Summary

Table of Content

Nanomaterials Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Nanomaterials Market Size

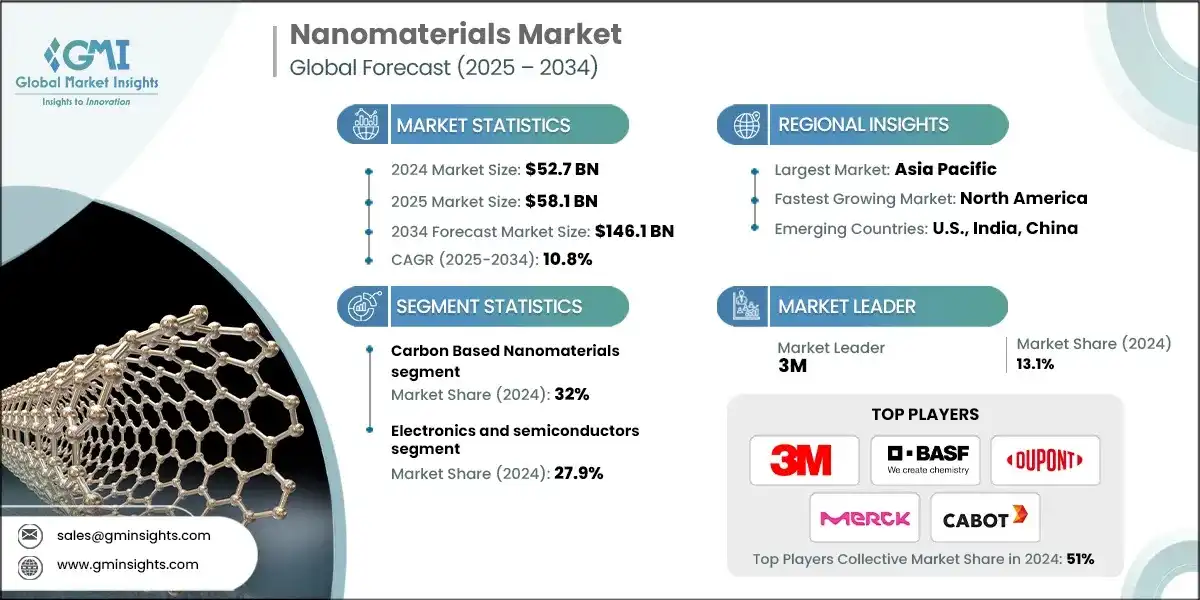

The global nanomaterials market was valued at USD 52.7 billion in 2024 and is projected to expand from USD 58.1 billion in 2025 to USD 146.1 billion by 2034, reflecting an 10.8% CAGR over 2025–2034, according to latest report published by Global Market Insights Inc.

To get key market trends

- The demand for nanoscale materials, as evident in electronics, healthcare, energy, and environmental applications, is slated to grow exponentially. While performance improvements often outweigh their cost and qualification hurdles, it can be said that emerging demand pools will diversify from consumer devices to critical infrastructures and advanced therapeutics. Hence, the risk will also be spread and sustain a solid investment in capacities within the whole nanomaterials market. Pricing discipline and the development of regulatory clarity in medical applications will further influence the trend toward steady adoption by scaling breakthroughs in carbon and quantum materials when pilot cases move into production.

- Convergence of nanomaterials for a 5G rollout, edge/AI compute, as well as dense IoT deployments require improved materials that will develop carrier mobility as well as transport at a high temperature; the mobility of CNTs may exceed 50,000 cm²/V·s and their thermal conductivity may surpass 1,000 W/mK, which directly supports device scaling and heat dissipation needs in the nanomaterials market.

- Precision medicine is beginning to routinely use nanoparticles as carriers to deliver drugs directly to the target tissues. These include applications in oncology and infectious disease, as well as immunology. Lipid nanoparticles became validated at commercial scale through mRNA vaccines during 2020 to 2021, with next-generation formulations moving through clinical pathways. This pull from healthcare adds to market growth.

Nanomaterials Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 52.7 Billion |

| Market Size in 2025 | USD 58.1 Billion |

| Forecast Period 2025 - 2034 CAGR | 10.8% |

| Market Size in 2034 | USD 146.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Electronics performance needs lift penetration across nodes and packaging | Drives increased adoption of nanoparticles in advanced electronic devices |

| Nanomedicine momentum shortens time-to-market for targeted therapies | Expands biomedical applications and market opportunities for nanoparticles |

| Sustainability mandates spur energy and remediation applications | Promotes growth of environmentally friendly nanoparticle solutions |

| Pitfalls & Challenges | Impact |

| Regulatory and EHS hurdles extend commercialization timelines | Challenges rapid market entry due to regulatory and safety compliance issues |

| Opportunities: | Impact |

| AI-enabled discovery and process control accelerate scale and quality | Speeds up production and improves quality, enabling faster commercialization |

| Market Leaders (2024) | |

| Market Leaders |

13.1% market share |

| Top Players |

Collective market share is 51% in 2024 |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Emerging Country | U.S., India, China |

| Future Outlook |

|

What are the growth opportunities in this market?

Nanomaterials Market Trends

- Carbon-Based Nanomaterials Dominance in Electronics: Carbon nanotubes and graphene dominate as base materials for high-performance interconnects, channels, and thermal paths, owing to the unmatched combination of conductivity and strength and flexibility in nanomaterials markets. CNT devices currently demonstrate switching frequencies of approaching 10 GHz with power advantages over equivalent silicon, indicating the selective entry of these devices into the RF, sensing, and flexible platforms as production capabilities allow.

- Sustainable and Biodegradable Nanomaterials Revolution: From drug delivery to water treatment, biodegradable and ecofriendly nanomaterials are becoming mainstream rather than mere concept, as regulators and customers gravitate toward safer chemistries and lower impact in environmental aspects regarding the nanomaterials market. Across the country, lipid nanoparticles and polymeric carriers have shown real-world safety and efficacy in vaccination programs, opening wider biopharma funding into programmable delivery systems and next-gen excipients.

- Quantum Dot Technology Advancement: Continued emission and narrow line widths, as well as high quantum yield, are expected to propel applications in displays, imaging, and energy through the use of quantum dots and are being targeted by many manufacturers toward the automotive and micro-LED ecosystems in addition to TVs and monitors. Fluorescent nanocrystals constitute a means for improved imaging and intraoperative guidance in health care, while several products are being moved through regulatory channels that prioritize safety and performance evaluation in the nanomaterials space.

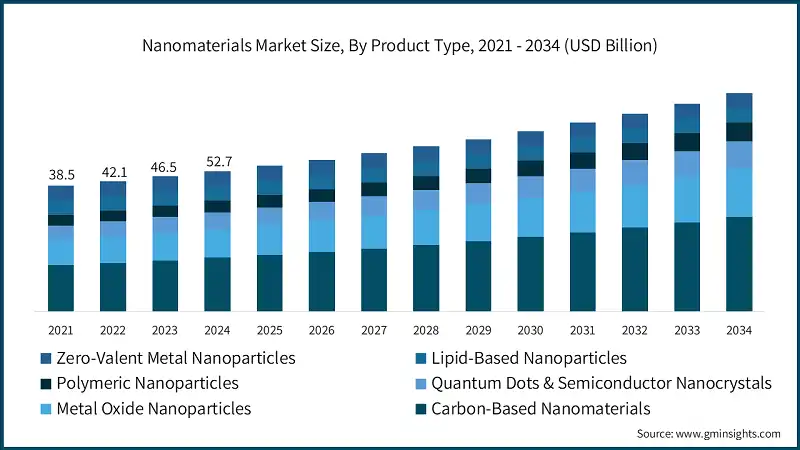

Nanomaterials Market Analysis

Learn more about the key segments shaping this market

In 2024, Carbon Based Nanomaterials reached about 32% market share of the growing nanomaterials industry (approximately USD 16.9 billion). CNTs, graphene, and other carbons are expected to have insertion points in semiconductor manufacturing, composites, and energy storage within this market, where it is growing at an annual growth rate of about 12.2% through 2034. The advances in CVD scaling, alignment control, and purification in the nanomaterials industry are helping to get benefits in many aspects of improvement concerning electrical and thermal performance, as well as lowering costs and defectivity per unit for high volume electronics. Graphene is soaring in the area of flexible electronics and transparent conductors where leading vendors are beefing up capacity to cater to needs for lightweight and durable production in the nanomaterials market for automotive and aerospace applications.

With 26% of Metal Oxide Nanoparticles, steady near 11% CAGR, led by TiO2 in sunscreens and coatings, followed by iron oxide in catalysis and remediation, and zinc oxide used in consumer and industrial formulations in the market. Established production footprints and regulatory familiarity lower barriers for large volume applications, while newer energy and environmental use cases add upside where performance and cost align. Quantum Dots and Semiconductor Nanocrystals account for about 11% market share and is expected to grow at 13% CAGR on the strength of display and imaging demands, where cadmium free and perovskite systems broaden the solution set for safety and efficiency in the nanomaterials market. Roughly 16 % of the market share, increasing at approximately 10.3% CAGR in the forecasted period, as biocompatible carriers such as PLGA promote drug delivery and diagnostics in addition to tissue engineering by clearer regulatory pathways.

Learn more about the key segments shaping this market

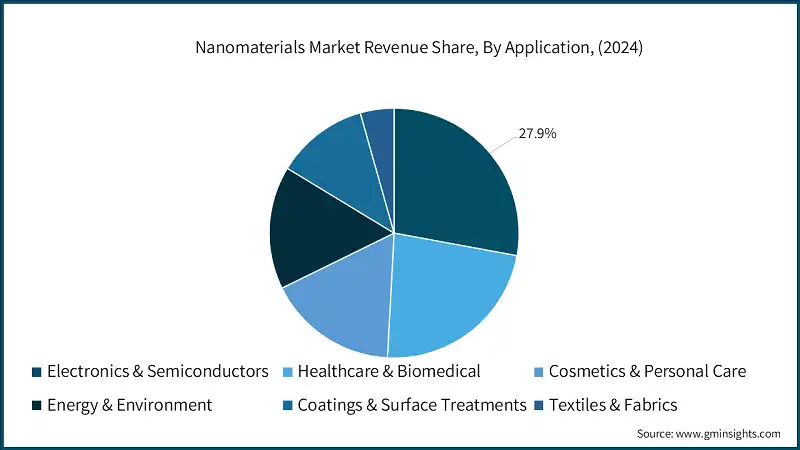

Electronics and semiconductors application held 27.9% market share in nanomaterials market, finding new applications in nanomaterials for 5G, AI inference, and edge compute scaling, especially in the reduction of dimensions, resistance, and thermal management. More interestingly, rather than replacing copper and silicon, carbon materials assist where the old techniques' effectiveness is limited by interconnect resistance, thermal bottlenecks, or flexibility in form factor. Healthcare & Biomedical account for nearly 23%, growing at around 13.3% CAGR, wherein lipid nanoparticles, polymeric carriers, and quantum dots allow for more accurate delivery, higher sensitivity imaging, and new modalities in the market. AI-guided design and process control are shortcuts in both sections from design to GMP-compliant production, thereby speeding up returns on R&D.

Looking for region specific data?

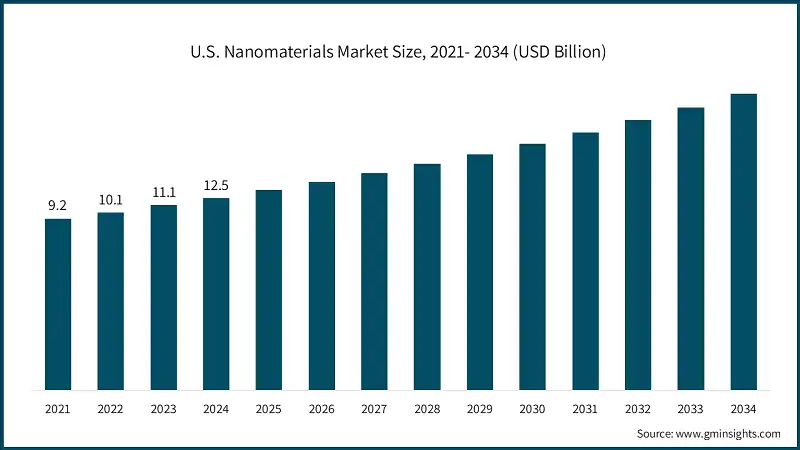

- Nanomaterials market account for USD 12.5 billion in the U.S. in 2024 and is expected to grow to USD 34.6 billion by 2034. In North America, nanomaterials possess roughly one-third share in 2024, while carrying the most rapid growth at about 14% CAGR in the forecasted period, which benefits from strong federal coordination through the National Nanotechnology Initiative and a deep capital market for scale up. The US market for nanomaterials derives support from its kinds of leadership in nanomedicine and semiconductor research, which are very effectively moving discoveries into industrial and clinical application. Although much of Canada's market leans into clean tech and advanced materials, there is a demand for sustainable nanomaterial solutions related to energy and environmental applications. The region's nanomaterials market is likely to see greater public-private partnerships concerning GMP manufacturing and testing networks, which will help compress time to market for regulated use cases.

- Europe's nanomaterials industry just less than 18% of total world value in 2024 and has a growth rate close to 12.5% CAGR with policy directions on safety, sustainability, and circularity shaping investments and adoption patterns. Germany continues to push automotive and industrial cases, and Switzerland and the Netherlands have an advanced shadow of pharmaceutical and biomedical nanomaterials, which reflects the regional strength in precision manufacturing and life sciences. Characterization to EU regulatory pathways would slow down the commercialization of the material by many but, at the same time, increases confidence for more systematic adoption in sensitive applications across Europe. The result is disciplined long cycle growth supported by Horizon Europe funding and cross-border R&D collaboration networks in the nanomaterials market.

- Asia-Pacific currently stands strong with close to 45% market share in nanomaterials in 2024, largely owing to a robust electronics base and high-throughput manufacturing capabilities in China, Japan, and South Korea, leading to significant economies of scale and cost advantages in many product classes. China would be the regional hub for nanomaterials production capacity; however, Japan would lead premium applications with its focus on high-value products such as quantum dots and composites. India and Southeast Asia have also taken larger strides with national initiatives and incentives on R&D and pilot-to-plant transfers that strengthen the overall resilience in the nanomaterials market within the region. More of China, Japan, and South Korea will rely on nanomaterials to drive their supply chains dedicated to displays, batteries, and semiconductors, as vendors localize their production for both export and domestic markets across the Asia Pacific market.

Nanomaterials Market Share

The nanomaterials sector is moderately consolidated, with the five most significant players controlling a combined market share of 51% in 2024, suggesting opportunities for small innovators to compete and partner for specific applications. The foremost company, 3M has a share of around 13.1%, followed by BASF, with ~11.2%, and DuPont de Nemours, with a share of ~9.8%, Merck with an ~8.9% share, and finally, Cabot Corporation, with an ~8.0% share. These concentrations serve to ensure the stability of supplies globally and support across segments, while simultaneously allowing regional specialists to differentiate themselves on the basis of speed, niche IP, or service depth in the nanomaterials market.

competitive pathways are being created by placing more emphasis on sustainable processing, characterization at near atomic resolution, and co-development in applications where specification requirements are tightening-up - more specifically, electronics, health care, and energy. The other side favors companies coordinating labs to fab and field support. M&A activities show vertical integration, accessing IP, and setting up joint ventures between material suppliers and OEMs, emphasizing the need for application-specific knowledge to realize value in the nanomaterials space. To name a few, recent expansions have included quantum dot capacity and investment in a cadmium-free platform and scaling carbon-based materials for semiconductor, display, and energy storage programs within regional industrial policies.

Nanomaterials Market Companies

Major players operating in the nanomaterials industry are:

- 3M

- BASF

- DuPont de Nemours

- Merck

- Cabot Corporation

- Nanosys

- Nanoco Technologies

- 3M

- The portfolio of 3M has advanced ceramics, carbon nanotubes, and specialty coatings across electronics, healthcare, and industrial market segments underpinned by a global innovation as well as a manufacturing footprint that guarantees a speedy development in the application of the nanomaterials markets. The strength of the company is in its R&D capabilities and diverse features of product offerings, which will quickly lead to adjustments with emerging market needs and technological advancements.

- BASF

- With chemical process leadership, BASF produces at scale different titanium dioxide, iron oxide, carbon black, and additive products geared toward paints, plastics, and personal care, all the while increasingly prioritizing sustainable nanomaterials and recycling initiatives. Hence, because of its sustainability and circular economy focus, BASF finds itself as a leader in the development of green nanomaterials.

- DuPont de Nemours

- In the nanomaterials market, DuPont de Nemours extends conductive inks, barrier films, and engineered polymers using nanoparticle technology to electronics, automotive, and industrial customers, taking advantage of their long-term relationships in high-spec markets. Its innovation and market access are driven by the expertise of the firm in high-performance materials and strong customer collaborations.

- Merck

- Merck is working in the field of life sciences and advanced electronics such as quantum dots, semiconductor materials, and pharmaceutical excipients, where very high purity and analytical rigor will be crucial for regulated supply. Therefore, with its concentration on quality and precision, Merck is in a leading position within those highly regulated industries of pharmaceuticals and electronics.

- Cabot Corporation

- Cabot Corporation is known for carbon black nanoparticles, fumed silica, and specialty carbons for tires, coatings, plastics, and energy storage. It relies on over twenty years of carbon materials expertise and sustained process improvements for cost leadership within the nanomaterials marketplace. Company innovation in functional additives and a growing emphasis on sustainability are also key assets contributing to its competitive advantage in very fast-growing sectors.

Nanomaterials Industry News

- In June 2024, OCSIAL launched its new single-wall carbon nanotube dispersion manufacturing facility in Europe. This facility is aimed for ramping up the company's production of sophisticated nanomaterials of high purity for advanced application. This strategic investment is expected to reinforce OCSIAL's footprint in European markets, especially those for electronics and energy storage. The new facility rests firmly on OCSIAL's commitment to advancing both innovation and sustainable development within nanotechnology.

- In March 2021, Cabot Corporation, a carbon based materials company, announced the launch of its new ENERMAX 6 series of carbon nanotubes. A significant landmark in nanomaterials technology for high performance, the ENERMAX 6 series shall cater to the fierce market demand for cutting-edge CNTs in various fields, including electronics, energy, and even automotive. This is yet another pledge by Cabot to stretch the imagination in relation to what nanotechnology can achieve in breakthrough materials development. The series targets the progressive enhancement of global product performances for the purpose of contributing to building sustainable modern technologies.

The nanomaterials market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Million) from 2021 to 2034, for the following segments:

Market, By Product Type

- Carbon-based nanomaterials

- Single-walled carbon nanotubes

- Multi-walled carbon nanotubes

- Graphene & graphene derivatives

- Fullerenes & carbon nanospheres

- Carbon nanofibers

- Metal oxide nanoparticles

- Titanium dioxide (TiO2) nanoparticles

- Zinc oxide (ZnO) nanoparticles

- Silicon dioxide (SiO2) nanoparticles

- Cerium oxide (CeO2) nanoparticles

- Iron oxide nanoparticles

- Quantum dots & semiconductor nanocrystals

- Polymeric nanoparticles

- Lipid-based nanoparticles

- Zero-valent metal nanoparticles

Market, By Application

- Electronics & semiconductors

- Conductive inks & coatings

- Memory devices & data storage

- Sensors & detectors

- Display technologies

- Healthcare & biomedical

- Drug delivery systems

- Medical imaging & diagnostics

- Regenerative medicine

- Antimicrobial applications

- Cosmetics & personal care

- UV protection & sunscreens

- Anti-aging & skin care

- Color cosmetics

- Energy & environment

- Solar cells & photovoltaics

- Energy storage systems

- Catalysts & fuel cells

- Water treatment & purification

- Coatings & surface treatments

- Protective coatings

- Self-cleaning surfaces

- Antimicrobial coatings

- Textiles & fabrics

- Functional textiles

- Smart fabrics

- Protective clothing

Market, By End Use

- Chemical manufacturing

- Specialty chemicals

- Industrial chemicals

- Catalysts & additives

- Electronics & computer manufacturing

- Semiconductor fabrication

- Electronic components

- Printed circuit boards

- Pharmaceutical & biotechnology

- Drug formulation & delivery

- Medical device manufacturing

- Diagnostic systems

- Automotive & transportation

- Lightweight materials

- Coatings & surface treatments

- Sensors & electronics

- Construction & building materials

- Concrete & cement additives

- Insulation materials

- Protective coatings

- Research & development services

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

Who are the key players in the nanomaterials market?

Leading companies include 3M, BASF, DuPont de Nemours, Merck, Cabot Corporation, Nanosys, and Nanoco Technologies, focusing on nanomedicine, electronics, composites, and clean energy innovations.

What are the upcoming trends in the nanomaterials industry?

Key trends include sustainable and biodegradable nanomaterials, AI-enabled material discovery, and integration of quantum and carbon-based nanomaterials in energy and healthcare applications.

What is the valuation of the U.S. nanomaterials market in 2024?

The U.S. market was valued at USD 12.5 billion in 2024 and is projected to reach USD 34.6 billion by 2034. Growth is driven by federal R&D initiatives, advanced semiconductor research, and strong leadership in nanomedicine commercialization.

What is the growth outlook for quantum dots and semiconductor nanocrystals from 2025 to 2034?

Quantum dots and semiconductor nanocrystals are expected to grow at a 13% CAGR through 2034.

What was the valuation of metal oxide nanoparticles segment in 2024?

The metal oxide nanoparticles segment captured 26% market share in 2024.

What is the market size of the nanomaterials industry in 2024?

The market size was USD 52.7 billion in 2024, reflecting strong demand across electronics, healthcare, energy, and environmental sectors. Growth is supported by expanding nanotechnology applications and rising investments in advanced materials innovation.

How much revenue did the carbon-based nanomaterials segment generate in 2024?

Carbon-based nanomaterials accounted for approximately USD 16.9 billion in 2024, holding around 32% market share.

What is the projected value of the nanomaterials market by 2034?

The global market size for nanomaterials is expected to reach USD 146.1 billion by 2034, registering a CAGR of 10.8% from 2025 to 2034, fueled by rapid adoption in quantum, nanomedicine, and clean energy applications.

What is the current nanomaterials market size in 2025?

The market size is projected to reach USD 58.1 billion in 2025, driven by growing commercialization of carbon-based nanomaterials and sustainable production advancements.

Nanomaterials Market Scope

Related Reports