Summary

Table of Content

Decentralized Identity Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Decentralized Identity Market Size

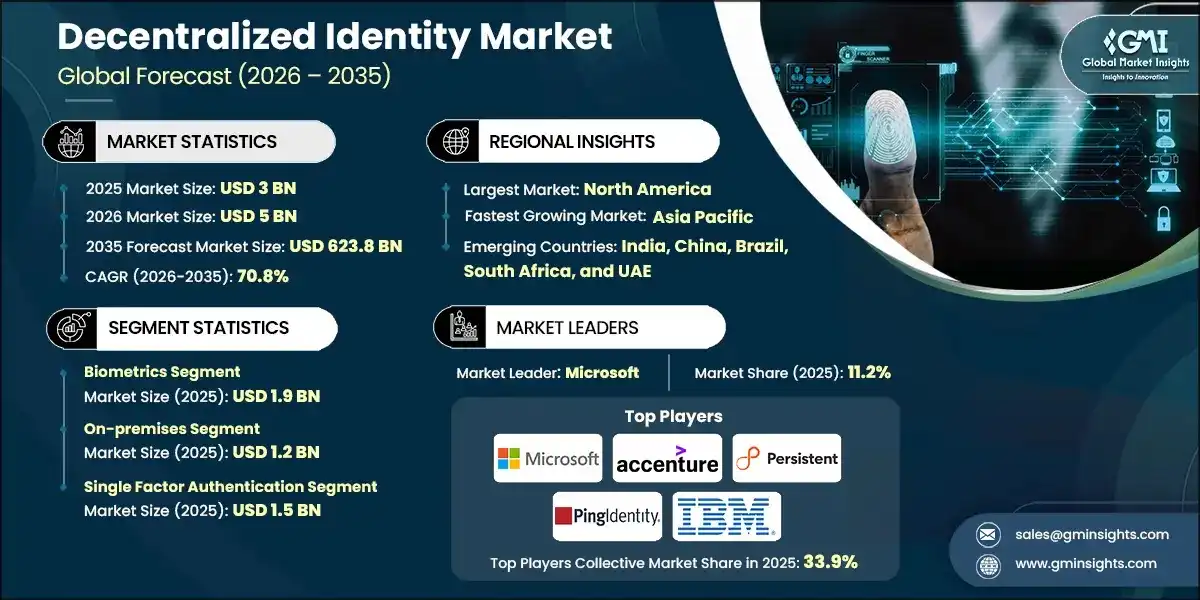

The global decentralized identity market size was estimated at USD 3 billion in 2025. The market is expected to grow from USD 5 billion in 2026 to USD 623.8 billion by 2035, at a CAGR of 70.8% during the forecast period.

To get key market trends

- Government sponsored digital identity wallets are new tools that are changing the way consumers authenticate online. According to the EU Digital Identity Framework (2024), each of the EU member countries has to start issuing one digital identity wallet to individuals and businesses by the year 2026. This is to allow for smooth and secure mobile identity verification needed for public and private services across the EU member countries.

- For instance, in May 2024 the regulation entered into force, formalizing a pan-European digital identity system that promises cross-border recognition, strong privacy protections, and simplifies access to e-government, banking, travel, and other services, as stated by European Commission.

- As cybercrime and identity fraud surge, enterprises and governments look for stronger identity assurance mechanisms. The FBI reported that in 2024 there were over 859,000 complaints and more than USD 16 million in losses. This is a 33% increase from 2023, and demonstrates a dramatic increase in fraud, data breaches, and identity theft. This shows an even bigger need for decentralized identity systems that reduce risk with user controlled credentials.

- Due to the regulatory requirements (i.e., KYC/AML, privacy laws) and the development of online services ecosystems, organizations need compliant and effective identity onboarding. A secure digital identity wallet provides reusable, cryptographically validated credentials, reducing repetitive verifications, lowering friction, saving time and compliance costs, while user privacy is maintained. The regulatory push of the EU Digital Identity Wallet supports this inclination.

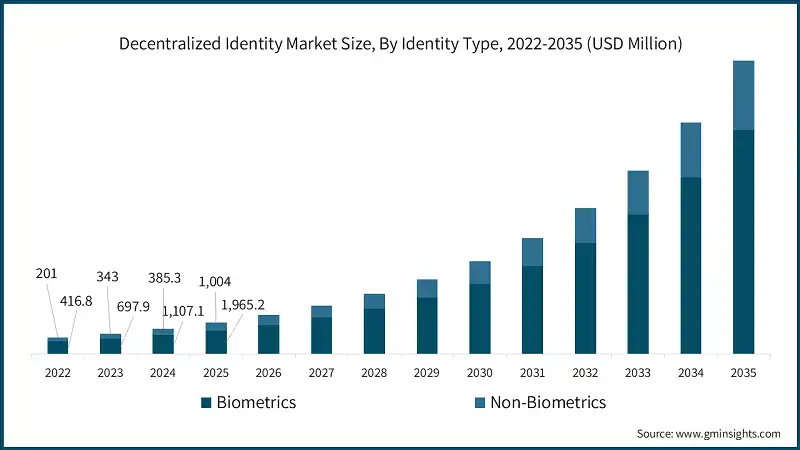

- Based on identity type, the decentralized identity market is segmented into biometrics and non-biometrics. The biometric segment was the largest market and was valued at USD 1.96 billion in 2025. The expansion is being fueled by the greater adoption of fraud resistant verifiable credentials, stronger authentication, and government funded digital programs incorporating biometrics for safe digital ID.

- North America dominated the decentralized identity market with a share of 34.6% market share and was valued at USD 1 billion in 2025. The ongoing negotiations of federal data privacy laws in conjunction with the California Consumer Privacy Act (CCPA) have accelerated the implementation of decentralized identification systems. Canada is also becoming a major player with initiatives like the Pan-Canadian Trust Framework, which seeks to develop uniform digital identity systems.

Decentralized Identity Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 3 Billion |

| Market Size in 2026 | USD 5 Billion |

| Forecast Period 2026-2035 CAGR | 70.8% |

| Market Size in 2035 | USD 623.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Government-Led Digital ID Programs | Enables secure, verifiable digital identities across citizens and enterprises, driving large-scale adoption in e-governance and fintech services. |

| Rising Fraud, Data Breaches & Identity Theft Costs | Increases demand for SSI, verifiable credentials, and multi-factor authentication, reducing financial losses and improving cybersecurity compliance. |

| Enterprise Need for Streamlined & Compliant Onboarding | Accelerates 30% decentralized identity deployment in banking, telecom, and enterprises, enabling faster, automated, and regulation-compliant onboarding processes. |

| Growth of Web3, Tokenized Assets & Digital Wallet Ecosystems | Supports 15% blockchain-based identity wallets, secure authentication, and asset management in DeFi, NFT, and metaverse platforms. |

| Increased Multi-Cloud & Zero-Trust Adoption | Integrates 10% decentralized identity with cloud and zero-trust architectures, ensuring secure authentication, access, and governance across distributed systems. |

| Pitfalls & Challenges | Impact |

| Lack of Global Trust Frameworks & Legal Recognition | Limits cross-border adoption and interoperability; reduces enterprise confidence in SSI deployment, slowing market growth globally. |

| Poor User Experience & Interoperability Gaps | Frustrates end-users and enterprises, impeding adoption; inconsistent platforms and fragmented standards restrict seamless integration across applications and services. |

| Opportunities: | Impact |

| Expansion of Government Digital ID Programs | Will drive adoption of SSI and verifiable credentials across public services and fintech sectors globally. |

| Integration with Web3, Tokenized Assets & Digital Wallets | Will drive demand for blockchain-based identity wallets, supporting secure authentication and asset management in emerging digital ecosystems. |

| Market Leaders (2025) | |

| Market Leaders |

11.2% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | India, China, Brazil, South Africa, and UAE |

| Future Outlook |

|

What are the growth opportunities in this market?

Decentralized Identity Market Trends

- Businesses are moving to decentralized data systems and implementing self-sovereign Identity (SSI) models to increase privacy. Users control and manage secure wallets, share selective attributes, and bonafide information to lower the risk of breaches, thus improving system trust.

- There is a drive SSI to become the primary system for managing the identification of individuals and workers, and enterprise assets within complex digital ecosystems, led by regulations of eIDAS 2.0, W3C Verifiable Credentials 2.0, and various state sponsored digital wallets. Expansion of SSI services and systems grew after pilot scheme projects of 2023, coupled with the W3C guidelines, and after enforcement of eIDAS 2.0.

- Organizations are embedding blockchains into their decentralized identity frameworks to manage decentralized identifiers, record revocation lists, and store verification records as attestation logs to build dependence away from core databases while also implementing zero-trust authentication modernization. Blockchains are being used in the BFSI and healthcare as well as in interconnected supply-chain networks to improve the ability to prevent fraud and issues rapidly and to provide cryptographically verifiable credentials.

- The enterprise wallet infrastructure and ledger-agnostic frameworks are now sufficiently developed to facilitate broad implementations across the economic sector without a need for organizations to commit to a particular blockchain network. From experimental framework registries in 2021 to enterprise-grade in 2023, integration of blockchain-based identity reached significant new adoption in 2024 – 2025, as more DI frameworks became ledger agnostic.

- As more industries begin to adopt decentralized identity, cross-system functionality has become an increasingly crucial focus. Organizations such as the W3C, DIF, and OpenID Foundation have made progress determining the specifications for interoperable digital wallets, issuers, and verification systems, including Decentralized Identifiers (DIDs), Verifiable Credentials (VCs), and DIDComm, OpenID4VC.

- These standards reduce vendor lock-in, enable cross-border identity exchange, and support large-scale rollouts in government, financial services, and healthcare ecosystems that require unified, interoperable identity frameworks. Interoperability efforts grew from early DID/VC work in 2021, advanced significantly with OIDC4VC in 2023, and became mainstream after VC 2.0 formalization in 2024–2025.

Decentralized Identity Market Analysis

Learn more about the key segments shaping this market

Based on identity type, the decentralized identity market is divided into biometrics & non-biometrics.

- The biometrics segment was the largest market and was valued at USD 1.9 billion in 2025. Increasing instances of identity fraud, deep-fakes and spoofing are pushing regulated sectors such as finance, border security and healthcare to demand biometric-anchored verifiable credentials that are difficult to forge or duplicate. For instance, biometric-enabled digital identity wallets and mobile-ID solutions are projected to gain widespread use within two years.

- Member states must implement certified digital identity wallets by 2026 as a result of the adoption of the updated eIDAS 2.0 legal framework, which will increase demand from wallet issuers and service providers for biometric credential modules and identity-assurance services.

- Manufacturers of biometric sensors and secure identity devices should prioritize development of privacy-preserving, certified biometric modules (e.g. liveness detection) to meet demand from eID-wallet issuers and high-security sectors.

- The non-biometrics segment is the fastest growing market and is anticipated to grow with a CAGR of 73.1% during the forecast period. Organizations and individuals increasingly prefer identity solutions that avoid storing sensitive biometric or personal data centrally, using cryptographic credentials, decentralized identifiers (DIDs) and verifiable credentials instead. This supports compliance with data-protection laws while maintaining user-data ownership.

- Manufacturers should invest in software-centric wallet SDKs and secure credential-storage hardware (e.g. secure elements), enabling lightweight non-biometric identity solutions, appealing to privacy-first markets and regulators supporting EUDI Wallet adoption.

Learn more about the key segments shaping this market

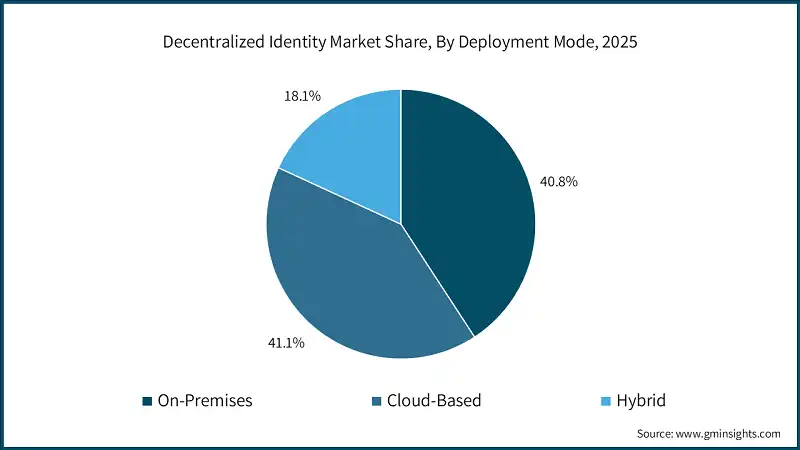

On the basis of deployment mode, the decentralized identity market is segmented into on-premises, cloud-based, and hybrid.

- The on-premises segment was the largest market and was valued at USD 1.2 billion in 2025. To maintain complete control over sensitive identity data, organizations with stringent data sovereignty requirements, such as governments and major financial institutions, prefer on-premises DI solutions. For instance, in March 2024, the European Banking Authority emphasized the need for banks to store critical customer identity information within EU jurisdictions to comply with GDPR and operational risk regulations.

- Businesses can customize identity workflows, integrate with legacy IAM systems, and enforce internal security policies with on-premises solutions. For instance, in January 2025, a leading European bank implemented a fully on-premises decentralized identity system to meet internal audit requirements while integrating with existing access management tools.

- Manufacturers and system integrators should offer modular, on-premises DI solutions that can be deployed within enterprise data centres or government infrastructures, providing customizable workflows and compliance-ready reporting.

- The cloud based segment is the fastest growing market and is anticipated to grow with a CAGR of 77.4% during the forecast period. Cloud document and onboarding solutions provide businesses the ability to rapidly expand user onboarding, reduce infrastructure, and support worldwide accessibility. For instance, in September 2024, Microsoft announced that its Entra Verified ID cloud service enabled multi-million users onboarding for enterprise and government pilots across Europe.

- Manufacturers and solutions providers need to prioritise developing, and, or, deployed, flexible, cloud-native DI solutions with strong SLA, multi-region, and global privacy and compliance capabilities.

Based on authentication method, the decentralized identity market is divided into single-factor authentication, and multi-factor authentication.

- The single factor authentication was the largest market and was valued at USD 1.5 billion in 2025. This type of authentication covers things like PINs and passwords. Since they are easy to implement in lower-risk situations, this form of authentication will likely be more commonly accepted by users as they find it easier to understand. For instance, according to a report released by UK Government Digital Service on October 2023, over 40% of UK government websites, which are available to the public, have single-factor authentication for the initial using of digital ID solutions.

- Solution providers need to offer lightweight and easy to integrate modules as self-sovereign identities for decentralized solutions and should target low risk and cost sensitive industries.

- The multi-factor authentication is the fastest growing market and is anticipated to grow with a CAGR of 76% during the forecast period. Multi-factor authentication provides strong assurance for decentralized identity deployments and is essential for the sectors dealing with sensitive financial or personal information.

- Manufacturers should focus on developing MFA-enabled DI solutions with a customizable combination of factors to meet the regulatory compliance requirements of the sector along with a high-security environment of finance, healthcare, government, etc.

Looking for region specific data?

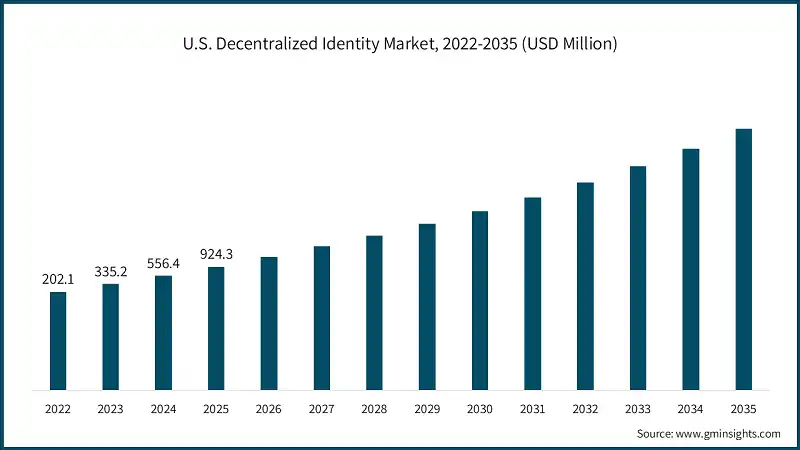

North America dominated and held 34.6% of the decentralized identity market in 2025. The region is witnessing rapid growth due to investments in cloud-based digital wallets, blockchain-enabled identity, and enterprise IAM integration.

- The U.S. decentralized identity market was valued at USD 924.3 million in 2025 and is expected to grow at a CAGR of 66.7% during 2026 to 2035. This growth can be attributed to the investments in the digital wallets that are blockchain-based identity systems and in the integration of enterprise IAM systems. Federal adoption of services such as NIST digital identity guidelines are pushing the finance, healthcare, and citizen digital services sectors to adopt these systems faster.

- Manufacturers need to spend more on technological advancements of the cloud and work with the government on grants so that they can develop compliant decentralized IAM solutions with the tools of enterprise partnerships.

- Canada’s decentralized identity market is anticipated to grow at a CAGR of 71.1% by 2035. Innovation, Science, and Economic Development Canada's ISED funding programs and national digital identity pilot programs have been spearheading this growth. Targeted areas of interest are e-government services, financial verification, and healthcare identity systems.

The European decentralized identity market was valued at USD 839.7 million in 2025. Strong presence of OEMs, government agencies, and industrial automation centres supports adoption of decentralized identity solutions.

- Germany’s decentralized identity market is projected to grow at a CAGR of 71.4%, due to German government-backed pilots of ID Wallets through eIDAS 2.0 that aim at digitizing government services and banking. For instance, in November 2025, the German Government Signed a memorandum of understanding with 75+ stakeholders in implementing the EU Digital Identity Wallet, demonstrating a strong public-private partnership and expediting the decentralised identity infrastructure in the country.

- The UK market is projected to surpass USD 39.3 billion by 2035. Although outside the EU, UK enterprises and financial institutions require cross-border identity verification. The EU’s eIDAS 2.0 framework encourages adoption of decentralized identity solutions that align with European standards, helping provide secure services for clients dealing with EU markets.

- Manufacturers should build UK-compliant decentralized identity solutions that align with EU standards, enabling cross-border interoperability and supporting financial, healthcare, and government service providers.

The Asia Pacific decentralized identity market is the fastest growing market and is anticipated to grow with a CAGR of 75.3% during the forecast period. Rapid adoption of mobile-first digital wallets and national digital identity programs across Asia-Pacific is driving decentralized identity demand. As per ACI Worldwide Report 2024, in 2023 around 49% of the global real-time payment transactions happened in India.

- The decentralized identity market in China is anticipated to surpass USD 86.1 billion by 2035, growing with a CAGR of 76.9%. In July 2025, the Chinese government introduces its own centralized digital ID system for online identity credentials and centralized authentication, which rapidly drives the roll-out of decentralized identity infrastructure nationwide for e-service and fintech.

- Solution providers need to create credential systems that are compliant with the state and can work in a permissioned network, as well as collaborate with local platforms to add the new digital- ID feature to apps and services.

- The decentralized identity market in Japan was valued at USD 156.4 million in 2025. In January 2025, the launch of the Asia Pacific Digital Identity Consortium (APDI) in Japan signalled strong regional collaboration for cross-border digital credentials, paving the way for interoperable, standards-based decentralized identity across APAC.

- Manufacturers should invest in interoperable, standard-compliant identity wallets (e.g. supporting ISO/IEC standards), and participate in cross-border credentialing pilots to build APAC-wide solutions.

- The India decentralized identity market is anticipated to grow with a CAGR of 79.4% during the forecast period. In November 2025, the national digital-wallet ecosystem in India expanded with a new app embedding biometric credentials for the country’s identity infrastructure, signalling strong momentum in decentralized identity adoption across services such as SIM activation, banking KYC, and e-governance.

- Manufacturers should create adaptable, lightweight, biometric-enabled wallets, then collaborate with fintech companies or government agencies to facilitate and integrate service offerings to assist with the large-scale deployment of identity wallets.

The decentralized identity market in Latin America was valued at USD 169 million in 2025, driven by rising adoption of blockchain-based digital ID and e-governance in Brazil, Mexico, and other states.

The MEA decentralized identity market is projected to surpass USD 27.4 billion by 2035. The MEA region is witnessing accelerating adoption of decentralized identity systems, particularly through national ID modernisation, smart-governance and financial-inclusion programs in several countries.

- The South African government will implement a nationwide unified digital ID to replace the fragmented ID, tax, health, and social-grant identifiers. The South African government is scheduled to provide citizens with a Digital ID and Smart ID which will allow citizens to remotely authenticate, share digital documents, access e-services, and authenticate actively. The South African government hopes to achieve mass adoption of the credential by 2028. The initiative is part of the South African governments efforts to digitize the public sector and reduce identity fraud.

- Solution providers should build secure credential-wallet and verification infrastructure tailored for South African regulatory environment and engage early with public agencies to integrate identity services with banking, healthcare and social-welfare platforms.

- The decentralized identity market in Saudi Arabia is projected to show tremendous growth. Under its Vision 2030 agenda, Saudi Arabia has built a unified national digital-identity ecosystem via platforms such as Absher and Nafath, enabling over 28.5 million users by early 2025 to access more than 470 government and private-sector services with a single identity credential. This widespread adoption across public services, finance, healthcare and commerce is accelerating demand for robust identity-authentication and credential-management systems.

- The decentralized identity market in UAE is anticipated to surpass USD 9.7 billion by 2035. The UAE’s national digital identity platform UAE Pass now serves over 11 million users and facilitates access to 5,000+ government and private-sector services, reflecting strong public-and private-sector adoption and digital transformation momentum across the federation.

- Manufacturers should focus on building secure, mobile-first wallet and credential solutions that integrate with UAE Pass’s biometric + digital-signature capabilities and target government, banking, and private-service adoption.

Decentralized Identity Market Share

The competitive landscape of the decentralized identity industry is defined by rapid technological innovation and strategic collaborations among leading technology providers, system integrators, and cybersecurity solution vendors. Top players hold a combined market share of approximately 33.9% globally. These companies are heavily investing in research and development to advance self-sovereign identity frameworks, strengthen data privacy, enhance interoperability, and integrate decentralized identity solutions across enterprise, government, and financial platforms. The market is also witnessing partnerships, joint ventures, and acquisitions aimed at accelerating solution deployment and expanding global adoption.

Additionally, smaller startups and niche technology firms are contributing by developing blockchain-based identity platforms, verifiable credentials, and zero-trust authentication models, fostering innovation and differentiation. This dynamic ecosystem is driving rapid technological progress and supporting the broader adoption and scalability of decentralized identity solutions worldwide.

Decentralized Identity Market Companies

The top prominent companies operating in the decentralized identity industry include:

- 1Kosmos Inc.

- Accenture

- Affinidi

- Alchemy Insights, Inc.

- Civic Technologies, Inc.

- Datarella GmbH

- Dragonchain Inc.

- Evernym Inc.

- Finema Co., Ltd.

- Gen Digital Inc.

- Kiva Microfunds, Inc.

- Microsoft

- Nuggets

- Ontology

- Persistent Systems

- Ping Identity

- Validated ID, SL

- Wipro DICE ID

- IBM

- Microsoft

Microsoft held 11.2% of the market in 2025. It was able to do so by combining the features of its Azure Active Directory, decentralized identity solutions (ION on Bitcoin), and enterprise ecosystem. Essentially, Microsoft's power is in the linkage of decentralized identity with cloud services, identity governance, and secure authentication for global enterprises. The extensive Microsoft installed base along with its perpetual R&D investments are major enablers for a wide adoption among enterprise and government clients.

Accenture had a market share amounting to 8.5% in 2025, due to their consulting-led decentralized identity programs, blockchain identity models, and cross-sector identity platforms. With their powerful connections to governments, banks, and multinationals, Accenture is prepared to assist large-scale regionally compliant deployments.

Persistent Systems accounted for 4.3% market share in 2025, and provided blockchain-based decentralized identity platforms, credential management solutions, and enterprise-grade digital wallets. Its ability to integrate identity solutions with enterprise IT and regulatory compliance places it as a key innovator in the middle-market segment.

Ping identity held 4.2% of the market share in 2025, when it comes to offering cloud-based identity management coupled with decentralized authentication solutions. Its strength is the secure single sign-on, multi-factor authentication, and identity federation abilities for enterprise buyers.

IBM was able to obtain 5.7% of the market in 2025, by leveraging blockchain-based identity solutions, identity-as-a-service solutions, and secure credential issuance. Its ecosystem alliances within the healthcare, finance, and government verticals aid the scaling of decentralized identity solutions and assist in the compliant regulation.

Decentralized Identity Industry News

- In March 2022, Microsoft presented its new identity and access management solution offerings under the name Entra. The new offerings included Cloud Infrastructure Entitlement Management (CIEM) and Decentralized Identity, and also included some older products such as Azure AD. The Entra solution was developed to safeguard users' access to any application or resource and assist security teams in discovering and managing rights in multi-cloud environments to protect digital identities fully.

- In November 2025, 1Kosmos released "1Kosmos Verify," a high-assurance identity verification tool using biometrics and password less authentication for secure workforce account recovery and password resets.

- In February 2023, Wipro Lab45 launched its "Decentralized Identity and Credential Exchange (DICE) ID," a blockchain-enabled platform for issuing and verifying digital credentials, giving users control over their personal data.

This decentralized identity market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) from 2022 to 2035, for the following segments:

Market, By Identity Type

- Biometrics

- Non-biometrics

Market, By Component

- Solutions/platforms

- Decentralized identity platforms

- Identity wallets

- Verifiable credential management systems

- Blockchain identity networks

- Services

- Consulting & implementation

- Integration & interoperability services

- Managed services

- Identity governance services

Market, By Deployment Mode

- On-premises

- Cloud-based

- Hybrid

Market, By Authentication Method

- Single-factor authentication

- Multi-factor authentication

Market, By Enterprise Size

- Large enterprises

- Small and medium-sized enterprises

Market, By Industry Vertical

- BFSI

- Retail & eCommerce

- IT & telecommunication

- Government & public sector

- Healthcare

- Real estate

- Media & entertainment

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Latin America

- Brazil

- Mexico

- MEA

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

Who are the key players in the decentralized identity industry?

Key players include 1Kosmos Inc., Accenture, Affinidi, Alchemy Insights, Inc., Civic Technologies, Inc., Datarella GmbH, Dragonchain Inc., Evernym Inc., Finema Co., Ltd., Gen Digital Inc., Kiva Microfunds, Inc., Microsoft, and Nuggets.

Which region leads the decentralized identity sector?

North America leads the market, with the U.S. alone valued at USD 924.3 million in 2025 and is set to expand at a CAGR of 66.7% till 2035. Growth is supported by investments in digital wallets and enterprise IAM systems.

What are the upcoming trends in the decentralized identity market?

Key trends include self-sovereign identity (SSI), blockchain-based decentralized identifiers, interoperable digital wallets, biometric solutions, and ledger-agnostic frameworks, with growing adoption of standards like VC 2.0 and OIDC4VC.

How much revenue did the biometrics segment generate in 2025?

The biometrics segment generated approximately USD 1.9 billion in 2025. The market is led by the demand for secure, verifiable credentials in regulated sectors like finance, border security, and healthcare.

What was the valuation of the on-premises segment in 2025?

The on-premises segment was valued at USD 1.2 billion in 2025, as organizations with stringent data sovereignty requirements, such as governments and financial institutions, preferred these solutions.

What is the expected size of the decentralized identity industry in 2026?

The market size is projected to reach USD 5 billion in 2026.

What is the market size of the decentralized identity in 2025?

The market size was estimated at USD 3 billion in 2025, with a CAGR of 70.8% expected through 2035. The growth is driven by government-backed digital identity wallets, blockchain integration, and increasing adoption of self-sovereign identity (SSI) models.

What is the projected value of the decentralized identity market by 2035?

The market is poised to reach USD 623.8 billion by 2035, fueled by advancements in interoperable identity frameworks, ledger-agnostic solutions, and the adoption of biometric-anchored verifiable credentials.

Decentralized Identity Market Scope

Related Reports