Summary

Table of Content

Cold Chain Monitoring Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Cold Chain Monitoring Market Size

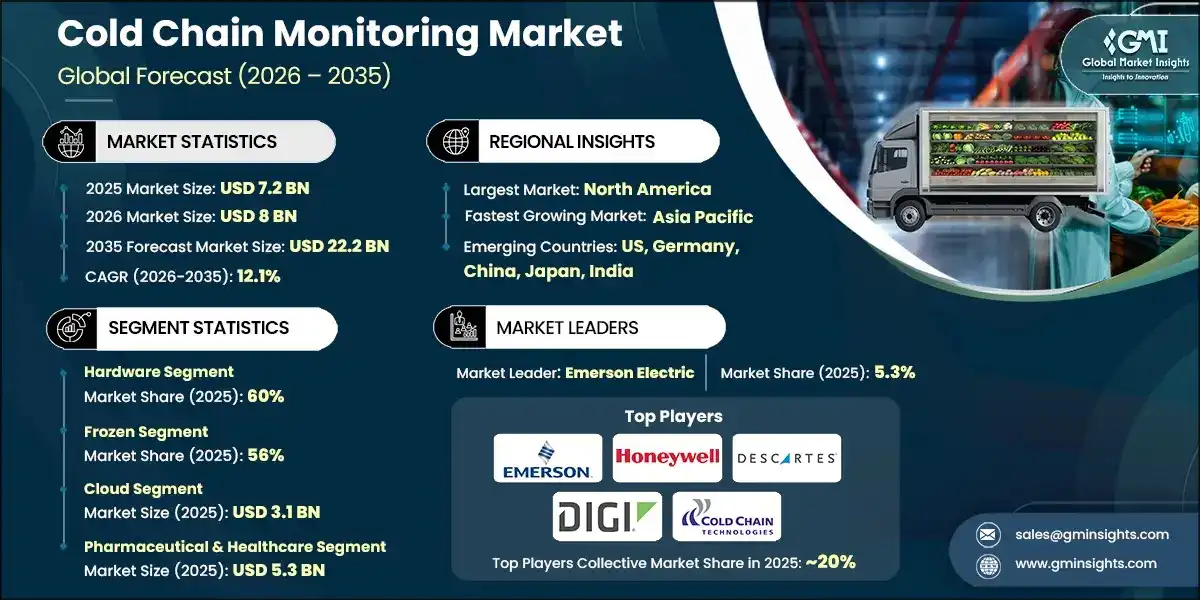

The global cold chain monitoring market was valued at USD 7.2 billion in 2025 and is set to expand from USD 8 billion in 2026 to USD 22.2 billion by 2035, growing at a 12.1% CAGR from 2026 to 2035, according to latest report published by Global Market Insights Inc.

To get key market trends

Increasing consumption of perishables-fresh produce, meat, dairy, frozen foods, seafood, and ready-to-eat products-have put massive pressure on supply chains to maintain strict temperature control. Companies can't afford product spoilage or quality degradation as distribution networks grow increasingly larger and delivery times get increasingly shorter. Each shipment needs end-to-end traceability and consistent temperature compliance for modern retailers. Growing international trade of perishable goods further raises the requirement bar for real-time monitoring across long distances. Besides increasing consumer expectations and brand demands for quality, in general, cold-chain monitoring becomes indispensable in maintaining freshness and reducing waste.

Cold-chain monitoring is a high-priority requirement because pharmaceuticals, biologics, specialty drugs, and vaccines are sensitive to even slight deviations in temperature. The fast-rising number of biologics and mRNA-based therapies hastens the demand for high-precision temperature tracking, from manufacturing through storage to distribution.

Many of these products operate within narrow temperature bands and, thus, have to follow very strict rules and global regulatory standards. Large-scale vaccine distribution during pandemics accelerated the digital adoption process. Pharma companies now put real-time, validated monitoring systems with audit trails and automated alerts at the top of their priority list. With increasing volumes of drugs and growing global exports, the demand for accurate, compliant cold-chain monitoring continues to rise.

The rise of online grocery platforms, express food delivery, and same-day shipments of cold products have changed last-mile logistics. Even on short, urban routes, fresh food, frozen items, dairy, and meal kits require strict temperature conditions. This is increasing demand for small, low-cost monitoring devices and real-time delivery visibility. Amazon, Walmart, Alibaba, and Meituan have recently expanded their cold last-mile significantly, forcing suppliers to integrate monitoring solutions into vans, bikes, insulated boxes, and micro-fulfillment centers. As consumer expectations for freshness increase, monitoring has become key to ensuring the quality of last-mile supply chains.

The highly industrialized food and pharmaceutical ecosystem, along with strict regulatory frameworks like FDA's FSMA, USDA standards, and GDP guidelines that demand continuous temperature tracking with traceability, acts as a key driver for North America's cold chain monitoring market. The region boasts one of the most developed logistics infrastructures in the world, an extensive long haul refrigerated transport network, and widespread IoT and telematics adoption. Strong technology readiness, combined with large-scale distribution operations and this regulatory rigor, fuels the rapid deployment of real-time monitoring systems across storage, transport, and last-mile delivery.

UPS Healthcare announced a significant U.S. cold-chain logistics network expansion across Kentucky, Illinois, and California in 2024, fueled by growing demand for pharmaceutical and biologics. The rollout includes new GDP-compliant cold storage hubs and smart reefer fleets equipped with continuous temperature monitoring, cellular IoT trackers, and AI-based excursion alerts.

Rapid expansion in its cold chain infrastructure, fueled by rising urbanization, burgeoning demand from the middle class for perishables, and booming e-commerce. Countries such as China, India, Japan, and others in Southeast Asia build cold storage, reefer fleets, and smart logistics hubs. Another driver for the region's fast-growing Active Temperature-Controlled Systems market, including validated monitoring systems, has been the rapidly growing pharmaceutical manufacturing sector. Improvement in food safety laws coupled with accelerating digitization means that adoption rates across APAC are sharp regarding IoT sensors and cloud-based monitoring platforms.

Cold Chain Monitoring Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 7.2 Billion |

| Market Size in 2026 | USD 8 Billion |

| Forecast Period 2026 - 2035 CAGR | 12.1% |

| Market Size in 2035 | USD 22.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising Demand for Temperature-Sensitive Food & Perishables | Increasing volumes of fresh and frozen foods require continuous temperature visibility to prevent spoilage and ensure product quality. This accelerates adoption of sensors, data loggers, and real-time monitoring across transport and storage. |

| Expansion of Pharmaceutical, Biologics & Vaccine Distribution | High-value biologics and vaccines require precise, validated temperature control throughout the logistics cycle. Pharma companies accelerate deployments of IoT monitoring, excursion alerts, and audit-ready compliance platforms. |

| Stringent Food Safety & Pharmaceutical Regulations Worldwide | FSMA, HACCP, GDP, and other global standards mandate continuous logging and traceability across cold-chain operations. Regulatory enforcement pushes companies to adopt certified sensors, automated reporting, and cloud-based visibility tools. |

| Rising E-Commerce, Online Grocery & Last-Mile Delivery Demand | Growth in online grocery, quick commerce, and refrigerated home delivery expands cold-chain needs into last-mile networks. Compact sensors, portable trackers, and real-time alerts become critical to safeguard product quality in short-cycle delivery. |

| Pitfalls & Challenges | Impact |

| High Deployment & Operational Costs | Cold-chain monitoring requires investment in sensors, telematics, connectivity, and cloud platforms, which increases upfront costs especially for small logistics firms. These expenses slow adoption in price-sensitive markets and limit full fleet or warehouse coverage. |

| Integration Challenges with Existing Systems | Legacy logistics systems often lack APIs or compatibility with modern IoT platforms. This complicates data consolidation and prevents seamless end-to-end visibility across the cold chain. |

| Opportunities: | Impact |

| Growing Investments in Modern Cold-Chain Infrastructure | Large-scale expansion of cold warehouses, reefer fleets, and temperature-controlled logistics hubs creates new demand for monitoring systems. As new facilities go digital-first, adoption of sensors, cloud platforms, and integrated telematics becomes standard. |

| Expansion of E-Commerce, Quick Commerce & Last-Mile Cold Delivery | Rising demand for fresh and frozen home deliveries creates new use cases for portable sensors and box-level monitoring. Retailers and delivery platforms require real-time temperature tracking to guarantee freshness and reduce returns. |

| Market Leaders (2025) | |

| Market Leaders |

5.3% market share |

| Top Players |

Collective market share in 2024 is ~20% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | US, Germany, China, Japan, India |

| Future outlook |

|

What are the growth opportunities in this market?

Cold Chain Monitoring Market Trends

Global regulations across food and pharmaceutical supply chains are making continuous temperature visibility and validated digital records mandatory rather than optional. Requirements for audit trails, calibrated sensors, documented handling steps, and real-time alerting are reshaping how cold chains operate. As enforcement tightens, companies increasingly adopt certified IoT platforms with built-in compliance features, and vendors offering end-to-end validation gain a strong competitive advantage.

Cloud-based IoT ecosystems now integrate real-time sensor data with advanced analytics, enabling early detection of temperature risks and automated decision-making. AI and machine learning enhance forecasting, route planning, and warehouse optimization, transforming monitoring from passive logging to proactive quality control. As organizations scale digital operations, cloud-first and AI-driven architectures increasingly win new deployments and become the backbone of modern cold chains.

Sensitech acquired cold-chain monitoring systems business of Berlinger & Co. AG in 2024, thereby expanding its life-sciences cold-chain offering with Berlinger’s hardware, software, and analytics suite. This move strengthens Sensitech’s portfolio for temperature-sensitive goods especially pharmaceuticals, biologics, and global health shipments by combining real-time monitoring, validated data logging, and comprehensive supply-chain visibility under one global player

Cold-chain facilities are rapidly adopting automation, including robotic storage systems, autonomous mobile robots, and computer-vision technologies. These systems rely on tightly integrated monitoring to synchronize material flow with temperature control, ensuring product integrity while easing labor shortages. Vendors capable of unifying equipment telemetry, environmental data, and operational alerts into a single control layer are gaining traction as automated infrastructure becomes mainstream.

The rise of online grocery, quick-commerce services, and urban micro-fulfillment is extending temperature-controlled logistics into smaller, more distributed nodes. Monitoring now needs to support fast, stop-and-go delivery patterns, frequent door openings, and varied packaging conditions. Lightweight, resilient, and tamper-aware sensors are becoming essential as temperature control shifts from long-haul transport to dynamic, doorstep-level logistics environments.

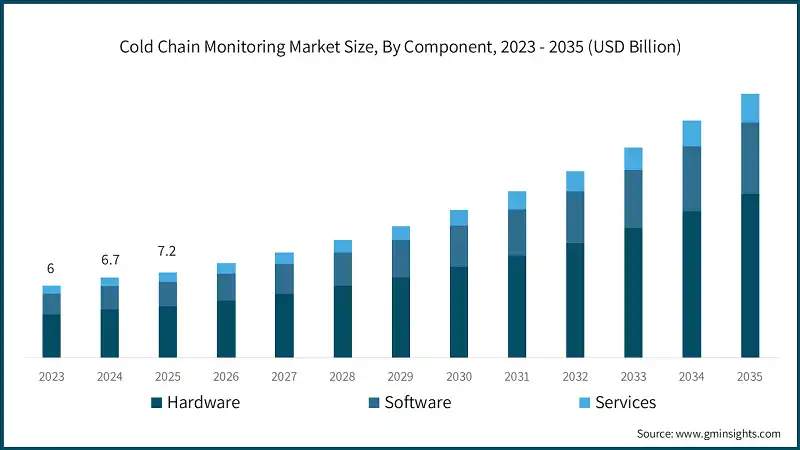

Cold Chain Monitoring Market Analysis

Learn more about the key segments shaping this market

Based on components, the cold chain monitoring market is divided into hardware, software, and services. The hardware segment dominated the market accounting for around 60% in 2025 and is expected to grow at a CAGR of 12.4% from 2026 to 2035.

- Cold chains require large numbers of physical devices temperature sensors, data loggers, GPS trackers, humidity meters, door-state sensors, and telematics units installed across warehouses, refer trucks, containers, and last-mile assets. Because every shipment, pallet, or storage zone must be instrumented, hardware scales faster than software licenses. The sheer footprint of devices needed to continuously monitor perishable goods ensures hardware remains the largest revenue-generating segment.

- Regulatory frameworks such as GDP, HACCP, and food safety standards require validated, calibrated hardware for accurate temperature measurement. These mandates specify sensor accuracy, calibration cycles, placement requirements, and frequency of readings making physical devices indispensable. As regulatory enforcement tightens across pharmaceuticals and food distribution, compliance pushes companies to invest heavily in certified monitoring hardware, further strengthening its dominance.

- The shift from manual logging to continuous, real-time visibility has driven mass adoption of IoT sensors, cellular trackers, BLE beacons, and multi-parameter monitoring devices. As cold chains digitize, companies deploy more hardware per shipment, including shock, tilt, vibration, and location sensors. The expansion of real-time telematics across global fleets significantly boosts hardware procurement volumes and cements hardware’s market dominance.

- ORBCOMM in mid-2024 launched CT 3600, a next-generation monitoring device for reefer containers and shipping lines, designed for easier installation (no drilling), long battery life, Bluetooth sensor support, and compliance with container-leasing and maritime standards.

Learn more about the key segments shaping this market

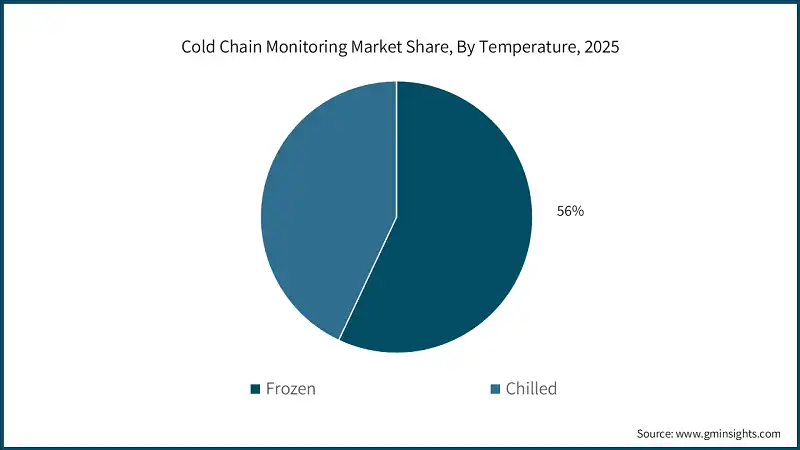

Based on temperature, the cold chain monitoring market is categorized into frozen, and chilled. Frozen segment dominated the market with around 56% share in 2025, and the segment is expected to grow at a CAGR of 12.4% between 2026 and 2035.

- Frozen foods, vaccines, biologics, and specialty pharmaceutical products require strict and uninterrupted low-temperature conditions to maintain efficacy and safety. Even minor temperature deviations can cause irreversible damage, making continuous monitoring essential. Because frozen items cannot tolerate thermal fluctuations, companies invest heavily in sensors, data loggers, and real-time tracking technologies driving the frozen segment’s dominance across global cold-chain monitoring deployments.

- Rising consumption of ready-to-cook meals, frozen meat, seafood, bakery items, and long-shelf-life convenience foods. Frozen products move across long distances, international shipping routes, and multi-stage distribution networks. This high logistics complexity increases reliance on monitoring systems to prevent thaw cycles or freezer failures, making the frozen segment the largest user of cold-chain monitoring technologies.

- Food safety authorities impose stringent compliance standards for frozen meats, seafood, and processed foods, requiring continuous temperature logs, tamper-proof data, and validated storage conditions. Regulations often mandate strict documentation of freezing processes, transportation temperature ranges, and product-level traceability. These compliance pressures drive companies to deploy more monitoring hardware and cloud systems in the frozen category than in chilled or ambient segments.

- Online grocery and home-delivery platforms have heavily expanded frozen categories like ice cream, frozen meals, and frozen meats. Maintaining frozen integrity during last-mile delivery where temperature fluctuations are highest requires compact sensors, freezer-grade packaging, and continuous monitoring. As frozen e-commerce surges, demand for monitoring solutions in this segment grows disproportionately compared to other temperature ranges.

Based on deployment, the cold chain monitoring market is divided into cloud, on-premises, and hybrid. Cloud segment dominate the market and was valued at USD 3.1 billion in 2025.

- Cloud platforms allow companies to collect temperature, humidity, location, and excursion data from sensors across warehouses, reefer fleets, containers, and last-mile assets in a single unified dashboard. This eliminates data silos and enables instant, remote decision-making. As cold chains expand across regions and partners, cloud-based monitoring becomes the most scalable way to maintain end-to-end visibility without heavy on-premise infrastructure.

- Cloud architecture is designed to ingest large volumes of IoT telemetry data and support advanced analytics such as anomaly detection, predictive maintenance, and automated excursion management. AI/ML tools require high computing capacity and aggregated datasets capabilities the cloud provides natively. As cold chains shift from manual logging to intelligent prediction, cloud becomes the backbone for next-generation monitoring systems.

- Cloud providers offer enterprise-grade cybersecurity—encryption, multi-factor authentication, role-based access, data redundancy, and automatic backups—features often difficult for smaller firms to match with internal systems. As cold-chain data becomes more sensitive and valuable, cloud-based monitoring ensures higher protection, business continuity, and regulatory adherence than most on-prem alternatives.

- In November 2023, Sensitech launched its cloud-based SensiWatch Platform, enabling end-to-end, real-time visibility for global cold-chain operations by aggregating temperature, humidity, and location data from IoT sensors into a centralized cloud dashboard. This launch reinforced the dominance of cloud architectures in cold-chain monitoring by offering remote access, automated alerts, compliance-ready records, and multi-stakeholder collaboration across transport, storage, and last-mile environments.

Based on end use, the cold chain monitoring market is divided into pharmaceutical & healthcare, food & beverage, logistics & distribution, chemical and others. The pharmaceutical & healthcare segment dominates the market and was valued at USD 5.3 billion in 2025.

- Modern therapeutics such as cell therapies, gene therapies, monoclonal antibodies, and mRNA vaccines are extremely temperature-sensitive and degrade irreversibly if exposed to even slight fluctuations. This makes precise, real-time temperature and humidity monitoring essential across every node of the supply chain. The heightened stability requirements of next-generation drugs push the pharmaceutical sector to deploy more sophisticated sensors, data loggers, and real-time trackers than any other industry.

- Pharma and biotech production has expanded globally, with large volumes of vaccines, injectables, and biologics shipped across continents. These long distribution routes and multi-modal transport chains greatly increase the risk of excursions. As a result, the need for real-time visibility, telematics, and cloud-enabled monitoring becomes non-negotiable.

- Pharmaceutical products especially biologics and specialty therapies carry extremely high economic value. A single temperature excursion can destroy entire shipments worth millions and disrupt supply to hospitals and treatment centers. To minimize financial risk, pharma companies prioritize advanced monitoring solutions that offer predictive alerts, excursion analytics, and validated hardware.

Looking for region specific data?

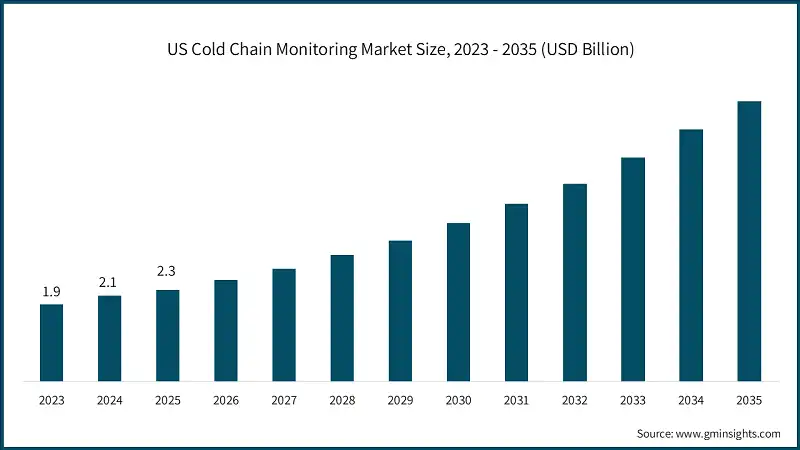

US dominated North America cold chain monitoring market with revenue of USD 2.3 billion in 2025.

- U.S. has one of the world’s largest networks of refrigerated warehouses, cold-storage facilities, and temperature-controlled transport fleets. This extensive infrastructure accelerates adoption of monitoring solutions, as operators require real-time visibility, compliance tracking, and automation to handle massive volumes of perishable food, pharmaceuticals, and biologics efficiently.

- Packaged foods, fresh produce distribution, frozen foods, and advanced pharmaceuticals and biologics. These industries have strict temperature requirements, making monitoring systems essential. High SKU diversity, long distribution distances, and retailer standards like those from Walmart and Kroger create constant demand for precise monitoring technologies.

- U.S. logistics and life-science companies rapidly adopt IoT sensors, cellular IoT, cloud platforms, predictive analytics, and integrated software systems. Strong innovation ecosystems, access to venture capital, and partnerships between logistics providers, tech firms, and platform vendors accelerate deployment of advanced monitoring solutions across transport, warehousing, and last-mile delivery.

- Country has a highly complex logistics environment with long-haul trucking routes, national distribution centers, and fast-growing grocery e-commerce. Temperature-sensitive products move across thousands of miles, increasing risk of excursions. Companies rely on monitoring to ensure product quality, reduce spoilage, and meet service-level expectations across vast and time-sensitive supply networks.

Germany cold chain monitoring market will grow tremendously with CAGR of 11.6% between 2026 and 2035.

- Germany is home to Europe’s largest logistics hub, with extensive warehousing, cross-border transport routes, and world-class cold-storage facilities. Its infrastructure supports massive volumes of perishable food, pharmaceuticals, and chemicals moving across the EU. With long-distance transport and high export activity, real-time temperature monitoring becomes essential, driving widespread adoption across road, rail, and air freight networks.

- Global manufacturing base for vaccines, biologics, APIs, and specialty drugs, Germany has strict temperature control requirements across production, storage, and distribution. Pharma giants such as Bayer, Boehringer Ingelheim, and Merck demand validated monitoring systems that ensure regulatory compliance and protect high-value shipments. This deep pharma presence creates continuous demand for advanced sensors, analytics, and auditing technologies.

- Germany follows stringent EU regulations such as GDP (Good Distribution Practice), HACCP, and EMA guidelines, which require continuous temperature logging, traceability, and validated data records. Compliance expectations are among the toughest in Europe, pushing companies to invest in high-accuracy, real-time monitoring solutions. Frequent inspections and certification requirements further accelerate market adoption and technology upgrades.

- German companies integrate advanced telemetry, cloud platforms, and predictive analytics into cold-chain operations faster than many European counterparts. Strong R&D spending, collaboration between tech providers and logistics firms, and rapid digital transformation make Germany an early adopter of cutting-edge monitoring solutions.

The cold chain monitoring market in China will experience robust growth during 2026-2035.

- China has invested heavily in refrigerated warehouses, cold rooms, reefer fleets, and integrated temperature-controlled logistics hubs to support rising domestic consumption and export activities. As new infrastructure comes online, monitoring technologies sensors, IoT systems, telematics, and cloud platforms are deployed at scale to ensure operational efficiency, reduce spoilage, and meet strict quality requirements in food, pharma, and e-commerce supply chains.

The cold chain monitoring market in Brazil will experience significant growth between 2026 & 2035.

- Latin America holds a 7.5% share of the cold chain monitoring market in 2025 and is expected to grow at a significant CAGR of 9%. Brazil is one of the world’s largest producers and exporters of meat, poultry, fruits, and dairy all of which require strict temperature control throughout transport and storage. As export volumes grow and distribution networks expand across vast geographies, the need for real-time temperature monitoring becomes essential to maintain product quality and meet international safety standards.

- Brazil’s pharmaceutical market is one of the fastest growing in Latin America, with rising production of temperature-sensitive medicines and increased demand for vaccines, biologics, and insulin. Healthcare distribution requires strict compliance with ANVISA regulations, which mandate continuous monitoring and validated records. As hospitals and pharmacies expand cold-storage capacity, the reliance on IoT sensors, data loggers, and real-time monitoring platforms grows significantly.

- Brazilian regulators have tightened cold-chain requirements for food and drug handling, enforcing documented temperature records, traceability, and compliance with national quality standards. Export-oriented industries must also meet international regulations such as HACCP and GDP. These tightening rules push logistics providers, food processors, and pharma distributors to adopt more accurate and secure monitoring systems to pass audits and avoid shipment rejections.

The cold chain monitoring market in UAE is expected to experience robust growth between 2026 & 2035.

- The UAE sits at a crossroads between Europe, Asia and Africa, and its world-class ports and airports (seaports like Jebel Ali Port, airports such as Dubai International) make it a major trans-shipment hub. Because many temperature-sensitive products (food, pharmaceuticals) from different continents pass through UAE enroute to regional markets, there is high demand for robust cold-chain monitoring. This geographic advantage gives the UAE a structural edge in the cold-chain market.

- The UAE has limited domestic agricultural production and relies heavily on imports to meet demand for food, seafood, dairy, and medical supplies. Because imported goods must maintain strict temperature control from origin to delivery, the need for reliable cold-chain monitoring (sensors, tracking, storage) is high, boosting infrastructure investment and market growth in cold-chain services.

- Consumer demand in the UAE for fresh produce, frozen foods, and perishable goods has surged, supported by rising incomes, urbanization, and a large expatriate population. In parallel, online grocery shopping and food-service delivery are expanding, requiring temperature-controlled logistics and monitoring even in last-mile delivery and small cold-storage facilities. This trend fuels demand for cold-chain monitoring solutions across storage, transport, and delivery.

- The UAE’s growing healthcare sector, including import and distribution of temperature-sensitive medicines and vaccines, raises the need for GDP-compliant cold-chain facilities. Logistics providers and pharma distributors in UAE are increasingly adopting real-time monitoring systems, validated warehousing, and strict temperature-control protocols. This demand from the pharma/healthcare segment significantly bolsters the cold-chain monitoring market in UAE.

Cold Chain Monitoring Market Share

- The top 7 companies in the market are Sensitech, Emerson Electric, Honeywell International, Descartes Systems Group, Digi International, Cold Chain Technologies and Zebra Technologies. These companies hold around 24% of the market share in 2025.

- Sensitech leads the market due to its comprehensive portfolio of single-use loggers, real-time IoT trackers, and cloud visibility platforms. Its deep expertise in pharmaceuticals and food, strong global support network, and integration with Carrier’s refrigeration technologies make it a dominant, end-to-end cold-chain solutions provider.

- Emerson stands out through its highly reliable data loggers, real-time trackers, and compliance-ready platforms used across mission-critical cold-chain environments. Its broad HVACR expertise, extensive service footprint, and strong presence in food, retail, and industrial segments reinforce its position as a trusted global monitoring leader.

- Honeywell ranks among the top players through its strong sensing hardware portfolio, validated data loggers, and the Honeywell Forge analytics platform. Its large industrial customer base and channel reach allow it to integrate cold-chain monitoring with automation, safety, and enterprise-level optimization tools.

- Descartes embeds temperature monitoring directly into its logistics and supply chain software ecosystem. Its platform is widely adopted by 3PLs and complex shippers seeking unified visibility, regulatory compliance, and end-to-end coordination across multimodal cold-chain operations.

- Digi International specializes in IoT connectivity, offering 4G/5G, LTE-M, and NB-IoT gateways essential for in-transit cold-chain uptime. Its secure device-management capabilities and reliable telematics solutions position it as a core backbone supplier for real-time monitoring systems.

- Cold Chain Technologies validated temperature-controlled packaging solutions and integrated monitoring systems tailored for pharmaceuticals and clinical supplies. Its expertise in compliance, reusable systems, and high-performance insulation makes it a leading partner for sensitive healthcare logistics.

- Zebra offers bridging warehouse automation with cold-chain visibility, using RFID, mobile computing, and sensor-enabled tracking. Its strong analytics and asset-intelligence solutions support large retailers, distributors, and logistics operators seeking integrated temperature and inventory control across the supply chain.

Cold Chain Monitoring Market Companies

Major players operating in the cold chain monitoring industry include:

- Cold Chain Technologies

- Controlant

- Descartes Systems

- Digi International

- Emerson Electric

- Honeywell International

- ORBCOMM

- Sensitech

- Testo

- Zebra Technologies

- Sensitech (Carrier) offers end-to-end solutions spanning single-use loggers to real-time trackers with global cellular coverage, supported by a mature visibility platform. Its strengths include deep pharma and food domain expertise, global field support, and tight integration with Carrier refrigeration assets.

- ORBCOMM provides satellite-plus-cellular asset tracking that excels in maritime and intermodal corridors, delivering refer container and trailer monitoring for temperature, location, and door events, along with a growing analytics stack and integrations with TMS platforms for fleet-wide visibility.

- Honeywell International delivers a portfolio of sensing hardware, data loggers, and the Honeywell Forge platform for AI-powered optimization, leveraging broad channel reach and a large installed base in industrial automation and building systems to create strong cross-sell opportunities.

- Emerson Electric’s Cargo Solutions unit supplies data loggers, real-time trackers, and compliance-ready monitoring platforms backed by a large global service footprint, making it a trusted provider in mission-critical cold-chain environments.

- Zebra Technologies connects warehouse automation with temperature monitoring through strengths in mobile computing, RFID solutions, and analytics that enhance inventory and asset intelligence across cold-chain operations.

- Testo delivers high-precision measuring instruments and wireless monitoring systems, offering calibration and validation services that are essential to pharmaceutical quality assurance and food safety programs.

- Digi International specializes in connectivity solutions including 4G/5G, LTE-M, and NB-IoT routers, gateways, and device-management platforms, which are critical for maintaining in-transit uptime and enabling secure remote updates.

- Descartes Systems provides logistics and supply-chain software with embedded cold-chain monitoring, widely used by 3PLs and complex shippers seeking a unified platform that manages everything from planning to execution.

- Controlant offers a cloud-native visibility platform and real-time trackers with a strong focus on pharmaceuticals, combining rapid deployment with robust compliance features suited for regulated environments.

- Cold Chain Technologies focuses on temperature-controlled packaging and monitoring solutions for clinical and specialty pharmaceuticals, with validation services and reusable systems forming key differentiators in high-value healthcare logistics.

Cold Chain Monitoring Industry News

- In April 2024, FedEx opened its Life Science Center in Mumbai, India, featuring centralized temperature and humidity monitoring systems aligned with GMP, GCP, and GDP standards. The facility enhances FedEx’s regional capabilities for time- and temperature-sensitive healthcare shipments, supporting real-time visibility across APAC supply chains.

- In March 2024, Maersk expanded its “Captain Peter” reefer monitoring platform globally, integrating AI-driven temperature prediction, CO2 tracking, and humidity analytics across its 380,000 refrigerated containers. The solution provides shippers with real-time cargo visibility and proactive alerts to reduce spoilage during long-haul transport.

- In December 2023, the U.S. FDA began implementation of the FSMA Rule 204 traceability requirements, mandating digital record-keeping and temperature monitoring for high-risk foods such as seafood, dairy, and fresh produce. The rule is accelerating IoT adoption and cloud data integration across North American cold chains.

- In July 2024, Samsara introduced its 5G-connected temperature monitoring solutions for refrigerated fleets, integrating onboard sensors, door tracking, and route optimization for food distributors and retailers. The platform enables real-time visibility and automated compliance reporting for last-mile operations.

The cold chain monitoring market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($Bn) & shipment (units) from 2021 to 2034, for the following segments:

Market, By Component

- Hardware

- Sensors

- RFID devices

- Telematics

- Networking devices

- Others

- Software

- Real-time monitoring

- Analytics and reporting

- Services

- Professional services

- Managed services

Market, By Temperature

- Frozen

- Chilled

Market, By Deployment

- Cloud

- On-premises

- Hybrid

Market, By Logistics

- Storage

- Transportation

Market, By End Use

- Pharmaceutical & healthcare

- Food & beverage

- Logistics & distribution

- Chemical

- Others

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Benelux

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Thailand

- Indonesia

- Singapore

- Vietnam

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What is the growth outlook for the pharmaceutical and healthcare segment?

The pharmaceutical and healthcare segment, valued at USD 5.3 billion in 2025, due to the rising demand for precise, real-time monitoring of temperature-sensitive therapeutics such as cell therapies, gene therapies, and mRNA vaccines.

What are the upcoming trends in the cold chain monitoring market?

Key trends include AI-driven quality control, cloud-based IoT monitoring, cold-chain automation, and lightweight, tamper-aware sensors for dynamic logistics.

Who are the key players in the cold chain monitoring industry?

Major players include Cold Chain Technologies, Controlant, Descartes Systems, Digi International, Emerson Electric, Honeywell International, ORBCOMM, Sensitech, Testo, and Zebra Technologies.

Which region leads the cold chain monitoring sector?

The United States leads the North American market, generating USD 2.3 billion in revenue in 2025. The country’s extensive refrigerated infrastructure and demand for real-time visibility and compliance tracking drive this dominance.

What is the expected size of the global cold chain monitoring industry in 2026?

The market size is projected to reach USD 8 billion in 2026.

How much revenue did the hardware segment generate in 2025?

The hardware segment accounted for approximately 60% of the market in 2025 and is expected to grow at a CAGR of 12.4% from 2026 to 2035.

What was the market share of the frozen segment in 2025?

The frozen segment dominated the market with a 56% share in 2025 and is anticipated to expand at a CAGR of 12.4% between 2026 and 2035.

What is the market size of the cold chain monitoring in 2025?

The market size was valued at USD 7.2 billion in 2025, with a CAGR of 12.1% expected from 2026 to 2035. The growth is driven by increasing demand for perishables, stringent temperature control requirements, and advancements in IoT-based monitoring solutions.

What is the projected value of the global cold chain monitoring market by 2035?

The market is poised to reach USD 22.2 billion by 2035, fueled by the adoption of AI-driven architectures, cloud-based IoT ecosystems, and the expansion of temperature-controlled logistics.

Cold Chain Monitoring Market Scope

Related Reports