Summary

Table of Content

Edible Packaging Materials Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Edible Packaging Materials Market Size

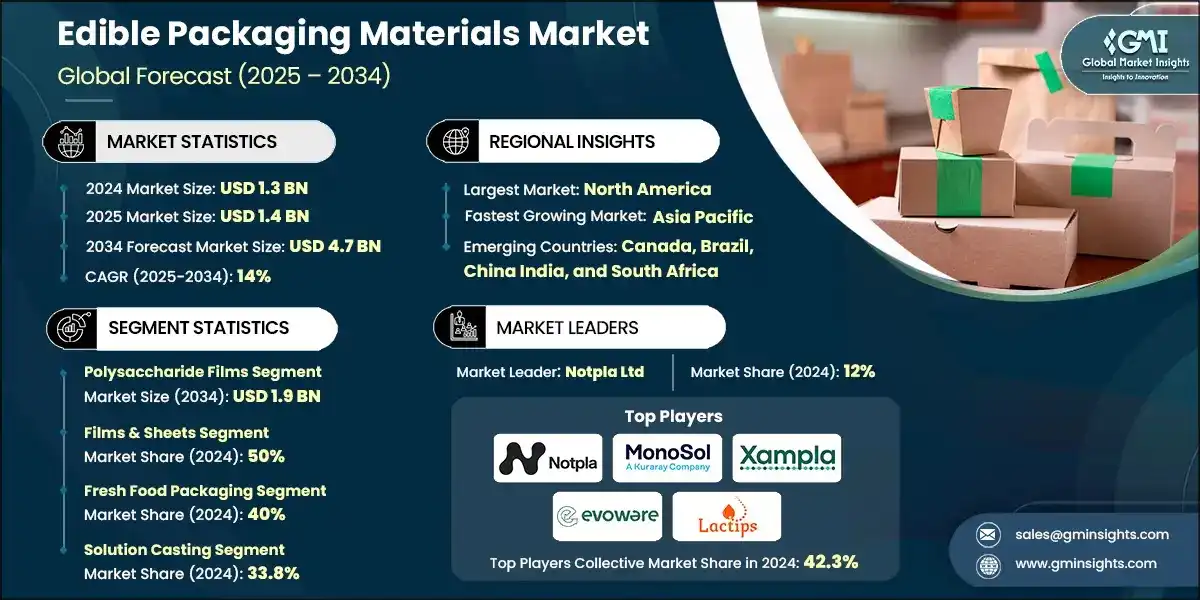

The global edible packaging materials market was estimated at USD 1.3 billion in 2024. The market is expected to grow from USD 1.4 billion in 2025 to USD 4.7 billion in 2034, at a CAGR of 14% according to latest report published by Global Market Insights Inc.

To get key market trends

- The market trajectory reflects accelerating adoption of biodegradable packaging solutions driven by stringent environmental regulations and corporate sustainability commitments. The EU's Single-Use Plastics Directive and similar legislation worldwide are creating regulatory tailwinds for edible packaging alternatives, particularly in food service and retail applications.

- Global food packaging waste exceeding millions of tons annually creates substantial market opportunity for edible alternatives, with regulatory frameworks increasingly favoring circular economy principles. The FDA's Generally Recognized as Safe (GRAS) pathway has streamlined approval processes for edible packaging materials, reducing time-to-market for innovative solutions.

- Technological advances in biopolymer processing and barrier enhancement are expanding application scope beyond traditional confectionery uses into fresh produce, processed foods, and beverage sectors. Investment in edible packaging research and development has increased significantly, with major CPG companies establishing dedicated sustainable packaging divisions.

- With 35% market share, North America leads adoption, supported by robust regulatory frameworks and consumer willingness to pay premiums for sustainable packaging. Asia-Pacific emerges as the fastest-growing region at 13.8% CAGR, driven by rapid industrialization, growing environmental awareness, and supportive government policies in China and India.

Edible Packaging Materials Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 1.3 Billion |

| Market Size in 2025 | USD 1.4 Billion |

| Forecast Period 2025 – 2034 CAGR | 14% |

| Market Size in 2034 | USD 4.7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Environmental regulations drive plastic alternatives | Creates mandatory adoption in key markets and accelerates corporate sustainability initiatives |

| Consumer demand for zero-waste packaging solutions | Drives premium positioning and brand differentiation opportunities |

| Technological advances in barrier properties | Expands application scope into moisture and oxygen-sensitive products |

| Government incentives for sustainable packaging | Reduces adoption costs and accelerates market penetration |

| Pitfalls & Challenges | Impact |

| Limited shelf-life and storage requirements | Restricts distribution scope and requires specialized handling infrastructure |

| Higher production costs vs conventional packaging | Limits mass market adoption and requires premium pricing strategies |

| Regulatory approval complexities across markets | Delays product launches and increases compliance costs |

| Opportunities: | Impact |

| Fresh produce packaging applications | Opens large-volume applications with significant environmental impact |

| Pharmaceutical and nutraceutical encapsulation | Enables high-value applications with functional benefits |

| Integration with smart packaging technologies | Creates differentiated solutions with enhanced consumer experience |

| Market Leaders (2024) | |

| Market Leaders |

Market Share 12% |

| Top Players |

Collective market share in 2024 is Market Share 42.3% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia-Pacific |

| Emerging countries | Canada, Brazil, China India, and South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Edible Packaging Materials Market Trends

Environmental Regulation Acceleration:

- Regulatory frameworks worldwide are creating unprecedented demand for plastic alternatives, with the EU's Single-Use Plastics Directive serving as a global template for similar legislation. The trend has accelerated in recent years with extended producer responsibility schemes and plastic tax implementations across major markets. Government incentives for sustainable packaging, including tax credits and grants, are reducing adoption barriers. The FDA's streamlined GRAS approval process for edible materials has shortened regulatory timelines significantly. Corporate sustainability commitments from leading global companies have created binding procurement targets for sustainable packaging, with numerous major brands committing to eliminate single-use plastics within the next decade. This regulatory momentum is expected to contribute substantially to overall category growth.

Technological Barrier Enhancement:

- Advanced biopolymer processing technologies are overcoming traditional limitations of edible packaging, particularly in moisture and oxygen barrier applications. Nanotechnology integration and multi-layer composite films have achieved barrier properties comparable to conventional plastics in many uses. Rising research investment has accelerated the development of temperature-stable formulations and extended shelf-life solutions. The integration of natural antimicrobial compounds and active packaging technologies is broadening adoption in fresh produce and processed food sectors. Patent activity in edible packaging has grown rapidly, signaling a robust innovation pipeline. These advancements are expected to significantly boost market growth as application scope expands beyond traditional confectionery.

Circular Economy Integration:

- Edible packaging aligns seamlessly with circular economy principles, reinforcing waste reduction initiatives and sustainability goals. Zero-waste retail formats and bulk food stores are driving demand for packaging that eliminates disposal requirements. Integration with composting infrastructure and waste-to-energy systems enhances the value proposition beyond conventional packaging. Corporate procurement policies increasingly favor solutions with clear end-of-life benefits, creating preference for edible alternatives. Global sustainability initiatives, such as those led by major environmental foundations, have endorsed edible packaging as a cornerstone of circular economy strategies, driving institutional adoption. This alignment is expected to accelerate market expansion worldwide.

Premium Positioning and Consumer Willingness:

- Consumer research shows strong willingness to pay premiums for sustainable packaging options, supporting economic viability for edible packaging adoption. Millennials and Gen-Z consumers show particularly high preference for zero-waste packaging, fueling demand in premium and natural food categories. Social media amplification of innovative sustainable packaging drives brand visibility and engagement. Retail partnerships with eco-conscious outlets and natural food stores provide shelf presence and promotional advantages. Brands adopting edible packaging achieve meaningful differentiation and enhanced customer loyalty. This growing consumer enthusiasm is expected to sustain premium pricing and support long-term market growth.

Manufacturing Scale and Cost Optimization:

- Investment in manufacturing capacity and process automation is driving down production costs, improving the commercial feasibility of edible packaging. The adoption of automated lines and continuous production systems has significantly reduced costs. Partnerships between edible and conventional packaging manufacturers are enabling faster scale-up and technological integration. Government incentives and sustainability-linked funding are supporting new facility development. Improvements in raw material sourcing and supply chain efficiency are further lowering operational costs. This evolution in manufacturing capability is expected to strengthen cost competitiveness and accelerate mainstream adoption across industries.

Edible Packaging Materials Market Analysis

Learn more about the key segments shaping this market

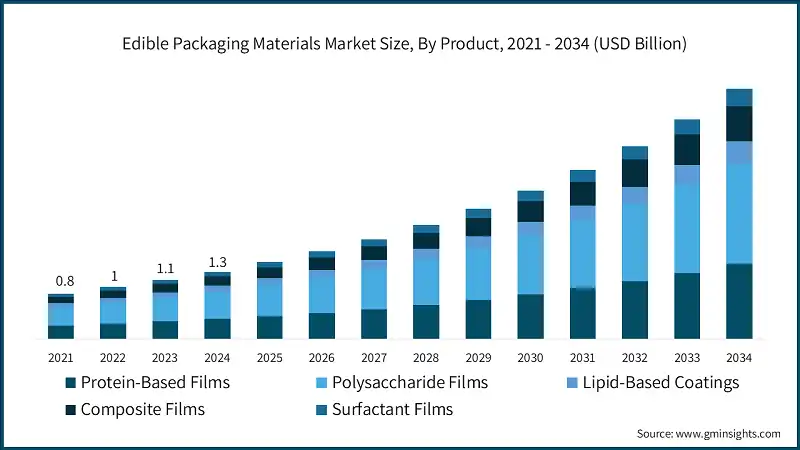

Based on product, the global edible packaging materials market is segmented into protein-based films, polysaccharide films, lipid-based coatings, composite films, and surfactant films. Polysaccharide films dominate the market, accounting for approximately 40% of the total market share in 2024, projected to grow from USD 572.3 million in 2025 to USD 1.9 billion in 2034, at a CAGR of 14.3%.

- Polysaccharide films lead market adoption due to their excellent film-forming properties, natural abundance, and regulatory acceptance across global markets. Starch-based and cellulose-derived films offer optimal balance of barrier properties, processability, and cost-effectiveness for food packaging applications. Innovation in modified starches and nanocellulose composites is expanding application scope into moisture-sensitive products. Major manufacturers are investing in proprietary polysaccharide formulations that enhance mechanical strength and water resistance while maintaining biodegradability.

- Protein-based films represent the second-largest segment with strong growth potential, particularly in applications requiring enhanced barrier properties and nutritional value addition. Whey protein, casein, and plant-based protein films offer superior oxygen barrier properties compared to polysaccharide alternatives. The segment benefits from abundant raw material availability from food processing waste streams, supporting circular economy objectives. Research into protein-polysaccharide hybrid films is creating next-generation solutions with enhanced performance characteristics.

Learn more about the key segments shaping this market

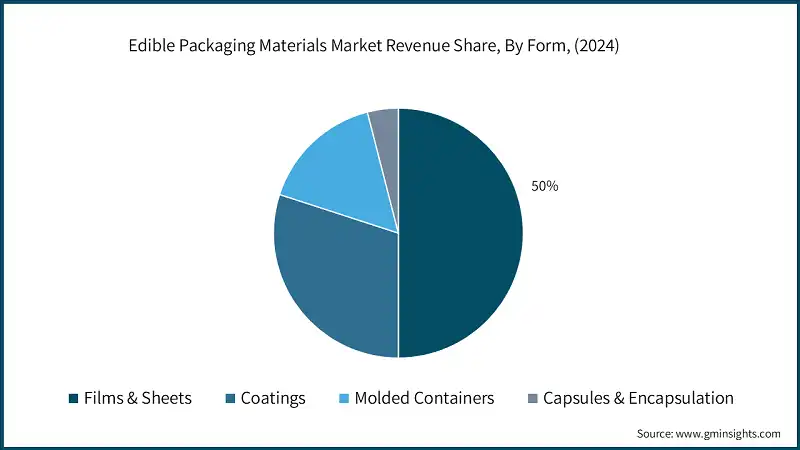

Based on form, the edible packaging materials market includes films & sheets, coatings, molded containers, and capsules & encapsulation. In 2024 the films & sheets dominate with approximately 50% market share, while molded containers show exceptional growth potential at 14.1% CAGR.

- Films & sheets applications lead due to versatility across multiple food packaging applications and established manufacturing processes. Flexible packaging formats align with consumer convenience preferences and retail display requirements. Innovation in multi-layer films and laminated structures is expanding barrier property capabilities. The segment benefits from existing converting equipment compatibility, reducing adoption barriers for packaging manufacturers.

- Molded containers represent emerging high-growth applications, particularly in food service and ready-to-eat meal segments. Three-dimensional packaging formats offer enhanced product protection and premium presentation opportunities. Compression molding and thermoforming technologies are enabling complex geometries and functional designs. The segment aligns with zero-waste restaurant initiatives and sustainable food service programs.

Based on application, the edible packaging materials market is segmented into fresh food packaging, processed food packaging, beverage applications, confectionery & bakery applications, and pharmaceutical & nutraceutical applications. In 2024, the fresh food packaging leads with 40% market share, projected to grow at a CAGR of 13.9%.

- Fresh food packaging applications drive market growth due to large addressable market size and significant environmental impact potential. Edible coatings for fruits and vegetables extend shelf-life while eliminating plastic wrap requirements. Innovation in antimicrobial and antioxidant-enhanced films provides functional benefits beyond traditional packaging. The segment benefits from retail sustainability initiatives and consumer demand for plastic-free produce options.

- Processed food packaging represents established applications with proven commercial viability, particularly in confectionery and snack segments. Ready-to-eat meal packaging offers significant growth potential as food service sustainability initiatives expand. The segment benefits from established regulatory pathways and consumer acceptance in traditional edible packaging applications.

Based on manufacturing process, the edible packaging materials market includes solution casting, extrusion, compression molding, and coating & lamination. In 2024 the solution casting leads with approximately 33.8% market share, while extrusion shows strong growth at 14.2% CAGR.

- Solution casting dominates due to versatility in film thickness control and multi-layer structure capability. The process enables incorporation of functional additives and precise barrier property optimization. Laboratory-scale development and pilot production benefit from solution casting flexibility. Equipment investment requirements are moderate compared to extrusion alternatives.

- Extrusion processes offer superior scalability and continuous production capabilities for high-volume applications. Blown film and cast film extrusion technologies are being adapted for biopolymer processing. The process enables cost-effective production at commercial scales with consistent quality control. Integration with existing packaging manufacturing infrastructure reduces adoption barriers.

Looking for region specific data?

North America Edible Packaging Materials Market Trends

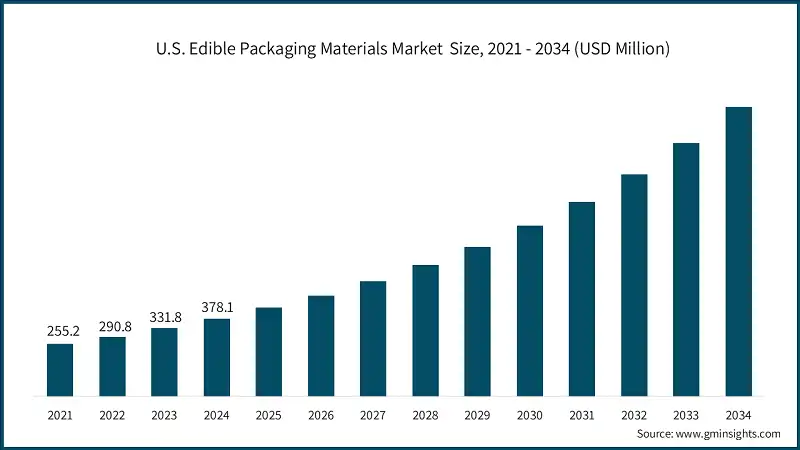

The North America market leads with a 35% share and an estimated USD 439.6 million value in financial year 2024, anchored by robust regulatory support and strong corporate sustainability commitments.

- The U.S. dominates regional consumption with established FDA regulatory pathways and significant investment in sustainable packaging R&D. Corporate procurement policies from major CPG companies create stable demand for edible packaging solutions. The USDA's BioPreferred Program provides procurement preferences for bio-based packaging materials, supporting market adoption. California's plastic reduction legislation and similar state-level initiatives create regulatory tailwinds for edible alternatives.

- Canada shows strong growth potential with supportive government policies and growing consumer environmental awareness. The Canadian Food Inspection Agency's streamlined approval processes for novel packaging materials reduce market entry barriers. Provincial waste reduction initiatives and extended producer responsibility programs favor sustainable packaging alternatives.

Europe Edible Packaging Materials Market The Europe market holds around 30% share in 2024 with policy-driven sustainability initiatives and circular economy integration. The Asia Pacific edible packaging materials industry captures 22% share in 2024 and grows fastest at 14.3% CAGR, powered by rapid industrialization and growing environmental awareness. Latin America holds approximately 9% of the global market, with Brazil leading regional consumption. The market is projected to grow at a CAGR of 13.1% in 2024, supported by expanding food processing industry and growing environmental awareness. In 2024, the global edible packaging materials industry was led by a group of innovative companies where the top seven players collectively held approximately 42.3% of the market share, which included Notpla Ltd., MonoSol LLC (Kuraray Group), Xampla Ltd., Evoware (PT. Evogaia Karya Indonesia), Lactips. These companies maintain strong positions in the market owing to their proprietary biopolymer technologies, established regulatory approvals, strategic partnerships with CPG brands, and significant investment in R&D for sustainable packaging solutions. Major players operating in the edible packaging materials industry include:Asia Pacific Edible Packaging Materials Market

Latin America Edible Packaging Materials Market

Middle East & Africa Edible Packaging Materials Market

Edible Packaging Materials Market Share

Edible Packaging Materials Market Companies

Edible Packaging Materials Industry News

This edible packaging materials market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Million) and volume (Kilo Tons) from 2025 to 2034, for the following segments:

Market, By Product

- Protein-based films

- Casein films

- Whey protein films

- Gelatin films

- Collagen films

- Soy protein films

- Wheat gluten films

- Polysaccharide films

- Starch-based films

- Cellulose films

- Chitosan films

- Pectin films

- Alginate films

- Carrageenan films

- Lipid-based coatings

- Natural wax coatings

- Fatty acid films

- Essential oil-based barriers

- Composite films

- Protein-polysaccharide combinations

- Multi-layer film technologies

- Nanocomposite integration

- Surfactant films

- Lecithin-based films

- Specialty emulsifier systems

Market By Form

- Films & sheets

- Flexible films

- Rigid sheets

- Laminated structures

- Coatings

- Spray-applied coatings

- Dip coatings

- Brush-on applications

- Molded containers

- Thermoformed containers

- Injection molded solutions

- 3D printed packaging

- Capsules & encapsulation

- Hard capsules

- Soft capsules

- Microencapsulation

Market, By Barrier Properties

- Moisture barrier applications

- High moisture barrier

- Controlled permeability

- Humidity-responsive systems

- Oxygen barrier applications

- High oxygen barrier

- Selective permeability

- Active oxygen scavenging

- Antimicrobial properties

- Natural antimicrobial agents

- Chitosan-based systems

- Silver nanoparticle integration

- UV protection applications

- Light-sensitive product protection

- Photodegradation prevention systems

- Color stability enhancement

Market, By Application

- Fresh food packaging applications

- Fruits & vegetables

- Meat & poultry

- Seafood & marine products

- Dairy products

- Processed food packaging applications

- Ready-to-eat meals

- Frozen foods

- Snack foods

- Baked goods

- Beverage applications

- Liquid containers

- Beverage pods & single-serve

- Bottle coatings & closures

- Confectionery & bakery applications

- Chocolate & candy

- Cake & pastry

- Ice cream & frozen desserts

- Pharmaceutical & nutraceutical applications

- Drug delivery systems

- Dietary supplements

- Medical foods

Market, By Manufacturing Process

- Solution casting process

- Laboratory-scale production

- Pilot-scale manufacturing

- Commercial-scale operations

- Extrusion process

- Blown film extrusion

- Cast film extrusion

- Co-extrusion

- Compression molding

- Hot press molding

- Cold press applications

- Vacuum forming

- Coating & lamination

- Spray coating systems

- Dip coating processes

- Lamination technologies

Market, By Distribution Channel

- Direct sales to manufacturers

- Food & beverage manufacturers

- Pharmaceutical companies

- Contract packaging organizations

- Packaging distributors & wholesalers

- Regional packaging distributors

- Specialty packaging wholesalers

- International trading companies

- Online & digital channels

- B2B e-commerce platforms

- Manufacturer direct sales

- Specialty chemical distributors

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the key players in the edible packaging materials market?

Key players include Notpla Ltd., MonoSol LLC (Kuraray Group), Xampla Ltd., Evoware (PT. Evogaia Karya Indonesia), Lactips, FlexSea Ltd., Sway (Sway Innovation Co.), Apeel Sciences, and Loliware Inc.

What is the market size of the edible packaging materials industry in 2024?

The market size was USD 1.3 billion in 2024, with a CAGR of 14% expected through 2034, driven by environmental regulations and increasing demand for sustainable packaging solutions.

What is the current edible packaging materials market size in 2025?

The market size is projected to reach USD 1.4 billion in 2025.

What is the projected value of the edible packaging materials market by 2034?

The market size for edible packaging materials is expected to reach USD 4.7 billion by 2034, supported by advancements in biopolymer technologies and expanding applications in food and pharmaceutical sectors.

What was the market share of polysaccharide films in 2024?

Polysaccharide films accounted for approximately 40% of the market share in 2024.

What is the growth outlook for molded containers from 2025 to 2034?

Molded containers are projected to grow at a 14.1% CAGR till 2034, driven by their increasing adoption in fresh food and pharmaceutical packaging applications.

What are the upcoming trends in the edible packaging materials industry?

Key trends include the integration of smart packaging technologies, advancements in barrier properties, and the adoption of circular economy initiatives to enhance sustainability.

Which region leads the edible packaging materials market?

North America held 35% market share with an estimated USD 439.6 million in 2024. Strong regulatory support and corporate sustainability initiatives drive the region's leadership.

Edible Packaging Materials Market Scope

Related Reports