Summary

Table of Content

MXenes (2D Carbides Nitrides) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

MXenes (2D Carbides Nitrides) Market Size

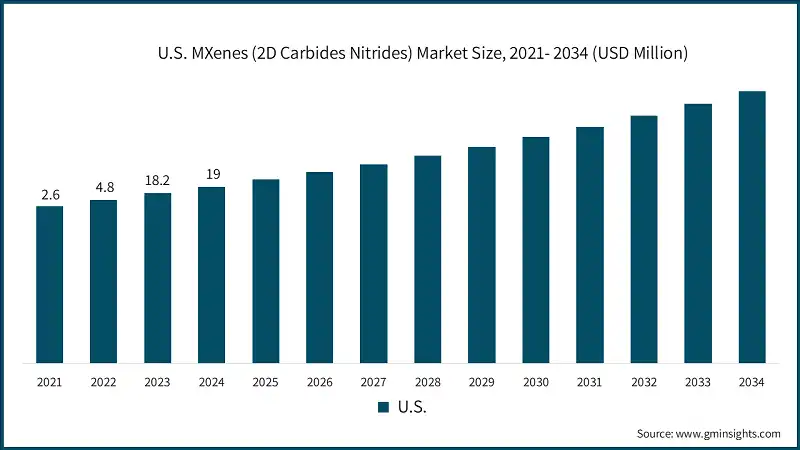

The global MXenes (2D Carbides Nitrides) market was valued at USD 67 million in 2024. The market is expected to grow from USD 125 million in 2025 to USD 1.94 billion in 2034, at a CAGR of 35.6%, according to the latest report published by Global Market Insights Inc. Key Growth drivers include recent advances in nanotechnology, new demand for advanced materials, and increasing investments in energy storage and electronics.

To get key market trends

MXenes, a subclass of 2D transition metal carbides, nitrides, and carbonitrides derived from MAX phases, are presenting themselves as highly useful materials with their distinctive combination of metallic conductivity, hydrophilicity, surface chemistry, and mechanical flexibility characteristics.

One key growth factor is the increasing commercialization of advanced energy storage systems, such as Li-Ion, Na-ion, and Zn-ion batteries. MXenes such as Ti3C2Tx have shown extremely favorable electrochemical properties, such as high volumetric capacitance (~1500 F/cm³) and rapid ion transport, for next-gen anode and supercapacitor applications. The electrification of the automotive and grid sectors is further leading to the strong demand for efficient materials, and MXenes are positioned as high-value materials in the energy materials supply chain globally.

The electronics and telecommunications industry is also an important application area. With exceptional electrical conductivity (~10,000 S/cm) and good EMI shielding performances (>60 dB for thin films), MXenes are being integrated in flexible electronics, antenna materials, RF shielding, and sensors. The demand for EMI shielding materials is likely to grow at significant CAGR and MXenes are presenting themselves as lightweight, high-performance alternatives to traditional metal solutions.

In the biomedical and healthcare industry, MXenes have revolutionary applications in biosensing, drug delivery, photothermal therapy, and antibacterial coatings. Recent discoveries of biocompatibility and bacterial inhibition properties for Ti3C2Tx and Nb2C MXenes have emerged. The healthcare sector's increasing emphasis on nano-enabled devices, minimally invasive diagnostics, and smart access devices is opening new multi-million-dollar sub-markets for functionalized MXene materials within North America, Europe, and Asia Pacific.

MXenes (2D Carbides Nitrides) Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 67 Million |

| Market Size in 2025 | USD 125 Million |

| Forecast Period 2025 - 2034 CAGR | 35.6% |

| Market Size in 2034 | USD 1.94 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rapid Adoption in Energy Storage | High conductivity and ion transport propel MXene usage in next-gen batteries and supercapacitors. |

| Advanced EMI Shielding in Electronics | MXenes outperform metals in electromagnetic interference shielding, fueling consumer electronics demand. |

| Surge in Government-Funded 2D Material Research | Public sector R&D accelerates breakthroughs and propels early commercialization pipelines. |

| Pitfalls & Challenges | Impact |

| Toxic & Hazardous Synthesis Methods | HF etching poses production and regulatory risks, holding back industrial scalability. |

| High Production Costs at Scale | Expensive precursor materials and batch-based processes limit large-scale economic viability. |

| Material Instability and Oxidation Sensitivity | Oxidation in ambient conditions reduces shelf life and functionality of MXene-based products. |

| Opportunities: | Impact |

| Biomedical & Biosensor Applications | Biocompatible MXenes offer new possibilities in diagnostics, drug delivery, and smart implants. |

| Flexible & Wearable Electronics | MXene-based films open up commercialization for printed, foldable, and wearable technologies. |

| HF-Free & Green Synthesis Innovations | Emerging eco-friendly production methods lower health risks and attract ESG-conscious investors. |

| Market Leaders (2024) | |

| Market Leaders |

Approximately 18% |

| Top Players |

Collective market share in 2024 is Approximately 55% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Latin America |

| Emerging countries | Brazil, Indonesia |

| Future outlook |

|

What are the growth opportunities in this market?

MXenes (2D Carbides Nitrides) Market Trends

- The rise of hf-free as a commercial standard: Conventional HF-based wet chemical etching raises genuine concerns related to toxicity, corrosion, and regulatory bottlenecks for large-scale industrial applications. In this context, companies and research centers have developed in-situ fluoride generation (e.g., LiF + HCl) and molten salt etching strategies that are safer, scalable, and / or cost effective. By way of example, the patent landscape associated with HF free etching has grown by 64% between 2020 and 2023, according to the European Patent Office (EPO), indicating a strong industrial interest.

- Increase in demand from unmet energy storage application: MXenes, particularly Ti3C2Tx and Nb2C, are strategically positioned to fill gaps in markets characterized by high-rate, large capacity energy storage technology. While lithium-ion batteries populated the energy storage landscape, the limitations associated with power density, charge time, and life cycle continue to impede their larger deployment into the marketplace. MXenes can offer a distinct blend of metallic conductivity, low barriers for diffusion, and favorable hydrophilic surfaces that may yield ultra-fast charge/discharge capabilities while maintaining long-term stability.

- Government-funded consortia for innovation in MXenes: China's Ministry of Science & Technology (MOST) has devoted nearly USD 40 million towards labs focused on MXenes from 2021-2023. The EU Graphene Flagship project and Korean National Nanotech Initiative have included MXenes as part of broader clusters for 2D materials policy. In all these cases, a top-down approach is in action to facilitate more academic-industry collaboration, patent activity, and early-stage commercialization of MXenes through tech incubators and licensing programs.

- Application-specific MXenes via functionalization & customization: Another trend that is particularly evident in MXene R&D is surface-functionalized and application-spaced optimized MXenes, aimed at addressing various industry sectors, ranging from EMI shielding to biomedical devices. Research is now oriented towards controlled termination groups (–O, –OH, –Cl, –Br) and multilayered heterostructures in order to achieve greater specificity towards user service targets while improving stability of products.

MXenes (2D Carbides Nitrides) Market Analysis

Learn more about the key segments shaping this market

Based on composition, the market is divided into single-element m-site MXenes, multi-element m-site MXenes, x-site composition, and surface termination. Single-element m-site MXenes segment generated a revenue of USD 34.7 Million in 2024 and USD 989.9 Million in 2034 at a CAGR of 35.4%.

- The Single-element M-site MXenes segment has the highest market share of the MXenes composition types. The reasons for its high market share are due to demonstrated scalability in synthesis and continued high performance in several important applications. The majority of commercial and academic MXene products on the market or developed to date are based on Ti-MXenes, predominantly Ti3C2Tx as the first and most widely studied MXene to date. The well-defined synthesis pathway, reproducibility and demonstrated performance have positioned the Ti-MXenes to a point where industrial development of MXenes is feasible.

- From a performance perspective, Single-Element MXenes(M= (e.g., Ti2C, Ti3C2, Mo2C, & Nb2C)) have shown excellent properties including high electronic conductivity (>10,000 S/cm), tunable surface chemistry, and multiple oxidation states. These characteristics make them a good candidate for industry's high demand sectors, for example, supercapacitors, lithium ion batteries, electromagnetic interference shielding, and biosensors.

- Most of the current materials science and surface functionalization work involving new materials such as fluorine-free synthesis techniques, improved oxidation resistance schemes, and polymer-MXene composites fall into this category. These materials are the base templates for modified or application-specific MXenes, adding to their commercial and academic importance.

- This category is also valuable because of the cost benefit. MAX phases based on titanium and molybdenum are somewhat less expensive and more readily available around the world than elements such as Ta, Hf, and rare high-entropy compounds. There are established methods and production methods and protocols for fabricating Ti-based MXenes that improve yield and safety, along with reducing manufacturing cost and risk, as it relates to the goal of scale-up and commercialization.

Learn more about the key segments shaping this market

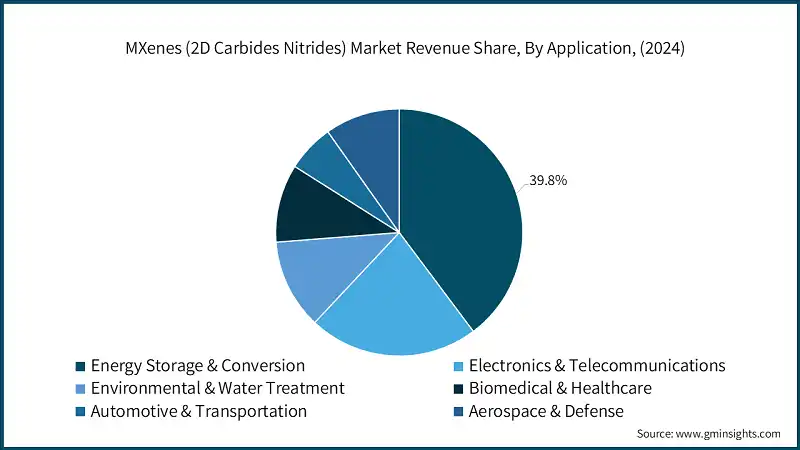

Based on application, the MXenes (2D Carbides Nitrides) market is divided into energy storage & conversion, electronics & telecommunications, environmental & water treatment, biomedical & healthcare, automotive & transportation, aerospace & defense. In 2024, energy storage & conversion segment held major market share, accounted for 39.8% share.

- 2D MXenes such as Ti3C2Tx and Nb2C have been highlighted for an optimal combination of high metallic-like conductivity, redox-active surfaces, and large layered structures containing channels to intercalate ions, making them ideal for rapid and efficient ion transport as well as high-surface capacity charge storage.

- Within lithium ion and sodium ion batteries, MXenes have been proposed for use as high-capacity anodes due to the low thermodynamic (or diffusion) barriers (~0.017 eV for Li+ ) and the strong pseudocapacitive behavior that can be expected. Studies have reported Ti3C2Tx anodes as achieving specific capacities of the order of 380-450 mAh/g and cyclability of more than 2000 cycles.

- The supercapacitor market segment is also viewed as a high impact sub-segment where MXenes enable ultra-high volumetric capacitance (~1500 F/cm³) and outperform activated carbon, particularly with current designs and space requirements, with a shift toward hybrid capacitated devices for use in regenerative braking systems and grid balancing.

- Furthermore, innovations regarding MXene based inks for flexible, wearable supercapacitors are also gaining traction within the consumer electronics and Internet of Things (IoT) markets.

Looking for region specific data?

North America MXenes (2D Carbides Nitrides) Market Top 5 companies in the MXenes (2D Carbides Nitrides) industry are Beike 2D Materials Co., Ltd., ACS Material LLC, 6Carbon Technology (Shenzhen) Co., Ltd., Nanjing XFNANO Materials Tech Co., Ltd., and Sigma-Aldrich (Merck KGaA). The competitive dynamics of the Global MXenes Market is still evolving but is more merging around an amalgamation of academic spin-offs, deep-tech companies, and advanced materials companies, particularly from the U.S., China, and Europe. Competition is occurring based on both material purity and scale of production, depth of innovations under patent, and low toxicity synthesis methods. For instance, we see Adden Energy with a leading position in roll-to-roll scalable products of Ti3C2Tx films developed for supercapacitors, and Beike New Materials is focusing on bulk powders supplies of type MXenes optimized for lithium-ion applications. Most companies align with research institutions to co-develop functionalizations specific to applications of interest. Given the nascent stage of the market, product innovation is generally more significant than price. Companies are developing HF-free and green methods; technologies for tuning surface terminations; and integrations at the device level. In strategic value, even though the innovation is important, it is an equally a function of the patents that form the formulations, and partnerships for go to market efficiency.Europe MXenes (2D Carbides Nitrides) Market

Asia Pacific MXenes (2D Carbides Nitrides) Market

Latin America MXenes (2D Carbides Nitrides) Market

Middle East & Africa MXenes (2D Carbides Nitrides) Market

MXenes (2D Carbides Nitrides) Market Share

MXenes (2D Carbides Nitrides) Market Companies

MXenes (2D Carbides Nitrides) Industry News

The MXenes (2D Carbides Nitrides) market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Million) & volume (Tons) from 2021 to 2034, for the following segments:

Market, By Composition

- Single-Element M-Site MXenes

- Titanium MXenes

- Vanadium MXenes

- Niobium MXenes

- Molybdenum MXenes

- Other Single-Element MXenes

- Multi-Element M-Site MXenes

- Solid Solution MXenes

- Ordered Double M MXenes

- High-Entropy MXenes

- X-Site Composition

- Pure Carbides

- Pure Nitrides

- Carbonitrides

- Surface Termination

- Fluorine-Terminated MXenes

- Oxygen/Hydroxyl-Terminated MXenes

- Chlorine-Terminated MXenes

- Mixed Terminations

Market, By Synthesis Technology

- Chemical Etching Methods

- Fluoride-Based Etching

- HF-Free Chemical Etching

- Physical / Electrochemical Methods

- Electrochemical Etching

- Thermal Methods

- Bottom-Up Synthesis

- Vapor Deposition

- Solution-Based Synthesis

Market, By Application

- Energy Storage & Conversion

- Electrochemical Energy Storage

- Electrochemical Conversion Applications

- Electronics & Telecommunications

- Electromagnetic Applications

- Electronic Components

- Environmental & Water Treatment

- Water Purification

- Air Treatment

- Biomedical & Healthcare

- Diagnostic Applications

- Therapeutic Applications

- Automotive & Transportation

- Electric Vehicle Components

- Structural Applications

- Aerospace & Defense

- Structural Materials

- Electronic Warfare Applications

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Which region leads the MXenes (2D Carbides Nitrides) market?

Asia Pacific dominated the global market in 2024, led by China’s revenue of USD 12.2 million and rapid industrialization of MXene production.

Which companies are the top players in the MXenes (2D Carbides Nitrides) industry?

Top players include Beike 2D Materials Co., Ltd., ACS Material LLC, 6Carbon Technology (Shenzhen) Co., Ltd., Nanjing XFNANO Materials Tech Co., Ltd., and Sigma-Aldrich (Merck KGaA) — collectively holding around 55% market share in 2024.

What are the key trends shaping the MXenes (2D Carbides Nitrides) market?

Major trends include HF-free synthesis innovations, commercialization of Ti₃C₂-based powders, functionalized MXenes for biomedical uses, and government-funded research consortia across China, the EU, and Korea driving early commercialization.

What was the market share of the energy storage & conversion application segment in 2024?

The energy storage & conversion segment held 39.8% market share in 2024, propelled by demand for high-performance supercapacitors and Li-ion batteries using Ti₃C₂Tₓ and Nb₂C MXenes.

How much revenue did the Single-Element M-site MXenes segment generate in 2024?

Single-Element M-site MXenes generated USD 34.7 million in 2024, dominating the composition segment due to scalability, reproducibility, and excellent electrical conductivity.

What is the current MXenes (2D Carbides Nitrides) market size in 2025?

The market size is projected to reach USD 125 million in 2025, supported by rising demand in electronics and defense applications.

What is the projected value of the MXenes (2D Carbides Nitrides) market by 2034?

The MXenes (2D Carbides Nitrides) market is expected to reach USD 1.94 billion by 2034, driven by commercialization in energy storage, EMI shielding, and biomedical applications.

What is the market size of the MXenes (2D Carbides Nitrides) market in 2024?

The market size was USD 67 million in 2024, with a CAGR of 35.6% expected through 2034 driven by rapid adoption in energy storage and advanced nanotechnology applications.

MXenes (2D Carbides Nitrides) Market Scope

Related Reports