Summary

Table of Content

Natural Oil Polyols Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Natural Oil Polyols Market Size

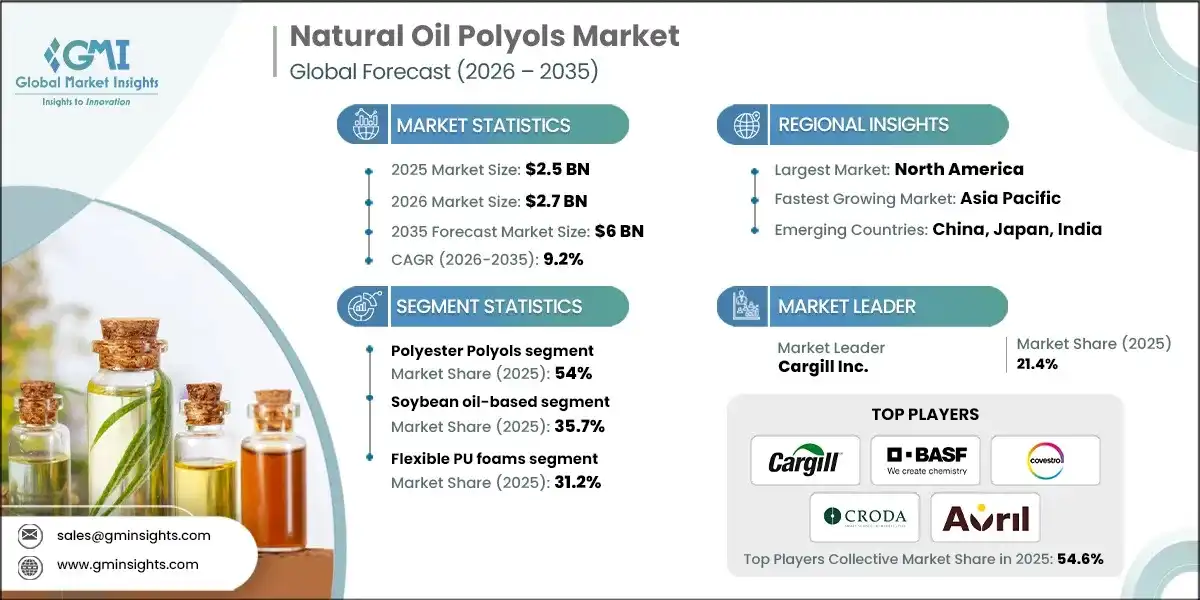

The global natural oil polyols market was valued at USD 2.5 billion in 2025. The market is expected to grow from USD 2.7 billion in 2026 to USD 6 billion in 2035, at a CAGR of 9.2% according to latest report published by Global Market Insights Inc.

To get key market trends

- Increasing environmental regulations, consumer preference for eco-friendly products, and growing adoption across automotive, construction, furniture, and industrial sectors are the primary growth drivers. Manufacturers are innovating bio-based formulations that enhance mechanical, thermal, and chemical properties, supporting high-performance applications while reducing carbon footprints.

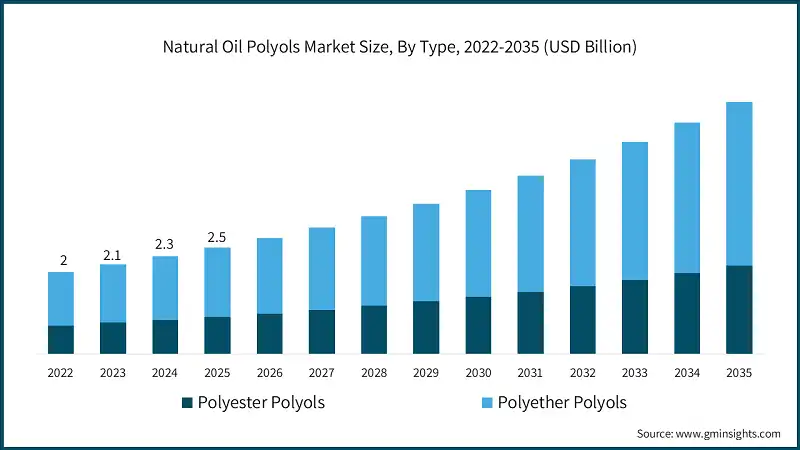

- Polyester polyols dominated the market in 2025 with a 54% share due to their superior chemical resistance and mechanical strength. They are projected to grow at a CAGR of 8.1%, reaching USD 2.9 billion by 2035. Polyether polyols, offering excellent flexibility and moisture resistance, are expected to grow faster at a CAGR of 10.3%, driven by demand in flexible foams, coatings, adhesives, and elastomers.

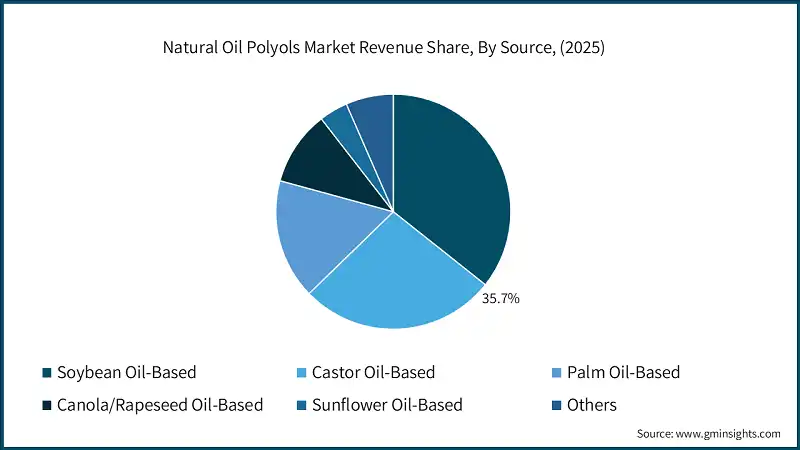

- Soybean oil-based polyols led the market in 2025 with a 35.7% share and are projected to grow at 5.8% CAGR. Castor oil-based polyols will reach USD 1.5 billion at an 8.3% CAGR, while emerging feedstocks like canola, sunflower, and alternative oils are expanding rapidly, reflecting innovation and sustainability trends.

- Flexible PU foams dominated in 2025 with 31.2% share and are expected to reach USD 1.5 billion by 2035 at 7.1% CAGR, supported by furniture, bedding, and automotive applications. Rigid PU foams will reach USD 1.7 billion at 9.5% CAGR, driven by insulation and energy-efficient construction demand.

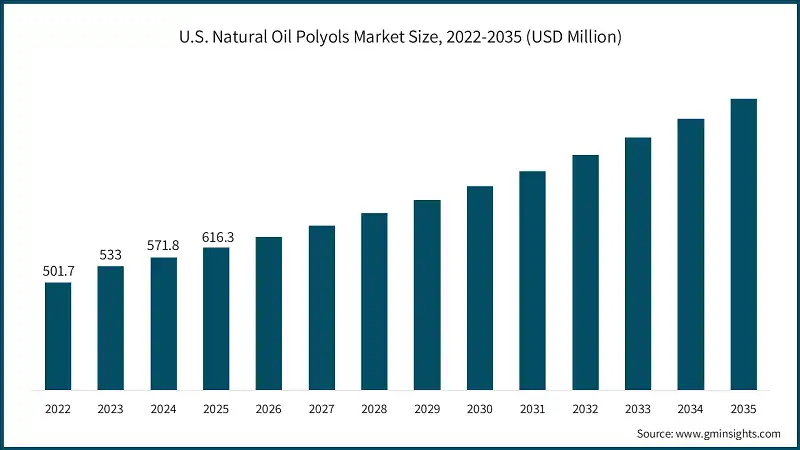

- North America leads with USD 821.8 million revenue in 2025, supported by strong R&D and sustainability adoption. Europe holds 30.9% share due to strict environmental policies. Asia Pacific is the fastest-growing region at 9.7% CAGR, fueled by industrialization and construction growth. Latin America and MEA are emerging markets, benefiting from renewable feedstock availability and green initiatives.

Natural Oil Polyols Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 2.5 Billion |

| Market Size in 2026 | USD 2.7 Billion |

| Forecast Period 2026 - 2035 CAGR | 9.2% |

| Market Size in 2035 | USD 6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising demand for eco-friendly and sustainable polyols across multiple industries | Drives adoption as industries shift toward renewable, low-carbon, and environmentally friendly materials. |

| Increasing usage of polyols in flexible and rigid polyurethane foams | Expands market due to growing demand for lightweight, durable, and high-performance PU foams. |

| Government incentives promoting bio-based chemicals and products | Encourages investment, R&D, and adoption of natural polyols in multiple regions globally. |

| Pitfalls & Challenges | Impact |

| High production costs compared to petroleum-based polyols | Limits adoption in price-sensitive markets due to more expensive raw materials and processing. |

| Limited availability of consistent, high-quality feedstocks | Supply instability can disrupt production and restrict market growth in developing regions. |

| Opportunities: | Impact |

| Growing demand in coatings, adhesives, sealants, and elastomers | Expands applications as industries seek sustainable, high-performance bio-based formulations. |

| Increasing awareness and adoption of green building materials | Promotes natural polyols in construction, insulation, and energy-efficient projects globally. |

| Market Leaders (2025) | |

| Market Leaders |

21.4% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, Japan, India |

| Future outlook |

|

What are the growth opportunities in this market?

Natural Oil Polyols Market Trends

- Increase in demand for planet-friendly products has produced a dramatic increase in the use of bio-polyols. This trend has resulted from the enactment of numerous federal environmental statutes and regulations worldwide and the growing consumer desire for socially responsible products. Many industries including but not limited to the automotive, construction and furniture industries have begun using naturally based polyols in the manufacture of PU foams, coatings and adhesive products to enhance sustainability, lower their carbon footprint and encourage innovation in procurement and production processes.

- The manufacturers have now developed a wide range of bio-polyols with unique advanced characteristics and benefits. The new development includes bio-based polyols for premium coating products, adhesive products, elastomer products and flexible or rigid foam products that pop the industry's development of eco-friendly, high-performance solutions into the next decade or greater. With the development of the new natural bio-based polyols, companies are now able to diversify their product portfolio to include these new natural bio-based polyols and open up their business to premium product markets.

Natural Oil Polyols Market Analysis Based on type, the market is segmented into polyester polyols, and polyether polyols. Polyester Polyols dominated the market with an approximate market share of 54% in 2025 and is expected to grow with a CAGR of 8.1% by 2035. Based on source, the natural oil polyols market is segmented into soybean oil-based polyols, castor oil-based polyols, palm oil-based polyols, canola/rapeseed oil-based, sunflower oil-based polyols, others. Soybean oil-based polyols held the largest market share of 35.7% in 2025 and is expected to grow at a CAGR of 5.8% during 2025-2034. Based on application, the natural oil polyols market is segmented into flexible PU foams, rigid PU foams, coatings, adhesives, sealants, elastomers, and others. Flexible PU foams segment dominated the market with an approximate market share of 31.2% in 2025 and is expected to grow with the CAGR of 7.1% by 2035. North America natural oil polyols market leads the industry with revenue of USD 821.8 million in 2025 and is anticipated to show lucrative growth over the forecast period. The Europe natural oil polyols industry is growing rapidly on the global level with a market share of 30.9% in 2025. The Asia Pacific natural oil polyols market is anticipated to grow at a CAGR of 9.7% during the analysis timeframe. Latin America natural oil polyols market accounted for 6% market share in 2025 and is anticipated to show highest growth over the forecast period. Middle East & Africa natural oil polyols accounted for 3.9% market share in 2025 and is anticipated to show lucrative growth over the forecast period. The top 5 companies in natural oil polyols industry include Cargill Inc., BASF SE, Covestro AG, Croda International PLC, and Oléon-Novance (Avril).These are prominent companies operating in their respective regions covering approximately 54.6% of the market share in 2025. These companies hold strong positions due to their extensive experience in natural oil polyols market. Their diverse product portfolios, backed by robust production capabilities and distribution networks, enable them to meet the rising demand across various regions. Major players operating in the natural oil polyols industry include: Learn more about the key segments shaping this market

Learn more about the key segments shaping this market Learn more about the key segments shaping this market

Learn more about the key segments shaping this market Looking for region specific data?

Looking for region specific data?Natural Oil Polyols Market Share

Natural Oil Polyols Market Companies

Natural Oil Polyols Industry News

This natural oil polyols market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD billion) and volume (Kilo Tons) from 2025 to 2035, for the following segments:

Market, By Type

- Polyester Polyols

- Polyether Polyols

Market, By Source

- Soybean Oil-Based

- Castor Oil-Based

- Palm Oil-Based

- Canola/Rapeseed Oil-Based

- Sunflower Oil-Based

- Others

Market, By Application

- Flexible PU Foams

- Rigid PU Foams

- Coatings

- Adhesives

- Sealants

- Elastomers

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the key players in the natural oil polyols market?

Key players include Cargill Inc., BASF SE, Covestro AG, Croda International PLC, Oléon-Novance (Avril), Emery Oleochemicals, Econic Technologies, and Biobased Technologies. These companies are strengthening portfolios through sustainable feedstock sourcing, innovation, and capacity expansion.

What are the upcoming trends in the natural oil polyols industry?

Key trends include increasing use of bio-based and CO2-derived polyols, expansion of natural polyols in green building materials, innovation in alternative feedstocks such as canola and sunflower oils, and growing demand for low-carbon polyurethane solutions.

Which region leads the natural oil polyols market?

North America leads the market with USD 821.8 million revenue in 2025. The region’s leadership is driven by strong R&D activity, supportive green chemistry policies, and high adoption of sustainable polyurethane materials.

What is the growth outlook for the flexible PU foams segment from 2025 to 2035?

The flexible PU foams segment is projected to grow at a CAGR of 7.1% through 2035. Increasing demand from furniture, bedding, automotive seating, and comfort applications is driving sustained segment expansion.

How much revenue did the polyester polyols segment generate in 2025?

The polyester polyols segment accounted for approximately 54% of the market share in 2025, making it the largest type category. Strong chemical resistance, mechanical strength, and broad usage in industrial and construction applications support its leadership.

What was the valuation of the soybean oil-based polyols segment in 2025?

Soybean oil-based polyols led the market with a 35.7% share in 2025. Their dominance is driven by cost-effectiveness, abundant availability, and widespread adoption in flexible foams, coatings, and adhesive formulations.

What is the natural oil polyols market size in 2025?

The market size for natural oil polyols is valued at USD 2.5 billion in 2025. Rising demand for eco-friendly, bio-based materials across polyurethane foams, coatings, adhesives, and elastomers is supporting steady market growth.

What is the market size of the natural oil polyols industry in 2026?

The market size for natural oil polyols reached USD 2.7 billion in 2026, reflecting consistent expansion driven by sustainability regulations, green chemistry adoption, and increased use in flexible and rigid polyurethane applications.

What is the projected value of the natural oil polyols market by 2035?

The market size for natural oil polyols is expected to reach USD 6 billion by 2035, growing at a CAGR of 9.2%. This growth is fueled by renewable feedstock adoption, bio-based polyurethane demand, and advancements in high-performance polyol formulations.

Natural Oil Polyols Market Scope

Related Reports