Summary

Table of Content

Fermented Protein Hydrolysates Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Fermented Protein Hydrolysates Market Size

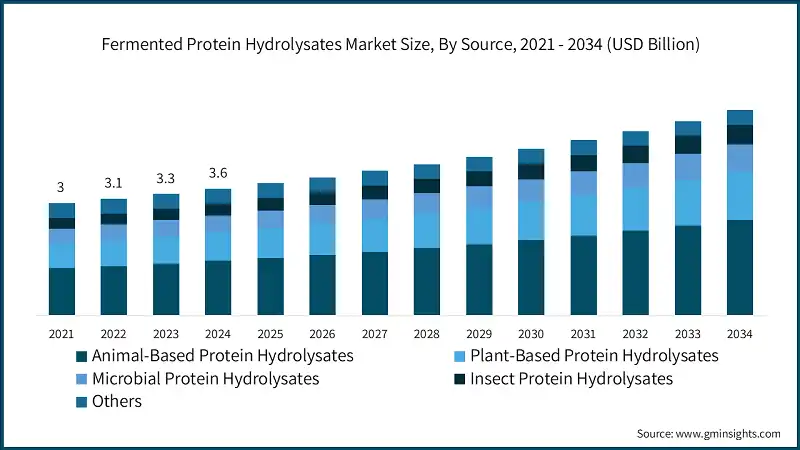

The global fermented protein hydrolysates market size was valued at USD 3.6 billion in 2024. The market is expected to grow from USD 3.9 billion in 2025 to USD 8.7 billion in 2034, at a CAGR of 9.4% according to latest report published by Global Market Insights Inc.

To get key market trends

- The soaring focus on health and wellness has created a global market of about USD 12-15 billion in demand for functional foods and dietary supplements using bioactive protein hydrolysates. Protein hydrolysates are associated with diverse bioactive events, including antioxidant, antimicrobial, antihypertensive (ACE-inhibitory), immunomodulatory, and anti-inflammatory effects. Evidence in support of these health benefits is substantiated through clinical findings and meta-analyses suggesting antihypertensive capability from consumption of 3-5 grams per day of bioactive peptides.

- The additive status for food for protein hydrolysates is acknowledged by WHO and it is expected that a safety assessment will be determined by the Joint FAO/WHO Expert committee on Food Additives to set value for Acceptable Daily Intake levels to push the market activities of protein hydrolysates. For instance, Calpis commercial products carry VPP and IPP tripeptides, and their treatments reported a blood pressure-lowering effect on mildly hypertensive subjects, confirming the application of fermented protein hydrolysates as functional foods.

- This contribution is expected to grow the fermented protein hydrolysate market. Such an increase will come mainly from animal feeds, particularly in aquaculture and livestock industries. The production of aquaculture around the world reached a record volume of 130.9 million metric tons in 2022, surpassing capture fisheries for the first time. According to the Food and Agriculture Organization, 89% of aquatic animals produced for fisheries purpose are for direct human consumption while the rest, mainly converted into fish meals and fish oils, create by-product streams which can be directly qualified for protein hydrolysate production.

- At inclusion levels between 2% and 8%, protein hydrolysates improve growth performance, feed efficiency, gut resistance, and disease resistance in weaned pigs, young calves, post-hatch poultry, and fish species.

Fermented Protein Hydrolysates Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 3.6 Billion |

| Market Size in 2025 | USD 3.9 Billion |

| Forecast Period 2025 - 2034 CAGR | 9.4% |

| Market Size in 2034 | USD 8.7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising Global Health Consciousness and Demand for Functional Foods | Increasing awareness of health benefits propels consumer preference for functional foods containing fermented protein hydrolysates. |

| Expansion of Animal Feed Industry in Aquaculture and Livestock Sectors | Growing demand for nutritious, digestible feed ingredients drives the adoption of fermented protein hydrolysates in animal nutrition. |

| Regulatory Support for Natural Ingredients and Clean-Label Products | Favorable policies promoting natural, minimally processed ingredients boost market acceptance of fermented protein hydrolysates. |

| Pitfalls & Challenges | Impact |

| High Production Costs Associated with Fermentation and Hydrolysis Processes | Elevated manufacturing expenses hinder large-scale adoption and market penetration. |

| Opportunities: | Impact |

| Expanding Applications in Infant Nutrition | Increasing use of fermented protein hydrolysates in infant formulas offers significant growth potential due to their digestibility and hypoallergenic properties. |

| Market Leaders (2024) | |

| Market Leaders |

13.1% market share |

| Top Players |

Collective market share is 52% in 2024 |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | China, India, Japan |

| Future Outlook |

|

What are the growth opportunities in this market?

Fermented Protein Hydrolysates Market Trends

- Precision Fermentation and Synthetic Biology Advances- Events in the fields of precision fermentation and synthetic biology-precision fermentation promotes a paradigm shift for the production of protein hydrolysates. Renowned genetically engineered microorganisms are used nowadays to manufacture protein ingredients of specific functionality and higher purity. Recombinant DNA techniques, CRISPR-Cas9 gene editing, and synthetic biology methods increasingly optimize a variety of microbial hosts such as Komagataella phaffii, Trichoderma reesei, and Saccharomyces cerevisiae for enhanced protein secretion, stress tolerance, and metabolic flux toward the desired products.

- In a series of decisions made on Generally Recognized as Safe status for the precision-germinated proteins, GRN 863 was assigned to Perfect Day's beta-lactoglobulins in 2020, with further approvals given for whey proteins until 2024-2025, thus paving regulatory pathways for commercialization.

- Circular Economy and By-Product Valorization- Principles of the circular economy are transforming fermented protein hydrolysate production by valorizing agro-industrial and seafood processing by-products. The Food and Agriculture Organization is promoting fish silage and dried by-product powders, as well as inexpensive fermentation technologies, for the conversion of processing wastes into nutritional protein ingredients so that economic value can be gained and waste reduced. Approximately 60% of waste in fish processing is classified as by biomass, which varies from heads, skins, viscera, bones, and liver that can be enzymatically converted into protein hydrolysates high in amino acids, antioxidants, and bioactive peptides.

- Solutions developed by Indonesia's National Research and Innovation Agency that convert fish waste into protein hydrolysate potentially applicable as peptone for cultured meat applications are illustrative of cross-sectoral innovations.

- Advanced Bioprocessing and Process Analytical Technology- Intensification of bioprocesses via advanced fermentation systems and Process Analytical Technology ensures product quality and improved economics. Sensor-integrated bioreactors enable real-time process control and increased consistency from batch to batch by monitoring parameters such as pH, temperature, dissolved oxygen, and biomass continuously with fluorescence, turbidimetry, and thread-based microprobes. Raman spectroscopy aided by machine learning has achieved more than 90% reduction in model training time and improved root mean square error in the prediction of ethanol, glycerol, and biomass, enabling inline quality control.

Fermented Protein Hydrolysates Market Analysis

Learn more about the key segments shaping this market

- Microbial protein hydrolysates held 68.5% of the fermented protein hydrolysates market share in 2024 due to the current established fermentation infrastructure, regulatory acceptance, and scalability of production economics. Among the microbial sources are bacteria, yeasts, filamentous fungi, and microalgae, each with protein content ranging from 30% to 80% on dry weight basis according to the organism and type. The biomass of Yarrowia lipolytica received EFSA novel food approval in 2019, and some metabolites derived by Y. lipolytica are GRAS by FDA, thus showing regulatory pathways for commercialization.

- Quorn mycoprotein from the filamentous fungus Fusarium venenatum reserves for itself the title of commercially successful microbial protein and has been in the marketplace since 1985. Its amino acid profile is like chicken with PDCAAS approaching microbial biomass fermentation with proteolytic enzymes or fermentation-assisted hydrolysis provides peptides with outstanding solubility, excellent emulsification, foaming, and gelation properties for versatile applications in food industry.

- Animal-based protein hydrolysates held 14.1% of the fermented protein hydrolysates market share in 2024, owing to availability of a huge amount of raw materials from seafoods and animal processing. Out of this enormous quantity of animal by-product suitable for hydrolysate production, approximately 54 billion kilograms comes from the livestock and poultry, while another 6 billion kilograms consist of processed fish.

- They represent from 33% up to 49% of live weight, depending on the species. Fish processing can leave up to 57% of raw material after filleting, comprising all the muscle trimmings, skins, fins, bones, heads, viscera, and scales, which can be hydrolyzed by enzymes into bioactive peptides possessing antioxidant, ACE-inhibitory and antimicrobial properties.

- European Union Regulation No. 1069/2009 mandates specified uses of animal by-products, with only Category 3 materials considered suitable for further processing and approved for food applications. This creates regulatory constraints but increases assurance of quality. It is a well-known fact that dairy proteins entered into the market as commercial protein hydrolysates obtained from whey and casein, with particular whey protein hydrolysates from Fonterra Co-operative Group Ltd. (January 2025) and FrieslandCampina Nederland B.V. admissible by EFSA for infant and follow-on formula with minimum uses of 2.0-2.4 g protein.

Learn more about the key segments shaping this market

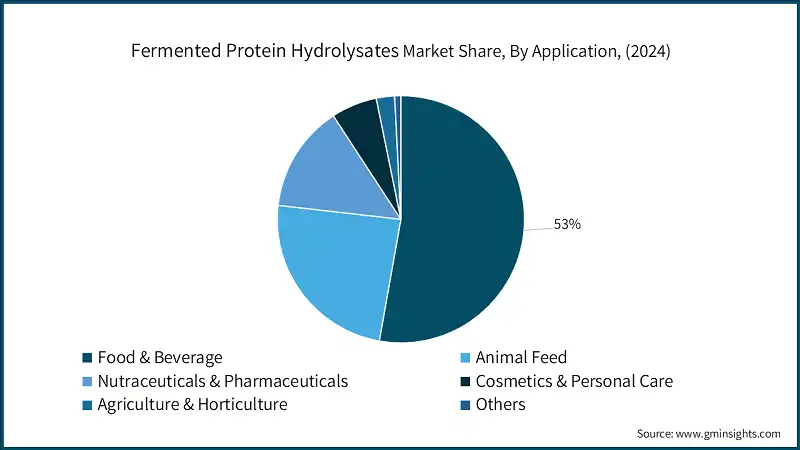

- In 2024, food and beverage applications will lead with 53% of the fermented protein hydrolysates market, comprising functional foods, protein beverages, sports nutrition, flavor enhancement, and food preservation. Protein hydrolysates enhanced solubility, emulsification, foaming, and gelation properties compared to whole proteins that can be incorporated into beverages, baked goods, dairy alternatives, and meat analogs. Bioactive peptides in hydrolysates imparts functional benefits such as blood pressure management through angiotensin-converting enzyme inhibition, reduction of oxidative stress through antioxidation, and preservation of food by exhibiting antimicrobial activity.

- Commercial products are Calpis, which contains VPP and tripeptides with IPP with proven blood-pressure-lowering effectiveness; and Evolus, which is rich in bioactive peptides from fermentation of Lactobacillus helveticus. Natural flavor enhancers-in which protein hydrolysates are included-also apply acidic hydrolysates which are high in glutamate. Such hydrolysates are usually used at a level of 1-2% to give savory umami taste.

- These peptides exhibit antimicrobial and antioxidant properties thereby allowing its utilization as a natural preservative and active component in edible films and coatings for the inhibition of lipid oxidation and microbial growth, thus extending shelf-life. Infant formula is an example of a specialized high-value application, with EFSA giving an approval for several whey protein hydrolysates from Fonterra, FrieslandCampina, and Healthcare Reckitt for use from units of 2.0-2.4 g protein per 100 kcal for 2024-2025.

- The protein hydrolysates are value-added proteins in meat and dairy alternatives, modifying the texture of those products and developing flavor. Among them are Plenti textured soy proteins of the Kerry Group and DSM-firmenich fermentation-derived cultures, which support innovation in products. This includes bitterness due to the presence of hydrophobic peptides that require debittering treatments or encapsulation, and regulatory requirements for health claim substantiation.

Looking for region specific data?

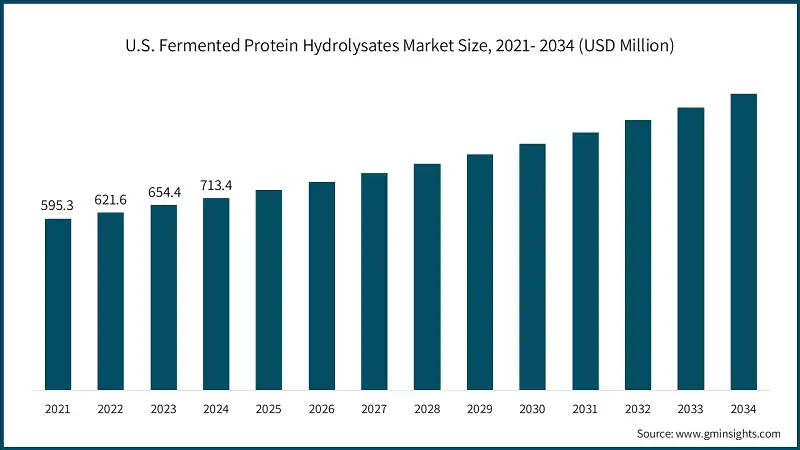

- The U.S. fermented protein hydrolysates market reached USD 713.4 million in 2024 and estimated to grow to almost USD 1.1 billion by 2034. North America holds a market share of 24% in 2024, characterized by advanced biotechnology capabilities, precision fermentation investments, and increased consumption of functional food. The U.S. Food and Drug Administration regulates fermentation-derived proteins under the Generally Recognized as Safe pathway, with regard to several GRAS determinations provided for precision-fermented proteins, including the beta-lactoglobulin of Perfect Day (GRN 863, 2020) and further whey protein approvals issued through to 2024-2025.

- The other fund was made available to Tufts University by the U.S. Department of Agriculture for setting up a National Institute for Cellular Agriculture, part of a USD 146 million overall sustainable agriculture R&D funding indicating government support for alternate protein technologies. Investing approximately USD 40 million across projects, the DARPA Cornucopia program supported alternative protein development.

- Europe keeps being the largest regional market holding 36.2% of market share in 2024. The reason for such market share is the comprehensive regulatory framework for fermentation, the well-established fermentation infrastructure, and high consumer acceptance for functional ingredients. The European Commission's Farm to Fork strategy distinctly mentioned alternative proteins that include microbial and fermented sources to be prioritized in increasing availability and sustainability, establishing thus a congenial policy environment. The European Food Safety Authority gives sufficient clarity to novel food applications in relation to protein hydrolysates, with comprehensive requirements regarding compositional characterization, safety assessment, and allergenicity evaluation.

- The Asia-Pacific region accounted for a 28.7% market share in 2024, spurred on by advancements in aquaculture and food processing alongside escalating protein requirements in countries such as China, India, and other regions of Southeast Asia. The area contributes around 91% of total aquaculture output worldwide, with China alone accounting for 36% of aquaculture production and ensuring the employment of 18.7 million people in aquaculture, all of which create significant demand for feed-grade protein hydrolysates. In addition to this, it is estimated that China accounts for 62% of the total farmed fish globally, making the country the largest consumer and producer of aquaculture feed ingredients.

- Latin America and the MEA add up to a small but guzzling market. Their growth is projected to accelerate with the development of health care systems in the regions and improved diagnostic services for IBD. Brazil and the GCC countries are leaders in very much developing the regional market through investments in health infrastructure and increased gastroenterology specialization.

Fermented Protein Hydrolysates Market Share

- Moderate concentration characterizes the fermented protein hydrolysates industry, with five players Kerry Group, Titan Biotech, Arla Foods Ingredients Group, Lesaffre Group, DSM-firmenich who together accounted for 52% of the market share in 2024. This implies competitiveness and has also provided opportunities for entry and growth for newer entrants.

- The market leader, Kerry Group plc, commands significant market share on the back of unique fermentation expertise, a broad global infrastructure, and integrated taste and nutrition capabilities. Between the years 2017-2024, the company has invested over USD 3.3 billion in its Science and Technology ecosystem and developed a footprint of over 1,200 scientists, including around 200 Ph.D. and Masters graduates, 1,200-plus patents and patent applications, over 60 international and external partnerships, and 33 Technology, Innovation and Application Centers.

- Specifically, proteins and protein hydrolysates are denoted within the Nutrition, Wellness & Functionality portfolio of Kerry Group, with fermentation being one of the leading taste technologies in the development of differentiated taste systems.

- Emerging markets have reportedly been a strong performer for the company: the taste and nutrition business achieved 8% volume growth from local manufacturing and R&D scale comprising 9,000+ employees in emerging markets, 500+ R&D scientists, 44 manufacturing facilities, 36 R&D and application centers, and 34 sales offices. Addressable specialty ingredients and flavors worth close to USD 93.5 billion potentially represent Kerry Group's near-term penetration opportunity of above USD 16.5 billion, making sustainable nutrition one of the differentiators for growth.

Fermented Protein Hydrolysates Market Companies

Major players operating in the fermented protein hydrolysates industry:

- Kerry Group

- Angel Yeast

- Arla Foods Ingredients Group

- Novozymes

- DSM-firmenich

- Fonterra

- Lesaffre Group

- Hebei Shuntian Biotechnology

- Sensient Technologies Corporation

- Tate & Lyle

- Kerry Group

- Kerry Group plc retains market leadership in integrated taste and nutrition capabilities, proprietary fermentation, and extensive global infrastructure inclusive of 33 Technology, Innovation, and Application Centers, over 1,200 scientists, around 200 PhDs and Masters, and about 1,200 patents and patent applications. The company's investment exceeds cumulative USD 3.3 billion in its science and technology ecosystem between 2017 and 2024 in support of the development of fermentation-derived proteins and protein hydrolysates.

- Titan Biotech

- Titan Biotech Limited is one of the largest manufacturers and exporters of biological products for various industries: pharmaceutical, nutraceutical, food and beverages, biotechnology, cosmetics, veterinary, animal feed, agriculture, microbiology culture medium, and plant tissue culture medium. With more than 30 years of experience, the company has established an incredible presence in 100-plus countries across the globe.

- DSM-firmenich

- Health, Nutrition & Care business with Early Life Nutrition, Dietary Supplements, Pharmaceuticals, Medical Nutrition, and Biomedical materials includes the delivery, regulatory affairs, formulation services, and sensory technologies for the nutritional ingredients and delivery systems, masking and flavor capabilities. DSM-firmenich posted 1% organic sales growth for 2024 due to the strategic portfolio transformation and greater biomedical facilities. DSM-firmenich expands its leadership within "Health from the Gut" with several new launches in prebiotics, probiotics, and postbiotics in 2024 solidifying focus on gut health ingredients intersecting with protein hydrolysate applications.

- Arla Foods Ingredients

- Arla Foods Ingredients Group P/S has strong positions in dairy-derived protein hydrolysates for which there are regulatory approvals on premium applications. Fonterra's whey protein hydrolysate achieved positive EFSA opinion in January 2025 for infant and follow-on formula with a minimum of 2.0 g protein per 100 kcal. FrieslandCampina's whey protein hydrolysate has been approved by the EFSA from July 2023 for a minimum of 2.4 g protein per 100 kcal. These approvals attest to technical capabilities and quality systems that meet the stringent requirements for infant formula.

- Lesaffre Group

- Lesaffre Group specializes in yeast extracts and fermentation-derived ingredients, which take advantage of a comprehensive yeast fermentation network and regulatory acceptance for all food, feed, and industrial applications. The firms provide yeast-derived protein hydrolysates and bioactive peptides for flavor enhancement, nutritional fortification, and functional food applications.

Fermented Protein Hydrolysates Industry News

- In April 2024, DSM-firmenich introduced new ingredients for pet food, including DHAgold, a fermented algae-derived DHA powder for dogs, and Veramaris Pets algal oil omega-3 product containing 60% EPA+DHA, thereby showcasing fermentation-based ingredient development for animal nutrition applications.

- In July 2024, Arla Foods Ingredients secured US Food & Drug Administration permission for the use of whey protein hydrolysates that support allergy management and gut comfort in infant formula. The FDA agreed that four ingredients in the company’s product known as Peptigen and Lacprodan ranges meet the definition of peptones in the US Code of Federal Regulations.

The fermented protein hydrolysates market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Billion) and volume (Kilo Tons) from 2021 to 2034, for the following segments:

Market, By Source

- Animal-based protein hydrolysates

- Fish protein hydrolysates

- Poultry protein hydrolysates

- Livestock protein hydrolysates (non-dairy)

- Dairy protein hydrolysates

- Others

- Plant-based protein hydrolysates

- Soy protein hydrolysates

- Pea protein hydrolysates

- Wheat protein hydrolysates

- Rice protein hydrolysates

- Others

- Microbial protein hydrolysates

- Yeast extract & autolysates

- Bacterial fermentation products

- Insect protein hydrolysates

- Others

Market, By Application

- Food & beverage applications

- Flavor enhancers & seasonings

- Protein fortification

- Infant formula & clinical nutrition

- Functional foods & beverages

- Animal feed applications

- Aquaculture feed

- Livestock feed

- Poultry feed

- Pet food

- Nutraceuticals & pharmaceuticals

- Bioactive peptides

- Dietary supplements

- Cosmetics & personal care

- Agriculture & horticulture

- Others

Market, By Form

- Fine powder

- Granular/agglomerated

- Liquid concentrate

- Paste/semi-solid

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

Who are the major players in the fermented protein hydrolysates industry?

Key players include Kerry Group, Angel Yeast, Arla Foods Ingredients Group, Novozymes, DSM-firmenich, Fonterra, Lesaffre Group, Hebei Shuntian Biotechnology, Sensient Technologies Corporation, and Tate & Lyle.

What are the key trends in the fermented protein hydrolysates market?

Key trends include precision fermentation and synthetic biology advances, circular economy-driven by-product valorization, next-gen bioprocessing technologies, and rising regulatory approvals for novel protein sources.

How much revenue did the food and beverage segment generate in 2024?

The food and beverage segment led the market with a 53% share in 2024, led by applications in functional foods, protein beverages, sports nutrition, and food preservation.

What was the valuation of the U.S. fermented protein hydrolysates sector?

The U.S. market was valued at USD 713.4 million in 2024 and is expected to surpass USD 1.1 billion by 2034.

What was the market share of microbial protein hydrolysates in 2024?

Microbial protein hydrolysates held a 68.5% market share in 2024, supported by established fermentation infrastructure, regulatory acceptance, and scalable production economics.

What was the market size of the fermented protein hydrolysates in 2024?

The market size was valued at USD 3.6 billion in 2024, with a CAGR of 9.4% expected through 2034. The growing focus on health and wellness is driving the market growth.

What is the expected size of the fermented protein hydrolysates industry in 2025?

The market size is projected to reach USD 3.9 billion in 2025.

What is the projected value of the fermented protein hydrolysates market by 2034?

The market is poised to reach USD 8.7 billion by 2034, driven by advancements in precision fermentation, synthetic biology, and increasing demand for functional foods and dietary supplements.

Fermented Protein Hydrolysates Market Scope

Related Reports