Summary

Table of Content

Non-Alcoholic Smart Beverages Machine Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Non-Alcoholic Smart Beverages Machine Market Size

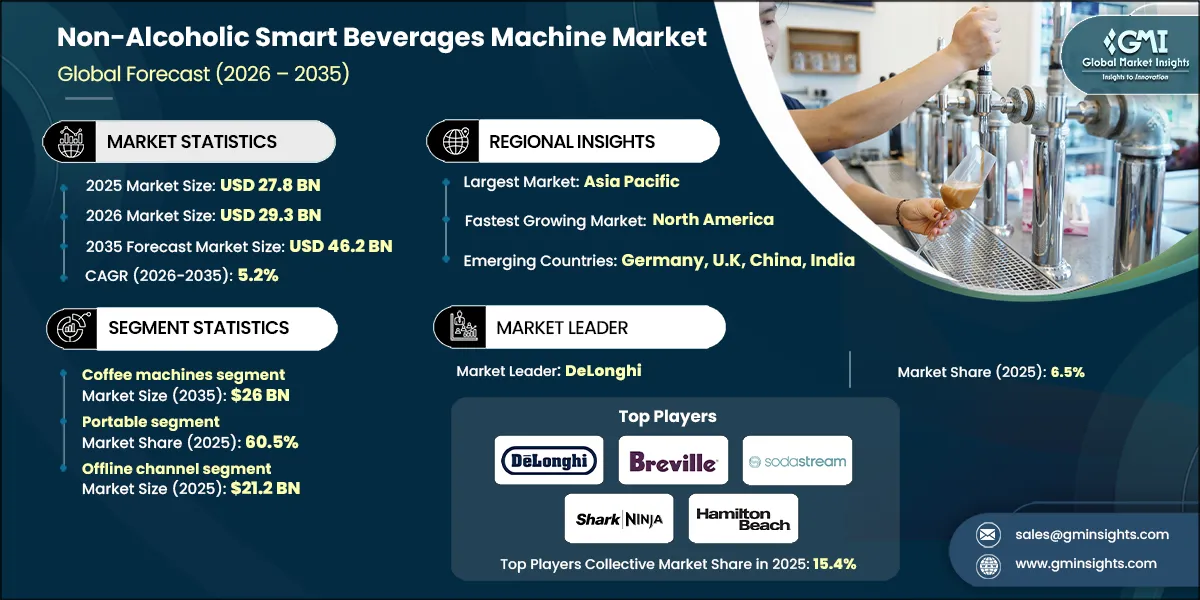

The global non-alcoholic smart beverages machine market was valued at USD 27.8 billion in 2025. The market is expected to grow from USD 29.3 billion in 2026 to USD 46.2 billion in 2035, at a CAGR of 5.2%, according to latest report published by Global Market Insights Inc.

To get key market trends

The non-alcoholic smart beverage machine market is experiencing growth due to increasing consumer demand for personalized experiences. Smart beverage machines are made available to allow a user to create their own beverage by selecting the flavour and sweetness level of the beverage. Coca-Cola's Freestyle smart beverage machine is an example of this new method of creating drinks. This type of customization will drive consumer demand for smart beverage machines.

Consumers are increasingly choosing products that contain natural and organic sweeteners, functional food additives, and "superfoods." According to the USDA report, natural and organic products are projected to grow by more than 5% annually until 2025. Smart beverage machines are able to incorporate many of the health and wellness elements that consumers are looking for in their beverage choices, allowing smart beverage machines to meet market demand.

Non-Alcoholic Smart Beverages Machine Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 27.8 Billion |

| Market Size in 2026 | USD 29.3 Billion |

| Forecast Period 2026 - 2035 CAGR | 5.2% |

| Market Size in 2035 | USD 46.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Smart technology integration | AI- and IoT-enabled features improve personalization, automation, and user experience, driving faster adoption across home and commercial environments. Touchscreens, automated dispensing, and connected interfaces enhance operational efficiency, making smart machines more attractive to health and convenience-driven consumers. |

| Growing numbers of household and restaurants across the world | Rising residential adoption of at-home beverage preparation boosts demand for countertop and portable smart machines. Expanding hospitality and foodservice sectors adopt smart dispensers for customization, speed, and efficiency, especially in urban markets. |

| Growing disposable income and change in the standard of living | Higher disposable income supports the purchase of premium, tech-integrated appliances for healthier and personalized beverage consumption. Urban lifestyle changes increase acceptance of automated, smart beverage systems that offer convenience and elevated user experience |

| Pitfalls & Challenges | Impact |

| Availability of counterfeit products | Counterfeit and low-quality devices erode consumer trust and create downward price pressure in emerging markets. These products undermine brand value and slow adoption of legitimate, high-tech smart beverage systems. |

| Easy availability of substitute products | Traditional dispensers, manual brewers, and low-tech beverage appliances limit the need for advanced smart machines in price-sensitive segments. Substitutes reduce switching incentives, especially where smart functionalities are seen as non-essential. |

| Opportunities: | Impact |

| Expansion into health‑focused, personalized beverage solutions. | Health‑conscious consumers increasingly seek customizable low‑sugar, functional, and infused beverages, boosting demand for smart dispensers. AI‑driven ingredient control allows brands to innovate with wellness‑oriented beverage platforms across home, office, and hospitality sectors |

| Growth in connected, IoT‑enabled machines for residential and commercial segments | IoT connectivity, predictive maintenance, and remote monitoring expand opportunities for cloud‑managed beverage systems. Rising adoption in homes, offices, cafes, and retail environments drives demand for scalable, automated smart beverage ecosystems. |

| Market Leaders (2025) | |

| Market Leaders |

6.5% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest market | Asia Pacific |

| Fastest growing market | North America |

| Emerging countries | Germany, U.K, China, India |

| Future outlook |

|

What are the growth opportunities in this market?

Further, urbanization is helping in the growth of the smart beverage machine market, with over 56% of the global population living in urban areas according to the World Bank- 2024, thus the need for convenient drink options also grows. Smart beverage machines are ideal for the fast-paced lifestyle of city residents, which is why they can be found in many offices, retail spaces, and public buildings throughout urban areas.

Demographic shifts, particularly among younger generations, are influencing demand for innovative and tech-driven solutions. Millennials and Gen Z, known for their preference for technology and convenience, are key adopters of smart beverage machines.

Thus, manufacturers navigate obstacles, including high research and development costs, as well as the complex process of merging multiple types of technology to create these systems. Integrating various systems of technology requires a substantial commitment financially and in knowledge to develop both the hardware and software needed to produce such systems. Therefore, these companies must have a significant level of capital in order to develop this.

Non-Alcoholic Smart Beverages Machine Market Trends

Changing innovation and technology transformation are important for the growth of the market.

- Due to the growing global emphasis on public health and safety, touchless technology adoption has risen dramatically. The World Health Organization (WHO) estimates that 80% of all infectious disease transmission occurs through touch. As a result, there has been an increase in demand for contactless/hands-free solutions. For example, smart beverage machines equipped with touchless interfaces, mobile applications to control the machines, and voice command technology allows for safer consumption experiences.

- In addition to the health benefits provided by touchless technology, IoT (Internet of Things) integration is already changing the beverage vending machine marketplace. Smart beverage machines offer integrated sensors and connectivity, which means the machines can analyze drinking habits and offer up personalized suggestions based on the user’s behavior. Nestlé's instant coffee maker is an excellent example. This appliance utilizes IoT to monitor what beverages the consumer drinks the most often, helping the appliance offer consumers the best beverage choices moving forward.

- Smart machines are utilizing environmentally-friendly materials and being developed with energy-efficient technologies. The SodaStream Professional from PepsiCo supports the growing market for reusable bottles by providing a product that meets consumer demand for sustainable products and improves convenience.

- Improving the efficiency of non-alcoholic smart beverage machines will be supported by government initiatives and continuing advancements in sustainable technology and innovation will accelerate the development and growth of this market sector over the forecast period. .

- Artificial Intelligence (AI) is also one of the driving forces behind this trend towards touchless technology. AI allows beverage manufacturers to build machines that can learn and adapt to their consumer’s preferences, recommend recipes, and evolve as a result of changing tastes. As a result, smart beverage machines such as the Keurig K-Supreme Plus Smart Brewer utilize AI to customize the brewing process depending on the end-users’ feedback, increasing the amount of personalization available to users.

Non-Alcoholic Smart Beverages Machine Market Analysis

Learn more about the key segments shaping this market

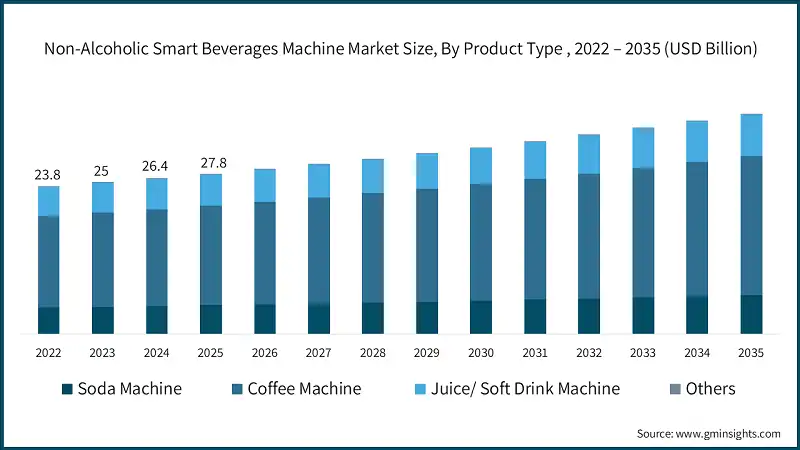

Based on product type, the non-alcoholic smart beverages machine industry is segmented into soda machine, coffee machines, juice/ soft drink machine and others. The coffee machines segment accounts for revenue of around USD 15.3 billion in the year 2025 and is expected to reach USD 26 billion by 2035.

- Coffee machines lead the global non-alcoholic smart beverage machine market due to increased global coffee demand and specialty drink preferences. The International Coffee Organization (ICO) estimates that total world coffee consumption will be 175.8 million bags by 2025, indicating the continued growth of coffee around the world.

- The capabilities of coffee machines, such as automated brewing, remote brewing, and user-customization options, are features that modern users will find very appealing. For example, the Nespresso Vertuo Next includes Bluetooth capability, which allows users to remotely control the coffee-brewing process and create customized settings to suit individual tastes. Innovations such as these are quickly becoming essential in satisfying consumers' needs for convenience and variety.

- Urbanization and the growth of the coffee culture are also factors driving the switch to coffee machines. Data from the U.S. Department of Agriculture (USDA) indicates that U.S. coffee imports will continue to grow at a rate of 2% per year until 2025, which shows sustained consumer interest in coffee-related products and technology.

- Top corporations have introduced an extensive range of high-tech products designed to improve their customers' experiences through the use of current and cutting-edge solutions. One example of this is the smart coffee maker developed by Keurig. This particular device allows customers to increase their enjoyment while using the product because they can remotely manage their coffee preparation through the use of a smartphone application.

- In addition to the technology and convenience associated with smart coffee makers, the current rise in coffee consumption across many parts of the world has led to the market's growth. Furthermore, many consumers now prefer a more personal and customized experience with their coffee.

Learn more about the key segments shaping this market

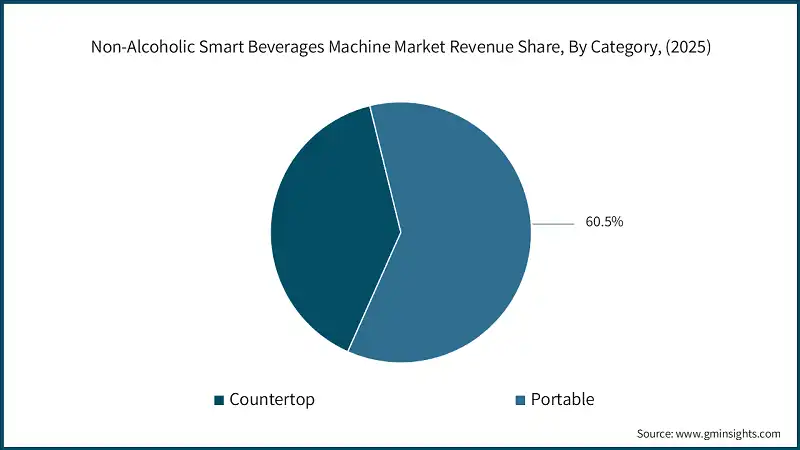

Based on the category, the non-alcoholic smart beverages machine market is bifurcated into countertop and portable. The portable segments held the largest share, accounting for 60.5% of the market in 2025.

- Portable machines are becoming increasingly popular because they are easy to use and can be used for many different purposes. They allow people who have busy lifestyles to enjoy their drink anywhere they go. In 2021, outdoor recreation contributed 862 billion dollars to the U.S. economy, with the number of people participating projected to increase by 2025. Thus, both of these factors have led to an increase in demand for portable smart beverage machines that are perfect for outdoor and travel use.

- Top manufacturers like Nespresso have taken advantage of this need with products such as the Nespresso Essenza Mini, a small, lightweight coffee maker. These types of products are designed specifically for mobility and quality, and they are the number one choice for anyone wanting to be able to travel with their drink conveniently while maintaining high performance.

- Further government programs aimed at encouraging people to be outdoors and participate in outdoor activities. For example, the programs administered through the U.S. Department of the Interior that work with both state and federal agencies to develop more accessible outdoor recreation opportunities that allow for the greater use of portable beverage makers.

- Urban growth has contributed to the increased demand for portable devices as many people have limited room in their homes, thus making these devices ideal choices. Urban dwellers want the benefits of portability, ease of operation, and the convenience of storing these devices where space is limited.

- Consumer trends continue to emphasize the need for mobility and convenience, creating expectations that portable devices will maintain their current position as the leading type of household appliance until at least 2025 and likely much longer. Since lifestyles are continually changing and new products are becoming available, this further solidifies that expectation.

Based on distribution channels, the non-alcoholic smart beverages machine market is segmented into online and offline channels. The offline channel segment held the largest share, generating a revenue of USD 21.2 billion of the market in 2025.

- The offline channel in the non-alcoholic smart beverages machine market has experienced significant growth due to its ability to meet consumer demand effectively. Offline retail outlets, including supermarkets, hypermarkets, and specialty stores, remain a dominant distribution channel, contributing substantially to market revenue.

- The offline channel’s success can be attributed to the fact that customers have the ability to physically evaluate products before making a purchase. When shopping in an offline environment, consumers can examine the machine, study the machine’s functions and ascertain the quality of the product before making a purchase, which increases the consumer's level of trust and confidence in the buying decision.

- Another contributor to the significant growth of this channel is the provision of immediate sales support and technical assistance available on-site at the offline store. Customers are more likely to value the fact that if they encounter a problem or need assistance, they can receive quick help in solving those problems, enhancing their overall shopping experience.

- The presence of specially trained staff in the offline retail environment will help to provide direct answers to customer concerns and queries, leading to greater levels of customer satisfaction.

- Additionally, offline channels often host promotional events and product demonstrations, helping customers to experience and try the machines in person. These events not only educate consumers about the product's features but also create a more engaging shopping experience, further driving sales through this channel.

Looking for region specific data?

North America Non-Alcoholic Smart Beverages Machine Market

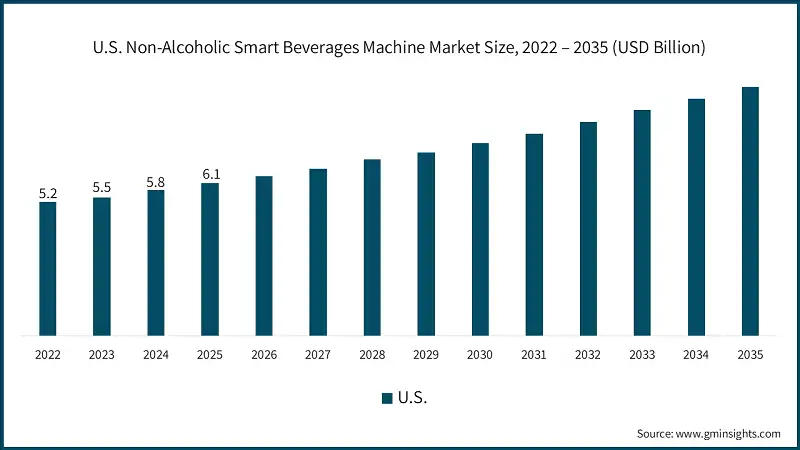

In 2025, the U.S. dominated the market growth in North America, accounting for 83.5% of the share in the region.

- Growth in U.S. is driven by high disposable incomes, strong adoption of IoT-enabled appliances, and rapid urban lifestyles that favor automated beverage solutions. The U.S. market benefits from its leadership in smart beverage technology and innovation-led upgrades across residential and commercial segments.

- According to the U.S. Bureau of Economic Analysis, demand for smart beverage machines correlates with rising automation trends and increased consumer spending on IoT-integrated home appliances. These economic indicators, combined with a well-established foodservice automation ecosystem, reinforce sustained regional expansion.

Asia Pacific Non-Alcoholic Smart Beverages Machine Market

Asia Pacific market is expected to grow at 5.2% during the forecast period.

- Asia Pacific’s growth is fueled by rapid urbanization, rising middle-class incomes, and strong government-backed digital transformation initiatives in countries such as China, Japan, and South Korea. Increasing adoption of IoT-enabled food & beverage systems and demand for traceability, safety, and automation further accelerates smart beverage machine penetration.

Europe Non-Alcoholic Smart Beverages Machine Market

Europe market is expected to grow at 5.3% during the forecast period.

- Europe’s market growth is driven by demand for sustainable, energy-efficient beverage systems aligned with EU environmental mandates and consumer eco-preferences. The region also benefits from rapid adoption of IoT, AI, and smart payment technologies in beverage automation, along with expansion into corporate, healthcare, and educational sectors.

Middle East and Africa Non-Alcoholic Smart Beverages Machine Market

Middle East and Africa market is expected to grow at 4.8% during the forecast period.

- The region’s growth is supported by increasing urbanization, rising disposable incomes, and expanding hospitality sectors that are investing in automated beverage technologies. Governments’ digitalization strategies and growing consumer interest in personalized, health-oriented beverages drive adoption of smart connected machines across homes, retail, and foodservice settings.

Non-Alcoholic Smart Beverages Machine Market Shares

The top companies in the market include DeLonghi, Breville, SodaStream, SharkNinja and Hamilton Beach and collectively hold a share of 15.4% of the market in 2025. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- De’Longhi develops advanced coffee and beverage systems designed for high performance, ease of use, and premium brewing quality. Its portfolio spans automatic espresso machines, drip systems, and connected devices that enhance personalization and consistency. With strong engineering and a global footprint, De’Longhi integrates sensors and smart controls to enable reliable beverage preparation and efficient maintenance.

- Breville delivers precision-engineered beverage machines built for craft-level performance in home and specialty coffee environments. Its product line includes smart espresso makers, specialty brewers, and app-enabled systems that support flavor profiling and user customization. Through intuitive interfaces and automation features, Breville enhances convenience while maintaining professional-grade beverage quality.

- SodaStream specializes in home carbonation technology, offering systems that allow users to create sparkling water and flavored beverages with adjustable carbonation levels. Its machines incorporate reusable CO2 cylinders, sustainability-focused design, and simple digital interfaces to elevate user control. The brand’s platform supports reduced plastic consumption and enables consistent, on demand beverage preparation.

Non-Alcoholic Smart Beverages Machine Market Companies

Major players operating in the non-alcoholic smart beverages machine industry are:

- Aicook

- Breville

- Cuisinart

- DeLonghi

- Hamilton Beach

- IFB Appliances

- Isoda

- Moccamaster

- Mr. Coffee

- Nebula

- Omega and Cold Press

- SharkNinja

- Smarter

- SodaStream

- Wonderchef

SharkNinja provides innovative beverage machines under the Ninja brand, featuring multi-brew systems, rapid-heating technology, and smart extraction mechanisms. Its appliances are engineered for versatility, enabling preparation of coffee, cold brew, tea, and specialty drinks with automated presets. Integrated controls and performance-monitoring features enhance convenience, productivity, and consistency across home and small commercial settings.

Hamilton Beach manufactures reliable and user-friendly beverage appliances tailored for households, restaurants, and quick-service environments. Its range spans coffee makers, drink mixers, and automated brewing systems built for durability and everyday performance. With programmable features and smart-compatible options, the company focuses on delivering convenience, operational efficiency, and consistent beverage quality.

Non-Alcoholic Smart Beverages Machine Industry News

- In November 2025 SodaStream launched four innovative products including the enso and ART GOLD sparkling water makers, Crafted non-alcoholic cocktail mixers, and the Fizz & Go COOL system. The lineup emphasizes premium design, sustainability, and customizable carbonation.

- In August 2025, Breville unveiled its next-generation Oracle Dual Boiler espresso machine featuring dual boilers, a 5.7-inch touchscreen, and Wi-Fi connectivity for remote operation and updates. The machine introduces advanced automation, 15 preset beverages, and integrated AI-powered brewing guidance.

- In June 2025, De’Longhi released the Dedica Duo, a slim dual-brew machine capable of both hot espresso and cold brew in under 5 minutes. Available in four new colors, it targets small kitchens and younger consumers seeking compact, modern beverage appliances.

- In May 2025, De’Longhi introduced the Rivelia, a fully automatic espresso machine with dual bean hoppers, Bean Adapt technology, and personalized user profiles. It expands De’Longhi’s smart coffee lineup with intelligent drink recommendations and cold-foam recipe capability.

- In March 2025, SharkNinja gained major attention with its viral Ninja SLUSHi frozen-drink maker, amassing a massive waitlist and fueling brand expansion across beverage categories. The product highlights SharkNinja’s engineering-driven approach and rapid category diversification.

The non-alcoholic smart beverages machine market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and (Thousand Units) (from 2022 to 2035), for the following segments:

Market, By Product Type

- Soda Machine

- Coffee Machine

- Espresso Machines

- Drip Coffee Makers

- Pod Machines

- Juice/ Soft Drink Machine

- Others (Water Maker Machine, etc.)

Market, By Category

- Countertop

- Portable

Market, By Price

- Low

- Medium

- High

Market, By End Use

- Residential

- Commercial

- Hotels

- Restaurants

- Others

Market, By Distribution Channel

- Online channels

- Ecommerce

- Company Owned Website

- Offline Channels

- Specialty Stores

- Mega Retail stores

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Who are the key players in the non-alcoholic smart beverage machine market?

Key players include Aicook, Breville, Cuisinart, DeLonghi, Hamilton Beach, IFB Appliances, Isoda, Moccamaster, Mr. Coffee, Nebula, and Omega and Cold Press.

Which region dominated the non-alcoholic smart beverage machine market in 2025?

The U.S. dominated the market in North America, accounting for 83.5% of the regional share in 2025.

What are the key trends in the non-alcoholic smart beverage machine industry?

Key trends include the adoption of touchless technology, IoT integration for personalized beverage recommendations, and the increasing use of mobile applications and voice command technology for safer and more convenient consumption.

Which distribution channel led the market in 2025?

The offline channel segment led the market, generating USD 21.2 billion in revenue in 2025.

What was the market share of the portable segment in 2025?

The portable segment held the largest share, accounting for 60.5% of the market in 2025.

What is the projected size of the non-alcoholic smart beverage machine market in 2026?

The market is projected to grow to USD 29.3 billion in 2026.

How much revenue did the coffee machine segment generate?

The coffee machine segment generated approximately USD 15.3 billion in 2025 and is expected to reach USD 26 billion by 2035.

What is the projected value of the non-alcoholic smart beverage machine market by 2035?

The market is expected to reach USD 46.2 billion by 2035, fueled by increasing demand for personalized beverage solutions and safer consumption experiences.

What was the market size of the non-alcoholic smart beverage machine market in 2025?

The market size was valued at USD 27.8 billion in 2025, with a CAGR of 5.2% expected through 2035, driven by advancements in touchless technology and IoT integration.

Non-Alcoholic Smart Beverages Machine Market Scope

Related Reports