Summary

Table of Content

Cosmetic Pigments Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Cosmetic Pigments Market Size

Global cosmetic pigments market size was over USD 700 million in 2019 and is estimated to grow over 6.5% CAGR between 2020 and 2026 owing to increasing applications of cosmetic pigments in personal care and grooming products. Increasing consumer awareness regarding the need to look more presentable in both personal and professional life will promote the market growth.

The ability of cosmetic pigments to transform individual appearances and give better and more presentable look to consumers is likely to raise the cosmetic pigments market demand in the coming years. Increasing consumer acceptance of changing fashion trends globally are compelling consumers to spend higher amounts on cosmetic and personal care products. Rising disposable income of people in developing economies is expected to raise the demand for cosmetic products from developing countries of the world.

To get key market trends

The increasing collaborations, agreements, and joint ventures between cosmetic pigment manufacturers may aid in new product development to meet the rising demands of consumers, thus boosting the cosmetic pigments market growth. For instance, in October 2019, Asahi Songwon Colors Limited, a global leader in blue pigments, announced a 51:49 joint venture agreement with Tennants Textile Colours (TTC) Limited of the U.K. to set up a state of the art red and yellow azopigments plant.

Cosmetic Pigments Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | USD 712.3 Bn |

| Forecast Period 2020 to 2026 CAGR | 6.5% |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

This strategic joint venture would enable the company to set its footprint in the manufacturing of azopigments, which are non-toxic and thus, a better alternative to toxic organic and inorganic pigments. The increasing use of innovative techniques and technological advancements such as pigment dispersion may help product manufacturers to strengthen their foothold in the global market. Furthermore, increasing investments by major stakeholders in manufacturing firms is likely to fuel the cosmetic pigments market.

However, the stringent regulations laid down by governing bodies of different countries on the use of color pigments in cosmetics are likely to restrain the growth of the cosmetic pigments market to some extent during the forecast period. For instance, on the basis of regulatory requirements, organic color pigments are classified as D&C Lake Colors (Drug and Cosmetics Lake Colors), FD&C Lake Colors (Food Drug and Cosmetics Lake Colors), Non D&C and FD&C Pigments, and EEC Lake Colours. Pigment manufacturers in India have to abide by the FD&C color guidelines to create cosmetics colour solutions for the US market. EEC Lake colors are prepared in accordance with the directive by the European Economic Community (EEC) for pigment colors used in cosmetics for the European markets.

These strict regulations to be followed by the cosmetic pigment manufacturers to produce color pigments for the cosmetic industry may pose a challenge for cosmetic pigments market manufacturers are likely to decline the growth of the product during the forecast period.

Cosmetic Pigments Market Analysis

Learn more about the key segments shaping this market

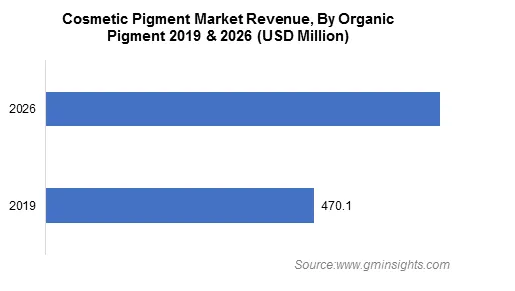

The cosmetic pigments market analysis is segmented by elemental composition into organic pigments and inorganic pigments. Organic pigments accounted for a revenue of USD 470.8 Million. The transition in consumer preferences towards the use of dark and vivid colors coupled with the reduced environmental impact is likely to raise the demand for organic cosmetic pigments in the years to come.

Consumers are preferring bright and vibrant colors in cosmetics, particularly in nail polish, eye lashes and lipsticks, which is likely to raise the demand for organic pigments in the near future. India is expected to be the second-largest market in terms of demand for organic pigments. India has dominated in the green and blue color segments.

Lakes segment is expected to reach over USD 200 million by 2026 growing at a CAGR of over 7.0% throughout the forecast period. The demand for lakes is expected to raise in the coming years on count of its high stability, adaptability and flexibility coupled with its property of not bleeding easily. Besides, it can be easily combined and mixed with cosmetic oils and are available in different color concentrations, which may increase its acceptability among consumers.

Learn more about the key segments shaping this market

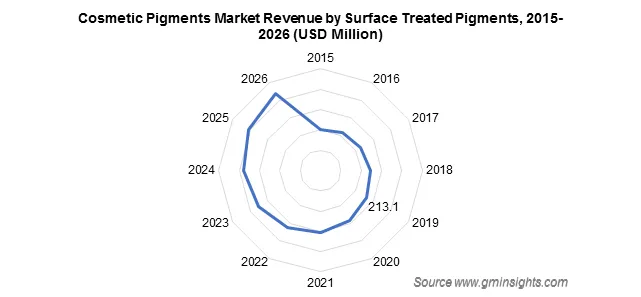

Global Cosmetic Pigments markets by product is bifurcated into surface treated pigments and natural colorants, nano pigments and special effect pigments. The surface treated pigments were valued at over USD 200 million in 2019 and is expected to grow at a CAGR of over 4.5% between 2020 and 2026. Improved stability, wearability, and feel is likely to raise the demand for surface treated pigments in cosmetic applications.

Besides, surface treated pigments ensure a long-lasting makeup with desirable characteristics such as resistance to high temperatures and kiss resistance, so they don’t smudge on contact. This is expected to further raise the cosmetic pigments market demand. Surface treating pigments such as silicon, metal soap, and amino acids add value both to the pigments themselves and to the final formulations of products such as eyeshadow, foundations, mascara or other makeup products.

Looking for region specific data?

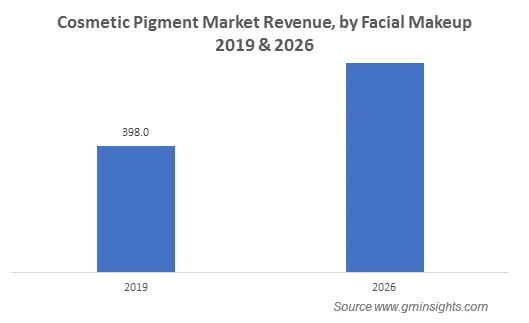

Based on application, cosmetic pigments market is divided into facial makeup, eye makeup, lip acre, hair care products, nail care and others. Increasing use of makeup demands an increasing use of foundation, which acts like a base for any makeup to stay intact for a longer time. The availability of foundations in different coverage ranges such as lighter coverage and full coverage depending on the facial skin type further aids in consumer convenience during usage. The ability of foundations to get the face rid of all the blemishes, even out the skin tone and give the face an instant uplift is expected to make it an ideal fit for several women as a makeup base.

The ability of a blusher to add a natural glow to the skin as well as add contours to the face is likely to raise the cosmetic pigments market share. The availability of a blusher in a powder, cream of even a gel form enhances consumer experience. Blusher segment is anticipated to rise over a CAGR of 4% over the foreseeable timeframe.

Eye makeup segment is expected to reach USD 102.1 million by 2026. The numerous benefits of eye makeup such as boosting up confidence, complementing overall looks, enabling experimenting with looks, giving a dramatic look, and helping in taking care of the eyes are likely to make eye makeup a daily routine for most women, thus boosting the market growth.

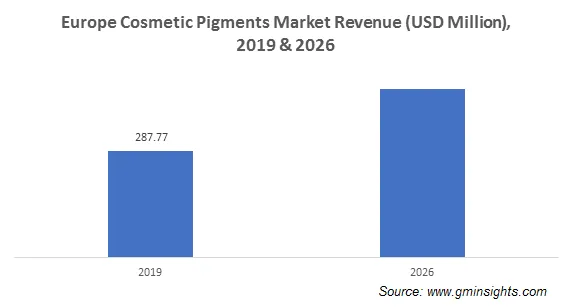

Increasing awareness regarding personal grooming and looking more presentable coupled with increasing urbanization and global trends such as digitization, individualization and resource consciousness are some of the important factors responsible for the growth of cosmetic pigments market in Europe. Europe dominated the overall market garnering a share over 35% in 2019. The European cosmetics and personal care business are the largest in the world with retails sales of €77 billion in 2016.

There are over 20,000 companies involved on the wholesale side of the cosmetics industry in Europe, with the majority located in Italy (18%), Spain (14%), and France (11%). According to a survey carried out by Cosmetics Europe, around 33% of women find it difficult to live without foundation or concealer, about 25% of men find it difficult to live without aftershave and around 88% of people find it difficult to live without cosmetics.

Cosmetic Pigments Market Share

Key players operating in the cosmetic pigments industry are

- Sun Chemicals

- Kobo Products

- BASF

- Sudarshan Chemical

- Sensient Cosmetic Technologies

- Geotech

- Huntsman

- Merck Performance

- Clariant LANXESS

- Chem India Pigments

- Eckart

- Li Pigments

- Dayglo Color

- Koel Colours

The market may witness consolidation in the form of acquisitions & joint ventures, and mergers which may strengthen product portfolio and augment share for global cosmetic pigments market. Besides players are also investing in research and development activities to develop better quality products and sustain their position in the market.

In November 2019, BASF announced that Colors & Effects, BASF’s brand focused on pigments, sources 100% of its natural mica flake demand for the production of effect pigments which are required for the Coatings, Plastics, Printing and Cosmetic industries from their own mica mine in the U.S.A. This strategic sourcing would enable the company to reduce its dependence on other raw material suppliers and contribute to sustainable growth of its pigments segment.

In August 2019, Sun Chemical, a subsidiary of the DIC Corporation entered into a definitive agreement with BASF to acquire the company’s Colors & Effects global pigments business. This strategic acquisition would enable the company to further strengthen its position in the cosmetic pigments market forecast.

The global cosmetic pigments market report includes in-depth coverage of the industry with estimates & forecast in terms of volume in Kilo Tons & revenue in USD Million from 2015 to 2026 for the following segments:

By Elemental Composition

- Organic Pigments

- Lakes

- True Pigments

- Toners

- Inorganic Pigments

- Zinc Oxide

- Others

By Product

- Surface Treated Pigments

- Natural Colorants

- Nano pigments

- Special Effect Pigments

By Application

- Facial Make-up

- Foundation

- Blusher

- Eye Make-up

- Lip Care

- Hair Care products

- Nail Care

- Others

The above information has been provided for the following countries:

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Malaysia

- Thailand

- Latin America

- Brazil

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Which product segment is likely to augment the industry size by 2026?

Surface treated cosmetic pigments was worth USD 200 million in 2019 and may exhibit 4.5% CAGR through 2026, due to the fact that it delivers better stability and wearability.

What factors will promote the use of cosmetic pigments in blushers?

Blushers help to provide a natural glow to the skin and add contours to the face as well. Global cosmetic pigments market size from blusher applications may depict 4% CAGR through 2026.

Why will eye makeup applications gain extensive prominence?

Eye makeup products help to take good care of eyes, boost confidence, and complement overall looks. The segment may cross USD 102.1 million by 2026.

Where will the global cosmetic products industry share depict an increase?

In 2019, Europe held 35% of the global cosmetic pigments industry share and may exhibit commendable traction due to rising awareness on personal grooming and global trends such as individualization and digitization.

Which segment, in terms of elemental composition, will push the global cosmetic pigments market growth?

Organic cosmetic pigments in 2019, was worth USD 470.8 Million & may exhibit appreciable growth due to changing consumer preferences toward using dark and vivid colors.

How much growth rate is the global cosmetic market expected to register through 2026?

In 2019, the global cosmetic pigments market size was worth USD 700 million and may depict 6.5% CAGR through 2026.

Cosmetic Pigments Market Scope

Related Reports