Summary

Table of Content

Biofertilizers Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Biofertilizers Market Size

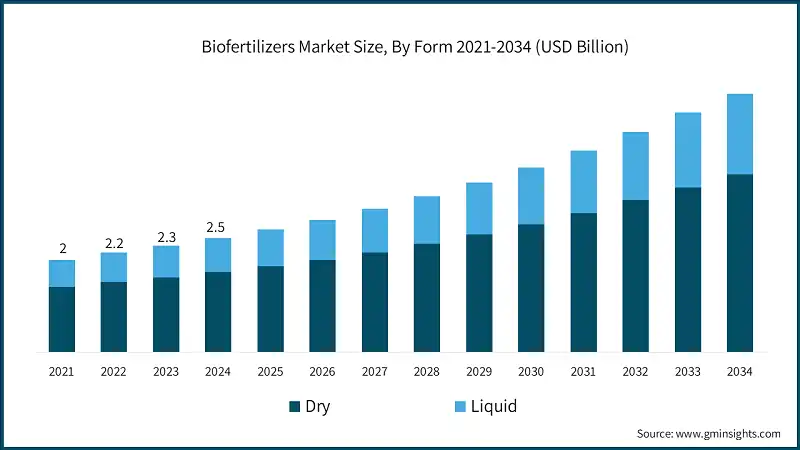

The global biofertilizers market was estimated at USD 2.5 billion in 2024. The market is expected to grow from USD 2.7 billion in 2025 to USD 5.6 billion in 2034, at a CAGR of 8.6%, according to Global Market Insights Inc.

To get key market trends

In a bid to tackle food security over the years and fix environmental related problems, countries across the globe have started endorsing sustainable agricultural practices. Policies like the Soil Health Card Scheme of India focuses on educating farmers on the appropriate nutrient composition for their soil which helps to replace chemical fertilizers with biological ones.

This also helps foster and expand the biofertilizers market because the initiatives developed focus on sustainable alternatives to fertilizers being given precedence. FAO has been promoting farming sustainability which has also helped increase the use of biofertilizers around the world.

Soil health has emerged as an issue of concern for policy makers as well as farmers, especially now that there is greater focus on sustainability. A wider focus on sustainability has led to falling productivity in many regions due to overused chemical fertilizers, soil erosion, and declining crop yields.

Programs such as the U.S. Department of Agriculture's (USDA) Natural Resources Conservation Service are promoting soil conservation and regenerative farming. They emphasize the importance of soil texture improvement, microbial organisms, and decaying organic matter. At the same time, farmers have started to make use of biofertilizers under the assumption that they enhance environmental productivity without adverse effects as the circle of awareness grows.

More advanced agriculture also includes systems for monitoring soil with IoT and for GPS guided application of fertilizers which increase productivity and decrease costs. These technologies aid in the worldwide struggle to reduce emissions on agriculture and increase farm profits, which is why the biofertilizers market will expand as more tech funding and innovations are provided towards the agricultural sector.

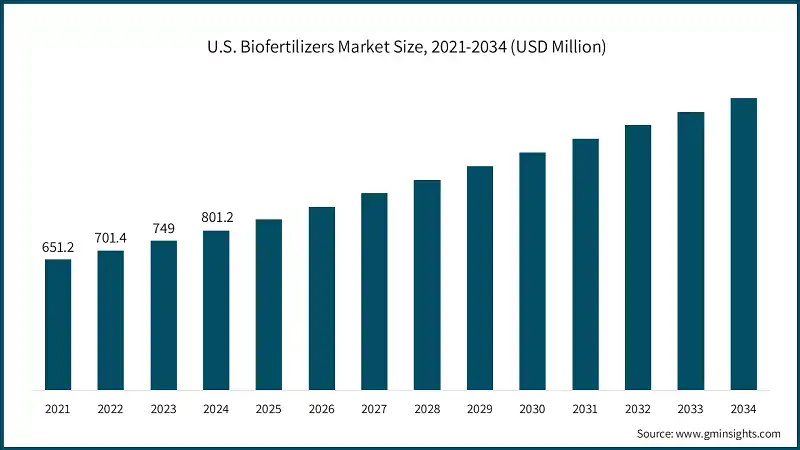

North America is the leading region in this market because of the blooming nations like U.S. and Canada.

Asia Pacific is the fastest growing region owing to increasing agricultural activities and a growing demand for quality crop care product.

Biofertilizers Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 2.5 billion |

| Market Size in 2025 | USD 2.7 billion |

| Forecast Period 2025 - 2034 CAGR | 8.6% |

| Market Size in 2034 | USD 5.6 billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising demand for organic farming | Consumers and farmers are increasingly shifting towards organic produce to meet health and environmental concerns, boosting the need for biofertilizers as eco-friendly alternatives to chemical fertilizers |

| Increasing awareness of sustainable agriculture | Growing awareness about the environmental impact of chemical fertilizers has led to greater adoption of biofertilizers, which improve soil health and reduce pollution |

| Government incentives and subsidies | Various government programs promote organic farming practices by providing financial support, encouraging farmers to adopt biofertilizers for better crop yields and sustainability |

| Pitfalls & Challenges | Impact |

| High production costs | Manufacturing biofertilizers often involves complex processes and quality control, resulting in higher costs compared to synthetic alternatives, which can hinder market growth |

| Lack of standardization and quality control | Inconsistent quality and efficacy of biofertilizer products due to lack of standardized production methods can reduce farmer confidence and adoption rates |

| Opportunities: | Impact |

| Expansion into emerging markets | Developing regions with growing agricultural sectors and increasing awareness present significant opportunities for market penetration and growth |

| Development of new biofertilizer formulations | Innovation in strains and formulations tailored to specific crops and soil types can enhance effectiveness and attract more users |

| Market Leaders (2024) | |

| Market Leaders |

7.5% |

| Top Players |

Collective market share in 2024 is 31.3% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | China, Japan, Canada, India, Brazil |

| Future Outlook |

|

What are the growth opportunities in this market?

Biofertilizers Market Trends

- Integration of digital technologies on biofertilizers is the adoption of improvements in precision agriculture such as IoT-based soil sensing systems. Biofertilizers are used efficiently through precision nutrient targeting. Technology applies soil temperature, moisture, and nutrients in real-time, sensing the conditions that are most suitable to apply biofertilizers for the best yield and minimal environmental impact. A specific study focused on the development of an inexpensive IoT based soil moisture and temperature monitoring system which unlike the other systems, have shown high correlation that suggested wide agricultural applicability.

- New trend that is being observed from various primary suppliers of agricultural input is their intentions to merge with or buy out different businesses to expand their portfolios and increase their reach within the biofertilizer industry. Consolidating partnerships allows for combining research and development efforts, rationalizing distribution systems, and improving the technical level, which facilitates better and more efficient biofertilizers and more extensive market penetration. Such industry partnerships will foster competition and the adoption of sustainable agricultural practices worldwide.

- The adoption of the European Green Deal and the sustainable cultivation biofertilizers promises to enhance the regulatory systems worldwide. The EU plans to ensure that by the year 2030 25% of the agricultural land is organically farmed. As of 2022, EU had already achieved 10.5% of its agricultural land being organically farmed and so with greater effort, the target can be achieved by 2030.

- The growing health and environmental concerns among the consumers have motivated the farmers to adopt organic farming since it uses biofertilizers which are friendly to the soil, crops, and the environment. It has been reported that EU is looking to achieve greater trust among consumers while simultaneously marketing sustainable products to achieve the goals of the organic action plan which will enable increases in the supply and demand for organic products.

Biofertilizers Market Analysis

Learn more about the key segments shaping this market

In 2021, the global market was valued at USD 2 billion. The following year, it saw a slight increase to USD 2.2 billion, and by 2023, the market further climbed to USD 2.3 billion.

Based on form, biofertilizers market is segmented into dry and liquid. Dry form generated USD 1.7 billion in 2024.

- Dry bioformulations are dominating the market for biofertilizers due to storage, shelf life and transport convenience benefits of dry forms over liquid ones. Dry formulations are more stable, longer in shelf life and ease of use in handling and thus very useful for very large and rural farmer communities. They are cost-effective, much easier to package and have low contamination potential.

- Liquid biofertilizers rapidly activate microbes, are easy to apply but are limited due to short shelf-life problems, storage issues, and higher costs of production. Liquid forms favour the method of precise farming and foliar application. Nevertheless, the dry form's affordability, stability, and logistical benefits uphold its dominance over the market especially in developing countries.

Learn more about the key segments shaping this market

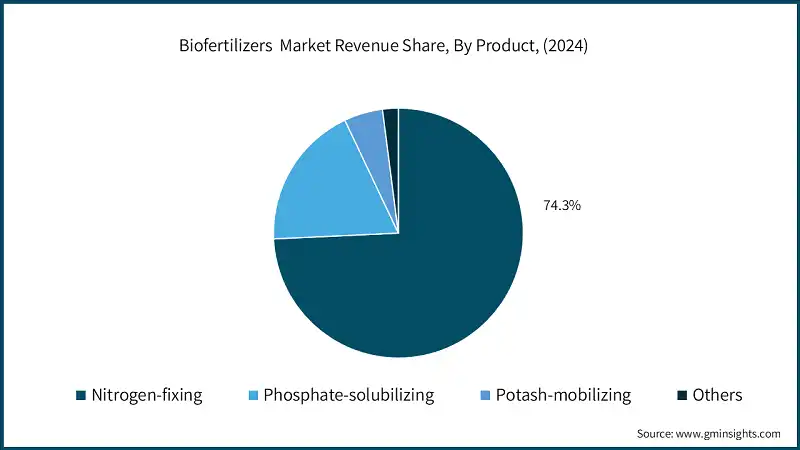

Based on product, the market is segmented into nitrogen-fixing, phosphate-solubilizing, potash-mobilizing and others. Nitrogen-fixing made up 74.3% of the market in 2024.

- The biofertilizers market is rapidly changing, particularly for nitrogen-fixing products, phosphate-solubilizing products, and potash-mobilizers, but nitrogen-fixing biofertilizers dominate the market because of their importance in improving crop growth and soil health. For example, use of nitrogen-fixing biofertilizers such as Rhizobium and Azospirillum has gained acceptance largely due to the dependence of plants on nitrogen as a vital nutrient for growth, together with lowering use of chemical fertilizers in achieving sustainable agriculture practices.

- Phosphate solubilizing biofertilizers are attracting attention by making phosphate more available in soils particularly in phosphate-deficient areas. Potash mobilizing bioproducts are still at the development stage, but significant prospects exist in terms of their future potential, particularly in improving crop cultivation in potassium-deficient soils. All in all, the nitrogen-fixing biofertilizer market, by having an effective performance record, applicability on a wide range of crops, and high acceptance among farmers, holds sway over the market.

Based on crop the biofertilizers market is segmented into cereals & grains, pulses & oil seeds, fruits & vegetables and others. Cereals and grains hold the market size of USD 1.1 billion in 2024 and expected to grow at a faster rate of 8.8% CAGR in 2034.

- Increased awareness of sustainable farming and the craving for organic produce stimulates the market for biofertilizers under the segments of cereals & grains, pulses & oilseeds, and fruits & vegetables. These markets mainly dominate with cereals & grains because these two hold the status of being popularly consumed staples worldwide while having vast areas under cultivation.

- Major crops like rice, wheat, maize and barley would increase soil fertility, yield and dependence on biofertilizers.

- In a more recent development, though adoption takes place at an increasing pace, fruits & vegetables lag behind cereals in market dominance due to shorter crop cycles and specific nutrient requirements. Cereals & grains till now have been the prime segment with substantial share in the biofertilizer market, driven by its important role in food security.

Based on application the biofertilizers market is segmented into seed treatment, soil treatment and others. Seed treatment accounted for 84.3% of the market share in 2024 and expected to grow at a CAGR of over 8.8% from 2025 to 2034.

- Seed treatment has emerged as the dominant method of application in the biofertilizers sector because of its effectiveness in improving seedling vigor and both early & late plant development. This method encompasses encapsulating seeds with biofertilizers such that advantageous microorganisms exist at the time of germination.

- The soil treatment is a direct application which enhances the formation of efficient root systems and nutrient absorption resulting in healthier crops with greater yields. Seed treatment is economical because less biofertilizers are needed as opposed to soil treatments thus lowering farmer input costs.

- In addition, changes to seed treatment strategies also enabled the development of novel biofertilizer products that are more efficient and simpler to use, thus increasing the willingness of farmers to use these products. These changes account for the dominance of this method in the market because it improves crop productivity and soil health.

Looking for region specific data?

North America Biofertilizers Market U.S. dominated the biofertilizers market in North America with around 82.3% share and generated USD 801.2 million in revenue in 2024. The biofertilizers industry in the Germany is expected to experience significant and promising growth from 2025 to 2034. The Asia-Pacific market is forecasted to grow at the fastest pace with a CAGR of 9.2% through the forecast period. The biofertilizers industry in the Brazil is expected to experience significant and promising growth from 2025 to 2034. The market in South Africa is expected to experience significant and promising growth from 2025 to 2034. Major players operating in the biofertilizers industry are: Chema Industries focuses its activities on the production of biofertilizers and products for soil health, contributing towards sustainable agriculture. The company believes in creating ecological solutions that help increase crop productivity and soil fertility while catering to the needs of the current market for environment-friendly farming inputs and sustainable agricultural practices. Gujarat State Fertilizers & Chemicals manufactures biofertilizers in its diversified fertilizer portfolio with a view to promoting sustainable agriculture through the provision of organic and eco-friendly biofertilizer options to enhance crop yield with minimal environmental impact. Rizobacter Argentina SA is one of the leading firms manufacturing biofertilizers and microbial solutions for agriculture. The company conducts research and development on bioinoculants that promise to enhance plant growth and soil health as a response to the worldwide drive for sustainable agriculture with diminished use of chemical input application. Koppert suppliers’ biological control and biofertilizer tools for sustainable agriculture and focuses on the positive use of natural microorganisms for soil fertility and plant health in response to the demand for safe and effective agricultural inputs. Lallemand is mainly into the development of microbial products that include biofertilizers to sustain sustainable agriculture and soil health. By innovative microbial answers, the company strives to enhance crop yields in a natural way and thus reduce dependence on chemical fertilizers within the environmentally sound farming system.Biofertilizers Market in Europe

Asia-Pacific Biofertilizers Market

Latin American Biofertilizers Market

Middle East and Africa Biofertilizers Market

Biofertilizers Market Share

Biofertilizers Market Companies

Biofertilizers Industry News

The biofertilizers market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Billion and volume in terms of Kilo Tons from 2021–2034 for the following segments:

Market, Form

- Dry

- Liquid

Market, Product

- Nitrogen-fixing

- Phosphate-solubilizing

- Potash-mobilizing

- Others

Market, By Crop

- Cereals & grains

- Pulses & oil seeds

- Fruits & vegetables

- Others

Market, By Application

- Seed treatment

- Soil treatment

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

Who are the key players in the biofertilizers market?

Key players include Gujarat State Fertilizers & Chemicals, Chema Industries, Rizobacter Argentina SA, Koppert, Lallemand, Agri Life, Ajay Bio-Tech, Cairochem, CBF China Bio-Fertilizer AG, Jay Enterprises, Madras Fertilizers, Peptech Biosciences, and Symborg.

What is the projected value of the biofertilizers market by 2034?

The market size for biofertilizers is expected to reach USD 5.6 billion by 2034, fueled by government incentives, innovation in formulations, and rising awareness of eco-friendly farming solutions.

How much revenue did the dry biofertilizers segment generate in 2024?

Dry biofertilizers generated USD 1.7 billion in 2024, leading the market with significant adoption due to ease of storage and application.

What was the valuation of the nitrogen-fixing biofertilizers segment in 2024?

Nitrogen-fixing biofertilizers accounted for 74.3% of the market in 2024, driven by their critical role in enhancing soil fertility and crop productivity.

What is the growth outlook for seed treatment applications from 2025 to 2034?

Seed treatment applications are projected to grow at a CAGR of over 8.8% till 2034, owing to their efficiency in improving seed germination and reducing dependency on chemical fertilizers.

What was the market share and revenue generated by the U.S. in the North American biofertilizers market in 2024?

In 2024, the U.S. held an 82.3% share of the North American biofertilizers market, generating USD 801.2 million in revenue.

What are the upcoming trends in the biofertilizers industry?

Key trends include the development of innovative biofertilizer formulations, expansion into emerging markets, and increasing focus on sustainable agriculture to address environmental concerns.

What is the market size of the biofertilizers industry in 2024?

The market size was USD 2.5 billion in 2024, with a CAGR of 8.6% expected through 2034, driven by increasing demand for organic farming and sustainable agricultural practices.

What is the current biofertilizers market size in 2025?

The market size is projected to reach USD 2.7 billion in 2025.

Biofertilizers Market Scope

Related Reports