Summary

Table of Content

Graphene Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Graphene Market Size

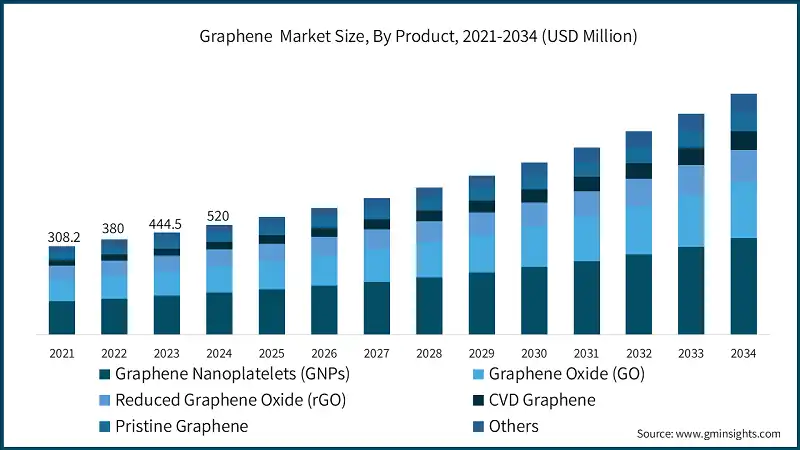

The global graphene market was estimated at USD 520 million in 2024. It is expected to grow from USD 650 million in 2025 to USD 4.2 billion by 2034, at a CAGR of 23%, according to latest report published by Global Market Insights Inc.

To get key market trends

- The global graphene market has moved from a niche research material into a commercialized sector, which is facilitated by production and many applications at an industrial scale. According to The Graphene Council, more than 700 commercialized forms of graphene are currently available, a sure sign that much diversification is underway in the product types of graphene oxide, nanoplatelets, and CVD graphene. Demand from electronics, energy storage, and composites together drive this proliferation; performance promises that are competitive due to conductivity and strength inherent in graphene have clear advantages.

- There is strong momentum of graphene for applications in electronics and energy storage, which together represent the largest share of graphene consumption. The Graphene Council asserts that energy storage systems, coatings, and composites are major growth drivers with strong support from government-sponsored R&D programs and industrial partnerships. Graphene production is majorly done in the Asia-Pacific region, particularly China and South Korea, which possess a huge manufacturing infrastructure for electronics and strategic investments in advanced materials. Meanwhile, North America and Europe harbor an active research and regulatory environment conducive to advancing sustainable technologies. An extensive global footprint, therefore, emphasizes the things that graphene is poised to disrupt in every high-tech industry.

- Graphene is held in strong environments of R&D activities and standardization initiatives from a trade and production perspective. These include the Drawing of the Graphene Flagship and ISO initiatives in which material classifications and quality-assurance frameworks work towards overcoming one of the primary roadblocks for the large-scale adoption of graphene: lack of consistency of material properties. These standards will make production scalable across global supply chains and ensure interoperability. Also, government-backed programs in Asia, Europe, and North America are pushing commercialization forward through funding and pilot projects, especially in energy storage and advanced composites.

Graphene Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 520 Million |

| Market Size in 2025 | USD 650 Million |

| Forecast Period 2025 - 2034 CAGR | 23% |

| Market Size in 2034 | USD 4.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing graphene penetration in the electronic industry | Boosts innovation in flexible electronics, sensors, and high-speed semiconductors, driving demand across consumer and industrial tech. |

| Increasing investment in research & development of graphene | Accelerates new applications and scalable production methods, reducing costs and expanding commercial adoption. |

| Increasing use of graphene in automotive & aerospace industries | Enhance lightweight composites, thermal management, and energy storage, improving fuel efficiency and performance. |

| Pitfalls & Challenges | Impact |

| High Manufacturing Cost and Environmental Concerns | Limits large-scale adoption and raises sustainability issues, slowing commercialization and increasing product pricing. |

| Lack of Standardization and Quality Control | Creates inconsistencies in graphene quality and performance, reducing trust among end-users and hindering global market growth. |

| Opportunities: | Impact |

| Integration in Next-Generation Energy Storage Systems | Enables faster charging and higher energy density, driving EV and renewable energy markets forward. |

| Expansion in Flexible and Wearable Electronics | Spurs innovation in consumer electronics and IoT, opening new revenue streams for advanced device manufacturers. |

| Market Leaders (2024) | |

| Market Leaders |

14% |

| Top Players |

Collective market share in 2024 is 52% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Middle East & Africa |

| Emerging Country | UAE, Saudi Arabia, Japan |

| Future Outlook |

|

What are the growth opportunities in this market?

Graphene Market Trends

- Integration of graphene in the systems for energy storage turned out to be one of the most promising trends in the market, where even lithium-ion batteries enhanced with graphene present up to five charging speed advancements over conventional batteries. One of the highest surface areas with marvelous electrical conductivity has given more to the critical energy density and very high cycle life in addressing the critical disadvantages present with current battery technologies.

- Improvement in graphene production methods using the market force can be observed. Chemical Vapor Deposition (CVD) technology is mostly utilized for the highest yields with adequate control on quality. Recent advances in liquid-phase exfoliation have reduced the overall production costs by around 30% while maintaining the quality standards of the material.

- The trend towards flexible and wearable electronics is making the way for graphene to be used in transparent conductive films, flexible displays, and in various sensor applications. The mechanical flexibility and electrical conductivity properties of graphene facilitate the manufacture of bendable smartphones, rollable displays, and smart textiles that can perform even under mechanical stress.

- The incorporation of graphene into composites is revolutionizing the aerospace and automotive industry, achieving reductions in weight between 20 and 30% while maintaining and sometimes improving mechanical strength. Within automotive applications, graphene-enhanced composites are primarily being developed for body panels, structural applications, and thermal management systems, thereby assisting with fuel efficiency and electric vehicle development.

Graphene Market Analysis

Learn more about the key segments shaping this market

Based on product, the market is segmented into graphene nanoplatelets (GNPs), graphene oxide (GO), reduced graphene oxide (rGO), CVD graphene, pristine graphene, and others. Graphene Nanoplatelets (GNPs) hold a significant share at a valuation of USD 270.4 million in 2024.

- Graphene Nanoplatelets are the most preferred material in the graphene arena due to their greatest performance versus cost and scalable mixture. With excellent electrical and thermal conductivity, mechanical strength, and lightness, they are used as energy storage devices and coatings, as well as composites. The segment is set to thrive purely because mature manufacturing technologies are available, and the automotive and energy sectors are realizing an unmet degree of demand for lightweight but effective materials.

- Graphene oxide has a favorable paradigm as it is soluble in water and easy to handle for membranes, bio drugs, and as a precursor to the reduced form of graphene oxide. It can be chemically modified to produce many variants, which is a further improvement in its versatility, especially regarding green technology. This segment is experiencing exponential growth due to the increase in demand for water treatment, drug delivery, and smart coatings, besides the growing global production capacity to meet market needs.

- CVD Graphene is a little miniature segment but gaining popularity due to its unmatched quality and performance for high-end optics and electronics. Its excellent electrical features, besides structural integrity, make it ideally suited for high-end applications, including semiconductors and flexible electronics. The continuous improvement in defect-free production technologies such as roll-to-roll further helps bring down the price, enabling broader usage across future classes of electronic systems.

Learn more about the key segments shaping this market

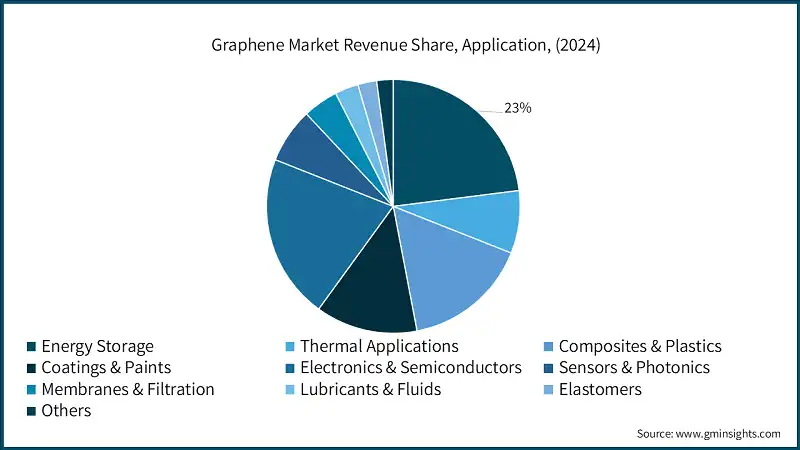

Based on application, the graphene market is segmented into energy storage, applications, composites & plastics, coatings & paints, electronics & semiconductors, sensors & photonics, membranes & filtration, lubricants & fluids, elastomers, and others. Energy storage is estimated to grasp a value of USD 150.5 million in 2025 and is expected to grow at 23.7% of CAGR during the forecast period.

- Application industries Energy storage has the largest market share at 23%, and the impressive performance of graphene in lithium-ion battery and supercapacitors. The segment also has a CAGR growth of 23.7% and this is backed by the increasing use of electric vehicles, as well as renewable energy storage needs. Graphene improved batteries show 5 times faster charging rates and much longer cycles compared to traditional systems. Large battery makers are already using the Graphene materials in making their products, and products are already being sold commercially.

- The energy storage industry boasts of impressive investment in research and development and government-funding programs are also in place that are promoting the development of graphene batteries. Graphene-aluminum ion batteries and graphene-enhanced supercapacitors are the recent discoveries that are opening new market opportunities. The expansion of the segment could also be facilitated by the growing needs in grid type energy storage system and the demand in portable electronic devices that need to be charged at a high rate.

- The composites segment is enjoying augmented regulatory demand towards enhancement of fuels efficiency and minimization of emission in the transportation industries. It has aerospace uses using graphene-reinforced carbon fiber composite in aircraft parts, which is better in fatigue resistance and damage tolerance. Graphene composite manufacturing procedures are increasingly becoming standardized and this allows the product to be used commercially in various industries.

Looking for region specific data?

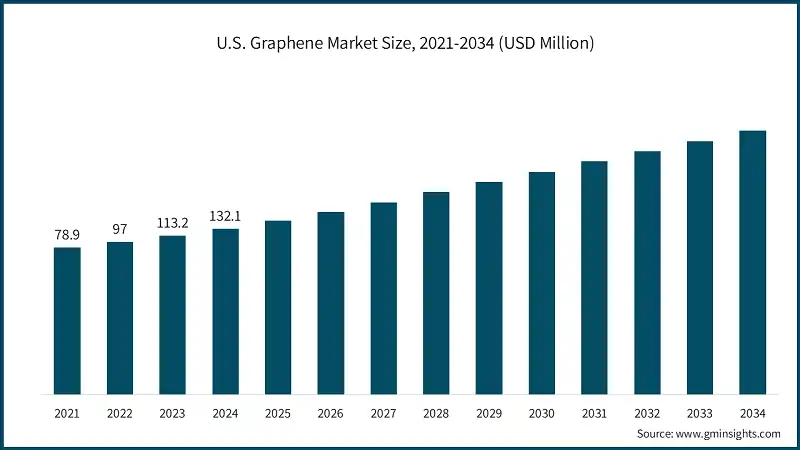

North America market accounted for USD 166.4 million in 2024 and is anticipated to show lucrative growth over the forecast period.

- In North American graphene market, good research efforts, uptake of materials and funding on the nanotechnology innovation by the government are sources of strength. Further investment in electronics, aerospace, and energy storage usage is what makes the U.S. the center of attention. Graphene-based composite and conductive inks have also been commercialized quicker due to collaborations between research institutions and commercial manufacturers. Also, there is a rising need of light weight and high strength materials in the automobile and defense industry which is encouraging growth. The intensive regulatory environment and investment in clean technologies in the region are also improving the use of graphene in industries.

Europe graphene market accounted for USD 145.6 million in 2024 and is anticipated to show lucrative growth over the forecast period.

- Europe is a technologically advanced market with high level of R&D investments and manufacturing geared towards sustainability. Nations like Germany, the U.K., and France are focusing on use of graphene in electric mobility, coating and renewable energy developments. The area enjoys good academic industrial cooperation through EU-funded initiatives such as the Graphene Flagship that will scale up the production and integration of graphene. Graphene composites are especially designed to be used in the automotive and aerospace industry to achieve a better fuel consumption rate and performance. Moreover, strict environmental policies are prompting the industries to consider using graphene as a more affordable and clean replacement of traditional materials.

Asia Pacific graphene market accounted for USD 171.6 million in 2024 and is anticipated to show lucrative growth over the forecast period.

- Asia Pacific has a 33% share of the global market in graphene because of the high manufacturing capacity and the government investment in the development of advanced materials. The infrastructure of the manufacturing of electronics in the area is well-established, especially in China, Japan, and South Korea, which forms a strong demand on the products based on graphene. China has invested heavily in the development of energy storage using graphene through the National Graphene Innovation Center and Japan through the National Institute of Materials Science is developing graphene nanocomposites.

Latin America market accounted for 4% market share in 2024 and is anticipated to show steady growth over the forecast period.

- Latin American graphene market is in its developing phase as it is assisted by the slow adoption of the technologies and growing scholarly attention to nanomaterials. Such nations as Brazil and Mexico are encouraging research, which deals with sustainable energy and new materials. Graphene has potential uses in improving corrosion resistance, composites and energy use and local industries are looking into this potential. Although there is no massive commercialization yet, the collaboration with international technology suppliers assists in the development of the production capacities. The increased recognition of the economic and environmental benefits of graphene is likely to generate investments in the future in the local high-end materials industry.

Middle East and Africa graphene market accounted for 3% market share in 2024 and is anticipated to show steady growth over the forecast period.

- The MEA region is experiencing slow growth in the use of graphene, which is mainly through the new industrial utilization and diversification programs in the Gulf economies. The early opportunity to use graphene is being created in investments in renewable energy, water desalination, and advanced coatings. The UAE and Saudi Arabia are on the forefront in the region in terms of R&D activities, graphene usages with national sustainability and innovation targets. Africa is looking into the use of graphene in the storage and building of energy resources, especially cost effective and strong materials. Although production in the country is minimal, the strategic partnerships with the international graphene manufactures are building the ecosystem in the region.

Graphene Market Share

The competitive environment in the global graphene industry is moderately competitive, with the leading 5 competitors, namely Directa Plus, Solidion Technology, Inc, First Graphene, Paragraf, and Graphene Manufacturing Group Ltd, owning about 52 percent of the overall market share in 2024. Such a concentration speaks of the specialization of the production of graphene and high technical skills in the manufacturing of high-quality materials. Companies that have a different approach to technology and regional strength are spread in the market and make the competition dynamic.

Many players are concentrating on proprietary production technologies which are efficient and sustainable like bio-based or plasma-based technologies. There are also strategic partnerships with industrial use, technology licensing deals, which allow quicker commercialization and penetration of high-growth markets such as energy storage, electronics and high-technology composites. Another strategy to secure supply and to control costs is vertical integration, starting with sourcing raw materials through the final products of graphene. Also, firms are increasing the production capacity and investment in research and development to create application specific solutions, especially of electric vehicles, grid storage and high-performance materials. All of the strategies are a response to the focus on innovation, scalability, and environmental responsibility as influential forces on competitiveness in the graphene industry.

Graphene Market Companies

Major players operating in the graphene industry are:

- Bio Graphene Solutions

- Solidion Technology, Inc

- First Graphene

- Directa Plus

- Intelligent Materials Private Limited

- Graphene Manufacturing Group Ltd

- Paragraf

- Graphenemax

- Miraculum Graphene Pvt. Ltd

- Tata Steel

- KNV'S Incorporation

- Carborundum Universal Limited

- LHP Nanotechnologies LLP

- Otto Chemie Pvt Ltd.

- BT Corp Generic Nano Private Ltd

Directa Plus is involved in different engineered graphene materials production under the brand of Graphene Plus (G+). The company uses its own proprietary, scalable, and modular processes to create high-quality graphene for textiles, water remediation, composites, elastomers, batteries, and paints. Collaborations with industrial partners are in place to integrate graphene into commercial products-the company also has an extensive intellectual property portfolio with numerous granted and pending patents.

Solidion Technology, Inc., is focused on marketing advanced battery technology, such as solid-state and lithium-sulfur batteries. The company has evolved from Honeycomb Battery Co., a subsidiary of G3, to possess a large patent portfolio in the battery sector that covers various next-generation battery innovations. Solidion is developing scalable solid-state batteries that could be used into lines currently producing lithium-ion batteries with the objective of increasing the EV range, safety, and cost-effectively. The roadmap for the associated display will consider silicon-rich anodes and graphene-enhanced materials for energy storage applications.

First Graphene manufactures high-performance graphene products using the brand PureGRAPH. The company has substantial capability in full-scale production and employs an exclusively owned electrochemical exfoliation process to produce pure graphene. The company's materials range across fields, including concretes, elastomers, coatings textiles, and energy storage. First Graphene is devoted to producing cost effectively on a large scale and also partners with research institutions to develop newer applications for graphene.

Paragraf has demonstrated its technology prowess by converting standard semiconductor processes into mass production for reaching the graphene-based electronic device market. The broad spectrum of its product portfolio includes graphene Hall sensors and field-effect transistors. These are aimed at the automotive, healthcare, quantum computing and industrial automation industries. Proprietary technology underlies a contamination-free graphene growth process developed by Paragraf.

Graphene Manufacturing Group Ltd is an Australian clean-tech company with proprietary processes for producing graphene from natural gas. It offers energy savings and energy-storage solutions such as HVAC coatings, lubricants, and graphene aluminum-ion batteries focused on collaborative development with the University of Queensland. GMG intends to benefit from sustainability by allowing energy savings and emission reductions in graphene-based products. GMG is venturing to applications for improving fuel and next-generation battery technology.

Graphene Industry News

- In July 2023, NanoXplore Inc. announced the successful commissioning of two anode material pilot lines, which will help the company achieve sustainable energy storage solutions.

- In September 2022, Haydale Graphene Industries PLC announced the launch of its new graphene-enhanced composites, designed to offer superior performance in the aerospace and automotive sectors.

- In June 2022, Graphenea and Grapheal joined forces to quicken the study on biosensors with GraphLAB, a graphene-based product. GraphLAB is a next-gen assessment method for protein disease and screening detection.

- In July 2021, AGM launched an innovative new series of eco-friendly GNP dispersions. These dispersions will enable coatings, paints, and composite material consumers to develop the sustainability of their various product formulations.

The graphene market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) & volume (Kilo Tons) from 2021 to 2034, for the following segments:

Market, By Product

- Graphene nanoplatelets (GNPs)

- Graphene oxide (GO)

- Reduced graphene oxide (rGO)

- CVD graphene

- Single-layer graphene (FLG)

- Few-layer graphene (MLG)

- Pristine graphene

- Others

Market, By Application

- Energy Storage

- Batteries

- Li-ion

- Al-ion

- Li-s

- Supercapacitors & ultracapacitors

- Fuel cells

- Hydrogen storage systems

- Batteries

- Thermal applications

- Thermal interface materials

- Heat spreaders & heat sinks

- Hvac coatings

- Electronic device cooling

- Composites & plastics

- Polymer matrix composites

- Fiber reinforced plastics

- Conductive plastics

- Structural composites

- Coatings & paints

- Anti-corrosion coatings

- Conductive coatings

- Barrier coatings

- Functional paints

- Electronics & semiconductors

- Transparent conductive films

- Flexible electronics

- Radio frequency applications

- Quantum devices

- Sensors & photonics

- Biosensors

- Gas sensors

- Photodetectors

- Pressure sensors

- Membranes & filtration

- Water purification membranes

- Gas separation membranes

- Desalination applications

- Industrial filtration

- Lubricants & fluids

- Engine oil additives

- Industrial lubricants

- Thermal fluids

- Specialty fluids

- Elastomers

- Tires

- Conveyor belts

- Seals & gaskets

- Other rubber products

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- MEA

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

What are the upcoming trends in the graphene industry?

Key trends include scalable CVD production, integration in flexible and wearable electronics, and adoption of graphene composites for lightweight and energy-efficient vehicles.

What is the projected value of the graphene market by 2034?

The global graphene market is expected to reach USD 4.2 billion by 2034, expanding at a CAGR of 23% due to increased integration in energy storage, electronics, and automotive sectors.

How much revenue did the graphene nanoplatelets (GNPs) segment generate in 2024?

Graphene nanoplatelets accounted for USD 270.4 million in 2024, leading the market with widespread use in composites, coatings, and energy storage applications.

Who are the key players in the graphene market?

Major companies include Directa Plus, Solidion Technology, Inc., First Graphene, Paragraf, Graphene Manufacturing Group Ltd, NanoXplore, and Haydale, focusing on advanced composites, energy storage, and clean-tech graphene solutions.

Which region leads the graphene market in North America, and what was its valuation in 2024?

The North America graphene market was valued at USD 166.4 million in 2024, reflecting strong research initiatives and early industrial adoption. Growth is driven by expanding applications in electronics, aerospace, and energy storage.

What was the valuation of the energy storage application segment in 2025?

The energy storage segment is estimated at USD 150.5 million in 2025.

What is the market size of the graphene industry in 2024?

The market size was USD 520 million in 2024, driven by strong research and commercialization of advanced graphene materials across energy, electronics, and composites industries.

What is the current graphene market size in 2025?

The market size is projected to reach USD 650 million in 2025, supported by rising industrial adoption and scalable graphene production technologies.

Graphene Market Scope

Related Reports