Summary

Table of Content

Industrial Actuators Market

Get a free sample of this report

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Industrial Actuators Market Size

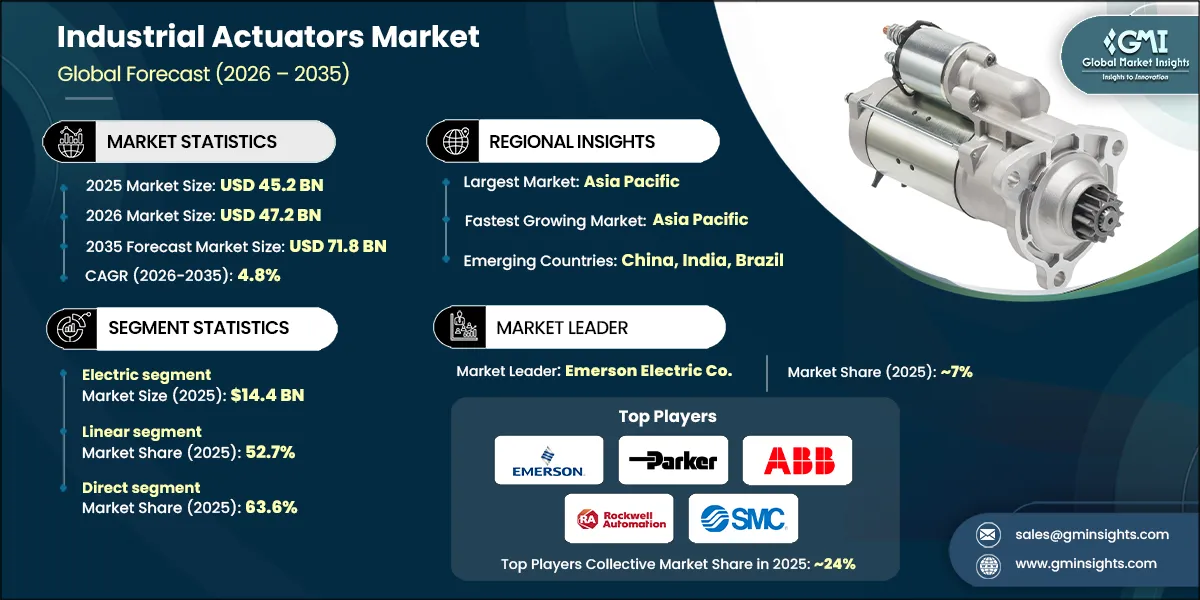

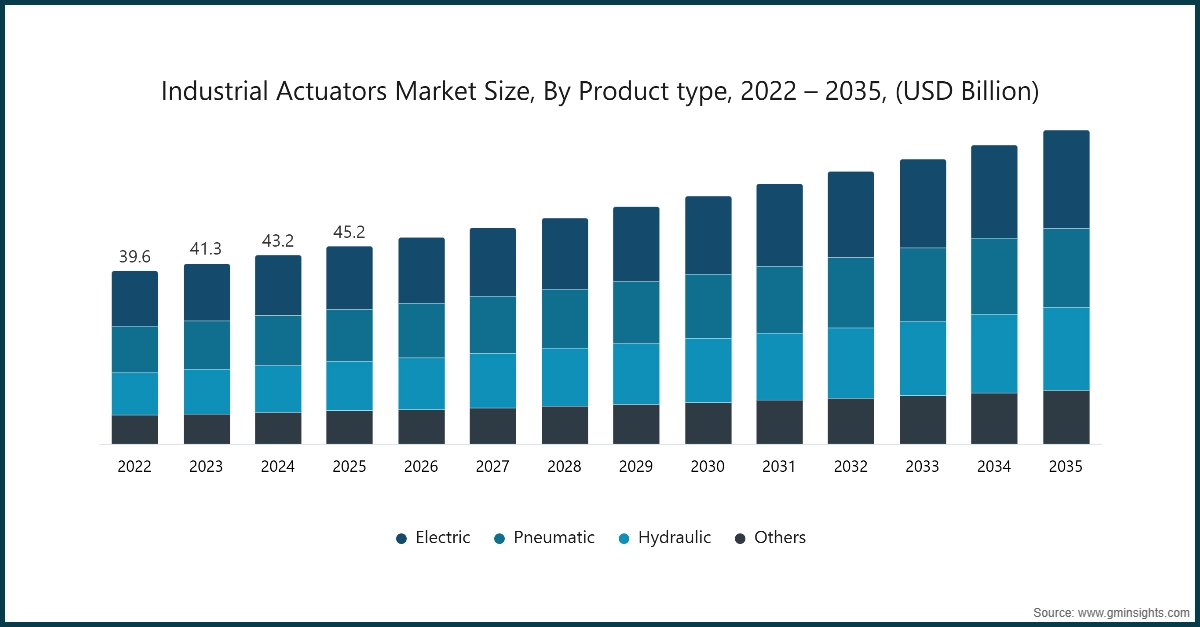

The industrial actuators market was estimated at USD 45.2 billion in 2025. The market is expected to grow from USD 47.2 billion in 2026 to USD 71.8 billion in 2035, at a CAGR of 4.8% according to latest report published by Global Market Insights Inc.

To get key market trends

- Automation and Robotics are being incorporated into various industries to help create a more efficient production process; provide a higher accuracy or improved precision of products and parts, and to create more economic production capacity. Since actuators are required for enabling motion in automated machinery and robotics, the demand for actuators has grown alongside increased automation within industries worldwide.

- Actuators are considered the main component of motion control systems, and therefore, they are essential to virtually all aspects of modern-day automated processes within virtually all forms of industry, including, but not limited to, the automotive industry. The continued drive toward more automated manufacturing processes has increased the reliance on actuator technology and will drive continual innovation and improvements within actuator technology as manufacturers and other industries continue to define their need for actuator technology as a means of accomplishing their ongoing production objectives.

- Electric actuators have recently become very popular due to their improved energy efficiency than other forms of actuator technologies, their low maintenance needs, and their ability to integrate with digital linear material handling control systems. electric actuators require less maintenance than hydraulic and pneumatic actuators, and they also do not consume as much energy as hydraulic or pneumatic actuators. with the increased priority within industries and businesses for developing and implementing more sustainable and environmentally responsible solutions, and with electric actuators being used as an example of that driving force, electric actuators have gained tremendous momentum within many industries and therefore continue to expand the available options for suppliers in all industries.

- The transition from traditional hydraulic and pneumatic systems to electric actuators is reshaping the market landscape. Hydraulic systems, while powerful, are often associated with issues such as fluid leakage, noise, and higher energy consumption. Similarly, pneumatic systems, though reliable, require a continuous supply of compressed air, which can be energy-intensive and costly. In contrast, electric actuators provide precise control, quieter operation, and reduced energy usage, making them an attractive option for industries aiming to modernize their operations. This shift is particularly evident in sectors such as manufacturing, where precision and efficiency are paramount, and in the automotive industry, where the push for electric and autonomous vehicles is creating new opportunities for electric actuator applications.

- Furthermore, the integration of electric actuators with advanced digital control systems is enabling industries to achieve greater levels of automation and connectivity. These actuators can be seamlessly incorporated into smart manufacturing setups, where they contribute to real-time monitoring, predictive maintenance, and enhanced process control. The compatibility of electric actuators with Industry 4.0 technologies, such as the Internet of Things (IoT) and artificial intelligence (AI), is further accelerating their adoption. As industries continue to invest in digital transformation, the demand for electric actuators is expected to rise significantly during the forecast period.

Industrial Actuators Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 45.2 Billion |

| Market Size in 2026 | USD 47.2 Billion |

| Forecast Period 2026-2035 CAGR | 4.8% |

| Market Size in 2035 | USD 71.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising industrial automation & robotics adoption | Industries are rapidly integrating automation and robotics to improve productivity and precision, which directly increases demand for actuators in machinery and robotic systems. These systems rely on actuators for motion control, making them essential components across modern automated operations. |

| Demand for energy-efficient & precise control systems | Electric actuators are gaining popularity due to their energy efficiency, low maintenance requirements, and compatibility with digital control systems. This shift from hydraulic and pneumatic systems fuels market growth as industries look for more sustainable and optimized solutions. |

| Growth of smart manufacturing (industry 4.0) | The integration of actuators with IoT, sensors, and AI enables predictive maintenance, real time diagnostics, and improved process reliability. These advancements support the transition to smart factories, where connected actuators play a critical role. |

| Pitfalls & Challenges | Impact |

| High cost of advanced actuators | While modern actuators offer improved performance, their initial cost—including installation and integration—can be significantly higher. This can be a barrier for small and mid sized industries with limited automation budgets |

| Requirement for skilled professionals | Advanced actuator systems require skilled engineers for installation, calibration, and maintenance. The shortage of such specialized talent slows adoption in certain industries and regions |

| Opportunities: | Impact |

| Rising adoption of electric actuators | Electric actuators are gaining traction due to precision, reliability, and energy efficiency, opening opportunities in automotive, robotics, and clean energy manufacturing segments. Their advantages make them ideal replacements for older technologies. |

| Expansion in Asia Pacific & emerging markets | Asia Pacific leads global adoption thanks to its strong manufacturing base, electronics production, and automation investments. Rapid industrialization and government supported modernization efforts present major growth opportunities. |

| Market Leaders (2025) | |

| Market Leader |

Market share of ~ 7% |

| Top Players |

The collective market share in 2025 ~24% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Industrial Actuators Market Trends

- The global market is witnessing a significant transition from traditional hydraulic and pneumatic systems to electric actuators. This shift is primarily driven by the superior advantages offered by electric actuators, including enhanced precision, energy efficiency, reduced maintenance requirements, and seamless integration with digital systems. The ongoing wave of electrification and automation across industries is further accelerating this trend. Electric actuators are increasingly being adopted in various applications due to their ability to deliver consistent performance while aligning with modern technological advancements. As industries prioritize operational efficiency and cost-effectiveness, the demand for electric actuators is expected to grow steadily in the coming years.

- The integration of advanced technologies such as sensors, Internet of Things (IoT) connectivity, and artificial intelligence (AI) is transforming the actuator landscape. Actuators embedded with these technologies are enabling predictive maintenance, real-time fault detection, and remote monitoring, which significantly enhance operational efficiency. These smart actuators are designed to provide improved process control and align with the objectives of Industry 4.0, which emphasizes automation and data exchange in manufacturing technologies. By leveraging AI-enabled analytics, industries can optimize actuator performance, reduce downtime, and achieve higher productivity. The adoption of smart and connected actuation systems is expected to expand further as industries continue to embrace digital transformation.

- The increasing focus on industrial automation is driving the demand for actuators, particularly linear and rotary types, which are essential components in robotic arms, automated machinery, and precision manufacturing systems. Robotics, in particular, has emerged as one of the fastest-growing application areas for actuators. As industries strive to enhance productivity and reduce operational costs, the adoption of automation technologies is becoming a strategic priority. Actuators play a critical role in enabling precise movements and control in automated systems, making them indispensable in the automation and robotics sectors. The growth of these industries is expected to further propel the demand for actuators during the forecast period.

- The automotive industry is undergoing a transformative phase with the increasing adoption of electric vehicles (EVs), advanced driver-assistance systems (ADAS), and automated manufacturing processes. Actuators, particularly electric actuators, are playing a pivotal role in this transformation by providing precision control and reliability in modern automotive systems. From controlling vehicle dynamics to enabling automated assembly lines, actuators are becoming integral to the automotive sector's evolution. The shift towards electrification and automation in the automotive industry is expected to drive the demand for actuators, creating significant growth opportunities for market players.

Industrial Actuators Market Analysis

Learn more about the key segments shaping this market

- Electric actuators are progressively replacing pneumatic and hydraulic systems due to their superior precision, energy efficiency, and seamless integration with modern digital control architectures. These features align closely with the objectives of Industry 4.0 and global decarbonization initiatives, making electric actuators a critical component in the evolution of industrial automation.

- Their reduced maintenance requirements, inherent compatibility with sensors and IoT technologies, and ability to support predictive diagnostics have positioned them as the preferred choice for new automation projects. Industries such as robotics, automotive, and smart manufacturing are increasingly adopting electric actuators, further cementing their dominance as the leading sub-segment in the industrial actuators market.

- Manufacturers are accelerating this transition by introducing innovative products and upgrades that incorporate advanced on-device intelligence, such as condition monitoring and fieldbus connectivity. These advancements, combined with tighter software integration, are driving the adoption of electric actuators at an unprecedented pace. Market trends indicate a sustained shift from pneumatic to electric actuation across various end-use industries. This transition is fueled by the need for enhanced performance, sustainability, and compliance with modern plant modernization requirements. As industries continue to prioritize energy efficiency and digital transformation, electric actuators are expected to maintain their leadership position in the market.

Learn more about the key segments shaping this market

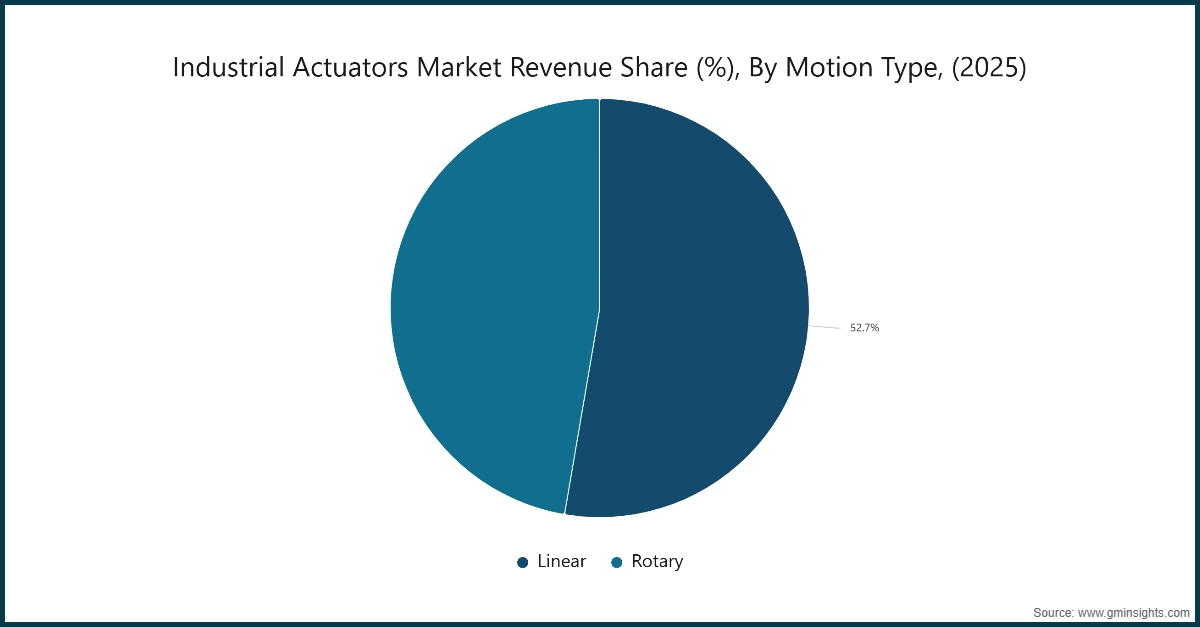

Based on motion type, the market consists of linear and rotary. The linear segment emerged as leader and held 52.7% of the total market share in 2025 and is anticipated to grow at a CAGR of 4.1% from 2026 to 2035.

- Linear actuators are widely recognized for their versatility, simplicity, and reliability, making them a cornerstone in industrial automation. They are extensively used across a broad range of applications, including assembly lines, material handling, robotics, and automotive production.

- Their adaptability and effectiveness have led to their widespread deployment, with the linear motion segment accounting for a significant share of revenue in the industrial actuators market. This dominance underscores the critical role of linear motion solutions in flow control and plant equipment, highlighting their structural importance in the industry.

- The growing adoption of smart factories and precision manufacturing has further amplified the demand for linear actuators. Their ability to deliver high positioning accuracy and repeatability translates directly into improved throughput and product quality, making them the default choice for both new production lines and retrofitting projects.

- As electrification continues to gain momentum, electric-linear architectures are enhancing these advantages by offering superior controllability and easier integration into existing systems. This combination of performance and adaptability ensures that linear actuators remain a vital component in the industrial automation landscape.

Based on distribution channel, the market consists of direct and indirect. The direct segment emerged as leader and held 63.6% of the total market share in 2025.

- In the industrial actuators market, where solutions are often engineered, configured-to-order, and integrated into complex control systems, direct distribution channels such as OEM and direct sales have emerged as the preferred approach. These channels provide manufacturers with greater control over product specifications, commissioning quality, and lifecycle support. This level of oversight is particularly critical in industries where precision and reliability are paramount. As a result, many market frameworks now explicitly differentiate between direct and distributor-based sales models, reflecting the strategic importance of direct engagement in this sector.

- Recent trends in industrial distribution highlight a structural shift towards direct channels, driven by the consolidation and digitization of manufacturers and large customers. This shift is characterized by a move to "cut out intermediaries," enabling closer collaboration between manufacturers and end-users. Direct sales models offer several advantages, including faster product iterations, improved data feedback loops for predictive maintenance and installed-base analytics, and customized service agreements.

North America Industrial Actuators Market

Looking for region specific data?

Looking for region specific data?

Looking for region specific data?

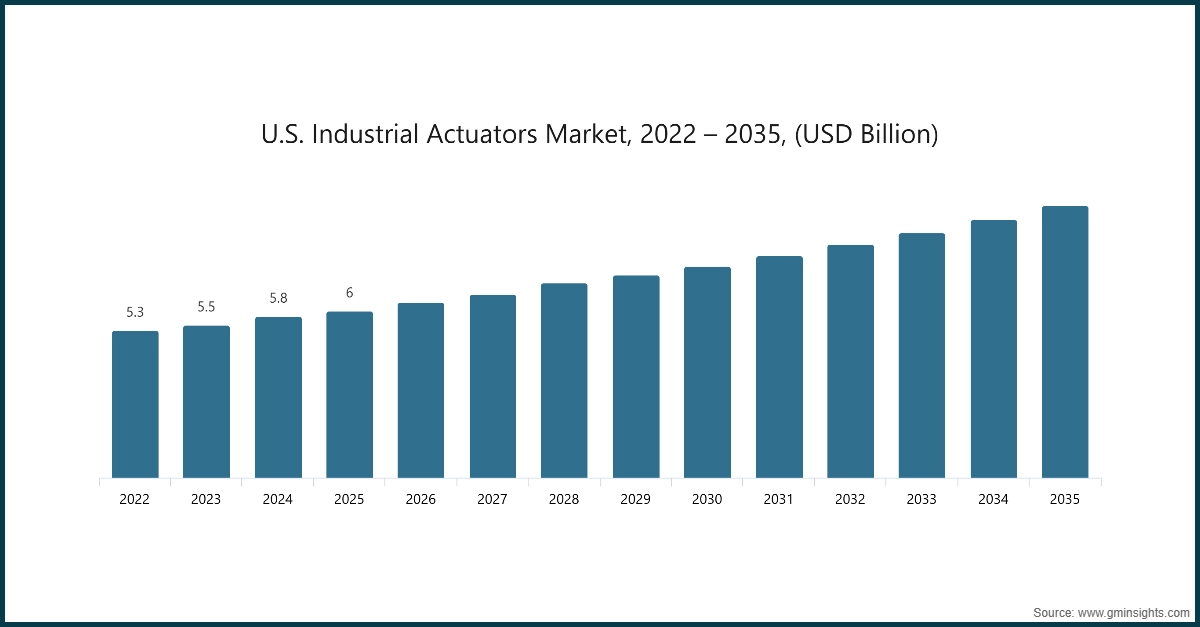

The U.S. dominates an overall North America market and valued at USD 6 billion in 2025 and is estimated to grow at a CAGR of 4.9% from 2026 to 2035.

- The U.S. continues to maintain a dominant position in the industrial actuators market, driven by its advanced industrial automation ecosystem, widespread adoption of robotics, and strong presence in high-value sectors such as aerospace and automotive. These industries demand high-precision actuation systems, which are critical for achieving operational efficiency and maintaining global competitiveness.

- North America, with the United States at its core, is frequently recognized as one of the largest markets for actuators. This is attributed to its mature manufacturing infrastructure, large-scale modernization initiatives, and early adoption of electric and smart actuators. Additionally, the U.S. leads in sectors such as oil and gas, power generation, and industrial machinery, all of which rely heavily on actuator-based control and automation technologies.

Europe Industrial Actuators Market

In the European market, Germany is expected to experience significant and promising growth from 2026 to 2035.

- The European Union’s leadership in the industrial actuators industry is underpinned by its technologically advanced manufacturing hubs, a strong automotive sector, and stringent energy-efficiency regulations. These factors collectively accelerate the adoption of electric and smart actuators across the region.

- Their contributions provide the EU with a competitive edge in the global market. Furthermore, Europe’s leadership in robotics, clean manufacturing, and industrial automation drives continuous upgrades in factories, process industries, and energy infrastructure.

- Government-backed sustainability initiatives, such as the EU Green Deal, play a significant role in promoting the replacement of outdated pneumatic systems with more efficient electric actuators.

Asia Pacific Industrial Actuators Market

In the Asia Pacific market, the China held 36.9% market share in 2025 and is anticipated to grow at a CAGR of 5.6% from 2026 to 2035.

- This dominance is fueled by rapid industrialization, the expansion of manufacturing capabilities, and significant investments in key sectors such as automotive, electronics, and infrastructure development.

- Countries like China, India, Japan, and South Korea are major contributors to this growth, driven by their large-scale factories and aggressive adoption of automation technologies.

Middle East and Africa Industrial Actuators Market

In the Middle East and Africa market, Saudi Arabia held 21.2% market share in 2025 promising growth from 2026 to 2035.

- Modernization of water treatment plants, refinery expansions, and renewable energy initiatives are key factors driving the demand for actuators in the region. Additionally, as MEA countries diversify their economies beyond oil, investments in manufacturing, logistics, and industrial automation are accelerating.

- Programs focused on smart cities, digital industrial upgrades, and renewable energy projects are further encouraging the adoption of electric and smart actuators. These developments position MEA as a high-growth region, steadily strengthening its role in the global actuator landscape.

Industrial Actuators Market Share

- In 2025, the prominent manufacturers in market are collectively held the market share of ~24%.

- Emerson Electric Co. holds a significant competitive edge through its broad automation portfolio, integrating valves, actuators, regulators, and advanced control systems into end-to-end industrial automation solutions. This allows the company to deliver tightly integrated actuator systems with embedded intelligence, enhancing reliability, diagnostics, and lifecycle performance.

- Parker Hannifin Corporation is a global leader in motion and control technologies, renowned for its extensive expertise and innovative solutions. The company offers a comprehensive portfolio of hydraulic, pneumatic, and electromechanical actuators, specifically designed to meet the demands of high-performance and heavy-duty applications.

- ABB is a distinguished leader in the field of robotics, automation, and motion control, offering cutting-edge actuator solutions that seamlessly integrate with digital manufacturing and Industry 4.0 environments. The company’s emphasis on energy-efficient technologies and intelligent automation systems has positioned it as a pioneer in high-precision actuation. ABB’s ability to deliver innovative solutions tailored to the needs of modern industries underscores its commitment to driving efficiency and sustainability.

Industrial Actuators Market Companies

Major players operating in the market include:

- ABB

- Curtiss-Wright

- Eaton Corporation plc

- Emerson Electric Co.

- Festo AG & Co. KG

- Flowserve Corporation

- IMI Critical Engineering

- KITZ Corporation

- Moog Inc.

- Parker Hannifin Corp

- Rockwell Automation

- Rotork plc

- SMC Corporation

- Tolomatic, Inc.

- Venture MFG. Co.

Rockwell Automation has established itself as a leader in industrial automation, specializing in the development of architectures that enable actuators to function seamlessly within connected control systems. This integration facilitates real-time monitoring and predictive maintenance, empowering industries to optimize actuator performance and improve operational efficiency.

SMC Corporation is a global leader in pneumatic actuation, offering an extensive range of air-driven actuators known for their cost-effectiveness, responsiveness, and reliability. The company’s continuous innovation in compact and high-functionality pneumatic and rotary actuators has enabled it to maintain a competitive edge in industries where clean, fast, and lightweight actuation is essential.

Industrial Actuators Industry News

- In August 2025, Parker announced the acquisition of Curtis Instruments, significantly expanding its electrification portfolio, including actuator-related motion and control technologies for EVs, industrial automation, and intelligent equipment. This positions Parker as a stronger competitor in electric actuation markets.

- In 2025, Emerson highlighted smart connectivity enhancements for electric actuators at its Ovation Users’ Group Conference, introducing digital tools and smarter device integration strengthening its leadership in intelligent actuation technology.

- In February 2024, Emerson introduced the Fisher easy-Drive 200R Electric Actuator, positioned as a sustainable alternative to pneumatic actuators. It offers self-calibration, near-zero emissions, ultra-low energy consumption, and remote monitoring directly impacting the industrial actuator landscape with a strong shift toward all-electric solutions.

The industrial actuators market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Billion) and volume (Thousand Units) from 2022 to 2035, for the following segments:

Market, By Product type

Electric

- Pneumatic

- Hydraulic

- Others

Market, By Motion Type

Linear

- Rotary

Market, By Application

Valves

- Pumps

- Dampers

- Conveyors

- Robotics

Market, By End Use

Oil & gas

- Power generation

- Water & wastewater treatment

- Chemical & petrochemical

- Food & beverage

- Pharmaceuticals

- Mining & metals

- Automotive & manufacturing

- Aerospace & defense

Market, By Distribution channel

Direct

- Indirect

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

What are the upcoming trends in the industrial actuators market?

Key trends include transition from hydraulic/pneumatic to electric actuators, integration of IoT and AI for predictive maintenance, rising demand in robotics and EV manufacturing, and smart factory implementation aligned with Industry 4.0.

Who are the key players in the industrial actuators market?

Key players include ABB, Curtiss-Wright, Eaton Corporation plc, Emerson Electric Co., Festo AG & Co. KG, Flowserve Corporation, IMI Critical Engineering, KITZ Corporation, Moog Inc., Parker Hannifin Corp, Rockwell Automation, Rotork plc, SMC Corporation, Tolomatic Inc., and Venture MFG. Co.

Which region leads the industrial actuators market?

The U.S. industrial actuators market was valued at USD 6 billion in 2025 and is projected to grow at a CAGR of 4.9% from 2026 to 2035.

What is the growth outlook for electric actuators from 2026 to 2035?

Electric actuators are projected to grow at a 4.6% CAGR through 2035, driven by Industry 4.0 adoption, decarbonization initiatives, and their compatibility with IoT and predictive diagnostics.

What was the market share of the linear motion type segment in 2025?

Linear actuators held 52.7% market share in 2025, valued for their versatility, reliability, and widespread use in assembly lines, material handling, robotics, and automotive production.

What is the market size of the industrial actuators in 2025?

The market size was USD 45.2 billion in 2025, with a CAGR of 4.8% expected through 2035 driven by rising industrial automation, robotics adoption, and the shift toward energy-efficient electric actuators.

What is the current industrial actuators market size in 2026?

The market size is projected to reach USD 47.2 billion in 2026.

How much revenue did the electric actuators segment generate in 2025?

Electric actuators generated USD 14.4 billion in 2025, demonstrating strong growth due to superior precision, energy efficiency, and seamless integration with digital control systems.

What is the projected value of the industrial actuators market by 2035?

The industrial actuators market is expected to reach USD 71.8 billion by 2035, propelled by smart manufacturing adoption, Industry 4.0 integration, and expanding automation in emerging markets.

Industrial Actuators Market Scope

Related Reports