Summary

Table of Content

Extreme Ultraviolet (EUV) Lithography Equipment Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Extreme Ultraviolet Lithography Equipment Market Size

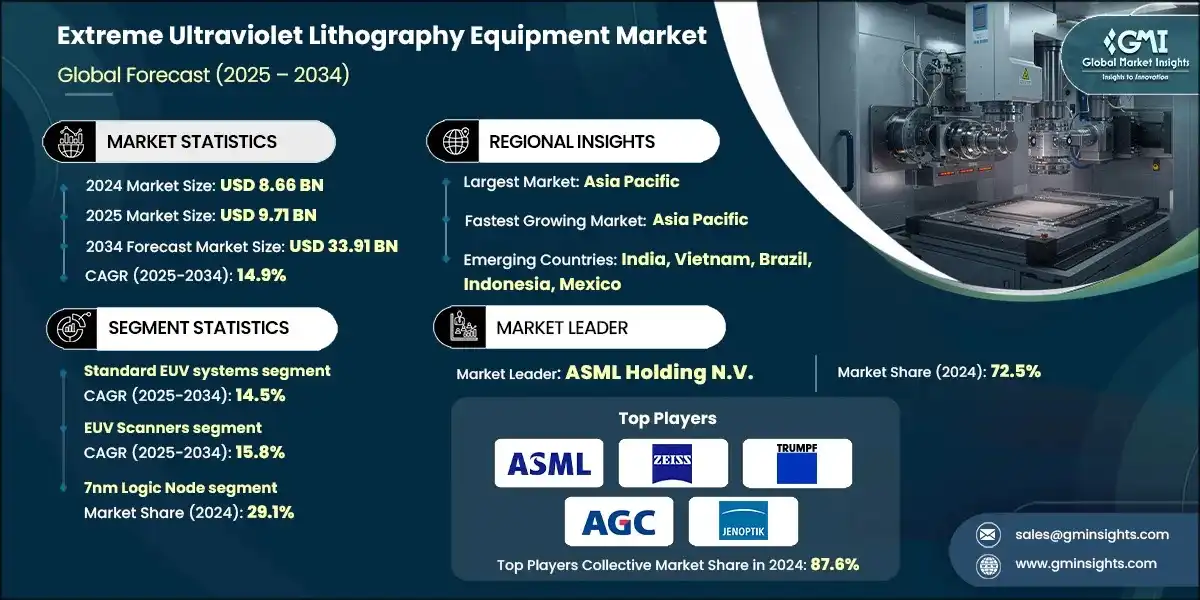

The global extreme ultraviolet lithography equipment market was estimated at USD 8.66 billion in 2024 with a volume of 40 units in 2024. The market is expected to grow from USD 9.71 billion in 2025 to USD 18.38 billion in 2030 and USD 33.91 billion by 2034 with a volume of 142 units, at a value CAGR of 14.9% and volume CAGR of 13.8% during the forecast period of 2025–2034.

To get key market trends

- The market for EUV lithography equipment is witnessing sustained growth because of the semiconductor industry’s move towards modern process nodes, along with the increase in complexity of modern electronics. The market’s value of USD 8.66 billion in 2024 signifies the importance of EUV technology for future semiconductor manufacturing capabilities.

- The growth from USD 9.71 billion in 2025 to USD 33.91 billion in 2034 represents a compound annual growth rate of 14.9%, which is well above growth in lithography markets. This is a direct result of the dramatic increase in EUV system deployments. The industry roadmaps indicate that the major foundries intend to install more than 500 EUV systems in aggregate by 2030.

- The growth in market size is driven by the unit economics of EUV adoption, in which the cost of systems that range from USD 200-400 million is overshadowed by the technology’s ability to manufacture advanced nodes that would otherwise only be productive through complex and costly multiple patterning techniques. The total addressable market calculation goes beyond EUV scanner systems to include the entire value chain consisting of light sources, optics, masks, metrology and support.

- Market size by region mirrors the distribution of advanced semiconductor manufacturing, with the Asia Pacific, which includes TSMC and Samsung, capturing 56.2% of market value. The 25.2% share of North America is generated by Intel’s aggressive EUV deployment and the demand for advanced nodes by leading fabless companies.

- The market assessment approach is inclusive of direct value of equipment sold and the market system covering service contracts, consumables, and systems upgrade value. The annual service revenue per EUV system, which is between USD 15-25 million, is critical in the understanding of the comprehensive market valuation coupled with the reoccurring revenue for equipment vendors.

Extreme Ultraviolet (EUV) Lithography Equipment Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 8.66 billion |

| Market Size in 2025 | USD 9.71 billion |

| Forecast Period 2025 - 2034 CAGR | 14.9% |

| Market Size in 2034 | USD 33.91 billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing demand for advanced semiconductor nodes | Drives the widespread adoption of EUV systems as chipmakers transition toward sub-5nm and 3nm nodes; contributes nearly 28% to overall market expansion by enabling superior patterning precision and transistor density. |

| Growing adoption of EUV in high-volume manufacturing by leading foundries | Accelerates market scalability as tier-one foundries integrate EUV tools for mass production; accounts for approximately 22% of growth through consistent wafer throughput and defect reduction. |

| Rising complexity of semiconductor devices requiring precise lithography | Spurs continuous equipment innovation and tighter overlay control; contributes around 18% to growth as manufacturers demand higher resolution for heterogeneous integration and advanced packaging. |

| Expansion of EUV applications beyond logic to advanced memory production | Opens new revenue streams in DRAM and NAND manufacturing; supports nearly 15% of market growth as EUV enables fine patterning and improved device performance in memory cells. |

| Pitfalls & Challenges | Impact |

| Extremely high capital expenditure and operational costs | Restrains adoption among smaller fabs and new entrants; imposes nearly 20% market limitation due to the need for billion-dollar fab investments and costly maintenance. |

| Limited EUV source power and throughput constraints | Reduces production efficiency and wafer yield; creates an estimated 12% operational bottleneck, pushing equipment makers to enhance light source reliability and resist performance. |

| Opportunities: | Impact |

| Integration of High-NA EUV Systems | Will unlock next-generation chip scaling below 2nm, driving long-term equipment demand and technological leadership. High-NA systems are expected to contribute nearly 25% to future market expansion by improving resolution and reducing multi-patterning steps. |

| Growing Penetration in Advanced Memory and Heterogeneous Packaging | Will create new revenue opportunities as EUV extends beyond logic chips into DRAM, NAND, and 3D integration. This diversification could account for around 18% of future growth by supporting faster, denser, and more energy-efficient semiconductor architectures. |

| Market Leaders (2024) | |

| Market Leaders |

72.5% |

| Top Players |

Collective market share in 2024 is 87.6% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | India, Vietnam, Brazil, Indonesia, Mexico |

| Future Outlook |

|

What are the growth opportunities in this market?

Extreme Ultraviolet Lithography Equipment Market Trends

- The primary factor leading growth in the market is the industry's transition from conventional 193nm immersion lithography to EUV for advanced node manufacturing. This change will fundamentally change the way the semiconductor manufacturing process is executed, moving from complicated multiple patterning methods to a simpler single exposure method using EUV. The transition timeline demonstrates accelerated mass adoption as illustrated by the EUV layer count per chip. This has increased from 5-10 number of layers in 7 nm nodes to 15-20 number of layers in 3 nm nodes with projections of reaching 25+ layers in 2nm manufacturing.

- The introduction of high numerical aperture (NA) extreme ultra-violet (EUV) systems entails the next evolution in lithography to achieve the resolution necessary for processing at the 2-nanometer (nm) and sub-2nm nodes. High-NA EUV systems utilize optics with a numerical aperture of 0.55 rather than 0.33, achieving minimum feature sizes of 8nm versus 13nm. This improvement in resolution is critical to sustaining Moore's Law scaling past known and defined limits of existing technology. For example, ASML's TWINSCAN EXE:5000 High-NA EUV system is priced at USD 370 – 400 million, compared to USD 200 million for their standard EUV systems, and was delivered first to Intel in December 2023 and later to TSMC in late 2024. Roadmaps for the deployment of high-NA EUV machinery published by leading foundries indicate plans for their installation starting in 2024 – 2025 to develop 2nm nodes, with deployment for volume manufacturing in 2026-2027.

- Another major reason for the market growth is shift from the old 193nm immersion lithography to EUV technology for advanced node manufacturing and its adoption across the industry. The change signifies a change in the approach to semiconductor manufacturing which includes the abandoning of the complicated multi-layered patterning for advanced manufacturing and instead utilizing EUV single-exposure methodologies. Adoption rates suggest growth the same way EUV layer counts per chip are likely to grow from the current 5 - 10 at the 7nm node to 25 at the 2nm node, from 15 - 20 at the 3nm node.

Extreme Ultraviolet Lithography Equipment Market Analysis

Learn more about the key segments shaping this market

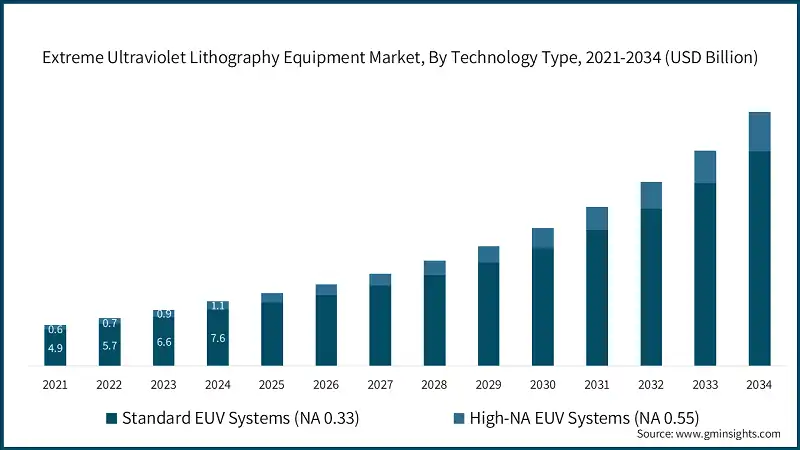

On the basis of technology type, the market is divided into standard EUV systems and high-NA EUV systems.

- The Standard EUV systems that are still running with 193nm immersion lithography with numerical aperture 0.33 optics, which can manufacture 7nm, 5nm, and even the early 3nm process nodes. This shows how the industry is gradually moving from older methods to newer EUV (Extreme Ultraviolet) technology.

- These standard EUV systems achieve minimum feature sizes of approximately 13nm and are fast enough for real production, processing about 170–200 wafers per hour. The CAGR of 14.5% is projected for standard EUV systems, which reflects continued deployment for established advanced nodes and expansion into memory applications.

- The High-NA EUV systems are lithography systems in development, that possess a higher numerical aperture (0.55 NA), which allows them to print even smaller features, capable of hitting minimum feature sizes of 8nm necessary for the 2nm and sub-2nm process nodes. The 17.6% CAGR for High-NA systems reflects the technology's migration from R&D into early production achieved from Intel and TSMC in 2023-2024.

- Even though High-NA systems come at an exorbitant cost of USD 370-400 million, which is more than conventional EUV system, they save money and complexity in the long run because they reduce the need for extra steps called double patterning, which is needed in older systems to make very small features.

Learn more about the key segments shaping this market

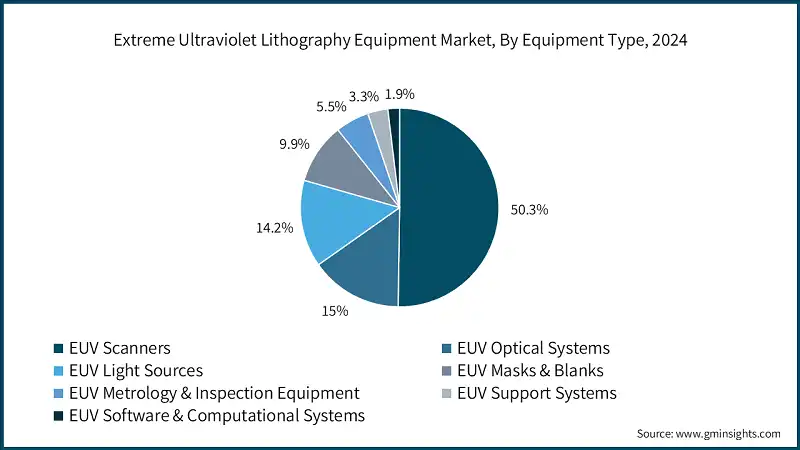

Based on the equipment type, the extreme ultraviolet lithography equipment market is segmented into EUV Scanners, EUV Optical Systems, EUV Light Sources, EUV Masks & Blanks, EUV Metrology & Inspection Equipment, EUV Support Systems, and EUV Software & Computational Systems.

- The equipment type divisions highlight the detailed ecosystem necessary for EUV lithography execution, with EUV Scanners holding the largest market share of 50.3% and is projected to grow with a 15.8% CAGR up to 2034. The power of the scanners form the core of the lithography process, and they are extremely expensive, each costs USD 200 –400 million depending on its features.

- EUV Optical Systems account for 15% of the market share with 14.3% CAGR and entail the precision mirrors, collectors, and optical components that deliver the performance of the EUV system. ZEISS has exclusive supply agreements with ASML for EUV optics where each system requires 10-11 precision mirrors highly demanding the manufacturers in terms of the accuracy down to picometers.

- EUV Light Sources account for 14.2% market share with 15% CAGR, representing one of the most technically challenging components in the EUV ecosystem. Current systems use powerful CO2 lasers to hit tiny tin droplets, producing EUV light at 250–300 watts. To meet High-NA scanner demands, source power needs to scale to 500+ watts, making this a key area of development.

On the basis of technology node application, the extreme ultraviolet lithography equipment market is bifurcated into 7nm Logic Node, 5nm Logic Node, 3nm Logic Node, 2nm Logic Node, Sub-2nm Logic Nodes, Advanced DRAM (10nm-class & below), and Advanced NAND Flash.

- 7nm Logic Node applications are at the forefront with a 29.1% market share and 14% CAGR. This segment is the first significant commercial deployment of EUV technology, where the economics of EUV vs. multiple patterning reached a break-even point for high-volume manufacturing.

- 5nm Logic Node applications accounted for market share of 25.3% in 2024, and is projected to grow with a 14.8% CAGR, thus representing the current high-volume manufacturing focus of leading foundries. At the 5nm nodes, EUV technology is applied to 10-15 critical layers, which reduces process complexity as compared to 193nm immersion alternatives and at the same time enables transistor density and performance requirements for advanced processors and mobile SoCs.

- 3nm Logic Node applications are at 20.7% of the market with a 15.5% CAGR, thus being the technology frontier for production deployment. 3nm nodes use EUV for 15-20 critical layers and require all the features of current-generation EUV systems such as better overlay accuracy and fewer stochastic effects. Top foundries are increasing 3nm production with EUV as the technology that makes it possible. technology.

Looking for region specific data?

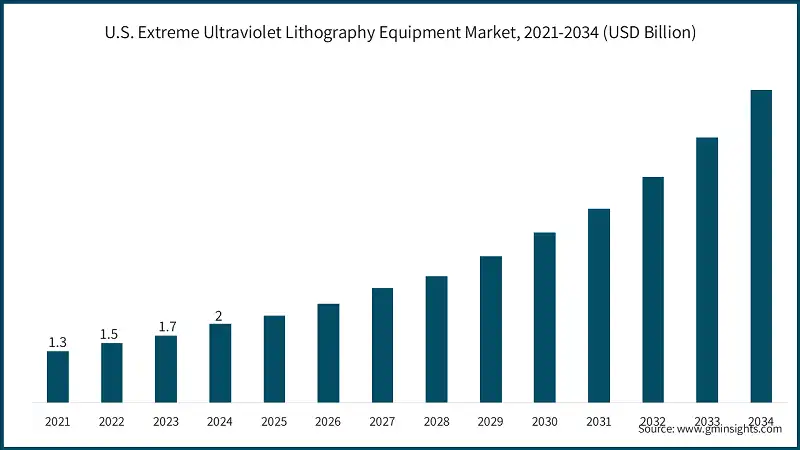

North America held 25.2% of the market share in 2024 and is anticipated to grow with a 14.9% CAGR. This is mostly influenced by Intel's aggressive EUV deployment for advanced node manufacturing and the concentration of major fabless companies that require EUV-enabled manufacturing services. Through its investment in High-NA EUV technology, Intel not only becomes the technology leader but also the first one to have the next-generation lithography capabilities.

- The U.S. extreme ultraviolet lithography equipment market was worth USD 2 billion in 2024 and is expected to grow at a CAGR of 15% throughout the forecast period 2025 - 2034. According to the CHIPS Act of the United States Government, USD 825 million is allocated for the EUV Accelerator programs that support the domestic semiconductor manufacturing capabilities and help in reducing the dependence on the production of foreign EUV-enabled products. This government aid is the reason the private sector is getting active in investing in EUV technology and domestic manufacturing capacity.

- Manufacturers can take benefit of the CHIPS Act grants and work alongside U.S. fabs to localize supply chains that will not only ensure the rapid deployment of technology but will also make the high-performance semiconductor production sector more competitive.

- The extreme ultraviolet lithography equipment market in Canada is expected to expand at a CAGR of 13.8% by 2034. Canada's Extreme Ultraviolet (EUV) Lithography Equipment market is growing due to the increasing government support for semiconductor R&D, the rising investments in advanced manufacturing, and the expanding demand for precision chips in AI, aerospace, and telecommunication sectors. The collaboration between the research institutions and the global chipmakers will not only inspire but also accelerate the adoption of technology.

- Manufacturers can better use their time and resources if they first focus on building relationships with Canadian research centers and then take advantage of the government incentives to set up local assembly or testing operations. In this way, they will be contributing to supply chain resilience and regional technological competitiveness.

Europe holds 15.6% of the market with a 13.3% CAGR in 2024. The growth is mainly contributed by the extensive research and development activities at institutions such as IMEC and CEA-Leti, in addition to the manufacturers of specialty semiconductors that require EUV capabilities for niche applications. Several initiatives of the European Union, including the Chips Joint Undertaking, are providing the necessary funding to EUV technology development and its deployment.

- The extreme ultraviolet lithography equipment market in Germany is expected to grow at a CAGR of 14.6% by 2034. The growth of the Extreme Ultraviolet (EUV) Lithography Equipment market in Germany is mainly driven by semiconductor R&D investments, increasing demand for the electronics of the automotive sector, and chip innovation influenced by Industry 4.0. Numerous funding programs supported by the government and the resulting partnerships among research institutes and chipmakers that are helping fast lithography deployment are solidifying Germany's position as a hub for high-end semiconductor manufacturing.

- Manufacturers in Germany should emphasize on collaborating with industrial and automotive players and aligning with federal funding programs. These activities will help them to not only accelerate the commercialization of EUV technology but also establish strong partnerships.

- UK extreme ultraviolet lithography equipment market is expected to generate more than USD 1.27 billion by 2034. One of the factors that lead to the UK EUV Lithography Equipment market's success is the increased investment in semiconductor design, quantum computing, and nanotechnology research. Several initiatives of the government including the National Semiconductor Strategy and collaborations of academia are the main contributors to innovation, thus EUV is becoming more popular for the precision of chip fabrication and technology applications of high value.

- The manufacturers should work closely with research institutes in the UK, take full advantage of innovation grants, and collaborate in the development of EUV-enabled semiconductor processes to upgrade the local technological capability and gain an advantage in the country’s emerging chip ecosystem.

Asia Pacific asserted its dominance in the market with a 56.2% share and 15.5% CAGR, which was largely attributed to the concentration of the world's top semiconductor manufacturers and the region's vigorous investment of advanced node technologies. The region, therefore, is home to TSMC, Samsung, SK Hynix, among others, which in turn, are the largest customers for EUV technology as these are the companies that represent the primary foundries and memory manufacturers.

- China extreme ultraviolet (EUV) lithography equipment market was valued at USD 1.86 billion in 2024 with 38.1% of total APAC market share. China's share of the Asia Pacific market is limited due to a series of export control measures that restrict the access to EUV technology thereby providing an opportunity to other markets. Consequently Japan, Singapore, and the emerging market of Southeast Asia are some of the beneficiaries of these restrictions. Sony and Renesas, by way of example, are Japanese companies that are increasing EUV adoption for specialty semiconductor applications.

- Manufacturers must explore the feasibility of strategic joint ventures, take full advantage of the government incentives, and concentrate on the localized technology of adaptation to be able to overcome the regulatory challenges and make use of China's huge semiconductor manufacturing ecosystem in an efficient way.

- The extreme ultraviolet (EUV) lithography equipment market in South Korea is anticipated to grow with a CAGR of 14.7% during the forecast period. South Korea is the second most significant market in the Asia Pacific region with foundry operations at Samsung and memory manufacturing by Samsung, which have seen the largest EUV investments for both logic and DRAM applications. A collaboration between Samsung and ASML has a USD 760 million investment in EUV technology research and implementation across several product lines.

- The extreme ultraviolet (EUV) lithography equipment market in India is projected to surpass USD 5.23 billion by 2024. Indian market for lithography tools that support Extreme Ultraviolet (EUV) is powered by government-supported semiconductor programs like the "India Semiconductor Mission" that targets the development of domestic chip fabrication capacity. The rising trend of electronics manufacturing, digitalization, and incentives provided to foreign semiconductor players are equally contributing to the adoption of EUV technology, which is required to meet the demand for advanced node chip production that is rapidly increasing.

- Manufacturers should collaborate with Indian fabs align with government incentives and create an early EUV base which will be conducive to local chip production and coherent with the country's long-term semiconductor self-reliance goals.

The Latin America extreme ultraviolet lithography equipment market is projected to surpass USD 257.7 million by 2034. The demand for advanced computing and automotive electronics has become the main driver of the region's investments in next-generation lithography systems for improved chip miniaturization and production efficiency.

The EUV (extreme ultraviolet) lithography machine market in the Middle East and Africa region is expected to exceed 552.8 million by 2034. The growth of the MEA EUV lithography equipment market is mainly attributed to the semiconductor assembly hubs that are emerging in the UAE and Israel, with the support of the investments in the electronics, aerospace, and defense sectors.

- The South Africa extreme ultraviolet lithography equipment market was valued at USD 31.9 million in 2024. The South African market of EUV lithography equipment is growing with the increased interest in the manufacturing of microelectronics and innovation centers based on the research-and-development. The focus of the government on digital industrialization and the development of semiconductor skills is promoting partnerships with the world chip equipment manufacturers, and the goal is to strengthen local fabrication opportunities and reduce dependence on imported semiconductor technologies.

- Manufacturers should focus on collaborative training programs and technology transfer initiatives to establish early dominance in South Africa’s emerging semiconductor ecosystem and local R&D-based chip production efforts.

- The extreme ultraviolet lithography equipment market in Saudi Arabia is projected to grow with a CAGR of 13.3% during the forecast period. Saudi Arabia’s Vision 2030 initiative is accelerating investments in semiconductor manufacturing as part of its digital transformation goals. The government’s focus on smart infrastructure, defense electronics, and renewable technologies is driving demand for advanced chip production tools, including EUV lithography systems, to support localized fabrication and technology sovereignty efforts.

- Manufacturers should partner with state-backed innovation programs and industrial clusters to align EUV deployments with Saudi Arabia’s strategic goals in semiconductor self-sufficiency and high-tech industrial diversification.

- The extreme ultraviolet (EUV) lithography equipment market in UAE is anticipated to surpass USD 167 million by 2034. The UAE is developing rapidly as a hub of semiconductor innovation with extensive investment in AI, smart cities, and defense technology. Its strategic partnerships with international semiconductor companies and favorable regulatory environment are driving the adoption of EUV lithography in order to support indigenous chip design, testing, and advanced packaging.

Extreme Ultraviolet Lithography Equipment Market Share

- The top 5 players combined share of 87.61% includes ASML's scanner systems plus critical component suppliers that form the essential EUV ecosystem. ZEISS maintains an exclusive relationship with ASML for EUV optical systems, providing precision mirrors and optical assemblies that define system performance. Each EUV system requires 10-11 precision mirrors manufactured to tolerances measured in picometers, representing a multi-million dollar optical system value per scanner as per ZEISS research.

- The EUV lithography equipment market in the European Union is a highly concentrated one in terms of competitive landscape, where ASML Holding N.V. is the major player holding 72.5% of the broader lithography equipment segment market and nearly 100% of the commercial EUV scanner systems market. The reason for ASML's leading position in the market is a focused investment in EUV technology development for more than 20 years, which included collaborating with top semiconductor manufacturers, government-funded research institutions, and suppliers of components.

- Coherent Corporation after the acquisition of coherent laser systems and components is the leader in the technology of extreme UV light sources. The company's high-power CO2 lasers are the main components of laser-produced plasma (LPP) EUV sources, where each system needs multiple laser modules that operate at kilowatt power levels. According to Coherent Corporation, the company's position in the market is strengthened by the continuous development of next-generation laser technologies required for High-NA EUV systems.

- Trumpf SE + Co. KG, with its industrial laser expertise and collaborations with EUV source developers, is in a good position to further develop the laser technology needed for the EUV sources. The maximum power of the company's laser system made it a determinant component in the architecture of EUV sources. According to the results of the research done at Trumpf, the company has ongoing development aimed at power scaling and reliability improvements, which are necessary for high-volume manufacturing.

- KLA Corporation is a leader in EUV metrology and inspection equipment helping to provide the specialized measurement systems needed for EUV process control and yield optimization. KLA's actinic inspection systems operate at EUV wavelengths to detect defects and measure critical dimensions with sub-nanometer accuracy, hence, can command very high prices due to their ultra-precise capabilities as stated by KLA Corporation.

Extreme Ultraviolet Lithography Equipment Market Companies

The top prominent companies operating in the extreme ultraviolet (EUV) lithography equipment market include:

- ASML Holding N.V.

- Coherent Corporation

- Trumpf SE + Co. KG

- Jenoptik AG

- KLA Corporation

- Applied Materials, Inc.

- Lam Research Corporation

- Nikon Corporation

- Canon Inc.

- Gigaphoton Inc.

- NuFlare Technology, Inc.

- Lasertec Corporation

- Veeco Instruments Inc.

- SUSS MicroTec SE

- EV Group E. Thallner GmbH

- SET Corporation

- Oxford Instruments plc

- Plasma-Therm LLC

- Oxford Instruments plc

- Plasma-Therm LLC

The major players in the extreme ultraviolet lithography equipment market portray a full ecosystem that goes beyond system integration to include critical components, materials, and support services. The market structure reflects the extremely specialized nature of EUV technology and the long supply chain that is necessary to deliver functional lithography systems.

ASML Holding N.V. stands as the undisputed leader in EUV scanner systems with it’s TWINSCAN NXE series represents the current generation of production EUV systems, while the TWINSCAN EXE:5000 High-NA system defines the next technology frontier. Coherent Corporation maintains a critical position in EUV light source technology through its high-power laser systems and components. The company's industrial laser expertise enables the kilowatt-class CO2 lasers required for laser-produced plasma (LPP) EUV sources

Jenoptik AG offers precision optical components and systems that are integral to the EUV ecosystem. This includes specialized optics and metrology equipment. The company's precision manufacturing and optical systems technology not only helps the development of EUV scanners but also supports metrology requirements at the fab level.

Complementing EUV lithography systems, Applied Materials, Inc. offers process equipment and material solutions that can be seamlessly integrated. The company's strategic moves are the creation of EUV-compatible deposition and etch processes, use of advanced materials for EUV applications, and the development of integrated process solutions that maximize the performance of EUV.

Veeco Instruments Inc., SUSS MicroTec SE, EV Group E. Thallner GmbH, SET Corporation, Oxford Instruments plc, and Plasma-Therm LLC are the six contributors who are facilitating the EUV fab implementation and operation with specialized process equipment, materials handling systems, and other complementary technologies.

Extreme Ultraviolet Lithography Equipment Industry News

- In October 2024, Coherent Corporation announced development of 50kW CO2 laser systems for next-generation EUV sources, representing a 2x power increase over current systems and enabling the source power scaling required for High-NA EUV manufacturing as per Coherent Corporation.

- In March 2024, Lasertec released a new generation of its actinic extreme ultraviolet (EUV) mask inspection system, the ACTIS A300. This system is a critical component in manufacturing advanced semiconductors because it uses the same 13.5 nm wavelength of light as EUV lithography to detect defects.

The extreme ultraviolet lithography equipment market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Units) from 2021 to 2034, for the following segments:

Market, By Technology Type

- Standard EUV Systems (NA 0.33)

- NXE:3400C Systems

- NXE:3600D Systems

- NXE:3800E Systems

- High-NA EUV Systems (NA 0.55)

- EXE:5000 Systems

- EXE:5200B Systems

- Next-Generation High-NA Systems

Market, By Equipment Type

- EUV Scanners

- EUV Optical Systems

- Illumination Systems

- Projection Optics

- Mirror Systems & Multilayer Coatings

- EUV Light Sources

- CO2 Laser Systems

- Plasma Generation Equipment

- Power Conditioning Systems

- EUV Masks & Blanks

- Mask Substrate Blanks

- Pellicle Systems

- Mask Manufacturing Equipment

- EUV Metrology & Inspection Equipment

- Defect Inspection Systems

- Overlay Metrology Systems

- Critical Dimension Measurement Systems

- EUV Support Systems

- Vacuum Systems

- Abatement Equipment

- Environmental Control Systems

- EUV Software & Computational Systems

- Computational Lithography Software

- Process Control Software

- Mask Design Software

Market, By Technology Node Application

- 7nm Logic Node

- 5nm Logic Node

- 3nm Logic Node

- 2nm Logic Node

- Sub-2nm Logic Nodes

- Advanced DRAM (10nm-class & Below)

- Advanced NAND Flash

Market, By End Use Type

- Pure-Play Foundries

- Integrated Device Manufacturers (IDMs)

- Memory Manufacturers

Market, By End Use Industry

- Mobile & Consumer Electronics

- Automotive Semiconductors

- Artificial Intelligence & Machine Learning

- Data Center & High-Performance Computing

- 5G & Telecommunications Infrastructure

- Industrial & IoT Applications

- Aerospace & Defense

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Latin America

- Brazil

- Mexico

- MEA

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

What are the upcoming trends in the EUV lithography equipment industry?

Key trends include the transition to High-NA EUV systems for sub-2nm nodes, integration of AI-driven computational lithography, and expansion of EUV use into advanced memory (DRAM, NAND) and heterogeneous packaging applications.

Which region leads the EUV lithography equipment market?

The U.S. market was valued at USD 2 billion in 2024, expected to grow at a 15% CAGR. Growth is powered by the CHIPS Act, which allocates USD 825 million for domestic EUV accelerator programs and advanced semiconductor manufacturing.

Who are the key players in the extreme ultraviolet lithography equipment market?

Key players include ASML Holding N.V., Coherent Corporation, Trumpf SE + Co. KG, Jenoptik AG, KLA Corporation, Applied Materials Inc., Lam Research Corporation, Nikon Corporation, Canon Inc., and Gigaphoton Inc.

What is the market share of the 5nm logic node segment in 2024?

The 5nm logic node segment held a 25.3% share in 2024, with a 14.8% CAGR, driven by its widespread adoption in advanced processors and SoCs requiring high transistor density.

Which technology node dominates the EUV lithography market?

The 7nm logic node led the market with a 29.1% share in 2024, growing at a 14% CAGR as manufacturers leverage EUV for high-volume production and improved patterning precision.

What was the market share of EUV Optical Systems in 2024?

EUV Optical Systems accounted for 15% share in 2024, expanding at a 14.3% CAGR, supported by rising demand for precision mirrors and optics supplied under exclusive partnerships, particularly by ZEISS.

What is the current extreme ultraviolet lithography equipment market size in 2025?

The market size is projected to reach USD 9.71 billion in 2025.

What is the projected value of the extreme ultraviolet lithography equipment market by 2034?

The market is expected to reach USD 33.91 billion by 2034, fueled by high-volume manufacturing adoption, High-NA EUV system integration, and sub-2nm node developments.

Which equipment type led the EUV lithography equipment industry in 2024?

EUV Scanners led the market with a 50.3% share in 2024, growing at a projected 15.8% CAGR. Their dominance stems from their central role in wafer processing and semiconductor node scaling.

What is the market size of the extreme ultraviolet (EUV) lithography equipment industry in 2024?

The market size was USD 8.66 billion in 2024, with a CAGR of 14.9% expected through 2034, driven by the surging demand for advanced semiconductor nodes and miniaturization of chips.

Extreme Ultraviolet (EUV) Lithography Equipment Market Scope

Related Reports