Summary

Table of Content

Canada Smart Home Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Canada Smart Home Market Size

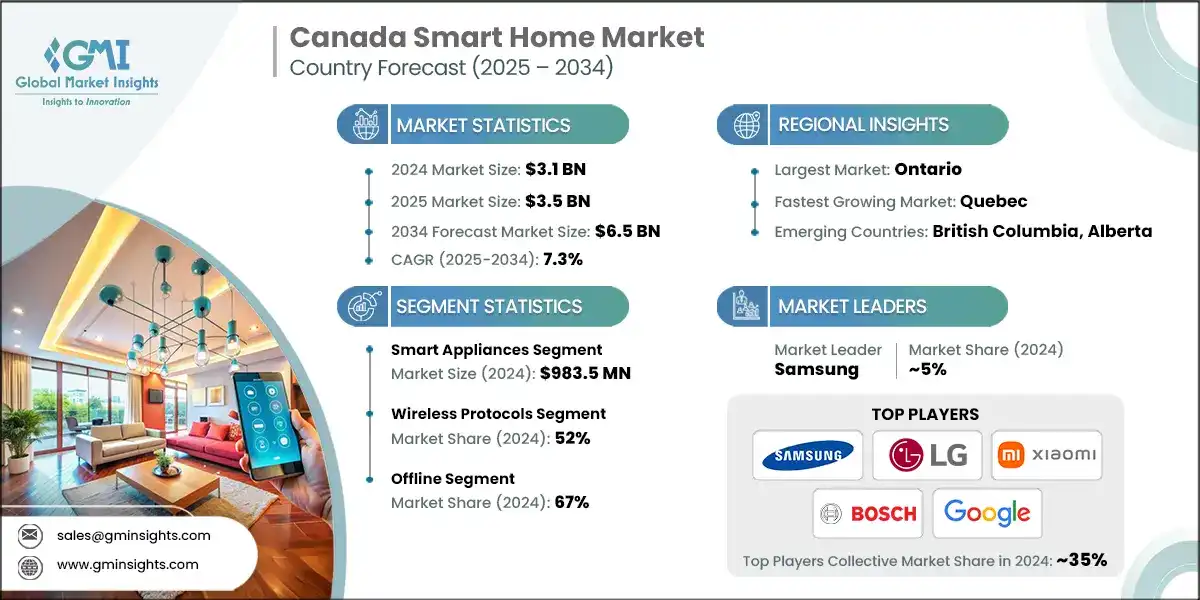

The Canada smart home market was estimated at USD 3.1 billion in 2024. The market is expected to grow from USD 3.5 billion in 2025 to USD 6.5 billion in 2034, at a CAGR of 7.3%, according to Global Market Insights Inc.

To get key market trends

- The Canadian smart home market continues to grow strongly because of the increasing spending power among citizens, heightened concern for energy efficiency, and heightened concern for security. An increasing number of Canadians are benefiting from an elevation in their level of disposable income which heightens the willingness to spend on convenience enhancing and cost saving technologies. According to Statistics Canada, the average household disposable income in Canada increased by 3.5% in 2023, further supporting the adoption of smart home technologies.

- Nowadays, smart home assistants, smart lights, and smart thermostats are not considered luxury items, rather, as practical tools that enhance ease of daily life. The fact that several home appliances can now be controlled through mobile devices or voice commands has made consumers prefer smart home appliances that improve functionality and lifestyle. This is further reinforced by the Canadian government’s support for innovation and technology which positively impacts the willingness to adopt these products in urban and suburban homes and households.

- At the same time, the increasing attention towards energy savings is quite noticeably changing market dynamics. Consumers are trying to conserve more energy as well as protect the environment, which impacts their purchasing behavior. Smart home technologies such as programmable thermostats, energy-saving bulbs, and smart HVAC systems can actively manage and control energy consumption to meet individual financial objectives as well as larger sustainability goals. As per the Canadian Energy Regulator, residential energy consumption accounted for approximately 17% of total energy use in 2023, highlighting the growing need for energy-efficient solutions in households.

- Furthermore, the growing concern for home security owing to rising urban population and incidences of burglary has increased the popularity of smart cameras, doorbell cameras, and remote access monitoring systems. According to Federal Bureau of Investigation (FBI) figures, a burglary occurs every 30 seconds in the United States, resulting in approximately 3,000 burglaries every day. These systems offer instant notifications and remote-control access which help to alleviate stress for homeowners while increasing the attractiveness of smart home technology in Canada.

Canada Smart Home Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 3.1 Billion |

| Forecast Period 2025 - 2034 CAGR | 7.3% |

| Market Size in 2034 | USD 6.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising disposable income | Enables more households to invest in premium smart home technologies, boosting market expansion. |

| Increasing awareness of energy efficiency | Drives demand for smart thermostats, lighting, and appliances that reduce energy consumption and utility bills. |

| Growing security concerns | Fuels adoption of smart surveillance systems, doorbells, and alarms for enhanced home protection. |

| Technological advancements | Accelerates innovation and affordability of smart devices, making them more accessible to Canadian consumers. |

| Government initiatives and rebates | Encourages adoption of energy-efficient smart home solutions through financial incentives and policy support. |

| Pitfalls & Challenges | Impact |

| Data privacy and security | Raises consumer hesitation due to concerns over surveillance, hacking, and misuse of personal data. |

| High initial costs | Limits adoption among budget-conscious households, especially for comprehensive smart home systems. |

| Data privacy and security | Discourages non-tech-savvy users due to setup difficulties and compatibility issues across devices. |

| Opportunities: | Impact |

| Expansion of smart energy management solutions | Enhances household energy efficiency and cost savings, driving adoption of smart thermostats, meters, and automation systems. |

| Integration with renewable energy systems | Supports sustainable living by enabling smart homes to optimize solar and wind energy usage, aligning with Canada’s green energy goals. |

| Market Leaders (2024) | |

| Market Leaders |

Market share of ~5% |

| Top Players |

Collective market share in 2024 ~35% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Ontario |

| Fastest Growing Market | Quebec |

| Emerging Province | British Columbia, Alberta |

| Future outlook |

|

What are the growth opportunities in this market?

Canada Smart Home Market Trends

- Smart technology and automation are a significant trend in smart home industry and will continue to grow, affecting many industries like consumer electronic, home security etc. One major development in smart home technology is the increasing use of artificial intelligence. Machine learning enables artificial intelligence to monitor and predict important actions from a sensor before the homeowner. For example, in October 2022, Google made it possible to use voice input for message typing as well as add emojis to messages with Google Assistant for better messaging experience.

- Also, the adoption of internet technology is increasing. Today, the market is flooded with various IoT devices like smart homes, smart wearables, and intelligent cities. Particularly, smart homes can enjoy convenient and secure devices such as Amazon Alexa, smart locks, smart thermostats, smart lighting systems, and security systems.

- Fitness goals and daily routine activities are tracked by wearable technology, which includes smartwatches and fitness trackers. Products that can be integrated with voice assistant have huge market demand. This is another effective solution to the connectivity problem and voice control for any smart home appliance. In September 2022, Lutron Electronics Co., Inc. introduced the Diva Smart Dimmer and Claro Smart Switch for wireless smart lighting control and other home automation features.

Canada Smart Home Market Analysis

Learn more about the key segments shaping this market

Based on product type, the market of Canada smart home is categorized into security & access controls, lighting control, entertainment devices, HVAC, smart appliances, home appliances, smart furniture, home healthcare, and others device. The smart appliances segment accounted for revenue of around USD 983.5 million in the year 2024 and is estimated to grow at a CAGR of 7.7% from 2025 to 2034.

- Canadians are adopting new smart technologies that allow them to control and monitor devices like refrigerators, ovens, washing machines, and dishwashers from their smartphones or voice assistants. This transformation is supported by the advancements in IoT technology and strong alliances with smart home systems such as Amazon Alexa and Google Home. Moreover, increased sensitivity toward environmentally friendly practices as well as conserving electricity and water has led consumers to purchase smart appliances with energy-saving attributes and real-time usage monitoring systems.

- Government incentives and rebates for energy-efficient appliances are also helpful in shifting the economic burden towards advanced technologies, appliances, and devices targeted at lower-income consumers. As more brands equip their products with cutting-edge technologies at reasonable prices, the smart devices market will continue to grow significantly in the next few years.

Based on connectivity, the Canada smart home market is segmented into wireless protocols, wired protocols, and hybrid. In 2024, the wireless protocols dominate the market with 52% market share, and the segment is expected to grow at a CAGR of over 7.4% from 2025 to 2034.

- The above dominance has been primarily associated with the installation convenience, flexibility, and scalability of wireless solutions for homeowners. Unlike wired systems, wireless protocols such as Wi-Fi, Zigbee, Z-Wave, and Bluetooth permit the addition of smart devices without structural integration, which is particularly advantageous for retrofitting older homes that constitute a sizable portion of Canada’s housing stock.

- Additionally, there is greater consumer adoption of fully wireless smart home ecosystems as cheap intelligent new devices are introduced alongside advancements in the speed, security, and reliability of wireless technology.

Learn more about the key segments shaping this market

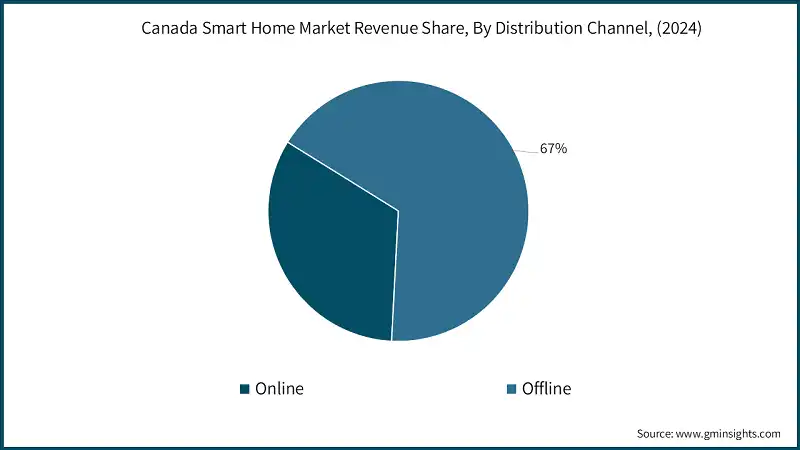

The distribution channel of Canada smart home market consists of two major channels namely online and offline platforms. The offline segment emerged as leader and held 67% of the total market share in 2024 and is anticipated to grow at a CAGR of 7.1% from 2025 to 2034.

- This dominance continues because of the remarkable spending power that accompanies the high value, advanced technological products and the need for them to be shopped physically. A significant number of Canadians prospected from home still love having a smart home device placed right in front of them on a countertop and love having the opportunity to interact, aura cadent, receive demonstrations and get advice by an actual sales attendant before setting their money down.

- Smart home device specialty shops, electronics retail stores, and various other outlets offer a cumulative buying approach which enables the customers to test the formerly purchased devices. In this way, they can verify if the product indeed performs well and if it can adapt and function with other devices and achieve enhanced standard. These retail and wholesale stores enable the patrons to enjoy the try before you purchase method.

Canada Smart Home Market Share

- The top 5 companies in smart home industry include Apple Inc., Emerson Electric Co., Google LLC, Haier Group, Samsung and they collectively hold a share of ~35% in 2024. Smart Homes manufacturers are most often selling high-priced products, as people know about their quality and feel comfortable using them in their homes. These companies are well established and have been in the smart home market for many years.

- These manufacturers provide many benefits since they make different smart devices and systems work together, which gives more choices to customers who want to buy them. Unfortunately, these well-known brands in the Smart Home industry charge premium prices compared to new companies that have just recently started making Smart Homes. Their higher prices come from their brand value, extra features, and wide variety of products they offer.

- Google LLC, a major player in the smart home market, reported USD 278.1 billion in revenue in 2023 due to their advancements and extensive product portfolio in smart home products.

Canada Smart Home Market Companies

Major players operating in the Canada smart home industry include:

- ADT Canada

- AlarmForce

- Apple (HomeKit)

- Amazon (Echo/Alexa)

- Bell Canada

- Canadian Smart Home Startups

- Google (Nest)

- Haier Group

- Honeywell International Inc.

- LG Electronics Canada

- Rogers Communications

- Samsung (SmartThings)

- TELUS

- Vivint

- Whirlpool Canada

Apple Inc. is another major company in the smart home market reporting annual revenue amounted to around 391 billion U.S. dollars in their 2024. Apple makes itself different by giving customers a safe and connected system through the smooth connection of smart home appliances. With products like Apple TV, HomePod, and Apple Watch, Apple gives people a complete range of smart home solutions that are easy for people to use and can be managed through iOS smartphones and the Siri voice assistant.

Canada Smart Home Industry News

- In June 2024, ABB launched ReliaHome Smart Panel, a new smart home energy management system. The product, intended for residential projects in the U.S. and Canada, was developed in partnership with software provider Lumin. The smart panel coordinates home energy assets, enabling energy optimization, circuit scheduling, and real-time control.

- In May 2024, Haier unveil the newly named company Haier Smart Home UK & Ireland. This was revealed alongside its plans to become the undisputed leader in the smart home in the UK and Ireland. The company also revealed it has developed a new connected smart home appliance product called the “Smart Cube” which includes an Inverter, battery storage, EV charger and Heat Pump controller all stacked in one unit.

- In June of 2024, Bosch Smart Home expanded the Bosch Smart Home Controller II with a new update that addressed the new Matter standard for communication. With this upgrade, Bosch Smart Home products can now be connected to a universal smart home ecosystem regardless of the brand. The standard created by the CSA enables integration of devices from different vendors allowing customizable setups for different users.

- In April 2024, Samsung introduced new connected bespoke AI-powered home appliances to enhance the performance of appliances. With built-in Wi-Fi, internal cameras, AI chips and compatibility with the SmartThings application, Samsung’s latest Bespoke AI appliances come with enhanced features and connectivity to lay the foundation for a truly smart home.

- In April of 2024, Gira launched a new product in the field of home automation, the KNX Weather Sensor. It integrates perfectly with the already-known Weather Centre and provides up-to-date information on temperature, brightness, precipitation, and wind speed.

- In April 2024, Xiaomi unveiled its all-new smart home appliances line that includes Robot Vacuum cleaner S10 and Xiaomi Handheld Garment Steamer. Robot Vacuum cleaner S10 features a laser-based navigation system with 4000Pa suction and supports Alexa and Google Assistant. On the other hand, Xiaomi Handheld Garment Steamer heats up within 26 seconds, kills up to 99.99% of bacteria and removes allergens from fabrics.

The Canada smart home market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Million) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Product Type

- Security & access controls

- Security cameras

- Video door phones

- Smart locks

- Others

- Lighting control

- Smart lights

- Relays & switches

- Occupancy sensors

- Dimmers

- Others

- Entertainment devices

- Smart displays/TV

- Streaming devices

- Sound Bars & speakers

- HVAC

- Smart thermostats

- Smart vents

- Others

- Smart appliances

- Kitchen appliances

- Refrigerators

- Dish washers

- Cooktops

- Microwave/Ovens

- Others

- Home appliances

- Smart washing machines

- Smart refrigerator

- Smart vacuum cleaners

- Others

- Kitchen appliances

- Control and connectivity

Market, By Connectivity

- Wireless protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired protocols

- Hybrid

Market, By Price Range

- Low

- Medium

- High

Market, By Application

- New construction

- Retrofit

Market, By Distribution Channel

- Online

- Offline

The above information is provided for the following provinces:

- Ontario

- Quebec

- British Columbia

- Alberta

- Rest of Canada

Frequently Asked Question(FAQ) :

Who are the key players in the Canada smart home market?

Key players include Samsung, LG, Xiaomi, Bosch, Google, Apple, Amazon, Honeywell, Rogers Communications, and TELUS, with the top five holding ~35% share in 2024.

Which province leads the Canada smart home market?

Ontario accounted for the largest market in 2024 with strong consumer tech adoption and advanced digital infrastructure, making it the hub for smart home innovation in Canada.

What are the upcoming trends in the Canada smart home industry?

Key trends include adoption of AI-powered devices, integration of IoT ecosystems, rising demand for smart security systems, and government-backed incentives for energy-efficient solutions.

What is the growth outlook for the offline distribution channel from 2025 to 2034?

The offline channel, with 67% share in 2024, is expected to grow at a 7.1% CAGR through 2034, supported by consumer preference for physical product demonstrations and expert guidance.

How much revenue did the smart appliances segment generate in 2024?

Smart appliances generated USD 983.5 million in 2024 and are anticipated to grow at a CAGR of 7.7% till 2034 due to IoT adoption and eco-friendly preferences.

What was the valuation of wireless connectivity protocols in 2024?

Wireless protocols held 52% market share in 2024 and are projected to expand at a CAGR of over 7.4% through 2034, driven by installation convenience and scalability.

What is the current Canada smart home market size in 2025?

The market size is projected to reach USD 3.5 billion in 2025.

What is the projected value of the Canada smart home market by 2034?

The Canada smart home industry is expected to reach USD 6.5 billion by 2034, fueled by sustainability trends, AI integration, and increasing consumer demand for connected living.

What is the market size of the Canada smart home industry in 2024?

The market size was USD 3.1 billion in 2024, with a CAGR of 7.3% expected from 2025 to 2034 driven by rising disposable income, energy efficiency awareness, and security needs.

Canada Smart Home Market Scope

Related Reports