Summary

Table of Content

Nitrogen Gas Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Nitrogen Gas Market Size

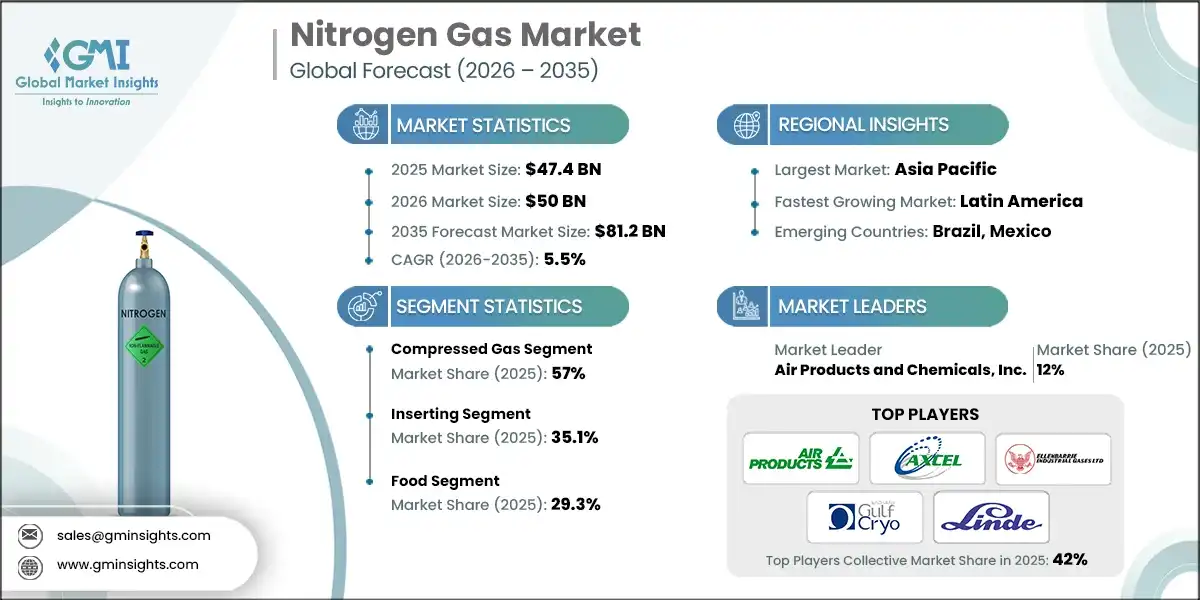

The global nitrogen gas market was valued at USD 47.4 billion in 2025. The market is expected to grow from USD 50 billion in 2026 to USD 81.2 billion in 2035, at a CAGR of 5.5% according to latest report published by Global Market Insights Inc.

To get key market trends

- Nitrogen gas had its most substantial demand growth across industry sectors like manufacturing, chemicals, and metals processing, and the latter saw its first post pandemic growth in the years 2021 to 2025. The International Energy Agency reports that the world’s production across all sectors and energy utilization (in manufacturing oils, petrochemical and other refineries) increased which, in turn, increased the demand for nitrogen gas utilization in inserting, blanketing, and process protective measures.

- During the years 2021 to 2025, the food and beverage sectors showed a great pillar of accepted growth. Volumes of global food processing and trade, also reported by the FAO, increased nitrogen use for the protection of cold chain operation silos and in modified atmospheres used for packaging. The visibility of liquid nitrogen in the production of ready meals and it’s used in rapid freezing also increased.

- Activity in the pharma and biotech sectors increased nitrogen use, especially in the years 2021 to 2025. The WHO and OECD reported increased production rates in biologics and vaccine which need large proportions of nitrogen to inert reactors and to freeze dry samples. The high purity nitrogen gas is also used to Cryo store cell lines and other biological material, especially in the manufacturing of mRNA and other advanced therapeutic products.

- Electronics and semiconductor growth increased the demand for high purity nitrogen gas used in the industry. Reports published by industry show a large increase between 2021 and 2025 in the production of chips and the capacity to fabricate wafers in Asia, the U.S and Europe. This industry relies heavily on nitrogen gas for purging clean rooms and for providing inert gas for leak testing, which is required for all fab's and advanced packaging plants used in semiconductor manufacturing.

Nitrogen Gas Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 47.4 Billion |

| Market Size in 2026 | USD 50 Billion |

| Forecast Period 2026 - 2035 CAGR | 5.5% |

| Market Size in 2035 | USD 81.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising industrial production and manufacturing output | Boosts demand for inert atmospheres and process protection |

| Growth in food processing and cold-chain logistics | Increases use in freezing, chilling, and packaging |

| Expansion of pharma, biotech and semiconductor sectors | Drives high-purity nitrogen for clean, controlled environments |

| Pitfalls & Challenges | Impact |

| High energy costs for air separation plants | Raise production costs and pressure margins for suppliers |

| On-site generation reducing bulk delivery volumes | Erodes traditional merchant gas sales in mature markets |

| Opportunities: | Impact |

| Adoption of green, low‑carbon nitrogen production | Differentiates suppliers with sustainability‑focused customers |

| Emerging market industrialization and infrastructure | Opens new demand for packaged and bulk nitrogen solutions |

| Market Leaders (2025) | |

| Market Leaders |

12% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Latin America |

| Emerging countries | Brazil, Mexico |

| Future outlook |

|

What are the growth opportunities in this market?

Nitrogen Gas Market Trends

- To enhance energy efficiency and reduce carbon emissions in industrial gas production: Industry leaders are making efforts to optimize and innovate the separation of air and integrating new sources of electricity and heat to further reduce the carbon emissions stemming from the production of nitrogen. For instance, in Europe and Asia, a number of new air separation units are modernized and integrated with steel or petrochemical complexes, where they improve the utilization of process off-gases and use optimized turbines to reduce electricity consumption.

- Increasing trend towards the customer on-site supply and pipeline network models: Major customers, in industries such as steel, refining, chemicals, and electronics, are now preferring on-site nitrogen production facilities or pipeline networks as opposed to delivery by trucks. This reliability of nitrogen supply also decreases production and transport emissions. The gas supply companies enter long-term “over-the-fence” supply contracts whereby they are able to construct custom customer on-site air separation units.

- Increasing high-purity requirements from the pharma industry and electronics: For the purpose of inserting and purging, biologics facilities, semiconductor fabrication facilities, and battery production facilities require high-purity nitrogen. Recently there has been a significant addition to high-purity nitrogen production and supply in new semiconductor fabrication facilities in the United States, Europe, and Asia. Large scale production facilities of vaccines and mRNA also require nitrogen for the lyophilization process and for storage at cryogenic temperatures.

- Expansion of frozen and ready-to-eat meals has the food processing and cold chain sector utilizing liquid nitrogen for individual quick freezing, crust freezing, and temperature management. The foreign processors continue to use nitrogen based modified atmosphere packaging to extend shelf life and reduce waste, mainly for meat and bakery, fresh food, and convenience meals.

Nitrogen Gas Market Analysis

Learn more about the key segments shaping this market

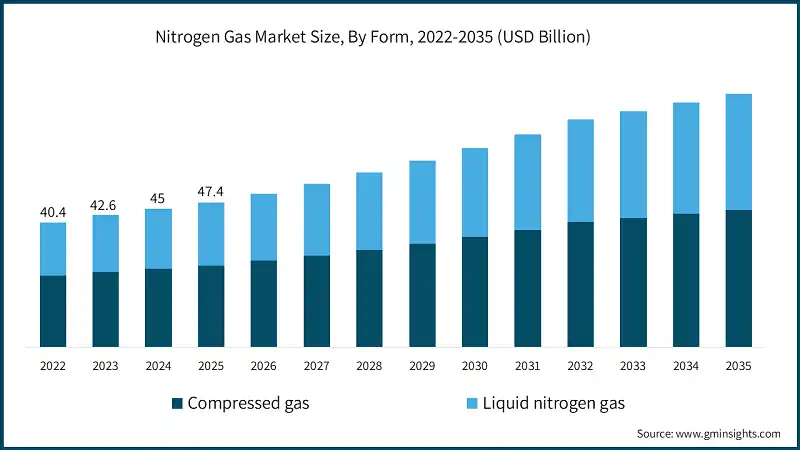

Based on form, the market is segmented into compressed gas, and liquid nitrogen gas. Compressed gas dominated the market with an approximate market share of 57% in 2025 and is expected to grow with a CAGR of 5.3% by 2035.

- The combination of compressed gases and liquid nitrogen offers complimentary income opportunities for suppliers in the sector. In the manufacture of metals and chemicals, inert, blanketing, welding, and purging are routine operations where compressed nitrogen is typically delivered through cylinder, bundle, or bulk trailer. In food, pharmaceuticals, and some specialized processes, liquid nitrogen is necessary for cryogenic and high-volume cooling where the removal of heat is both intense and rapid and is needed for processes.

- Business models are evolving from simple merchant sales to cross-integrated supply arrangements in both streams. Major gas suppliers are optimizing their asset portfolios with on-site generators for compressed nitrogen at large facilities, while regional deployments with satellite tankers are designed for liquid food and lab processors. Customers evaluate total costs of ownership, and asset (reliability and sustainability) value more than the price per cubic meter.

Based on application, the nitrogen gas market is segmented into inserting, blanketing, welding & cutting, purging, others. Inserting held the largest market share of 35.1% in 2025 and is expected to grow at a CAGR of 14.8% during 2026-2035.

- Inserting, blanketing, welding and cutting, and purging collectively demonstrate how nitrogen gas is integrated in industrial safety and quality background processes. Across the chemicals, oil and gas, metals, and food industries, buyers are standardizing nitrogen-based protection to mitigate fire, oxidation, and contamination risk while meeting increasingly stringent process of safety and product defect avoidance.

- Suppliers are no longer focusing on generic gas volumes but are rather focusing on specific application packages—uniting the nitrogen supply with partnerships, engineering, and control systems for monitoring, and control systems for inserting, blanketing, welding, and purging. This, in turn, creates stickier, long-term contracts, differentiation from low-cost competitors and justifies premium pricing as uptime, purity, and safety become critical.

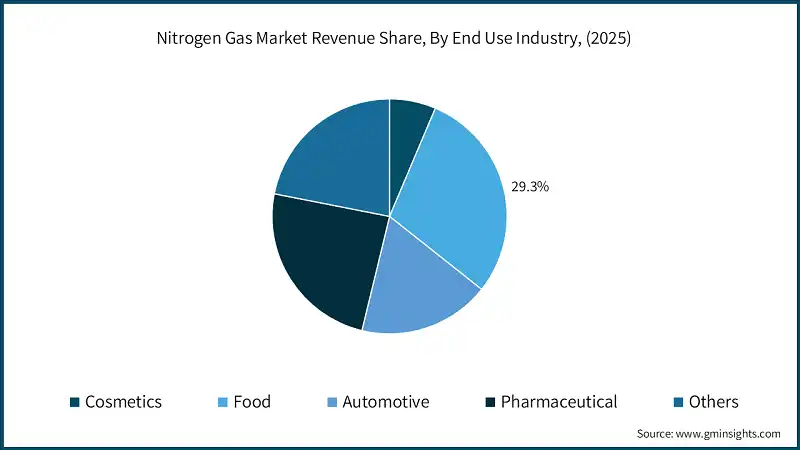

Learn more about the key segments shaping this market

Based on end use industry, the nitrogen gas market is segmented into cosmetics, food, automotive, pharmaceutical, others. Food segment dominated the market with an approximate market share of 29.3% in 2025 and is expected to grow with the CAGR of 14.6% by 2035.

- End-use industries, namely, cosmetics, food, automotive, pharmaceuticals, and others are converging on nitrogen as it becomes an enabler of reliability and quality. Nitrogen preserves sensitive formulations, extends the shelf life of food, and supports precise welding in augmented clean manufacture. Thus, it underpins brand reputation, compliance with regulations, and reduction of waste in products consumed daily and in industrial applications.

- Business trends focus on devising explicit service models for each end-use cluster. Food and pharma customers demand more purity and documentation, while automotive and “others” (electronics, metals, chemicals) focus on streamlined continuous flow and seamless process integration. This is why gas companies bundle nitrogen with monitoring, maintenance and optimization services as they develop deep partnerships and make it less attractive for customers to change suppliers.

Looking for region specific data?

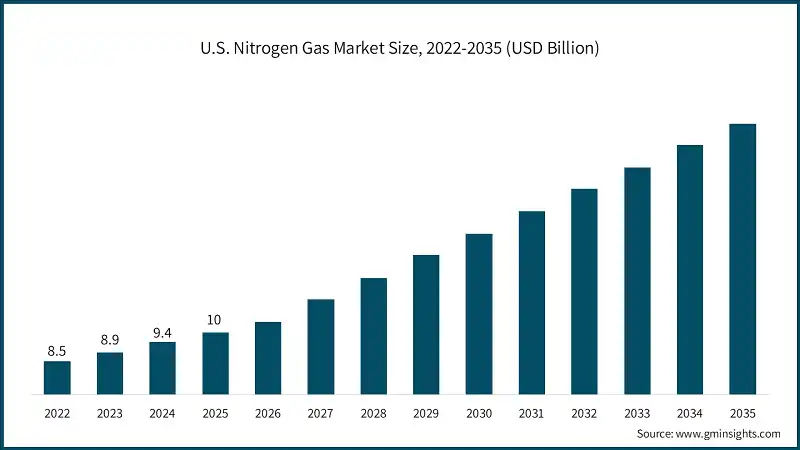

North America maintains a strong position in the global nitrogen gas market, increasing from about USD 11.9 billion in 2025 to around USD 20.4 billion in 2035, mainly driven by diversified industrial demand and well-developed pipeline and on-site supply networks. Growth is supported by chemicals, refining, food processing, metal fabrication, and an expanding semiconductor and battery manufacturing base.

- The U.S. is the primary nitrogen gas consumer within North America. A large installed base of refineries, petrochemical plants, food processors, and advanced manufacturing facilities underpins sustained demand, while new semiconductor fabs and EV-related investments further lift requirements for high-purity and bulk nitrogen solutions.

Europe accounts for a significant share of the nitrogen gas market, rising from about USD 11 billion in 2025 to roughly USD 18.7 billion in 2035, mainly driven by mature industrial clusters and stringent safety and quality regulations. Growth is steady as chemical, steel, food, and pharmaceutical sectors optimize energy use and adopt more efficient gas supply schemes.

- Germany represents a key nitrogen gas industry in Europe. Its strong chemical, automotive, machinery, and pharmaceutical industries require reliable nitrogen for inerting, heat treatment, and packaging, with suppliers increasingly offering energy-efficient ASUs and integrated on-site systems to meet decarbonization and cost-competitiveness goals.

Asia Pacific is the largest and steadily growing regional nitrogen gas market, expanding from about USD 17.1 billion in 2025 to around USD 29.7 billion in 2035, mainly driven by rapid industrialization, electronics manufacturing, and food processing growth. A robust CAGR of about 5.7% reflects ongoing investment in steel, chemicals, semiconductors, and healthcare infrastructure.

- China is the leading market within Asia Pacific. Massive steel, petrochemical, and electronics sectors, alongside growing pharmaceutical and food industries, underpin large-scale demand, while domestic industrial gas companies and global majors continue to add ASUs and pipeline networks to support long-term supply security.

Latin America contributes a smaller but fastest growing market share, increasing from about USD 3.8 billion in 2025 to nearly USD 6.2 billion in 2035, at 5.9%. Mainly driven by chemicals, metals, food processing, and emerging healthcare applications. Investments in refining upgrades and packaged-gas distribution networks support broader access to nitrogen across industrializing economies.

- Brazil is the principal nitrogen gas market in Latin America. Its large food processing base, steel and mining activities, and refining operations rely on nitrogen for inerting, cooling, and quality control, with gradual expansion into pharmaceuticals and electronics assembly further diversifying demand.

MEA shows healthy growth in the nitrogen gas market, moving from about USD 3.4 billion in 2025 to close to USD 5.8 billion in 2035, mainly driven by oil and gas, petrochemicals, and expanding industrial and healthcare sectors. A CAGR, near 5.8%, reflects new ASUs tied to refining, fertilizers, and large-scale industrial projects.

- Saudi Arabia is an important nitrogen gas consumer in MEA. Its extensive refining, petrochemical, and fertilizer complexes use large volumes of nitrogen for process safety and inerting, while investments in mining, metals, and healthcare infrastructure open additional opportunities for bulk and high-purity nitrogen supply.

Nitrogen Gas Market Share

The top 5 companies are Air Products and Chemicals, Inc., Axcel Gases, Ellenbarrie Industrial Gases, Gulfcryo, and Linde PLC together account for about 42% of the nitrogen gas industry, combining global scale with strong regional distribution networks, advanced air separation technologies, and long-term contracts that anchor supply to petrochemical, refining, metals, food, healthcare, and electronics customers worldwide.

- Air Products and Chemicals, Inc.: Air Products is a leading global nitrogen supplier with about 12% share. It operates extensive air separation assets and pipeline networks, focusing on long-term “over-the-fence” contracts for steel, refining, chemicals, electronics, and energy projects. Recent investments target large ASUs near mega-projects in the Middle East, Asia, and North America.

- Axcel Gases: Axcel Gases hold roughly 10% share, with strength in packaged gases, cylinders, and bulk nitrogen supply, particularly across emerging markets. The company emphasizes reliable logistics, custom mixtures, and solutions for smaller industrial customers. Growth is supported by rising demand from automotive, fabrication, and food sectors requiring flexible, cylinder-based or mini-bulk nitrogen services.

- Ellenbarrie Industrial Gases: Ellenbarrie Industrial Gases accounts for around 8% share, focused primarily on South Asian markets. It supplies liquid and compressed nitrogen to steel, healthcare, chemicals, and food industries. The company continues expanding distribution networks and on-site generation offerings, leveraging local knowledge to compete effectively against larger multinationals in its core geographies.

- Gulfcryo: Gulfcryo commands close to 7% share, specializing in industrial gases across the Middle East and surrounding regions. It serves petrochemicals, refining, metals, and healthcare with bulk, liquid, and on-site nitrogen. Recent activity includes investment in new ASUs and distribution facilities aligned with regional industrialization and energy-transition projects.

- Linde PLC: Linde PLC holds about 5% share in this context, though it is one of the largest global industrial gas groups overall. It operates extensive ASUs, pipelines, and on-site nitrogen systems across all major regions, focusing on high-purity supply for electronics, healthcare, and advanced manufacturing, alongside decarbonization and energy-efficiency upgrades.

Nitrogen Gas Market Companies

Major players operating in the nitrogen gas industry include:

- Air Products and Chemicals, Inc.

- Axcel Gases

- Ellenbarrie industrial Gases.

- Gulfcryo

- Linde PLC

- Messer Group

- Omega Air

- PARKER HANNIFIN CORP

- Praxair Technology, Inc.

- Southern Industrial Gas

- Universal Industrial Gases, Inc.

- Yingde Gases Group

Nitrogen Gas Industry News This nitrogen gas market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2026 to 2035, for the following segments:

Market, By Form

- Compressed gas

- High-pressure cylinders

- Bulk / tube trailers

- On-site generated compressed nitrogen

- Liquid nitrogen gas

- Bulk storage tanks

- Dewars / portable containers

- On-site cryogenic plants

Market, By Application

- Inerting

- Reactor and vessel inerting

- Storage tank inerting

- Pipeline inerting

- Blanketing

- Food and beverage headspace blanketing

- Chemical and solvent tank blanketing

- Oil and fuel storage blanketing

- Welding & cutting

- Metal welding shielding gas blends

- Laser cutting and plasma cutting support

- Heat treatment and brazing atmospheres

- Purging

- Pipeline and process line purging

- Start-up and shutdown purging of equipment

- Purging for maintenance and safety operations

- Others

Market, By End Use Industry

- Cosmetics

- Food

- Automotive

- Pharmaceutical

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Which end-use industry led the nitrogen gas market in 2025?

The food industry led the market with around 29.3% share in 2025. Rising use of nitrogen in freezing, chilling, and modified-atmosphere packaging is supporting sustained demand.

What is the growth outlook for the North America nitrogen gas industry?

The North America market is expected to grow from about USD 11.9 billion in 2025 to around USD 20.4 billion by 2035, driven by diversified industrial demand and well-developed pipeline and on-site supply networks across the region.

What are the key trends in the nitrogen gas industry?

Key trends include increasing adoption of on-site nitrogen generation, development of energy-efficient air separation units, rising demand for high-purity nitrogen in electronics and pharmaceuticals, and growing focus on low-carbon nitrogen production technologies.

Who are the key players in the nitrogen gas market?

Key players include Air Products and Chemicals, Inc., Linde PLC, Axcel Gases, Ellenbarrie Industrial Gases, Gulfcryo, Messer Group, and Praxair Technology, Inc.

Which form segment dominated the nitrogen gas market in 2025?

Compressed gas dominated the market in 2025, accounting for approximately 57% share. Its widespread use in metal fabrication, chemicals processing, and on-site industrial applications supports segment leadership.

What was the largest application segment in the nitrogen gas industry in 2025?

Inerting was the largest application segment in 2025, holding 35.1% market share. High adoption across chemicals, oil & gas, metals, and food industries is driving strong demand for nitrogen-based safety and protection processes.

What is the nitrogen gas market size in 2025?

The market size for nitrogen gas is valued at USD 47.4 billion in 2025. Strong demand from manufacturing, chemicals, food processing, and semiconductor industries is supporting steady market growth.

What is the market size of the nitrogen gas industry in 2026?

The market size for nitrogen gas reached USD 50 billion in 2026, reflecting expansion in industrial production, cold-chain logistics, and high-purity gas applications.

What is the projected value of the nitrogen gas market by 2035?

The market is expected to reach USD 81.2 billion by 2035, growing at a CAGR of 5.5%. Growth is driven by rising use of inerting and blanketing processes, expansion of pharma and biotech manufacturing, and increasing semiconductor fabrication capacity.

Nitrogen Gas Market Scope

Related Reports