Summary

Table of Content

Membranes Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Membranes Market Size

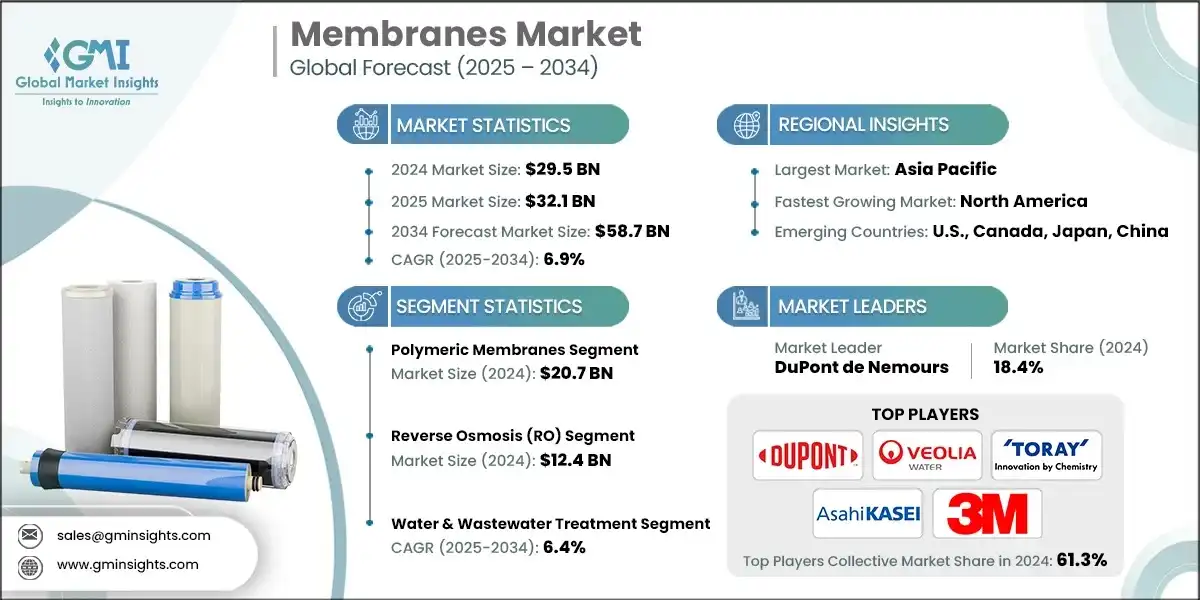

The global membranes market was estimated at USD 29.5 billion in 2024. It is expected to grow from USD 32.1 billion in 2025 to USD 58.7 billion by 2034, at a CAGR of 6.9%, according to latest report published by Global Market Insights Inc.

To get key market trends

- The membranes market is growing as the world makes stricter rules about water, and a greater amount of money is allocated to infrastructure. The U.S. EPA, under the Bipartisan Infrastructure Law, has provided water and wastewater systems with more than USD 17.2 billion to modernize the systems, leading to improved use of advanced membrane filtration technologies. This type of regulatory enforcement would guarantee the constant need for high efficiency RO and UF systems by the utility sector.

- There is increasing shortage of freshwater that is driving governments and industries to the desalination and reuse of water using membranes as the technology. The growth in investments in seawater and brackish water RO plants, particularly in others such as the Middle East, India, and the U.S. are greatly increasing the consumption of the membrane. This change promotes the growth of the market in the long term by sustainable water management practices.

- The implementation of tougher discharge requirements and new effluent targets in manufacturing, power and chemical industries are evaluating the integration of membrane into industrial wastewater lines of treatment. Recent Effluent Limitation Guidelines (ELGs) by EPA promote the application of the membrane bioreactor and RO systems to comply with zero liquid discharge. This is the direction taken by regulation making industries to seek cost efficiency with high recovery membrane.

- Thin-film composite (TFC) and PVDF-based membranes have been subjected to constant improvements in their permeability, fouling resistance and lifetime. Such improvements lower the operational costs and increase the membrane usage in difficult applications in solvent filtration and recovery of brine. The market growth is being ramped up by continuous research and development activities and pilot projects.

Membranes Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 29.5 Billion |

| Market Size in 2025 | USD 32.1 Billion |

| Forecast Period 2025 - 2034 CAGR | 6.9% |

| Market Size in 2034 | USD 58.7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Stringent Water Quality Regulations & EPA Compliance Requirements | Drive adoption of advanced membrane systems to meet stricter purification and discharge standards. |

| Growing Water Scarcity & Desalination Demand | Boost demand for high-efficiency membranes in seawater desalination and water reuse projects. |

| Industrial Wastewater Treatment Mandates | Accelerate membrane deployment in industries to comply with zero-liquid discharge and pollution control norms. |

| Pitfalls & Challenges | Impact |

| High Initial Capital Investment & System Costs | Limit adoption in cost-sensitive markets despite long-term operational benefits |

| Membrane Fouling & Operational Challenges | Increase maintenance needs and reduce system efficiency, impacting lifecycle performance |

| Opportunities: | Impact |

| Integration with Renewable Energy Systems | Enables energy-efficient membrane operations, especially in off-grid and remote areas |

| Smart Membrane Technologies & IoT Integration | Unlock real-time monitoring and predictive maintenance, enhancing reliability and uptime |

| Market Leaders (2024) | |

| Market Leaders |

18.4% |

| Top Players |

Collective market share in 2024 is 61.3% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Emerging Country | U.S., Canada, Japan, China |

| Future Outlook |

|

What are the growth opportunities in this market?

Membranes Market Trends

- Membrane systems are combined with sensors, IoT and predictive analytics to control performance. AI-based tools are cutting down the downtime and increasing the life of the membranes. This tendency is associated with the tendency of the operators to switch to service-based models of maintenance as opposed to reactive and suggests that suppliers will have to supply not merely hardware but rather hardware that is smart.

- The increased use of membranes in freshwater treatment is being overshadowed by a growing interest in reusing and recycling water (as in industrial parks, municipal plants, etc.). As mentioned above, a lot of areas are incorporating Membranes in water-reuse facilities. The implication is that vendors of membranes must deal with a variety of feed streams (high fouling, lumpy quality) and ensure that the systems they offer are resistant to reuse instead of traditional supply.

- Membrane plants (large central plants only) are increasingly being replaced by modular smaller footprint plants (remote sites, industrial sites, reuse). There is one source that refers to expansion of decentralized treatment units. This pushes market consequences: elasticity, quick implementation, plug-and-play parts come to be differentiators, and the vendors can have a rivalry of how to provide field services and modularization rather than by membrane elements alone.

- Membrane technology is also going to other fields like industrial processing, biopharmaceuticals, food and beverage, gas separation and other markets that are not water related. The reports in the market show the higher adoption in those segments. It implies that business models in the membrane industry should become more diversified and resilient to changes in regulatory and purity regimes having wider portfolios, partners in related industries, and the capabilities of serving different regulatory and purity regimes.

Membranes Market Analysis

Learn more about the key segments shaping this market

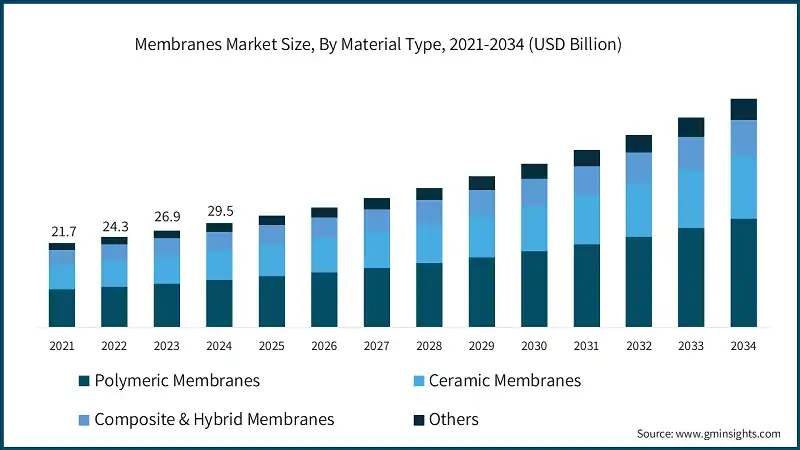

Based on materials type, the market is segmented into polymeric membranes, ceramic membranes, composite & hybrid membranes, and others. Polymeric membranes hold a significant share at a valuation of USD 20.7 billion in 2024.

- The polymeric membrane segment has occupied the largest share in membranes market for its flexibility, and performance effectiveness. PVDF, PES, and PA have found wide applications in RO, UF, and MF in water treatment, food processing, and pharmaceutical applications. Their elevated levels of permeability, chemical stability and ability to scale readily make them the choice of most industrial and municipal applications. This is even further prolonging their life span and dependability given constant innovation of antifouling’s and surface modification.

- Ceramic and composite membranes have high resistance to harsh chemicals, thermal stability and have an elevated level of durability in heavy industries, and hence their demand is increasing gradually. There is development of composite and hybrids to integrate benefits of polymeric and inorganic materials to increase selectivity and efficiency. Nonetheless, polymeric membranes are still the most used solution due to their affordability, simplicity of production and flexibility to a wide variety of applications in terms of separation and purification.

Based on technology, the membranes market is segmented into microfiltration (MF), ultrafiltration (UF), nanofiltration (NF), reverse osmosis (RO), electrodialysis (ED), and others. Reverse osmosis (RO) holds a significant share at a valuation of USD 12.4 billion in 2024.

- The Reverse Osmosis (RO) segment is the leading segment in the technology segmentation, due to its effectiveness in eluting dissolved salts, impurities, and contaminants of water. It is widely used in desalination, municipal water purification, and industrial wastewater recycling as it is more superior to other methods in terms of separation and energy optimization. This together with the constant improvement of the thin-film composite (TFC) membrane and low-energy RO systems is improving the efficiency of the process and lowers the operating costs further, only increasing the strength of its dominance both in the developed and emerging economies.

- The Ultrafiltration (UF), Nanofiltration (NF), and Microfiltration (MF) all are other types of membrane technologies that are increasingly being applied in the pre-treatment, bioprocessing and food and beverage filtration. UF and NF are becoming popular supplemental steps prior to RO systems to enhance recovery rates, whereas Electrodialysis (ED) is becoming popular in places such as brackish water desalination and departmental splits.

Learn more about the key segments shaping this market

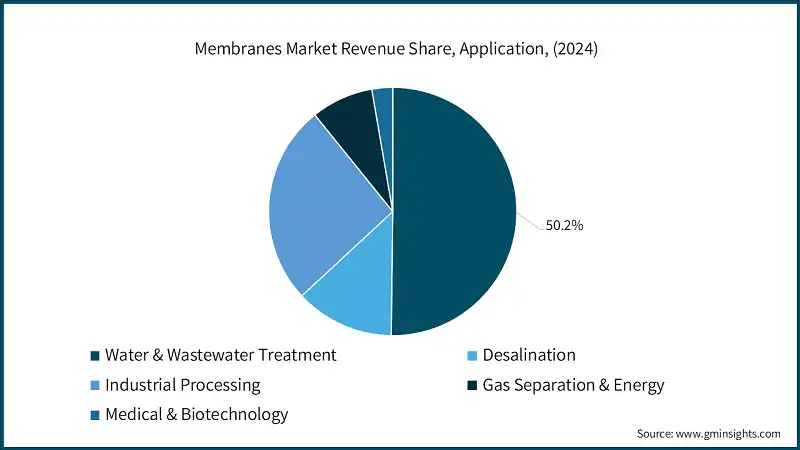

Based on application, the membranes market is segmented into water & wastewater treatment, desalination, industrial processing, gas separation & energy, and medical & biotechnology. Water & wastewater treatment is estimated to grasp a value of USD 16.1 billion in 2025 and is expected to grow at 6.4% of CAGR during the forecast period.

- Water and Wastewater Treatment dominate the application segmentation due to the increasing need for safe drinking water, urbanization as well as new policies and regulations on the topic. The municipal and industrial industries are also adopting RO, UF and MF membrane systems to treat dirty water, remove suspended sewage and allow reuse of water. Large-scale membrane installation is also driven by government programs and infrastructure investments, especially in Asia and North America to have a sustainable water management process in both sewage and effluent treatment plants.

- Other uses include Desalination, Industrial Processing, Gas Separation, and Medical and Biotechnology which are under constant growth with the help of high-performance and application specific membrane technology. Desalination is another important development in the arid areas and industrial customers in chemicals and food, and beverage industries are also using membranes as ways of concentrating and purifying their products.

Looking for region specific data?

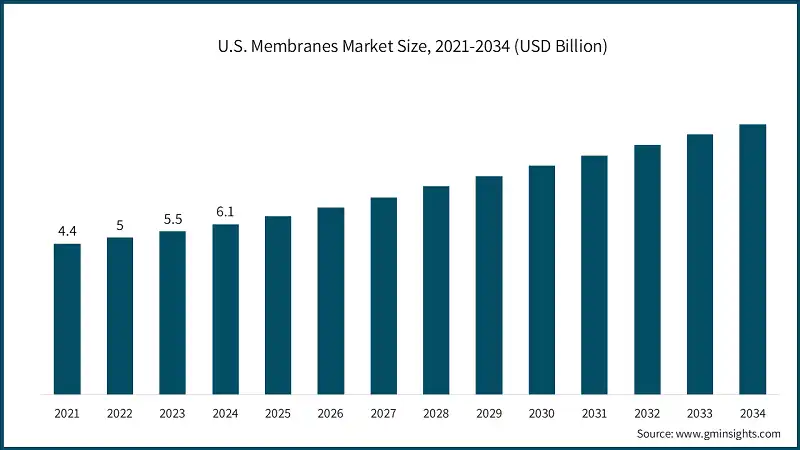

North America market accounted for USD 7.7 billion in 2024 and is anticipated to show lucrative growth over the forecast period.

- North America has a market share of about 26.1% of the membranes market in 2024 and U.S. plays key role as it has an established industrial base and good regulations in water and wastewater treatment. Growth of the region is aided by the increasing investment in municipal water reuse, desalination facilities and upgrading of industrial filtration systems within pharmaceutical, food and beverages and power generation industries. The imperative to improve the environment has improved the use of reverse osmosis and ultrafiltration systems by increasing the amount of EPA standards that regulate contaminants such as PFAS.

- The digital monitoring, AI-based diagnostics, and energy-efficient membrane systems are also enhancing the availability of technologies to expand markets in North America to increase the level of performance and decrease the costs of operations. Also, the cooperation of technology providers with utility operators is promoting breakthroughs in next-generation polymeric and ceramic membranes that are enabling the region to become a leader in sustainable water technology development.

Europe accounted for USD 6.8 billion in 2024 and is anticipated to show lucrative growth over the forecast period.

- Europe has a market share of approximately 23.1% of the market of the membranes market in 2024, influenced by the stringent EU water rules, high sustainability criteria, and large-scale use of wastewater recycling and desalination methods. Germany, France, Spain, and U.K. are the leading contributors because they have developed industrial sectors and continue the modernization of the municipal water systems. EU Water Framework Directive and specifically reducing industrial discharge have generated a continuous demand for ultrafiltration, nanofiltration type, and reverse osmosis membrane in the region.

- This market is also facilitated by the fact that Europe is becoming more focused on the concept of the circular economy and zero-liquid-discharge (ZLD) projects and stimulates industries to use membrane solutions with high efficiency. Continuous development of bio-based membrane materials, as well as development in membrane bioreactor (MBR) systems, is also improving treatment efficiency, which allows Europe to continue the steady growth with heavy emphasis on environmental compliance and innovation.

Asia Pacific membranes market accounted for USD 11.8 billion in 2024 and is anticipated to show lucrative growth over the forecast period.

- Asia Pacific has nearly 40% market share in 2024 of the membrane market globally through the fast urbanization, industrial growth, and growing water shortage in China, India, Japan and South Korea. Government activities such as the encouragement of wastewater treatment, seawater desalination, and industrial water recycling have enhanced the implementation of the membrane technologies in the municipal and industrial.

- The expansion of the region is also boosted by heavy investments in the production of membranes and supply chain localizations which are favored by global players who are moving their production facilities to Asia. The advanced ultrafiltration and reverse osmosis systems are also driven by increased demand of these systems by industries like semiconductors, pharmaceuticals and food and beverages.

Latin America market accounted for 8.1% market share in 2024 and is anticipated to show steady growth over the forecast period.

- The membranes market of Latin America is growing steadily, and the growth is backed by increasing investments in municipal water treatment and industrial wastewater management within the countries such as Brazil, Chile, and Mexico. The growing interest in water contamination and shortage is leading to the implementation of reverse osmosis systems and ultrafiltration systems in public and private systems. Membrane based purification is being incorporated in infrastructure projects funded by regional governments through the assistance of organizations like the Inter-American Development Bank (IDB) to improve water reuse and quality especially in urban and mining regions.

Middle East and Africa membranes market accounted for 2.7% market share in 2024 and is anticipated to show steady growth over the forecast period.

- Middle East & Africa (MEA) has been experiencing slow market growth mostly because of increasing desalination and water reutilization initiatives across the Gulf Cooperation Council (GCC) states and South Africa. Using membrane desalination facilities is a costly measure aimed at fixing chronic freshwater shortages by governments, the UAE, and Saudi Arabia pioneer the large-scale installations. The entrance of the region into energy-efficient and large-capacity membrane systems, combined with the trend to gain more partnerships between world suppliers and local EPC contractors is maintaining stable market development regardless of difficult climatic and economic circumstances.

Membranes Market Share

The world market is relatively consolidated and the top five players as DuPont de Nemours, Toray Industries, Veolia Water Technologies, Asahi Kasei Corporation and 3M Company have a combined market share of approximately 61.3% in 2024. The companies control the ultrafiltration, nanofiltration, reverse osmosis and microfiltration segments, based on the strong brand loyalty, integrated production plants, and diversification of product portfolio. Their market leadership is also enhanced by their broad distribution networks across the globe as well as their specialization in water treatment, bioprocessing and the use of gas separation.

To stay competitive, the major manufacturers of membranes are increasingly concerned with research and development and the investment into sustainability, as well as optimization of digital processes. The repurchase of bio-based or recyclable materials, the introduction of low-energy and high-flux membranes, and increased production footprint in Asia-pacific and the Middle East point to efforts by companies to meet demand in the region. Besides, businesses are establishing strategic alliances, conducting mergers and acquisitions and integrating AI-based performance management to boost operational efficiency, enhance durability, and adjust to the stringent environmental standards.

Membranes Market Companies

Major players operating in the membranes market are:

- DuPont de Nemours, Inc.

- Toray Industries, Inc.

- Hydranautics (Nitto Group)

- Koch Membrane Systems

- Pall Corporation (Danaher)

- Asahi Kasei Corporation

- LG Chem Ltd.

- Veolia Water Technologies

- Pentair plc

- 3M Company

- Ionomr Innovations Inc.

- Aquaporin A/S

- Modern Water plc

- Gradiant Corporation

- Membrion, Inc.

DuPont is a major producer of membranes in the world market in its DuPont Water Solutions division which produces brands like FilmTec (reverse osmosis), IntegraFlux (ultrafiltration) and AmberLite (ion exchange). The company provides services in the municipal industry, industrial and desalination industry with a high degree of concern on energy-efficient, low-fouling membranes. DuPont has gained a foothold in Asia by acquiring such companies as Sinochem RO Memtech and maintains investment in sustainable and circular water-treatment solutions.

Veolia Water Technologies is a unit of Veolia Environnement that incorporates membrane systems into their end-to-end solution of water and wastewater treatment. In industrial and municipal clients, it uses reverse osmosis, nanofiltration, ultrafiltration, and membrane bioreactors (MBR) in its systems. The business focuses on mobile water treatment products and circular water reuse and pays attention to proprietary technologies such as Hydrex membranes and integrated process designs. Veolia is increasingly making use of digital monitoring in optimization of membrane-based plants worldwide.

Toray is one of the largest manufacturing companies of reverse osmosis (RO) and ultrafiltration (UF) membranes in the world, serving desalination, wastewater reuse, and purification in industries. Its Romembra product line finds application in the large-scale desalination plants all over Asia and the Middle East. The company still advances the new RO membrane systems because they were designed to be low energy consuming and chemically resistant. The recent investments that Toray made in new manufacturing plants and in MEWTEC Water Treatment Center underscores that the company is pursuing the system-integration approach.

Asahi Kasei produces membranes that specialize in microfiltration/ultrafiltration membranes (Microza), which are used to remove microplasmids like viruses (Planova), as well as filters used in biopharmaceutical production (Planova). The company specializes in operation in high-performance hollow-fiber membrane filters, which treat water, wastewater and biotech. Its continuous growth in capacity in Japan propels the fulfillment of world needs that appeal to the increased population in high purity and virus retentive membrane to sustain the environment and the life science industry.

3M focuses on filtration and separation solutions, such as membrane modules, filter cartridges, and forward polymeric membranes. They are common in industrial water purification, food and beverage purification as well as pharmaceuticals. Through its materials science capabilities, 3M has developed high efficiency, low pressure drops membranes and emphasizes sustainability by caring about the product life cycle and incorporating designs that increase the life cycle of its products, as well as using less material. 3M further has been investing in R&D on new memory separation membranes, under its Purification and Filtration division.

Membranes Industry News

- In September 2025, Pall introduced its Membralox GP-IC ceramic membrane systems, which had a 45% higher filtration capacity than conventional ceramic filters of the same size and could recover value-add side-stream products up to 95% in food and beverage processing.

- In July 2025, Asahi Kasei intended to construct a new spinning plant in Nobeoka City (Miyazaki Prefecture, Japan) in, to operate its Planova virus-removal hollow-fiber filters, to commence operation in January 2030.

- In January 2025, Toray Industries, Inc. launched a high-performance separation membrane module, meant to be used in biopharmaceutical production.

- In December 2021, DuPont collaborated with a global nonprofit organization, Water.org, to increase global access to safe water.

The membranes market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Billion) & volume (Kilo Tons) from 2021 to 2034, for the following segments:

Market, By Material Type

- Polymeric Membranes

- Ceramic Membranes

- Composite & Hybrid Membranes

- Others

Market, By Technology

- Microfiltration (MF)

- Ultrafiltration (UF)

- Nanofiltration (NF)

- Reverse Osmosis (RO)

- Electrodialysis (ED)

- Others

Market, By Application

- Water & wastewater treatment

- Municipal drinking water treatment

- Industrial wastewater processing

- Membrane bioreactor (MBR) systems

- Water reuse & reclamation

- Desalination applications

- Seawater reverse osmosis (SWRO)

- Brackish water treatment

- Energy recovery & optimization

- Industrial processing

- Food & beverage applications

- Pharmaceutical & biotechnology

- Chemical & petrochemical processing

- Oil & gas produced water treatment

- Mining & metal recovery

- Gas separation & energy applications

- Hydrogen purification & fuel cells

- Natural gas processing

- Air separation applications

- Energy storage & battery separators

- Medical & biotechnology applications

- Hemodialysis & medical devices

- Sterile filtration & bioprocessing

- In-vitro diagnostics (IVD)

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- MEA

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the key players in the membranes market?

Key players include DuPont de Nemours, Toray Industries, Veolia Water Technologies, Asahi Kasei Corporation, and 3M Company. These companies focus on R&D, low-energy RO systems, and bio-based membranes to enhance efficiency and sustainability.

What are the upcoming trends in the membranes industry?

Key trends include the integration of AI, IoT, and smart diagnostics for predictive maintenance, the emergence of modular decentralized membrane systems, and growing use in non-water applications such as biopharmaceuticals, gas separation, and food processing.

Which region leads the membranes market?

The U.S. membranes industry was valued at USD 7.7 billion in 2024, representing North America’s 26.1% share. Growth is driven by federal infrastructure funding, adoption of RO and UF technologies, and EPA standards targeting water reuse and PFAS removal.

What is the growth outlook for the water & wastewater treatment application segment from 2025 to 2034?

The water & wastewater treatment segment is projected to grow at a 6.4% CAGR till 2034, supported by urbanization, regulatory mandates on effluent discharge, and expansion of municipal reuse projects.

What was the valuation of the reverse osmosis (RO) technology segment in 2024?

The reverse osmosis segment was valued at USD 12.4 billion in 2024, maintaining dominance due to its superior efficiency in desalination and municipal water purification processes.

How much revenue did the polymeric membranes segment generate in 2024?

The polymeric membranes segment generated USD 20.7 billion in 2024, leading the industry due to its flexibility, cost-effectiveness, and extensive use across water treatment, food, and pharmaceutical applications.

What is the current membranes market size in 2025?

The market size is projected to reach USD 32.1 billion in 2025, supported by infrastructure investments and the modernization of water and wastewater systems globally.

What is the projected value of the membranes market by 2034?

The market size for membranes is expected to reach USD 58.7 billion by 2034, driven by sustainable water management initiatives, industrial reuse applications, and advancements in reverse osmosis (RO) and ultrafiltration (UF) technologies.

What is the market size of the membranes industry in 2024?

The market size was USD 29.5 billion in 2024, with a CAGR of 6.9% expected through 2034 driven by growing water scarcity, stricter water quality regulations, and rapid adoption of desalination technologies.

Membranes Market Scope

Related Reports