Summary

Table of Content

Medical Non-woven Disposables Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Medical Non-woven Disposables Market Size

Medical Non-woven Disposables Market Size was valued at USD 17.4 billion in 2018 and is expected to witness 6.5% CAGR from 2019 to 2025.

To get key market trends

To get key market trends

Growing geriatric population suffering from dementia and other chronic diseases will increase the demand for medical non-woven disposables market growth. Dementia is a syndrome with multiple causes, and it is characterized by loss of control and sensory impairments. According to WHO, incidences of dementia is rising across the globe and every year around 10 million new cases are recorded. These patients need medical non-woven disposable products such as diapers and underwear as they assist in minimizing disability associated with urinary incontinence. Availability of superior quality incontinence products for geriatric population with chronic diseases will drive the market growth.

Medical Non-woven Disposables Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2018 |

| Market Size in 2018 | 17.4 Billion (USD) |

| Forecast Period 2019 - 2025 CAGR | 6.5% |

| Market Size in 2025 | 26.5 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Increasing government funding for providing continence care to patients in emerging countries will render a significant positive impact on market growth. Furthermore, public and private organizations are taking several initiatives to educate people and preach advantages of incontinence products. Such initiatives increase awareness regarding incontinence products in developing countries such as India and China. However, environmental degradation resulting from disposal of incontinence products may hamper the global market growth to some extent.

Medical Non-woven Disposables Market Analysis

Incontinence hygiene products segment of medical non-woven disposables market is anticipated to witness around 6.5% growth over analysis timeframe. Incontinence condition has significant implications on personal dignity and quality of life. Moreover, aged people are susceptible to urinary incontinence that results in social stigma, depression, and hygienic problem. To overcome these issues, elderly people are increasingly adopting incontinence hygiene products such as pads, ostomy liners disposable underwear and diapers that will positively stimulate the segment growth.

Surgical non-woven products segment accounted for more than 60% revenue share in 2018. Lucrative segment share can be attributed to the benefits of surgical non-woven products. Fabrics of non-woven products forbid penetration of microbes and prevent surgical side infections. Moreover, surgical non-woven products are waterproof and water-repellent that reduce occupational infections amongst healthcare professionals. Surgical non-woven products are soft on skin, enables air permeability and easy manoeuvrability. These benefits will result in increased demand for surgical non-woven products.

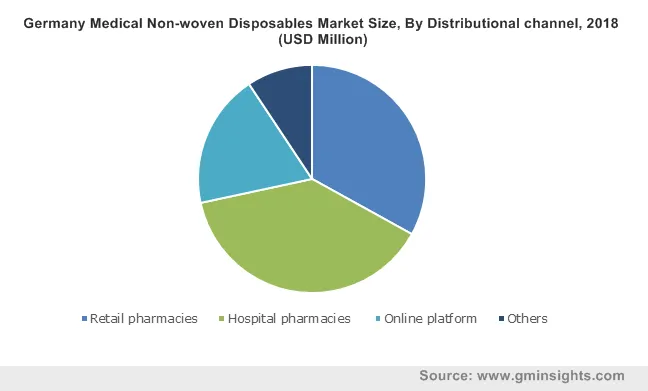

Hospital pharmacies segment of global market was valued around USD 6.5 billion in 2018 and it is predicted to witness robust growth in coming years. These pharmacies are easily accessible to patients taking treatments from hospitals. Moreover, increasing surgical procedures in obstetrics and gynaecology due rising birth rates will augment the demand for medical non-woven disposables. Furthermore, hospital pharmacies are well connected with the distributors of non-woven disposables. Aforementioned factors will escalate the usage of medical non-woven disposables in hospital pharmacies, thereby fostering segment growth.

Online platform segment is anticipated to witness around 7% growth over the forecast period. Elderly population base suffering from chronic diseases such as urinary incontinence and dementia require medical non-woven disposables frequently. These patients prefer ordering medical non-woven disposables in large quantity and low prices available through online platforms. As a result, increasing patient preference towards online pharmacies due to ease and convenience associated with it will augment segment growth over forecast timeframe.

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

North America medical non-woven disposables market size is estimated to witness more than 6% CAGR from 2019 to 2025. Favourable demographic trends have positively influenced the demand for medical non-woven disposables. For instance, increasing geriatric population suffering from chronic incontinence disorders require medical non-woven disposables on a regular basis. Moreover, strong foothold of industry players in the U.S. will result in availability of superior quality non-woven disposable medical products that should surge the regional growth.

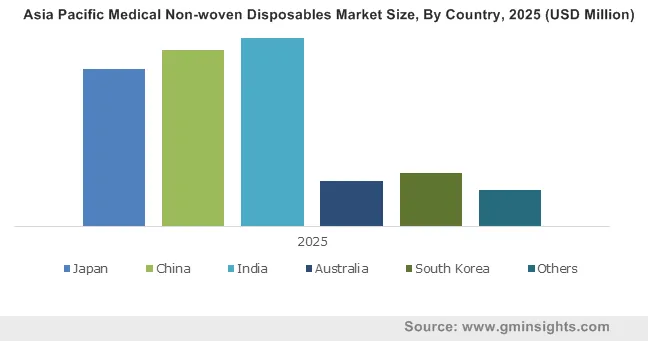

Asia Pacific market accounted for around 33% revenue share in 2018. Increasing birth rates will augment demand for disposable diapers in the region. Moreover, government organizations in the region fund projects and take initiatives to make people aware about the availability of medical nonwoven disposable products. Above mentioned factors coupled with growing number of surgical procedures will positively influence the industry growth in coming years.

Learn more about the key segments shaping this market

Medical Non-woven Disposables Market Size

Some of the notable players operating in the medical non-woven disposables market are

- Domtar

- Medtronic

- Kimberly Clark

- MRK Healthcare

- Asahi Kasei

- Molnlycke Health Care

- First Quality Enterprises

- Unicharm

- Ontex

- Cypress Medical

These industry players are adopting several strategies such as product launches, collaborations, mergers and acquisitions to sustain industry competition and capture more market share.

Recent industry developments:

- In May 2019, Domtar announced that its personal care division has launched incontinence product in North America. Product has dry containment core to provide comfort to patient. Innovative product launches will help company to gain competitive advantage, thereby augmenting business revenue.

- In October 2018, Unicharm launched products within its adult and baby care segments. The company has launched baby diapers that avoids leakage and are available in various sizes. This strategy was aimed at upgrading product pipeline that will enable company to garner higher market share.

Medical Non-woven Disposables Industry Background

Medical non-woven disposables industry can be traced back to late 1900’s. In 1968, The Disposable Association was established to collect and develop factual data pertaining to common problems that needed to be resolved. Later in 1972, the organization became International Nonwovens and Disposables Association (INDA) to promote developments in nonwoven fabrics as well as to address issues associated with surgical non-woven disposables. INDA brings medical non-woven disposables companies together to address and solve issues and encourage industry players to develop innovative solutions. Medical nonwoven disposable market is matured in developed economies such as North America and Europe and it is in developing stages in emerging economies such as Asia Pacific and Latin America. Medical nonwoven disposable industry is expected to witness numerous growth opportunities in future with an increase in number of births and incontinence diseases. Moreover, key industry players are focusing R&D efforts to promote developments in the incontinence products that should prove beneficial for the industry growth.

Frequently Asked Question(FAQ) :

How much did the global medical nonwoven disposables market size account for in 2018?

The market size of medical nonwoven disposables exceeded USD 17.4 billion in 2018.

How much growth will the medical nonwoven disposables industry share witness during the forecast timeframe?

The industry share of medical nonwoven disposables is expected to witness 6.5% CAGR from 2019 to 2025.

Medical Non-woven Disposables Market Scope

Related Reports