Summary

Table of Content

North America Acoustic Barrier Market

Get a free sample of this report

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

North America Acoustic Barrier Market Size

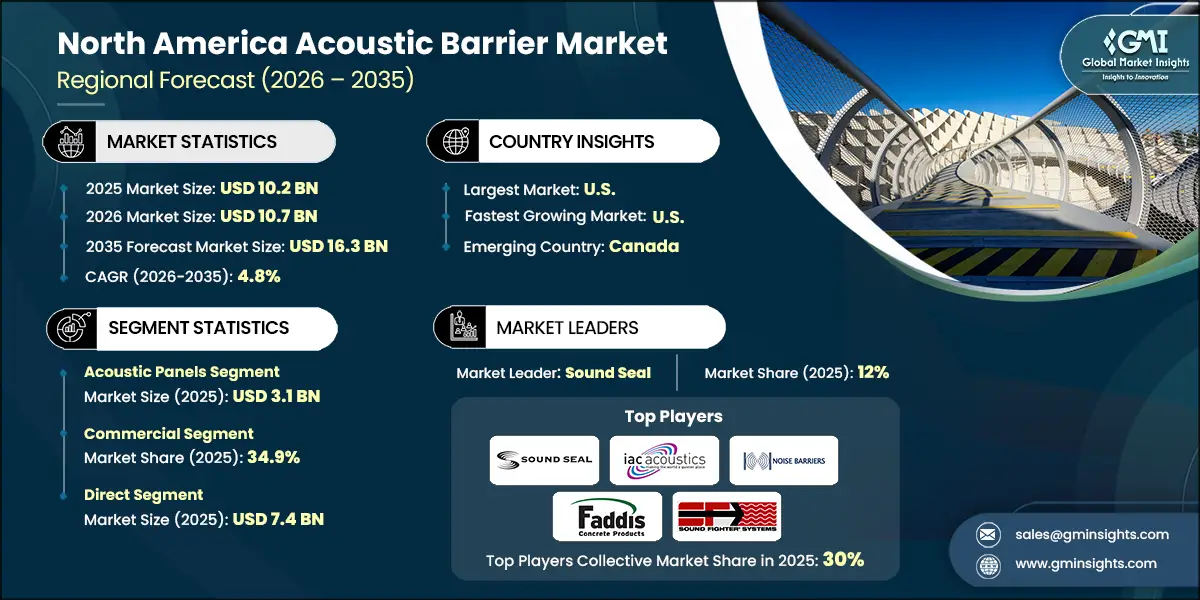

The North America acoustic barrier market was estimated at USD 10.2 billion in 2025. The market is expected to grow from USD 10.7 billion in 2026 to USD 16.3 billion in 2035, at a CAGR of 4.8% according to latest report published by Global Market Insights Inc.

To get key market trends

The rapid urbanization of North America has caused growth in transportation systems such as highways, railroads, and public transportation networks. With cities growing and populations becoming more densely populated, noise pollution has become a serious concern for residential and commercial buildings that are close to these systems. Acoustic barriers can help reduce traffic and industrial noise pollution, help meet environmental standards, and increase the quality of life for those who live in urban areas.

Furthermore, the development of large infrastructure projects by federal & state governments results in constant demand for noise mitigation products. Urban renewal projects and smart city projects have increased this need, as urban planners want to provide sustainable and livable communities. Acoustic barriers are being used increasingly often as part of these types of projects, both for performance purposes and for visual enhancement. They conform to current architectural trends.

In North America, noise regulations impose greater restrictions than ever and are being driven by increased recognition of the adverse impacts of excessive noise on people's health as well as the environment. As a result of increasing awareness, both federal and state governments increasingly mandate that noise abatement measures be implemented in connection to transportation corridors, industrial zones, and residential developments with proximate access to high-traffic areas. For this reason, the requirement for developers and contractors to implement acoustic barriers in the design of their projects is one of the major contributing factors to the growth of the market for these products.

Additionally, municipalities throughout North America are passing local ordinances to address their constituents' concerns about noise pollution. The result is a growing opportunity for manufacturers to innovate using new materials and design techniques that will provide acoustic barrier solutions either equal to or better in performance than those currently available on the market, as noise regulations are becoming increasingly enforced in cities and towns. Therefore, if companies can provide cost-effective, durable, and aesthetically appealing solutions, they will capture greater market share and profit margins, especially with the increasing numbers of municipalities enforcing noise regulations.

North America Acoustic Barrier Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 10.2 Billion |

| Market Size in 2026 | USD 10.7 Billion |

| Forecast Period 2026-2035 CAGR | 4.8% |

| Market Size in 2035 | USD 16.3 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Infrastructure & urbanization expansion | Increasing demands for noise barriers along highways, railroads, and urban developments to mitigate the impact of these transportation systems on both residential and commercial areas. |

| Stringent noise regulations | Mandatory compliance to install acoustic barrier systems as part of all transportation and construction projects will be enforced. |

| Technological advancements | Enhances barrier performance, aesthetic qualities, and ease of installation, thereby providing a means for companies to differentiate themselves from competitors. |

| Pitfalls & Challenges | Impact |

| High initial cost | Reduces the acceptance of noise barriers in smaller-scale projects, therefore causing delays in investment decisions. |

| Maintenance & durability issues | Increases overall lifecycle costs of acoustic barriers located in areas experiencing severe weather conditions; thus, adversely affecting the overall return on investment. |

| Opportunities: | Impact |

| Smart acoustic barriers | Provides the opportunity for real-time noise monitoring and predictive maintenance aligning with the development of smart cities. |

| Eco-friendly materials | Allows for sustainability goals and green building certifications to be met and makes it possible to appeal to environmentally conscious projects. |

| Market Leaders (2025) | |

| Market Leader |

12% market share |

| Top Players |

The collective market share in 2025 is 30% |

| Competitive Edge |

|

| Regional Insights | |

| Largest market | U.S. |

| Fastest growing market | U.S. |

| Emerging countries | Canada |

| Future Outlook |

|

What are the growth opportunities in this market?

North America Acoustic Barrier Market Trends

The North America acoustic barrier industry is rapidly evolving because of technological innovations, regulatory pressures and changing urban environments. These factors are having a significant influence on the development of an increasing amount of infrastructure, as well as heightened awareness of noise pollution, and the increasing need for sustainable solutions. In addition, advances in smart technology and modular solutions are creating opportunities for manufacturers and contractors to provide high-performance, cost-effective solutions to diverse applications.

- Barriers are made of intelligent materials that are more responsive to changing environmental conditions than traditional acoustic barriers. This form of acoustic barrier is part of the Smart City Initiative, whereby smart technologies are being incorporated into the urban experience to improve quality of life via data-based solutions. Smart barriers can also help reduce maintenance costs through predictive analytics and continuous improvement of performance.

- With an increasing focus on sustainability, acoustic barriers constructed from alternative materials have been developed in recent years. Examples of these types of materials are using recycled and/or renewable raw materials and using low-carbon concrete. Manufacturers who participate in the manufacturing of sustainable acoustic barriers can take advantage of a growing market that has been created through government and market-driven interest for green-certified projects.

- City planners and architects are increasingly looking for sound walls that enhance the city landscape instead of blocking it off. For example, using clear panels made of acrylic or polycarbonate to be used on scenic highways, residential neighborhoods, and commercial areas. These systems provide an open visual feel as well as reduce sound effectively. Customization options such as a variety of colors and art designs are quickly becoming standard options. These barriers provide functionality while also adding to the aesthetics of the urban environment.

- With more short-term projects and urban development environments being created, there has been an increased demand for portable and modular acoustic noise wall solutions. Portable modular acoustic noise wall solutions offer an excellent alternative to traditional sound walls at construction and special events, as well as renewable energy projects, that require short-term noise control barriers. Portable Modular Acoustic Noise Walls can be easily installed, moved, and reused, thus providing a cost-effective noise wall solution to contractors and event planners. Due to this benefit, portable modular acoustic noise walls will likely continue to grow in popularity.

North America Acoustic Barrier Market Analysis

Learn more about the key segments shaping this market

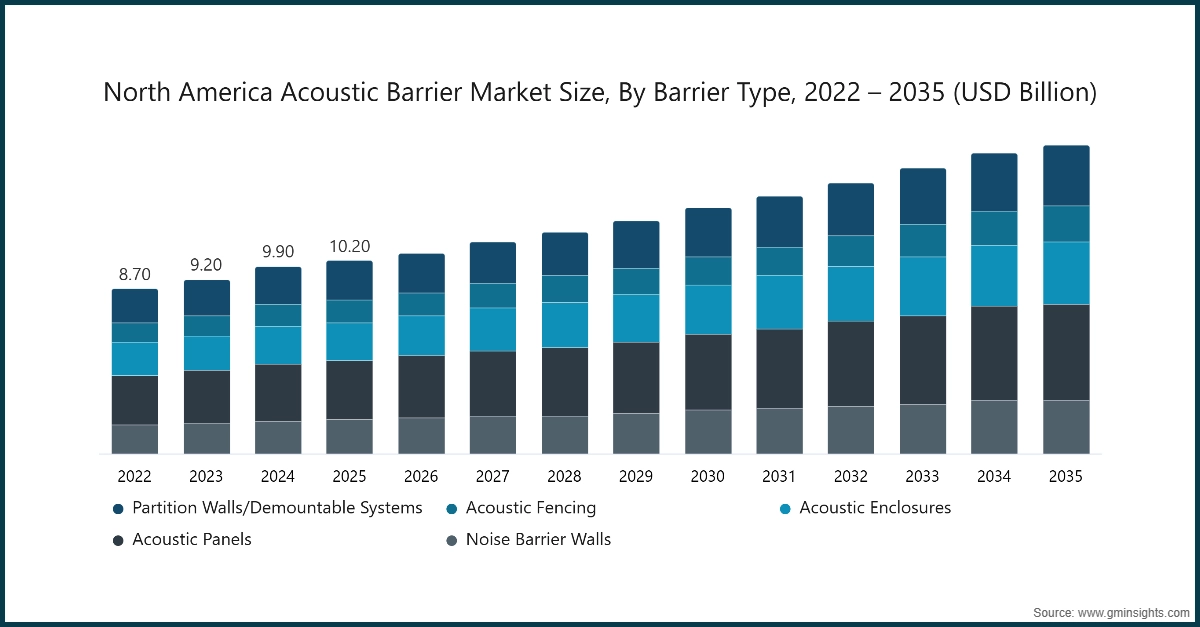

Based on barrier type, the market is divided into noise barrier walls, acoustic panels, acoustic enclosures, acoustic fencing and partition walls/demountable systems. In 2025, acoustic panels held the major market share, generating a revenue of USD 3.1 billion.

- Acoustic panels are sound absorbing materials that reduce noise levels and control sound reflections in a room or other environment. Unlike soundproofing, which prevents sound from entering or leaving, the primary focus of acoustic panels is to improve the way the acoustic environment of a room sounds by reducing echoes and reverberation. Acoustic panels are frequently used in offices and recording studios, at theaters and in homes to make the space more comfortable and productive.

- Acoustic panels absorb sound waves that would normally reflect off hard materials removed from the walls, ceilings and floors. Acoustic panel materials are porous, including foam, fiberglass, or fabric-wrapped core panels and can take the sound energy, through friction created as the sound travels through them, and convert that sound energy into heat. Acoustic panels reduce the amount of reflected sound making it easier to hear and understand. Therefore, when installed in locations where vocal communication is occurring, they are critical components to making sure the music and/or speech is clearly understood and heard.

- Acoustic panels can be used in a variety of different locations and types of businesses. In offices, acoustic panels help to reduce environmental sounds so employees can concentrate better on their work and get more done. In recording studios and home movie theatres, they provide an accurate representation of sound recorded or played back. The use of acoustic panels in our daily lives creates healthier and less stressful environments due to the reduction in harmful environmental sounds. Because of the many designs available, including different colors, shapes and patterns, acoustic panels have both functional and decorative uses.

Learn more about the key segments shaping this market

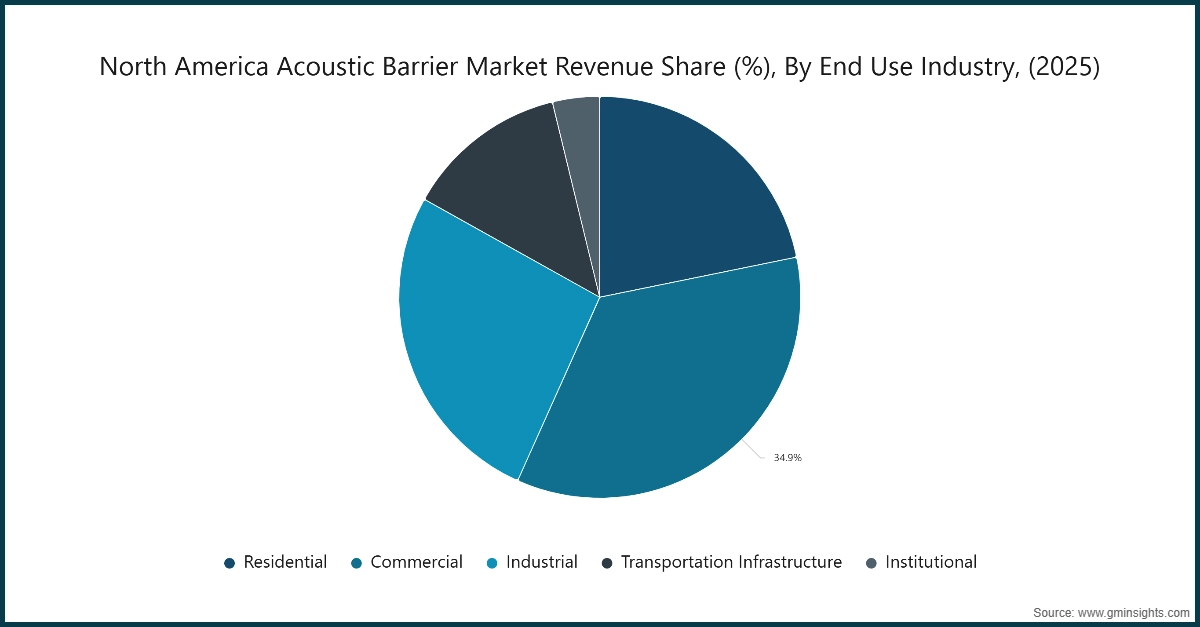

Based on end use industry, the North America acoustic barrier market is segmented into residential, commercial, industrial, transportation infrastructure and institutional. The commercial segment held around 34.9% of the revenue share in 2025.

- The commercial sector has emerged as a major force, impacting the growth of acoustic barrier sales in recent years due to a growing demand for more comfortable and productive locations. This sector includes office buildings, shopping centers, hotels, and a variety of mixed-use developments. Each of these buildings typically has their own unique sound environment issues related to things like vehicle traffic, HVAC systems, and industrial areas nearby. By their very nature, acoustic barriers assist with these common noise-related problems by providing adequate protection against noise coming into a commercial space, as well as creating a much-improved level of indoor acoustic quality. This ultimately leads to increased employee output and improved customer experiences in most cases.

- The trend of urbanization and the increased number of high-density commercial spaces being developed on or adjacent to major transportation routes has created more demands for solutions to control noise. Businesses are placing greater emphasis on developing and maintaining a comfortable acoustic environment, as part of their sustainability and wellness initiatives.

- The commercial end-use segment has great opportunities for growth for companies that create acoustic barriers. There are many new inventive ways to create aesthetically pleasing products and designs as well as using clear and transparent panels and developing modular configuration systems to meet both architectural and functional requirements. The use of smart technology that can monitor noise levels in real-time will likely become a standard feature for all commercial properties. As companies continue to invest in premium-based infrastructure and employee wellness programs, the need for superior acoustic solutions will remain strong.

Based on distribution channel, the North America acoustic barrier market is segmented direct and indirect. In 2025, direct segment held the largest market share, generating a revenue of USD 7.4 billion.

- One of the advantages of direct distribution is that by having no intermediary, the manufacturer and/or solution provider can control the specification of products and how they are manufactured including any customization such as height, width, material mix, transparency, etc. Furthermore, the use of a direct distribution channel streamlines the technical support function in that the manufacturer and/or solution provider can provide acoustic design modelling, site surveys, installation guidance, and post-installation maintenance as a single package. For projects that require multiple compliance and performance metrics, such as commercial or transportation projects, a direct route provides the opportunity to minimize miscommunication and ensure acoustic performance aligns with the design intent.

- From a commercial perspective, the opportunity to improve margins and foster long-term relationships with clients through service-level agreements and lifecycle programming can be enhanced through direct distribution. The disadvantage to a direct distribution channel lies in the labor intensity and therefore cost associated with building, operating and maintaining a direct distribution channel, as the volume of sales; the level of service provided; the cost of logistics; the capability to provide for installation and maintenance must all be done internally. Manufacturers utilizing a direct distribution method often build a regional team, develop a demo site, and use digital tools such as quotation-configurators and BIM-libraries to assist in reducing the friction in the selling process and promote quicker buyer's decisions.

Looking for region specific data?

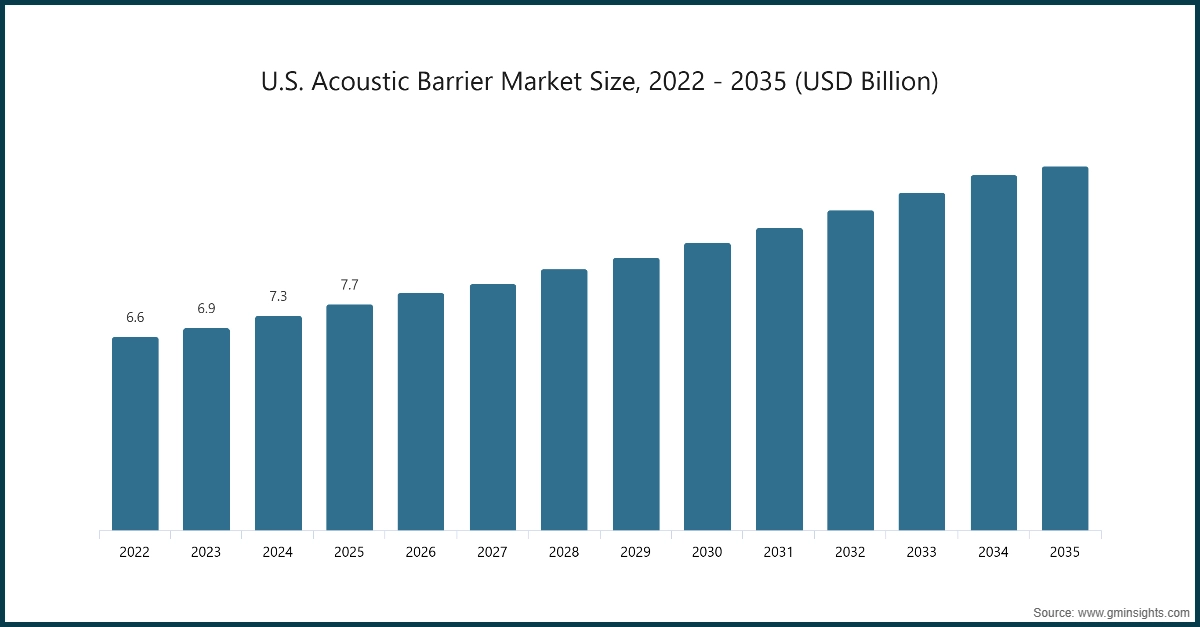

In 2025, the U.S dominated the North America acoustic barrier market, accounting for around 75.4% and generating around USD 7.7 billion revenue in the same year.

The volume of sound barrier installations in the U.S. is one of the highest and most developed acoustic markets worldwide. Due to major infrastructure development and high levels of regulation by environmental agencies, the U.S. has the largest number of sound barrier installations coordinated by both Federal and State authorities. As the U.S. has created an extensive transportation network that continues to grow and present increasing issues with sound coming from this network, both residential and commercial properties, through Federal and State programs, must comply with strict requirements regarding the sound abatement of the land adjacent to their property. Increasingly many people are becoming aware of the adverse effects of noise pollution on human health and how much sound can negatively affect the quality of people's lives. The rise in public awareness of noise-related health issues, coupled with the creation of new noise abatement regulations, will continue to drive customer demand for sound barriers.

- The United States has been greatly influenced by both technological innovation and sustainability trends. Manufacturers now see an opportunity to supply new advanced solutions with transparent panels for scenic routes, eco-friendly materials for green-certified projects, etc. and state-of-the-art smart barriers containing IoT sensors that provide real-time noise monitoring. Urban renewal programs and smart city programming are creating new markets for aesthetically pleasing barriers that serve multiple purposes.

North America Acoustic Barrier Market Share

Sound Seal is leading with 12% market share. Sound Seal, IAC Acoustics, Noise Barriers, Faddis Concrete Products, Sound Fighter Systems collectively hold around 30%, indicating moderately fragmented market concentration. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

Sound Seal is an industry leader in North America for the provision of solutions that control noise with a variety of acoustic products for the industrial, architectural, and the environmental marketplace. Sound Seal has developed many innovative product designs utilizing high-performance materials. Sound Seal's focus on custom designing products and compliance with the strict noise regulation requirements for many projects in the marketplace has allowed Sound Seal to position itself as a partner of choice for larger scale projects in the marketplace.

IAC Acoustics is a provider of engineered noise control solutions. The company develops designs, and manufactures noise barriers, enclosures, and soundproofing systems for industrial and commercial use. IAC is recognized for its technical competence and ability to develop customized solutions to the most complex noise problems. The company has a presence in a variety of markets, including power generation, transportation, and manufacturing, and continues to focus on providing end-users with the highest level of durability, performance, and regulatory compliance in the development of its product offering.

North America Acoustic Barrier Market Companies

Major players operating in the North America acoustic barrier industry are:

- Acoustical Surfaces

- Echo Barrier USA

- Faddis Concrete Products

- IAC Acoustics

- Kinetics Noise Control

- Noise Barriers

- Permacast Walls

- Polymer Technologies

- Shaver Industries

- Sound Fighter Systems

- Sound Seal

- Steel Guard Safety

- Technicon Acoustics

- Tricon Precast

- Valmont Structures

Echo Barrier USA specializes in producing portable or temporary acoustic barriers for use at construction sites, events and other short-term projects. All Echo Barrier acoustic barrier products are lightweight, modular and easy to install, making them the ideal solution in a dynamic environment that requires high levels of flexibility. The company has built a successful business around offering portable acoustic barriers and their associated products which provide effective means of reducing noise while also being portable. This has allowed Echo Barrier to serve industries that need rapid deployment of their products as well as reusing many of their products, thereby creating a steady stream of sales.

Kinetics Noise Control manufactures and sells vibration and noise control solutions, including acoustic barriers, isolation systems and sound-absorbing materials. Kinetics Noise Control serves the commercial, industrial and architectural industries and provides products that improve the acoustic comfort of the workplace and support sustainability initiatives. Kinetics' commitment to innovation and addressing the growing trends of integration with modern building designs allows them to distinguish themselves from others when selecting products for projects that require performance and aesthetics.

North America Acoustic Barrier Industry News

- In September 2025, Kinetics Noise Control announced the availability of a new Product, the NoiseBlock PW275, lightweight rigid-PVC modular barrier wall, designed with tongue and groove panels, durable, low-maintenance surfaces with UV protection, available in neutral colors (white, grey, tan), and quick-to-produce turnarounds for use in mechanical equipment enclosures, rooftop screening applications, or very harsh outdoor environments.

- In July 2025, IAC Acoustics updated their website. Users now have a simplified way to select Noishield barrier systems that typically perform between STC 30 and 33, have NRC ratings around 1.00 to 1.05, use galvanized, galvannealed or stainless steel/aluminum, are finished with powder after assembly, can support spans of 16 ft unbraced, and are provided to the user via turnkey service from design through installation for transport applications, utility facilities, data centers, and mechanical plants.

- In 2025, Echo Barrier USA has released the H-Series temporary acoustic panels to be available in The U.S. Versions of this product are available; The H10 has been tested by an independent lab to reduce sound levels up to 43.4 dB. The H-Series products also have an ASTM E84 fire rating; IPX6 and IPX9 ratings for waterproofness; EN 60529 (dustproof); a reinforced mesh back to add durability, and fast (fence-mounted) installation for construction sites/rail/trade ventures.

- In March 2024, Noise Barriers released the QuietSwing Alexis Door, a product with patented concealed hinges; factory-sealed joints and door handles; optional impact-resistant finishes, and a two-piece design for quick installations using the retrofit style of assembly. The QuietSwing Alexis Door was designed for high STC-rated architectural use, where excellent aesthetics and sound isolation are critical.

The North America acoustic barrier market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) & volume (Thousand Square Meters) from 2022 to 2035, for the following segments:

Market, By Barrier Type

- Noise barrier walls

- Acoustic panels

- Wall-mounted

- Ceiling-mounted

- Free-standing

- Acoustic enclosures

- Acoustic fencing

- Partition walls/demountable systems

Market, By Material

- Concrete-based barriers

- Metal-based barriers

- Transparent/acrylic-based barriers

- Wood-based barriers

- Mineral wool-based

- Rock wool

- Glass wool

- Foam/polymer-based barriers

- Composite/multi-material barrier

Market, By End Use Industry

- Residential

- Commercial

- Office

- Hospitality

- Retail

- Entertainment & recreation

- Industrial

- Transportation infrastructure

- Institutional

Market, By Distribution Channel

- Direct

- Indirect

The above information is provided for the following countries:

- U.S.

- Canada

Frequently Asked Question(FAQ) :

Who are the key players in the North America acoustic barrier market?

Key players include Sound Seal, IAC Acoustics, Noise Barriers, Faddis Concrete Products, Sound Fighter Systems, Acoustical Surfaces, Echo Barrier USA, Kinetics Noise Control, Permacast Walls, Polymer Technologies, Shaver Industries, Steel Guard Safety, Technicon Acoustics, Tricon Precast, and Valmont Structures.

What are the upcoming trends in the North America acoustic barrier market?

Key trends include integration of IoT sensors for smart acoustic barriers with real-time monitoring, adoption of eco-friendly materials like recycled composites and low-carbon concrete, transparent panels for aesthetic appeal, and modular portable solutions for temporary noise control.

Which country leads the North America acoustic barrier market?

The U.S. dominates the market, holding 75.4% regional share and generating USD 7.7 billion in 2025, driven by extensive transportation networks, strict federal and state noise regulations, and advanced infrastructure development programs.

What was the market share of the commercial end-use segment in 2025?

The commercial segment held 34.9% market share in 2025, driven by increasing demand for comfortable acoustic environments in office buildings, shopping centers, hotels, and mixed-use developments near high-traffic areas.

What is the market size of the North America acoustic barrier in 2025?

The market size was USD 10.2 billion in 2025, with a CAGR of 4.8% expected through 2035 driven by rapid urbanization, infrastructure expansion, and stringent noise regulations across transportation corridors and residential developments.

What is the current North America acoustic barrier market size in 2026?

The market size is projected to reach USD 10.7 billion in 2026.

How much revenue did the acoustic panels segment generate in 2025?

Acoustic panels generated USD 3.1 billion in 2025, leading the market due to their versatility in controlling sound reflections and reducing noise levels across offices, recording studios, theaters, and residential spaces.

What is the projected value of the North America acoustic barrier market by 2035?

The North America acoustic barrier market is expected to reach USD 16.3 billion by 2035, propelled by smart city initiatives, eco-friendly material adoption, and increasing demand for aesthetically appealing noise mitigation solutions.

North America Acoustic Barrier Market Scope

Related Reports