Summary

Table of Content

Iron & Steel Casting Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Iron & Steel Casting Market Size

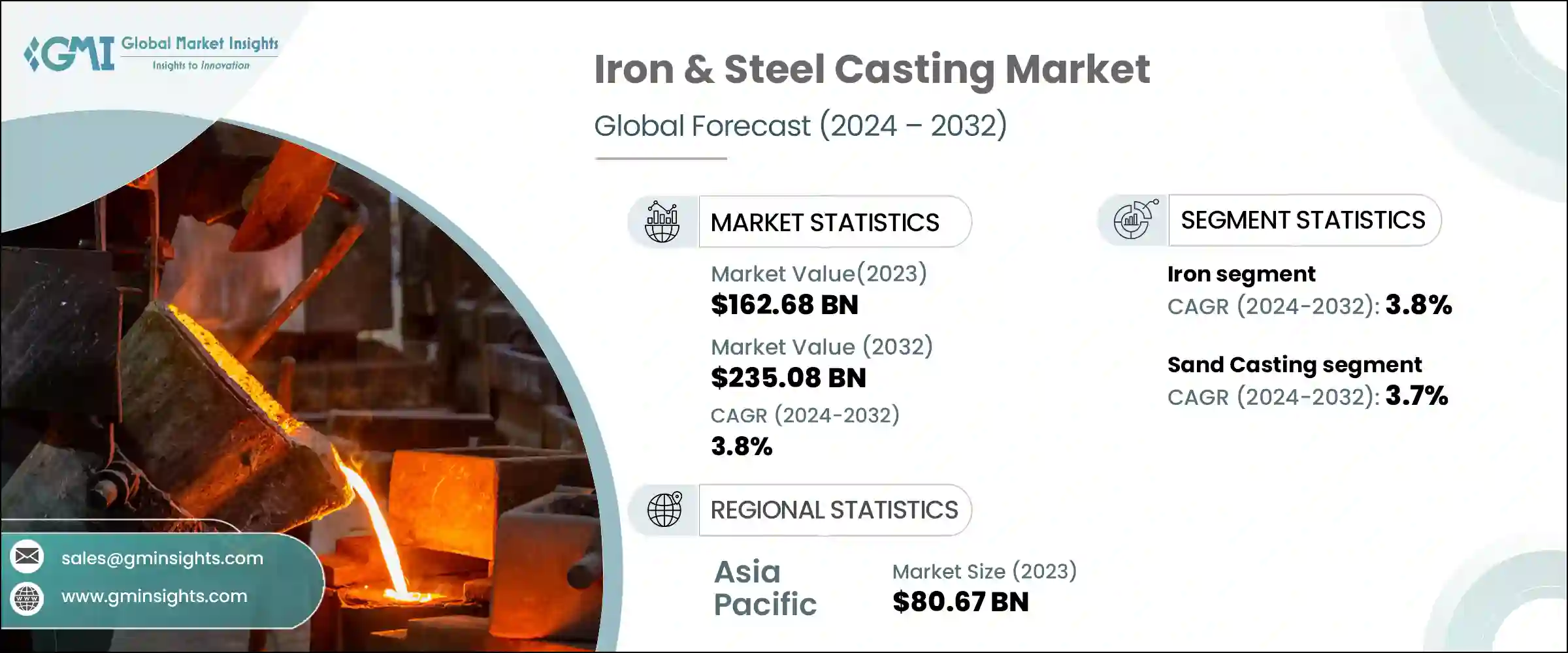

Iron & Steel Casting Market generated USD 162.68 billion in 2023 and will register 3.8% CAGR from 2024 to 2032. Emphasis on environmentally friendly production methods is emerging as a notable growth driver. Growing regulatory pressure and consumer awareness of environmental sustainability are forcing manufacturers to adopt more environmentally friendly processes.

To get key market trends

This includes adopting cleaner production techniques, recycling materials, and reducing the carbon footprint of casting throughout its life cycle. Companies that invest in sustainable practices meet regulatory requirements while attracting environmentally conscious customers and stakeholders, thus helping improve brand image and competitiveness in the market. In addition, advances in ecologically friendly casting techniques and materials allow greater efficiency and cost-effectiveness in the industry, minimizing environmental impacts.

Iron & Steel Casting Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2023 |

| Market Size in 2023 | USD 162.68 Billion |

| Forecast Period 2024 – 2032 CAGR | 3.8% |

| Market Size in 2032 | USD 235.08 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

For instance, In February 2024, Sweden-based H2 Green Steel selected Fluor Corporation, a multinational engineering and construction company headquartered in the United States, to collaborate on developing their pioneering project, referred to as the 'world's first renewable hydrogen-based integrated steel mill.

In addition, technological advancements in casting processes are also driving growth. Computer-aided design (CAD), simulation software, and additive manufacturing enhance precision, efficiency, and customization capabilities. These advancements enable manufacturers to produce complex geometries with reduced material waste and improved structural integrity, meeting the stringent requirements of diverse industries. Additionally, developments in automation and robotics are streamlining production processes, reducing labor costs, and enhancing overall operational efficiency.

Fluctuating demand significantly constrains the iron-steel smelting market. The industry is susceptible to cyclical fluctuations influenced by economic conditions, geopolitical factors, and changes in consumer preferences. These fluctuations can lead to unpredictable order volumes and production schedules, challenging manufacturers to maintain consistent operations and profitability. In addition, sudden changes in demand can cause problems with inventory management and strain supply chain capabilities. As companies deal with these uncertainties, strategic planning and flexibility become critical in adapting to market dynamics and reducing the impact of fluctuating demand on overall business operations.

Iron & Steel Casting Market Trends

A pivotal market trend revolves around strategic alliances and partnerships aimed at bolstering technological capabilities and extending market reach. Amidst challenges such as volatile raw material prices and stringent environmental regulations, companies are increasingly forming collaborations with complementary firms across the value chain. These alliances often prioritize joint research and development efforts to innovate manufacturing processes, enhance product quality, and streamline production costs.

By joining forces, companies can also access new markets and distribution channels, facilitating geographical expansion and fortifying their competitive positions. Moreover, strategic partnerships mitigate supply chain risks and foster knowledge sharing, fostering a more resilient industry ecosystem. Embracing these alliances enables participants to leverage synergies, pool resources effectively, and navigate the evolving global market dynamics more robustly.

For instance, In June 2023, Trinidad and Tobago’s TT Iron Steel Company (TTIS) acquired an idled iron and steel plant in Couva from ArcelorMittal seven years after its closure due to global steel price declines.

Another notable trend is the remarkable shift toward increased demand for light and strong casting components. This is due to advances in the automotive and aerospace industries, where reducing vehicle weight and maintaining structural integrity are paramount. Lightweight casting components offer better fuel economy, lower emissions, improved performance characteristics, and other benefits.

In addition, such components have also been adopted by industries such as renewable energy and construction to improve the efficiency and durability of these applications. As a result, iron and steel casting producers are focusing on developing innovative alloys, refining casting techniques, and investing in advanced manufacturing technologies such as 3D printing to meet the growing demand for lightweight, high-strength castings.

Iron & Steel Casting Market Analysis

Learn more about the key segments shaping this market

Based on material, the market is divided into iron and steel. The iron segment accounted for USD 128.67 billion in 2023 and is set to grow at a CAGR 3.8% through 2032 due to its remarkable properties and wide-ranging applications. Cast iron, with its excellent castability, wear resistance, and durability, is extensively used in the production of pipes, automotive components, machinery parts, and construction materials.

Its ability to absorb vibrations makes it particularly valuable in engine blocks and heavy machinery, where reducing noise and improving operational stability are crucial. Furthermore, advancements in alloying techniques have led to the development of specialized cast irons, such as ductile iron and gray iron, which offer enhanced mechanical properties and performance. The cost-effectiveness of iron, coupled with its recyclability, also aligns with growing environmental and economic considerations.

Learn more about the key segments shaping this market

Based on the process, the market is categorized into sand casting, die casting, and others. Sand Casting segment accounted for USD 83.72 billion in 2023 and will grow at 3.7% CAGR through 2032, owing to its versatility and cost-effectiveness, which involves creating molds from sand to form metal castings. This process is widely used due to its ability to produce complex shapes and large components, making it ideal for applications in the automotive, aerospace, and heavy machinery industries.

Sand casting offers significant advantages, including shorter lead times and the ability to use various metal alloys, providing manufacturers with the flexibility to meet diverse customer requirements. The process also benefits from continuous innovations, such as the development of advanced sand binders and additive manufacturing techniques, which enhance mold precision and casting quality. As industries demand increasingly intricate and high-performance cast components, sand casting remains a cornerstone of the iron and steel casting market, driving growth through its adaptability and efficiency.

By application, die casting is another emerging segment due to its ability to produce high-precision, complex components with excellent surface finish and dimensional accuracy. This process involves forcing molten metal into a mold cavity under high pressure, which results in parts that require minimal machining and post-processing.

Die casting is particularly favored in the automotive, aerospace, and electronics industries for its efficiency, consistency, and ability to produce lightweight components. Advancements in die-casting technologies, such as the development of high-strength alloys and automation, are further enhancing its appeal. As industries increasingly demand high-quality, intricate cast parts, the die-casting segment will exhibit robust growth, driven by its capability to meet stringent quality standards and production efficiency.

Looking for region specific data?

Asia Pacific dominated the iron & steel casting market in 2023. It generated a revenue of 80.67 billion USD in 2023 and will grow at 3.4% CAGR during the forecast period, driven by rapid industrialization, urbanization, and infrastructural development. Countries such as China, India, and Japan are leading contributors to market growth, with substantial investments in construction, automotive, and manufacturing sectors. China's dominance in the market is underscored by its vast production capacities, technological advancements, and government initiatives promoting infrastructure expansion.

India, with its burgeoning automotive industry and infrastructure projects, is also a key player, experiencing significant demand for high-quality cast components. The region benefits from a robust supply chain, skilled labor force, and increasing foreign investments, fostering a conducive environment for market expansion. Additionally, the adoption of advanced casting technologies and sustainable practices is enhancing the quality and efficiency of production processes across the region. As Asia Pacific continues to evolve as an industrial powerhouse, it is set to play a pivotal role in shaping the future of the global market.

In Asia Pacific, India is emerging as a significant player, driven by rapid industrialization and urbanization. The country’s burgeoning automotive industry, in line with extensive infrastructure projects, is fueling demand for high-quality cast components. Government initiatives like "Make in India" are attracting substantial foreign investments, enhancing manufacturing capabilities, and promoting technological advancements. The availability of a skilled labor force and a robust supply chain further bolsters India's position in the market. Additionally, the adoption of sustainable practices and advanced casting technologies is improving production efficiency and quality.

Iron & Steel Casting Market Share

Prominent players such as Kobe Steel, Hyundai Steel, and CALMET play integral roles in driving growth and innovation within the iron & steel casting industry. Their major growth strategies include investing in advanced technologies and automation to enhance production efficiency and product quality. This helps expand their production capacities to meet rising demand and focus on sustainability by adopting eco-friendly production processes.

Additionally, they are pursuing mergers and acquisitions to consolidate their market presence and gain access to new markets and resources. Companies are also emphasizing the development of high-performance and specialty castings to cater to specific industry needs, as well as forming strategic partnerships and collaborations to drive innovation and expand their product offerings. Through these multifaceted approaches, they aim to achieve competitive advantages and sustainable growth in the dynamic market.

Iron & Steel Casting Market Companies

Major players operating in the iron & steel casting industry include:

- Arcelor Mittal

- POSCO

- CALMET

- Waupaca Foundry Inc

- Uniabex

- Merck KGaA

- Nippon Steel Corporation

- Hyundai Steel

- Nucor Corporation

- Kobe Steel

Iron & Steel Casting Industry News

- In September 2023, Audi Basic Industries Corporation (SABIC) signed an agreement to sell its subsidiary Saudi Iron and Steel Company (Hadeed) to the Public Investment Fund (PIF). According to Reuters, the agreement valued Hadeed at SR12.5 billion ($3.33 billion).

- In October 2023, Nippon Steel Corporation (NSC), Japan’s largest steelmaker, agreed to acquire United States Steel Corporation (U. S. Steel) for $14.9 billion.

The iron & steel casting market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue and volume (USD Million) (Tons) from 2021 to 2032, for the following segments:

Market, By Material:

- Iron

- White Iron

- Ductile Iron

- Gray Iron

- Steel

Market, By Process:

- Sand Casting

- Die Casting

Market, By Application:

- Automotive

- Industrial Machinery

- Pipe, Fittings & Valves

- Power & Electrical

- Sanitary

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- MEA

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

Frequently Asked Question(FAQ) :

Which are the key companies operating in the iron & steel casting industry?

Some of the prominent industry players are Arcelor Mittal, POSCO, CALMET, Waupaca Foundry Inc, Uniabex, Merck KGaA, Nippon Steel Corporation, Hyundai Steel, Nucor Corporation, and Kobe Steel, among others.

How large is the Asia Pacific iron & steel casting industry?

Asia Pacific industry achieved USD 80.67 billion in 2023 and will expand at 3.4% CAGR through 2032, propelled by the region's extensive manufacturing base, growing construction activities, and automotive production.

Why the demand for iron casting is rising?

The iron segment in the iron & steel casting market reached USD 128.67 billion in 2023 and will record 3.8% CAGR through 2032, primarily due to its widespread applications across industries, such as automotive, construction, and machinery.

What is the size of the iron & steel casting market?

Industry size for iron & steel casting was worth USD 162.68 billion in 2023 and will grow at 3.8% CAGR between 2024 and 2032, driven by robust industrialization, infrastructure development, and demand from automotive and construction sectors.

Iron & Steel Casting Market Scope

Related Reports