% to 70% depending on the task and application, with the time of work done by mobile equipment reduced by 30-60% and that by stationary industrial presses only by 15-25%. Heavy machinery manufacturers utilize advanced design techniques such as welded cylinder construction, telescopic systems, and laser-clad rod coating to produce complex mechanical assemblies that not only allow them to lower fluid and downtime but also comply with stringent ISO 4413 and regional environmental standards.

The main reason for the unprecedented demand for high-quality hydraulic equipment that is capable of high-pressure, extreme environments is the rapid transition of the North American heavy equipment industry to precision construction methods and the imposition of stricter safety and emission regulations. Equipment owners require specially designed cylinders for oil & gas exploration, aerospace flight controls, and automated waste management. The adoption of smart hydraulic actuators can result in a project being completed 6-8% faster for every 10% reduction in manual diagnostic time. Therefore, contractors have strong reasons to invest in new fluid power technologies. Large-bore welded cylinders, and multi-stage telescopic units for heavy-duty work are among the major construction OEMs' implementation plan. The change entails a hefty investment in precision machine systems and automated assembly cells. That, therefore, is the main reason behind the factory’s approximately 35% contribution to the market's compound annual growth rate, making it the most significant growth driver for hydraulic cylinder equipment.

The Construction Equipment Rental Association (CERA) along with other industry organizations, have identified the robust investments in capital equipment as the primary factor for these activities, which was also manifested by the strong attendance at CONEXPO-CON/AGG with thousands of visitors and solid equipment orders. Some of the automated hydraulic systems' new features include robotic assembly cells, vision-based rod inspection, and closed-loop feedback control, which enable efficient manufacturing and 24/7 production. Advanced cylinders are equipped with automated cushioning, tool-less seal replacement that shortens setup times, and intelligent anti-cavitation protection systems that significantly limit equipment damage caused by real-time sensor monitoring. The industry foresees a deficit of skilled technicians and heavy-duty mechanics in the next few years, which is why remote diagnostics and automated processing equipment have been rapidly embraced. This rise in automation accounts for about 25% of the market.

The high-end aerospace and precision manufacturing segment features the most stringent requirements in terms of the precision, traceability, and quality of actuation operations that has resulted in increased usage of advanced servo-cylinders and simulation for system validation. Professional manufacturers are obliged to conform to local standards for quality management and obtain industry accreditation for specialized processes. Consequently, they require sophisticated hydraulic equipment equipped with integrated load cells, material traceability systems, and full process documentation capabilities. The most crucial system parts such as structural landing gear, precision press rams, and material handling grippers necessitate the use of advanced manufacturing methods like honing at high precision, high-pressure testing for complex seals, and friction welding for specialty alloy materials.

High-pressure hydraulic systems capable of operating at pressures of up to 350 bar (5,000 psi) are the preferred choice for heavy machinery with tight tolerances. They also contribute to energy savings which make rapid operational cycles of a few seconds rather than minutes possible. Higher growth rates are expected for professional industrial applications due to a post-pandemic demand recovery coupled with innovative technologies. This factor contributes approximately 20% to the overall market expansion.

North American construction and agricultural expenditures reached record levels in 2024. Besides new infrastructure projects funded by the Infrastructure Investment and Jobs Act, the rise of large-scale logistics centers and renewable energy projects are the primary drivers for the demand for hydraulic products such as telescopic loaders, lift systems, steering cylinders, and heavy-duty rams. The local sourcing trend combined with fast construction methods caused by high labor costs and the need for quicker project delivery is pushing manufacturers to relocate production closer to regional logistics hubs.

All demonstrated in the market signs of growing further as technology develops and the respective demand continues.

North America Hydraulic Cylinder Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 4.7 Billion |

| Market Size in 2026 | USD 4.9 Billion |

| Forecast Period 2026 - 2035 CAGR | 4.8% |

| Market Size in 2035 | USD 7.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| EV battery and power electronics heat shielding | Enables development of high value heat shields for EV batteries, improving safety performance while increasing content per vehicle significantly globally. |

| Adoption of lightweight and advanced insulation materials | Creates differentiation opportunities through lightweight composites and aerogels, supporting OEM efficiency targets and premium vehicle applications across global automotive markets. |

| Expansion of underbody and modular heat shield solutions | Supports growth in underbody and modular shielding solutions aligned with platform sharing, cost optimization, and simplified vehicle assembly processes worldwide. |

| Aftermarket and retrofit growth in emerging markets | Expands aftermarket and retrofit potential as regulatory upgrades and thermal safety awareness increase demand beyond OEM installations in emerging regions. |

| Pitfalls & Challenges | Impact |

| Dependence on volatile raw material prices (Steel/Aluminum) | Fluctuations in the cost of high-grade steel and specialized coatings impact the final product price and manufacturer profit margins, hindering stable pricing strategies for the regional market. |

| Competition from electric actuator alternatives | A growing challenge from high-efficiency electromechanical actuators in light-duty applications impacts the market share of traditional hydraulics, pushing OEMs to innovate with hybrid "smart" hydraulic solutions. |

| Opportunities: | Impact |

| Focus on safety features and environmental sealing | Creates a new revenue stream for manufacturers that develop cylinders with advanced leak-detection, integrated load-holding valves, and biodegradable fluid compatibility. These offer lower environmental risk and better operator safety. |

| Rise of the remanufacturing and service segment | Impacts regional markets by generating new demand for high-quality cylinder repair and seal-kit replacement in aging North American machinery fleets. Operators are increasingly opting for "re-lifing" equipment to manage capital costs. |

| Market Leaders (2025) | |

| Market Leaders |

16% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest market | U.S. |

| Fastest growing market | U.S. |

| Emerging countries | Canada, Mexico |

| Future outlook |

|

What are the growth opportunities in this market?

North America Hydraulic Cylinder Market Trends

One of the most significant changes in actuation operations is the transformation brought about by the integration of advanced digital control technology, so manufacturers are fitting integrated linear transducers, built-in smart chips, and real-time fluid analytics for a high level of power management, operational efficiency and component life extension. Ultramodern sensor networks implanted in hydraulic cylinders monitor real-time piston position, internal pressure, temperature, and seal condition and thereby facilitate closed-loop control and continuous quality management for the broad range of heavy-duty industrial applications.

- The main technological innovation that results in a considerable increase of precision, energy saving, and system response is the substitution of traditional "blind" cylinders and manual valves with integrated LDT (Linear Displacement Transducer) systems and electro-hydraulic valves. These smart cylinders enact electronic controls with programmable stroke management for the exact regulation of the speed, force, and extension during the entire cycle and at the same time, they provide application-specific motion profiles that improve lifting quality, shorten the cycle time, and extend the cylinder’s service life.

- The rapid transition of the North American construction sector to heavy automated machinery and large-scale infrastructure projects is not only influencing the changes in the hydraulic cylinder market, but contractors are also progressively raising the bar for the advanced processing capability of high-pressure (5,000+ PSI) systems, hard-chrome plated rods, and corrosive-resistant coatings. Apart from infrastructure, there are certain areas where specialized actuation has become indispensable, for instance, mining excavators that can supply a massive breakout force, waste management and dump truck telescopic units, precision aerospace flight controls, and renewable energy systems (e.g., solar tracking) for reliability to be maximized.

- The trend of efficient fleet management by means of thorough hydraulic system monitoring (via IoT/Cloud platforms) mainly propelled by productivity, asset utilization, and unplanned downtime concerns is very visible at present. Digitized condition monitoring, real-time cylinder diagnostics, and predictive maintenance alerts are present at modern job sites to reduce component failure occurrences and to maximize equipment uptime.

- Automated Manufacturing Systems replace manual assembly operations and, at the same time, they enable uninterrupted, high-volume production of standardized cylinder lines. The robotic welding and automated honing systems are the main components of modern production, setting accurate tolerances and ensuring that heavy-duty welded cylinders are capable of storing and handling extreme pressures, hence continuous operation is allowed for productivity and volume throughput to be increased.

Major North American markets have introduced local Manufacturing and Supply Chain Nearshoring targeted at high-demand industrial hubs characterized by fast local sourcing of raw materials and localized remanufacturing. Non-stop automated part handling together with Parker Hannifin’s localized service centers and Caterpillar’s manufacturing footprint is what facilitates 24/7 service and quick parts delivery.

Besides that, the upward trend allows the manufacturers to find new target groups and create products that will be interesting and appealing to particular niche groups such as precision agriculture equipment owners and specialized marine/offshore operators.

North America Hydraulic Cylinder Market Analysis

Learn more about the key segments shaping this market

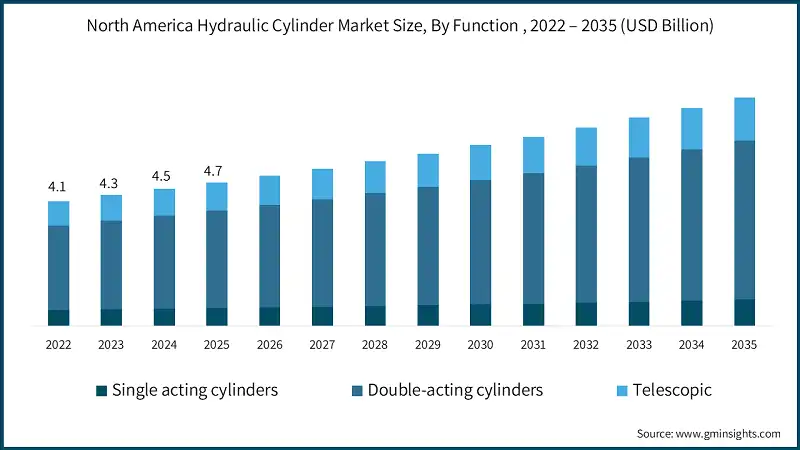

Based on function, the double-acting cylinders segment is projected to hold the largest share, accounting for 68% of the U.S. market in 2025

- Double-acting cylinders currently represent the majority share due to their ability to exert force in both directions (extension and retraction). This versatility is essential for the complex movements required in high-demand machinery such as excavators, forklifts, and industrial automation systems.

- Telescopic cylinders are projected to maintain a significant presence in the market, particularly in applications where space is constrained but a long stroke is required, such as in tipper trucks and material handling equipment.

- While single-acting cylinders offer a simpler and more cost-effective design for applications requiring force in only one direction (like simple clamping or lifting), their market share is expected to decline slightly as contractors and manufacturers shift toward more precise, bidirectional control.

Learn more about the key segments shaping this market

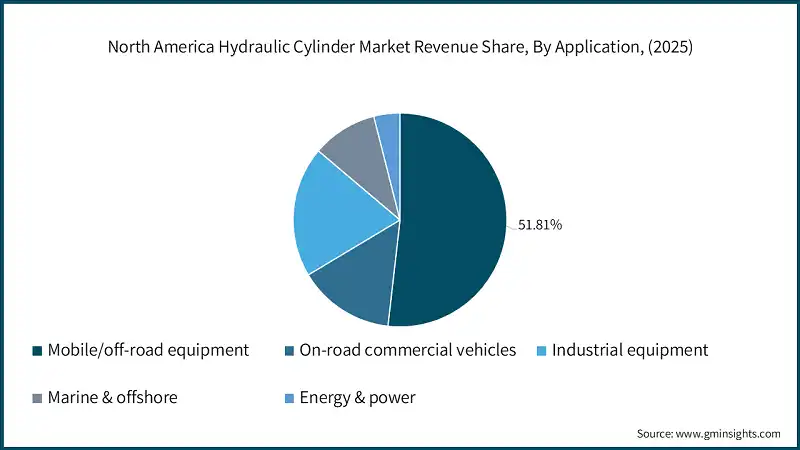

Based on Application, North America hydraulic cylinder market is segmented into mobile/off-road equipment, on-road commercial vehicles, industrial equipment, marine & offshore, and energy & power. The mobile/off-road equipment segment is projected to hold the largest share, accounting for 51.8% of the total U.S. market value in 2025.

- The mobile/off-road equipment segment is the largest consumer, driven primarily by the Earthmoving & Construction sub-segment. Massive infrastructure investments in the U.S. and Canada, such as road modernization and urban transit networks, require a high volume of heavy-duty hydraulic actuators.

- The earthmoving & construction equipment sub-segment exhibits the highest CAGR of 5.5% for the period of 2026-2035. This underscores the intense demand for excavators and wheel loaders capable of handling high-capacity loads in North America’s expanding construction sector.

- The industrial equipment segment is the second largest, driven by the ongoing trend of factory automation and Industry 4.0. Precision hydraulic cylinders are integral to robotic arms and assembly lines, which are seeing increased adoption to improve manufacturing throughput

Looking for region specific data?

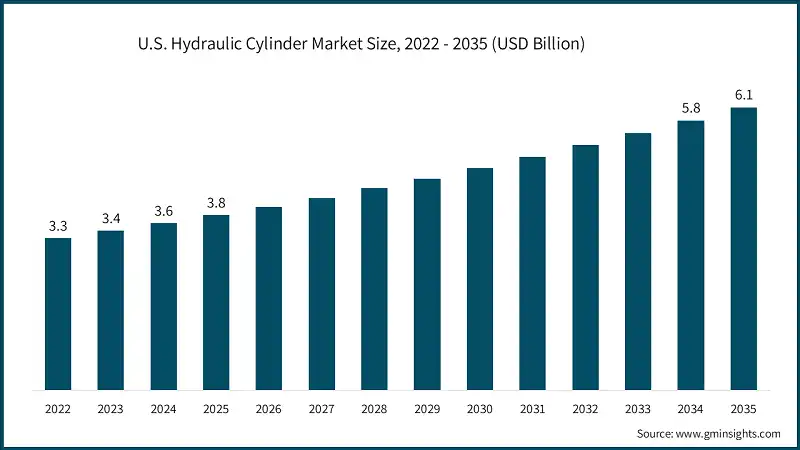

In 2025, the U.S. will dominate the North American market, accounting for 79.8% of the regional revenue, valued at USD 3.8 billion. The U.S. is also projected to maintain the highest CAGR of 4.9% in the forecast period of 2026-2035, with its regional share expected to reach nearly 81% by 2035.

- Canada is the second-largest market, with an estimated market share of 14.0% in 2025. While the market is mature, a steady CAGR of 4.3% reflects ongoing demand from the forestry, mining, and oil & gas sectors.

- Mexico holds a smaller but stable estimated share of 6.2% in 2025, with a CAGR of 4.0%. Growth here is primarily driven by the expansion of automotive manufacturing and assembly plants that rely on industrial hydraulic systems.

North America Hydraulic Cylinder Market Share

Parker Hannifin Corporation is leading with 16% market share. Parker Hannifin Corporation, Bosch Rexroth AG, Caterpillar Inc., Eaton, and Ligon Industries are collectively held around 56%, indicating moderately fragmented market concentration. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

Caterpillar Inc. is a massive, diversified heavy equipment group that operates as a premier manufacturer of both machinery and the high-performance hydraulic cylinders that power them. Caterpillar is recognized for its strategy of achieving vertical integration by relentlessly focusing on proprietary cylinder designs (welded and multi-stage) and highly innovative, performance-enhancing fluid power systems. With a massive manufacturing and operational base across the United States and Mexico, Caterpillar is uniquely positioned in the North American region to control the supply chain, cater to its massive construction and mining fleets, and drive the industry shift toward smart, sensor-integrated hydraulics across all major equipment types (excavators, loaders, and haul trucks).

Bosch Rexroth is a global powerhouse deeply rooted in the North American industrial and mobile hydraulics industry, offering a comprehensive line of products including mill-type, tie-rod, and large-bore cylinders. Bosch Rexroth is known for its strategy of providing a unified digital ecosystem (Connected Hydraulics) that spans its entire portfolio, emphasizing Industry 4.0 compatibility, IoT monitoring, and durability to meet the harsh demands of North American manufacturing and off-highway sectors. Their reputation for precision engineering, combined with an extensive local distribution and certified service center network built over decades in the U.S. and Canada, allows them to maintain a strong market share, particularly in factory automation and heavy-duty industrial applications where users value reliability and data-driven maintenance.

Parker Hannifin Corporation is a global motion and control powerhouse whose diverse hydraulic divisions are key players in the North American market. Parker’s strategy in the region is defined by product diversification and technological leadership, focusing heavily on their high-performance smart cylinders that utilize integrated linear transducers for precise position feedback and efficiency. Through specialized brands and divisions, they offer a portfolio of welded and tie-rod cylinders essential for everything from agriculture to aerospace. Parker leverages its North American innovation hubs and focuses on energy-efficient actuation to capture the evolving demands of both heavy-duty infrastructure contractors and the high-precision industrial segments across the United States and Canada.

North America Hydraulic Cylinder Market Companies

Major players operating in the North America hydraulic cylinder industry are:

- Bosch Rexroth AG

- Caterpillar Inc.

- Danfoss Power Solutions

- Eaton

- Enerpac Tool Group

- Hengli Hydraulic

- HYDAC International

- KYB Corporation

- Liebherr

- Ligon Industries, LLC

- Milwaukee Cylinder

- Parker Hannifin Corporation

- Prince Manufacturing Corporation

- Texas Hydraulics, Inc.

- Weber-Hydraulik Group

Ligon Industries, LLC is a highly specialized group focusing on custom hydraulic cylinder manufacturing and liquid waste solutions, particularly relevant in the diverse North American mobile equipment market. Ligon’s strategy is built on a federated model of specialized subsidiaries (such as Fisher and Great Lakes Hydraulics), targeting demanding applications in agriculture, waste management, and material handling. Their focus is on high-quality, U.S.-manufactured cylinders that offer rapid customization for mid-to-large volume OEMs. Ligon’s emphasis on domestic supply chain reliability and localized customer service makes them a preferred choice for North American equipment manufacturers seeking agile and high-performance hydraulic solutions.

North American Hydraulic Cylinder Market News

- In May 2025, Parker Hannifin significantly expanded its smart cylinder portfolio by launching a new series of IoT-enabled actuators, including a robust series for harsh-environment mining and specialized precision units for renewable energy tracking. These new components leverage proprietary sensor-integrated rods and feature an advanced sealing system designed to extend service intervals by 30% compared to traditional models. This launch directly addresses the high regional demand for reduced downtime and data-driven maintenance on rapidly developing infrastructure sites.

- In 2024, Danfoss Power Solutions continued its strategy of digital ecosystem domination by heavily marketing its digital displacement technology across North American construction hubs. Danfoss focuses on generating high-efficiency hydraulic systems designed to offer a 50% reduction in energy loss without sacrificing power. The company leverages its expanded manufacturing footprint in the U.S. Midwest and its position as a software-integration leader to drive the mobile equipment market’s transition toward hybrid and electric-hydraulic solutions.

- In 2025, Bosch Rexroth reinforced its position as an industrial specialist by showcasing its latest Hägglunds large-bore cylinder series and CytroMotion self-contained actuators at major regional trade shows like CONEXPO. Bosch Rexroth concentrates on developing sustainable, leak-free, and compact hydraulic solutions for heavy-duty industrial and mobile applications. This strategy targets the high-end infrastructure and automation segments where the ultimate force density and integrated digital feedback of modern hydraulics are required to support North America’s re-shoring of manufacturing.

The North American hydraulic cylinder market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2022 to 2035, for the following segments:

Market, By Function

- Single acting cylinders

- Double-acting cylinders

- Telescopic

Market, By Bore Size

- ≤ 50 mm

- 51 – 100 mm

- 101-150mm

- 151-250mm

- > 250 mm

Market, By Application

- Mobile/off-road equipment

- Earthmoving & construction equipment

- Excavators

- Wheel loaders & track loaders

- Backhoes & backhoe loaders

- Bulldozers & motor graders

- Earthmoving & construction equipment

- Compactors & road construction equipment

- Mining equipment

- Rigid mining dump trucks

- Articulated dump trucks

- Drilling rigs & underground loaders

- Mining equipment

- Rope shovels & draglines

- Material handling equipment

- Forklifts & reach stackers

- Telescopic handlers (telehandlers)

- Container handlers

- Material handling equipment

- Agricultural machinery

- Forestry equipment

- Specialty off-road

- On-road commercial vehicles

- Tipper/dump trucks

- Trailers

- Refuse & waste collection

- Truck-mounted equipment

- Specialty commercials (fire, airport, utility vehicles)

- Industrial equipment

- Marine & offshore

- Energy & power

Market, By Country

- U.S.

- Canada

- Mexico

Frequently Asked Question(FAQ) :

Who are the key players in the North America hydraulic cylinder market?

Key players include Parker Hannifin Corporation, Bosch Rexroth AG, Caterpillar Inc., Eaton, Ligon Industries, Danfoss Power Solutions, Enerpac Tool Group, Hengli Hydraulic, HYDAC International, KYB Corporation, Liebherr, Milwaukee Cylinder, Prince Manufacturing Corporation, Texas Hydraulics, and Weber-Hydraulik Group.

What are the upcoming trends in the North America hydraulic cylinder market?

Key trends include integration of IoT and connected hydraulic systems with real-time monitoring, adoption of smart electro-hydraulic technology with integrated sensors, and rise of remanufacturing services for aging equipment fleets.

Which country leads the North America hydraulic cylinder market?

The U.S. held 79.8% share with USD 3.8 billion in 2025. Massive federal infrastructure investments and advanced manufacturing capabilities fuel the country's dominance.

What is the growth outlook for earthmoving & construction equipment from 2026 to 2035?

The earthmoving & construction equipment sub-segment is projected to grow at the highest CAGR of 5.5% till 2035, due to massive infrastructure investments and urban transit network expansion.

What was the valuation of the mobile/off-road equipment segment in 2025?

The mobile/off-road equipment segment held 51.8% of the total U.S. market value in 2025, driven primarily by earthmoving and construction applications.

What is the market size of the North America hydraulic cylinder in 2025?

The market size was USD 4.7 billion in 2025, with a CAGR of 4.8% expected through 2035 driven by major technological and operational shifts reshaping industrial and off-highway machinery.

What is the projected value of the North America hydraulic cylinder market by 2035?

The North America hydraulic cylinder market is expected to reach USD 7.5 billion by 2035, propelled by smart electro-hydraulic technology adoption, IoT integration, and booming infrastructure development.

What is the current North America hydraulic cylinder market size in 2026?

The market size is projected to reach USD 4.9 billion in 2026.

How much revenue did the double-acting cylinders segment generate in 2025?

Double-acting cylinders held the largest share, accounting for 68% of the U.S. market in 2025, due to their ability to exert force in both extension and retraction directions.

North America Hydraulic Cylinder Market Scope

Related Reports