Summary

Table of Content

Agriculture Equipment Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Agriculture Equipment Market Size

The global agriculture equipment market was estimated at USD 172 billion in 2024. The market is expected to grow from USD 186.5 billion in 2025 to USD 291.3 billion in 2034, at a CAGR of 5.1%, according to latest report published by Global Market Insights Inc.

To get key market trends

The agricultural sector is increasing the adoption of mechanical solutions to improve productivity, reduce dependency on manual labor while bridging the gap for global food demand. Small and medium-sized farmers in emerging countries such as India are continuously investing in tractors, tillers, and harvesters. According to the Food and Agriculture Organization (FAO), mechanization has the potential to increase productivity by up to 30%, thus requires compact and utility tractors and multi-purpose implements. Manufacturers like John Deere, Mahindra & Mahindra, and Kubota are offering a wide range of mechanical solutions tailored to meet the needs of small and medium scale farmers.

Sustainability and climate resilience are becoming integral to modern agricultural practices with precision farming tools, such as GPS-enabled seeders and variable-rate fertilizer applicators aiding such practices. According to The International Energy Agency (IEA) the adoption of energy-efficient machinery in agriculture could reduce emissions by 20%, boosting demand for smart, sensor-equipped equipment.

Through the marketplace in equipment market, Agritech startups and digital platforms provide access to financing, rentals, and bundled services. In India, the agritech market is projected to grow at a CAGR of 18% during the forecast period, with mobile-first platforms bridging rural distribution gaps. With a shift towards digital demands, manufacturers are increasingly adopting omni-channel strategies and modular equipment designs. Companies such as Deere and Company have adopted omnichannel strategies to meet growing digital demands.

The livestock and horticulture sectors are shifting the demand for specialized equipment, including automated milking systems, greenhouse climate controllers, and orchard-specific tractors. High-precision, compact, and customizable machinery are the major requirements for such niche markets.

The growth of the adoption of equipment is also addressed by government subsidies and rural infrastructure development programs especially in rural regions. In India, the adoption of solar and electric farm equipment is promoted through schemes like PM-KUSUM and FAME, while the FAO’s climate-smart agriculture initiative advocates for low-emission machinery, such programs are shaping the future of agricultural equipment’s with focus on sustainability and automation.

Agriculture Equipment Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 172 Billion |

| Market Size in 2025 | USD 186.5 Billion |

| Forecast Period 2025 - 2034 CAGR | 5.1% |

| Market Size in 2034 | USD 291.3 billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing demand for high-capacity machinery | Drives the growth of the market by meeting the need for efficient large-scale operations. |

| Increasing demand for self-propelled machines | Enhances the agricultural machinery market by offering improved efficiency and reduced labor dependency. |

| Rising labor shortages and aging rural workforce | Boost demand for smart, self-operating machines that reduce manual effort and improve efficiency. |

| Pitfalls & Challenges | Impact |

| High costs of agricultural equipment | Slows mechanization and widens the productivity gap in developing regions. |

| Volatility of commodity prices | This affects farmers income and investment capacity, leading to delayed or reduced purchases of new equipment. |

| Opportunities: | Impact |

| Growth of precision agriculture | Drives require smart, data-driven equipment, boosting innovation and premium product sales. |

| Expansion of rental and leasing models | Expand market access for small farmers, increasing equipment utilization and overall sales volume. |

| Market Leaders (2024) | |

| Market Leaders |

14.4% market share |

| Top Players |

The collective market share in 2024 is 47.2% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | France, India, Australia, Brazil |

| Future Outlook |

|

What are the growth opportunities in this market?

Agriculture Equipment Market Trends

Driven by upcoming technologies such as the integration of AI, sensors and analytics, the agricultural equipment market is showing high growth. These innovations are helping in predictive maintenance, optimizing resource use, and enhancing decision-making, making farming operations more efficient and sustainable.

- AI-powered equipment offers real time data insights into several agricultural factors such as crop health, soil conditions and weather patterns improving farming methodologies. Companies like Deere & Company have been adding AI and machine learning into their equipment portfolio through AutoTrac and JDLink since 2019 to improve precision farming practices. Similarly, CNH Industrial has been developing autonomous tractors and smart implements, to meet the growing demand for advanced agricultural machinery.

- Technologies such as sensors and data analytics are increasingly being accessed by farmers due to their superior performance making real time monitoring possible, reducing downtime with prompt maintenance. AGCO Corporation and Kubota Corporation are continuously investing heavily in sensor-based technologies to improve their product portfolios and meet the needs of modern agriculture.

Agriculture Equipment Market Analysis

Learn more about the key segments shaping this market

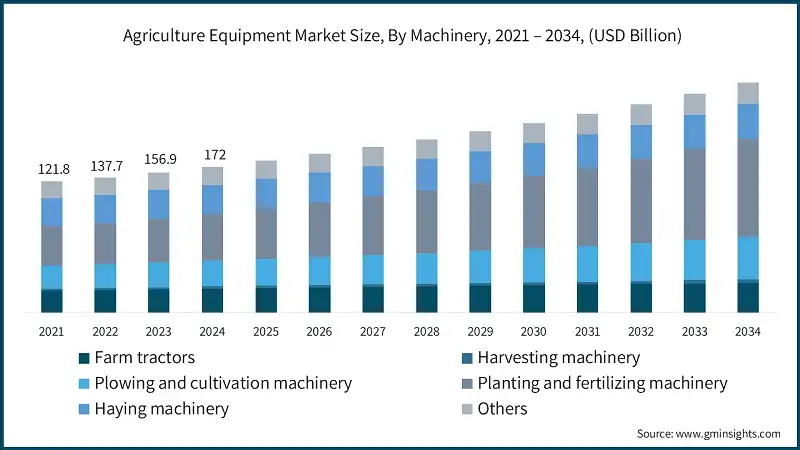

Based on machinery, the agricultural equipment market is segmented farm tractors, harvesting machinery, plowing and cultivation machinery, planting and fertilizing machinery, haying machinery and others. The farm tractors segment held the major market share, generating a revenue of USD 89.9 billion in 2024.

The farm tractor segment shows high growth, driven by its important role in modern agriculture. Tractors help with essential tasks such as plowing, planting, and transporting goods, vastly improving efficiency and productivity. According to the Food and Agriculture Organization (FAO), global agricultural productivity needs to increase by 70% by 2050 to meet rising food demand, further showing the importance of mechanization.

- Technological advancements are very important for this growth, John Deere introduced autonomous tractors equipped with AI and GPS, to help in precision farming and reduce operational problems. Similarly, CNH Industrial has developed methane-powered tractors, meeting the growing demand for sustainable farming solutions.

- In small and medium sized farms compact and affordable tractor models are gaining popularity, especially in growing regions. According to the World Bank, smallholder farms account for 80% of the world’s food supply, showing the growing need for accessible and affordable agricultural equipment.

- Government initiatives and subsidies further help in the adoption of farm tractors. For instance, India’s Ministry of Agriculture and Farmers Welfare offers subsidies of up to 50% on tractor purchases under various schemes, encouraging mechanization among small and marginal farmers. Similarly, the U.S. Department of Agriculture (USDA) provides grants and loans to promote the adoption of advanced agricultural machinery, including tractors.

- The farm tractor segment plays an important role in the agricultural equipment industry, supported by continuous innovation and a diverse range of offerings. With increasing investments in precision farming technologies, sustainable practices, and region-specific models, the segment is well-positioned to address modern agricultural challenges. As global food demand rises, the segment is expected to sustain its growth trajectory, playing a pivotal role in ensuring food security worldwide.

Learn more about the key segments shaping this market

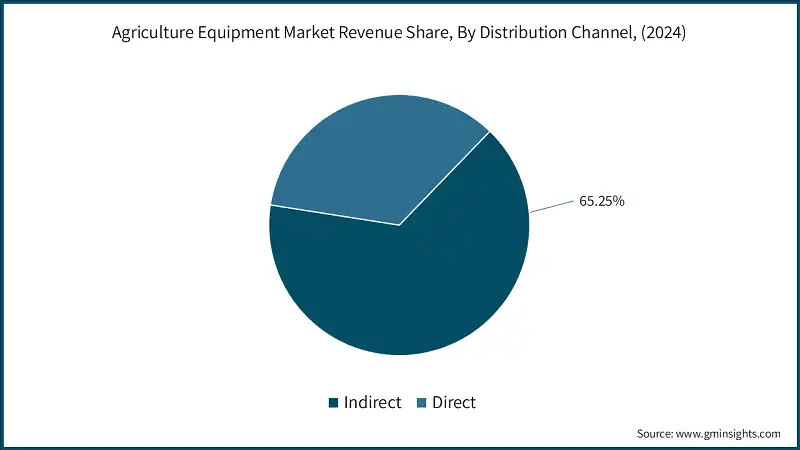

Based on the distribution channel, the agriculture equipment market is segmented into direct and indirect channels. The indirect segment held the largest share, accounting for 65.2% of the global agricultural equipment market in 2024.

- Indirect channels dominate due to the extensive network of local dealers and service centers, which are critical for selling, maintaining, and repairing agricultural machinery. According to the Association of Equipment Manufacturers (AEM), over 70% of agricultural machinery sales in rural areas occur through indirect channels, driven by easy access to the dealers, connectivity and after-sales support. Local dealers and service centers, including companies like John Deere, CNH Industrial, and AGCO Corporation, play a pivotal role in selling, maintaining, and repairing agricultural machinery via indirect means especially when it’s hard to connect with distant customers, leading to the dominance of indirect channels.

- Since such equipment’s are high investment purchase, farmers prefer sales through local dealers who generally have a good relationship with such individuals. The USDA reports that 65% of farmers rely on dealer recommendations tailored to local soil, crops, and climate conditions, which fosters confidence and loyalty among buyers.

- Authorized dealers predominantly channel government-backed subsidy schemes and procurement programs. The Food and Agriculture Organization (FAO) highlights that 80% of subsidy programs in developing nations mandate physical verification and dealer certification, underscoring the significance of offline dealer networks. Companies such as CLAAS and SAME Deutz-Fahr Group actively participate in these programs through their dealer networks.

- On-site demonstrations and training are essential for farmers to adeptly operate new machinery. The AEM emphasizes this, stating that 75% of farmers transitioning to precision farming equipment rely on dealers for crucial field trials and operator training. Companies like Massey Ferguson provide extensive support through their dealer networks to ensure successful implementation.

Looking for region specific data?

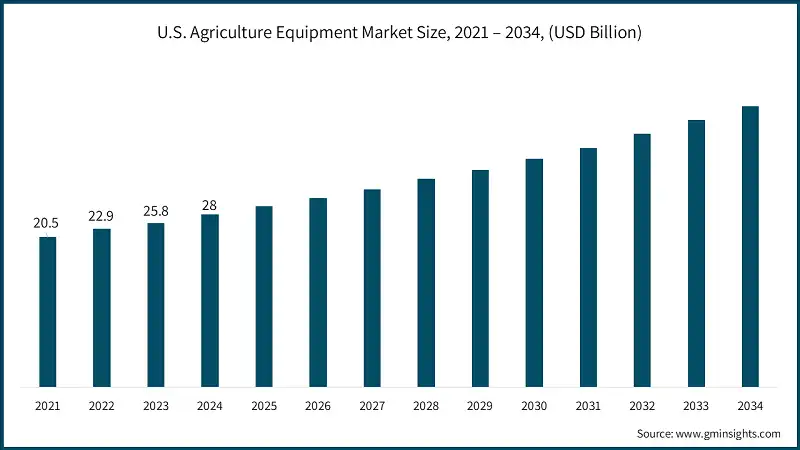

North America Agriculture Equipment Market North America market is expected to grow at a CAGR of 3.8% from 2025 to 2034. Asia pacific agricultural equipment market is expected to grow at 3.4% during the forecast period. Europe agricultural equipment market holds the second largest share in 2024 and is expected to grow at 3.4% during the forecast period. Major players operating in the agriculture equipment industry include: Kubota Corporation is a prominent leader in the compact and mid-sized agricultural machinery market, widely recognized for its reliability, fuel efficiency, and operator-focused design. The company addresses diverse farming requirements by offering tractors, rice transplanters, and utility vehicles across key regions, including Asia, North America, and Europe. By prioritizing smart agriculture solutions, such as autonomous tractors and precision farming systems, Kubota actively supports sustainable farming practices while driving productivity improvements for small to mid-scale farmers. CLAAS is a globally renowned manufacturer of high-performance agricultural equipment, celebrated for its advanced combine harvesters, forage harvesters, and tractors. The company’s dedication to engineering excellence ensures its machines deliver exceptional durability, precision, and adaptability to varying crop conditions. Additionally, CLAAS integrates cutting-edge digital technologies, such as telematics, yield mapping, and machine automation, to enhance harvesting efficiency and enable data-driven decision-making for modern farm management.Asia Pacific Agriculture Equipment Market

Europe Agriculture Equipment Market

Agriculture Equipment Market Share

Agriculture Equipment Market Companies

Agriculture Equipment Industry News

The agriculture equipment market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Billion) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Machinery

- Farm tractors

- Sub-compact utility tractor

- Compact utility tractors

- Specialty tractor

- Harvesting machinery

- Combine Harvester

- Forage Harvester

- Thresher

- Reaper

- Plowing and cultivation machinery

- Ploughs

- Harrows

- Cultivators & Tillers

- Planting and fertilizing machinery

- Seed Drills

- Planters

- Spreaders

- Sprayers

- Haying machinery

- Balers

- Mower-Conditioner

- Tedders & Rakes

- Others

Market By Power

- < 30 HP

- 31 - 100 HP

- 101 - 200 HP

- > 200 HP

Market, By Technology

- Manual

- Semi-Automated

- Fully Automated

Market, By Ownership model

- Owned Equipment

- Leased Equipment

- Rental Services

- Equipment-as-a-Service (EaaS)

Market, By Application

- Row Crops

- Fruits & Vegetables

- Vineyards & Orchards

- Livestock Farming

- Forestry

- Aquaculture

Market, By Distribution channel

- Direct

- Indirect

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What is the growth outlook for North America’s agriculture equipment market from 2025 to 2034?

North America is projected to grow at a 3.8% CAGR till 2034, fueled by adoption of precision farming technologies, supportive USDA programs, and strong demand for eco-friendly machinery.

What are the upcoming trends in the agriculture equipment industry?

Key trends include AI-powered machinery, autonomous tractors, precision farming tools, and sustainability-focused solutions such as energy-efficient and electric farm equipment.

Who are the key players in the agriculture equipment market?

Key players include Deere & Company, CNH Industrial, AGCO, Kubota, CLAAS, Mahindra & Mahindra, SDF Group, Valmont Industries, and Bucher Industries.

What was the market share of the indirect distribution channel in 2024?

Indirect channels accounted for 65.2% of the global agriculture equipment industry in 2024, driven by extensive dealer networks, government-backed subsidies, and strong after-sales support in rural areas.

What is the market size of the agriculture equipment industry in 2024?

The market size for agriculture equipment was valued at USD 172 billion in 2024, with a CAGR of 5.1% expected through 2034 driven by rising demand for high-capacity machinery.

How much revenue did the farm tractors segment generate in 2024?

The farm tractors segment generated USD 89.9 billion in 2024, dominating the market due to their critical role in plowing, planting, and transporting goods, with strong adoption across both large and small-scale farms.

What is the projected value of the agriculture equipment market by 2034?

The agriculture equipment industry is expected to reach USD 291.3 billion by 2034, supported by mechanization, sustainability initiatives, and adoption of precision farming technologies.

What is the current agriculture equipment market size in 2025?

The market size is projected to reach USD 186.5 billion in 2025.

Agriculture Equipment Market Scope

Related Reports