Summary

Table of Content

BREEAM-Compliant Materials Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

BREEAM-Compliant Materials Market Size

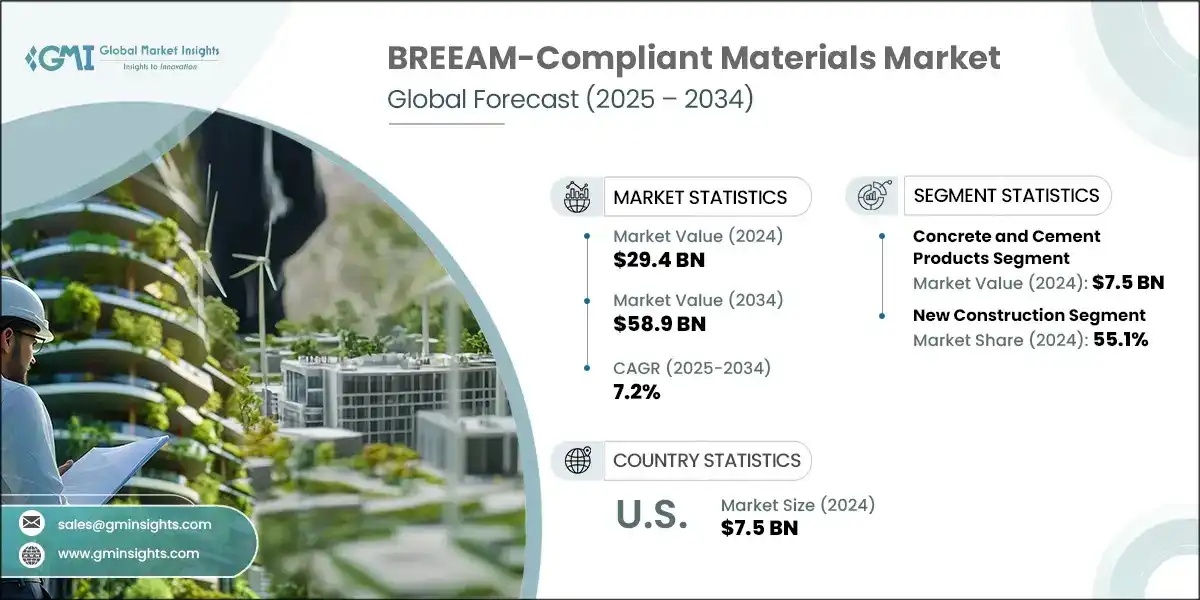

The global BREEAM-compliant materials market was valued at USD 29.4 billion in 2024. The market is expected to grow from USD 31.4 billion in 2025 to USD 58.9 billion in 2034, at a CAGR of 7.2%.

To get key market trends

- These BREEAM-compliant materials are construction products that meet sustainability criteria and are supposed to make minimal environment imprints over the very long haul-from being dug or manufactured to disposal. BREEAM certifies them. The rising demands from increased regulation pressure, commitments to corporate sustainability due to a raised bar of awareness over the fate of the planet, and climate change increased demands for such materials.

- Governments worldwide are putting together tougher codes of construction in order to limit carbon emissions from new buildings, and the result is that the claim for BREEAM-compliant materials has grown. For example, the Clean Growth Strategy (2017) of the UK government advocates that all buildings should be carbon neutral by 2050 and, thus speeding to sustainable construction practice. The European Green Deal (2019), where energy-efficient building standards are to be recognized all over the EU, thus binding developers to use low-carbon-accredited materials in their projects.

- The other new dimension is the growing consumer and investor interest in green buildings, as illustrated in the UK Green Building Council’s (UKGBC) Net Zero Whole Life Carbon Roadmap (2021), which puts more focus on sustainable materials toward decarbonization. Among the more than 20,000 buildings with ENERGY STAR certification, around 30% have received those certifications multiple times, improving their scores with time. According to EPA data, there has been a 30% increase in the number of green building certifications since 2015.

- With the tightening of regulations and the provision of incentives by governments and intensification of corporate sustainability goals, the demand for BREEAM-compliant materials will only continue to rise steadily for the foreseeable future, thereby creating a sustainable future in construction.

- Most extensive market in BREEAM-compliant materials is Europe, which has policies pertaining to sustainability standards that are very strict, widespread green building regulations, and highly encouraging government support for green construction. North America, on the other hand, is the fastest-growing market, encouraged by advanced manufacturing infrastructure, increasing investments in green building initiatives, and supportive regulatory frameworks. Such combined dynamics, encapsulate a vibrant global canvas towards the superior development of BREEAM-compliant materials.

BREEAM-Compliant Materials Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 29.4 Billion |

| Forecast Period 2025 - 2034 CAGR | 7.2% |

| Market Size in 2034 | USD 58.9 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing demand for sustainable buildings | Boosts market growth and accelerates adoption of BREEAM-compliant materials |

| Growth in green building projects worldwide | Expands market size and creates more opportunities for suppliers |

| Rising awareness of environmental impact | Drives consumer and developer preference for eco-friendly materials |

| Pitfalls & Challenges | Impact |

| Complex certification processes | Slows down project approvals and increases costs for stakeholders |

| Resistance to change from traditional building practices | Hinders widespread adoption of sustainable materials and methods |

| Opportunities: | Impact |

| Increasing investor interest in green buildings | Stimulates funding and development of innovative sustainable products |

| Integration with smart building technologies | Creates new markets and enhances the value proposition of eco-friendly materials |

| Market Leaders (2024) | |

| Market Leaders |

10.8% Market Share |

| Top Players |

Collective Market Share in 2024 is 36.4% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | India, Japan, Malaysia |

| Future Outlook |

|

What are the growth opportunities in this market?

BREEAM-Compliant Materials Market Trends

- Technological innovations in sustainable materials: Advances within material science support the next generation of products compliant with BREEAM. Examples of such innovative materials include bio-based, recycled, and low-carbon materials; they are available increasingly while improving the environmental performance and durability. The private sector efforts on research and development have resulted in materials such as carbon-negative concretes and recycled steel becoming widely accepted in promoting sustainable construction.

- Digitalization and building information modeling (BIM): Digitalization, particularly through building information modeling (BIM), is completely revolutionizing the ways in which construction might be made sustainable. BIM allows for the specification of materials with great precision, performance simulation, and resource management enabling sustainable materials to be used in the most optimized way and thereby waste saving. Integrated construction processes through BIM have enabled enhanced transparency and efficiency subsequently speeding up the adoption of BREEAM standards and facilitating better decision-making throughout life cycles of projects.

- Changed customer expectations and market transparency: Consumers and clients have increased the demand for transparency-on-sustainability in construction materials. Certification, such as BREEAM, is increasingly becoming a key determinant in procurement decisions prompting manufacturers to develop and market their "green" products. This is driving innovation within the companies and expanding what they can offer to meet the growing demand for environmentally responsible options for construction.

- Circular economy and material reuse initiatives: The movement toward circular economy principles sets the BREEAM-compliant material market. Reuse and recycling and waste minimization leads to the development of modular, recyclable, and adaptable building materials. The players in the market adopt sustainable manufacturing methods, with reduced environmental impacts and fit the core principles of BREEAM into the construction sector as a whole.

BREEAM-Compliant Materials Market Analysis

Learn more about the key segments shaping this market

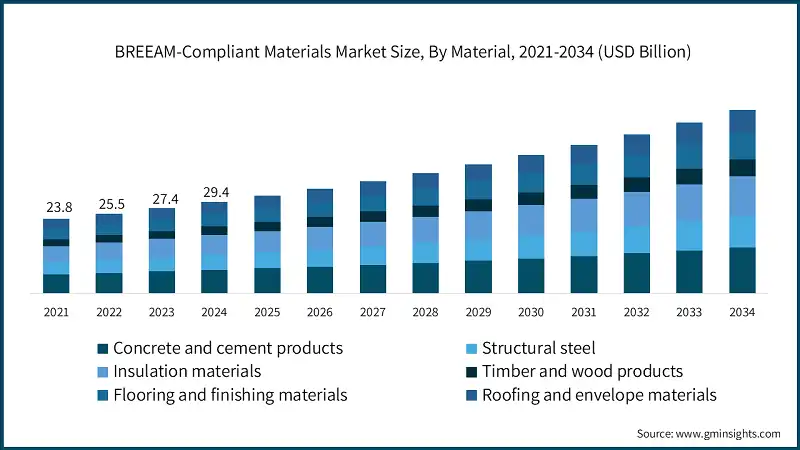

The market by material is segmented into concrete and cement products, structural steel, insulation materials, timber and wood products, flooring and finishing materials and roofing and envelope materials. Concrete and cement products generated USD 7.5 Billion in 2024.

- Concrete and cement products are the leading segment in the BREEAM-compliant materials market in relation to the structural elements to which they are mostly installed, thus becoming the foundation of higher-performing environmental criterion in construction projects. Moreover, their flexibility and affordability hasten the speed with which they are embraced in both new constructions and retrofits.

- Ongoing infrastructure development and urbanization are greatly contributing to the demand for concrete and cement, particularly in the case with areas that put emphasis on greener approaches to construction, thus further motivating the manufacturers to develop low-carbon alternatives to cement.

- Structural steel accounts for an insignificant fraction of this market as it is relatively expensive and recyclability concerns; however, it is an important attribute for large commercial and industrial projects expecting durable and sustainable structures. Insulation materials are embedded in the processes that enhance energy efficiency, especially in retrofits.

Learn more about the key segments shaping this market

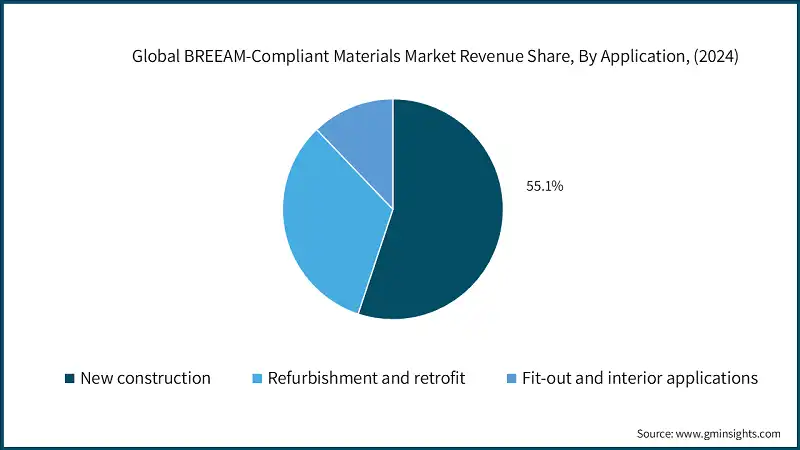

Based on application, the BREEAM-compliant materials market is segmented into new construction, refurbishment and retrofit and fit-out and interior applications. New construction made up 55.1% of the market in 2024.

- New construction is the dominant segment in market. The growing number of new projects targeting high environmental performance standards further enhances this growth, thereby making new construction the primary driver for market expansion.

- Refurbishment and retrofitting applications are another crucial arm of this sector, as there is pressure to upgrade existing buildings for contemporary sustainability standards and energy efficiency.

- Fit-out and interior applications are now being adopted by interior designers and contractors in renovation projects, particularly in commercial spaces including offices and hospitality.

Based on end use sector, the BREEAM-compliant materials market is segmented into commercial real estate, residential sector, institutional buildings and industrial and infrastructure. Commercial real estate leads the market in 2024.

- It is the commercial sector; this is where BREEAM-compliant materials are most extensively used. Majorly, efforts are made towards sustainable building design in all areas, and tenants and property owners place high value on certifications by green standards. BREEAM targets for many commercial buildings vary from offices to retail spaces to hospitality.

- Residential contributions largely, too, by rapidly increasing awareness of health and sustainability among consumers. BREEAM standards are increasingly adopted by developers in new residential projects to target environmentally aware home buyers. retrofit projects are also being popular in residential buildings to improve energy performance and indoor environmental quality.

- Institutional settings, like hospitals, schools, and government buildings, are becoming more inclined to practice the use of green materials because of increasing stringent environmental standards that such projects must adhere to.

- The industrial and infrastructure segment, although small, also increasingly adopts the BREEAM benchmark for the sustainability improvement and footprint reduction. Green materials have found their way into infrastructure projects, such as transportation hubs and utilities, due to industry standards as well as environmental commitments.

Looking for region specific data?

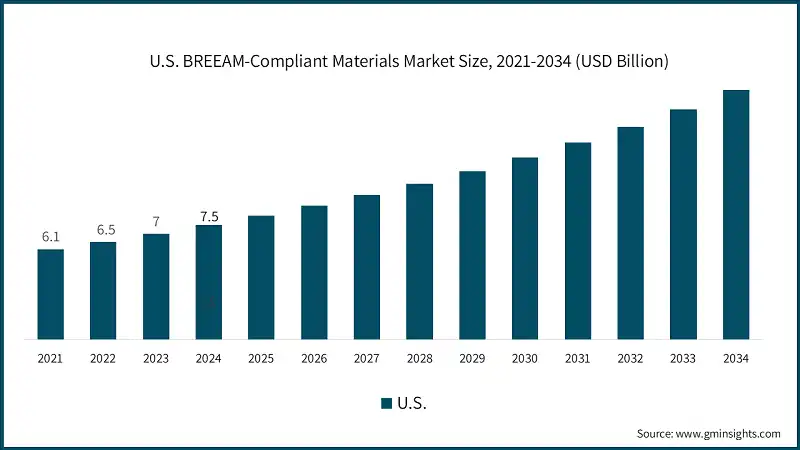

U.S. BREEAM-compliant materials market was accounted for USD 7.5 billion in 2024.

- With the emphasis on sustainable construction practices and green building certifications, the U.S. remains a major market with established regulatory frameworks and demand for ecologically friendly materials. Vigorously promoting the sourcing of eco-friendly materials and innovative manufacturing practices, BREEAM-compliant materials are gaining acceptance.

- Canadian rapid growth is also propelled by government policies. This collaborative effort across the industry and academic institutions assists in the adoption of BREEAM-compliant materials for commercial, healthcare, and residential sectors.

Germany BREEAM-compliant materials market is expected to reflect more robust growth from 2025 to 2034.

- Germany with much emphasis put on sustainability emphasis, Industry 4.0, and R&D investments. The principles of circular economy inform the sourcing of materials, especially in the aerospace, automotive, and construction sectors. National policies and public-private partnerships support these initiatives, making Germany a key hub for innovation.

- Smart manufacturing, digitalization, and regulatory compliance are real areas where the UK markets are improving. In alignment with high environmental buff and sustainability objectives, the UK is developing specialized BREEAM-compatible materials such as fire-resistant and UV-stable products. The growing progressive adoption of digital tools for delivery in construction will encourage further integration of sustainable materials within projects.

The BREEAM-compliant materials market of China will grow significantly between 2025 and 2034.

- Initiatives led by the government toward green urbanization, sustainable infrastructure, and eco-friendly buildings are the main motivating factors. Moreover, the advantages of China come from large production facilities and multi-technology manufacturing capability for BREEAM-compatible materials.

- A fast-growing population and urbanization make India a favorable market in light of the cost-effective nature of sustainable BREEAM-compliant materials. The focus remains on developing affordable and eco-friendly construction solutions.

The UAE BREEAM-compliant materials market will experience significant growth over the period from 2025 to 2034.

- BREEAM compliance follows the UAE vision for smart cities and sustainable development. Key factors include government support with investments in green building projects and sustainable infrastructure.

- With Saudi Arabia diversifying the economy while encouraging sustainable construction practices, it is nearing the status of BREEAM-compliant material hub. Large-scale projects focused on green building standardization will assist in boosting the growth of this market.

Brazil is expected to contribute significant future growth during the period between 2025 and 2034.

- Sustainable construction and affordable housing are receiving both federal and local government increases in institutional capacity within the Brazilian context, while BREEAM standards are undergoing an increasing conversion to more hitherto accepted ones. The government is incentivizing the market through eco-friendly materials and giving greater preference to bio-based and recycled materials, especially within urban development projects.

- As infrastructure developments and sustainable building practices are gaining momentum, Argentina is now shifting from pilot projects to more widespread application processes for eco-friendly materials. Rising economic development and government incentives for green construction are the primary drivers for the growth of this market.

BREEAM-Compliant Materials Market Share

- The market for BREEAM -compliant substances is quite scattered, with big players like Amorim Cork, Holcim, Kingspan, Owens Corning, Saint-Gobain counting about 36.4% of the total market shares.

- Innovation and sustainable product development are the focal areas of the companies to fulfill the increasing demand for eco-friendly construction materials. Their strategic focuses on investments in research and development while forging collaborations with stakeholders in the industry help these companies increase their market reach, aid in large-scale green building projects, and propel the adoption of BREEAM standards across various sectors.

BREEAM-Compliant Materials Market Companies

Major players operating in the BREEAM-compliant materials industry are:

- Amorim Cork

- BRE Global Ltd

- Concrete Centre

- EcoCocon

- Holcim

- Kingspan

- Owens Corning

- Saint-Gobain

Amorim Cork: It stands out in the production of sustainable building materials. Eco-friendly insulation for interior solutions and on renewable, biodegradable materials help with BREEAM prerequisites to increase energy efficiency and indoor air quality.

Holcim: One of the world leaders in cement, concrete, and aggregates, Holcim invests heavily in green building materials. They develop conscious cement and concrete mixes that comply with BREEAM, thus minimizing carbon emissions and environmental footprints.

Kingspan: It specializes in providing high-performance insulation and building envelope solutions. Their BREEAM-compliant products, such as insulated panels and facade systems, seek to be as environmentally friendly as possible.

Owens Corning: It is a manufacturer of roofing materials and fiberglass insulations aligned with sustainable construction. Products designed for thermal enhancing and environmental reduction fulfill BREEAM principles. The company invests in eco-friendly energy materials that could also be utilized for construction in green buildings.

Saint-Gobain: Saint-Gobain deploys an extensive range of sustainable building materials, including insulation, plasterboard, and glazing systems..

BREEAM-Compliant Materials Industry News

- July 2025: Minnesota expanded its data center tax incentive program by including newer environmental standards. As of June 30, 2025, to keep the benefits, qualifying data centers must get a BREEAM certification within three years, demonstrating the increasing emphasis on sustainability in infrastructure development.

- August 2024: Nova, Oxford- the first-ever project to achieve 100% in BREEAM award rating for its sustainability commitment-has received the highest BREEAM score in the UK. Developed by Wrenbridge and Buccleuch, it has incorporated renewable energy systems and biodiversity enhancements.

- January 2025: In 2024, BREEAM USA's review reported a 43% increase in certifications, driven by growing sector development and state-level adoption including Missouri's first project. Data centers and industrial properties have led the way in this growth reflecting increasing demand for sustainable, scientifically backed real estate solutions.

The BREEAM-Compliant Materials market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Billion and volume in terms of Kilo Tons from 2021–2034 for the following segments:

Market, By Material

- Concrete and cement products

- Ready-mix concrete

- Precast concrete elements

- Cement alternatives and blends

- Steel and metal products

- Structural steel

- Reinforcing steel

- Metal cladding and roofing

- Recycled metal content products

- Insulation materials

- Wood fiber insulation

- Cork-based insulation

- Hemp and bio-based insulation

- Recycled content insulation

- Timber and wood products

- Certified sustainable timber

- Engineered wood products

- Reclaimed and recycled wood

- Bamboo and alternative wood materials

- Flooring and finishing materials

- Sustainable flooring solutions

- Low-Voc paints and coatings

- Recycled content tiles and surfaces

- Bio-based finishing materials

- Roofing and envelope materials

- Green roofing systems

- High-performance glazing

- Sustainable cladding materials

- Weather barrier systems

Market, By Application

- New construction

- Commercial buildings

- Residential buildings

- Industrial facilities

- Infrastructure projects

- Refurbishment and retrofit

- Heritage building restoration

- Energy efficiency upgrades

- Sustainable renovation projects

- Building performance improvements

- Fit-out and interior applications

- Office fit-outs

- Retail spaces

- Healthcare facilities

- Educational buildings

Market, By End Use Sector

- Commercial real estate

- Office buildings

- Retail and shopping centers

- Hotels and hospitality

- Mixed-use developments

- Residential sector

- Single-family homes

- Multi-family housing

- Affordable housing projects

- Luxury residential developments

- Institutional buildings

- Healthcare facilities

- Educational institutions

- Government buildings

- Cultural and community centers

- Industrial and infrastructure

- Manufacturing facilities

- Warehouses and distribution centers

- Transportation infrastructure

- Utilities and energy projects

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

What is the market size of the BREEAM-compliant materials in 2024?

The market size was USD 29.4 billion in 2024, with a CAGR of 7.2% expected through 2034, driven by rising demand for sustainable buildings and stricter global green building standards.

What is the projected value of the BREEAM-compliant materials market by 2034?

The market is expected to reach USD 58.9 billion by 2034, fueled by sustainability mandates, circular economy initiatives, and growing green building certifications worldwide.

What is the projected size of the BREEAM-compliant materials industry in 2025?

The BREEAM-compliant materials market is expected to reach USD 31.4 billion in 2025.

How much revenue did the concrete and cement products segment generate?

Concrete and cement products generated USD 7.5 billion in 2024, leading the market due to their foundational role in sustainable construction and adaptability in new builds and retrofits.

What was the valuation of the new construction application segment?

New construction accounted for 55.1% of the market in 2024, making it the largest application segment driven by rising eco-friendly building developments.

What was the market size of the U.S. BREEAM-compliant materials market in 2024?

The U.S. BREEAM-compliant materials industry was valued at USD 7.5 billion in 2024.

What are the upcoming trends in the BREEAM-compliant materials industry?

Key trends include adoption of digital tools like BIM, use of bio-based and recycled materials, rising material transparency demands, and integration with smart building technologies.

Who are the key players in the BREEAM-compliant materials market?

Key players include Owens Corning, Saint-Gobain, Kingspan, Holcim, Amorim Cork, BRE Global Ltd, Concrete Centre, and EcoCocon.

BREEAM-Compliant Materials Market Scope

Related Reports