Summary

Table of Content

Asia Pacific Oil Storage Tank Service Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Asia Pacific Oil Storage Tank Service Market Size

Asia Pacific Oil Storage Tank Service Market size was valued over USD 165 million in 2018 and is expected to grow over 3.5% by 2025.

To get key market trends

Oil storage maintenance and service primarily includes periodic inspection, cleaning, and protection of the storage facilities. Flammable materials accumulated in extreme weather conditions leads to stress-induced corrosion in steel plates, joints, and weld-structures thereby impacting the overall tank integrity. Therefore, terminal operators need to follow pro-active protocols to ensure the proper safety and reliability of the facilities. The regular inspection by complying all relevant local and international standards helps the companies to avoid potential disasters and mitigate associate business risks. The study incorporates a detailed analysis of oil storage tank service market across Asia Pacific region bifurcated on a country basis. Furthermore, the estimates and forecasts are aligned with data represented by governing authorities including the IEA, API and associated company press releases and regional regulatory bodies.

Asia Pacific Oil Storage Tank Service Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2018 |

| Market Size in 2018 | 165 Million (USD) |

| Forecast Period 2019 to 2025 CAGR | 3.5% |

| Market Size in 2025 | 210 Million (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Over the years, investment towards the expansion of refining throughput capacity has increased significantly on account of growing application for various petrochemical products. Ethanol, epoxy and butane are few of the end products currently undergoing a strong demand, which has strengthened the focus toward the maintenance & development of oil tanks. For instance, as per the International Energy Forum, China’s refining throughput capacity was estimated 12.1 Mb/d in 2018 and in the same year the country’s crude oil import dependency reached 70.8%. Increasing application of these products in several manufacturing operations are facilitating the demand for high capacity oil terminals. Rise in the refinery production is further necessitating the requirement for more storage spaces with high safety index. This in turn will positively impact the oil storage tank service market outlook.

Stringent environmental norms augmenting the regional tank service prospect

Storing petroleum products require extensive investments to comply all the safety parameters defined by the regulators. These products come with a high risk of leakage or spillage which lead to severe environmental contamination and explosions. As a result, special designs are selected for handling different products with varied pressure and temperature level. Therefore, the policymakers regularly introduce amendments pertaining to cleaning, maintenance and inspection of existing storage facilities. Singapore’s, licensing branch of the Central Enforcement Department of SCDF has developed P&FM storage license under the Fire Safety Regulations in 2013. As per that license, storage of petroleum and flammable materials must comply with requirements of fire safety for flammable materials in premises. Moreover, the 4th edition of “Model code of safe practice, part 16, guidance on tank cleaning” published in 2017, also highlights the personnel health & safety hazards along with the environment protection associated with the cleaning operations. Introduction of such stringent measures to avoid collateral damage and protect the nearby environment will significantly boost the Asia Pacific oil storage tank service market revenue.

Asia Pacific Oil Storage Tank Service Market Analysis

Learn more about the key segments shaping this market

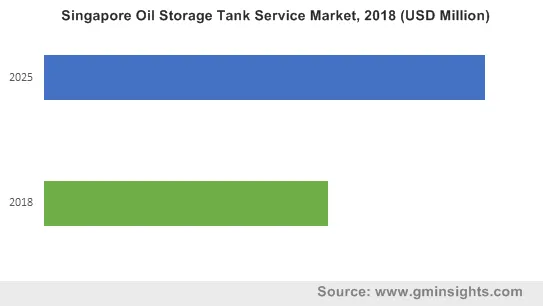

Singapore over the past few years has emerged as one of the leading importers of crude oil and its associated high value petroleum products. The country’s world-class warehouse and refining infrastructure along with the increasing net crude import has uplifted the demand for storage tank and its related services. As per the U.S. EIA, in 2016, Singapore’s government announced to promote long-term growth in refining and its storage capacity to maintain its position as a leading oil-trader. In 2018, the country imported 52 MT and 115 MT of crude oil and petroleum product, respectively. Rise in trade flows coupled with exclusive strategic measures to enhance the existing reserve capacity will stimulate oil storage tank storage service market over the forecast timeline.

Surging crude oil production along with recovering oil prices has significantly favored the upgradation and expansion of various tank farms, depots and terminals. The storage of hydrocarbons is important part of midstream and downstream operations before they are transported to refineries for processing. Growing energy demands of petroleum products is necessitating the expansion and modernization of existing storage facilities which is ultimately impacting the service industry. Moreover, regulators and policy makers across the region are also introducing numerous mandates to maintain the tank safety and security, which will further stimulate Asia Pacific oil storage tank service market growth.

Asia Pacific Oil Storage Tank Service Market Share

High potential risk and safety issues associated with the manual cleaning are leading the industry players to shift their focus towards the adoption of advanced automated systems. These systems come up with various artificial intelligence technologies which possess vast ability to tackle all the adverse situations during tank cleaning and maintenance. It mainly comprises of software, hardware, monitoring system, drones, and robots which can be easily operate from the remote location with user friendly interface. In addition, the inspection services also include 3D modeling of the complete tank with advanced non-destructive testing, and automated & detailed tank floor measurements. Technology manufacturers across the region are working aggressively to develop various intelligent models which not only improve the cleaning operational efficiency but also avoid human calamities. For instance, Zaopin Technologies is offering automatic tank cleaning systems which holds less downtime, and affordable disposal cost.

At present strategic partnership and investments in the R&D activities are some of the major strategies adopted by the leading industry player in the Asia Pacific oil storage tank service market. Some of the notable players operating across the industry includes:

- John Wood Group PLC

- Veolia

- SUEZ Environment

- Matrix Service

- SP Nanibame

- Zaopin Technologies

- China Oil HBP Group

- Petros

- MISTRAS Group, Inc

- NCH Corporation

- Oil Field Warehouse & Services Limited

- System Kikou Co., Ltd. (SKK)

Asia Pacific oil storage tank service market research report includes in-depth coverage of the industry with estimates & forecast in terms of “USD” from 2014 to 2025, for the following countries:

- China

- India

- Indonesia

- Malaysia

- Singapore

- Thailand

- South Korea

- Japan

- Australia

Frequently Asked Question(FAQ) :

What was the value of Asia Pacific oil storage tank service market in 2018?

The industry size of Asia Pacific oil storage tank service exceeded USD 165 million in 2018.

Which major players are active in the Asia Pacific market for oil storage tank service?

John Wood Group PLC, Veolia, SUEZ Environment, Matrix Service, SP Nanibame, Zaopin Technologies, China Oil HBP Group, Petros, MISTRAS Group, Inc., NCH Corporation and System Kikou Co., Ltd. are the major key players operating in the Asia Pacific industry for oil storage tank service.

How much will the Asia Pacific oil storage tank service business gain in the coming years?

The oil storage tank service industry in Asia Pacific is set to achieve over 3.5% CAGR up to 2025, according to a new report published by Global Market Insights, Inc.

What is the expected valuation that asia pacific oil storage tank service industry may hit by 2025?

According to report, asia pacific oil storage tank service market size is estimated to be pegged at $210 million by 2025.

What is the growth forecast of the asia pacific oil storage tank service market over the anticipated period?

The asia pacific oil storage tank service market is likely to register a crcr of 3.5% over the forecast period.

Asia Pacific Oil Storage Tank Service Market Scope

Related Reports