Oil and Gas Infrastructure Market in U.S. to exceed $80 bn By 2024

Published Date: November 2018

U.S. Oil & Gas Infrastructure Market size is set to exceed USD 80 billion by 2024; as reported in the latest study by Global Market Insights Inc.

Ongoing investments for the expansion of existing refineries along with along with establishment of new units with environmentally friendly footprint will positively influence the U.S. oil & gas infrastructure market growth. Furthermore, rising gasoline demand from Mexico on account of the country’s growing automotive sector has led to planning of new refineries in the nearby regions of the U.S. will complement the industry landscape.

Availability of proved gas reserves coupled with incessant increase in natural gas demand will augment the oil & gas infrastructure market share. Moreover, the government efforts to reduce generation of electricity from coal has resulted into inauguration of new natural gas fired power plants and modification of coal into natural gas, which will further complement the business landscape.

Get more details on this report - Request Free Sample PDF

Southwest, in 2017 accounted for over 30% of the U.S. oil & gas infrastructure market share. Availability of major shale plays in Texas including Eagle Ford and Barnett shales will drive investment across the region. Moreover, high energy consumption across industrial sector will positively influence the industry growth.

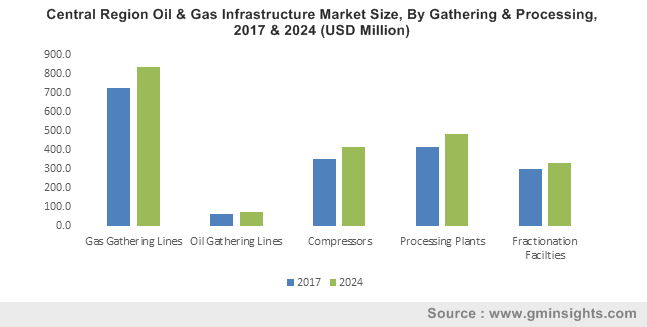

Browse key industry insights spread across 266 pages with 220 market data tables & 33 figures & charts from the report, “U.S. Oil & Gas Infrastructure Market Size By Category [Surface and Lease Equipment, Gathering & Processing (Gas Gathering Lines, Oil Gathering Lines, Compressors, Processing Plants, Fractionation Facilities), Oil, Gas & NGL Pipelines (Oil Lines, NGL Lines, Gas Lines, Oil Line Pumps, NGL Line Pumps, Gas Line Compressors), Oil & Gas Storage (Oil Storage, Gas Storage), Refining & Oil Products Transport (Refining, Oil Product Pipeline, Oil Product Pipeline Pumps, Rail Transport), Export Terminals (LNG, NGL)], Industry Analysis Report, Regional Outlook (Central, Midwest, Northeast, Southeast, Southwest, Western, Offshore Gulf of Mexico), Application Potential, Price Trends, Competitive Market Share & Forecast, 2018 – 2024” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/us-oil-and-gas-infrastructure-market

Rising demand for gasoline from a wide array of industries, primarily power and automobile will fuel the refining & oil products transport market growth. The U.S. has witnessed an increase in the consumption of gasoline over past few years. Furthermore, incessantly increasing export of crude oil will drive investment toward midstream oil & gas sector.

Southeast oil & gas infrastructure market size is set to witness growth owing to the retirement of coal fired power plants which has led to the addition of gas-fired capacity. Moreover, expansion of regional pipeline networks to bring shale gas to serve gas-fired generation will encourage investment toward midstream sector.

Government efforts to reduce greenhouse gas emissions has led to the application of LNG and CNG vehicles as an alternative to diesel which will drive the natural gas infrastructure market size. The consumption of vehicle fuel has increased uninterruptedly since 1990’s particularly in western states including California and Nevada. Moreover, the country has witnessed an increase in the consumption of LNG in cryogenic application in the industrial sector which will fuel the industry growth.

Key players in the U.S. oil and gas infrastructure market include Baker Hughes (GE), Shell, ExxonMobil, Halliburton, Hatch, Schlumberger, Kinder Morgan, BP, Total, Williams Companies, Chevron, Rosneft, ConocoPhillips, Marathon Oil Corporation, Occidental Petroleum Corporation, Energy Transfer Partners, Cheniere Energy, Oneok, NGL Energy Partners, DCP Midstream, Sprague Resources, Vopak, and Centrica.

U.S. oil & gas infrastructure market research report includes an in-depth coverage of the industry with estimates & forecast in terms of USD from 2013 to 2024, for the following segments:

U.S. Oil & Gas Infrastructure Market, By Category

- Surface and Lease Equipment

- Gathering & Processing

- Gas Gathering Lines

- Oil Gathering Lines

- Compressors

- Processing Plants

- Fractionation Facilities

- Oil, Gas & NGL Pipelines

- Oil Lines

- NGL Lines

- Gas Lines

- Oil Line Pumps

- NGL Line Pumps

- Gas Line Compressors

- Oil & Gas Storage

- Oil Storage

- Gas Storage

- Refining & Oil Products Transport

- Refining

- Oil Product Pipeline

- Oil Product Pipeline Pumps

- Rail Transport

- Export Terminals

- LNG

- NGL

The above-mentioned information will be provided for the following regions across the U.S.

- Central

- Midwest

- Northeast

- Southeast

- Southwest

- Western

- Offshore Gulf of Mexico

Ankit Gupta, Aditya Singh Bais