Summary

Table of Content

Carbon Credit Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Carbon Credit Market Size

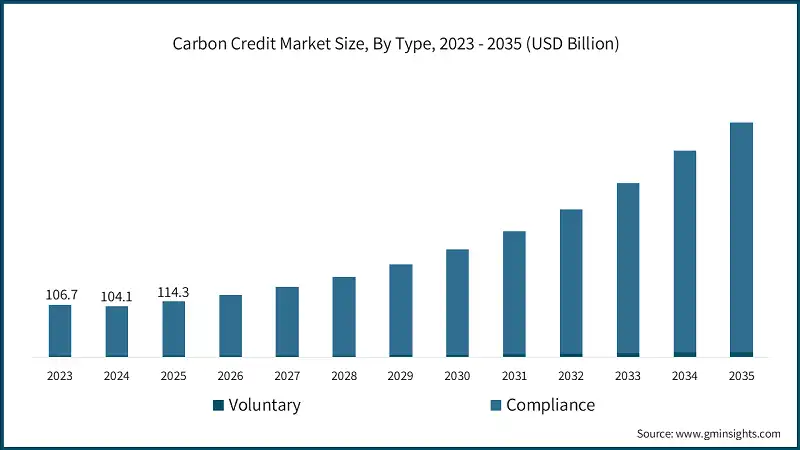

According to a recent study by Global Market Insights Inc., the carbon credit market was estimated at USD 114.3 billion in 2025. The market is expected to grow from USD 127.3 billion in 2026 to USD 482 billion in 2035, at a CAGR of 15.9%.

To get key market trends

- Increasing trade policies along with increasing adoption of compliance carbon offset trade in augmenting the market dynamics across the globe. Carbon pricing is now a trade compliance requirement for manufacturers and importers. In addition, border instruments are tightening reporting and verification rules, expanding product scope, and aligning methodologies with domestic ETS systems.

- This dynamic is pushing suppliers to quantify embedded emissions, adopt lowcarbon inputs, and secure credible credits for residuals. It also creates an incentive for jurisdictions to build compatible MRV systems and registries, because exporters need verifiable data that import authorities accept.

- For illustration, in December 2025, the European Commission issued a comprehensive CBAM, including a Q&A confirming scope expansion to 180 steel/aluminumintensive downstream goods and aligning calculation rules with the EU ETS ahead of the definitive phase starting Jan 1, 2026.

- Increasing integration of hardtoabate sectors into compliance carbon markets, which deepens the pool of obligated buyers and elevates the role of highintegrity credits for limited offset use is bolstering the market growth. Expansion typically begins with intensitybased allocation to acclimate firms to MRV and trading, then tightens benchmarks over time.

- In manufacturers terms, it is building emissions data systems down to process level, engaging in allowance strategy, and evaluating abatement versus credit procurement. It also diversifies carbon market liquidity beyond power generation and catalyzes industrial decarbonization technologies.

- Firms that already manage verified emissions and use credible credits gain a competitive compliance advantage as rules scale to more sectors. For instance, in December 2025, China’s Ministry of Ecology and Environment (MEE) formally released the Work Plan to cover steel, cement, and aluminum smelting under the national ETS, with CO, CF, and CF included where relevant.

- Rising statutory carbon taxes are creating demand for highquality credits. Jurisdictions that use carbon taxes are lifting rates and simultaneously opening limited windows for eligible international credits to manage cost and drive nearterm reductions.

- This combination forces facilities to quantify emissions precisely and weigh whether to abate or to source Article 6aligned credits that pass strict eligibility tests. Rolling offset limits between years allowed adds tactical flexibility but also underscores the need for reliable supply and verification.

- For instance, in March 2025, Atmosfair announced it had retired the first carbon credits from its industrial biochar project in Mafinga, Tanzania, marking the world’s first negative-emissions credits certified under the new Global Biochar C Sink standard. The Mafinga project’s pyrolysis plant converts sawmill waste into biochar for soil enrichment, permanently locking in carbon dioxide.

Carbon Credit Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 114.3 Billion |

| Market Size in 2026 | USD 127.3 Billion |

| Forecast Period 2026 to 2035 CAGR | 15.9% |

| Market Size in 2035 | USD 482 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Stern government policies and regulations | Stringent climate laws and carbon pricing frameworks are compelling businesses to adopt carbon credits as part of compliance and decarbonization strategies. |

| Increasing inclination towards biodiversity and conservation goals | Corporates and governments are prioritizing nature-based solutions, driving demand for credits linked to ecosystem restoration and biodiversity protection. |

| Growing number of carbon standards | The rise of globally recognized standards and registries is enhancing credibility and expanding participation in voluntary and compliance carbon markets. |

| Pitfalls & Challenges | Impact |

| Lack of awareness & quality concerns | Limited understanding of carbon credit mechanisms and persistent doubts about credit integrity hinder widespread adoption and trust in the market. |

| Opportunities: | Impact |

| Expansion of Article 6-authorized credits | Growing international cooperation under the Paris Agreement is creating new channels for authorized, high-integrity credits, opening opportunities for cross-border trading and compliance alignment. |

| Corporate demand for carbon removals | Increasing net-zero and net-negative commitments are driving procurement of durable carbon removal credits, fueling innovation in technologies like Direct Air Capture and bio-based sequestration. |

| Market Leaders (2025) | |

| Market Leaders |

10% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | China, India, Brazil, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Carbon Credit Market Trends

- Rising Reforms of large compliance schemes are translating into tangible abatement or set declining baselines, reforms are now yielding measurable compliance activity, thereby facilities are surrendering units, generating schemespecific credits, and relying on regulated offsets where permitted.

- This operational maturity, clear baselines, credit issuance rules, and public data, reduces policy uncertainty and increases corporate willingness to invest in abatement and credible credits. As regulators publish annual statements and databases, transparency strengthens market confidence and nudges finance towards legitimate projects.

- For instance, in January 2026, Australia’s Clean Energy Regulator reports the reformed Safeguard Mechanism is in effect, covering facilities above 100,000 tCOe, with Safeguard Mechanism Credit units (SMCs) and ACCUs surrendered in 2023–24. In addition, it noted the emissions from the largest facilities are decreasing after the first year of reforms.

- New national carbon markets are moving from design to implementation, which in turn is complementing the industry dynamics. It ensures credits have defensible baselines and that claims align with national objectives. Companies operating in these jurisdictions must ready MRV systems and internal governance to qualify for compliance certificates and, where allowed, voluntary credits.

- For illustration, in May 2025, CarbonClear named Aquascope Solutions as its Monitoring, Reporting, and Verification (MRV) partner for the flagship carbon initiative in Slovenia’s Notranjski Regional Park. This partnership supports CarbonClear’s commitment to delivering high-quality carbon credits aligned with the EU’s Carbon Removal and Carbon Farming (CRCF) framework by implementing stringent MRV standards.

- Dedicated carbon exchanges and registries are evolving quickly to support transparent issuance, trading, and retirement, integrating rules for Article 6 authorization and corresponding adjustments. As platforms add international functionality, project developers and buyers gain standardized processes that reduce friction and risk.

- Exchangeled integrity features, eligibility categories, MRV hooks, and public transaction data aid buyers navigate quality. For host countries, a functioning exchange signals readiness to attract climate finance into local projects, which in turn can seed more credible supply for global buyers.

- For instance, in July 2025, IDXCarbon (Indonesia’s official carbon exchange, licensed by OJK) announced achievements and recognition, reflecting the buildout of market infrastructure following the Jan 20, 2025 launch of international trading sessions with government partners.

- The voluntary market is consolidating around highintegrity standards with clear governance, quantification, permanence, and doublecounting safeguards. Buyers increasingly insist on credits that meet these thresholds, and regulators are referencing them in national guidance.

- For reference, in 2025, the Integrity Council for the Voluntary Carbon Market (ICVCM) published its Core Carbon Principles Impact Report 2025 and continued approving CCPeligible programs and methodologies, embedding CCPs at the heart of market transformation.

Carbon Credit Market Analysis

Learn more about the key segments shaping this market

- Based on type, the market is segmented into voluntary and compliance. The compliance carbon credit industry dominated about 98% of the revenue share in 2025 and is set to grow at a CAGR of 15.9% by 2035. Continued emissions reductions under cap-and-trade systems coupled with expansion of ETS scope to transport and buildings is complementing the market landscape.

- Compliance markets are delivering quantifiable emissions reductions in regulated sectors as cap-and-trade systems drive decarbonization. In addition, maritime and aviation fuels are now priced within the system, linking sectors more directly to ETS mechanisms. This reduction in emissions underlines the ETS’s efficacy, enhancing policy credibility and investor confidence.

- For instance, in 2025, the European Commission reported that EU ETS emissions from power and industry dropped nearly 11% year-on-year, with significant coal-to-gas switching and rising renewables penetration. As benchmarks tighten, the value of high-quality offsets remains smaller and crucial to smooth transition before direct abatement solutions become available.

- Furthermore, the EU’s Carbon Border Adjustment Mechanism (CBAM) are gaining importance as compliance measures for embedded emissions in imported goods. In its 2025 review, the commission confirmed CBAM’s phased rollout, full scope application by 2026, and integration with ETS pricing.

- The voluntary carbon credit market will grow at a CAGR of 17% by 2035, driven by increased governmental scrutiny and efforts to enhance transparency. A shift toward formal recognition of voluntary markets as essential tools for decarbonization, encouraging buyers to invest in high-integrity projects.

- For instance, in August 2025, the U.S. Government Accountability Office (GAO) details federal involvement in voluntary carbon markets and explores strategies, including certification and oversight to bolster integrity, which in turn will infuse growth to the voluntary carbon offset industry down the line.

- Rising demand for verified Carbon Dioxide Removal (CDR) credits is further augmenting the industry dynamics. Project developers are responding by refining MRV frameworks. As corporate and public demand for CDR grows, voluntary markets will likely fund more long-duration, scientifically validated removal solutions.

- For reference, in September 2024, the International Finance Corporation (IFC) and the Carbon Trust announced a partnership to help companies in emerging markets develop decarbonization roadmaps. The two organizations will collaborate on providing advisory and financing strategies that align corporate operations with net-zero targets.

Learn more about the key segments shaping this market

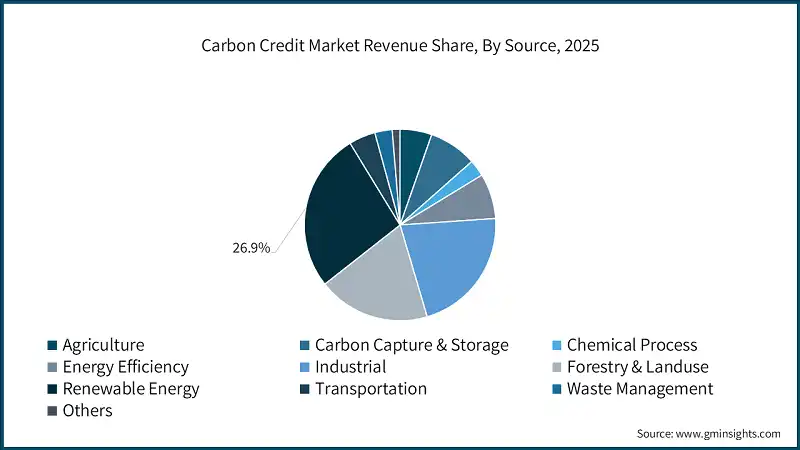

- Based on source, the market is segmented into agriculture, carbon capture & storage, chemical process, energy efficiency, industrial, forestry & land use, renewable energy, transportation, waste management, and others. The renewable energy industry held a revenue share of 26.9% in 2025 and will grow at a CAGR of 15.5% by 2035.

- Renewables are central to compliance markets and are linked to credit generation where permitted under national schemes. Expanded market infrastructure registries, trading platforms, and exchange rules, makes it easier to trace renewablerelated reductions and to integrate them within broader carbon market instruments.

- For instance, the European Commission’s 2025 Carbon Market Report confirms declining EU ETS emissions in the power sector in 2024 and highlights expansion to maritime transport, the Commission’s Carbon Markets portal documents ETS and international market diplomacy.

- The industrial carbon credit market will grow at a CAGR of 15% by 2035. Industrial sources including steel, cement, aluminum are entering national carbon markets, and that expansion is reshaping supply and demand for credits tied to process improvements, cleaner fuels, and verified reductions.

- For instance, in March 2025, 3Degrees announced it had listed the first-ever biochar carbon removal project on the Climate Action Reserve (CAR) registry. The project by Southwest Biochar became CAR’s inaugural biochar offset project after ramping up to full-scale operation in early 2025.

- The agriculture carbon credit market will cross USD 24.7 billion by 2035. Agricultural climate actions are moving from scattered pilots to standardized credit generation that can be trusted across borders. The push is toward robust MRV for soil carbon, rice methane management, nutrient optimization, and agroforestry practices, with safeguards for permanence and leakage.

- Governments are also incorporating Article 6 cooperation into agricultural landscapes, which means hostcountry authorization and corresponding adjustments will increasingly determine whether credits can sit in corporate portfolios. This overall trend is professionalizing farmlevel carbon into tradable, highquality instruments aligned with national climate strategies.

- For instance, in October 2025, one of the UK bank has urged various policymakers to aid farmers to earn additional income from voluntary carbon and nature market in a report to focus on nature-based growth opportunities for the country’s agriculture sector.

- Forestry and land use carbon credit market will grow at a CAGR of 16% by 2035. Crediting bodies advanced requirements for additionality, permanence (including buffer pools), social safeguards, and transparent registries. As a result, highquality afforestation, improved forest management, and mangrove restoration credits are becoming more investable and resilient to reputational risk.

Looking for region specific data?

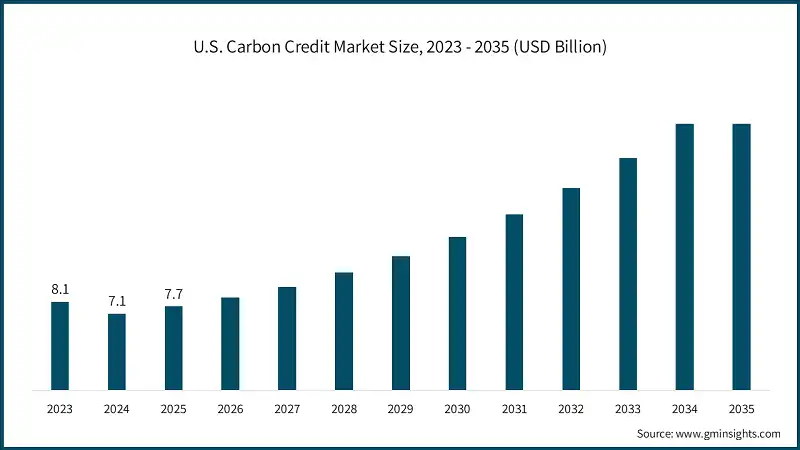

- The U.S. held 34.7% market share in 2025 and generated USD 7.7 billion in revenue. The regional carbon credit landscape is consolidating around higher integrity, clearer oversight, and deeper links to compliance experience. The U.S. regulators and auditors are sharpening the governance of voluntary instruments by setting principles and guidance that align credit quality with transparent MRV, permanence, and fraud prevention.

- For instance, in January 2026, in the U.S., 1PointFive, announced that Bain & Company has committed to purchasing 9,000 metric tons of carbon dioxide removal (CDR) credits over a three-year period through Direct Air Capture (DAC) technology. This agreement marks Bain’s first investment in DAC-based removal credits, aimed at addressing its residual operational emissions.

- The Europe carbon credit market will grow at a CAGR of 15.9% by 2035. The market growth is driven by strong regulatory frameworks, ambitious climate targets, and corporate sustainability commitments. The European Union has implemented the EU Emissions Trading System (EU ETS), which is the world’s largest compliance carbon market.

- For instance, in May 2025, Verra launched a groundbreaking methodology to issue carbon credits for projects that retire coal-fired power plants ahead of schedule and replace them with renewable energy. This long-anticipated methodology aims to accelerate the global coal-to-clean transition by enabling coal plant owners or developers to earn credits for decommissioning assets early.

- Asia Pacific carbon credit market will reach USD 12 billion by 2035. The common thread is tighter MRV, clearer government rules, and regional architectures that make both compliance and voluntary credits more interoperable across borders - reducing transaction risk and supporting finance flows into credible mitigation projects.

- For instance, in May 2025, Singapore has embedding international carbon credits into its tax framework and signing bilateral implementation agreements that authorize Article 6 transfers with corresponding adjustments, creating a legally robust pipeline for highquality credits.

- Middle East & Africa carbon credit market will grow at a CAGR of 14% by 2035. The region is region is emerging as a significant player in the global market, driven by economic diversification strategies, renewable energy investments, and the need to address climate vulnerabilities.

- For instance, in June 2025, in Saudi Arabia, the Voluntary Carbon Market Company (VCM) and ENOWA (NEOM) longterm agreement to deliver approximately 30 million tonnes of credits by 2030. This will advanced voluntary market infrastructure and longterm corporate offtakes via a sovereignbacked platform, signalling durable demand for highintegrity credits sourced.

- The Latin America carbon credit market will grow at a CAGR of 10% by 2035. The region in the global market due to its vast natural resources, biodiversity, and significant potential for nature-based solutions. The region is home to the Amazon rainforest, one of the largest carbon sinks in the world, making forestry and land-use projects central to its role in carbon markets.

Carbon Credit Market Share

- The top 5 companies in the carbon credit industry including Verra, South Pole, Climate Impact Partners, EcoAct, and 3Degrees held over 35% market share in the year 2025. Verra is the dominant global standard and registry for voluntary carbon credits, underpinning a large portion of market activity. Its Verified Carbon Standard (VCS) is widely recognized for rigorous methodologies and transparent governance, making it the benchmark for integrity in project certification.

- Climate Impact Partners specializes in delivering high-integrity carbon projects and tailored solutions for corporate clients. Known for its focus on social and environmental co-benefits, the company has carved out a niche in premium credits that meet stringent sustainability criteria.

- EcoAct, is one of the climate consultancy and project developer with a strong European footprint. It offers end-to-end services, from carbon accounting and strategy to sourcing verified credits, positioning itself as a bridge between compliance and voluntary markets.

Carbon Credit Market Companies

Major players operating in the carbon credit industry are:

- 3Degrees

- Allcot

- Atmosfair

- Carbon Clear

- Carbon Collective Company

- Carbon Credit Capital

- Carbonmark

- Carbonplace

- Climate Impact Partners

- Climeco

- EcoAct

- Ecosecurities

- Green Mountain Energy

- Shell

- South Pole

- Sterling Planet

- Terrapass

- The Carbon Trust

- Verra

- WGL Holdings

- 3Degrees is a certified B Corporation and an early pioneer in global climate solutions, offering tailored services in emissions strategy, renewable energy, and carbon markets. With approximately USD 130 million in annual revenue and over 500 employees, they serve a diverse global clientele spanning utilities, corporations, and industrials.

- Climate Impact Partners is a mission-focused carbon market specialist that develops, finances, and scales impactful carbon projects worldwide. They’ve facilitated reductions and removals of over 150 million tonnes COe through 600+ projects in more than 60 countries, as validated in their July 2025 Impact Report.

- South Pole serves as a global leader in project development and climate advisory, delivering end-to-end solutions in renewable energy, nature-based solutions, and carbon removal technologies. Their influence is marked by extensive corporate partnerships and actionable guidance for net-zero strategies.

Carbon Credit Industry News

- In December 2025, EcoSecurities was awarded a UK PACT technical assistance contract to support Indonesia’s voluntary carbon market. Over 15 months, EcoSecurities (with local partner INDEF) will work on Indonesia’s “PROTECT” program strengthening registry design, MRV systems, Article 6 operational rules, and stakeholder engagement.

- In August 2025, Climate Impact Partners (CIP) and Rizome jointly registered the Kawayan reforestation project under Verra’s new VM0047 afforestation/reforestation methodology. The Rizome Kawayan project will generate carbon removal credits from actively restoring degraded land in the Philippines. This pioneering registration exemplifies CIP’s focus on innovative, high-quality offset methodologies to scale global carbon removal efforts.

- In June 2025, Karbon-X announced the acquisition of ALLCOT, a global climate advisory firm with deep expertise in carbon markets and project development. The deal brings ALLCOT’s global operations, spanning Europe, Latin America and Africa, into Karbon-X’s climate platform, bolstering the combined company’s climate finance, advisory and carbon project development capabilities.

This carbon credit market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) from 2022 to 2035, for the following segments:

Market, By Type

- Voluntary

- Compliance

Market, By Source

- Agriculture

- Carbon capture & storage

- Chemical process

- Energy efficiency

- Industrial

- Forestry & land use

- Renewable energy

- Transportation

- Waste management

- Others

The above information has been provided for the following region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Frequently Asked Question(FAQ) :

What is the market size of the carbon credit industry in 2025?

The market size was USD 114.3 billion in 2025, with a CAGR of 15.9% expected through 2035 driven by stringent government policies, increasing inclination towards biodiversity and conservation goals, and growing number of carbon standards.

What is the projected value of the carbon credit market by 2035?

The carbon credit market is expected to reach USD 482 billion by 2035, propelled by expansion of compliance markets, corporate net-zero commitments, and rising demand for carbon removal credits.

What is the current carbon credit market size in 2026?

The market size is projected to reach USD 127.3 billion in 2026.

How much revenue did the compliance segment generate in 2025?

Compliance carbon credits dominated the market with approximately 98% revenue share in 2025, driven by cap-and-trade systems and expansion of ETS scope to transport and buildings.

Carbon Credit Market Scope

Related Reports