Summary

Table of Content

Asia Pacific Food Packaging Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Asia Pacific Food Packaging Market Size

Asia Pacific Food Packaging Market size was valued at over USD 125 billion in 2018 and is estimated to exhibit over 4.5% CAGR from 2019 to 2025.

To get key market trends

The e-commerce platform in the food industry has gained a significant acceptance in the region. This is because, it not only provides a wide range of food products but also ensures timely delivery of these products with appropriate packaging. Therefore, with the rise of e-commerce, the demand for food packaging is likely to increase. This is because proper and advanced packaging not only maintains the quality of the product but also increases its shelf life. Moreover, it also allows manufacturers to maintain proper inventory with an adequate lead time for the next supply of perishable food products. In addition to this, the packaging also plays a vital role from the distributors’ side of the value chain by maintaining the quality of the manufactured food for a longer duration and better transportation. The packaging food industries comprise companies that pack food in different types of materials including paperboard, glass, plastic, wood, and aluminum canning for retail sales.

Asia Pacific Food Packaging Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2018 |

| Market Size in 2018 | 125.6 Billion (USD) |

| Forecast Period 2019 - 2025 CAGR | 4.5% |

| Market Size in 2025 | 170.4 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Food packing includes packaging of flavored snacks, confections such as candy & chocolate, bread & cakes, cereals & oatmeal, meat & seafood, fruits, vegetables, cheeses, and condiments; for instance, ketchup and this category also comprises ready-to-eat packaged meals. Thus, food packing has increased the demand for food through internet retail spending. The current social & economic trends for processed & packed food consumption have witnessed a sharp growth over the past few years. The consumption of packaged breakfast cereals and different meals has surged over the years, providing a humongous growth in the packaged food industry.

Sizable economies in the region including China, India, Japan, Australia, and South Korea have set several regulations in order to monitor the quality and safety of packed food products. Regulations in these countries mainly emphasize on food quality, safety, and packaging norms. Food safety law, regulation for food contact materials, and food sanitation law are among the most commonly followed food regulations across the region, ensuring food safety in order to protect the physical health and life safety of the public. Similarly, stringent regulations toward food packaging and food contact materials may restrict growth in the food packing market over the near term. For instance, Food Safety and Standards Authority of India (FSSAI) in January 2019, announced new regulations with respect to food packing, which stresses the importance of packaging materials used for packing food.

Asia Pacific Food Packaging Market Analysis

Learn more about the key segments shaping this market

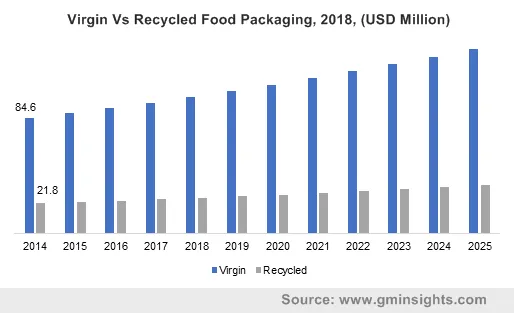

Virgin food packing products are manufactured directly from various raw materials and have never been used before for any purpose, including packaging. Recycled packaging is manufactured from various recycled materials and passes strict norms to be used as food packaging material. Virgin food packaging accounts for more than 70% volume share in the overall market and is likely to expanding with the significant rate in the coming years. Virgin packaging material is the initial primary source for all types of food packing materials such as plastic, metal, glass, paper & paperboard and wood. Furthermore, high durability of virgin products on the molecular level will increase its demand over the forecast spell.

Asia Pacific food packaging market based on the type of material used is classified into glass, metal, plastic, paper & paperboard and wood. Plastic dominates the revenue segment with the market share of more than 50% in 2018. This is due to its rising demand in food packing sector. Moreover, its durability, flexibility and ability to resist to external influences makes it favorable for food packing. Furthermore, high versatility of plastic makes it easier to recycle and reuse several times based on the requirements.

Learn more about the key segments shaping this market

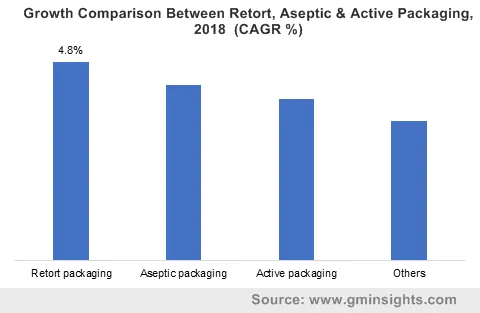

The Asia pacific food packaging market on the basis of technology is grouped into retort packaging, aseptic packaging, active packaging, and others. Retort packaging is the fastest growing packaging technology, which accounts for over USD 8 billion of the overall revenue in 2018. Owing to low manufacturing cost that uses laminates of flexible plastic and metal foils. Furthermore, convenient transportation and storage due to its lightweight nature will propel its demand by 2025.

China to dominate regional consumption

China is the largest market for food packing that accounts nearly 50% of share in the regional market. This can be credited to the presence of major manufacturers across the region. Moreover, improving lifestyle and consumer spending towards packaged food will further augment product demand in the region. India, Japan and South Korea, are among the fastest growing countries for food packing market owing to the shifting consumer preference to opt for such foods that are instant food making solutions and offers ideal nutritional value that meets their requirements. Additionally, improving lifestyle and consumer spending towards packaged food products will further augment the market demand.

Asia Pacific Food Packaging Market Share

The Asia Pacific food packaging market share is competitive in nature due to the presence of a few medium & large industry players operating in the comprehensive market. Several multinational corporations hold a significant share in the market. However, the majority of the market share is highly fragmented among the regional & small-scale manufacturers. For instance, in October 2018, Mondi PLC. introduced an innovative sustainable solution along with the next generation Bag-in-Box technical films for fruit juice, wine, or dairy products.

- Mondi PLC

- Amcor PLC

- Berry Global Group, Inc.

- Crown Holding Inc

- Ball Corporation

- Sealed Air Corporation

- Constantia Flexibles

- Plastipak Packaging Inc

- Sonoco Products Company

are some of the major revenue contributors in the overall market.

Industry Segmentation:

Asia Pacific Food Packaging Market, By Source

- Virgin

- Metal

- Plastic

- Others

- Recycled

- Metal

- Plastic

- Others

APAC Food Packaging Market, By Material

- Glass

- Metal

- Plastic

- Polypropylene

- Synthetic

- Bio-based

- Polyethylene Terephthalate (PET)

- Synthetic

- Bio-based

- Polystyrene (PS)

- Synthetic

- Bio-based

- Polyamide 6 (PA6)

- Synthetic

- Bio-based

- Polyamide 6 Copolymer (PA6 Copolymer)

- Synthetic

- Bio-based

- Ethylene Vinyl Acetate (EVA)

- Synthetic

- Bio-based

- Ethylene Vinyl Alcohol (EVOH)

- Synthetic

- Bio-based

- Others

- Polypropylene

- Paper & paperboard

- Wood

APAC Food Packaging Market, By Product

- Rigid packaging

- Oxygen barrier packaging

- Moisture barrier packaging

- Other barrier packaging

- Non-barrier packaging

- Flexible packaging

- Oxygen barrier packaging

- Moisture barrier packaging

- Other barrier packaging

- Non-barrier packaging

Asia Pacific Food Packaging Market Forecast By Layer

- Single layer

- Multi-layer

APAC Food Packaging Market Analysis By Visibility

- Transparent

- Opaque/translucent

Market Analysis By Sterilization

- High temperature treatment

- Low temperature treatment

- Vacuum treatment

- Others

Market Trends By Technology

- Retort packaging

- Aseptic packaging

- Active packaging

- Others

The above information is provided on a country basis for the following:

- Asia Pacific

- China

- Japan

- India

- Australia

- Indonesia

- Malaysia

- South Korea

- Thailand

Frequently Asked Question(FAQ) :

How much APAC food packing industry share does China hold?

Report estimates, China is the largest market for food packing that accounts for nearly 50% of share in the regional market.

Which is the fastest growing food packaging technology?

Retort packaging is the fastest growing packaging technology owing to low manufacturing cost that uses laminates of flexible plastic and metal foils. The retort packaging accounts for over USD 8 billion of the overall revenue in 2018.

What will be the market share of virgin materials in food packaging?

Virgin food packaging is expected to account for more than 70% volume share in the coming years, says a report by GMI.

Why does plastic material dominate the APAC food packaging industry?

According to this report, plastic dominates the revenue segment with the market share of more than 50% in 2018 due to its durability, flexibility and ability to resist external influences that makes it favorable for food packing.

How much did the global asia pacific food packaging market size account for in 2018?

The valuation of asia pacific food packaging market in the year 2018 was USD 125 billion.

What is the anticipated growth for the asia pacific food packaging industry over the forecast duration?

The overall asia pacific food packaging market is anticipated to record a crcr of 4.5% through 2025

Asia Pacific Food Packaging Market Scope

Related Reports