Electrical Conduit Market size to exceed $9bn by 2024

Published Date: October 2018

Electrical Conduit Market size will surpass USD 9 Billion by 2024, as reported in the latest study by Global Market Insights Inc.

Rising measures to curb fire, electrical supply faults, health, and other operational hazards along with favorable government policies pertaining to the development of standard product configurations will drive the overall electrical conduit market. Effective electrical infrastructure deficit across developing regions in line with ongoing revamping of existing grid infrastructure across developed nations will assimilate a favorable business landscape.

Increasing dependency on manufactured goods along with rapid economic escalation across developing countries have been the key factors driving industrial and commercial growth. Rising electricity consumption from industrial facilities and commercial establishments have positively swayed the global electrical conduit market share. In addition, positive consumer outlook favored by regulatory reforms towards electrification across grid isolated areas will further complement the business outlook.

Get more details on this report - Request Free Sample PDF

Power supply across large scale industries and manufacturing facilities have been critical applications, demanding safety and reliability of the entire electricity network. Thereby, growing measures to integrate a safe operational environment along with aesthetic proximities will enhance the > 3 marked electrical conduit market growth. Furthermore, increasing metal extraction activities coupled with rapid expansion of railway infrastructure require large scale electric network expansion which in turn will positively influence the industry scenario.

Browse key industry insights spread across 1250 pages with 3134 market data tables & 12 figures & charts from the report, “Global Electrical Conduit Market Size By Trade Size (½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, Others), By Classification (Metal [By Configuration {Rigid Metal (RMC), Galvanized Rigid (GRC), Intermediate Metal (IMC), Electrical Metal Tubing (EMT)}], Non-metal [By Configuration {PVC, Reinforced Thermosetting Resin (RTRC/FRE), Rigid Non-Metallic (RNC), Electrical Non-Metallic Tubing (ENT)}], Flexible [By Configuration {Flexible Metallic (FMC), Liquid-Tight Flexible Metal (LFMC), Flexible Metallic Tubing (FMT), Liquid-Tight Flexible Non-Metallic (LFNC)}] , Underground, Others), By Application (Rail infrastructure, Manufacturing facilities, Shipbuilding & offshore facilities, Process plants, Energy, Others), By End Use (Residential, Commercial, Industrial, Utility), Industry Analysis Report, Regional Outlook, Competitive Market Share & Forecast, 2018 – 2024” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/electrical-conduit-market

The Middle East and Africa electrical conduit market is anticipated to exceed USD 1 billion by 2024. Extensive increase in electricity consumption along with growing demand for an effective electric infrastructure will fuel the product demand. Rising private funding from financial institutions including the IFC, the World Bank, and the African Development Bank toward electrification across the region will boost the industry potential.

Lower cost, ease-of-installation and effective corrosion resistance have been the key factors complementing the adoption of underground electrical conduits. In addition, developed nations have continuously been focusing on the installation of underground electrical networks to sustain ecological damage from overhead lines. Positive utility inclination favored by huge ecological advantages associated with the underlined technologies will escalate the underground electrical conduit market growth.

Extensive power distribution infrastructure across large metal & mining industries along with high dependency on railway electric networks will complement the global metal electrical conduit market size. Although, ongoing adoption of effective non – metallic and flexible conduit technologies have hindered the product deployment however, standardized product specifications positively influenced by high cost of re-installation will endure the overall business scenario.

Asia Pacific electrical conduit market in the recent years has gained momentum on account of rising energy consumption and ongoing regulatory re-structuring across the region. Developing economies are considered as favorable areas as they continue to complement the existing infrastructure and power capacities to meet the increasing demand for electricity. The Government of India (GOI) in 2016, introduced its “One Nation One Grid” program to interlink all the state and national grids in order to achieve the target of a single tariff structure across the nation.

Eminent industry players across the electrical conduit market comprise of Schneider, ABB, Aliaxis, Hubbell, Astral, Atkore, Legrand, Mexichem, Hellermann Tyton, Champion Fiberglass, Wienerberger, Electri-Flex, ANAMET, Cantex, and Zekelman.

Electrical Conduit market research report includes in-depth coverage of the industry with estimates & forecast in terms of USD from 2013 to 2024, for the following segments:

Electrical Conduit Market, By Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- 3 to 4

- 5 to 6

- Others

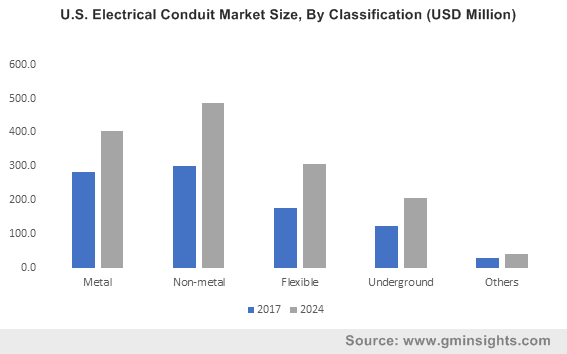

Electrical Conduit Market, By Classification

- Metal

- Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- 3 to 4

- 5 to 6

- Others

- Metal Configuration

- Rigid Metal (RMC)

- Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- 3 to 4

- 5 to 6

- Others

- Trade Size

- Galvanized Rigid (GRC)

- Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- 3 to 4

- 5 to 6

- Others

- Trade Size

- Intermediate Metal (IMC)

- Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- 3 to 4

- 5 to 6

- Others

- Trade Size

- Electrical Metal Tubing (EMT)

- Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- 3 to 4

- 5 to 6

- Others

- Trade Size

- Rigid Metal (RMC)

- Trade Size

- Non-Metal

- Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- 3 to 4

- 5 to 6

- Others

- Non-Metal Configuration

- PVC

- Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- 3 to 4

- 5 to 6

- Others

- Trade Size

- Reinforced Thermosetting Resin (RTRC/FRE)

- Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- 3 to 4

- 5 to 6

- Others

- Trade Size

- Rigid Non-Metallic (RNC)

- Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- 3 to 4

- 5 to 6

- Others

- Trade Size

- Electrical Non-Metallic Tubing (ENT)

- Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- 3 to 4

- 5 to 6

- Others

- Trade Size

- PVC

- Trade Size

- Flexible

- Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- 3 to 4

- 5 to 6

- Others

- Flexible Configuration

- Flexible Metallic (FMC)

- Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- 3 to 4

- 5 to 6

- Others

- Trade Size

- Liquid-Tight Flexible Metal (LFMC)

- Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- 3 to 4

- 5 to 6

- Others

- Trade Size

- Flexible Metallic Tubing (FMT)

- Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- 3 to 4

- 5 to 6

- Others

- Trade Size

- Liquid-Tight Flexible Non-Metallic (LFNC)

- Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- 3 to 4

- 5 to 6

- Others

- Trade Size

- Flexible Metallic (FMC)

- Trade Size

- Underground

- Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- 3 to 4

- 5 to 6

- Others

- Trade Size

- Others

- Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- 3 to 4

- 5 to 6

- Others

- Trade Size

Electrical Conduit Market, By Application

- Rail infrastructure

- Manufacturing facilities

- Shipbuilding & offshore facilities

- Process plants

- Energy

- Others

Electrical Conduit Market, By End Use

- Residential

- Commercial

- Industrial

- Utility

The above information is provided on a regional & country basis for the following:

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- Germany

- Spain

- Italy

- UK

- Austria

- Netherlands

- Sweden

- Russia

- Belgium

- Denmark

- Switzerland

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Philippines

- New Zealand

- Malaysia

- Thailand

- Singapore

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- Kuwait

- Oman

- Lebanon

- Turkey

- Jordan

- South Africa

- Nigeria

- Morocco

- CIS

- Azerbaijan

- Belarus

- Ukraine

- Kazakhstan

- Latin America

- Brazil

- Argentina

- Peru

Ankit Gupta, Aditya Singh Bais