Summary

Table of Content

Image Sensor Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Image Sensor Market Size

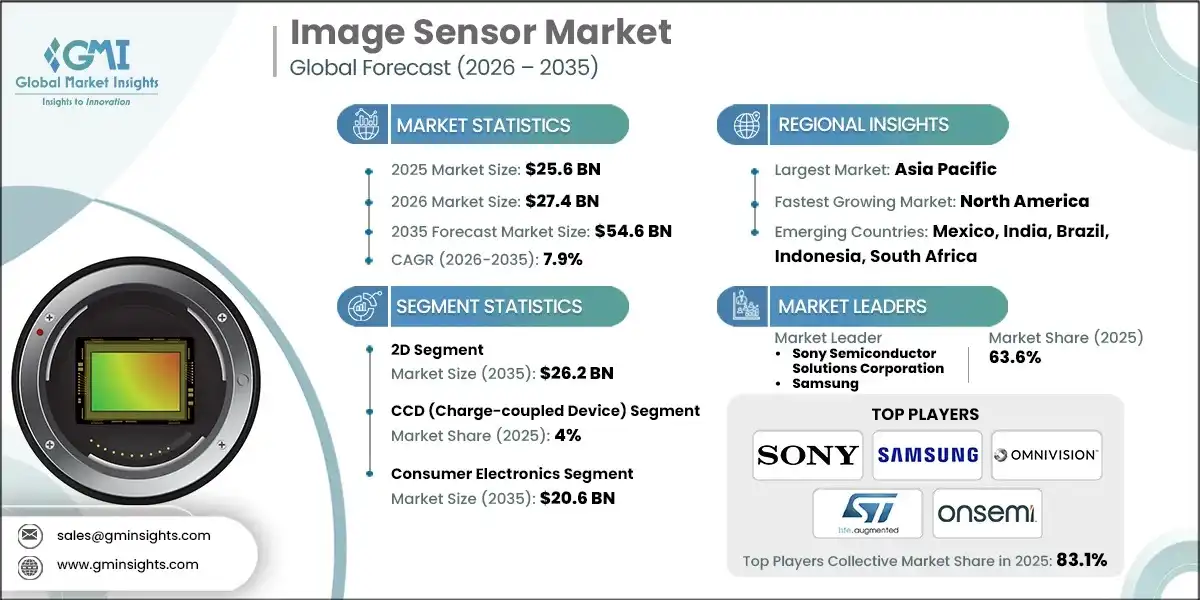

The global image sensor market size was valued at USD 25.6 billion in 2025 with a volume of 8.1 billion units. The market is expected to grow from USD 27.4 billion in 2026 to USD 39.9 billion by 2031 and USD 54.6 billion by 2035 with a volume of 27.5 billion units, growing at a value CAGR of 7.9% during the forecast period of 2026-2035.

To get key market trends

- The market is experiencing rapid growth due to technological advancement in CMOS technology, demand for image sensors for automotive applications, increasing demand for image sensors in consumer electronics and industrial & IoT applications, and rise in health care and medical imaging applications.

- The market is positively impacted by advancements in CMOS technologies that provide higher performance, lower power consumption, and greater integration capabilities. In October 2025, Sony Semiconductor Solutions announced the IMX828, the first CMOS image sensor, specifically targeting automotive applications, to include a built in MIPI APHY interface. This innovation supports the ability to obtain high resolution images, as well as HDR (High Dynamic Range) and the ability to process the images in real-time, while also simplifying other components in the system and improving the speed of data transfer. The ongoing advancements in fabrication and architecture of CMOS technology continue to broaden the scope of its applications in automotive, consumer electronic, medical imaging, and industrial vision system to meet the growing demand.

- Medical imaging and healthcare applications are promoting the expansion of the image sensor market by providing higher accuracy, superior diagnostics, and improved imaging features. SmartSens released the SC1400ME device at the end of June 2025, its first 2-megapixel CMOS image sensor targeted at medical imaging, designed for endoscopic systems. This device has been designed to improve visualization, allow for smaller devices to be integrated, as well as support real-time image processing capabilities supporting advancements within minimally invasive procedures and patient treatment.

- In 2025, Asia Pacific accounted for 50.6% share of the market. The growing smartphone penetration, automotive electronics adoption, and industrial automation continue to spur rapid growth in the market in the Asia Pacific.

Image Sensor Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 25.6 Billion |

| Market Size in 2026 | USD 27.4 Billion |

| Forecast Period 2026-2035 CAGR | 7.9% |

| Market Size in 2035 | USD 54.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Advancements in CMOS technology | Enhances sensor performance and reduces costs, driving market growth by an estimated 12% annually. Improved resolution and low-light capabilities expand applications across automotive, industrial, and consumer electronics sectors. |

| Rising demand for automotive image sensors | Boosts market revenue by approximately 15%, as advanced driver-assistance systems (ADAS) and autonomous vehicles require high-precision imaging solutions for safety and navigation. |

| Increasing demand for consumer electronics | Supports a 10% growth in the market, fueled by smartphones, tablets, and wearable devices integrating high-resolution cameras for enhanced user experience and multimedia functionality. |

| Growth of industrial and IoT applications | Accelerates adoption by nearly 13%, as machine vision, robotics, and IoT devices increasingly rely on image sensors for automation, monitoring, and predictive maintenance. |

| Healthcare and medical imaging applications | Expands the market by around 11%, driven by diagnostic imaging, endoscopy, and patient monitoring devices requiring precise, high-quality imaging for accurate analysis and treatment. |

| Pitfalls & Challenges | Impact |

| Cost and pricing pressures | Increases operational challenges for manufacturers, potentially reducing profit margins and slowing new product development in the image sensor market. |

| Supply chain disruptions and semiconductor shortages | Cause delays in production and delivery, impacting the availability of image sensors across automotive, industrial, and consumer electronics segments. |

| Opportunities: | Impact |

| Advancements in AI and machine vision integration | Enhance image sensor capabilities, enabling smarter automation, improved object recognition, and greater adoption in robotics, security, and industrial applications. |

| Emerging lidar and 3D sensing applications | Drive demand for specialized image sensors, supporting autonomous vehicles, robotics, and advanced mapping technologies with higher precision and depth-sensing capabilities. |

| Miniaturization and low-power sensor development | Facilitates integration into compact devices and wearables, improving energy efficiency while enabling broader adoption across consumer electronics, medical devices, and IoT applications. |

| Expansion in AR/VR and metaverse applications | Creates new opportunities for high-resolution, fast-response image sensors, supporting immersive experiences, gaming, and interactive applications in augmented and virtual reality environments. |

| Market Leaders (2025) | |

| Market Leaders |

63.6% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | North America |

| Emerging countries | Mexico, India, Brazil, Indonesia, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Image Sensor Market Trends

- The expansion of smart city initiatives, automotive ADAS, and industrial automation will drive the adoption of high-resolution, multi-spectral image sensors in Asia-Pacific, North America, and Europe between 2025 and 2032. These areas are becoming primary centers for the research and the deployment of new sensors.

- The use of AI to enhance image processing, and computational photography, is likely to improve considerably from 2025 to 2030. The combination of machine learning with image sensors will lead to progress in real-time analytics, detection of objects, and performance enhancement of low-light imaging in consumer, industrial, and automotive applications.

- Collaborations to develop next-generation low-cost, high-precision sensors are anticipated to enable rapid prototyping and streamlined production from 2026 to 2032. Sensor manufacturers, research institutions, and technology startups will form the focal points of these partnerships.

- Between 2026 and 2033, the deployment of 3D imaging and LiDAR-integrated sensors will grow. These systems will provide enhanced depth perception and improve gesture recognition and autonomous navigation in automotive systems and robotics for industrial inspection.

Image Sensor Market Analysis

Learn more about the key segments shaping this market

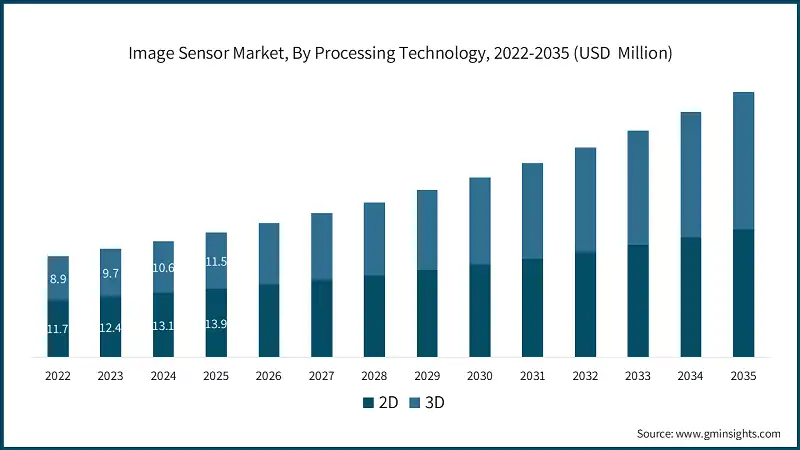

On the basis of processing technology, the market is segmented into 2D and 3D.

- The 2D segment is anticipated to reach USD 26.2 billion by 2035. Most surveillance cameras, automotive cameras, and smartphones still utilize two-dimensional imaging. Versatile market relevance across industries is explained by the cost effectiveness, high resolution, and extensive compatibilities of the imaging systems as industries integrate advanced image processing, HDR, and low-light imaging into mainstream devices and applications.

- Manufacturers should optimize 2D sensors for higher resolution and improved low-light performance to sustain competitiveness.

- The 3D segment is anticipated to grow at a CAGR of 9.4% during the forecast period 2026 - 2035. The implementation of three-dimensional imaging is becoming more widely used in fields such as robotics, Augmented Reality/Virtual Reality, automotive LiDAR, biometric authentication, and industrial inspections. The use of depth sensing, structured light, and time-of-flight technologies allow for accurate spatial computing and more sophisticated automation.

- Manufacturers should expand 3D sensor portfolios tailored for robotics, automotive, and immersive technology applications.

Learn more about the key segments shaping this market

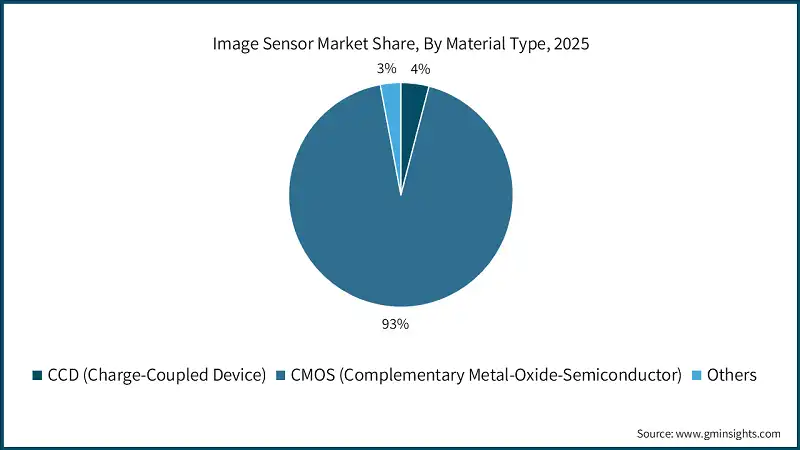

On the basis of sensor type, the image sensor market is divided into CCD (charge-coupled device), CMOS (complementary metal-oxide-semiconductor), and others.

- The CCD (charge-coupled device) segment held a market share of 4% in 2025. CCD sensors continue to find demand in scientific imaging, broadcast equipment, and applications requiring exceptional low-noise performance. The technological attributes, stability, uniformity, and increased dynamic range, continue to be in demand even as markets pivot to CMOS, especially in high-accuracy and high-precision industrial and medical imaging.

- Industry players must focus on niche, high-accuracy applications where the performance of CCD sensors is superior to that of CMOS sensors.

- The CMOS (complementary metal-oxide-semiconductor) market is anticipated to grow at a CAGR of 8.1% during the forecast period 2026 - 2035. Market dominance is due to speed, power efficiency, and integration effectiveness of CMOS sensors. Rapid advancement in stacked architecture, AI-driven processing and miniaturization is transitioning consumer electronics, industrial automation and automotive ADAS to more advanced systems.

- Manufacturers should invest in advanced CMOS designs with on-chip intelligence and energy efficiency features.

On the basis of application, the image sensor market is segmented into consumer electronics, automotive, industrial and manufacturing, healthcare and medical imaging, security and surveillance, and others.

- The consumer electronics market is anticipated to reach USD 20.6 billion by 2035. Smartphone upgrades, multi-camera arrangements, artificial intelligence (AI) photography, and ultra high-resolution imaging drive consumer electronics demand for image sensors. Growth in wearables, smart home devices, and personal imaging equipment, all assist in generating continued demand.

- Manufacturers must focus on energy-efficient and miniaturized consumer device sensors augmented with AI imaging capabilities.

- Automotive segment is anticipated to grow at a CAGR of 10.1% during the forecast period 2026 - 2035. The automotive industry is also rapidly expanding the use of image sensors for ADAS, autonomous driving, parking assistance, and cabin monitoring. Next-generation mobility systems require high dynamic range imaging in low-light situations, as well as functionality that meets safety standards.

- Manufacturers should develop automotive-grade sensors with enhanced reliability, safety certifications, and superior environmental tolerance.

Looking for region specific data?

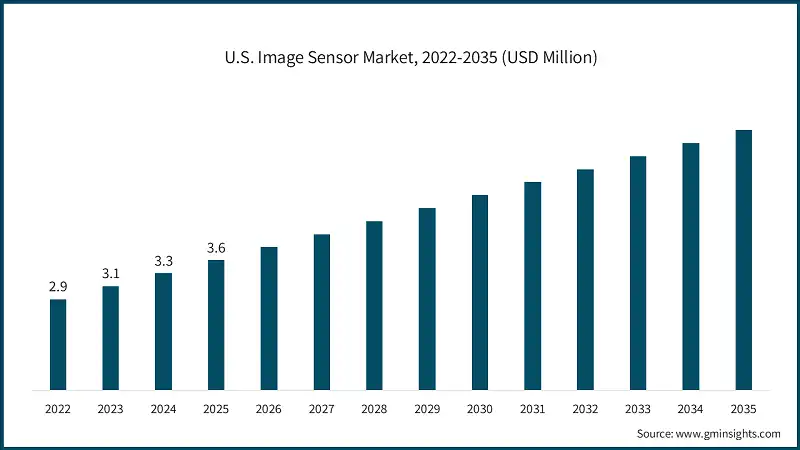

North America held a image sensor market share of 15.9% in 2025 and is anticipated to grow at a CAGR of 8.1% during the forecast period 2026 - 2035. North America is a key market for image sensors, driven by strong demand across automotive, consumer electronics, and industrial sectors. The region is witnessing significant investments to advance sensor technology and manufacturing capabilities.

- U.S. dominated the market, valued at USD 3.6 billion in the year 2025. Automotive ADAS systems and AI-capable cameras are fueling image sensor growth in the U.S., along with industrial automation and other applications. Innovation across the economy is being fueled by key investments in the R&D and fabrication of semiconductors.

- Manufacturers should prioritize developing AI-integrated, high-resolution sensors to capture the growing automotive and industrial demand in the U.S. market.

- Canada is anticipated to grow at a CAGR of 8.1% during the forecast period 2026 - 2035. In Canada, the image sensor manufacturing industry is receiving governmental support. In March 2025, Canada contributed about USD 8 million via the Strategic Innovation Fund to a USD 42 million investment by Teledyne in the Bromont, Quebec facility. These funds will allow for the expanded production of advanced image sensor manufacturing semiconductors.

- Canadian semiconductor facilities are encouraged to partner with U.S. manufacturers seeking to capitalize on production opportunities within a government-supported environment for advanced image sensors.

Europe accounted for 25% of the global image sensor market in 2025. Europe is the primary market owing to the increasing demand of industrial automation, automotive sector, consumer electronics and the rapid innovation in the regions. The area concentrates on the development of sensor technology and manufacturing and technological collaboration in mobility.

- Germany is anticipated to grow at a CAGR of 8.4% during the forecast period 2026 - 2035. The preeminence of the German economy in the fields of image sensors, automotive technology, industrial automation, and precision manufacturing continues to have a profound influence on the progression of advanced image sensors technology. Investments in the semiconductor's R&D and imaging in automotive are augmenting the country’s sensor ecosystem.

- Manufacturers should develop automotive-grade and industrial-grade image sensors to meet Germany’s high standards for precision and reliability.

- Manufacturers should collaborate with industrial partners in Germany to develop high-precision, fault-tolerant QPUs for commercial and research applications.

- UK's market is anticipated to grow at a 7.6% CAGR during the forecast period. The UK is advancing in automotive imaging, smart city projects, and AI-enabled surveillance systems. Government initiatives and private investments are promoting the development of next-generation image sensors.

- Manufacturers should focus on AI-enabled and smart city-compatible sensors to capitalize on the growing demand in the UK market.

Asia-Pacific held a share of 50.6% in the global image sensor market and is the fastest-growing region with a 8.6% CAGR during the forecast period. There is unprecedented growth in the market in Asia. Factors such as the widespread adoption of smartphones, the utilization of electronics in automobiles, and the growth of industrial automation are driving the growth. Investments in the manufacturing of semiconductors and the development of the technology in Asia are improving the regions capabilities.

- The market in China is anticipated to reach USD 13.8 billion by the year 2035. China has government-backed investments focused on advanced sensor technology, automotive imaging, consumer electronics, and industrial automation.

- Manufacturers have to localize their supply chains to develop production systems focused on low-cost, high-performance sensors to address the demand of China’s automotive and electronics industries in the country.

- Japan's image sensor market was valued at USD 2.4 billion in 2025. Due to its superior research and development structure and prominent semiconductor firms, Japan serves as a principal center for advanced imaging technologies, automotive ADAS and industrial robotics.

- To satisfy Japan's stringent industrial and automotive demands, manufacturers must concentrate on developing miniaturized sensors with enhanced precision.

- India's market is anticipated to grow at a CAGR of over 11% during the forecast period. India is emerging as a growth market for image sensors, driven by increasing smartphone adoption, automotive electronics, and surveillance system deployment. Government initiatives are promoting domestic electronics and semiconductor production.

- Manufacturers should target scalable, affordable sensors optimized for consumer electronics and surveillance applications in India.

Latin America held 5.1% image sensor market share in 2025 and is anticipated to grow at a 5.5% CAGR during the forecast period. Latin America is witnessing steady growth in the market, driven by increasing adoption in automotive, consumer electronics, and security applications. Investments in industrial automation and smart city initiatives are enhancing regional demand.

In 2024, the Middle East and Africa held a share of 3.4% and is anticipated to grow at a 5% CAGR during the forecast period 2026 - 2035. MEA industries are increasingly utilizing image sensors for automotive, industrial, and security purposes. The need for smart sensors for projected smart infrastructure and surveillance systems is growing across the region due to investments in tech and surveillance systems.

- Saudi Arabia accounted for an 35.4% market share of MEA in 2025. Saudi Arabia is amplifying the adoption of intelligent infrastructure, automotive imaging, and surveillance systems fueled by government- supported techno-initiatives.

- Manufacturers should focus on durable, high-performance sensors tailored for smart infrastructure and security projects in Saudi Arabia.

- The South Africa market is anticipated to grow at a CAGR of 4.1% during the forecast period. Driven by growing interest and investment from both the private sector in manufacturing, automotive and industrial automation.

- Manufacturers should develop cost-effective and robust sensors to meet South Africa’s industrial and security demands.

- The UAE accounted for a share of 27.5% in the market in 2025. The development of Smart Cities, surveillance, and automotive technologies in the UAE have increased the demand for advanced imaging technologies. Thus, driving the demand for image sensors in UAE.

- To help meet the smart city and automotive application needs in the UAE, manufacturers must provide high-resolution, AI-enabled sensors.

Image Sensor Market Share

The key players in the market are Sony Semiconductor Solutions Corporation, Samsung, OMNIVISION, STMicroelectronics, and Onsemi. Collectively, these companies held more than 83.1% of the market in 2025.

- Sony Semiconductor Solutions Corporation led the market with a 43.4% share in 2025. The company’s global leadership is attributable to the industry's most advanced technology in stacked, AI-integrated imaging architectures, high dynamic range, and CMOS sensor technology. Dominance in the global market is also aided by strategic relationships with smartphone manufacturers, automotive OEMs, and industrial solution providers.

- Samsung held a 20.2% market share in 2025. Samsung is expanding its presence by investing and improving next-gen pixel architectures, advancing ISOCELL tech, and adding high-resolution mobile sensors. The company's diverse clientele in smartphones, automotive, and IoT imaging broadens its competitive capability. Collaborations with device manufacturers, along with sustained R&D investments, bolster Samsung's leading position in the marketplace.

- OMNIVISION captured 10.8% of the market in 2025. The company develops small, power-efficient CMOS sensors for use in mobile, automotive, medical, and security fields. OMNIVISION's dominance in low-light performance, multispectral design, and compact imaging are firming its position in most imaging segments.

- STMicroelectronics held a 5.1% market share in 2025. The company differentiates itself with its depth-sensing, time-of-flight, and industrial-grade image sensors for automation, automotive, and smart devices. The company’s primary sensor integration and sensor innovation capabilities strengthen its position in the industrial and automotive imaging ecosystems.

- Onsemi accounted for 3.6% of the market in 2025. The company develops high-performance automotive and industrial image sensors with improved low-light sensitivity and high dynamic range. Specialization by Onsemi in the fields of ADAS, machine vision, and robotics applications, together with close collaboration with automotive OEMs, enables their leading position in the market.

Image Sensor Market Companies

Major players operating in the image sensor industry are:

- AlpsenTek

- ams-OSRAM AG

- Analog Devices, Inc.

- Canon Inc.

- CMOS Sensor Inc.

- GalaxyCore Shanghai Limited Corporation

- Hamamatsu Photonics K.K.

- Himax Technologies

- Infineon Technologies AG

- Sony Semiconductor Solutions Corporation, Samsung, OMNIVISION, STMicroelectronics, and Onsemi are considered leaders in the market. Their competitive strength is driven by advanced CMOS innovation, strong partnerships across consumer and automotive ecosystems, robust manufacturing capabilities, and sustained R&D investments that enable continued leadership in high-performance imaging technologies.

- Canon Inc., Panasonic Corporation, Sharp Corporation, Teledyne, Toshiba Corporation, Infineon Technologies AG, Analog Devices, Inc., and Tower Semiconductor are categorized as challengers. These companies compete through diversified sensor portfolios, specialization in industrial, medical, and scientific imaging, and strong integration with automotive and industrial OEMs to expand their market presence.

- Himax Technologies, GalaxyCore Shanghai Limited Corporation, AlpsenTek, CMOS Sensor Inc., and Hamamatsu Photonics K.K. are categorized as followers. Their strengths include cost-effective designs, tailored product offerings, and localized manufacturing. While innovation at these companies is limited, they still cater to the market for consumer electronics, wearables, and small-form-factor imaging devices.

- ams-OSRAM AG and PixArt Imaging Inc. are recognized as niche players. These companies focus on differentiation through the development of other types of proprietary imaging products such as optical, depth and multi-illumination integrated sensors and imaging systems. These players are able to establish more distinct positions and competitive advantages to the specific imaging marketplaces due to their developed customization and application-oriented solutions.

Image Sensor Market News

- In April 2025, OMNIVISION announced a new 50 megapixel smartphone image sensor that delivers ultra high dynamic range for both stills and video, aimed at flagship rear cameras and advanced mobile videography.

- In November 2025, Sony announced the LYTIA 901, a 200 megapixel smartphone image sensor that combines on sensor AI processing with up to 4x “in sensor” zoom to deliver high detail photos and video across a wide zoom range.

The image sensor market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Million) and volume (Units) from 2022 to 2035, for the following segments:

Market, By Sensor Type

- CCD (charge-coupled device)

- CMOS (complementary metal-oxide-semiconductor)

- Others

Market, By Resolution

- Low resolution (<2 MP)

- Medium resolution (2-12 MP)

- High resolution (>12 MP)

Market, By Processing Technology

- 2D

- 3D

Market, By Spectrum

- Visible spectrum sensors

- Infrared (IR) sensors

- Ultraviolet (UV) sensors

- Multispectral sensors

- Others

Market, By Application

- Consumer electronics

- Smartphones & tablets

- Digital cameras & camcorders

- Wearables

- Others

- Automotive

- ADAS

- In-vehicle monitoring systems

- Lidar

- Others

- Industrial & manufacturing

- Machine vision systems

- Robotics & automation

- Quality control / inspection

- Others

- Healthcare & medical imaging

- Diagnostic imaging

- Endoscopy & surgical cameras

- Others

- Security & surveillance

- CCTV cameras

- Access control

- Others

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- Uk

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

Which region led the image sensor market in 2025?

Asia Pacific dominated with a 50.6% share in 2025, fueled by high smartphone penetration, automotive electronics adoption, and expanding semiconductor manufacturing.

Which region is the fastest growing in the image sensor market?

North America is expected to grow at an 8.1% CAGR through 2035, supported by strong investments in advanced imaging for automotive ADAS, industrial automation, and AI-enabled cameras.

How fast is the 3D image processing technology segment expected to grow?

The 3D processing technology segment is anticipated to grow at a 9.4% CAGR between 2026 and 2035, driven by adoption in robotics, AR/VR, automotive LiDAR, and biometric authentication.

What was the market share of CCD sensors in 2025?

CCD sensors held a 4% share in 2025, maintaining relevance in scientific imaging, broadcasting, and high-precision industrial and medical applications.

Which sensor type held the largest share in 2025?

CMOS sensors dominated the market, benefiting from superior speed, power efficiency, and integration capabilities, and are projected to grow at an 8.1% CAGR through 2035.

What is the expected valuation of the image sensor market by 2035?

By 2035, the market is projected to reach USD 54.6 billion, with unit volumes rising to 27.5 billion, reflecting a 7.9% CAGR in value and 13% CAGR in volume.

What was the market size of the image sensor market in 2025?

The global market for image sensor was valued at USD 25.6 billion in 2025, with a volume of 8.1 billion units, driven by strong demand in consumer electronics, automotive imaging, and industrial automation.

What is the projected market size of the image sensor industry in 2026?

The market is expected to reach USD 27.4 billion in 2026, supported by growing adoption of CMOS sensors and expansion in automotive ADAS and IoT applications.

Which application segment will be the largest by 2035?

The consumer electronics segment is projected to reach USD 20.6 billion by 2035, driven by smartphone upgrades, multi-camera systems, AI-powered photography, and growth in wearables.

Image Sensor Market Scope

Related Reports