Summary

Table of Content

Field Service Management Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Field Service Management Market Size

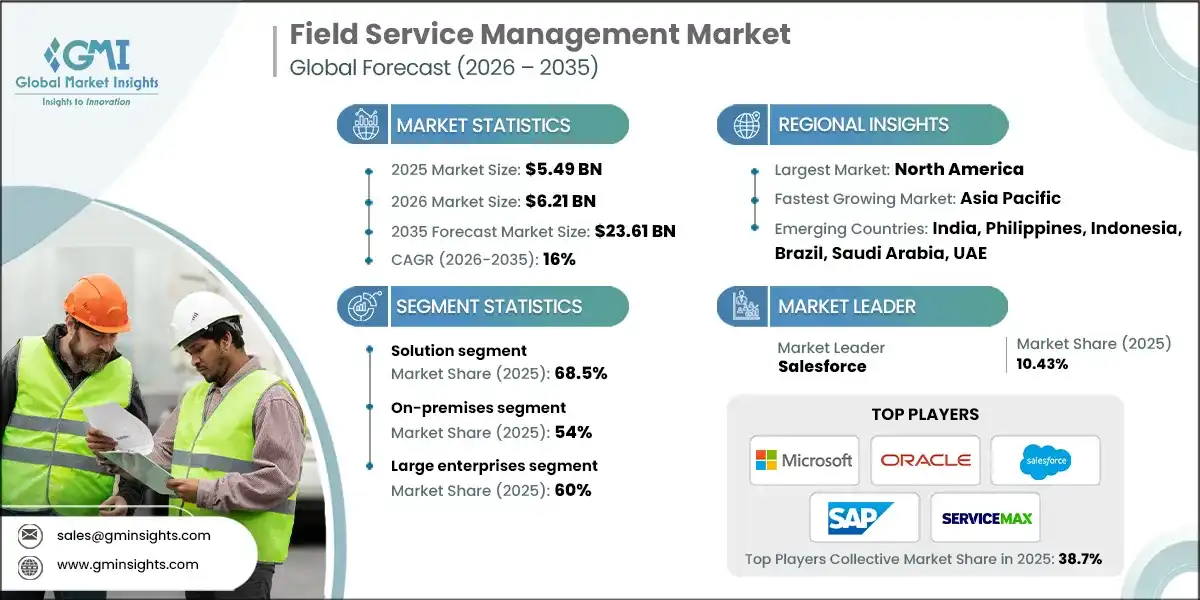

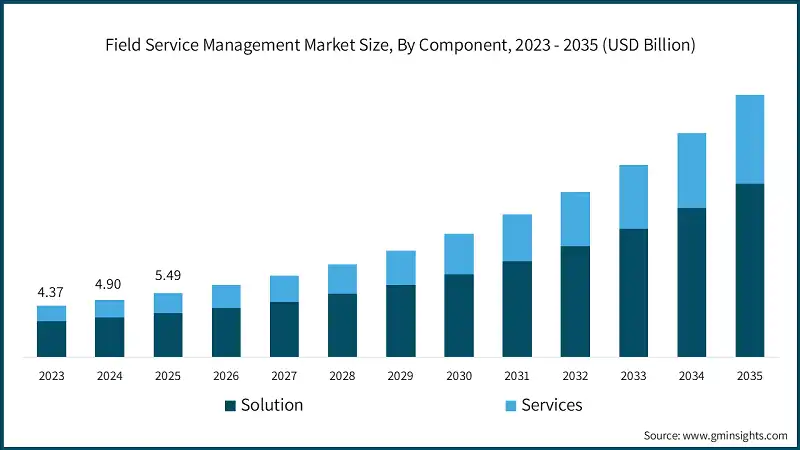

The global field service management market size was estimated at USD 5.49 billion in 2025. The market is expected to grow from USD 6.21 billion in 2026 to USD 23.61 billion in 2035, at a CAGR of 16%, according to latest report published by Global Market Insights Inc.

To get key market trends

The accelerating shift toward digital-first operations, intelligent workforce automation, and connected asset ecosystems is redefining the field service management (FSM) market. Modern FSM platforms integrate mobile workforce applications, AI-driven scheduling engines, IoT-enabled asset diagnostics, and cloud-native service orchestration. These capabilities allow enterprises to reduce service downtime, enhance technician productivity, improve first-time fix rates, and strengthen customer experience benchmarks.

Industries including utilities, telecom, manufacturing, HVAC, healthcare, and oil & gas are rapidly adopting FSM solutions to meet rising service expectations, comply with safety regulations, and modernize decentralized field operations. This transition eliminates manual paperwork, minimizes dispatch inefficiencies, supports predictive maintenance, and elevates overall service delivery outcomes.

For instance, in January 2024, Zuper raised a Series A funding round to accelerate product development and global expansion. The investment highlights strong confidence in cloud-native FSM platforms, supporting Zuper’s mobile-first design, rapid deployment model, offline capabilities, and flexible pricing strategy.

Strategic investments, platform consolidation, and technology partnerships are shaping the evolution of the FSM landscape. Leading FSM providers and industrial technology companies are developing advanced field automation suites, integrating AI copilots, low-code customization, augmented reality (AR) support tools, and real-time asset monitoring capabilities. IoT device manufacturers, cloud hyperscalers, and ERP vendors are jointly creating interoperable ecosystems that support seamless technician dispatching, workflow automation, digital documentation, and remote troubleshooting.

For example, in 2024, several global FSM vendors partnered with cloud service providers to deploy scalable multi-tenant architectures and integrate generative AI assistants for automated job planning, knowledge retrieval, and customer communication workflows.

The strong adoption of FSM platforms is driven by rising service complexity, the need to optimize workforce efficiency, increasing equipment digitalization, and growing customer demand for faster resolutions. Digital field service operations offer long-term benefits through reduced operational costs, improved asset up time, and enhanced visibility into technician performance. AI-augmented service systems can now auto-assign jobs based on skill, location, and priority, predict asset failures, and help organizations comply with SLA timelines without manual intervention.

FSM solutions are also expanding rapidly in after-sales service, industrial maintenance, healthcare equipment servicing, and construction site management. Enterprises are deploying mobile applications, intelligent routing engines, digital forms, remote support tools, AR-guided repair workflows, and cloud dashboards to enhance safety, reduce field operating costs, and streamline service documentation. This integrated digital environment improves technician efficiency, reduces time-to-resolution, and strengthens long-term customer retention.

North America and Europe represent high-value FSM markets due to advanced digital infrastructure, strong enterprise IT spending, and mature adoption of cloud and mobile service management platforms. Regulatory pressure for safety compliance, asset reliability, and workforce monitoring further accelerates uptake. Key areas of innovation include AI-driven dispatching, AR-based remote assistance, predictive maintenance engines, and unified service lifecycle management.

The Asia-Pacific region shows the fastest growth potential, driven by rapid industrialization, infrastructure investments, digital transformation initiatives, and workforce expansion. Countries such as China, India, Japan, and South Korea are adopting mobile-first FSM platforms, IoT-enabled asset health monitoring, and flexible service delivery models for telecom, utilities, manufacturing, and smart building management. Increasing penetration of affordable cloud solutions and government-backed digital initiatives further strengthen FSM adoption across APAC.

Field Service Management Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 5.49 Billion |

| Market Size in 2026 | USD 6.21 Billion |

| Forecast Period 2026 - 2035 CAGR | 16% |

| Market Size in 2035 | USD 23.61 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increase in equipment complexity requires advanced field service solutions. | Industrial equipment, telecom infrastructure, medical devices, and smart home systems are becoming more complex. Companies require FSM platforms to standardize maintenance workflows, automate diagnostics, and ensure skilled technician deployment. The rising complexity pushes organizations to adopt digital service tools to maintain uptime, reduce errors, and support equipment reliability. |

| Rise in predictive maintenance adoption across industrial sectors. | Industries are shifting from reactive and preventive maintenance to predictive service models supported by IoT and AI analytics. FSM platforms help identify early failure signs, schedule maintenance precisely, and reduce costly unplanned downtime. This shift drives strong adoption of FSM solutions across manufacturing, energy, utilities, and transportation sectors. |

| Surge in demand for faster service resolution and SLA compliance. | Businesses rely on FSM platforms to meet tight service-level agreements, minimize customer wait times, and improve first-time fix rates. Automated scheduling, digital diagnostics, and real-time technician tracking enable faster service cycles. As customer expectations rise, companies increasingly adopt FSM to enhance reliability and service quality. |

| Increase in digital transformation initiatives in utilities, telecom, and manufacturing. | Large industries are investing in digital service automation to modernize workflows, optimize technician routing, and gain real-time operational insights. FSM platforms integrate with SCADA, ERP, and CRM systems to support seamless service operations. These digital transformation efforts accelerate FSM adoption across critical sectors with large field teams. |

| Pitfalls & Challenges | Impact |

| Complexities in the Existing CRM or ERP Systems | Integrating FSM solutions with legacy CRM or ERP systems often creates significant technical challenges. Older platforms lack standardized APIs, leading to data inconsistencies, workflow disruptions, and higher customization costs. These complexities slow deployment, hinder real-time data flow, and discourage small and mid-sized enterprises from adopting advanced FSM platforms, limiting overall market growth. |

| Insufficient Skilled Technicians | A shortage of trained field technicians capable of using digital tools slows FSM adoption. Many technicians struggle with mobile apps, analytics dashboards, or IoT-enabled systems, reducing operational efficiency. Companies must invest heavily in training and skill development, increasing implementation costs and delaying ROI. This talent gap remains a major barrier to scaling FSM solutions. |

| Opportunities: | Impact |

| Surge in adoption of AI copilots and generative AI for field automation | AI copilots can auto-generate work summaries, troubleshoot issues, recommend repair steps, and optimize job assignments. Generative AI reduces administrative burden and improves accuracy in diagnostics and reporting. As companies shift toward automated service operations, generative AI offers significant opportunities to boost productivity and technician efficiency. |

| Increase in IoT-connected asset installations driving predictive service opportunities | Growing deployment of IoT-enabled equipment across factories, buildings, logistics, and utilities generates rich operational data. FSM platforms can use these insights to automate service triggers, optimize spare part usage, and schedule repairs in advance. This rapidly expanding IoT ecosystem creates vast opportunities for predictive service models. |

| Rise in remote and autonomous maintenance tools, including drones and AR support | Remote service tools enable technicians to diagnose and solve problems without visiting the site. Drone inspections, sensor-based monitoring, and AR-enabled guidance reduce travel costs and expedite issue resolution. This opportunity supports companies managing dispersed assets such as pipelines, solar farms, telecom towers, and industrial sites. |

| Growing demand for cost-effective cloud FSM solutions in emerging markets | Small and mid-sized enterprises in Asia-Pacific, Africa, and Latin America are adopting low-cost cloud FSM platforms to digitize field operations. Cloud-based tools offer scalability, easy onboarding, and reduced IT investments. This creates significant opportunities for SaaS vendors to expand their penetration in emerging high-growth regions. |

| Market Leaders (2025) | |

| Market Leaders |

10.43 % market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, Philippines, Indonesia, Brazil, Saudi Arabia, UAE |

| Future outlook |

|

What are the growth opportunities in this market?

Field Service Management Market Trends

AI-powered FSM platforms are transforming workforce planning by analyzing technician skills, job priority, traffic conditions, and historical data to automate dispatching. This ensures faster job completion, fewer delays, and better SLA compliance. Companies increasingly rely on intelligent scheduling engines to reduce operational waste and improve customer satisfaction through real-time optimization.

For instance, in February 2025, PTC Launches ServiceMax AI enables technicians to automatically reschedule appointments, automate documentation, review asset history, get predictive-maintenance guidance, and use a chat-based interface to get job-specific answers aiming to boost technician productivity, reduce manual work and streamline field operations.

IoT sensors embedded in industrial equipment, utilities, telecom towers, HVAC systems, and machinery enable continuous monitoring of asset health. FSM platforms use this data to predict failures before they occur. This trend reduces downtime, minimizes maintenance costs, and shifts organizations toward proactive, rather than reactive, field service strategies.

Enterprises are adopting mobile field service apps to empower technicians with work orders, manuals, diagnostics, and parts availability while on-site. Mobile-first FSM enhances productivity by ensuring real-time communication, digital reporting, and instant customer updates. This shift is essential for organizations seeking faster response times and streamlined service workflows.

Augmented and virtual reality tools allow technicians to receive real-time expert assistance and hands-on training from remote specialists. AR overlays guide on-site repairs, while VR simulations help new technicians practice complex tasks safely. This trend reduces travel expenses, accelerates issue resolution, and supports scalable workforce skill development.

Field Service Management Market Analysis

Learn more about the key segments shaping this market

Based on component, the field service management market is divided into solution and services. The solution segment dominated the market, accounting for around 68.5% in 2025 and is expected to grow at a CAGR of more than 15.5% through 2035.

- The solution segment dominates the field service management (FSM) industry because organizations increasingly rely on advanced software platforms to streamline scheduling, work order management, asset tracking, and technician productivity. FSM solutions integrate AI, IoT, GPS, and automation tools that significantly reduce operational inefficiencies and improve first-time fix rates. As enterprises scale, they prioritize unified digital platforms over manual or fragmented processes, driving strong adoption of FSM solutions across manufacturing, utilities, telecom, energy, and healthcare.

- Additionally, FSM solutions enable predictive maintenance, real-time field visibility, compliance tracking, and customer-experience enhancement of all critical priorities for service-driven businesses. The integration of cloud-based platforms further accelerates adoption by offering flexibility, faster deployment, lower upfront costs, and seamless mobility for technicians. This makes solutions the core revenue driver of the FSM market.

- In April 2025, Salesforce announced expansion of its field-service capabilities via Salesforce Field Service, offering AI-driven dispatch automation, real-time asset monitoring, and improved on-site service workflows.

- The service segment will grow at a CAGR of over 16.9% due to the accelerating shift toward cloud-based deployments, AI-enabled support, and outsourced service optimization. Companies across utilities, telecom, manufacturing, and healthcare increasingly rely on third-party service providers to enhance technician productivity, modernize legacy workflows, and enable 24/7 remote support. The demand for implementation, integration, training, and consulting services is rising as organizations adopt complex FSM platforms and require expert support to ensure seamless interoperability with ERP, CRM, IoT, and asset-management systems.

Learn more about the key segments shaping this market

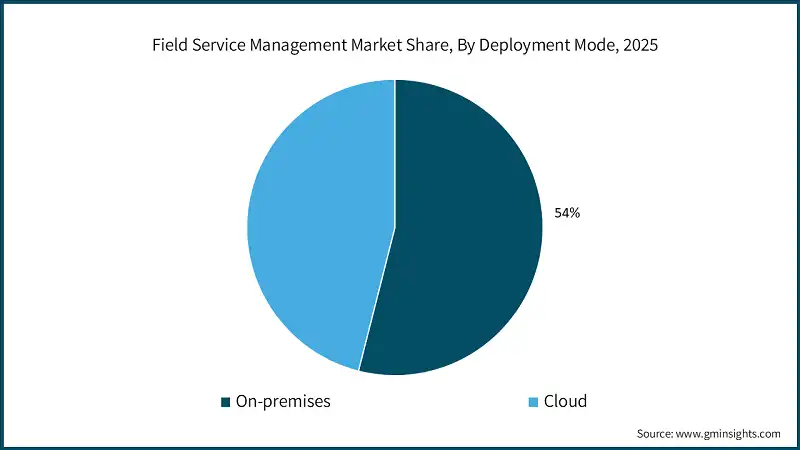

Based on deployment mode, the field service management market is segmented into On-premises, and Cloud. The On-premises segment dominates the market accounting for around 54% share in 2025, and the segment is expected to grow at a CAGR of over 15.1% from 2026 to 2035.

- The on-premises segment dominates the field service management market due to its strong appeal among industries that prioritize data security, regulatory compliance, and full system control. Sectors such as utilities, oil & gas, defense, manufacturing, and healthcare often handle mission-critical field data, sensitive asset information, and confidential operational insights. These organizations prefer on-premises FSM deployments because they allow complete ownership of servers, customizable security configurations, and strict governance aligned with internal IT policies. This ensures uninterrupted access to data, even in low-connectivity regions, and reduces the risk associated with third-party cloud vulnerabilities.

- Additionally, large enterprises with long-established IT infrastructure continue to rely on on-premises FSM systems to fully customize workflows, integrate legacy applications, and maintain predictable, one-time capital expenditures. On-premises models support highly tailored configurations, advanced technician scheduling, and integration with proprietary tools that many organizations are reluctant to shift to cloud environments. Industries operating in remote areas or locations with unstable network connectivity also favor on-premises solutions to guarantee system reliability and operational continuity.

- For instance, in May 2024, Oracle announced Oracle Cloud CX Service updates including enhanced mobile offline capabilities supporting extended field operations without connectivity, improved integration with Oracle Cloud ERP and supply chain management, AI-driven predictive maintenance recommendations, and real-time route optimization considering traffic and weather patterns.

- Cloud segment will grow at a higher rate of over 17% due to increasing adoption of SaaS-based solutions, real-time data access, and seamless scalability. Cloud platforms enable remote workforce management, predictive maintenance, and AI-driven scheduling, reducing operational costs and enhancing service efficiency. Enterprises prefer cloud deployments for faster integration and lower upfront infrastructure investment.

Based on enterprise size, the field service management market is segmented into SMEs, and large enterprises. Large enterprises segment dominates with around 60% share in 2025 due to higher IT budgets, complex operations, extensive field workforce, and greater adoption of advanced solutions for efficiency, automation, and real-time monitoring.

- The large enterprises segment is the most dominant market segment in the field service management market due to its substantial resources, extensive workforce, and complex operational requirements. These organizations typically manage large-scale service operations across multiple regions, requiring advanced FSM solutions for efficient scheduling, dispatching, and real-time monitoring. The high IT budgets of large enterprises allow them to invest in integrated platforms featuring AI, IoT, and predictive analytics, which enhance productivity, reduce downtime, and improve customer satisfaction. Additionally, these enterprises prioritize compliance, safety, and performance optimization, which further drives the adoption of sophisticated FSM tools tailored to their operational needs.

- Furthermore, large enterprises benefit from scalable FSM solutions that can support multiple departments, diverse service lines, and a global customer base. By leveraging centralized dashboards, mobile applications, and automated workflows, they streamline service delivery while reducing operational costs. Strategic partnerships with leading FSM providers ensure continuous technological upgrades and support, enabling large enterprises to maintain a competitive edge. The focus on digital transformation and real-time analytics positions large enterprises as early adopters, accelerating market growth and reinforcing their dominant share within the FSM industry.

- The SMEs segment is expected to grow with a CAGR of more than 16.7% due to increasing digital adoption, the need for operational efficiency, and rising competition among small and medium businesses. SMEs are increasingly leveraging FSM solutions to streamline scheduling, dispatch, and workforce management, enabling cost savings and faster service delivery. Cloud-based and subscription models make advanced FSM technologies more accessible, reducing upfront investment barriers.

Based on industry vertical, the field service management market is divided into energy & utilities, IT and telecom, manufacturing, healthcare, BFSI, transportation & logistics, retail and e-commerce, and others. The IT and Telecom segment dominated the field service management market.

- The IT and Telecom segments dominate the field service management (FSM) market due to its high demand for real-time service delivery, complex network maintenance, and extensive field workforce management. Telecom operators and IT service providers require efficient scheduling, dispatch, and monitoring systems to maintain uninterrupted services and minimize downtime. FSM solutions allow these companies to optimize routes, track technicians, and predict maintenance needs, ensuring faster issue resolution and enhanced customer satisfaction. The rapid expansion of broadband networks, 5G rollout, and cloud-based services has further increased the reliance on advanced FSM platforms to manage large-scale field operations effectively.

- Additionally, IT and Telecom companies are investing heavily in digital transformation initiatives. Integration of AI, IoT, and analytics into FSM systems helps in proactive troubleshooting, automated task allocation, and predictive maintenance. These technologies reduce operational costs, improve workforce productivity, and enable seamless customer support. As service level agreements (SLAs) become more stringent and customer expectations rise, FSM solutions provide a critical competitive advantage, making the IT and Telecom segment the leading adopter in the global FSM market.

- The healthcare segment is expected to grow at a CAGR of 18% due to the increasing demand for timely medical equipment maintenance, patient-centric services, and regulatory compliance. Hospitals, clinics, and diagnostic centers require efficient field service management to ensure uninterrupted operations of critical devices. Integration of IoT-enabled monitoring, predictive maintenance, and remote service scheduling enhances operational efficiency, reduces downtime, and improves patient care quality, driving the adoption of FSM solutions in the healthcare sector.

Looking for region specific data?

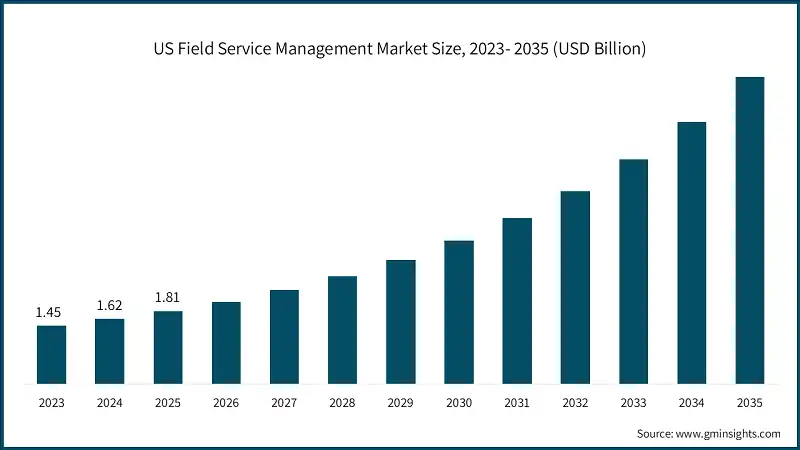

US dominated the field service management market in North America with around 85% share and generated USD 1.81 billion in revenue in 2025.

- The US field service management (FSM) market is experiencing robust growth due to the increasing adoption of digital solutions by enterprises aiming to streamline operations, reduce service response times, and enhance customer satisfaction. Organizations across industries such as IT & telecom, healthcare, and manufacturing are leveraging FSM platforms to optimize workforce scheduling, track field technicians in real time, and automated service workflows. The rise of IoT-enabled devices and predictive maintenance solutions is further driving the demand for efficient field service management systems.

- Additionally, government initiatives promoting smart infrastructure, coupled with the growing emphasis on operational efficiency and cost reduction, are accelerating FSM adoption in the US. Leading vendors like ServiceMax, Salesforce, and Oracle are expanding their cloud-based offerings, mobile applications, and AI-powered solutions, enabling companies to enhance service reliability, reduce downtime, and improve overall productivity, thereby strengthening the US FSM market.

- For instance, in September 2025, PTC expanded its service?lifecycle offerings with enhanced AI capabilities in both ServiceMax and Servigistics enabling autonomous supply?chain planning, parts forecasting and better first?time?fix rates for field operations.

- Canada is projected to grow at a significant CAGR of 17.6% due to increasing digital transformation initiatives across industries such as IT, healthcare, and manufacturing. Companies are adopting FSM solutions to enhance workforce efficiency, optimize scheduling, and improve real-time tracking of field operations.

The field service management market in Germany is expected to experience significant and promising growth from 2026-2035.

- Europe accounts for over 27% of the field service management market in 2025 and is expected to grow at a CAGR of around 15.2% driven by widespread adoption of digital solutions across industries such as manufacturing, healthcare, and utilities. Enterprises in countries like Germany, France, and the UK are increasingly integrating cloud-based FSM platforms to optimize field operations, enhance customer experience, and reduce operational costs.

- Germany is a leading market for field service management (FSM) due to its strong industrial base, particularly in manufacturing, automotive, and engineering sectors. Companies are increasingly adopting digital FSM solutions to optimize field operations, reduce downtime, and improve productivity. Advanced technologies such as AI-driven scheduling, IoT-enabled asset monitoring, and mobile workforce management are widely implemented, enabling organizations to enhance service efficiency, predictive maintenance, and customer satisfaction.

- Additionally, Germany’s emphasis on Industry 4.0, smart factories, and digital transformation drives FSM adoption. Robust IT infrastructure, high smartphone penetration, and supportive government policies for technological innovation further accelerate market growth. Leading German companies are partnering with FSM software providers to implement integrated platforms for seamless field service execution.

- For instance, in 2025, many German manufacturers (including Bosch and Siemens) rolled out IoT?based predictive?maintenance across plants, reducing downtime and boosting interest in real?time asset monitoring and service management solutions.

- The UK is emerging as a strong growth market for field service management due to increasing adoption of cloud-based service solutions, expansion of digital infrastructure, and growing demand for predictive maintenance across industries. Strong regulatory support, IoT integration, and rising focus on operational efficiency are driving organizations to implement FSM platforms for improved productivity, cost savings, and customer satisfaction.

The field service management market in China is expected to experience significant and promising growth from 2026-2035.

- Asia Pacific accounts for over 23% of the field service management market in 2025 and is expected to grow at a CAGR of around 17.8% due to rapid industrialization, increasing adoption of digital service solutions, growth in manufacturing and telecom sectors, and rising demand for real-time asset monitoring, predictive maintenance, and enhanced operational efficiency across enterprises.

- China leads the field service management (FSM) market due to its rapidly expanding industrial and manufacturing sectors, widespread digital transformation initiatives, and strong government support for smart technologies. Enterprises are increasingly adopting FSM solutions to enhance operational efficiency, monitor equipment in real time, and streamline service workflows. Advanced technologies such as AI, IoT, and cloud-based platforms are enabling predictive maintenance, automated scheduling, and improved customer service, giving Chinese companies a competitive advantage in service delivery.

- Additionally, the growing focus on urban infrastructure, logistics, and telecom network expansion drives the need for efficient field operations. Partnerships between technology providers and large enterprises further accelerate FSM adoption, ensuring cost optimization, workforce productivity, and enhanced service quality.

- India is becoming one of the fastest-growing markets in the field service management sector due to rapid digitalization, expanding telecom and IT services, and increasing adoption of cloud-based and mobile FSM solutions. Companies are leveraging AI-driven scheduling, real-time tracking, and predictive maintenance to enhance operational efficiency.

The field service management market in Brazil is expected to experience significant and promising growth from 2026 to 2035.

- Latin America holds around 7% of the field service management market in 2025 and is growing steadily at a CAGR of around 14.2% due to the modernization of utilities, telecom, and industrial services. Companies are increasingly adopting cloud-based and mobile FSM solutions to enhance workforce productivity and reduce service delays.

- Brazil dominates the field service management market in Latin America due to its large and diversified industrial base, including energy, telecommunications, and manufacturing sectors. Companies in Brazil are increasingly implementing FSM solutions to optimize workforce management, reduce service turnaround times, and enhance operational efficiency. Cloud-based and mobile FSM platforms are being widely adopted to support real-time service tracking and predictive maintenance, enabling organizations to respond quickly to service demands.

- Additionally, Brazil’s government initiatives promoting digital transformation and smart infrastructure development are accelerating the adoption of FSM solutions. Strategic partnerships between local service providers and global FSM software vendors are also driving market growth. Increasing urbanization and the need for efficient field operations further strengthen Brazil’s leading position in the region.

- The field service management market in Mexico is experiencing high growth due to rapid industrialization, expansion of the telecommunications and energy sectors, and increasing adoption of digital solutions for workforce and service optimization. Companies are investing in cloud-based and mobile FSM platforms to enhance operational efficiency, reduce service delays, and improve customer satisfaction.

The field service management market in UAE is expected to experience significant and promising growth from 2026 to 2035.

- MEA holds around 4% of the field service management market in 2025 and is growing steadily at a CAGR of around 12.1% due to rapid infrastructure development, expansion of oil & gas and utility sectors, and increasing digitalization initiatives. Companies are adopting cloud-based FSM solutions to enhance workforce efficiency, reduce operational costs, and improve service delivery in remote and urban locations.

- The UAE dominates the MEA field service management (FSM) market due to its rapid infrastructure development, smart city initiatives, and strong focus on digital transformation across sectors such as utilities, oil & gas, and transportation. Companies in the UAE are increasingly adopting FSM solutions to enhance operational efficiency, optimize field workforce management, and deliver superior customer service. Cloud-based and mobile-enabled FSM platforms are gaining traction, enabling real-time monitoring, predictive maintenance, and automated scheduling for service operations.

- Moreover, government-led programs promoting innovation, smart grids, and IoT integration are accelerating FSM adoption in the UAE. Strategic collaborations between local enterprises and global FSM technology providers are supporting seamless deployment, reducing downtime, and improving productivity across industries.

- Saudi Arabia is expected to grow at the fastest CAGR in the MEA field service management (FSM) market owing to its ambitious Vision 2030 initiatives, rapid industrialization, and digital transformation across oil & gas, utilities, and logistics sectors. Companies are increasingly deploying FSM solutions to optimize field operations, enhance workforce productivity, and ensure timely service delivery.

Field Service Management Market Share

- The top 7 companies in the field service management industry are Oracle, Salesforce, Microsoft, ServiceMax, SAP, Jobber, and Housecall Pro contributed around 42.1% of the market in 2025.

- Oracle focuses on strengthening its unified cloud ecosystem by integrating FSM deeply with its ERP, SCM, and CX platforms. Its strategy centers on AI-driven scheduling, predictive maintenance, and automation to streamline field workflows. Oracle is expanding industry-specific FSM capabilities for utilities, manufacturing, and telecom. Continuous enhancements in mobile tools, analytics, and IoT connectivity help Oracle position FSM as part of a broader digital operations suite.

- Salesforce leverages its dominant CRM ecosystem to expand Field Service offerings through Service Cloud, Einstein AI, and industry-focused modules. Its strategy emphasizes connecting customer engagement with field operations for seamless service experiences. Salesforce invests in AI-powered scheduling, mobile technician tools, and integrated customer communication. Strengthening low-code customization, ecosystem integrations, and vertical-specific solutions are key pillars driving its FSM growth across global service-centric enterprises.

- Microsoft’s strategy centers on leveraging Dynamics 365 Field Service integrated with Azure IoT, AI, and cloud analytics. The company focuses on enabling remote monitoring, predictive maintenance, and intelligent resource scheduling. Deep integration with Teams and Microsoft 365 strengthens collaboration between office and field workers. Microsoft continues expanding vertical-specific FSM modules while promoting scalable, secure, and adaptable cloud solutions to support digital service transformation across industries.

- ServiceMax continues positioning itself as a specialist in asset-centric field service, focusing on maximizing uptime and asset performance. Its strategy includes expanding predictive service capabilities through IoT integration and analytics. ServiceMax invests heavily in mobile-first field tools, contractor management, and complex work order automation. The company also strengthens partnerships, particularly in manufacturing, medical devices, and industrial equipment, to deliver deep industry-tailored FSM solutions.

- SAP’s FSM strategy is built around tight integration with SAP S/4HANA, ERP, and supply chain systems to deliver end-to-end service management. It prioritizes real-time inventory visibility, AI-enhanced scheduling, and mobile technician enablement. SAP expands its capabilities in connected asset management, predictive service, and field logistics. The company continues to enhance cross-industry modules, ensuring large enterprises benefit from unified data flow across service, operations, and finance.

- Jobber focuses on empowering small service businesses such as HVAC, cleaning, plumbing, and home services through simple, affordable, and mobile-friendly FSM solutions. Its strategy emphasizes ease of use, workflow automation, online booking, quoting, invoicing, and customer communication. Jobber continues expanding integrations with payment platforms, marketing tools, and accounting software. The company aims to grow by simplifying field operations for SMEs and improving customer engagement tools

- Housecall Pro targets home service professionals with an all-in-one FSM platform focused on job scheduling, dispatching, payments, and customer communication. Its strategy centers on mobile-first usability, embedded financial services, online booking, and customer experience tools. The company emphasizes community-driven product evolution and strong contractor support programs. Feature expansion into CRM, automated marketing, and job costing helps Housecall Pro strengthen its leadership in the home services segment.

Field Service Management Market Companies

Major players operating in the field service management industry are:

- Housecall

- IFS

- Jobber

- Microsoft

- Oracle

- Salesforce

- SAP

- ServiceMax

- Zinier

- Trimble

- Field service management providers are increasingly integrating IoT, mobile platforms, AI-driven scheduling, and remote diagnostics to create intelligent, connected service ecosystems. Real-time asset monitoring, AR-assisted repairs, automated workflow routing, and predictive maintenance models help technicians resolve issues faster and reduce downtime. Cloud-based FSM platforms connect field teams with centralized systems, improving visibility, productivity, and customer experience while enabling data-driven decision-making across service operations.

- Growing partnerships between FSM vendors, equipment manufacturers, telecom operators, and cloud providers are accelerating advancements in connected service delivery. These collaborations support interoperable platforms, industry-specific integrations, and enhanced mobile capabilities. Joint innovation in 5G, edge computing, and digital twins is reshaping field operations, enabling fully connected service networks that offer proactive maintenance, optimized resource utilization, and seamless service-to-enterprise data flow worldwide.

Field Service Management Industry News

- In October 2024, Salesforce introduced Connected Assets for Manufacturing Cloud, offering real-time visibility by unifying telematics, IoT, customer, and service data. New AI features support predictive maintenance, automated alerts, and sensor insights. Kawasaki Engines adopted the solution, reflecting rising industry demand for proactive, data-driven service models powered by connected assets and artificial intelligence.

- In September 2024, ServicePower launched enhanced AI scheduling tools using machine learning to optimize technician deployment based on skills, location, traffic, weather, and job urgency. Early users reported significant productivity gains, including more complete jobs and reduced travel time. The update highlights increasing industry focus on AI differentiation and measurable service efficiency improvements.

- In August 2024, Microsoft expanded Dynamics 365 Field Service with deeper Azure IoT integration, improved offline mobile capabilities, enhanced scheduling algorithms, and mixed-reality support via HoloLens. The updates strengthen predictive maintenance and remote assistance workflows, reinforcing Microsoft’s strategy of ecosystem integration and AI-driven optimization for manufacturing, utilities, and telecom field operations.

- In July 2024, IFS released Cloud 24R1 featuring AI-enabled work order routing, predictive parts forecasting, upgraded AR remote assistance, and sustainability monitoring. The update gained traction in European utilities adopting predictive maintenance models. Flexible modular deployment allows customers to activate targeted capabilities, reflecting IFS’s focus on vertical depth and configurable enterprise service platforms.

- In June 2024, ServiceTitan reached USD 1 billion in annual recurring revenue, driven by strong adoption among residential service contractors. New enhancements include improved offline mobile tools, AI-powered customer communication, expanded financing options, and technology acquisitions to strengthen dispatching. The milestone underscores growing FSM demand in home services and the success of vertical-focused platforms.

- In May 2024, Oracle introduced Cloud CX Service updates featuring enhanced mobile offline support, improved ERP and supply chain integration, AI-based maintenance recommendations, and real-time route optimization. The enhancements address needs in oil and gas, utilities, and telecom sectors, emphasizing scalability, deep integration, and industry-specific capabilities for large, distributed field operations.

The field service management market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($Bn), from 2022 to 2035, for the following segments:

Market, By Component

- Solution

- Mobile field execution

- Service contract management

- Warranty management

- Workforce management

- Customer management

- Inventory management

- Others

- Services

- Implementation

- Training & support

- Consulting & advisory

Market, By Deployment Mode

- On-premises

- Cloud

Market, By Enterprise Size

- SME

- Large Enterprises

Market, By Industry Vertical

- Energy & utilities

- IT and Telecom

- Manufacturing

- Healthcare

- BFSI

- Transportation & logistics

- Retail and E-commerce

- Others

Market, By Application

- Work Order Management

- Contract Management

- Mobile Workforce Management

- Asset Management

- Fleet Monitoring

- Others

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Philippines

- Indonesia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the field service management industry?

Key players include Housecall, IFS, Jobber, Microsoft, Oracle, Salesforce, SAP, ServiceMax, Zinier, and Trimble.

What was the market share of the on-premises segment in 2025?

The on-premises segment held a 54% market share in 2025 and is set to expand at a CAGR of over 15.1% till 2035.

Which region dominated the field service management sector?

The United States dominated the North American market with an 85% share, generating USD 1.81 billion in revenue in 2025.

What are the upcoming trends in the field service management market?

Key trends include AI-powered workforce planning, IoT-enabled predictive maintenance, mobile-first FSM applications, and the integration of augmented and virtual reality tools for technician training and support.

How much revenue did the solution segment generate in 2025?

The solution segment accounted for approximately 68.5% of the market share in 2025 and is expected to grow at a CAGR of over 15.5% through 2035.

What is the expected size of the field service management industry in 2026?

The market size is projected to reach USD 6.21 billion in 2026.

What was the market size of the field service management in 2025?

The market size was USD 5.49 billion in 2025, with a CAGR of 16% expected through 2035. The shift toward digital-first operations, intelligent workforce automation, and connected asset ecosystems is driving market growth.

What is the projected value of the field service management market by 2035?

The market is poised to reach USD 23.61 billion by 2035, driven by advancements in AI-driven scheduling, IoT-enabled diagnostics, and cloud-native service orchestration.

Field Service Management Market Scope

Related Reports