LNG Bunkering Market to surpass $12bn by 2024

Published Date: June 2017

LNG Bunkering Market size is set to exceed USD 12 billion by 2024, according to a new research report by Global Market Insights Inc.

Growing demand for cleaner fuel coupled with strict emission regulations to reduce the airborne emissions predominantly in North America and Europe will stimulate LNG bunkering market. In 2015, International Maritime Organization (IMO) introduced Tier III norms to curb NOx emissions from marine vessels among Emission Control Areas (ECAs) under maritime boundaries.

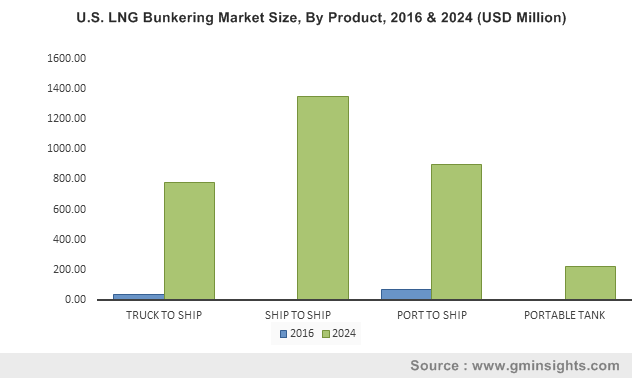

U.S. LNG bunkering market is predicted to exceed 3,000 kilotons by 2024 owing to the advent of shale gas. Increasing liquefaction plants has spurred the production of liquefied natural gas in the U.S. enabling its adoption as marine fuel. Strict government norms against emissions will further complement the business landscape. In 2015, the EPA implemented the MARPOL Annex VI norms with an aim to limit NOx in marine fuel oil to 0.5% from current levels.

Get more details on this report - Request Free Sample PDF

Rising environmental concerns along with government initiatives towards adoption of natural gas as ship fuel will augment the LNG bunkering market. The EU introduced Climate and Energy Package 2020, with an aim to achieve 20% reduction in GHG emissions. In 2014, Trans-European Transport Network (TEN-T) announced funding of USD 138 million towards the development of seven bunkering stations across Western Europe.

Shifting trends towards low-cost and eco-friendly marine fuel will drive the LNG bunkering market size. LNGe-380 is comparatively less expensive than IFO-380 fuel that help companies to recover the cost of retrofitting fleets. Positive outlook towards maritime trade along with rising investments toward the deployment of floating liquefied natural gas will further complement the industry outlook. In 2016, Petronas invested USD 1.16 billion for FLNG project in Malaysia with a capacity of 1.2 mtpa.

Browse key industry insights spread across 200 pages with 239 market data tables & 11 figures & charts from the report, “LNG Bunkering Market Size By Product (Truck-to-Ship, Port-to-Ship, Ship-to-Ship, Portable Tanks), By End-Use (Container Vessels, Cruise-ships, Bulk Carriers, Ferries, Offshore Support Vessels), Industry Analysis Report, Regional Outlook (U.S., Canada, Norway, The Netherlands, Germany, Belgium, Denmark, UK, China, South Korea, Japan, India, Australia, Singapore), Price Trends, Competitive Market Share & Forecast, 2017-2024” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/lng-bunkering-market

Container vessel is set to expand by over 40% through to 2024. Germany holds the largest container base in Europe with over 170 new builds container vessels orderbook. High speed transfer rate, location flexibility and ability to transfer large volume of gas will drive the ship-to-ship LNG bunkering market. Standard operation accounts for a transfer rate of 1,100 cu. m/ hr.

Increasing investment towards development of infrastructure along with government initiatives to encourage the natural gas adoption will positively impact Singapore LNG bunkering market. In 2017, Ministry of Port Authority of Singapore announced the funding of USD 1.45 million for six vessels under pilot programme.

Abundant availability of LNG along with measures to reduce carbon footprints will stimulate Qatar LNG bunkering market. Qatar will be the prime source for flexible liquefied natural gas supply with the capacity of 77.8 mtpa. In 2016, Qatargas, Shell and Maersk group signed a Memorandum of Understanding for developing LNG bunkering industry in Middle East.

Notable participants in LNG bunkering market include Skangas, Korea Gas, Crowley Maritime, Evol, Royal Dutch Shell, Engie, Harvey Gulf, Bomin Linde, ENN Energy, Prima LNG, Fjord Line and Polskie.

LNG bunkering market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume (kilotons) and revenue (USD Million) from 2014 to 2024, for the following segments:

Global LNG Bunkering Market, By Product

- Truck-to-Ship

- Ship-to-Ship

- Port-to-Ship

- Portable tanks

Global LNG Bunkering Market, By End-Use

- Container Vessels

- Cruise-ships

- Bulk Carriers

- Ferries

- Offshore Support Vessels (OSVs)

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Norway

- Netherlands

- Germany

- Belgium

- Denmark

- UK

- Asia Pacific

- China

- South Korea

- Japan

- India

- Australia

- Singapore

- Rest of World

Ankit Gupta, Aditya Singh Bais