Summary

Table of Content

Data Center Liquid Cooling Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Data Center Liquid Cooling Market Size

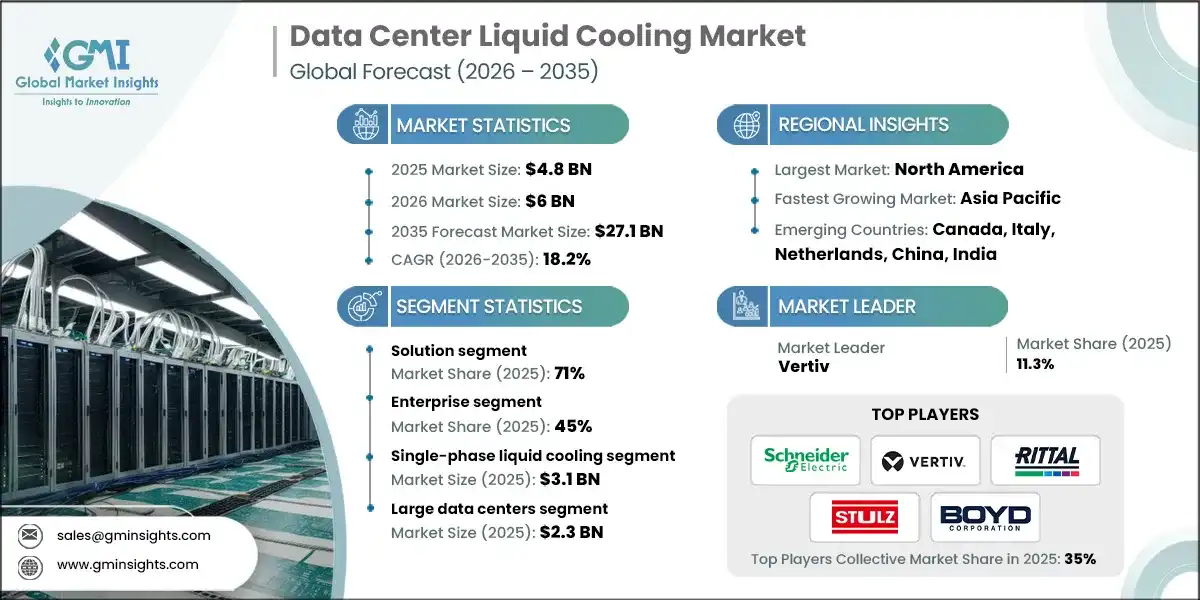

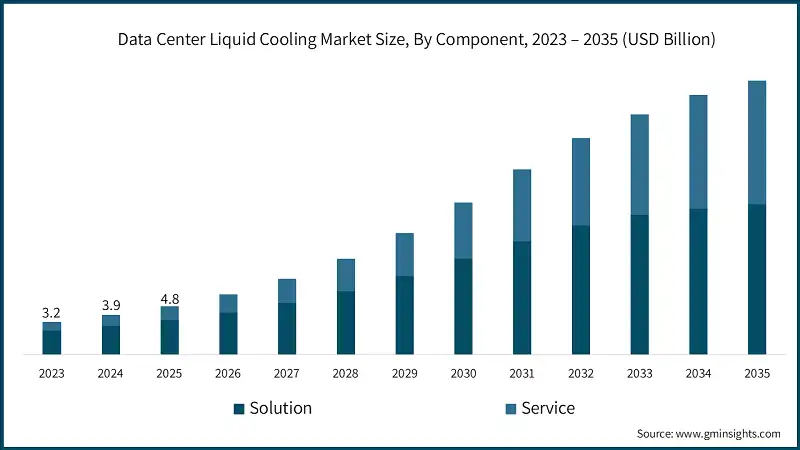

The global data center liquid cooling market was valued at USD 4.8 billion in 2025 and is set to expand from USD 6 billion in 2026 to USD 27.1 billion by 2035, growing at 18.2% CAGR over 2026–2035, according to latest report published by Global Market Insights Inc.

To get key market trends

Rising AI densities, stringent PUE thresholds, and grid/water constraints are reinforcing a structural shift toward liquid cooling across enterprise, telecom, and cloud facilities. The 2024 United States Data Center Energy Usage Report shows, U.S. data center electricity rose to 176 TWh in 2023 and could reach 325–580 TWh by 2028, with cooling comprising 38–40% of total load, making efficiency improvements a direct route to Opex reductions.

Escalating energy costs and stringent sustainability mandates are accelerating adoption of liquid cooling solutions across data center market. Liquid cooling systems can achieve Power Usage Effectiveness (PUE) ratios as low as 1.05-1.15 compared to 1.4-1.8 for air-cooled facilities, directly reducing electricity consumption and carbon emissions. Regulatory frameworks including the EU Energy Efficiency Directive, Germany's Energy Efficiency Act (mandating PUE ≤1.3 by 2027), and California's data center efficiency standards are compelling operators to implement advanced cooling technologies. Additionally, waste heat recovery capabilities inherent in liquid cooling systems enable district heating integration and industrial process heat reuse, transforming data centers from pure energy consumers into contributors to circular energy economies and supporting corporate net-zero commitments.

North America remains the dominant region in the data center liquid cooling market, driven by the high concentration of hyperscale cloud operators, advanced semiconductor vendors, and system integrators that are aggressively deploying high-density AI and HPC infrastructure. Major hyperscalers continue to expand capacity across the U.S., reinforcing early adoption of direct-to-chip and immersion cooling solutions to support next-generation processors with rapidly rising thermal design power (TDP).

The ongoing expansion of hyperscale campuses, colocation facilities, and edge computing infrastructure creates substantial demand for scalable, high-density cooling solutions. Cloud service providers including AWS, Microsoft Azure, Google Cloud, and Oracle are constructing multi-hundred-megawatt facilities with AI-optimized specifications requiring liquid cooling as foundational infrastructure.

Colocation providers are retrofitting existing facilities and designing new builds with liquid cooling options to attract high-density tenants deploying AI workloads. This infrastructure modernization cycle, combined with the shift from ownership to leased capacity models, drives sustained investment in liquid cooling deployment across enterprise, telecom, and cloud segments.

Operator and vendor like Equinix analyses show liquid cooling can reduce total site energy by about 25–30% versus air-only baselines, with best-in-class deployments keeping PUE near ~1.1; water consumption can fall materially in closed-loop warm-water designs compared with evaporative systems. The numbers indicate that each percentage-point improvement in PUE compounds across megawatt-scale sites, strengthening the ROI case for direct-to-chip hardware and supporting hydronic infrastructure.

Data Center Liquid Cooling Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 4.8 Billion |

| Market Size in 2026 | USD 6 Billion |

| Forecast Period 2026 - 2035 CAGR | 18.2% |

| Market Size in 2035 | USD 27.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Exponential Growth in AI and High-Performance Computing Workloads | AI training and inference workloads demand rack densities of 60-150+ kW, far exceeding air-cooling capabilities (typically limited to 15-20 kW per rack). Liquid cooling solutions provide superior thermal conductivity and efficiency, enabling direct heat removal from GPUs, CPUs, and memory modules |

| Increasing Energy Costs and Sustainability Mandates | Data centers consume approximately 2-3% of global electricity, with cooling systems accounting for 35-40% of total facility power consumption. Liquid cooling technologies reduce cooling energy consumption by 30-50% compared to traditional air-based systems, achieving PUE ratios as low as 1.05-1.15 |

| Expansion of Hyperscale and Colocation Data Center Infrastructure | Hyperscale cloud providers and colocation operators are constructing multi-hundred-megawatt campuses specifically designed for AI-intensive workloads requiring liquid cooling infrastructure |

| Proliferation of Edge Computing and Distributed Architectures | Edge computing deployments for autonomous vehicles, smart manufacturing, 5G network infrastructure, and real-time content delivery require high-performance computing in space-constrained locations. Liquid cooling solutions deliver superior thermal performance in compact footprints compared to air-based systems |

| Pitfalls & Challenges | Impact |

| High Initial Capital Investment and Complexity | Liquid cooling implementations require substantially higher upfront investment compared to traditional air-cooling systems, including specialized equipment (CDUs, cold plates, pumps, heat exchangers), facility infrastructure modifications (piping, leak detection, drainage), and extensive engineering design |

| Technical Risks and Operational Concerns | Operators express concerns about potential liquid leakage risks near sensitive IT equipment, despite advanced leak detection systems and use of non-conductive coolants. System complexity increases operational requirements including coolant quality monitoring, pump and valve maintenance, filter replacements, and thermal performance validation |

| Opportunities: | Impact |

| Retrofit and Modernization of Existing Data Center Facilities | The global installed base of operational data centers represents a substantial retrofit opportunity as operators face increasing power density requirements without available expansion capacity |

| Development of Hybrid Cooling Architectures | Hybrid approaches combining air and liquid cooling enable operators to optimize costs while addressing diverse workload requirements within single facilities. Standard server racks continue using air cooling (10-20 kW density) while AI clusters, HPC nodes, and high-performance storage systems deploy liquid cooling (60-150+ kW density) |

| Emergence of Cooling-as-a-Service and Managed Service Models | Growing complexity of liquid cooling technologies creates opportunities for vendors to offer comprehensive managed service models including remote monitoring, predictive maintenance, performance optimization, and guaranteed SLA-based thermal management |

| Market Leaders (2025) | |

| Market Leaders |

11.3% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | Canada, Italy, Netherlands, China, India |

| Future outlook |

|

What are the growth opportunities in this market?

Data Center Liquid Cooling Market Trends

GPU-accelerated servers jumped from <2 TWh in 2017 to >40 TWh in 2023, and projected AI server energy use by 2028 sits at 240–380 TWh. For example, NVIDIA’s GB200: racks call for around 140 kW of liquid capacity, far beyond the 7–10 kW air-cooled baseline. This shift accounts for direct liquid cooling systems being integrated from the outset in AI-optimized data center designs. A key factor remains the nine-month doubling cycle of compute power required to train cutting-edge models, accelerating cooling requirements along the same trajectory.

Immersion cooling systems, where entire servers or IT components are submerged in dielectric fluid, are gaining commercial traction beyond early-adopter deployments, particularly for ultra-high-density AI and cryptocurrency mining applications exceeding 100 kW per rack. Single-phase immersion using mineral oil or synthetic fluids achieves rack densities of 100-120 kW, while two-phase immersion leveraging fluid boiling and condensation supports 150+ kW configurations.

Immersion cooling eliminates traditional air-moving equipment, reduces facility space requirements by 30-40%, and enables waste heat recovery at higher temperatures (45-60°C) suitable for district heating or industrial processes. Bitcoin mining operations were early adopters, but AI training workloads now represent the fastest-growing immersion cooling segment.

Standardization efforts by industry bodies including the Open Compute Project (OCP), Sustainable Digital Infrastructure Alliance (SDIA), and European Code of Conduct for Data Centre Energy Efficiency are accelerating liquid cooling adoption by reducing perceived technical risks and implementation complexity. OCP's Advanced Cooling Solutions subproject has published reference designs for direct-to-chip and immersion cooling, enabling broader ecosystem participation and interoperability.

ASHRAE's Liquid Cooling Technical Committee develops best practice guidelines for coolant selection, piping design, leak detection, and safety protocols. These standardization initiatives provide operators with validated approaches, reduce custom engineering costs, and build confidence among risk-averse enterprises previously hesitant about proprietary liquid cooling implementations. Component manufacturers increasingly offer standards-compliant products with published performance specifications, accelerating procurement and reducing total project costs.

Data Center Liquid Cooling Market Analysis

Learn more about the key segments shaping this market

Based on component, the market is divided into solution and service. The solution segment dominated the market accounting for around 71% share in 2025 and is expected to grow at a CAGR of over 15% from 2026 to 2035.

- Direct-to-chip cooling solutions represent the most rapidly deployed liquid cooling technology, with cold plates and micro-channel coolers mounted directly on high-power processors, GPUs, and memory modules to remove 60-80% of component heat before it enters the airstream. Cold plates use precision-machined channels or embedded tubing to circulate coolants (typically water with corrosion inhibitors or glycol mixtures) across chip surfaces, achieving thermal resistance as low as 0.01-0.05°C/W.

- These solutions effectively support rack densities of 60-100 kW, making them the standard choice for AI training clusters deploying NVIDIA H100/H200 GPUs and next-generation Blackwell architectures.

- Managed services represent a rapidly growing segment as operators seek to reduce operational complexity and risk associated with liquid cooling implementations. Remote monitoring services provide 24/7 surveillance of CDU performance, coolant temperatures, flow rates, pressure levels, and leak detection sensors, with automated alerting.

- Performance optimization services include continuous analysis of thermal efficiency, identification of hot spots or inefficient cooling patterns, coolant quality management recommendations, and seasonal adjustments to maximize energy efficiency while maintaining reliability.

- Maintenance and support services encompass scheduled preventive maintenance for pumps, valves, filters, and heat exchangers, emergency response for system failures or leaks, spare parts management, and ongoing firmware updates for intelligent CDU systems.

Learn more about the key segments shaping this market

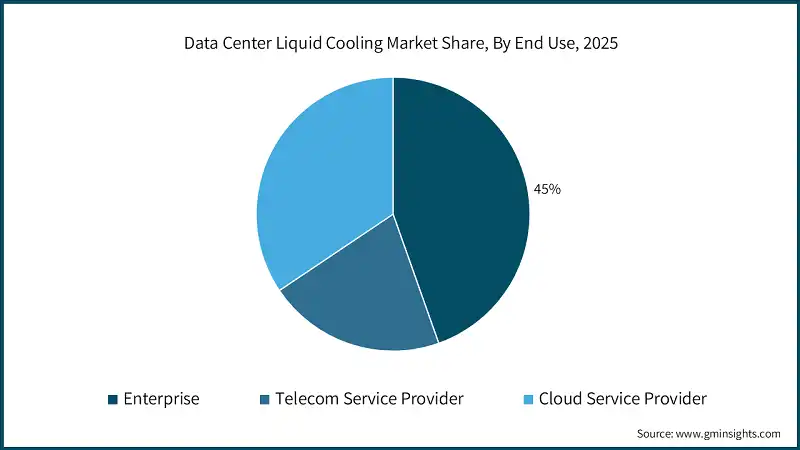

Based on end use, the data center liquid cooling market is divided into enterprise, telecom service provider, and cloud service provider. Enterprise segment dominates the market with around 45% share in 2025, and the segment is expected to grow at a CAGR of over 16% between 2026 and 2035.

- Cloud service providers including hyperscalers (AWS, Microsoft Azure, Google Cloud, Oracle, Alibaba Cloud) and regional cloud operators represent the largest and fastest-growing segment for data center liquid cooling adoption, driven by massive AI infrastructure investments and construction of purpose-built AI-ready facilities.

- These operators deploy GPU clusters with 60-100+ kW per rack for AI training workloads including large language models, computer vision systems, recommendation engines, and generative AI applications that fundamentally require liquid cooling to achieve target performance and efficiency metrics.

- Cloud providers prioritize PUE reduction and total cost of ownership optimization, making liquid cooling's 30-50% energy savings (compared to air cooling at equivalent densities) economically compelling despite capital premiums.

- Major implementations include Meta's AI Research SuperCluster and production AI systems using direct-to-chip cooling across thousands of GPU nodes, Microsoft's liquid-cooled Azure regions supporting OpenAI's GPT models and enterprise AI services, Google's custom TPU cooling systems for AI training and inference, and Chinese hyperscalers including Alibaba, Tencent deploying immersion cooling driven by government efficiency mandates and high electricity costs.

- Enterprise deployments span diverse industries each with unique liquid cooling drivers and adoption patterns. BFSI institutions including banks, insurance companies, investment firms, and payment processors implement liquid cooling primarily for AI-powered applications including fraud detection requiring real-time transaction analysis at high throughput, algorithmic trading systems demanding ultra-low latency compute infrastructure, risk modeling and stress testing conducting intensive Monte Carlo simulations, and customer analytics processing massive transaction datasets for personalization and retention.

Based on cooling mechanism, the market is divided into single-phase liquid cooling and two-phase liquid cooling. Single-phase liquid cooling segment dominates the market and was valued at USD 3.1 billion in 2025.

- Single-phase liquid cooling systems maintain coolant in liquid state throughout the thermal cycle, with heat transfer occurring through conduction and convection without phase change. Coolants circulate through cold plates, immersion tanks, or heat exchangers at temperatures typically ranging from 18-50°C depending on design specifications, with facility chilled water, dry coolers, or cooling towers removing heat from the cooling loop.

- This approach dominates commercial deployments due to their relative simplicity, use of familiar water-based or glycol-based coolants requiring minimal specialized handling, compatibility with existing facility cooling infrastructure, and lower risk profile compared to two-phase systems. Single-phase direct-to-chip implementations effectively support rack densities of 60-100 kW, while single-phase immersion cooling handles 100-120 kW per rack.

- Two-phase liquid cooling systems utilize coolant phase transitions, evaporation and condensation to transfer heat with minimal temperature differential between heat source and heat sink. Specialized coolants with low boiling points (typically 40-65°C at atmospheric pressure) boil when contacting hot components, with vapor rising and condensing on cooler surfaces, releasing latent heat and returning liquid to the evaporation zone through gravity (passive systems) or pumped circulation (active systems).

Based on data center, the data center liquid cooling market is categorized into small, medium, and large data centers. The large data centers segment dominates the market and was valued at USD 2.3 billion in 2025.

- Large-scale facilities ranging from 20 MW to 500+ MW represent the primary deployment environment for liquid cooling technologies, driven by hyperscale cloud providers, AI companies, and large colocation operators constructing purpose-built AI-ready infrastructure. These facilities implement liquid cooling from initial design phases rather than as retrofits, enabling optimal architectural integration including centralized CDU farms, overhead piping distribution minimizing floor space consumption, redundant cooling loops matching power redundancy configurations, and waste heat recovery systems feeding district heating networks or industrial processes.

- Medium-scale facilities ranging from 5-20 MW serve regional cloud providers, large enterprises, government agencies, and secondary-market colocation operators increasingly adopting liquid cooling to support edge AI inference, regional data processing, and high-density compute requirements in distributed architectures. These deployments typically implement hybrid cooling approaches with air cooling for standard infrastructure (web servers, storage, network equipment at 5-15 kW per rack) and targeted liquid cooling for specialized workloads.

- Small-scale facilities under 5 MW including enterprise data centers, edge computing nodes, telecom central offices, and micro data centers face unique liquid cooling adoption dynamics balancing density requirements against cost constraints and operational complexity. These deployments typically implement targeted liquid cooling for specific applications rather than facility-wide installations, focusing on use cases where density, efficiency, or space constraints create compelling business cases.

Looking for region specific data?

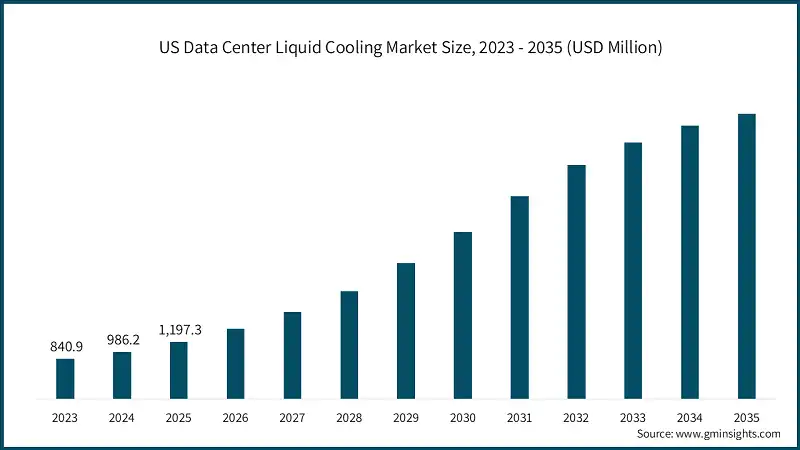

US dominated North America data center liquid cooling market with revenue of USD 1.29 billion in 2025.

- US government initiatives including the Department of Energy's AI and HPC programs, CHIPS Act funding for domestic semiconductor manufacturing with associated data center requirements, and Department of Defense modernization efforts incorporating AI capabilities drive public sector liquid cooling adoption.

- Major deployments include Lawrence Livermore National Laboratory's El Capitan exascale supercomputer using advanced liquid cooling, Oak Ridge National Laboratory's Frontier system, and various classified AI systems for intelligence and defense applications.

- Canada benefits from spillover demand from constrained US markets, abundant hydroelectric power supporting sustainability-focused operators, and cooler climates enabling highly efficient free cooling combined with liquid cooling systems. Quebec and Ontario attract data center investment with renewable energy availability, government incentives, and supportive regulatory environments, with major projects from IBM, Microsoft, and regional cloud providers incorporating liquid cooling designs.

- Mexico's data center market is growing rapidly driven by nearshoring of manufacturing and business processes from Asia to North America, with Querétaro, Mexico City, and Monterrey attracting investment in liquid-cooled facilities supporting local AI and edge computing requirements.

UK data center liquid cooling market will grow tremendously with CAGR of over 19% between 2026 and 2035.

- UK market is experiencing robust growth driven by London's position as Europe's largest data center market, government initiatives supporting AI development and digital infrastructure, and stringent energy efficiency regulations compelling sustainable cooling approaches. The UK's Energy-related Products Policy Framework establishes efficiency standards for data center equipment, while local planning authorities increasingly scrutinize environmental impacts including energy consumption and carbon emissions, making liquid cooling's superior efficiency essential for project approvals in constrained markets like Greater London.

- Germany represents Europe's second-largest market, driven by the Energy Efficiency Act mandating PUE ≤1.3 for new data centers from 2027 and requiring waste heat recovery where technically and economically feasible, effectively necessitating liquid cooling for facilities exceeding modest sizes. Frankfurt, Germany's primary data center hub and global financial center, hosts major liquid cooling deployments from cloud providers, financial institutions, and colocation operators including Deutsche Telekom, 1&1, and Interxion (Digital Realty).

- France's data center market concentrates in Paris and surrounding Île-de-France region, with operators including OVHcloud, Scaleway, and Interxion deploying liquid cooling for high-density workloads and to meet French environmental regulations including requirements for environmental impact assessments and energy consumption reporting.

The data center liquid cooling market in China will experience robust growth during 2026-2035.

- China represents the dominating data center liquid cooling industry in APAC, driven by government mandates requiring new data centers to meet strict efficiency standards (PUE ≤1.3), aggressive AI development by domestic technology giants, and large-scale hyperscale construction supporting the world's largest internet user base. Over 40% of new hyperscale facilities in China are expected to incorporate liquid cooling capabilities by 2025, with both direct-to-chip and immersion cooling gaining significant traction.

- Major deployments include Alibaba Cloud's AI-optimized data centers using immersion cooling for ultra-high-density GPU clusters, Tencent's liquid-cooled facilities supporting gaming, social media, and AI services, ByteDance infrastructure powering TikTok recommendation algorithms and generative AI research, and Huawei Cloud's regional facilities with advanced cooling architectures. China's national strategy positioning AI as critical technological priority drives government support for advanced data center infrastructure, with preferential policies, subsidies, and streamlined approvals for facilities meeting efficiency requirements including liquid cooling implementation.

- India represents one of the fastest-growing markets globally. Mumbai, India's financial capital and largest data center market, hosts liquid cooling deployments from cloud providers (AWS, Google Cloud, Microsoft Azure), large enterprises in BFSI and technology sectors, and colocation operators serving growing domestic and international demand. Delhi NCR, Bangalore, Hyderabad, and Chennai are expanding rapidly, with new facilities increasingly incorporating liquid cooling for AI workloads and high-density applications.

- Japanese market concentrates in Tokyo and Osaka, with strong emphasis on reliability, seismic resistance, and precision engineering. Japanese data centers serve the world's third-largest economy, supporting financial services, manufacturing, retail, and government sectors with stringent uptime and disaster resilience requirements.

- Southeast Asian markets including Indonesia, Thailand, Vietnam, and Philippines represent emerging opportunities with rapid economic development, digitalization initiatives, and improving telecommunications infrastructure supporting data center growth. These markets prioritize cost-effective solutions, with liquid cooling adoption focused on specific high-value applications rather than broad deployment.

The data center liquid cooling market in Brazil will experience significant growth between 2026 & 2035.

- Brazil dominates Latin America's market, with São Paulo serving as the region's largest data center hub hosting operations from major cloud providers, domestic service providers, enterprises, and colocation operators. The market is driven by Brazil's large economy and population, robust domestic demand for cloud services, e-commerce growth, digital banking expansion, and government digitalization initiatives. Brazilian facilities face tropical climate challenges with high ambient temperatures and humidity across most regions, with over 45% of new data centers utilizing water-cooled or evaporative cooling systems to manage environmental conditions.

- Mexico represents Latin America's second-largest market, with Querétaro emerging as a primary data center hub complementing established Mexico City presence. The country benefits from proximity to US markets supporting nearshoring of data processing and cloud services, USMCA trade agreement facilitating cross-border data flows and investment, improving telecommunications infrastructure through fiber deployment and submarine cable connections, and government initiatives supporting digital transformation and technology investment.

- Chile's Santiago market has expanded rapidly with major cloud provider investments from AWS, Google Cloud, and Microsoft Azure establishing regional presence, attracted by political stability, renewable energy abundance from solar and wind resources, strong telecommunications infrastructure and submarine cable connectivity, and business-friendly regulatory environment.

The data center liquid cooling market in UAE is expected to experience robust growth between 2026 & 2035.

- UAE dominates MEA region's market, driven by Dubai and Abu Dhabi's positions as regional business, finance, and technology hubs. The country's extreme climate with ambient temperatures regularly exceeding 45°C creates severe cooling challenges where traditional air cooling becomes inefficient and expensive, with over 50% of new data center constructions incorporating liquid or hybrid cooling systems as essential infrastructure for reliable operations.

- Saudi Arabia's data center market is expanding rapidly driven by Vision 2030 initiatives promoting economic diversification and digital transformation, with Riyadh, Jeddah, and emerging NEOM project attracting major investments. The kingdom implements policies requiring local data processing and storage for government and sensitive commercial data, compelling international cloud providers and enterprises to establish in-country presence.

- Saudi facilities face similar climate challenges as UAE with extreme heat necessitating advanced cooling, combined with government focus on renewable energy and sustainability making liquid cooling's efficiency advantages aligned with national priorities.

Data Center Liquid Cooling Market Share

- The top 7 companies in the market are Schneider Electric, Vertiv, Rittal, Stulz, Boyd, Cool IT, Alfa Laval. These companies hold around 35% of the market share in 2025.

- Vertiv: Provides comprehensive liquid cooling portfolio including CoolChip CDU family (70kW-1350kW capacity) supporting diverse rack densities, direct-to-chip cooling systems with precision-engineered cold plates, immersion cooling platforms for ultra-high-density deployments, and intelligent thermal management software integrating with facility DCIM systems. Leverages global scale with manufacturing, engineering, and service presence across all major markets, deep relationships with hyperscale operators and colocation providers established through decades of critical power and cooling infrastructure supply, and technical expertise spanning electrical, mechanical, and controls engineering enabling comprehensive data center solutions.

- Schneider Electric: Dramatically expanded liquid cooling capabilities through 2025 acquisition of Motivair, instantly adding market-leading CDU technology, direct-to-chip cooling systems, immersion cooling expertise, and specialized thermal engineering talent. Integrates liquid cooling with EcoStruxure platform providing unified management of power distribution, cooling systems, building management, and DCIM software, creating comprehensive solutions for AI-ready facilities. Competitive advantage stems from end-to-end solution capabilities spanning everything from utility interconnection through IT equipment cooling, financial strength enabling strategic acquisitions and technology investments, and commitment to sustainability aligned with corporate and government requirements worldwide.

- Rittal: Delivers engineered direct liquid cooling solutions seamlessly integrated with IT enclosures, containment systems, and rack infrastructure, enabling turnkey implementations. Provides modular CDU systems scalable from small deployments to large facilities, precision-manufactured components leveraging German engineering heritage, and comprehensive design and engineering support. Strong presence in European markets particularly Germany, with expanding global reach through parent company Friedhelm Loh Group's infrastructure.

- Stulz : Specializes in precision cooling for mission-critical environments with deep expertise translating into liquid cooling leadership. CyberCool CMU (Coolant Management/Distribution Unit) platforms handle diverse coolant types, temperature ranges, and facility configurations, integrated DCLC systems combining CDUs with facility cooling infrastructure, and solutions for both direct-to-chip and immersion implementations. Strong presence in EMEA markets built over decades supplying precision air cooling, with expansion into Americas and Asia Pacific regions.

- Boyd: Delivers advanced cold plate designs optimized for specific processor architectures and thermal requirements, custom thermal solutions for unique applications or form factors, and high-capacity CDU systems supporting large AI clusters.

- Alfa Laval: Supplies plate heat exchangers critical for liquid cooling secondary loops, direct-to-chip cooling components through partnerships like SEGUENTE COLDWARE collaboration, immersion cooling heat rejection systems, and free cooling solutions maximizing efficiency. Leverages century-plus history in heat exchanger technology and thermal systems, industrial expertise applicable to data center cooling requirements, global manufacturing and service presence, and strong reputation for product quality and performance.

- CoolIT Systems: Delivers CHx CDU series supporting capacities up to 1500kW for large AI clusters, OMNI coldplates using advanced microchannel technology for maximum thermal performance, direct-to-chip cooling systems integrated with server infrastructure, and AHx180 liquid-to-air CDU for hybrid cooling architectures.

Data Center Liquid Cooling Market Companies

Major players operating in the data center liquid cooling industry include:

- Alfa Laval

- Asetek

- Boyd

- CoolIT Systems

- Green Revolution Cooling (GRC)

- LiquidStack

- Rittal

- Schneider Electric (Motivair)

- Stulz

- Vertiv

- The data center liquid cooling market is highly competitive, with leading solution providers such as Alfa Laval, Asetek, Boyd, CoolIT Systems, Green Revolution Cooling (GRC), LiquidStack, Rittal, Schneider Electric (Motivair), Stulz, and Vertiv occupying key segments across direct-to-chip liquid cooling, immersion cooling, liquid-to-air hybrid systems, rear-door heat exchangers, cooling distribution units (CDUs), and thermal management solutions for hyperscale, colocation, and enterprise data centers.

- Alfa Laval, Vertiv, Schneider Electric (Motivair), and Rittal lead the market with end-to-end liquid cooling portfolios, integrating high-efficiency heat exchangers, liquid cooling distribution units, pumped refrigerant systems, hybrid liquid–air architectures, and modular cooling platforms. These companies focus on enabling high-density rack deployments, AI and HPC workloads, energy efficiency improvements, and scalable thermal infrastructure, supporting data center operators in reducing power usage effectiveness (PUE), cooling energy consumption, and operational complexity across large-scale facilities.

- Asetek, CoolIT Systems, LiquidStack, and Green Revolution Cooling (GRC) specialize in advanced liquid cooling technologies, with strong emphasis on direct-to-chip cold plate solutions, single-phase and two-phase immersion cooling, and high-performance cooling systems for AI, HPC, and GPU-dense environments. Their offerings are designed to address extreme heat flux, rising rack power densities, and space constraints, enabling data centers to support next-generation processors while improving thermal reliability, reducing water and energy usage, and extending equipment lifespan.

- Boyd and Stulz GmbH on customized thermal management and precision cooling solutions, including liquid-cooled cold plates, thermal interface assemblies, hybrid cooling systems, and liquid-assisted precision air conditioning units. These companies support OEMs, hyperscalers, and colocation providers with tailored solutions that enhance thermal performance, system integration flexibility, and deployment efficiency in mixed-load and retrofit data center environments.

- Overall, the market is characterized by rapid adoption of liquid-based cooling architectures driven by AI, HPC, and high-density computing workloads, with vendors increasingly investing in modular designs, hybrid cooling strategies, intelligent monitoring, and scalable liquid infrastructure. Market participants are focused on delivering high-performance, energy-efficient, and future-ready cooling solutions, enabling data center operators to manage escalating thermal loads, optimize energy efficiency, and support next-generation compute deployments across hyperscale, colocation, and enterprise data centers.

Data Center Liquid Cooling Industry News

- In Feb 2025, Carrier Global announced a strategic investment in ZutaCore to accelerate the scaling of two-phase, direct-to-chip liquid cooling solutions for AI-focused data centers. The collaboration is aimed at moving beyond pilots into validated, repeatable deployments by combining ZutaCore’s dielectric fluid technology with Carrier’s expertise in thermal systems, safety engineering, and global service infrastructure. This partnership reflects growing confidence in two-phase DTC as a viable solution for extreme AI heat flux and long-term operational stability.

- In Feb 2025, Asperitas joined the Cisco Engineering Alliance to pre-validate immersion cooling compatibility with Cisco UCS platforms. This initiative allows data center operators to specify immersion-cooled infrastructure within multi-vendor environments while reducing system integration and qualification risk. The collaboration supports broader enterprise and cloud adoption of immersion cooling by aligning server, network, and cooling design assumptions upfront.

- In Feb 2025, Modine secured approximately USD 180 million in orders through its Airedale business from a leading AI infrastructure developer. The contracts indicate sustained procurement demand for high-efficiency cooling systems designed for next-generation AI data halls, reinforcing Modine’s position in scalable thermal solutions for high-density and liquid-assisted environments.

- In Dec 2024, CoolIT Systems expanded its manufacturing capacity in Calgary and introduced the CHx1000 liquid-to-liquid coolant distribution unit (CDU). The new platform offers higher cooling capacity, advanced controls, and improved redundancy to support AI and HPC racks targeting power densities above 100 kW. This move addresses increasing customer demand for scalable, rack-level liquid cooling infrastructure.

- In Dec 2024, Microsoft and Schneider Electric jointly published reference designs for high-efficiency liquid-cooled architectures optimized for next-generation AI accelerators. The designs integrate power distribution, direct-to-chip liquid cooling, and software-based control systems to enable predictable thermal performance, energy efficiency, and scalable deployment across large AI data center campuses.

- In Nov 2024, Schneider Electric announced plans to acquire a majority stake in Motivair for approximately USD 850 million. The acquisition strengthens Schneider’s capabilities in rack-level and row-level liquid cooling, particularly for AI-class workloads, while expanding its lifecycle services offering across design, deployment, and long-term operations.

- In Oct 2024, Meta presented an Open Compute Project (OCP) “Catalina” rack concept designed for NVIDIA GB200-class systems, featuring liquid cooling capacity of approximately 140 kW per rack. The concept raises hyperscale expectations around manifold design, CDU performance, leak detection, and safety mechanisms required to support ultra-high-density AI deployments.

- In Oct 2024, Jabil acquired Mikros Technologies to add advanced microchannel cold plate manufacturing capabilities, supporting heat flux levels exceeding 1 kW/cm². The acquisition enables Jabil to scale component supply for AI liquid cooling systems while addressing precision manufacturing and reliability requirements at high volumes.

- In Oct 2024, Submer and Zero Two announced a partnership to deploy liquid-cooled AI compute infrastructure in the UAE. The collaboration highlights growing interest in immersion cooling across the Middle East, particularly for regions with high ambient temperatures where air cooling efficiency and water usage present structural limitations.

The data center liquid cooling market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($Bn) from 2022 to 2035, for the following segments:

Market, By Component

- Solution

- Direct to chip

- Cold plates

- Micro-channel coolers

- Immersive

- IT Chassis

- Tub/Open bath

- Rear-door heat exchangers

- Active (pumped)

- Passive

- Direct to chip

- Service

- Managed service

- Remote monitoring

- Performance optimization

- Maintenance & support services

- Professional service

- Consultation & design

- Installation & deployment

- Managed service

Market, By Cooling Mechanism

- Single-phase liquid cooling

- Two-phase liquid cooling

Market, By Coolant

- Water-based coolants

- Dielectric fluids

- Synthetic fluids

- Mineral oils

- Bio-based/Natural coolants

Market, By Data Center

- Small data centers

- Medium data centers

- Large data centers

Market, By Application

- Server cooling

- CPU cooling

- GPU/AI accelerator cooling

- Storage cooling

- Networking cooling

- Others

Market, By End Use

- Enterprise

- BFSI

- Retail & e-commerce

- Government

- Healthcare

- Manufacturing

- IT enabled services (ITeS)

- Others

- Telecom service provider

- Cloud service provider

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Poland

- Benelux

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Southeast Asia

- Latin America

- Brazil

- Colombia

- Argentina

- Chile

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Which region leads the data center liquid cooling market?

North America leads the market, with the U.S. generating USD 1.29 billion in revenue in 2025. Market leadership is driven by hyperscale cloud expansion, AI and HPC investments, and early adoption of direct-to-chip and immersion cooling technologies.

What are the upcoming trends in the data center liquid cooling industry?

Key trends include rapid adoption of direct-to-chip cooling, increasing deployment of immersion cooling for ultra-high-density racks, standardization by OCP and ASHRAE, waste heat recovery integration, and growth of cooling-as-a-service and managed cooling models.

What was the valuation of the single-phase liquid cooling segment in 2025?

The single-phase liquid cooling segment was valued at USD 3.1 billion in 2025, dominating the market due to its lower complexity, compatibility with existing infrastructure, and suitability for high-density AI and HPC deployments.

Who are the key players in the data center liquid cooling market?

Key players include Schneider Electric, Vertiv, Rittal, Stulz, Boyd, CoolIT Systems, Alfa Laval, Asetek, LiquidStack, and Green Revolution Cooling (GRC). These companies are expanding portfolios focused on AI-ready cooling systems, CDUs, immersion platforms, and integrated thermal management solutions.

How much revenue did the solution segment generate in 2025?

The solution segment accounted for around 71% of the market share in 2025, making it the largest component category. Strong demand for direct-to-chip cooling, immersion cooling systems, and cooling distribution units (CDUs) supports segment dominance.

What is the projected value of the data center liquid cooling market by 2035?

The market size for data center liquid cooling is expected to reach USD 27.1 billion by 2035, growing at a CAGR of 18.2%. This growth is fueled by widespread deployment of AI accelerators, increasing rack densities above 60 kW, sustainability regulations, and the shift from air to liquid cooling architectures.

What is the data center liquid cooling market size in 2025?

The market size for data center liquid cooling is valued at USD 4.8 billion in 2025. Rapid growth in AI workloads, high-performance computing (HPC), and rising rack power densities is accelerating adoption of advanced liquid-based cooling technologies across hyperscale and enterprise data centers.

What is the market size of the data center liquid cooling industry in 2026?

The market size for data center liquid cooling reached USD 6 billion in 2026, reflecting strong expansion driven by hyperscale cloud investments, AI-ready data center construction, and growing emphasis on energy efficiency and PUE optimization.

Data Center Liquid Cooling Market Scope

Related Reports