Summary

Table of Content

Hollow Fiber Membrane Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Hollow Fiber Membrane Market Size

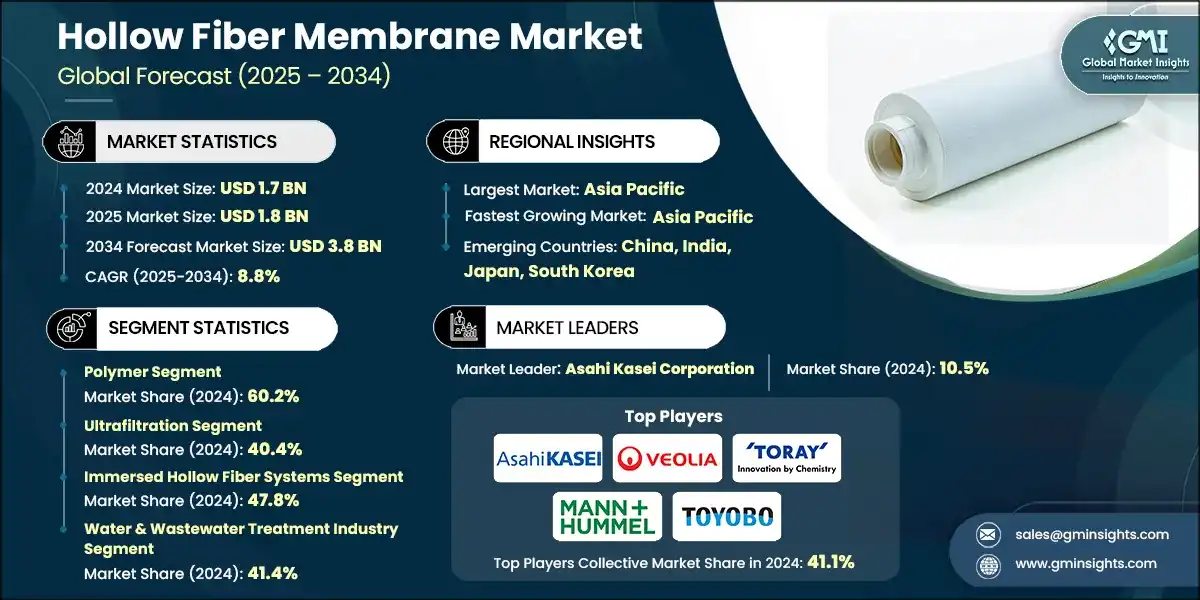

The global hollow fiber membrane market was valued at USD 1.7 billion in 2024. The market is expected to grow from USD 1.8 billion in 2025 to USD 3.8 billion in 2034, at a CAGR of 8.8%, according to latest report published by Global Market Insights Inc.

To get key market trends

- Hollow fiber membranes, which were originally developed for laboratory scale applications only, found their way into critical infrastructure and life-support systems, supported by increasing regulatory attention, for example, the membranes have been identified as Best Available Technologies by the U.S. Environmental Protection Agency for treating contaminants such as PFAS. Also, Food and Drug Administration plays a role in safety and efficacy assessment for healthcare uses, such as hemodialysis and blood purification.

- The industry is built on complicated polymer chemistry and precision manufacturing processes to produce membranes with tightly controlled pore structures. The high entry barriers resulting from complex regulatory certifications, a requirement for substantial investments, and the possession of advanced technical know-how tend to favor well-established, vertically integrated companies with a proven record of their products across applications.

- The federal purchasing behavior underlines the strategic importance of the industry. The market turns out to be segmented among healthcare-specialized firms who prioritize safety and compliance, industrial providers offering cost-effective and more durable solutions, and multi-segment players with cross-application portfolios.

Hollow Fiber Membrane Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 1.7 Billion |

| Market Size in 2025 | USD 1.8 Billion |

| Forecast Period 2025 - 2034 CAGR | 8.8% |

| Market Size in 2034 | USD 3.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| PFAS regulations: the regulatory catalyst transforming water treatment | Stricter PFAS rules are driving demand for advanced water treatment membranes. |

| Aging infrastructure: infrastructure imperative driving modernization | Outdated water systems are fueling the need for modern membrane solutions. |

| Healthcare demand: demographic destiny driving medical membrane growth | Growing medical applications boost the need for specialized hollow fiber membranes. |

| Pitfalls & Challenges | Impact |

| Regulatory complexity: the compliance labyrinth constraining market growth | Complex regulations challenge market growth and innovation. |

| Supply chain disruptions: the vulnerability threatening market stability | Disruptions threaten the steady supply of membrane materials and products. |

| Opportunities: | Impact |

| Emerging markets expansion | Growing urbanization and water scarcity in developing regions present significant opportunities for membrane adoption. |

| Industrial wastewater treatment | Increasing industrial regulations and environmental concerns drive demand for efficient membrane-based wastewater purification solutions. |

| Market Leaders (2024) | |

| Market Leaders |

10.5% market share |

| Top Players |

Collective market share in 2024 is 41.1% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Japan, South Korea |

| Future outlook |

|

What are the growth opportunities in this market?

Hollow Fiber Membrane Market Trends

- Technological advancements are key, since such innovations center on improvement in performance, durability, and selectivity of membranes. Nanotechnology and composite material development render membranes that present higher flux rates, better fouling resistance, and long life; hence reducing both operational costs and energy consumption. Technologically improved membranes can then be applied broadly in the areas of water treatment, health care, biotechnology, and others.

- Furthermore, regulatory aspects increasingly become stricter, especially in terms of water quality and environmental standards. Governments and industry bodies enforce stricter limits on pollutants, thus encouraging an increased adoption of advanced membrane technologies to ensure compliance. This regulatory demand speeds up innovations leading to the deployment of such high-performance meters, especially in the wastewater treatment and desalination sectors.

- Product innovation continues to be one major trend with companies developing specialized membranes to meet different application needs. Besides that, smart sensors and IoT technology integrated into membrane systems permit onward monitoring and predictive maintenance and operational efficiency.

Hollow Fiber Membrane Market Analysis

Learn more about the key segments shaping this market

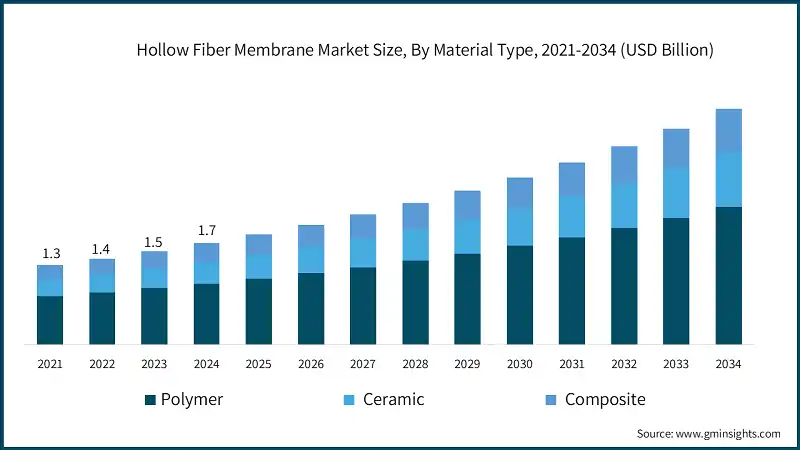

Based on material type, the market is segmented into polymer, ceramic, and composite. Polymer dominated the market with an approximate market share of 60.2% in 2024 and is expected to grow with a CAGR of 8.5% by 2034.

- With their increased application for water treatment, dialysis, and numerous industrial processes, polymer membranes dominate the industry, owing to their versatility, cost-effectiveness, and ease of nucleation. Technological advances in polymer membranes over the years have further increased their permeability, durability, and fouling resistance, thus spurring market growth.

- Ceramic hollow fiber membranes are highly appreciated because of their excellent stable conditions of chemicals and temperature, long life, and performance under severe situations. Hence, these membranes are highly effective in the petrochemical, pharmaceutical, and wastewater treatment sectors because there, resistance against extreme pH, temperature, and fouling conditions is expected.

- Composite hollow fiber membranes are a new trend in the market. The advantages that those membranes bring together are the ones of polymer and ceramic materials. At the same time, they serve very complex performance requirement separation processes that promise increased selectivity, mechanical strength, and chemical resistance when applied.

Learn more about the key segments shaping this market

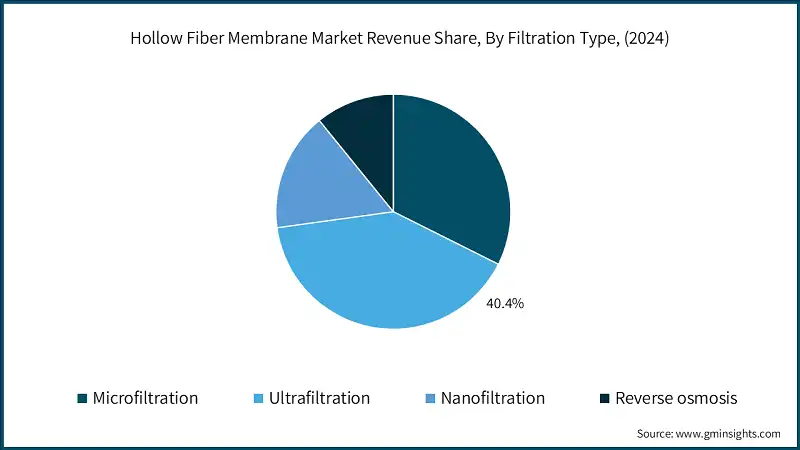

Based on filtration type, the hollow fiber membrane market is segmented into microfiltration, ultrafiltration, nanofiltration, and reverse osmosis. Ultrafiltration held the largest market share of 40.4% in 2024 and is expected to grow at a CAGR of 9.1% during 2025-2034.

- Microfiltration is increasingly gaining popularity in the market. Microfiltration effectively removes larger particles, bacteria, and suspended solids from liquids. This drives the growing application of microfiltration in water treatment, food and beverage processing, and pharmaceuticals industries, with firm rest of standards and need for clean and safe water.

- Growth in the ultrafiltration (UF) membranes market is attributed to their effectiveness in separating viruses, proteins, and other high-molecular-weight compounds from water and fluids. A focus on the reuse and recycling of water in industrial and municipal settings has boosted acceptance of ultrafiltration technology in both areas. The convenience of less energy use and lower operational costs of UF membranes compared with others has made the membranes an even more attractive option.

- Nanofiltration membranes are gaining a lot of attention because they can hardly prevent divalent salts from flowing across the membrane while allowing monovalent ions, such as sodium and chloride, to flow across the membrane. Because they are highly selective, these membranes are very appropriate to perform water softening or removal of pesticides, pharmaceuticals, and micropollutants.

- Reverse osmosis (RO) technology is still predominant in the hollow fiber membrane market worldwide as it virtually removes a nearly complete range of contaminants without any further detail about dissolved salts and bacteria, and viruses or organic compounds. The amount of fresh water consumed worldwide, coupled with the increased industrialization and urbanization, significantly increases the application of RO membranes in seawater desalination, wastewater treatment, and industrial processes.

Based on technology configuration, the market is segmented into immersed hollow fiber systems, tangential flow filtration, dead-end filtration, and vacuum membrane distillation. Immersed hollow fiber systems segment dominated the market with an approximate market share of 47.8% in 2024 and is expected to grow with the CAGR of 7.5% by 2034.

- The hollow fiber immersion systems are gaining popularity in the hollow fiber membrane market because it is simple, scalable, and economical for the treatment of water and wastewater. The hollow fiber membranes are completely immersed in feed water for filtration and easy cleaning and maintenance through backflushing or chemical cleaning.

- Tangential flow is also rapidly growing in the hollow fiber membrane industry as it processes high solids contents at high selectivity in the separation of particles, proteins, and other biomolecules. TFF finds much favor in biopharmaceuticals, food processing, and industrial applications where product purity is critical. The design minimizes membrane fouling and concentration polarization thus prolonging operation and minimizes downtime.

- Dead-end filtration has remained crucial and widely used in the hollow fiber membrane market, especially in laboratory, pharmaceutical, and small-scale industrial settings. In its simplest operation, fed water or fluids are filtered through the membrane until the level of filtration is achieved, after which the membrane is generally cleaned or replaced. Low operational costs and effectiveness in removing particulates are among the advantages of dead-end filtration that make it a relevant option for some applications.

- Vacuum membrane distillation (VMD) is still a new-born technology in the hollow fiber membrane family. It is potentially energy-efficient for desalination and water purification. VMD basically puts a vacuum- created pressure across a membrane to improve the evaporation process over that membrane, leading to much reduced consumption of energy during the treatment of high-salinity brine and wastewater.

Based on application, the market is segmented into water & wastewater treatment, pharmaceutical & biotechnology, food & beverage processing, chemical processing, blood purification/hemodialysis, environmental protection, gas separation & recovery, and others. Water & wastewater treatment industry segment dominated the market with an approximate market share of 41.4% in 2024 and is expected to grow with a CAGR of 8.7% by 2034.

- Water and wastewater treatment is the largest single application segment and currently the fastest-growing segment in the global hollow fiber membrane market. Increased urbanization, industrialization, and strict regulations on environmental protection have increased demand for such technologies that are efficient and environmentally friendly in purifying water.

- The hollow fiber membrane market has been greatly impacted by the fast-growing pharmaceutical or biotechnology sectors. Membranes are commonly applied for applications such as sterile filtration, cell separation and bioprocessing where the purity and product integrity are of utmost importance. Revamped membranes' materials and design improve selectivity, throughput, and fouling resistance, which are essential in manufacturing complex biopharmaceutical products.

- Hollow fiber membranes are increasingly being used to achieve clarification, concentration, and sterilization in food and beverage industries. Hollow fiber membranes are extremely effective in the separation of microorganisms, proteins, and other particles, and thus add value to a product in terms of quality and safety.

- The chemical processing industry is adopting hollow fiber technologies in various separation and purification tasks, for instance, solvent recovery, catalyst recovery, and emulsion separation. These membranes provide energy-efficient alternatives to conventional thermal and mechanical forms of separation.

Based on end use, the market is segmented into municipal, industrial, healthcare, and food & Beverage. Municipal industry segment dominated the market with an approximate market share of 36.4% in 2024 and is expected to grow with a CAGR of 8.7% by 2034.

- Municipal applications lead in the global hollow fiber membrane market because of the increasing rates of urbanization and the resultant need for sustainable water management solutions. Since strict regulations on water quality and wastewater disposals are applied throughout the world by various governments and municipalities, this increases the urgency of demand for innovative filtration techniques.

- The industrial segment consists of huge growth prospects owing to the advanced separation and purification processes required in different industries like chemicals, petrochemicals, and manufacturing. Hollow fiber membranes are now deployed in a bigger extent for recovery of solvents, recycling of process water, and treatment of effluents in line with an emerging global trend that promotes sustainable and eco-friendly practices in manufacturing processes.

- To maintain the product safe and of high quality in the food and beverages industry, hollow fiber membranes are used increasingly for clarification, concentration, and sterilization processes. The increasing consumer demand for food products that are natural, preservative-free, and high-quality is leading to the adoption of membrane filtration technology.

Looking for region specific data?

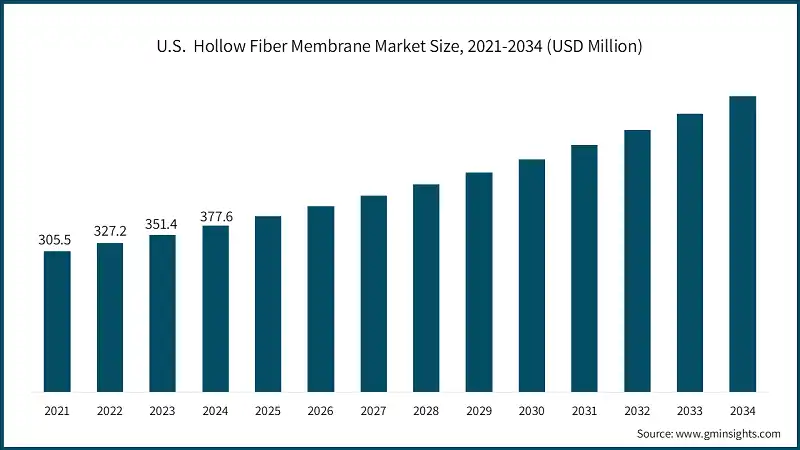

The North America hollow fiber membrane industry is growing rapidly on the global level with a market share of 26.3% in 2024.

- The North American region retains the hollow fiber membranes market driven by high expenditure on environmental regulations and stress on sustainable treatment water solutions. The U.S. accounts for USD 377.6 million in 2024 due to its large industrial base, advanced healthcare infrastructure, and fast-paced introduction of novel membrane technologies into the municipal as well as industrial applications.

Europe hollow fiber membrane market leads the industry with revenue of USD 302.5 million in 2024 and is anticipated to show lucrative growth over the forecast period.

- A mature but changing market for hollow fiber membranes in Europe is characterized by the stress on environmental sustainability and compliance with stringent regulations. The stringent directive on the waste discharge and water quality standards contributes to demand for efficient membrane filtration systems in the municipal, industrial, and healthcare sectors. Germany, the UK, and France are the main proliferators of membrane technology adoption, bolstered by initiatives for water conservation and pollution control.

The Asia Pacific hollow fiber membrane market is anticipated to grow at a CAGR of 9.5% during the analysis timeframe.

- The Asia Pacific has turned out to be the fastest-growing region of the hollow fiber membranes market, largely because of fast urbanization and industrialization. The countries such as China and India are spending heavily on a water treatment infrastructure to cater for their expanding populations and supporting increasing industrial base. Cost-effective and highly efficient membrane solutions are in great demand across this region, as they are increasingly being adopted in municipal water supply, wastewater recycling, and food & beverage industries.

Latin America hollow fiber membrane accounted for 1.8% market share in 2024 and is anticipated to show steady growth over the forecast period.

- The hollow fiber membranes market in Latin America is gradually expanding, driven mainly by needs for improved water and wastewater treatment infrastructure in the context of growing urban populations and industrial activities. Countries like Brazil and Mexico are stepping up investments into membrane treatment plants for compliance and to tackle water scarcity. Another driving force for the regional growth is increasing awareness on one hand concerning issues of environmental significance and on the other enhanced focus on sustainable water management practices.

Middle East & Africa hollow fiber membrane accounted for 4.4% market share in 2024 and is anticipated to show lucrative growth over the forecast period.

- The region of the Middle East & Africa is experiencing rapid expansion in the hollow fiber membrane market due to acute water scarcity, a tide of industrialization, and huge urban areas. Desalination systems and advanced water treatment facilities are funded by countries like Saudi Arabia, UAE, and South Africa to secure these water supplies for their populations and industries. It has been estimated that this region of the world in its entirety has a great demand of seawater desalination and brackish water treatment, and hollow fiber membranes contribute to this demand efficiency and compact design.

Hollow Fiber Membrane Market Share

The top 5 companies in hollow fiber membrane industry include Asahi Kasei Corporation, Veolia, Toray Industries, Inc., Mann+Hummel, Toyobo Co., Ltd. These are prominent companies operating in their respective regions covering approximately 41.4% of the market share in 2024. These companies hold strong positions due to their extensive experience in hollow fiber membrane market. Their diverse product portfolios, backed by robust production capabilities and distribution networks, enable them to meet the rising demand across various regions.

- Asahi Kasei Corporation is a key market player in the hollow fiber membrane business worldwide. The concerns of the company in its Chemical and Material Science division are innovative membrane technologies that are for water treatment, healthcare, and pure industrial uses, respecting the worth of product durability and functions.

- Veolia is an international leader in water, waste, and energy services. The worldwide market presence combined with an integrated service-provision model allows it to offer complete solutions to the customers, thereby appearing as any northern star for municipal and industrial clients exploring sustainable and efficient membrane systems.

- TORAY specialized in innovative membrane technologies utilizing most advanced material sciences. It used a R&D focus and execution toward production of high-performance hollow fiber membrane, the main leading innovation.

- MANN+HUMMEL is globally leading with filtration solutions and has significant presence in the hollow fiber membrane industry. Their strength includes wide range product portfolio, vast technical expertise, and a strong commitment to sustainable filtration technologies.

- TOYOBO deals specifically with specialty fibers and membranes for medical, water treatment, and industrial uses. They takes advantage of the blend of innovation and a persistent high level of quality in a narrow market to give Toyobo a unique edge in the market for competitive hollow fiber membranes.

Hollow Fiber Membrane Market Companies

Major players operating in the hollow fiber membrane industry include:

- Asahi Kasei Corporation

- Kovalus Separation Solutions

- Polymem France

- Mitsubishi Chemical Corporation

- DuPont

- NX Filtration

- Oxymo Technology

- Mann+Hummel

- Toray Industries, Inc.

- PHILOS Co., Ltd

- Theway Membranes

- Zig Sheng Industrial Co., Ltd

- Jiuwu Hi-Tech Membrane Technology

- Aquabrane Water Technologies Pvt. Ltd.

- Toyobo

- LG Chem

- Medica Group

- Veolia

- Zena Membranes

Hollow Fiber Membrane Industry News

- In June 2025, Toray Industries, Inc., announced that Toray Membrane Middle East LLC (“TMME”) began operations at its Middle East Water Treatment Technical Center (“MEWTEC”) in Dammam, Saudi Arabia, in April. The new facility provides integrated technology services, covering everything from membranes through full treatment processes.

- In April 2024, Asahi Kasei announced that it began selling a membrane system to produce WFI (water for injection), a type of sterile water that is used for the preparation of injections. The membrane system was developed as an alternative to the conventional distillation processes to produce WFI by leveraging system design and development capabilities of Microza hollow-fiber membrane for water treatment and filtration of liquid products. By reducing the need to generate steam, this system enables lower CO2 emissions and lower costs in the production of WFI.

- In October 2023, an affiliate of Sun Capital Partners acquired Koch Separation Solutions and rebranded the business as Kovalus Separation Solutions. Kovalus specializes in advanced membrane filtration technologies, offering innovative solutions for diverse industries. Their product portfolio includes high-performance ceramic membranes designed for efficient separation and purification processes.

This hollow fiber membrane market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Million) and volume (Thousand Square Meter) from 2025 to 2034, for the following segments:

Market, By Material Type

- Polymer

- Polysulfone (PS)

- Polyethersulfone (PES)

- Polyvinylidene Fluoride (PVDF)

- Polyacrylonitrile (PAN)

- Polyimide (PI)

- Other Polymers

- Ceramic

- Composite

Market, By Filtration Type

- Microfiltration

- Ultrafiltration

- Nanofiltration

- Reverse osmosis

Market, By Technology Configuration

- Immersed hollow fiber systems

- Tangential flow filtration (TFF)

- Dead-end filtration

- Vacuum membrane distillation

Market, By Application

- Water & wastewater treatment

- Pharmaceutical & biotechnology

- Food & beverage processing

- Chemical processing

- Blood purification/hemodialysis

- Environmental protection

- Gas separation & recovery

- Others

Market, By End Use

- Municipal

- Industrial

- Manufacturing

- Power generation

- Oil & gas

- Healthcare

- Food & beverage

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

What is the market size of the hollow fiber membrane industry in 2024?

The market size was USD 1.7 billion in 2024, with a CAGR of 8.8% expected through 2034 driven by regulatory catalysts transforming water treatment.

What is the current hollow fiber membrane market size in 2025?

The market size is projected to reach USD 1.8 billion in 2025. The industry is expanding due to increasing adoption of membrane-based purification across municipal, industrial, and healthcare applications.

What is the projected value of the hollow fiber membrane market by 2034?

The market size for hollow fiber membrane is expected to reach USD 3.8 billion by 2034, driven by advancements in polymer and ceramic membrane technologies and rising demand for energy-efficient water and wastewater treatment solutions.

Who are the key players in the hollow fiber membrane market?

Major players include Asahi Kasei Corporation, Veolia, Toray Industries, Inc., Mann+Hummel, Toyobo Co., Ltd., Kovalus Separation Solutions, Mitsubishi Chemical Corporation, DuPont, NX Filtration, and LG Chem.

Which region leads the hollow fiber membrane market?

The U.S. market accounted for USD 377.6 million in 2024. Growth is driven by strong environmental regulations, a large industrial base, and rapid adoption of advanced membrane technologies across municipal and healthcare sectors.

What are the upcoming trends in the hollow fiber membrane industry?

Key trends include nanotechnology-enhanced membranes, IoT-enabled smart filtration systems, and the rise of composite membranes offering higher flux and fouling resistance. Regulatory pressure on pollutant limits, especially PFAS, is accelerating innovation and deployment of high-performance membranes globally.

What is the growth outlook for immersed hollow fiber systems from 2025 to 2034?

The immersed hollow fiber systems segment is projected to grow at a CAGR of 7.5% through 2034.

What was the valuation of the ultrafiltration segment in 2024?

The ultrafiltration segment held 40.4% market share in 2024. Its growth is supported by strong adoption in virus and protein separation, water recycling, and municipal infrastructure upgrades.

How much revenue did the polymer material segment generate in 2024?

The polymer material segment held a 60.2% market share in 2024, driven by high versatility, cost efficiency, and increasing use in water treatment, dialysis, and industrial separation processes.

Hollow Fiber Membrane Market Scope

Related Reports