Summary

Table of Content

Europe Antimicrobial Additives Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Europe Antimicrobial Additives Market Size

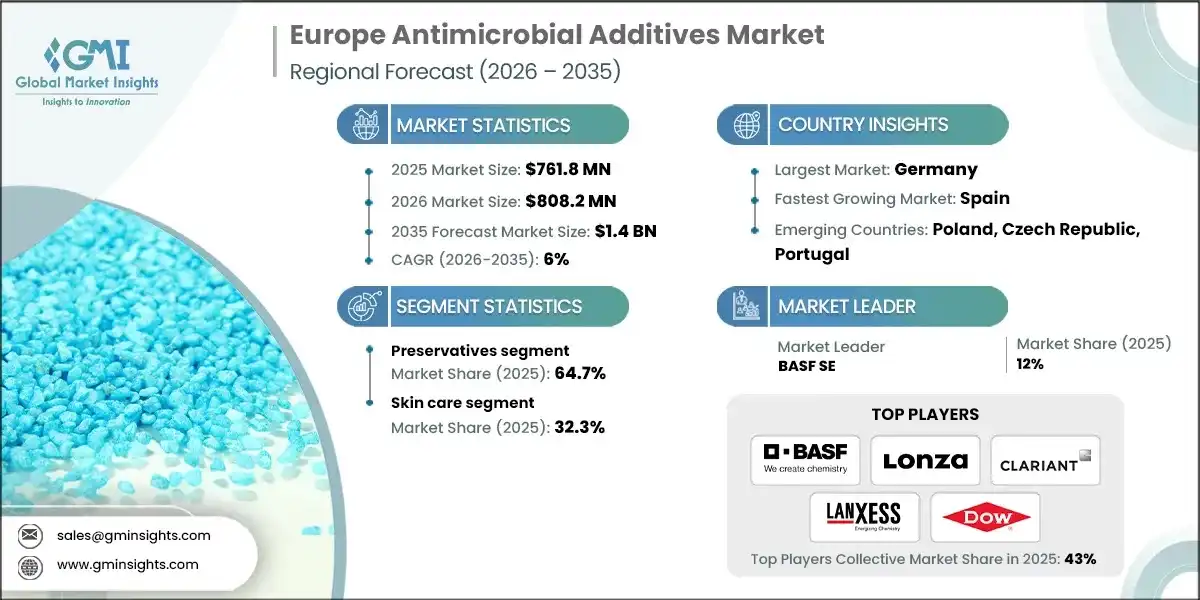

The Europe antimicrobial additives market was valued at USD 761.8 million in 2025. The market is expected to grow from USD 808.2 million in 2026 to USD 1.4 billion in 2035, at a CAGR of 6% according to latest report published by Global Market Insights Inc.

Europe Antimicrobial Additives Market Key Takeaways

Market Size & Growth

- 2025 Market Size: USD 761.8 Million

- 2026 Market Size: USD 808.2 Million

- 2035 Forecast Market Size: USD 1.4 Billion

- CAGR (2026–2035): 6%

Key Market Drivers

- Rising demand for safe, long?lasting cosmetics.

- Stringent EU cosmetic and biocidal regulations.

- Growth in skin, hair, baby care segments.

Challenges

- Regulatory restrictions on legacy preservative chemistries.

- Clean?label, preservative?free consumer positioning.

Opportunity

- Microbiome friendly and natural derived antimicrobials.

- Technological synergies with multifunctional cosmetic ingredients.

Key Players

- Market Leader: BASF SE led with over 12% market share in 2025.

- Leading Players: Top 5 players in this market include BASF SE, Lonza Group AG (Arxada), Clariant AG, LANXESS AG, The Dow Chemical Company, which collectively held a market share of 43% in 2025.

Get Market Insights & Growth Opportunities

- As consumers look for more durable and safer products, the demand for antimicrobial additives in the European personal care market is growing. From 2021 to 2024, the number of EU cosmetic products claiming to be “preservative-free” or “microbiome friendly” grew each year. At the same time, the EU Cosmetics Regulation, which deals with the screening of antimicrobial systems, has complicated the process for cosmetic manufacturers and pushes them to use more innovative, and often multifunctional, antimicrobial systems.

- After the COVID-19 pandemic, the first two years of the post-pandemic period were characterized by a pronounced demand recovery. This was accompanied by an increase in hand cleansers, wipes, and hygiene related toiletries. The antimicrobial and preservative ingredients within beauty and personal wash products were also consumed to a higher extent. Eurostat noted that within this time span, there was an increase in the production of soaps, detergents, and cleaning wipes, which in turn meant that there was an increase in the products that contained antimicrobials and preservatives.

- In 2023, the European Chemical Agency confirmed that there is a higher level of scrutiny regarding preservatives and biocides. This means that the number of biocides that a company can use is smaller. This has greatly increased the challenges that the antimicrobial industry faces, especially tech, compliance, and manufacturing, and therefore, bolstered the need for “blends” with lower antimicrobial levels, “anti-microbials” which are more eco-friendly, and “nature-inspired” products.

- By 2024-2025, the market is characterized by two trends: premiumization and compliance. Major players combine R&D and toxicology to develop bespoke systems for skin, hair, and baby care products that comply with the most stringent toxicological regulations. Meanwhile, microbiological safety, clean label, and transparency expectations from retailers and consumers sustain demand for effective antimicrobial solutions.

To get key market trends

Europe Antimicrobial Additives Market Trends

- Regulatory-driven reformulation and low-dose systems: Regulatory control of the Biocidal Products and EU Cosmetic regulations keep closing the net regarding the amount of preservatives and the levels of exposure which makes brands reformulate using compliant, low-dose systems. An example would be phenoxyethanol blends and organic acids which restrain some parabens and isothiazolinones and are used in synergy to maintain some lower single component efficacy.

- A shift to preservation that is clean and friendly to the microbiome: Consumer demands clean, sensitive, and microbiome friendly. This has had a compounding effect of making preservation systems gentler and more transparent. It is now common for brands to avoid the use of strong preservatives, especially in skin care and baby products which provide secondary antimicrobial properties along with conditioning such as organic acids, gluconolactone, and some multifunctional humectants.

- Increase with the use of multifunctional cosmetic ingredients: To control cost as well as label perception, formulators are using more ingredients with dual functions of performance and preservation. There is an increasing use of emollients, surfactants, and humectants that are antimicrobial as well as other protective properties. For example, certain caprylyl glycols of ethylhexylglycerin are used to enhance other preservatives making lower levels of preservatives and a more marketable ingredient list.

- Digitalization, traceability, and sustainability pressure: European retailers and major brands now demand full traceability, life?cycle data, and verifiable sustainability credentials for antimicrobial additives. Suppliers respond by publishing biodegradability profiles, renewable?carbon content, and third?party certifications, while using digital tools for batch tracking and regulatory documentation. This makes “green chemistry” and transparent supply chains as important to purchasing decisions as technical efficacy and cost.

Europe Antimicrobial Additives Market Analysis

Learn more about the key segments shaping this market

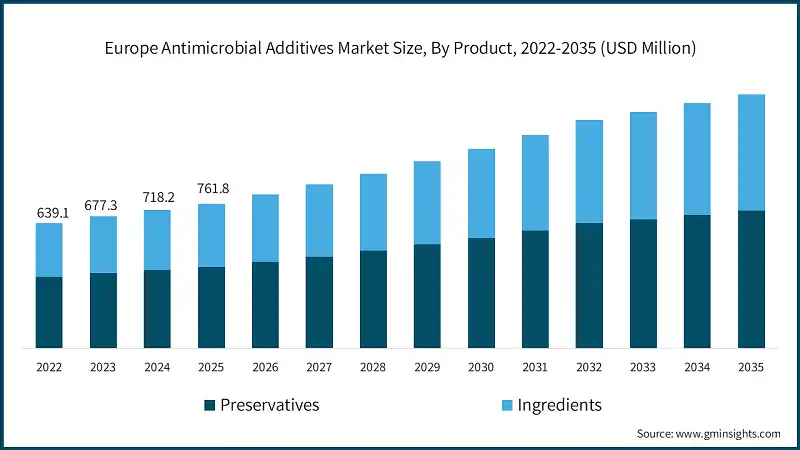

Based on product, the Europe antimicrobial additives industry is segmented into preservatives, and ingredients. Preservatives held the largest market share of 64.7% in 2025 and are expected to grow at a CAGR of 5.8% during 2026-2035.

- In Europe, antimicrobial additives for personal care are still being affected by the structuring of recession and premiumization. The largest and most integrated chemical and specialty ingredient companies are using their in house toxicologists, regulatory experts, and application scientists to develop proprietary and co-create preservative systems with brand owners. Supply contracts, technical services, and customized collection blends for specific skin/hair claims are becoming more important.

- There is also widespread repositioning in the market as companies remove more controversial chemistries, add more nature-inspired and skin microbiome friendly options, and develop more sustainable production methods. The cross-regional mergers and acquisitions and collaboration partnerships are also enhancing the mid-sized formulator niche plays in baby care, dermo cosmetics, and sensitive skin with differentiated low multifunctional, antimicrobial, clean beauty aligned products.

Learn more about the key segments shaping this market

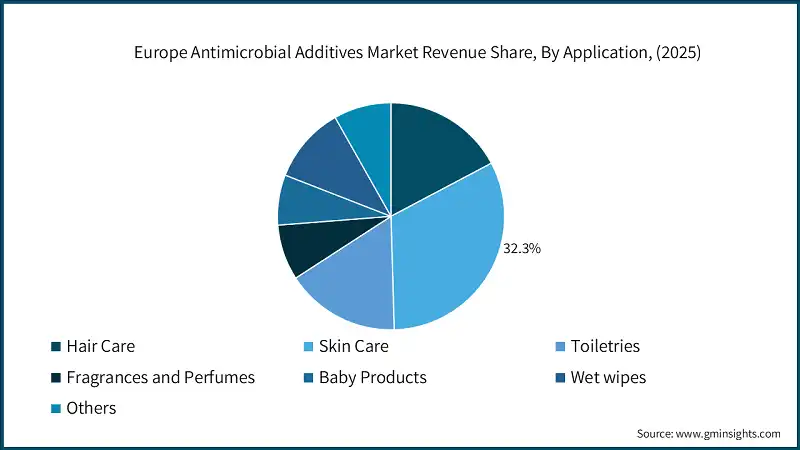

Based on application, the Europe antimicrobial additives market is segmented into hair care, skin care, toiletries, fragrances and perfumes, baby products, wet wipes, and others. Skin care held the largest market share of 32.3% in 2025 and is expected to grow at a CAGR of 5.8% during 2026-2035.

- The brand owners of hair care, skin care, toiletries, fragrances, baby products, wet wipes, and others are moving to preservative systems that are more balanced between consumer friendly sensory attributes, and preservation efficacy, while using fewer ingredients. The most stringent demand for gentleness and nature-identical multifunctional ingredients is in baby and sensitive skin. However, the high throughput categories of wipes and shampoos still need strong and economically antimicrobial systems.

- Upgrades across all of these applications are driven by regulatory pressures and clean beauty expectations. Companies are setting aside problematic chemistries and adopting microbiome-friendly blends, hurdle technology, and multifunctional agents that combine preservation with performance. Antimicrobial strategies are increasingly being tailored to specific product formats, target consumers, and distribution or storage conditions through collaborative development between ingredient suppliers and formulators.

Looking for region specific data?

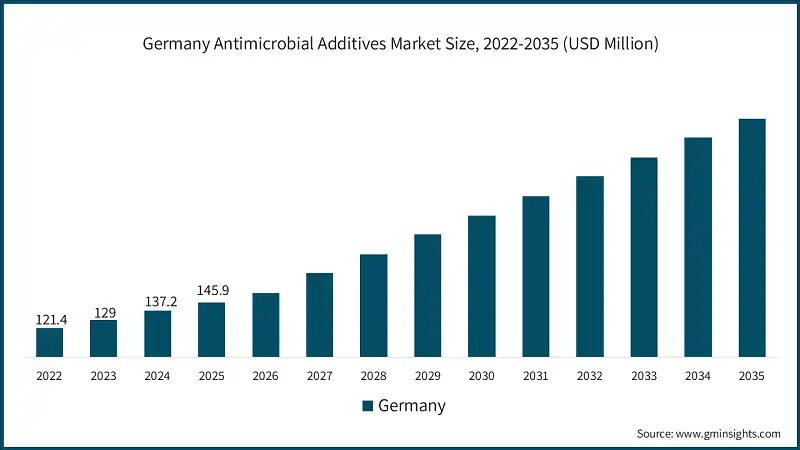

Europe region is one of the largest markets, increasing from USD 761.8 million in 2025 to USD 1.4 billion in 2035, driven by stringent EU regulations and sophisticated consumer expectations. With about 6% CAGR to 2035, Europe emphasizes safety, efficacy, and clean?beauty alignment in antimicrobial additive selection.

- Germany is a key European engine for specialty chemicals and premium cosmetics. Its market, valued at USD 145.9 million in 2025, benefits from strong R&D, export?oriented brands, and close collaboration between formulators and ingredient suppliers to create compliant, high?performance preservative systems.

- France is another major European hub for luxury and dermo cosmetic brands. Its market, valued at USD 97.9 million in 2025, is supported by intensive product innovation, strong pharmacy and prestige channels, and a focus on sensorial, sensitive?skin?friendly formulations that rely on advanced, low?dose antimicrobial systems.

Europe Antimicrobial Additives Market Share

The competitive landscape in Europe antimicrobial additives industry is led by a handful of global specialty and diversified chemical groups. BASF SE, Lonza Group (Arxada), Clariant, LANXESS, and Dow together hold about 43% share, leveraging broad portfolios, regulatory expertise, and strong application support. Smaller players and niche formulators compete via specialization, microbiome?friendly systems, and clean?label?driven innovation.

- BASF SE: BASF holds around 12% share, benefiting from its extensive personal care portfolio, strong European presence, and integrated R&D. The company offers broad-spectrum preservative systems and multifunctional ingredients aligned with EU regulations and clean?beauty trends, while continued investments in sustainable solutions and digital formulation tools strengthen its role as a preferred partner for major brands.

- Lonza Group AG (Arxada): Arxada, with roughly 10% share, is a key specialist in microbial control and preservation technologies. Its expertise in biocides and cosmetic preservation gives it a strong foothold in Europe’s tightly regulated environment. The company focuses on high?performance blends, regulatory support, and tailored solutions for skin care, hair care, and wipes, especially under stringent EU safety frameworks.

- Clariant AG: Clariant commands about 8% share, driven by its focus on specialty personal care ingredients and sensorial, mild preservation systems. The company emphasizes sustainability, naturally derived solutions, and microbiome?friendly concepts. Its formulation centers and close collaboration with brand owners allow Clariant to develop customized antimicrobial systems that balance efficacy, label appeal, and regulatory compliance.

- LANXESS AG: LANXESS holds around 7% share, leveraging its Material Protection Products business and strong expertise in biocidal chemistries. In personal care, it provides targeted preservative solutions and technical guidance to meet evolving EU regulations. The company’s portfolio optimization, focus on safer actives, and strong industrial footprint support reliable supply and compliance for European formulators.

- The Dow Chemical Company: Dow has roughly 6% share, supported by its broad range of polymers, surfactants, and multifunctional ingredients that can contribute to preservation strategies. While not solely a preservative specialist, Dow integrates antimicrobial performance into wider formulation solutions, helping customers achieve stability, aesthetics, and regulatory compliance in personal care products across skin, hair, and cleansing categories.

Europe Antimicrobial Additives Market Companies

Major players operating in the Europe antimicrobial additives industry include:

- BASF SE

- Clariant AG

- Lonza Group AG (now Arxada)

- LANXESS AG

- Solvay S.A.

- The Dow Chemical Company

- Evonik Industries AG

- Croda International Plc

- Ashland Global Holdings Inc.

- Symrise AG

- DSM-Firmenich

Europe Antimicrobial Additives Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 761.8 Million |

| Market Size in 2026 | USD 808.2 Million |

| Forecast Period 2026-2035 CAGR | 6% |

| Market Size in 2035 | USD 1.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising demand for safe, long?lasting cosmetics | Boosts consumption of advanced, compliant additives |

| Stringent EU cosmetic and biocidal regulations | Drives shift to higher?value, approved technologies |

| Growth in skin, hair, baby care segments | Expands addressable antimicrobial additives volumes |

| Pitfalls & Challenges | Impact |

| Regulatory restrictions on legacy preservative chemistries | Limits available actives, raises reformulation costs |

| Clean?label, preservative?free consumer positioning | Can reduce usage levels in certain products |

| Opportunities: | Impact |

| Microbiome friendly and natural derived antimicrobials | Opens premium niches and differentiation avenues |

| Technological synergies with multifunctional cosmetic ingredients | Enables combined benefits, improving value proposition |

| Market Leaders (2025) | |

| Market Leaders |

12% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Germany |

| Fastest Growing Market | Spain |

| Emerging Country | Poland, Czech Republic, Portugal |

| Future Outlook |

|

What are the growth opportunities in this market?

Europe Antimicrobial Additives Industry News

- In October 2024, BASF SE announced expanded European capacity and portfolio upgrades for multifunctional preservation ingredients in personal care, emphasizing nature?inspired molecules and improved toxicological profiles to meet tightening EU Cosmetics Regulation and Biocidal Products Regulation requirements, particularly for skin care and baby care formulations.

- In May 2024, Arxada (Lonza Group’s specialty chemicals spin?off) introduced new preservative blends for cosmetic and personal care applications in Europe, designed to reduce single?active load and support microbiome?friendly positioning, while providing detailed regulatory guidance for formulators navigating EU and UK compliance frameworks.

- In September 2023, Clariant AG launched an extended range of naturally derived and nature?identical preservation boosters for European personal care brands, integrating sustainability metrics and transparent sourcing data, aimed at formulators seeking “clean label” antimicrobial systems without compromising broad?spectrum efficacy in skin care and toiletries.

This Europe antimicrobial additives market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Million) and volume (Kilo Tons) from 2026 to 2035, for the following segments:

Market By Product

- Preservatives

- 2-bromo-2-nitropropane-1,3-diol

- Benzoic Acid

- Benzyl Alcohol

- Chlorphenesin

- Dehydroacetic Acid

- Diazolidinyl Urea

- DMDM Hydantoin

- Ethylparaben

- Methylchloroisothiazolinone

- Methylparaben

- Phenoxyethanol

- Potassium Sorbate

- Propylparaben

- Sodium Benzoate

- Triclosan

- Others

- Ingredients

- 1,2-hexanediol

- Caprylhydroxamic Acid

- Caprylyl Glycol

- Ethylhexylglycerin

- Glyceryl Caprylate

- Levulinic Acid

- Octenidine HCl

- P-anisic Acid

- Pentylene Glycol

- Phenethyl Alcohol

- Propylene Glycol

- Sorbitan Caprylate

- Others

Market, By Application

- Hair Care

- Skin Care

- Toiletries

- Fragrances and Perfumes

- Baby Products

- Wet wipes

- Others

The above information is provided for the following regions and countries:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Netherlands

- Switzerland

- Sweden

- Belgium

- Rest of Europe

Frequently Asked Question(FAQ) :

Who are the key players in the Europe antimicrobial additives market?

Key companies operating in the Europe antimicrobial additives industry include BASF SE, Lonza Group AG (Arxada), Clariant AG, LANXESS AG, The Dow Chemical Company, Evonik Industries AG, Croda International Plc, Ashland Global Holdings Inc., Symrise AG, and DSM-Firmenich.

What are the key trends in the Europe antimicrobial additives market?

Major trends include regulatory-driven reformulation, rising demand for microbiome-friendly preservatives, and increased use of multifunctional cosmetic ingredients to reduce overall preservative load.

What was the market share of the skin care application segment in 2025?

Skin care held 32.3% share of the Europe antimicrobial additives industry in 2025, supported by premiumization trends and demand for gentle, compliant preservation systems.

What is the growth outlook for the preservatives segment from 2026 to 2035?

The preservatives segment is expected to grow at a CAGR of 5.8% through 2035, driven by reformulation needs and increased use of low-dose, multifunctional antimicrobial blends.

How much revenue did the preservatives segment generate in 2025?

Preservatives accounted for the largest share of the Europe antimicrobial additives industry with 64.7% market share in 2025, driven by their widespread use in skin care, hair care, and toiletries.

What is the projected value of the Europe antimicrobial additives industry by 2035?

The market is expected to reach USD 1.4 billion by 2035, expanding at a CAGR of 6% due to clean-label trends, microbiome-friendly formulations, and tightening EU cosmetic regulations.

What is the current Europe antimicrobial additives market size in 2026?

The market size is projected to reach USD 808.2 million in 2026, supported by increasing adoption of compliant antimicrobial systems in personal care and hygiene applications.

What is the market size of the Europe antimicrobial additives market in 2025?

The Europe antimicrobial additives industry size was valued at USD 761.8 million in 2025 and is expected to grow at a CAGR of 6% during 2026–2035, driven by rising demand for safe, long-lasting cosmetics and stringent regulatory compliance across the region.

Europe Antimicrobial Additives Market Scope

Related Reports