Summary

Table of Content

Customer Information System Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Customer Information System Market Size

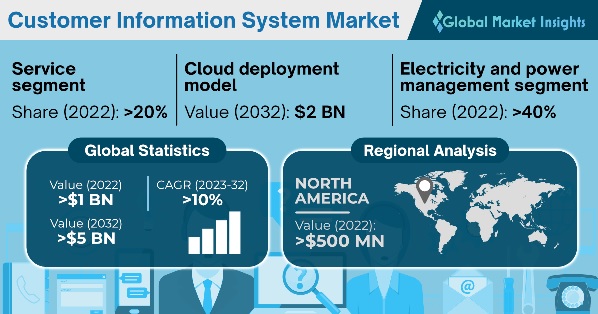

Customer Information System Market size valued at USD 1 billion in 2022 and is anticipated to grow at 10% CAGR from 2023 to 2032, driven by the growing investment toward smart city development projects.

To get key market trends

Government and private organizations are prioritizing smart city development programs by using sophisticated technology and components to improve the urban environment. For instance, in October 2022, Honeywell, a global building controls firm, and Accelerator for America, a non-profit organization, developed the Honeywell Smart City Accelerator Program to assist communities in strategically planning their futures and enhancing the ability to support transformative initiatives. Furthermore, smart cities are emerging as a platform for citizen interaction, collaboration, and co-creation, with city administrations using customer information system solutions to design utilities, manage healthcare, transportation, and public safety, and minimize downtime and costs.

Risk of cyberattacks and data breaches to impede the customer information system market growth

Cyberattacks and data breaches against utilities are on the rise. In recent years, attackers have targeted smaller-scale institutions since they are less protected, less suspicious, and can still pay significant ransom amounts. The provision of sophisticated customer information system solutions and services on cloud infrastructure presents potential risks of cyberattacks, which is expected to negatively influence product adoption. However, customer information system service providers are taking efforts to integrate robust data and cyber security systems in order to minimize the risks.

Customer Information System Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2022 |

| Market Size in 2022 | USD 1 billion |

| Forecast Period 2023 to 2032 CAGR | 10% |

| Market Size in 2032 | USD 5 billion |

| Key Market Trends | |

| Growth Drivers | |

| Pitfalls & Challenges | |

What are the growth opportunities in this market?

Customer Information System Market Analysis

In terms of components, the customer information system market from the service segment accounted for 20% revenue share in 2022. Growing utility and industry complexities, coupled with changing consumer expectations, are putting significant strain on utilities. To achieve optimal business service delivery, a majority of providers are updating their old CIS systems and installing sophisticated CIS solutions to manage commercial and operational activities across utilities, which is set to boost the market revenue. In April 2022, Pasadena Water and Power (PWP), a non-profit public utility company, upgraded its customer billing system, which was intended to improve system performance and customer experience.

-market-share-by-services-2023-2032.webp)

Learn more about the key segments shaping this market

The customer information system market size from the implementation service segment accounted for USD 250 million in 2022, as an increasing number of large firms prefer to use software solutions to digitize and improve business operations. Implementation service providers streamline the deployment process while also supporting and training the company employees to deploy CIS solutions since the transfer and installation of the program are both overly complex and technical.

In terms of application, the electricity and power management segment held more than 40% customer information systems market share in 2022, owing to the growing need for new billing systems with effective and efficient network billing capabilities that allow electricity and energy management businesses to maintain compliance with network power market laws and interact with retailers. Additionally, industry players are innovating different solutions and systems capable of handling a utility's customer-facing procedures, from meter reads to invoicing and consumer inquiries which is likely to promote the market expansion.

The customer information system market size from cloud deployment model segment is projected to reach USD 2 billion by 2032, due to the widespread digitization and upgradation of utility infrastructures. Cloud deployment models are in high demand as utilities strive to optimize business operations and drive down TCO by eliminating the need for extra components on-premises. Furthermore, continuous upgradation capabilities are making utilities more agile and allowing them to expand their IT infrastructure and scope of application in a non-disruptive manner while focusing their resources on new business opportunities.

Learn more about the key segments shaping this market

The North America customer information system market reached a valuation of over USD 500 million in 2022. Major energy and utility businesses across North America are accelerating digital transformation in their operations, particularly cloud-based transformation strategies to keep up with the rising demand for improved customer engagement. Furthermore, many companies are placing a strong emphasis on upgrading their customer information services to consolidate their market share. To quote an instance, leading software and services provider Hansen Technologies secured many new and upgrade-focused Hansen CIS deals in 2022, strengthening its position as a major CIS provider of choice in North America.

Customer Information System Market Share

Some of the leading companies involved in the customer information system market include

- NorthStar Utilities Solutions

- Gentrack

- SAP SE

- Oracle Corporation

- Hansen Technologies Corporation

- Vertexone

These companies are investing in product development and innovations and utility enterprises are focusing on strategic partnerships to deploy advanced CIS solutions.

For instance, in January 2023, NorthStar Utilities Solutions partnered with Util-Assist Inc. to offer utilities-managed billing services powered by the NorthStar Customer Information System. Util-Assist will join NorthStar as a business associate for clients seeking business process outsourcing solutions, particularly in the areas of hosted billing information and customer care solutions and assistance.

Impact of COVID-19 pandemic

After the onset of COVID-19, businesses worldwide relied on innovative technologies to ensure employee safety, speed up information transmission, and continue their operations. A burgeoning number of utility firms implemented advanced customer information system solutions and modified their existing CIS to meet rapid changes in customer service and network operating operations amid the pandemic. Furthermore, massive government investments in emerging technology have also aided market expansion during the COVID-19 pandemic.

This customer information system market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue in USD from 2018 to 2032 for the following segments:

Market, By Component

- Solution

- Service

- Implementation

- Support & Maintenance

- Consulting

Market, By Deployment Model

- On-premise

- Cloud

Market, By Deployment Model

- Electricity and power management

- Water and wastewater management

- Utility gas management

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Southeast Asia

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- MEA

- UAE

- South Africa

- Saudi Arabia

- Qatar

Frequently Asked Question(FAQ) :

How big is the Global Customer Information System Market?

The market size of customer information systems was surpassed USD 1 billion in 2022 and is expected to witness over 10% CAGR from 2023 to 2032, owing to the growing focus on smart city development projects.

What is the valuation of the electricity and power management segment?

The electricity and power management segment accounted for 40% market share in 2022, driven by the rising need for new billing systems with effective and efficient network billing capabilities.

Who are the leading companies in the customer information system landscape?

NorthStar Utilities Solutions, Gentrack, SAP SE, Oracle Corporation, Hansen Technologies Corporation, and Vertexone are some of the major companies operating in the market.

Which factors are aiding the North America customer information system industry expansion?

The market for customer information system in North America was worth more than USD 500 million in 2022, owing to the expanding digitization across energy and utility businesses.

Customer Information System Market Scope

Related Reports