Scissor Lift Market worth around $4 Bn by 2027

Published Date: November 2021

Scissor Lift Market size is set to surpass USD 4 billion by 2027, according to a new research report by Global Market Insights Inc.

Scissor lifts are witnessing a significant demand owing to the growing need for efficient material handling and roof construction activities. Market players are investing in R&D for innovative equipment development.

Several governments are investing in infrastructure development to accelerate the growth of their economy with rising population and urbanization. For instance, in November 2020, the Government of Mexico announced 29 new infrastructure projects with an investment of USD 11.1 billion.

Growing investments in tunnel projects for road construction are encouraging industry participants to develop the equipment that meets the regional needs. The companies, such as Genie (Terex Corporation) and Aichi Corporation, are launching new products for specific business sectors to improve their scissor lift market revenue.

Get more details on this report - Request Free Sample PDF

Analyst view: “The emergence of electric scissor lifts with advanced telematics systems is driving the industry growth. Integrated telematics system & connectivity solutions play a key role in reducing the overall maintenance cost and increasing the operational efficiency of scissor lifts.”

The requirement of heavy initial investments is the key factor challenging the market expansion. Additionally, rising incidents of equipment falling from steep surface due to mishandling and machine failure are hampering their net sales. The oils need to be replaced frequently, and hydraulic system faces oil leakage issues often in the pumping system. OEMs are integrating telematics systems into their equipment to allow owners to monitor and plan the maintenance of their scissor lifts.

The outbreak of COVID-19 virus has significantly impacted the overall scissor lift market growth. Industry leaders are primarily facing shortage of raw materials, body components, and electronic chip shortages led by the disruption in global production and supply chain. The decreasing demand by the temporary suspension of construction activities and unavailability of labors is impacting the OEM market demand.

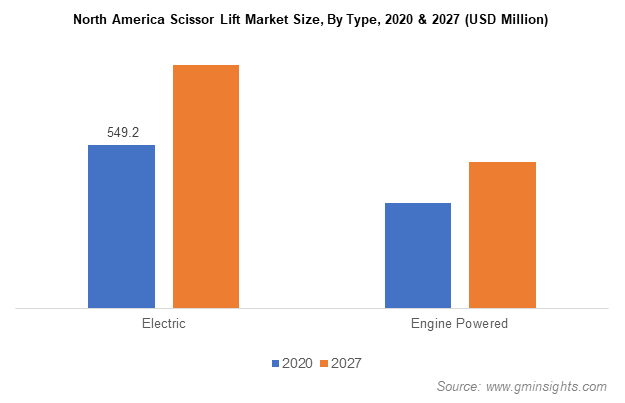

Browse key industry insights spread across 200 pages with 319 market data tables & 22 figures & charts from the report, “Scissor Lift Market Size By Type (Electric, Engine Powered), By Platform Height (Below 10 Meters, 10 to 20 Meters, 20 to 25 Meters, Above 25 Meters), By Application (Rental, Construction & Mining, Government, Transportation & Logistics, Utility), COVID19 Impact Analysis, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2021 - 2027” in detail along with the table of contents

https://www.gminsights.com/industry-analysis/scissor-lift-market

High engine power and efficient material handling are boosting the engine-powered scissor lifts sale

In 2020, around 40% of the scissor lift market share held by engine-powered lifts in Europe, with over 10,000 new units sold. Due to high horsepower capacity, diesel-powered engines offer maximum working height as compared to electric-powered equipment. Moreover, their wider availability across the globe is playing a key role in improving their statistics.

The engine-powered equipment is experiencing a remarkable demand impelled by its ability to perform versatile operations. Companies such as Skyjack Inc., Zhejiang Dingli Machinery Co., Ltd., and Holland Lift International by, are launching new diesel engine equipment to stay competitive in this market.

Shifting construction companies’ focus toward economical and environment-friendly construction & mining

The construction sector in North America held more than 25% of the revenue share in 2020. Industry players are participating in the exhibitions to advertise their products to potential customers related to the construction sector to enhance their brand identity. For instance, in September 2021, Zoomlion Heavy Industry Science and Technology Co., Ltd. displayed its latest innovations at China-Africa Economic and Trade Expo in Hunan Province, China. The company showcased its different construction equipment including electric scissor lift and self-propelled booms to enhance its market.

Growing investments in the Asia Pacific public and private construction sectors

The Asia Pacific scissor lift market is expected to reach around USD 1 billion by 2027. The high demand in the region can be attributed to growing investments in the private & public sectors by government and construction companies. The proliferation of infrastructure development projects by several APAC nations, such as India, China, Australia, and Japan, will create robust market opportunities.

Industry participants are expanding their operations to potential markets to accelerate their net sales. The companies, such as Haulotte Group, Hunan SINOBOOM Heavy Industry Co., Ltd., and Snorkel, Inc., are adopting various business strategies such as mergers & acquisitions to expand their regional operations.

Major scissor lift market players include Zoomlion Heavy Industry Science and Technology Co., Ltd., Zhejiang Dingli Machinery Co, Ltd., Snorkel, Tadano Limited, Skyjack, Hunan Sinoboom Heavy Industry Co. Ltd., Aichi Corporation, JLG Industries, Inc., Dinolift OY, Haulotte Group, and Terex Corporation (Genie).

Preeti Wadhwani, Prasenjit Saha