Summary

Table of Content

Microgrid Controller Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Microgrid Controller Market Size

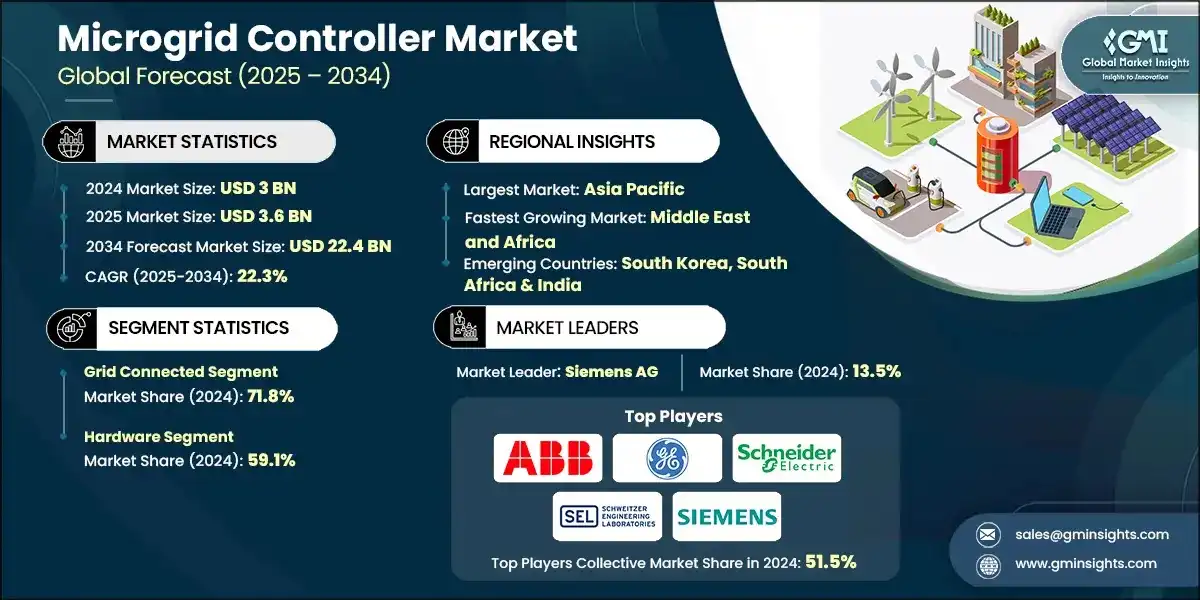

The global microgrid controller market was estimated at USD 3 billion in 2024. The market is expected to grow from USD 3.6 billion in 2025 to USD 22.4 billion in 2034, at a CAGR of 22.3% according to Global Market Insights Inc.

To get key market trends

- Rising integration of renewable resources in microgrid setups is driving demand for the product to manage the variability and intermittency of renewable energy sources, including solar and wind. They also optimize energy flow, balance supply and demand, and ensure grid stability, leading to making the product a preferred choice.

- Growing global push for decarbonization improves microgrids adoption on account of its potential to offer a localized solution to integrate renewables efficiently. This escalates controller popularity, which enables seamless switching between energy sources, storage systems, and loads, making them vital for maintaining reliability and maximizing renewable penetration. Their ability to forecast generation and adjust operations in real-time enhances energy efficiency and supports sustainability goals, further improve their adoption.

- A microgrid controller is an intelligent system that manages and optimizes the operation of a microgrid by coordinating energy generation, storage, and consumption. It ensures a reliable power supply, enables seamless integration of renewable energy sources, and allows autonomous operation during grid outages. The controller balances loads, monitors performance, and supports real-time decision-making for efficient energy use.

- Increasing microgrid deployment in developing regions will uplift the product adoption. For instance, in September 2024, Honeywell's microgrid battery energy storage system in Lakshadweep combines 1.7 MW solar capacity with 1.4 MWh storage. The system, featuring Honeywell's Energy Management System and Power Plant Controller, targets USD 28 million in lifetime savings while reducing diesel usage by 19.8 million liters and carbon emissions by 58,000 tonnes. Furthermore, rising government and regulatory bodies' focus on promoting microgrids through policies, subsidies, and mandates will propel controller demand to help operators comply with evolving regulations related to emissions, grid interconnection, and energy efficiency.

- The microgrid controller market was valued at USD 1.7 billion in 2021 and grew at a CAGR of 20% through 2024. Increasing companies' efforts in developing a reliable grid network will create lucrative opportunities for controller demand. The product enhances grid resilience by enabling autonomous operation during outages or grid disturbances. They allow microgrids to disconnect from the main grid and continue supplying power locally, particularly crucial for critical infrastructure, including hospitals, military bases, and data centers.

- Increasing demand for continuous power in natural disaster-prone areas improves microgrid deployment. For instance, the Emergency Events Database (EM-DAT) recorded 393 natural hazard-related disasters in 2024. These disasters resulted in 16,753 deaths and impacted 167.2 million people. In regions prone to natural disasters or unstable grids, microgrid deployment becomes a necessity, boosting microgrid controllers' adoption as a dependable backup, reducing downtime and economic losses. Additionally, their intelligent control systems ensure a continuous power supply and faster recovery.

- Asia Pacific is among the dominant regions, primarily driven by rapid urbanization, rising energy demand, and a strong push for renewable energy integration. Countries such as India, China, and Australia are investing heavily in decentralized energy systems to improve grid reliability and reduce carbon emissions. This uplifts microgrid controllers' adoption as a crucial component for managing diverse energy sources and ensuring a stable supply in remote and disaster-prone areas.

- China holds a major share in the Asia Pacific microgrid controller market predominantly due to the growing renewable industry and rising incorporation of controllers in these projects. For instance, in January 2024, Tencent implemented a microgrid project at its data center in China that generates solar energy equivalent to powering 6,000 households. The project incorporates advanced components and software, including microgrid controllers. Additionally, growing countries’ focus on reducing energy costs propels the product adoption that optimizes when and how energy is generated, stored, and consumed, leading to minimizing the energy cost.

Microgrid Controller Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 3 Billion |

| Market Size in 2025 | USD 3.6 Billion |

| Forecast Period 2025 - 2034 CAGR | 22.3% |

| Market Size in 2034 | USD 22.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Renewable energy integration | Microgrid controllers enable efficient use of solar and wind, improving grid stability and supporting global decarbonization efforts. |

| Energy resilience needs | They ensure uninterrupted power during outages, making them vital for critical infrastructure and disaster-prone regions. |

| Pitfalls & Challenges | Impact |

| High initial costs | Expensive setup and technology limit adoption, especially in developing regions with constrained budgets. |

| Technical complexity | Advanced control systems require skilled personnel, posing challenges in areas lacking technical expertise and training. |

| Opportunities: | Impact |

| Smart city development | Microgrid controllers can support smart cities by enabling intelligent energy distribution, integrating renewables, and enhancing grid reliability for urban infrastructure and public services. |

| Electrification of remote areas | The product offers scalable solutions for powering off-grid communities, improving energy access, supporting education and healthcare, and fostering economic development in underserved regions. |

| Market Leaders (2024) | |

| Market Leaders |

13.5% market share |

| Top Players |

Collective market share in 2024 is 51.5% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Middle East and Africa |

| Emerging Country | South Korea, South Africa & India |

| Future Outlook |

|

What are the growth opportunities in this market?

Microgrid Controller Market Trends

- The increasing frequency of grid failures due to natural disasters, cyberattacks, and aging infrastructure is driving demand for resilient energy systems. Microgrid controllers play a vital role in enabling autonomous operation and seamless transition between grid-connected and island modes. This ensures uninterrupted power for critical infrastructure such as hospitals, military bases, and data centers.

- Additionally, growing public-private collaborations, which help in expanding microgrid reach in unreserved areas with high renewable energy sources, will augment the business landscape. In January 2024, the Royal Johannesburg and Kensington Golf Club launched South Africa’s largest solar-powered microgrid system. This advanced setup includes 452 solar panels, Huawei inverters, FreedomWon battery stacks, and an ATESS power conversion system (PCS) inverter. The microgrid is designed to enhance energy independence and sustainability for the facility.

- Growing investment in evolving smart grid technologies and the proliferation of IoT devices will transform microgrid controller capabilities. Companies' growing focus on developing advanced controllers with real-time monitoring, predictive analytics, and remote management features uplifts the business scenario. These innovations allow for dynamic load balancing, fault detection, and automated decision-making. Additionally, integration with cloud platforms and AI algorithms further enhances operational efficiency and scalability.

- The emergence of Energy as a Service (EaaS) business models is reshaping how energy systems are financed and operated. Microgrid controllers are central to these models, enabling third-party providers to manage energy generation, distribution, and billing. Companies are investing in developing microgrid-focused EaaS systems to improve product reach to customers. For instance, in August 2025, SolMicroGrid launched its EaaS Partner Program to acquire operational or near-complete solar and microgrid systems. The company manages and maintains these systems, allowing clients to access energy services without infrastructure ownership. SolMicroGrid's acquisition scope ranges from 500-kW grocery store arrays to multi-MW microgrids, encompassing rooftop solar, battery storage, generator sets, and EV infrastructure.

- Additionally, emerging markets in Asia Pacific, the Middle East, and Africa are witnessing increased adoption of microgrid controllers due to rural electrification initiatives and the need for resilient power systems. Governments' rising investment in decentralized energy solutions to improve energy access and reduce reliance on fossil fuels is set to influence the product growth. In these regions, microgrid controllers enable cost-effective deployment of renewable energy and storage systems.

Microgrid Controller Market Analysis

Learn more about the key segments shaping this market

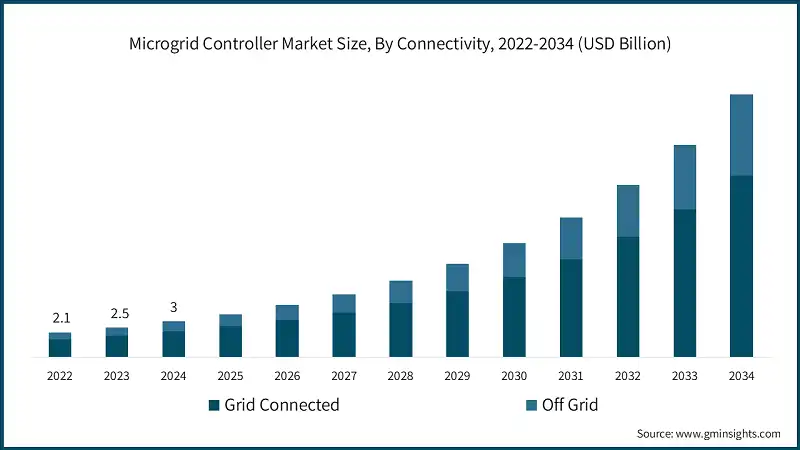

Based on connectivity, the industry is segmented into grid connected and off grid. The grid connected segment dominated around 71.8% market share in 2024 and is expected to grow at a CAGR of 21.9% through 2034.

- Rising demand for energy optimization and market participation in grid connected microgrids escalates the controller’s demand. These controllers manage distributed energy resources (DERs) to reduce peak demand, lower energy costs, and sell excess power back to the grid. They also support demand response programs and regulatory compliance. Furthermore, growing utilities' efforts in modernizing their infrastructure propel controller penetration, which allows seamless integration with smart grids, enhancing flexibility and reliability.

- The off grid connectivity market will grow at a CAGR of 23.4% through 2034. In remote or underserved regions, off grid microgrids are essential for providing reliable electricity, where microgrid controllers play a critical role in balancing generation and consumption, especially when using renewable sources such as solar and wind. They ensure stable voltage and frequency, manage battery storage, and prioritize critical loads. Additionally, rising off grid systems operations in harsh environments make intelligent control vital for system longevity and performance. These controllers enable autonomous operation, fault detection, and real-time adjustments, making them indispensable for rural electrification, disaster recovery, and mission-critical applications where grid access is unavailable or unreliable.

- Growing government incentives, grants, and supportive policies, along with rising awareness of electrification in remote and off-grid areas, are significantly driving the growth of the microgrid controller market. Microgrid controllers play a crucial role in managing distributed energy resources, ensuring a stable power supply, and enabling autonomous operation in isolated regions. For instance, in September 2023, the U.S. Department of Energy approved a USD 72.8 million loan guarantee for a microgrid project on tribal lands in California. This project includes a 70 MWh long-duration battery energy storage system and a 15 MW solar installation, both coordinated by advanced microgrid controllers to ensure efficient energy management and grid resilience.

Learn more about the key segments shaping this market

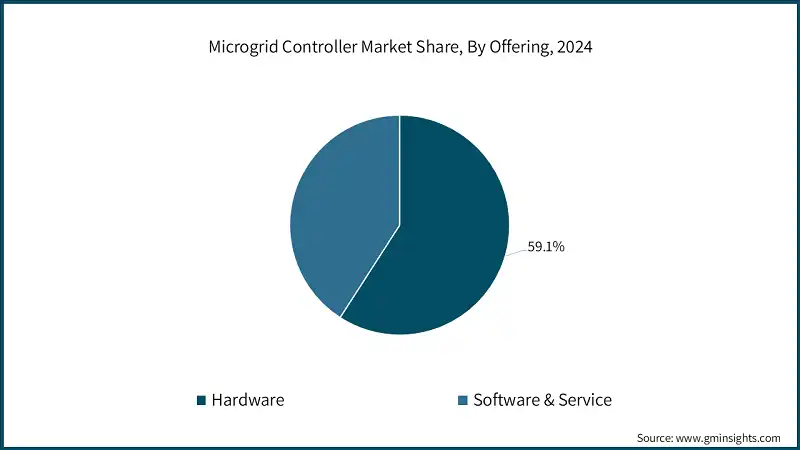

Based on offering, the industry is segmented into hardware, software & service. The hardware segment dominated the market with a 59.1% share in 2024 and is expected to grow at a CAGR of 21.9% from 2025 to 2034.

- Increasing need for robust, real-time control and reliable system performance escalates hardware components adoption. Hardware includes sensors, communication modules, processors, and power electronics that enable precise monitoring and control of distributed energy resources (DERs). Rising complexity of microgrids improves hardware demand to support high-speed data acquisition, fault detection, and seamless switching between grid-connected and islanded modes. The rise in renewable energy installations and battery storage systems demands advanced hardware capable of handling variable loads and ensuring grid stability.

- Additionally, ruggedized and modular hardware designs are gaining traction in remote and harsh environments, where durability and scalability are critical. Innovations in embedded systems and edge computing are further enhancing controller responsiveness and autonomy. The growing demand for decentralized energy systems, especially in industrial and military applications, is fueling investment in high-performance microgrid controller hardware.

- The software & service segment is set to grow at a CAGR of 22.9% through 2034, driven by its advanced analytics, remote monitoring, and predictive maintenance. Rising demand for software that can integrate real-time data from DERs, weather forecasts, and load profiles to optimize energy dispatch and storage utilization will uplift the offering adoption. Additionally, cloud-based services allow operators to manage multiple microgrids remotely, improving scalability and operational efficiency, making the process less complex, thus driving its penetration.

Looking for region specific data?

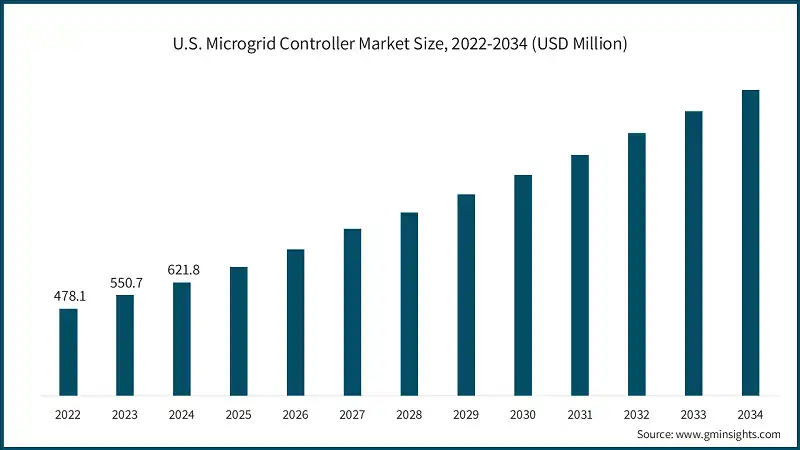

- The U.S. dominated the microgrid controller market in North America with around 81.5% share in 2024 and is expected to generate over USD 1.6 billion revenue by 2034, driven by federal initiatives such as the Inflation Reduction Act and state-level programs that offer tax credits, grants, and loan guarantees for microgrid projects, significantly reducing upfront costs and encouraging deployment.

- Additionally, increasing frequency and severity of natural disasters expose the limitations of conventional centralized power networks, driving the demand for alternative solutions such as microgrids with controllers to enable seamless islanding and load prioritization, ensuring uninterrupted power. According to NCEI, the United States experienced 403 weather-related and climate disasters between 1980 and 2024, with each causing losses exceeding USD 1 billion. These events create demand for the product as a reliable energy source in vulnerable geographic regions.

- The North America microgrid controller market accounted for a market value of USD 763.1 million in 2024, due to aging infrastructure, extreme weather events, and rising energy demand. Microgrid controllers enable autonomous operation and seamless islanding, ensuring uninterrupted power for critical facilities, including hospitals, data centers, and military bases. Their ability to manage distributed energy resources (DERs) and maintain grid stability is crucial for enhancing energy resilience, leading to fostering the industry scenario.

- The Asia Pacific microgrid controller market is anticipated to reach over USD 13.6 billion by 2034. Limited or no access to reliable electricity in various Asia Pacific countries, including India, Indonesia, and the Philippines, necessitates microgrid deployment. As per the Indian government data, power outage surveys in India revealed that 38% of households faced daily electricity disruptions in May 2024, primarily due to increased temperatures and higher power demand. This improves controller adoption to enable efficient management of off-grid systems powered by renewables, ensuring stable and autonomous operation.

- Europe microgrid controller market is set to grow at a CAGR of 15.3% through 2034. Aging infrastructure and the shift toward decentralized energy systems are prompting investments in smart grid technologies, boosting microgrid controllers' adoption to enable dynamic load balancing, fault detection, and seamless grid interaction. Their ability to support both grid-connected and islanded operations makes them vital for modernizing Europe’s energy networks and improving resilience against outages and cyber threats.

- Middle East & Africa microgrid controller market is expected to reach USD 1 billion by 2034. The rising need for reliable power in remote and underserved areas of Africa and parts of the Middle East due to the absence of centralized power infrastructure improves controller’s demand. The product enables autonomous operation of off-grid systems, ensuring a stable electricity supply for rural communities, schools, and healthcare facilities. Their ability to manage distributed energy resources (DERs) such as solar and batteries makes them essential for expanding energy access.

Microgrid Controller Market Share

- The top 5 companies, including ABB Ltd, General Electric, Schneider Electric, Schweitzer Engineering Laboratories, Siemens AG, account for around 51.5% market share. Companies are prioritizing research in AI, machine learning, and edge computing to develop smarter, predictive microgrid controllers. Innovations in real-time analytics, fault detection, and autonomous control to enhance system performance and reliability. By staying ahead technologically, firms are aiming to offer differentiated products that meet evolving customer needs and regulatory standards, positioning themselves as leaders in a rapidly digitizing energy landscape.

- Key players are targeting regions including Asia Pacific, Africa, and Latin America, offering significant growth potential due to rising electrification and renewable energy adoption. Companies are forming strategic partnerships with local governments, NGOs, and utilities to deploy microgrids in remote and underserved areas. Offering region-specific solutions and training programs will help build trust and long-term market presence, while addressing critical energy access challenges.

- Companies are providing end-to-end microgrid solutions, including hardware, software, and services, which simplifies deployment for customers and enhances value. Bundled offerings reduce complexity, improve interoperability, and ensure seamless performance. This approach appeals to commercial, industrial, and municipal clients seeking reliable, scalable energy systems. It also opens opportunities for recurring revenue through maintenance, upgrades, and performance optimization services.

Microgrid Controller Market Companies

- ABB Ltd, a global leader in electrification and automation, offers advanced microgrid controllers that integrate renewables and storage for grid stability. Its distributed control systems support real-time optimization and islanding. ABB reported revenues of over USD 32.9 billion in 2024, with strong growth in energy management solutions. Its controllers are widely used in industrial, utility, and remote applications.

- General Electric (GE)’s GridNode microgrid solution offers real-time control, market participation, and renewable integration. Its controllers support seamless islanding, load shedding, and energy cost optimization. The company’s microgrid technologies are deployed across utilities, commercial sites, and remote locations, enhancing energy resilience and operational efficiency.

- Schneider Electric’s EcoStruxure platform powers its microgrid controllers, enabling smart energy management, predictive analytics, and DER integration. The company operates in over 100 countries and generated USD 44.1 billion in revenue in 2024. Its controllers are widely adopted in smart cities, campuses, and healthcare facilities, supporting sustainability and energy-as-a-service models.

- Schweitzer Engineering Laboratories SEL’s powerMAX microgrid control system is known for subcycle response, seamless islanding, and cybersecure operation. It serves critical infrastructure such as military bases, hospitals, and data centers. Its controllers are highly customizable and proven in field deployments for over 15 years.

- Siemens AG offers scalable microgrid controllers integrated with its smart grid solutions, supporting AI-based optimization and renewable energy orchestration. With USD 88 billion in annual revenue, Siemens is a major player in energy automation. Its controllers are used in industrial parks, campuses, and R&D facilities, enabling decentralized energy systems and grid modernization.

Eminent players operating in the microgrid controller market are:

- ABB Ltd

- AutoGrid Systems Inc

- Caterpillar Inn

- Cummins Inc

- Eaton Corporation

- Emerson Electric Co.

- Enchanted Rock

- Encorp Inc.

- General Electric (GE)

- Heila Technologies

- Hitachi Energy Ltd

- HOMER Energy

- Honeywell International Inc

- Power Analytics Corporation

- Pxise Energy Solutions

- S&C Electric Company

- Schneider Electric

- Schweitzer Engineering Laboratories

- Siemens AG

- Tesla Energy

Microgrid Controller Industry News:

- In September 2025, Eaton formed a strategic partnership with US-based Xendee Corporation to create an integrated microgrid system. This collaboration integrates Eaton's microgrid infrastructure and technical expertise with Xendee's Model Predictive Control software for microgrid system optimization and evaluation.

- In August 2025, Generac Power Systems completed the acquisition of Ageto. The company specializes in microgrid control systems that combine and manage various power sources, including conventional resources, renewable energy, and EV charging infrastructure for commercial and industrial applications. The companies did not disclose financial details of the transaction.

This microgrid controller market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in “(USD Billion)” from 2021 to 2034, for the following segments:

Market, By Connectivity

- Grid connected

- Off grid

Market, By Offering

- Hardware

- Software & service

Market, By End Use

- Healthcare

- Educational institutes

- Military

- Utility

- Industrial/ commercial

- Remote

- Others

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Russia

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Latin America

- Brazil

- Argentina

Frequently Asked Question(FAQ) :

Who are the key players in the microgrid controller market?

Key players include ABB Ltd, General Electric, Schneider Electric, Schweitzer Engineering Laboratories, Siemens AG, AutoGrid Systems Inc, Caterpillar Inc, Cummins Inc, Eaton Corporation, Emerson Electric Co., Enchanted Rock, Encorp Inc., Heila Technologies, Hitachi Energy Ltd, HOMER Energy, Honeywell International Inc, Power Analytics Corporation, Pxise Energy Solutions, S&C Electric Company, and Tesla Energy.

Which region leads the microgrid controller market?

The U.S. dominated the North America microgrid controller market with around 81.5% share in 2024 and is expected to generate over USD 1.6 billion in revenue by 2034

How much revenue did the hardware segment generate in 2024?

The hardware segment dominated the market with 59.1% share in 2024, generating approximately USD 1.8 billion, leading due to the need for robust real-time control and reliable system performance.

What is the growth outlook for off grid systems from 2025 to 2034?

Off grid connectivity systems are projected to grow at a CAGR of 23.4% through 2034, due to demand for reliable electricity in remote regions and autonomous operation capabilities.

What was the market share of the grid connected segment in 2024?

Grid connected microgrids held 71.8% market share in 2024, fueled by energy optimization and market participation capabilities.

What is the current microgrid controller market size in 2025?

The market size is projected to reach USD 3.6 billion in 2025.

What is the market size of the microgrid controller in 2024?

The market size was USD 3 billion in 2024, with a CAGR of 22.3% expected through 2034 driven by rising integration of renewable energy sources such as solar and wind to effectively manage their variability and intermittency.

What is the projected value of the microgrid controller market by 2034?

The microgrid controller market is expected to reach USD 22.4 billion by 2034, propelled by renewable energy integration, grid resilience needs, and demand for autonomous operation during outages.

What are the upcoming trends in the microgrid controller market?

Key trends include integration of AI and machine learning for predictive energy management, blockchain technology for secure peer-to-peer energy trading, and increasing adoption of cloud-based services for remote monitoring and management.

Microgrid Controller Market Scope

Related Reports