Summary

Table of Content

Gold Nanoparticles Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Gold Nanoparticles Market Size

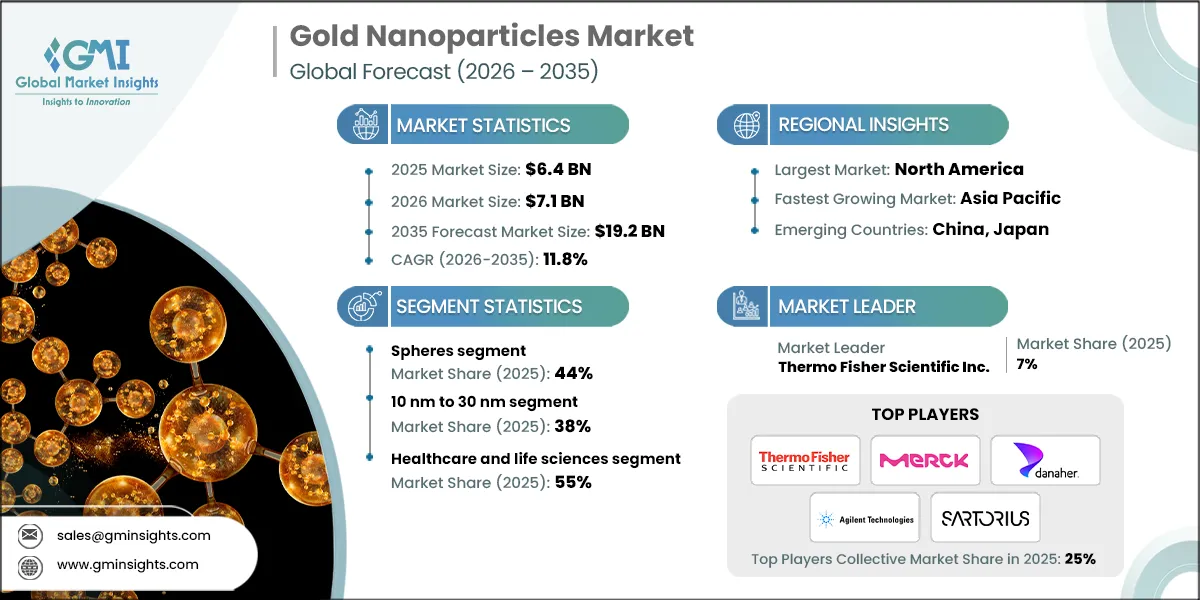

The global gold nanoparticles market was valued at USD 6.4 billion in 2025. The market is expected to grow from USD 7.1 billion in 2026 to USD 19.2 billion in 2035, at a CAGR of 11.8% according to latest report published by Global Market Insights Inc.

To get key market trends

- Starting from a niche lab interest and becoming a scalable input material, gold nanoparticles have successfully solved the problems of stable bio-labeling and adjustable optical properties. Along with electronic uses, demand from 2021 to 2025 has been shaped by expanding diagnostic workflows and a renewed focus on life science tools.

- The integration of colloidal gold with rapid immunoassays across the board defined the period of 2021 to 2025. A wave of SARS-CoV-2 (COVID-19) brought about global lateral flow testing which increased demand for gold conjugated lateral flow test components. The World Health Organization (WHO) reports the mass distribution of SARS-CoV-2 rapid test kits which support LFT utilization during the referenced period. (Source: WHO)

- While the COVID-19 pandemic was prevalent, funding towards the life sciences was at an all-time high alongside the massive publication output. Gold nanoparticles are often acquired as research assay components or reagents. The Organization for Economic Cooperation and Development and United Nations Educational Scientific and Cultural Organization (OECD, UNESCO) report sustained research and development levels as well as public science engagement, reflecting the continued baseline growth, notwithstanding the specific testing demands attributed to the pandemic. (Sources: OECD, UNESCO)

- The most significant region of 2021 - 2025 was the Asia-Pacific as the region's growth accelerated. Manufacturing scale up, advanced diagnostics (including gold nanoparticle LFD) production, and semiconductors (for gold LFDs) supply chain configurations added further complexities. The United Nations (UN) OECD, and World Bank report improved industrial and trade output from Asian nations across high-technology and added advanced materials. In part, these advanced materials are gold nanomaterials. (Sources: UN Comtrade, World Bank)

Gold Nanoparticles Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 6.4 Billion |

| Market Size in 2026 | USD 7.1 Billion |

| Forecast Period 2026 - 2035 CAGR | 11.8% |

| Market Size in 2035 | USD 19.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Expansion of rapid diagnostics and biosensors | Increases demand for functionalized gold nanoparticle labels |

| Rising nanomedicine research and translational pipelines | Boosts reagent consumption across academia and pharma |

| Growth in plasmonics and advanced optical devices | Expands in high value applications beyond healthcare |

| Pitfalls & Challenges | Impact |

| High cost and price volatility of gold | Raises input costs and discourages large scale use |

| Regulatory and safety validation burden | Slows clinical adoption and commercialization timelines |

| Opportunities: | Impact |

| Targeted drug delivery and photothermal therapy | Enables premium therapeutics with strong differentiation |

| Scalable green synthesis and surface functionalization | Lowers costs and broadens end use acceptance |

| Market Leaders (2025) | |

| Market Leader |

7% Market Share |

| Top 5 Players |

Collective Market Share of 25% in 2025 |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia pacific |

| Emerging countries | China, Japan, China |

| Future outlook |

|

What are the growth opportunities in this market?

Gold Nanoparticles Market Trends

- Standardization of materials and its quality: Buyers' demands are pushing vendors to more standardized documentation and traceability. Buyers want more specifications in qc, traceability, and documentation. These are more visible in IVD and bioconjugation. Similarly, more users are adopting iso aligned systems in the life science supply chains and more users are adopting a certificate of analysis as a basis to fund the supply chain.

- Diagnostics and biosensing pull: Gold nanoparticles are still as versatile as ever. Technology and applications are still advancing. In addition to current applications, other technologies are being incorporated into testing to advance the technologies used. The rapid test technology that emerged as a result of the pandemic also had a lot of other automation and technology that can be offered as a result of the new systems that were developed.

- Functionalization and turnkey bioconjugates: The industry is moving towards selling fully finished tech bioconjugates, such as pre-coated, reacted, and ready to use nanoparticles, as well as selling conjugation kits and protocols. This is evident in the increased SKUs in life science supply companies and the increased use of kits in academic and biotech labs to decrease variances and increase the speed of the validation process.

- The Asia Pacific region is continuing to increase in share across synthesis, coating, and downstream device manufacturing, along with diverse applications in electronics and photonics. Examples include regional semiconductor and advanced electronics capacity buildout, coupled with the increasing regional supplier base for domestic diagnostics. Simultaneously, sustained R and D activity focused on photothermal therapy and imaging continues to diversify longer term demand from testing.

Gold Nanoparticles Market Analysis

Learn more about the key segments shaping this market

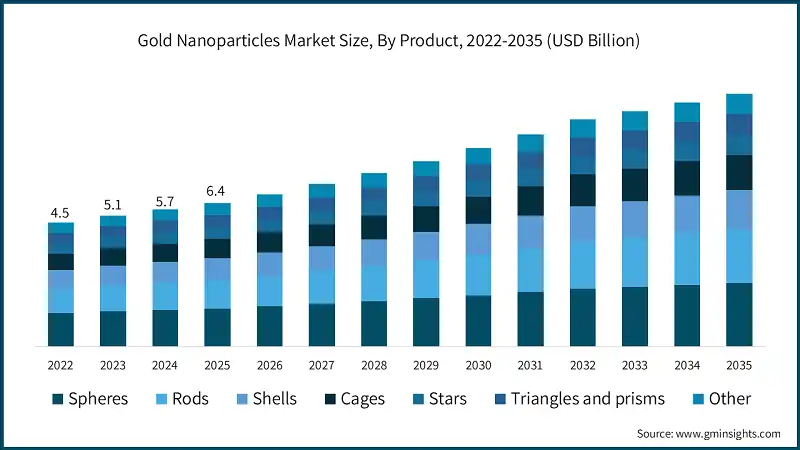

Based on product, the market is segmented into spheres, rods, shells, cages, stars, triangles and prisms, other. Spheres dominated the market with an approximate market share of 44% in 2025 and are expected to grow with a CAGR of 11.1% by 2035.

- The product mixes are focusing on high volume, easy to validate formats, with routine labeling and assay manufacturing spheres dominating the market due to their scalability and reproducibility. Simultaneously, buyers are increasingly maintaining a secondary portfolio of anisotropic shaped, such as rods and stars, to obtain tunable plasmonic peaks for sensing and photothermal applications. Suppliers are responding to these shifts by offering broader catalogs and increasing expectations for batch consistency.

- The primary focus of the commercial shifts from selling “shape only” to selling performance in specific applications, more so, for optical response, surface chemistry stability, and the ability to conjugate. Shells, cages and prisms are seen as a premium offering with the potential for a higher profit margin tied to the research, imaging and plasmonic, and “other” shapes are often used for custom R and D. As complexity builds, contract synthesis and customization increase.

Based on size range, the gold nanoparticles market is segmented into less than 10 nm, 10 nm to 30 nm, 31 nm to 50 nm, 51 nm to 100 nm, more than 100 nm. nm to 30 nm held the largest market share of 38% in 2025 and is expected to grow at a CAGR of 14.8% during 2026-2035.

- Demand for size is increasingly gathering around mid-range 10 to 30 nm particles. A strong optical signal, colloidal stability, and bioconjugation practical to assays and routine research is increasingly seen as a perfect balance. Though sub 10 nm are increasingly chosen for applications that require better tissue penetration or higher surface area, they come with stricter control requirements. Larger sizes are still required for scattering and visibility.

- It is reasonable to say that size, in a commercial sense, is becoming more of an application case than a catalog default. Vendors, therefore, cover size along with coating and stability promises. Customers expect the entire catalog to deliver high and consistent extinction with validated conjugation. As these workflows become more regulated, suppliers focus on metrology, documentation, and stability, in addition to diameter.

Learn more about the key segments shaping this market

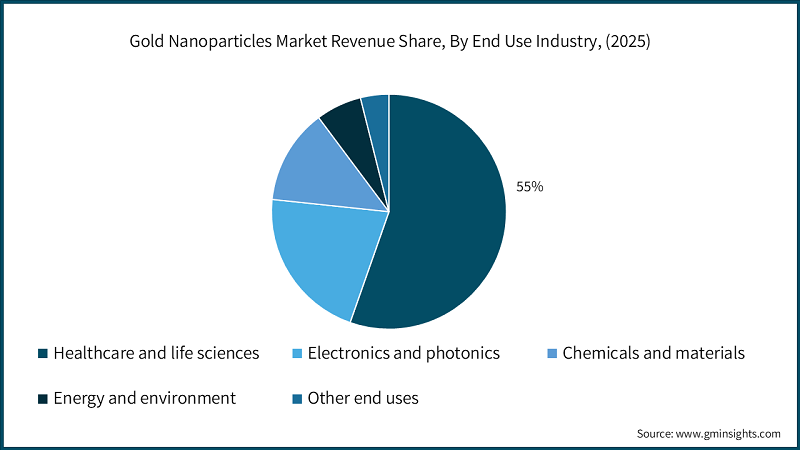

Based on end use industry, the gold nanoparticles market is segmented into healthcare and life sciences, electronics and photonics, chemicals and materials, energy and environment, other. Healthcare and life sciences segment dominated the market with an approximate market share of 55% in 2025 and is expected to grow with the CAGR of 14.1% by 2035.

- The gold nanoparticles’ demand continues to be in the healthcare and life sciences. Here, the gold nanoparticles are recognized for their reliable optical readouts and bioconjugation in diagnostics and biosensors as well as for routine research. The demand also relies on imaging, contrast enhancement, and early-stage therapeutics, where the demand is for more specialized coatings and tighter QC. Increasingly, buyers expect to find application ready particles rather than raw colloids.

- Aside from life sciences, the adoption of electronics and photonics is on the rise with the demand for plasmonic and optical components that are closer to manufacturable designs. Conductive inks and optoelectronics remain selective, performance driven niches. Catalysis and composite enhancement are also chemically and materially focused which are volume driven and cost sensitive. The use of the environment and energy is also growing with sensing and pilot scale applications with the validation and customization as the key selling points.

Looking for region specific data?

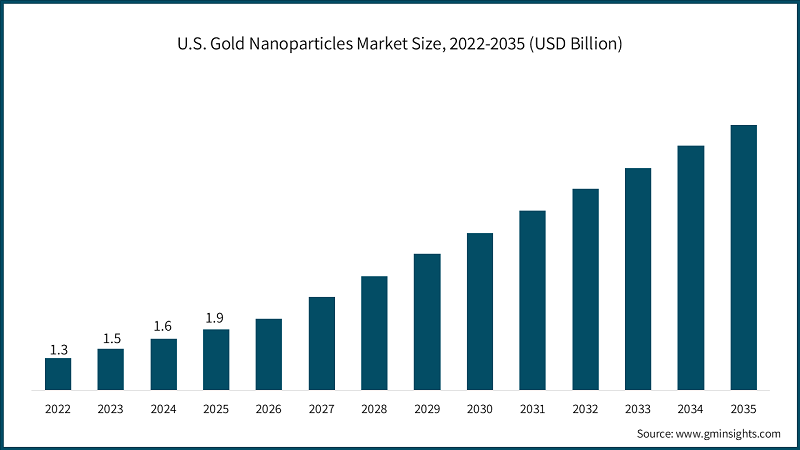

North America gold nanoparticles market is forecasted to uplift from USD 2.2 billion in 2025 to USD 7.1 billion in 2035, supported by strong diagnostics demand, bioconjugation supply chains, and a 12.5% CAGR. North America benefits from dense life science R and D clusters and established procurement standards, which favor high quality, well documented nanoparticles. Scaling of assay manufacturing and sustained funding for translational research keep demand resilient across diagnostics, imaging, and early therapeutics.

- U.S. market was valued at USD 1.9 billion in 2025. The U.S. combines large IVD development capacity with deep academic and biotech ecosystems, driving repeat purchases. Buyers often prioritize validated coatings, consistent lots, and regulatory ready documentation, supporting premium pricing and long term supplier relationships.

Europe gold nanoparticles market is anticipated to grow from USD 1.6 billion in 2025 to USD 4 billion in 2035, driven by regulated adoption, strong research networks, and industrial materials innovation. Europe’s demand is shaped by quality and compliance expectations, pushing suppliers toward traceability and standardized characterization. Growth is steady across diagnostics and research, with selective pull from photonics and materials applications where performance validation and sustainability narratives influence procurement.

- Germany market was valued at USD 279 million in 2025. Germany’s strength in precision manufacturing and applied research supports consistent demand for reproducible nanomaterials. Activity spans biosensing development and materials engineering, with purchasing decisions strongly influenced by supplier documentation, lot consistency, and technical support depth.

Asia pacific gold nanoparticles market is projected to rise from USD 1.9 billion in 2025 to USD 6.3 billion in 2035, propelled by manufacturing scale up, expanding diagnostics production, and a 12.5% CAGR. Asia pacific demand accelerates as more synthesis, functionalization, and downstream device production occur locally. Diagnostics and biosensors remain a base load, while electronics and photonics add momentum where plasmonic components and optical devices move closer to scalable manufacturing.

- China market was valued at USD 873 million in 2025. China’s growth is supported by expanding domestic suppliers and high throughput manufacturing ecosystems serving diagnostics and research. Increased focus on localization and scale favors vendors that can deliver consistent specifications, stable coatings, and reliable lead times across large order volumes.

Latin America gold nanoparticles market is expected to increase from USD 372 million in 2025 to USD 1 billion in 2035, mainly supported by growing diagnostics access and expanding research capacity. Latin America remains smaller but broadening, with demand concentrated in clinical testing workflows and university research procurement. Adoption improves as distributors strengthen coverage and laboratories standardize methods, reducing variability concerns and enabling more repeatable assay development programs.

- Brazil market was valued at USD 115 million in 2025. Brazil leads regional uptake through comparatively larger healthcare demand and research activity. Market growth leans on distributor networks, public health testing needs, and gradual expansion of local assay development, which increases recurring consumption of standard gold nanoparticle formats.

MEA market is expected to grow from USD 256 million in 2025 to USD 794 million in 2035, driven by healthcare modernization, lab capacity buildout, and expanding applied research. MEA demand is concentrated in centralized labs and import led supply, with growth tied to diagnostics scale up and investment in research infrastructure. Buyers typically prioritize reliable sourcing and shelf stability, favoring established suppliers and distributor supported service models.

- Saudi Arabia market was valued at USD 84 million in 2025. Saudi Arabia’s demand is supported by healthcare system investment and laboratory expansion. Uptake focuses on diagnostics and research use, with purchasing influenced by supplier qualification, consistent quality documentation, and training support to standardize assay preparation and handling.

Gold Nanoparticles Market Share

The top 5 companies in gold nanoparticles industry include Thermo Fisher Scientific, Merck KGaA, Danaher Corporation, Agilent Technologies, and Sartorius together account for 25% of the market. These companies shape the competitive landscape through breadth of life science catalogues, validated QC, and global distribution that fits regulated and near regulated purchasing. The market remains fragmented beyond the leaders, with many specialist nanoparticle suppliers competing on customization and niche shapes. Leadership is reinforced by application support, documentation, and bundling nanoparticles with workflows such as assays, conjugation, and analytical characterization.

- Thermo Fisher Scientific Inc.: Thermo Fisher leverages end to end life science workflows, selling gold nanoparticles alongside reagents, instruments, and assay development consumables. Its scale and QA infrastructure support regulated buyers needing lot consistency and documentation. Share is 7%. Recent emphasis on integrated solutions strengthens stickiness in diagnostics and research procurement.

- Merck KGaA: Merck KGaA competes via broad research grade materials and bioconjugation adjacencies, aligning gold nanoparticles with life science reagent purchasing patterns. Strong regulatory and quality credentials help in IVD development and translational research supply. Share is 6%. Ongoing portfolio refinement toward application ready surfaces supports repeat, specification driven demand.

- Danaher Corporation: Danaher benefits from a life sciences platform approach, with demand pulled through diagnostics, analytical, and bioprocess ecosystems across operating companies. Gold nanoparticles fit as enabling materials for assays and characterization workflows. Share is 5%. The competitive edge is strong customer access and service infrastructure that reduces switching for labs scaling methods.

- Agilent Technologies, Inc.: Agilent’s position is reinforced by analytical credibility and deep relationships with regulated and research laboratories, where characterization and method reproducibility matter. Gold nanoparticle demand links to assay development, nanomaterial analysis, and advanced measurement needs. Share is 4%. Continued focus on lab productivity and validated workflows supports steady adoption across segments.

- Sartorius AG: Sartorius is strongest where quality systems, documentation, and reproducibility drive procurement, benefiting from trust in regulated life science environments. Gold nanoparticles align indirectly through bioscience research and workflow consumables that emphasize consistency. Share is 3%. Growth is supported by lab standardization trends and customers prefer fewer qualified vendors.

Gold Nanoparticles Market Companies

Major players operating in the gold nanoparticles industry include:

- Cytodiagnostics Inc.

- nanoComposix

- BBI Solutions

- Merck KGaA

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Sartorius AG

- Agilent Technologies, Inc.

- PerkinElmer, Inc.

- Luminex Corporation

- Tanaka Precious Metals

- AMETEK, Inc.

- Strem Chemicals, Inc.

- Nanopartz Inc.

- Meliorum Technologies, Inc.

- Goldsol, Inc.

Gold Nanoparticles Industry News

- In 2025, Thermo Fisher Scientific Inc. expanded its gold nanoparticle portfolio with more application-ready surface chemistries, improving conjugation consistency for diagnostics and biosensors. The update strengthened regulated workflow adoption and reduced batch variability concerns for IVD developers.

- In 2024, Danaher Corporation announced capacity or distribution expansion impacting nanoparticle-enabled assay components, improving lead times and regional availability. This supported scaling of lateral flow and rapid immunoassay manufacturing beyond pandemic-driven demand.

This gold nanoparticles market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2026 to 2035, for the following segments:

Market, By Product

- Spheres

- Rods

- Shells

- Cages

- Stars

- Triangles and prisms

- Other

Market, By Size Range

- Less than 10 nm

- 10 nm to 30 nm

- 31 nm to 50 nm

- 51 nm to 100 nm

- More than 100 nm

Market, By End Use Industry

- Healthcare and life sciences

- In vitro diagnostics

- Imaging and contrast agents

- Drug delivery and therapeutics

- Biosensors

- Research and laboratory use

- Electronics and photonics

- Conductive inks

- Displays and optoelectronics

- Plasmonic devices

- Photothermal and optical components

- Chemicals and materials

- Catalysts

- Coatings and composites

- Energy and environment

- Solar and fuel cell applications

- Water treatment and environmental sensing

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Which region leads the gold nanoparticles market?

North America led the market with USD 2.2 billion revenue in 2025. Its dominance is driven by strong life science R&D ecosystems, high diagnostics demand, and early adoption of application-ready and regulated nanoparticle solutions.

Who are the key players in the gold nanoparticles market?

Key players include Thermo Fisher Scientific, Merck KGaA, Danaher Corporation, Agilent Technologies, Sartorius AG, PerkinElmer, nanoComposix, BBI Solutions, and Cytodiagnostics.

What are the upcoming trends in the gold nanoparticles industry?

Key trends include standardization of quality and traceability, growth in application-ready and turnkey bioconjugates, expanding use in photothermal therapy and targeted drug delivery, and increased adoption of gold nanoparticles in electronics and photonics applications.

What is the projected value of the gold nanoparticles market by 2035?

The market size for gold nanoparticles is expected to reach USD 19.2 billion by 2035, growing at a CAGR of 11.8%. This expansion is fueled by growth in nanomedicine research, plasmonics-based technologies, biosensing applications, and scalable surface functionalization techniques.

How much revenue did the spheres product segment generate in 2025?

The spheres segment accounted for approximately 44% of the market in 2025, making it the largest product category. Strong demand for scalable, reproducible formats in diagnostics, labeling, and routine assay manufacturing supports segment leadership.

What was the valuation of the 10 nm to 30 nm size range segment in 2025?

The 10 nm to 30 nm size range segment held around 38% share in 2025, driven by its optimal balance of optical performance, colloidal stability, and bioconjugation suitability for diagnostic and research applications.

What is the growth outlook for the healthcare and life sciences segment from 2025 to 2035?

The healthcare and life sciences segment is projected to grow at a CAGR of 14.1% through 2035. Increasing use of gold nanoparticles in diagnostics, biosensors, imaging, and early-stage therapeutics is driving sustained market expansion.

What is the gold nanoparticles market size in 2025?

The gold nanoparticles industry is valued at USD 6.4 billion in 2025. Rising demand from diagnostics, biosensors, and life science research, along with expanding nanomedicine pipelines, supports continued market growth.

What is the market size of the gold nanoparticles industry in 2026?

The market size for gold nanoparticles reached USD 7.1 billion in 2026, reflecting steady expansion driven by increased adoption in diagnostics, translational research, and advanced materials applications.

Gold Nanoparticles Market Scope

Related Reports