Plant Based Meat Market size worth $320 Mn by 2025

Published Date: July 2019

Plant Based Meat Market size is set to surpass USD 320 million by 2025; according to a new research report by Global Market Insights Inc.

Increasing demand for plant based meat alternatives on account of rising consumer awareness towards health benefits to minimize cancer risk, healthier insulin, and improve cholesterol levels should accelerate market growth. Plant based meat can be sourced from various sources including wheat, soy, pea, lentils, & oats which gives consumer to make different foods such as Chinese, Vietnamese, and European which should foster plant based meat market growth.

Pea based meat market demand should witness significant gains at over 10.5% by 2025. Growing consumer preference for plant alternatives to meat owing to increased concentration of fiber, vitamin, healthy fats, and roughage should foster plant based meat market growth. Increasing consumer awareness on environmental susceptibility is changing buying perceptions as plants require fewer resources like water, and space which should trigger demand for plant based meat.

Get more details on this report - Request Free Sample PDF

Increasing cases of diseases caused by seafood contamination such as listeria, shigella, and salmonella is changing buyers attitudes towards plant based meat. Soy is preferably used as an alternative to white meat owing to high concentration of protein and lipids. Increasing regulations for deep sea fishing is increasing prices for fish products such as roe and cod liver oil which is making consumers opt for affordable plant based alternatives. Soy preparations can be utilized to substitute exotic fish dishes made from salmon, tuna, & lobsters which may fuel plant based meat market share.

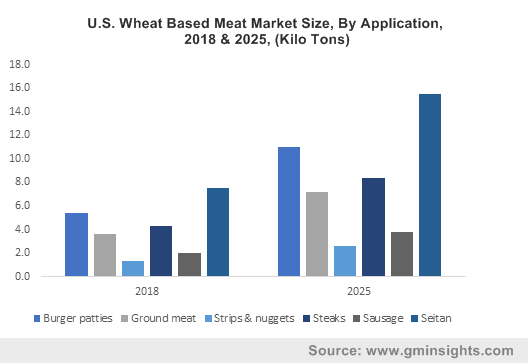

In 2018, ground meat wheat based meat market size was at about USD 3 million. Increasing pressure on water, land and animal resources to produce meat for the growing population has led to growing demand of meat substitutes. Wheat based meat alternatives can be utilized to prepare various types of meatball dishes as Turkish, Swedish, and Köttbullar. Wheat has effective binding proteins which gives it juicy texture like meat protein & is rich in amino acids, lipids, and fiber which should accelerate plant based meat market demand.

Browse key industry insights spread across 460 pages with 843 market data tables and 25 figures & charts from the report, “Plant Based Meat Market Size By Source (Soy {By Type [Burger Patties, Strips & Nuggets, Meatballs, Sausage, Ground Meat], By Type [Chicken, Pork, Beef, Fish], By Distribution Channel [Grocery Stores, Food & Drink Specialty Stores, Convenience Stores, Food & Drink Specialty Stores, Online Retail, Restaurant]}, Wheat {By Product [Burger Patties, Ground Meat, Strips & Nuggets, Steaks, Sausage, Seitan], By Type [Chicken, Bacon, Beef], By Distribution Channel [Grocery Stores, Food & Drinks Specialty Stores, Online Retail, Restaurant]}, Pea {By Product [Burger Patties, Meatballs, Strips & Nuggets], By Type [Chicken, Beef, Bacon, Fish], By Distribution Channel [Grocery Stores, Convenience Stores, Food & Drinks Specialty Stores, Restaurants]}), Industry Analysis Report, Regional Analysis (U.S., Canada, Mexico, Germany, UK, France, Italy, Netherlands, Spain, Russia, China, India, Japan, South Korea, Australia, Brazil, Argentina, Saudi Arabia, UAE, South Africa, Egypt), Application Development, Price Trends, Competitive Market Share Forecast, 2019 – 2025” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/plant-based-meat-market

U.S. soy based meat industry demand should witness consumption at over 100 kilo tons during the forecast period. The product’s ability to serve as a whole protein source, suitability for various recipes and tendency to absorb flavor from food should promote plant based meat market demand. Increasing prevalence of digestive disorders such as gastric ulcers, gastritis, and diarrhea has increased demand for soy & pea alternatives owing to high concentration of vital amino acids, affordable nature, and easily digestible characteristics should boost plant based meat market growth.

Germany bacon wheat based meat market size should register over 10% gains by 2025. Significant spurt in fast food chains where the product finds use in various dishes owing to its relatively neutral flavor should boost plant based meat market growth . Rise in awareness campaigns by PETA and Eurogroup for animals is shifting consumer preference towards plant based nutrition. Soy, wheat, & oats can be easily substituted for pork products & are utilized to make traditional German dishes such as sausages & schnitzel without the loss of flavor, texture, and nutrition which should accelerate plant based meat market growth.

India chicken pea based meat market demand shall register significant gains at over 12.5% by the end of forecast period. Rising prevalence of diabetes, cardiovascular diseases, and obesity along with significant protein deficiency in the regional diet should stimulate demand for plant based meat sources. Chicken is a popular protein source which can be easily substituted by pea and soy alternatives to make baked, fried, or traditional dishes which may stimulate plant based meat market share.

DuPont, Amy’s Kitchen, Quorn Foods, Maple Leaf Foods, The Vegetarian Butcher, Impossible Foods, and Gardein Protein are key participants in plant based meat market. Companies are focusing to expand their product line by offering alternative plant based sources for exotic red & white meat derived from veal, turkey, quail, tune, rabbit, ostrich, venison, & elk to widen product portfolio and widen geographical presence which should boost plant based meat market growth.

The plant based meat market research report includes in-depth coverage of the industry, with estimates & forecast in terms of volume in Tons and revenue in USD from 2014 to 2025, for the following segments:

Plant Based Meat Market, By Source

- Soy

- By Product

- Burger Patties

- Strips & Nuggets

- Meatballs

- Sausage

- Ground Meat

- By Type

- Chicken

- Pork

- Beef

- Fish

- By Distribution Channel

- Grocery Stores

- Convenience Stores

- Food & Drink Specialty Stores

- Online Retail

- Restaurants

- By Product

- Wheat

- By Product

- Burger Patties

- Ground Meat

- Strips & Nuggets

- Steaks

- Sausage

- Seitan

- By Type

- Chicken

- Bacon

- Beef

- By Distribution Channel

- Grocery Stores

- Food & Drink Specialty Stores

- Online Retail

- Restaurants

- By Product

- Pea

- By Product

- Burger Patties

- Meatballs

- Strips & Nuggets

- By Type

- Chicken

- Beef

- Bacon

- Fish

- By Distribution Channel

- Grocery Stores

- Convenience Stores

- Food & Drink Specialty Stores

- Restaurants

- By Product

- Others

- By Product

- Burger Patties

- Strips & Nuggets

- Meatballs

- By Type

- Beef

- Pork

- Chicken

- By Distributional Channel

- Grocery Stores

- Online Retail

- Convenience Stores

- Food & Drink Specialty Stores

- Restaurants

- By Product

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Netherlands

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- LATAM

- Brazil

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

- Egypt

Kunal Ahuja, Kritika Mamtani