Summary

Table of Content

Automotive Evaporative Emission Control (EVAP) System Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Automotive Evaporative Emission Control System Market Size

Automotive Evaporative Emission Control System Market size valued at USD 46 billion in 2018 and is estimated to exhibit 5.5% CAGR from 2019 to 2025.

To get key market trends

Rising solar radiation and ambient temperature across the globe increases the fuel tank temperature. High tank temperature results in the evaporation of petrol with a consistent increment in the internal pressure causing fuel expansion. According to Environmental Protection Agency (EPA), two-wheelers loose around 2%-5% fuel due to high temperature. Rising fuel losses and air pollution owing to evaporative emission will drive the automotive evaporative emission control system market size over the forecast period.

Automotive Evaporative Emission Control System Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2018 |

| Market Size in 2018 | 46 Billion (USD) |

| Forecast Period 2019 - 2025 CAGR | 5.5% |

| Market Size in 2025 | 65 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

What are the growth opportunities in this market?

Stringent government standards focusing on reducing evaporation of volatile organic compounds and tail pipe discharge is propelling the product demand. Regulatory standards such as California Air Resources Board (CARB) are emphasizing on controlling carbon monoxide, hydrocarbons, and nitrogen oxide pollution for improving air quality, leading to automotive evaporative emission control system market expansion.

Regulatory entities such as United Nations Economic Commission for Europe (UNECE) are introducing vehicle testing procedures to check vehicular pollution. For instance, in 2017, UNECE introduced Worldwide Harmonised Light Vehicle Test Procedure (WLTP) to control fuel consumption, pollutant emissions and evaluate on-road performance. Such initiative will induce significant potential in the market size over the forecast timeline.

Emergence of stringent government regulations is leading to development in vehicle fuel system. For instance, in 2015, CARB reduced the running loss (grams per mile) for passenger cars and light-duty trucks to 0.05. Vehicle manufacturers are replacing the Stage II vapour recovery system with onboard refuelling vapor recovery (ORVR) systems for superior monitoring and emission control efficiency.

Automobile manufacturers are extensively investing in R&D to innovate cleaner vehicles technologies driving the automotive evaporative emission control system market share. Industry participants are combining on-board diagnostic sensors with the vehicle fuel system for efficient functioning of the system. Introduction of advanced system integration with EVAP will drive the industry size over study timeframe.

Rising adaption of hybrid and electric vehicles will restrict the market size. Increasing government initiatives such as tax rebate and development of supporting infrastructure is shifting consumer inclination towards the alternate vehicles. Further, ongoing steps to reduce vehicle ownership cost will hamper the automotive EVAP system market growth till 2025.

Automotive Evaporative Emission Control System Market Analysis

Heavy commercial vehicles will showcase significant growth over the projected timeframe owing to proliferating logistic and construction industry. High evaporative and tail pipe pollution from HCVs is encouraging the vehicle manufacturers to incorporate EVAP systems. Further, rising freight transportation demand with increasing trade activities will support the segment penetration in next six years.

In 2018, two wheelers accounted for over 35% share in the automotive evaporative emission control system market size on account of their relative affordability and higher fuel efficiency. In addition, rising two wheelers demand for personal and commercial transportation in emerging nations will drive the industry size. According to Society of Indian Automobile Manufacturers, (SIAM), in 2017, the two wheelers production increased by around 16% as compared to 2016.

Learn more about the key segments shaping this market

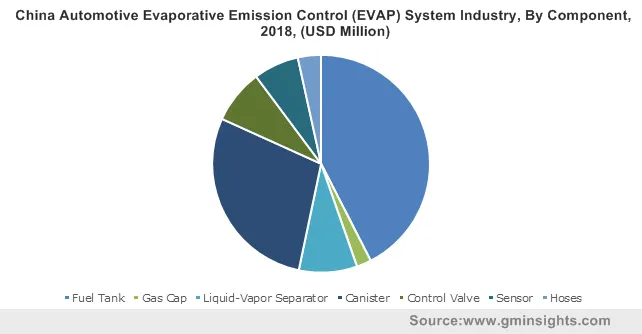

Canister will account for a significant share in the automotive evaporative emission control system market size over the study timeframe. The product traps the vapours produced by the petrol evaporation contained in the fuel tank until getting soaked by the activated carbon. Component manufacturers are implementing EPDM foam in canister to enhance the adsorption efficiency for petrol. Adaption of high efficiency components in the EVAP system will drive the segment penetration over the study timeframe.

Liquid-vapor separator will exhibit a considerable growth in the automotive market share owing to its fitment to prevent petrol from entering the EVAP canister. The component enhances the canister’s capability to store fuel vapours and reduces the risk of canister overloading.

OEM holds a significant volume share in the automotive evaporative emission control system market on account of advanced technology innovation and adoption of systems to adhere to vehicular pollution standards. For instance, industry players are developing highly efficient advanced canister modules including advanced electronic controller and electrically-heated hydrocarbon scrubber, strengthening the segment share.

Aftermarket segment will witness considerable growth in the automotive EVAP system market size owing to rising incidences of defects in emission control system. In addition, emerging aftermarket in emerging nations for damaged automotive components related to evaporation emission control will accelerate the segment expansion.

Learn more about the key segments shaping this market

Asia Pacific leads the automotive evaporative emission control system market size owing to increasing vehicles production to meet consumer demand. Rising government initiatives for reducing vehicular pollution and clean transportation will induce significant growth potential in EVAP industry. In September 2017, South Korea introduced RDE test procedure for automobiles to measure emissions from petrol fuel vehicles.

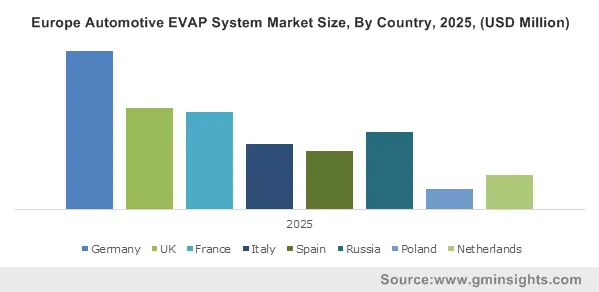

Europe will showcase over 6% CAGR in the market size owing to presence of major industry players. Ongoing initiatives by European Commission emphasizing on greenhouse gas reduction and air quality protection will further drive the product demand.

Automotive Evaporative Emission Control System Market Share

Major players in the automotive evaporative emission control system market includes :

- Delphi Technologies

- Didac International

- Eagle Industry Co., Ltd

- TI Automotive

- Padmini VNA Mechatronics Pvt Ltd

- Plastic Fuel Systems

- Robert Bosch

- Sentec Group

- Standard Motor Products Inc

- Stant Corporation

- The Plastic Omnium Group

Industry participants are expanding the manufacturing facilities to enhance production capability. For instance, in June 2016, TI Automotive introduced advanced fuel tank systems manufacturing facility in China to increase production and strengthen its presence in Asia Pacific.

Industry Background

Automotive evaporative emission control industry is majorly driven by regional and international organization concerns regarding vehicular emissions. The government entities such as EPA, CARB, and Manufacturers of Emission Controls Association (MECA) produce substantial challenges and opportunities for automotive manufacturers in combination with other objectives including fuel performance and economy. Major methods utilized for fuel vapor recovery includes ORVR and vapor recovery systems (VRS). OVOR system is installed in vehicles for non-refuelling conditions and VRS for refuelling process.

Frequently Asked Question(FAQ) :

Which companies are currently innovating new EVAP systems?

Companies such as Eagle Industry Co., Didac International, Ltd., Delphi Technologies, Padmini VNA Mechatronics Pvt Ltd., TI Automotive, and Robert Bosch, Sentec Group are currently innovating new evaporative emission control (EVAP) systems.

What is the anticipated growth for the automotive evaporative emission control system industry share during the forecast period?

The industry share of automotive evaporative emission control system is estimated to exhibit 5.5% CAGR to 2025.

What are the key factors driving the automotive EVAP system market growth?

Strict government standards regarding VOC emissions and tailpipe discharge along with burgeoning investments in R&D to develop cutting edge clean vehicle technologies are augmenting the industry growth.

Why are automakers in Asia Pacific emphasizing on EVAP system deployment?

Introduction of new government initiatives focused on reducing automotive pollution and encouraging clean transportation have led automakers in APAC to adopt EVAP systems.

How is the heavy commercial vehicle sector contributing to EVAP system demand?

High tailpipe pollution and emissions from HCVs has prompted vehicle manufacturers to incorporate EVAP systems in their upcoming vehicle segments.

What was the estimated global automotive evaporative emission control system market size in 2018?

The market size of automotive evaporative emission control system was valued at USD 46 billion in 2018.

Automotive Evaporative Emission Control System Market Scope

Related Reports