Calcium Aluminate Cement Market size to exceed $650 Mn by 2026

Published Date: November 2020

Calcium Aluminate Cement Market size is likely to surpass USD 650 million by 2026, according to a new research report by Global Market Insights Inc.

Proliferating product usage in the construction and infrastructure sector will prosper the calcium aluminate cement industry growth. The global construction sector is poised to reach over USD 8 trillion by 2030 with Asia Pacific region dominating the market. Strong government initiatives and growing construction expenditure in residential & commercial construction are expected to drive the demand for CAC-based building chemicals in the region.

CAC is majorly used for building chemistry in various applications such as self-leveling toppings, sealers, non-shrink grouts, repair mortars, bedding mortars, etc. Rising industrialization, increasing population, rapid urbanization and robust economic development are chief factors propelling the regional construction industry growth which will fuel the calcium aluminate cement market demand.

Get more details on this report - Request Free Sample PDF

Beijing Municipal Commission unveiled 300 new construction projects comprising 100 projects to support the ongoing development in high-tech industries, 100 projects focused on the betterment of the citizens’ livelihood, and 100 infrastructure development projects. India’s construction spending reached around USD 82 billion in 2019 from USD 75.9 billion in 2018. The growth in spending can be attributed to government initiatives such as the Government of India’s recent Smart City Project to build around 100 smart cities, which is an important opportunity for real estate companies.

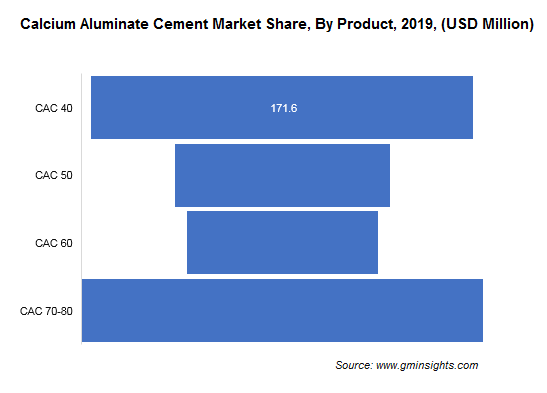

Browse key industry insights spread across 110 pages with 89 market data tables & 24 figures & charts from the report, “Calcium Aluminate Cement Market Size By Product (CAC 40, CAC 50, CAC 60, CAC 70 - 80), Industry Analysis Report, Regional Outlook, Application Growth Potential, Price Trends, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/calcium-aluminate-cement-market

CAC 70 - 80 will be a major revenue contributor

The CAC 70-80 product type is poised to hold around 30% calcium aluminate cement market share in 2026. CAC 60 and CAC 70 - 80 contain a high amount of alumina, i.e., above 60%, and can be used in high-temperature applications up to 1,800°C as they possess higher refractoriness. High alumina cement possesses a short setting time, high whiteness, high chemical purity, is appropriate for self-leveling & vibratory methods, excellent workability, and lower water demand. The cement also provides excellent fluidity and workability of mortar with different contents of the binder.

Europe will be the most lucrative region

Europe calcium aluminate cement market is expected to capture more than 50% share by 2026 due to the presence of leading CAC manufacturers along with rising demand from regional end-use industries. The leading manufacturers of CAC, such as Imerys, Calucem, Gorka, Almatis, Cementos Molins, and Caltra Nederland, possess robust production sites and distribution networks in the region. There is a significant domestic consumption on account of rising demand for CAC as a substitute for OPC in some of the building chemistry applications owing to its high whiteness, quick strength, and less water applicability.

RHI Magnesita, a market leader in refractories, is one of the key consumers of CAC in the production of refractories in the region. The company accounted for the highest revenue sales of approximately 29% in Europe. Russia’s strong cement sector and cement consumption increased by 8% to 57.8 million tons in 2019. In Europe, Russia and Germany are the leading countries in steelmaking with crude steel production of 71.6 and 39.7 million tons respectively. Rising product demand from the regional refractory and construction industry will prosper product consumption.

Production facility upgrading and geographical expansion to enhance market position

The major calcium aluminate cement market participants include, The Calucem Group, Imerys Aluminates, Cementos Molins, Gorka Cement, Almatis GmbH, Union Cement, Cimsa Cimento, Zhengzhou Dengfeng Smelting Materials Co., Ltd. (DFSM), Henan Fengrun Metallurgy Materials, Mahakoshal Refractories Pvt. Ltd., Curimbaba Group, Carborundum Universal Limited (CUMI), Denka Company, AGC Ceramics Co., Ltd, Royal White Cement, Caltra Nederland B.V, Meenal Ceramics, and Shree Trading Co.

The key industry players are chiefly focusing on acquisition, production facility upgrading, and geographical expansion to strengthen their competitive edge in the global market. In April 2020, the Calucem Group invested USD 3.5 million to upgrade its manufacturing facility in Croatia, making it more efficient and environment friendly.