Summary

Table of Content

Home Healthcare Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Home Healthcare Market Size

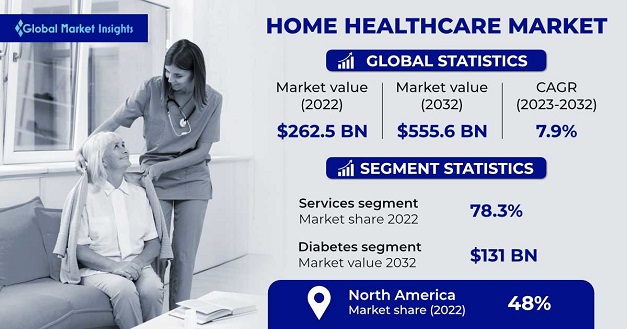

Home Healthcare Market size accounted for USD 262.5 billion in 2022 and is estimated to grow at 7.9% to reach USD 555.6 billion by 2032. Increasing prevalence of target diseases, especially Alzheimer’s & dementia, growing need for cost effective healthcare delivery, and rapid technological advancements are some of the drivers fostering the market growth.

To get key market trends

Additionally, the growing geriatric population is one of the significant factors in driving the market expansion. For instance, according to the World Health Organization (WHO) report, in 2020, the number of people aged 60 years and older outnumbered children younger than 5 years. Between 2015 and 2050, the proportion of the world's population over 60 years will nearly double from 12% to 22%. Therefore, geriatric population are more susceptible to chronic conditions that will necessitate long-term care, will supplementing the market progress. Global pediatric home healthcare industry is estimated to grow at 7.6% CAGR between 2023 and 2032 due to increasing prevalence of chronic ailments among infants.

Home healthcare refers to a range of medical, therapeutic, and support services provided to individuals in the comfort and convenience of their own homes. It involves the delivery of personalized and comprehensive healthcare solutions to patients who may have difficulty accessing traditional healthcare settings due to age, illness, or mobility limitations.

Home Healthcare Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2022 |

| Market Size in 2022 | USD 262.5 Billion |

| Forecast Period 2023 to 2032 CAGR | 7.9% |

| Market Size in 2032 | USD 555.6 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

COVID-19 Impact

With the increasing number of COVID-19 cases, several local and national regulatory bodies imposed stringent restrictions on the movement of people and goods. This caused significant disruptions in the normal workflow of almost all sectors, disrupting the global supply chain network. The COVID-19 pandemic largely affected the overall healthcare sector globally, leading to postponement and suspensions of treatment and diagnosis of non-essential conditions. However, the COVID-19 pandemic boosted the overall adoption of home healthcare across geographies. The imposed restrictions were noted to affect individuals with significantly increased reports relating to isolation, insomnia, anxiety, depression, fear, frustration as well as substance abuse, leading to an increased prevalence of chronic conditions and behavioral disorders.

Home Healthcare Market Trends

The growing prevalence of target diseases, particularly Alzheimer's and dementia, is expected to be a significant market growth. As the global population ages and life expectancy increases, there has been a substantial rise in the number of individuals affected by these neurodegenerative conditions. For instance, according to the National Institutes of health (NIH) report, Alzheimer is the sixth-leading cause of death in the U.S. and the fifth-leading cause of death among Americans aged 65 and older. An estimated of 6.2 million Americans aged 65 and older are living with Alzheimer's dementia (AD). This number could grow to 13.8 million by 2060 barring the development of medical breakthroughs to prevent, slow or cure AD. Thus, increasing prevalence of AD is creating a higher demand for specialized care services, including home healthcare to support patients and their families, thereby fostering the market progress.

Home Healthcare Market Restraint

Changing reimbursement policies may restraint the market growth. Reimbursement policies play a crucial role in determining the financial viability of home healthcare services. Any modifications or adjustments to these policies can have a direct impact on the revenue and profitability of home healthcare providers. Changes in reimbursement rates, restrictions on covered services, or increased administrative burdens can create financial challenges for businesses in the sector. Moreover, the complexity and variability of reimbursement policies across different regions may hamper the market revenue.

Home Healthcare Market Analysis

Learn more about the key segments shaping this market

By component, the home healthcare market is classified into product and services. The services segment accounted for 78.3% of the business share in 2022 and is projected to witness robust growth over the analysis timeframe. As the demand for home-based healthcare services continues to rise, there is a growing necessity for a wide range of specialized services to cater to diverse patient needs. Home healthcare providers are expanding their service offerings to include a comprehensive range of medical, therapeutic, and support services. These may include skilled nursing care, physical therapy, occupational therapy, speech therapy, wound care, medication management, palliative care, and chronic disease management, among others. By offering an extensive portfolio of services, home healthcare providers can effectively address the complex healthcare requirement of patients, providing holistic and personalized care at homes.

Learn more about the key segments shaping this market

Based on indication, the home healthcare market is segmented into cardiovascular disorder, hypertension, diabetes, respiratory disease, cancer, maternal disorders, trauma, renal disorders, neurovascular disorders, mobility disorders, and other indications. The diabetes segment is expected to register around USD 131 billion by 2032. With the escalating prevalence of diabetes globally, there is an increasing demand for specialized home-based healthcare diabetes care devices tailored to effectively manage this chronic condition.

For instance, as per International Diabetes Federation report, in 2021, approximately 537 million adults (20-79 years) were living with diabetes. Hence, home healthcare providers are diversifying their range of services and products to offer comprehensive solutions for diabetes management. These solutions include remote glucose monitoring, administering insulin with insulin delivery devices, managing medications, providing nutritional guidance, and offering lifestyle counselling. Therefore, with the help of these solutions’ healthcare providers can remotely monitor blood sugar levels, offer real-time guidance, and provide personalized support to individuals with diabetes, thereby boosting the market size.

Looking for region specific data?

North America home healthcare market accounted for 48% business share in 2022 and is anticipated to grow at considerable growth rate during the forecast timeframe. Some of the main factors driving this market include the sizeable ageing population coupled with advanced healthcare system and relatively high disposable incomes. Also, the rising prevalence of chronic diseases, such as diabetes, cardiovascular conditions, and respiratory disorders, will further drive the need for specialized care in the comfort of patients home.

For instance, according to the American Heart Association report, cardiovascular disease (CVD) remain as the leading cause of death in the U.S., accounted for 928,741 deaths in the year 2020. Thus, increasing use of home healthcare products and services in the treatment of chronic diseases will escalate the market growth. Moreover, advancements in technology have gained significant traction in North America enabling healthcare professionals to deliver high-quality care remotely.

Home Healthcare Market Share

Major market players operating in the home healthcare market include :

- 3M Healthcare

- Amedisys Home Health and Hospice Care, B.

- Braun Melsungen AG

- Becton

- Dickinson and Company

- Kindred Healthcare, Inc.

- Addus Homecare, and Home Instead, Inc.

These industry players majorly adopt various strategies including collaborations, acquisitions, mergers, and partnerships to create a global footprint and sustain market competition.

Home Healthcare Industry News:

- In February 2023, 3M launched a new medical adhesive, designed for use with a range of sensors, health monitors, and long-term medical wearables. This strategy helped the company to expand their product offering and customer base.

- In March 2022, Axxess, the leading technology innovator for healthcare at home, launched a fully independent palliative care software solution. Axxess Palliative Care is the latest innovation in Axxess’ complete suite of solutions developed for organizations that provide care in the home. This strategy helped the company to enhance its product offering in market and assist in strengthening the market position.

The home healthcare market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2018 to 2032, for the following segments:

By Component

- Product

- Therapeutic

- Home IV Pumps

- Home Dialysis Equipment

- Insulin Delivery Devices

- Home Respiratory Therapy Equipment

- Other Therapeutics

- Diagnostic

- Heart Rate Monitors

- Multi Para Diagnostic Monitors

- Diabetic Care Unit

- Apnea and Sleep Monitors

- BP Monitors

- Holter Monitors

- Home Pregnancy and Fertility Kits

- Other Diagnostics

- Mobility Care

- Wheelchair

- Walking Assist Devices

- Home Medical Furniture

- Services

- Rehabilitation Therapy Services

- Skilled Nursing Services

- Personal Care Assistance

- Other Services

Application

- Diabetes

- Trauma

- Hypertension

- Respiratory Disease

- Cancer

- Cardiovascular Disorder

- Mobility Disorders

- Maternal Disorders

- Renal Disorders

- Neurovascular Disorders

- Other Indications

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

Why are home healthcare services in high demand?

Home healthcare services market accounted for a 78.3% share in 2022 as the demand for home-based healthcare services continues to rise, there is a growing necessity for a wide range of specialized services to cater to diverse patient needs.

Why is the leading regional market for home healthcare?

North America home healthcare market share was 48% in 2022 owing to the sizeable aging population coupled with an advanced healthcare system and relatively high disposable incomes.

What is the 2032 market forecast for home healthcare?

Home healthcare market accounted for USD 262.5 billion in 2022 and will cross 7.9% CAGR from 2023 to 2032 to reach USD 555.6 billion by the end of 2032.

Which are the major players in global home healthcare market?

3M Healthcare, Amedisys Home Health and Hospice Care, B. Braun Melsungen AG, Becton, Dickinson and Company, Kindred Healthcare, Inc., Addus Homecare, and Home Instead, Inc., among others.

Home Healthcare Market Scope

Related Reports